TigerSoft and Peerless Daily

Hotline

-----------------------------------------------------------------------------------------------------------------------

(C) 1985-2014

William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger

Software 858-273-5900

PO Box

22784 San Diego, CA 92192

Email william_schmidt@hotmail.com

Previous Hotline -http://tigersoftware.com/112211-H/index.htm 11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

Past Hotline Predictions http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

----------------------------------------------------------------------------------------------------------------------

PLEASE...Sharing this hotline address with

non-subscribers is a violation of our contract

with you and a violation of copyright laws. I

work hard for you. Respect that effort!

---> To

renew this Hotline, order

here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

--------------------------------------------------------------------------------------------------------------------

A

Guide To Profitably Using The Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70

1970

1970-1

1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

1976

1976-7

1977 1977-1978

1978 1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

1985 1985-1986

1986

1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7

1997

1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Background and New Studies

Announcement:

The address for this Hotline will change Thursday AM, Pacific Coast Time.

Current

subscribers should have received a notice giving the new address today.

But we may have

made a mistake in your email address, so just let me

know and I will

send you the new address or tell you if your subscription

has expired

according to records here.

The On-Line Explosive Stocks

is finished.

The On-Line Killer

Short Sales book is also finished, but

some re-editing is being done this coming week.

I call your attention now to the many new concepts and

the considerable new research in these on-line books: "

For example:

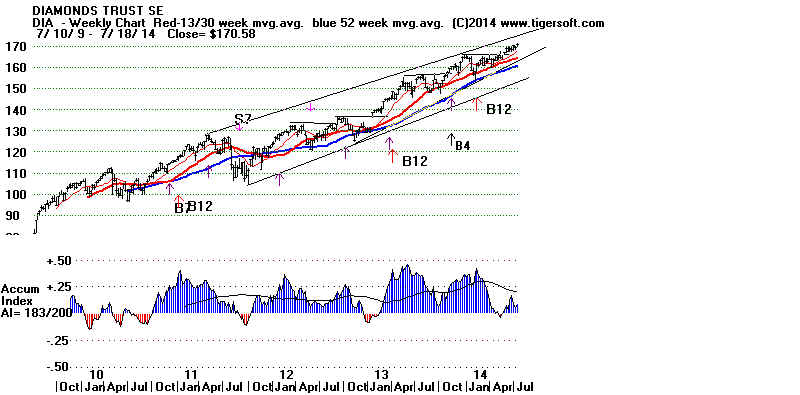

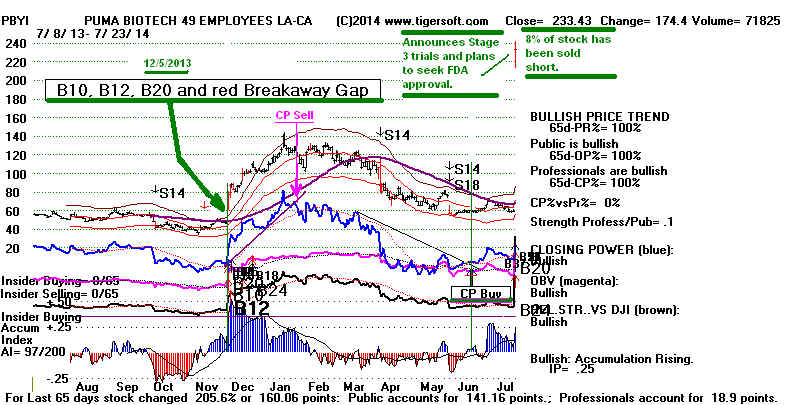

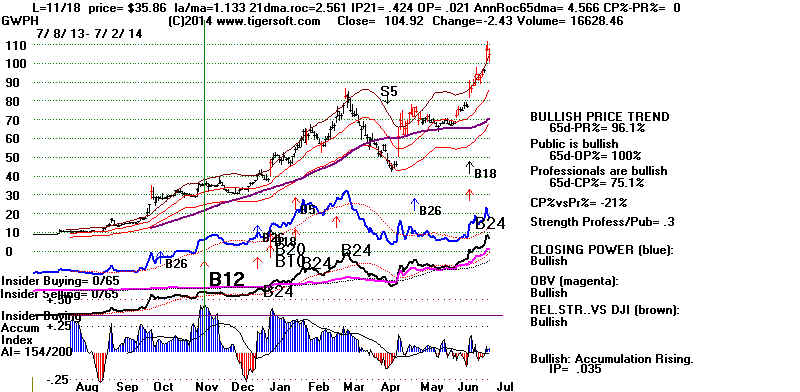

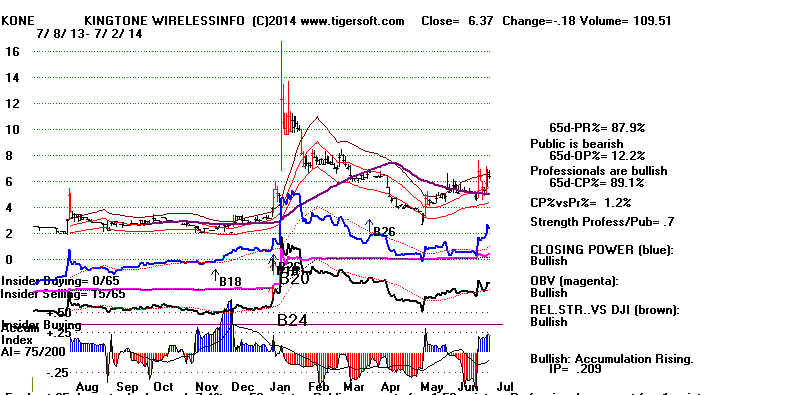

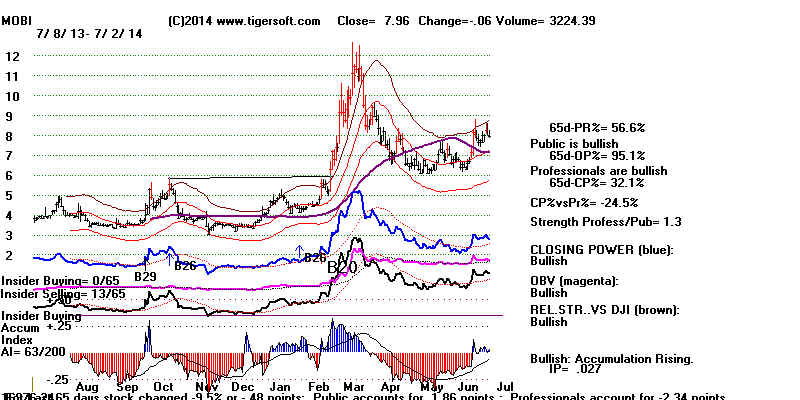

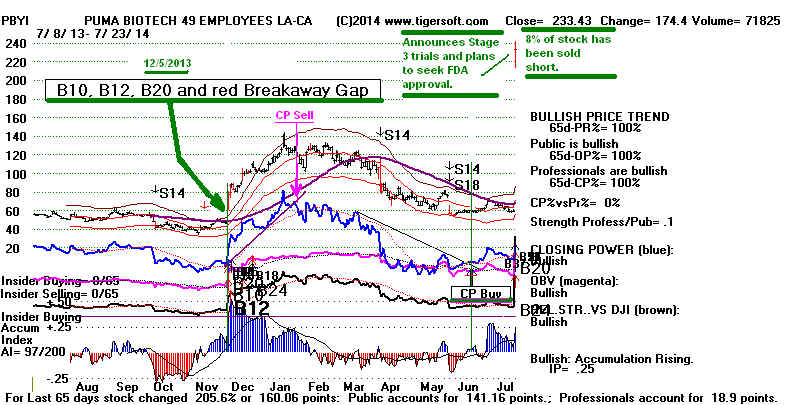

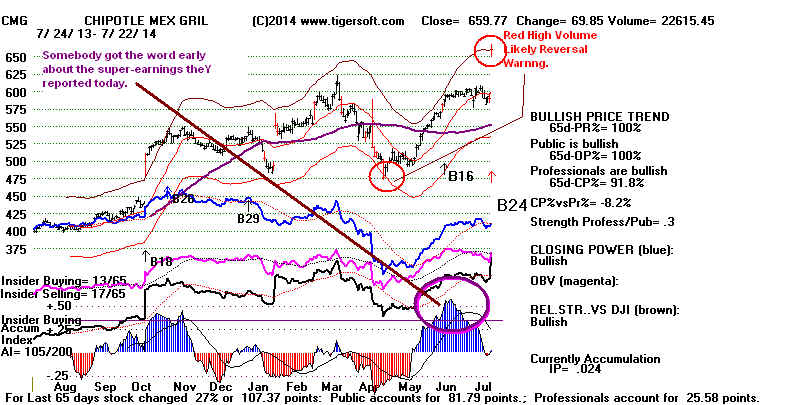

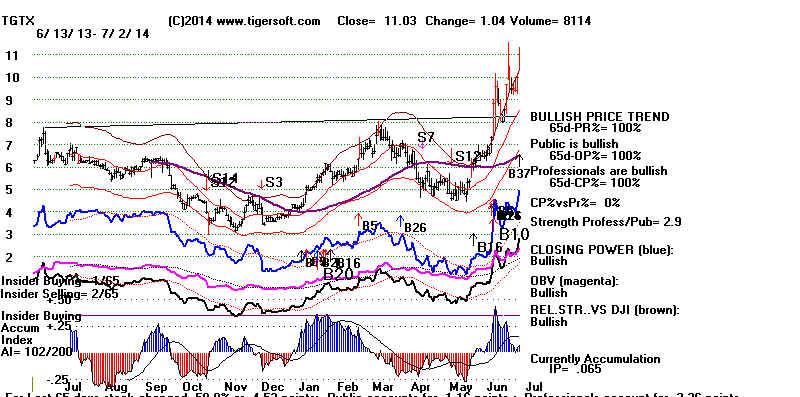

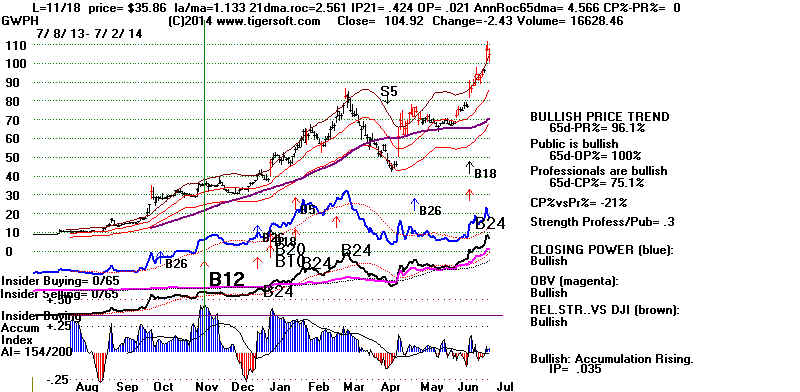

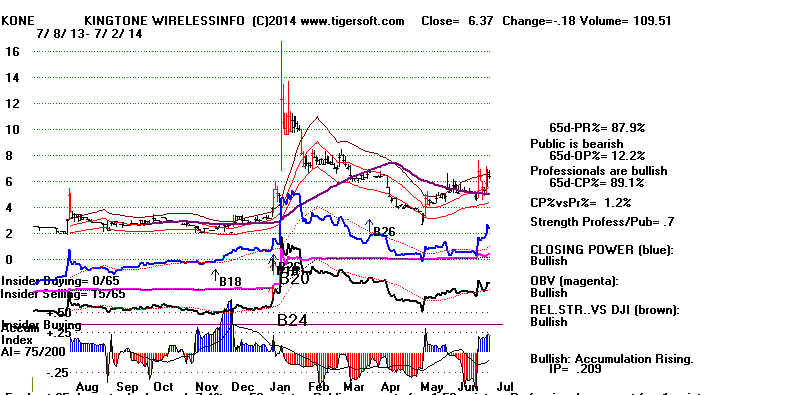

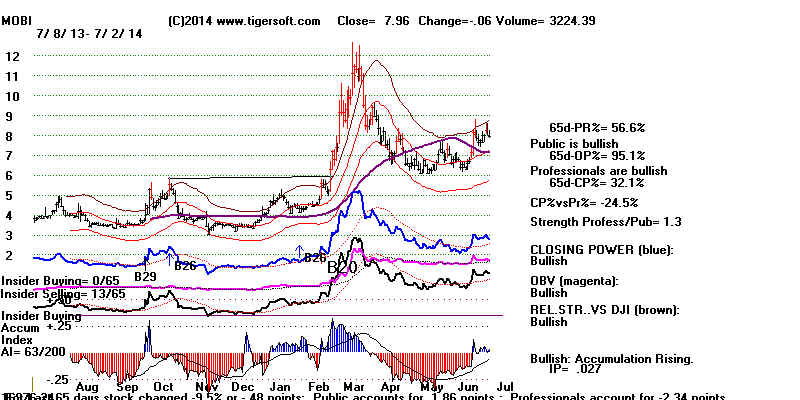

1) A very good New Tiger Buy B12 for Low Priced Stocks

2) Red high volume reversal days

3) Buy the stocks the Federal Govt wants you to buy

4) 100-Day Power Rankings...

5) Using Closing Power Hooks after Buy B26s and B20s.

6) How A Stock Reacts to Its Earnings Report Is Very important.

7) TigerSoft Major Buy Signals' Combinations

Which are most Powerful? Reliable?

8) Augmented Buy B20s' Independent Success Rate.

9) What factors warn a rising 65-dma will not hold?

Purchase each all new book by CC for $42.50 or send a check

for $37.50 to me: William Schmidt, 5970 Gullstrand St., San Diego, CA 92122.

4/15/2014 Introduction to Tiger/Peerless Buys and Sells.

Peerless Charts and Signals

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

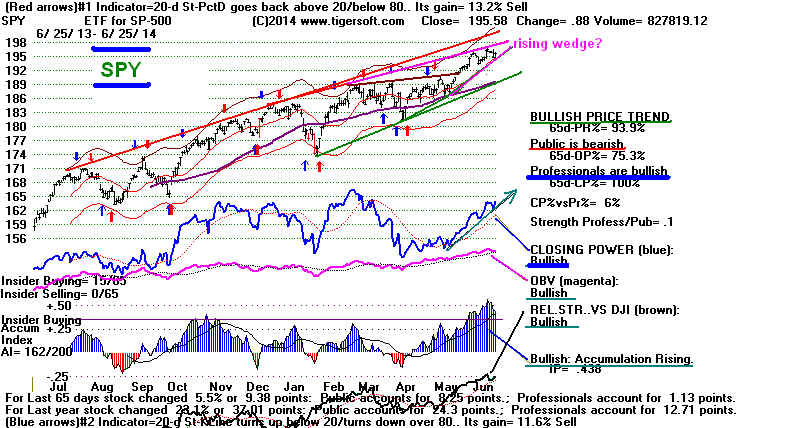

SPY Charts since 1994:

Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized

Signals.

New Fine-Tuning TigerSoft Buy Signals:

9/1/2014 - 2014 Tiger B19s - Steady rallying and no pullbacks

below the 21-day ma.

4/7/2014 Advisory Pink Closing Power

S7s at ETF at top since 1994

1994 1996 1997 1998 1999

2000 QQQ SPY

DIA 2002

2007

2008

SPY 2011 2013-2014

The New 2014 Peerless.exe Software has now been posted on the Elite Stock Professional

Page.

---> To Older Hotlines

Lines

====================================================================================

9/2/2014

Important: 1) Hotline's address will change Thursday AM.

2) Also sometimes, the full Hotline disappears. It may have

happened last night. I'm sorry. It may be because I saved the full

changes under the name index.html but not under index.htm

So, if it appears to be unusually short in the future,

try both of the names below www.tigersoftware.com/XXXXXX/index.htm

and www.tigersoftware.com/XXXXX/index.html,

but substitute the

new address, of course.

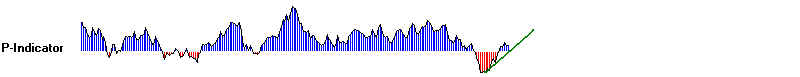

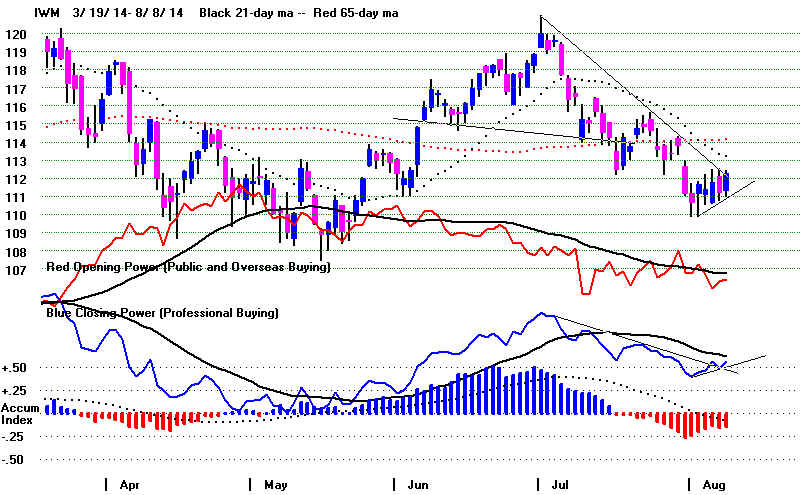

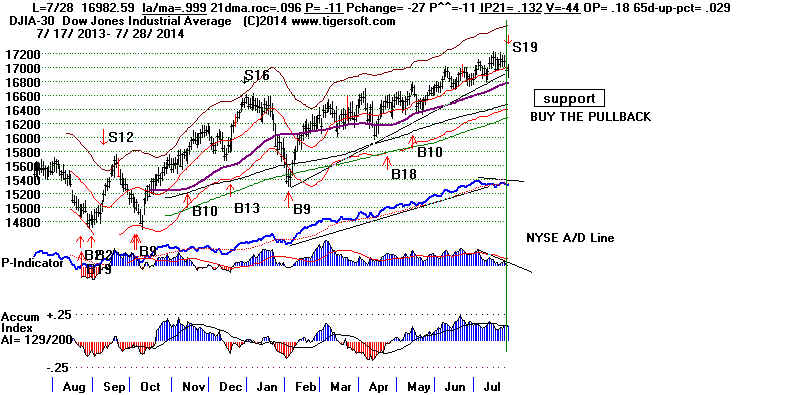

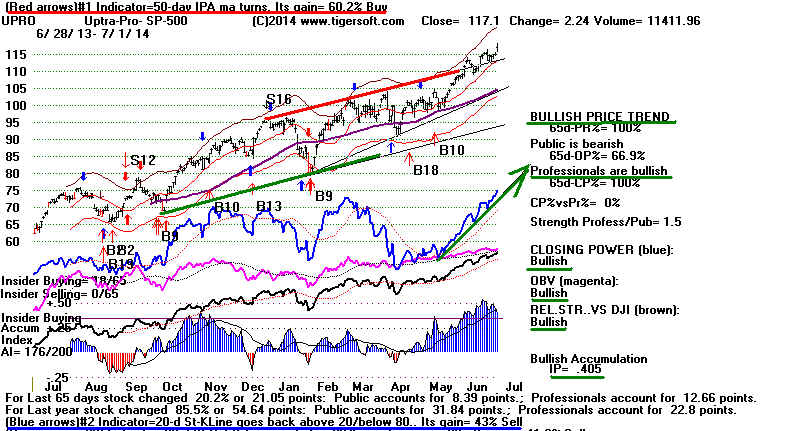

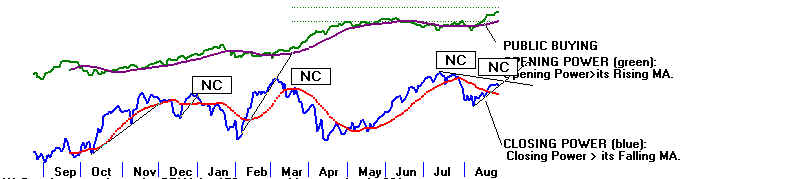

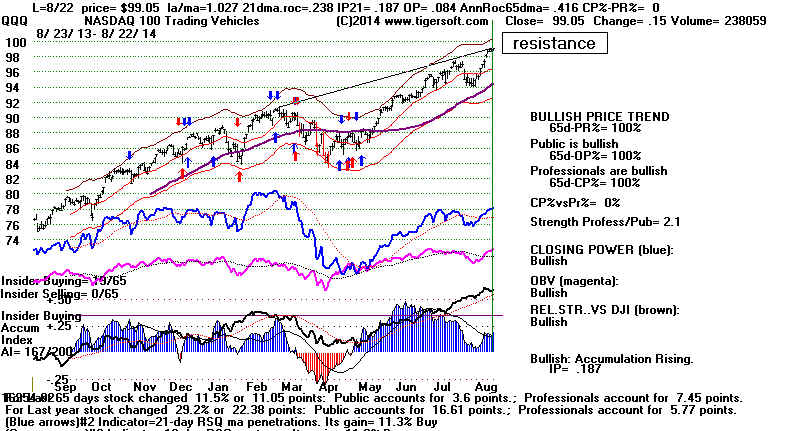

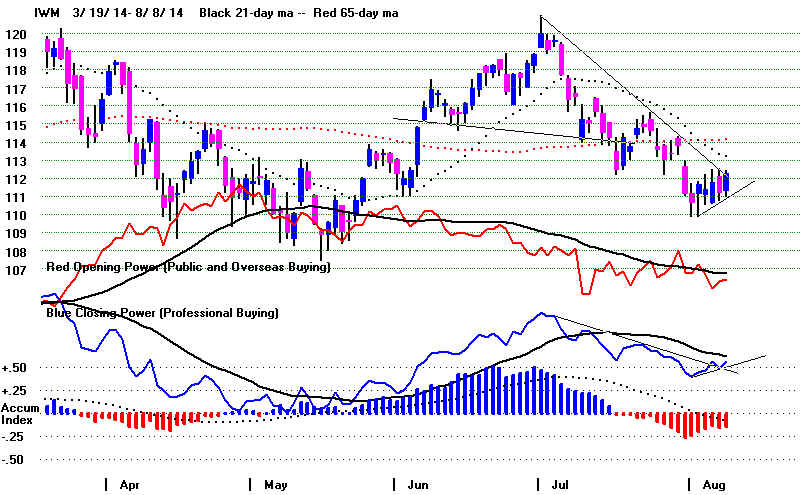

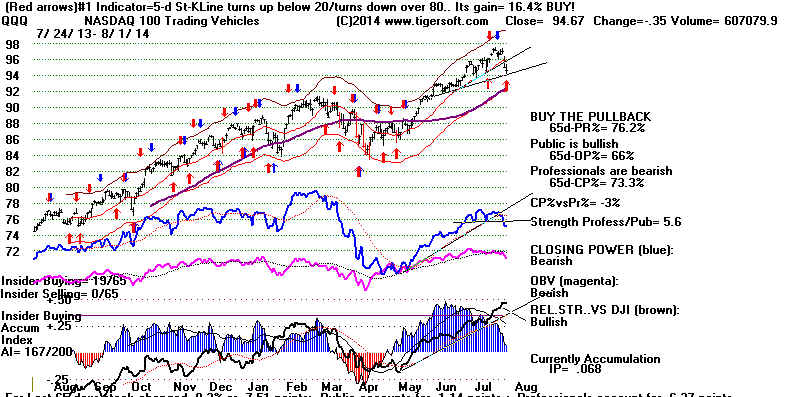

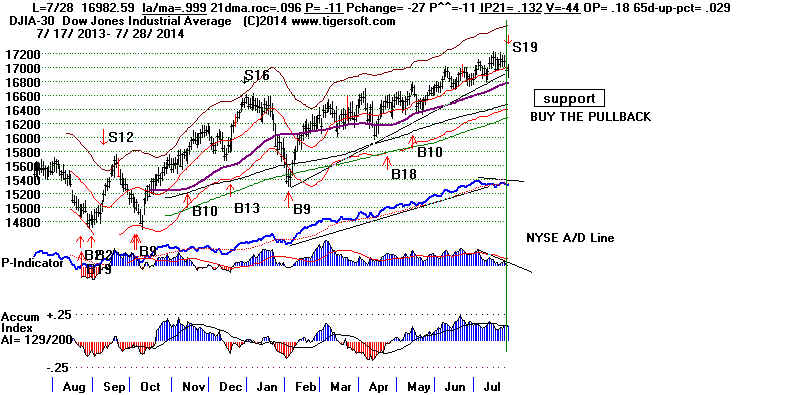

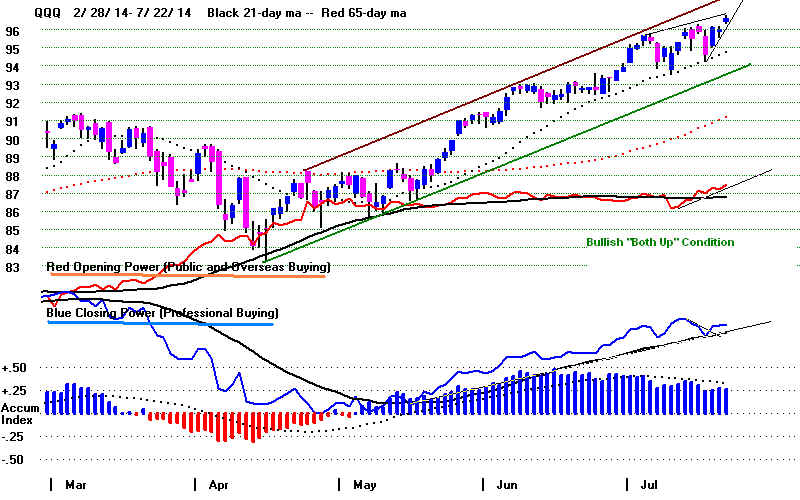

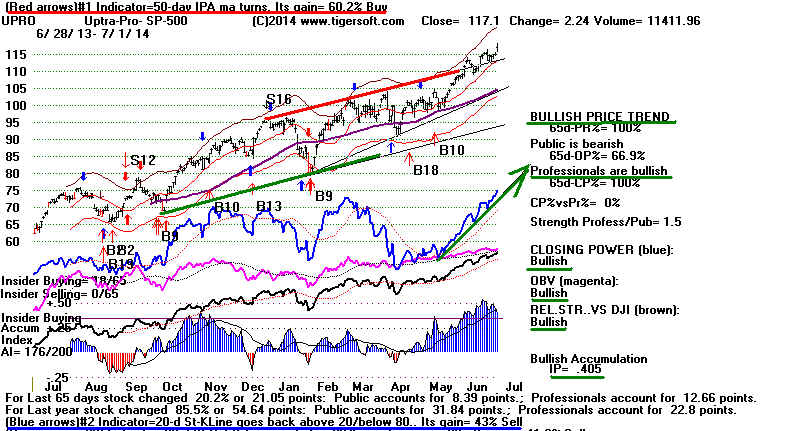

The Closing Powers did not break their uptrends, so I would give the

NASDAQ, QQQ, IWM and IBB more time to advance

despite the frequent

bearishness of September. The new

Buy B20 is reliable. The previous Sell S19.

is not a particularly strong. There are still a number of Bullish

MAXCP

stocks. The DJI definitely is weaker. But no

Peerless Sell seems close.

Most of the market internals, our Peerless key values, improved today

despite the pullback.

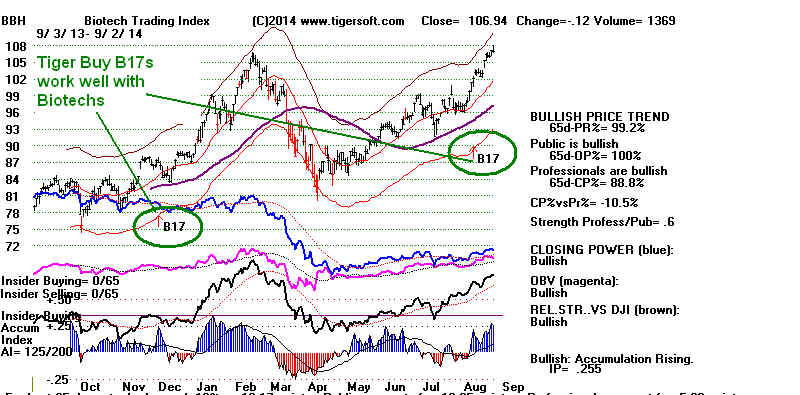

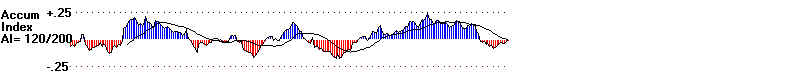

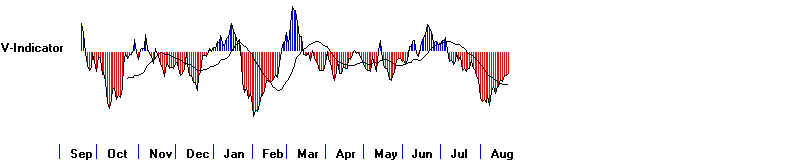

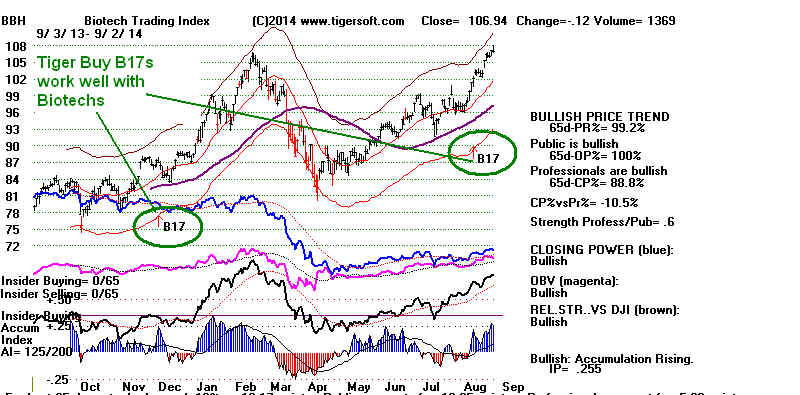

Tiger Buy B17 - Sudden Rise in "IP21",

TigerSoft's Accumulation Index

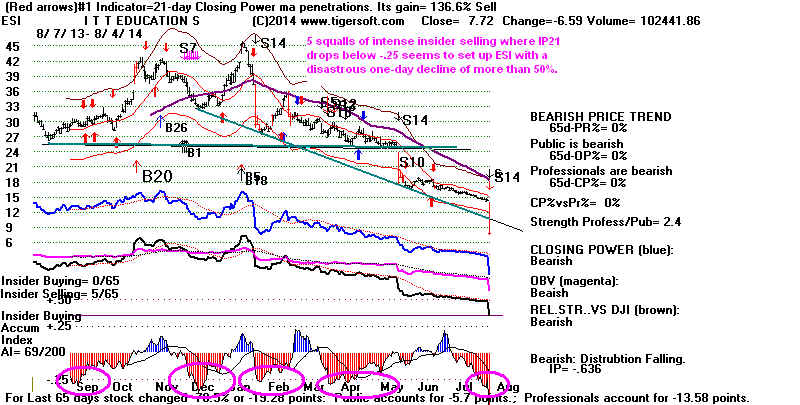

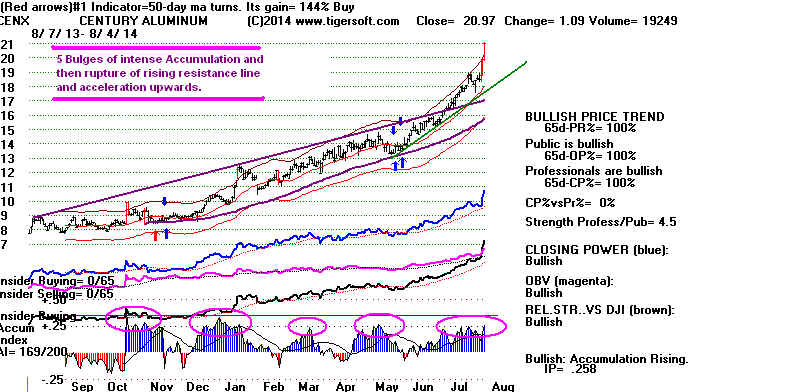

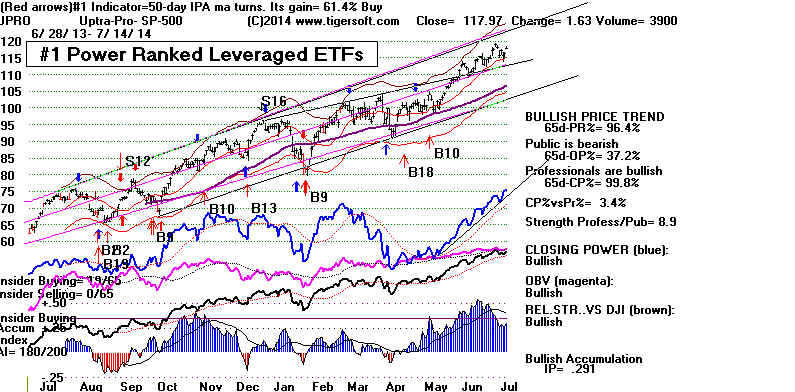

I spoke today with a former stock broker who has been a regular Tiger customer

and Hotline subscriber for more than thirty years. As the manager of a large

office of stock brokers, his words were most important. His view is that if

someone really wants to make a lot of money in the stock market, he or

she should concentrate on individual stocks. Peerless is great he says,

but we should also be looking for bulges of Insider Accumulation and watching

what Professionals are doing using the TigerSoft's charts.

I was pleased he said this, because I wanted to ask him about the value of

the new research I am doing for this Hotline on the Tiger Buy and Sell

(not Peerless) signals for individual stocks. He was glad to see it. It

would help others.

In this connection, I posted research this weekend of Tiger Buy B19s -

relentless upward momentum signal. I showed that certain accompanying

key values gave these B19s success rates of 80% or higher.

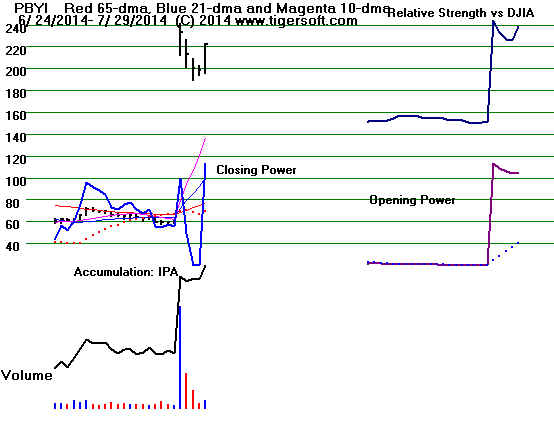

Tonight, I want to post the preliminary results for Tiger

Buy B17s -

sudden increases in Accumulation (IP21). You can see the sampling

methodology I used. The success rate here also is close to 80%,

especially, when the Buy B17 occurs while the stock appears to

be innocently sitting in a base. To show this, I want to make a list tonight

of the B17s in the past 11 months with biotechs. I will just go through

the biotechs we have on our data page and show the first 25 B17s.

Sampling this many cases gives us a reliable result. You can readily produce

the B17s exactly like I show here using the commands:

PEERCOMM + Charts-2014 + Daily Stocks + All Stks + Signals1 +

Display User Selected TigerSoft Signal + enter B17 + OK + 2 (right side

of keyboard to go to next stock. Num-lock must be OFF.)

18 of the 25 (72%) gained at least 10 before a loss of much more than 10%

occurred. Looking at these charts will show you that most of the losses

could have easily been avoided by not buying just below the resistance of

a 65-dma or where the stock's IP21 was still quite negative despite being

far above the 21-dma. I will work on these B17s studies some more

and you can view more complete studies in links I will provide in a few days.

Click on the links to see the charts of these 25 B17s stocks.

Buy B17s in Biotechs:

November - August 2014

la/ma 21-dma

Price Next Low

Next High

ROC

---------------------------------------------------------------------------------------------------------------------------

ACAD

4/23/2014 .941

-2.261 20.55

18.05

26.61 5 months later. Success

ACHN 11/22/2013

1.174 2,112

3.07

4.12 in six weeks. Success

ACOR

6/5/.2014 1.102

1.165

34.96

18.45

Loss

ACRX 11/13/2013

1.034 - .518

7.82

--------

12.69 in two months Success

ACST 11/27/2013

.688 -5.18

1.20

-------

1.50 in 6 weeks

Success

AEGR

1/8/2014 1.074

1.092 73.23

56.54

Loss

(At falling 65-dma resistance. Avoid these.)

AFFX 12/23/2913

1.066 1.414

8.85

7.90

9.75

Success

AFFY

12/27/2013 .946 -.142

0.79

-----

1.18 in 5 days

Success

AGEN 12/11/2013

.993 .093

2.54

------

5.10 in 19 weeks

Success

ALNY

5/19/2014 1.077 .972

58.26

------

70 in a month

Success

ALXN

12/23/2013 1.051 .921

130.90

------

183 in 2 months

Success

AMAG

1/15/2013 .988 -.123

22.99

19.97

Loss

(Just bekow 65-dma resistance. Avoid these.)

AMED

6/27/2014 1.247 2.404

17.46

15.49

22 in 5 weeks

Success

(Best to wait for a pullback and CP hook up when stock spikes up like this.)

AMGN 12/9/2013

1.000 .31

113.99

129 in 3 months Success

AMRI 12/23/2013

.959 -1.234

20.31

-------

2o in 3 months

Success

ANAC 12/9/2013

1.236 3.945

16.98

--------

22.75

Success

ANIK 11/27/2013

1.111 2.438

34.30

---------

39. in 6 weeks Success

AOLS 11/19/2013

1.015 -.134

0.27 ---------- .40 in 2

months Success

APDN 11/12/2013

.935 -2.144

0.11

---------- 0.19 in one

month Success

APH

4/28/2014 1.018

.506

94.73

.............. 104.9 in 5 months

Success

ARIA 1/28/2014

1.146 1.777

8.04

6.88

9..23 n 3

weeks Success

(Dangerous because IP21 was -.074 with stock 14.6% over 21-dma)

ARNA 1/15/2014

1.224 3.536

7.31

6.0

(7.97)

Success

(Just bekow 65-dma resistance. Avoid these.)

ARQL 2/19/2014 .96

-1.535

2.22

1.30

Loss

-------------------------------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

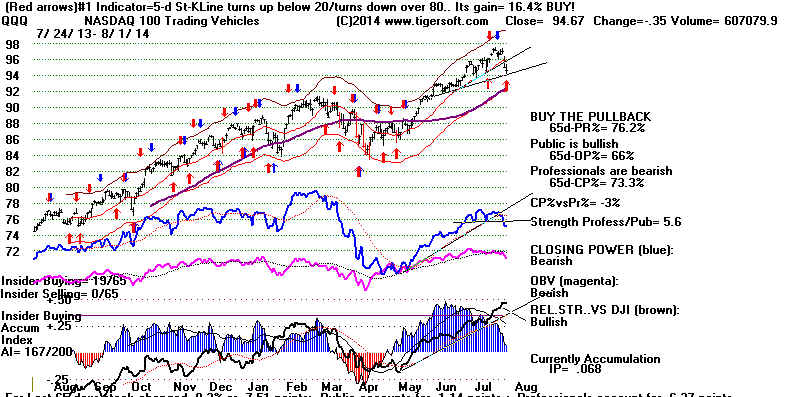

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

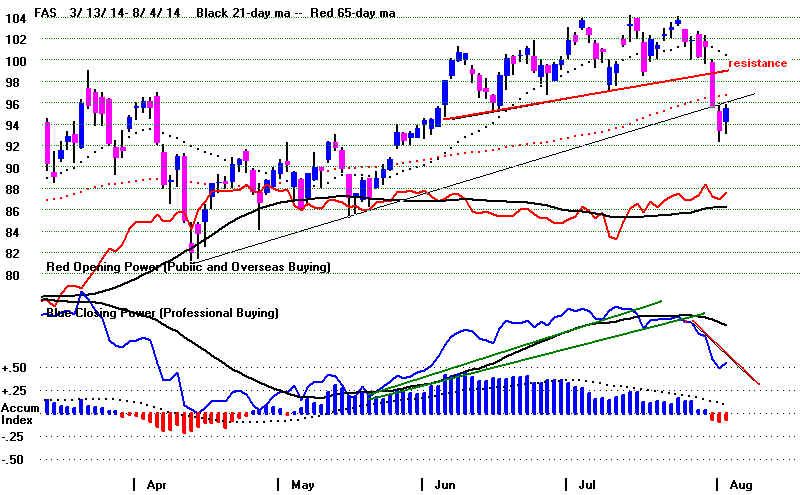

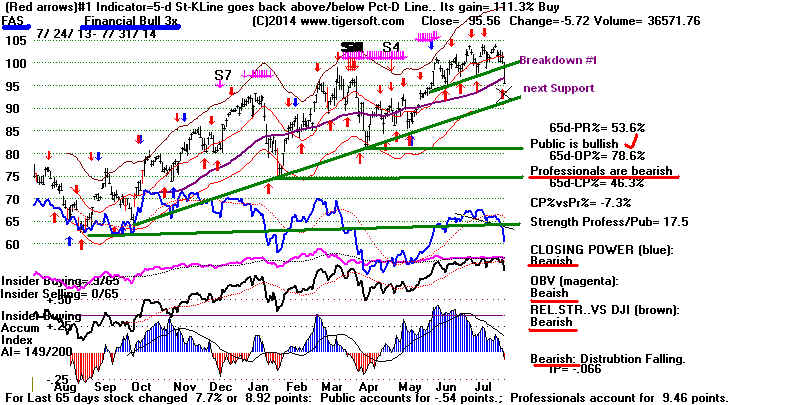

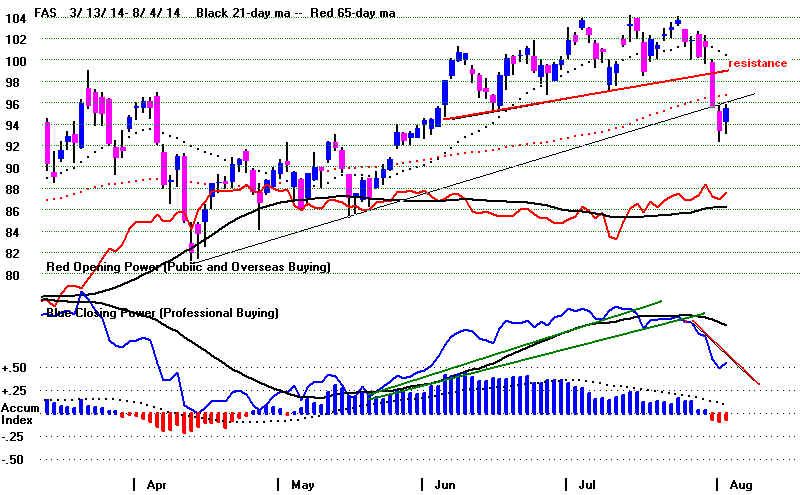

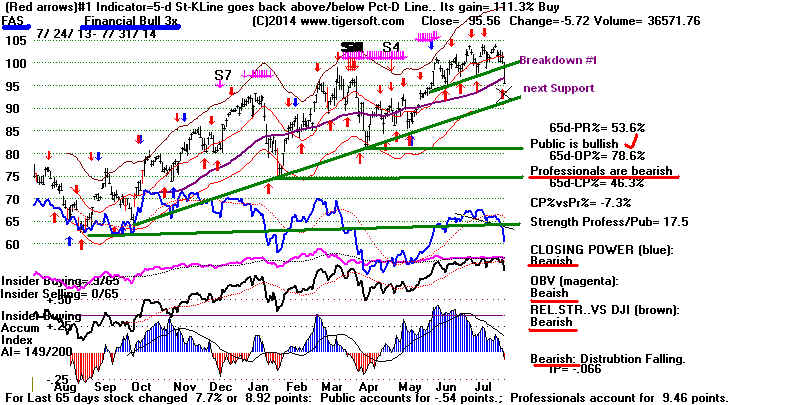

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->113 +17 MAXCP stocks Bullish MAXCP Stocks (9/2/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 62

+20 MINCP stocks Bearish MINCP Stocks (8/29/2014)

-->

83 +33 New Highs on NASDAQ

21 +8 new lows. Bullish plurality

--> 107 -11

New Highs on NYSE 6 new lows. Bullish plurality

-------------------------------------------------------------------------------------------------------------------------

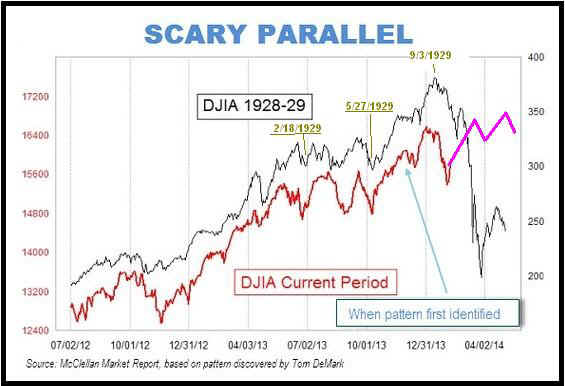

Why The Market Could Drop Soon.

The sabre-rattling is getting scary.

Putin, in an effort

The sabre-rattling is getting scary.

Putin, in an effort

apparently to show his "restraint" says that Russia could take Kiev "in two

weeks

if it wanted to". Not to be outdone, America must pound on its chest,

too.

The the US Army's 173rd Inantry Brigade will participate in "training exercises"

with Polish and Ukrainian forces close in Eastern Poland in two weeks. This

can

only increase the new cold war tensions.

Why do we care about whether Eastern Ukraine's Russian-speaking population

rejoins Russia or becomes an independent country? Hillary says Putin is another

Hitler about to invade the Sudetenland. He would restore the Tsarist Empire

if he could. But just as likely, many think NATO in the absence of a Red Menace

simply needs an opponent to justify their existence and we are now playing a very

, dangerous game, because no Russian government could tolerate missiles pointed

at it from neighboring Uraine.

Lech Walesa, a Nobel Peace Prize winner, is someone who knows something

about Russia. He says that NATO's involevment with and arming Ukraise

"could lead to a nuclear war... Must we then destroy each other?

Among the Yahoo comments at

http://news.yahoo.com/arming-ukraine-could-lead-nuclear-war-lech-walesa-183453862.html

Sic Semper Tyrannis

Guest

It is good that anti-communist hero like Lech Walesa has said this. Anyone else would be

attacked as communist or Russian sympathizer. Some people don't understand the seriousness

of nuclear war. Just because we avoided nuclear war in the past doesn't mean we will never

have one. We have to constantly work and remain vigilant to avoid nuclear war. Taking

anti-missile systems close to Russian border makes no sense. Russia is so big

geographically and they have so many nukes that even if they decide to nuke themselves,

the whole world will be radioactive. If we nuke Russia, we have to use so many nukes that

whole world will be radioactive and everyone will eventually die. Question is why

are we interested in Ukraine ? It makes no sense to fight nuclear war over Ukraine.

====================================================================================

OLDER HOTLINES

====================================================================================

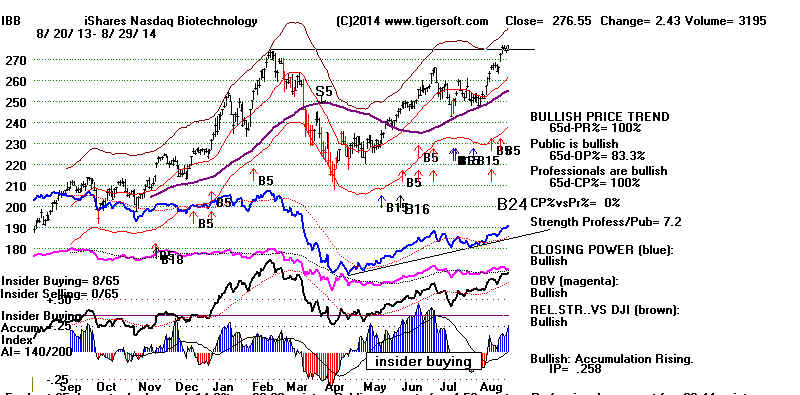

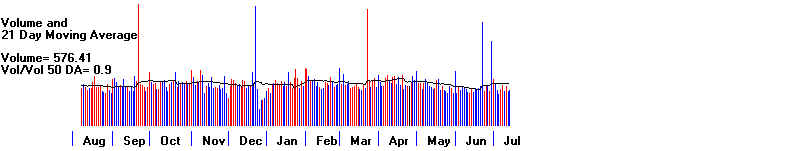

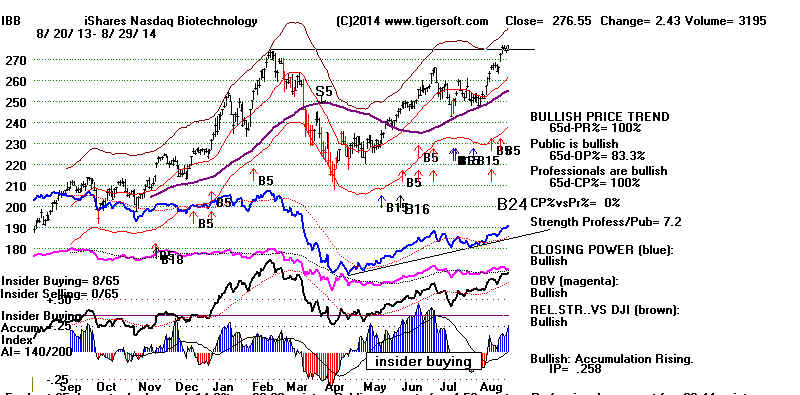

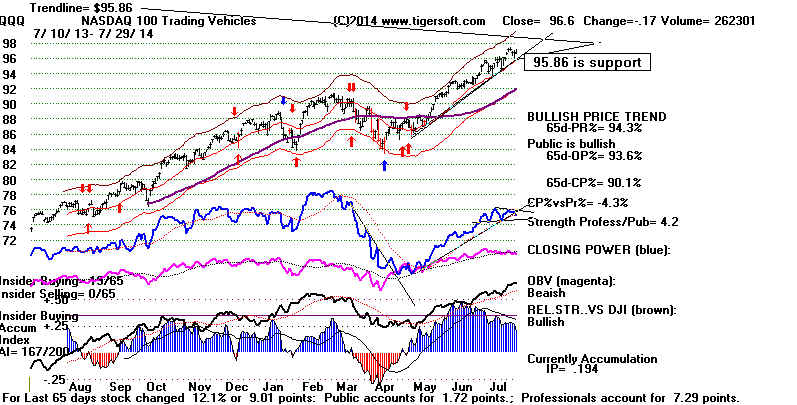

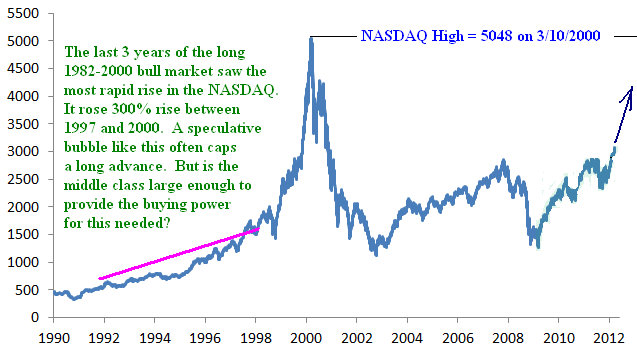

9/1/2014 We should keep

watching to see if the NASDAQ, QQQ,

BBH and

IBB breakouts can bring big gains, as they did in 1999-2000

to climax a five

year-long bull market. Very bullish biotech announcements are being issued

more and more frequently. How can this not bring a breakout-run by

leading biotechs? And how can this not boost QQQ and the NASDAQ?

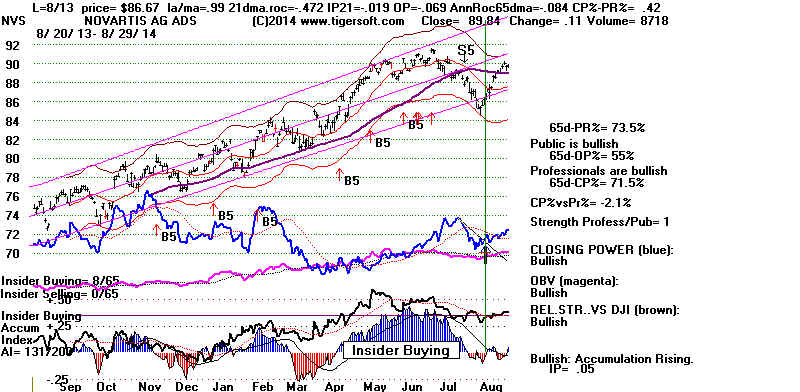

See the Bullish MAXCPs and Biotechs tonight and the Novartis

breakthrough

story of this weekend.

IBB - Tests of previous highs with IP21

above +.25

are more likely to bring breakout-runs.

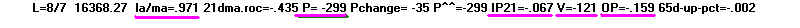

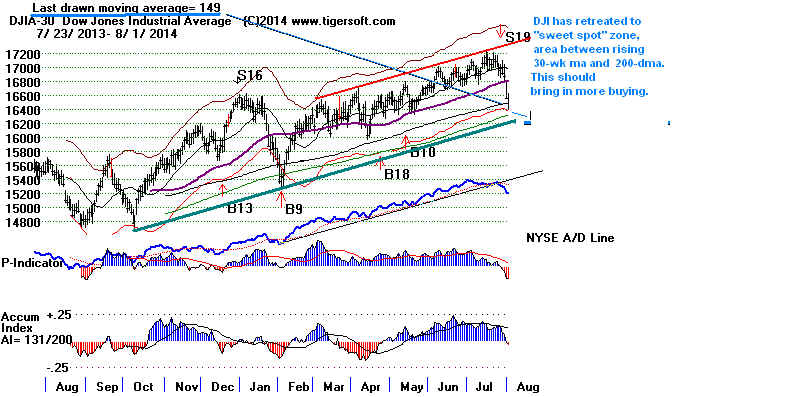

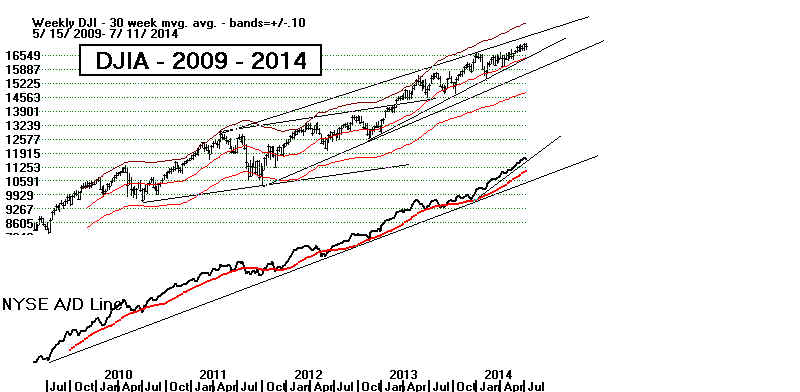

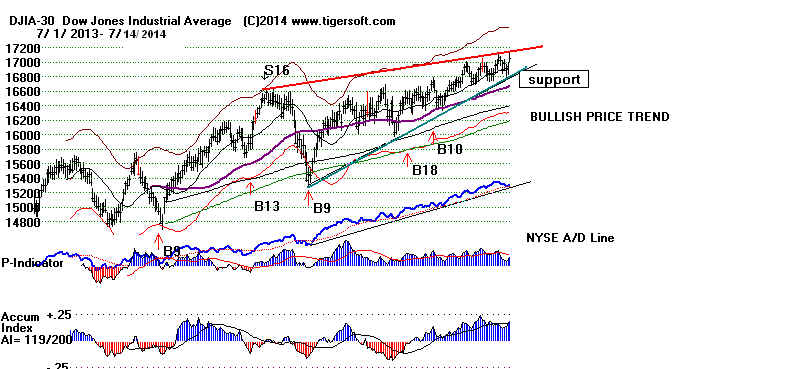

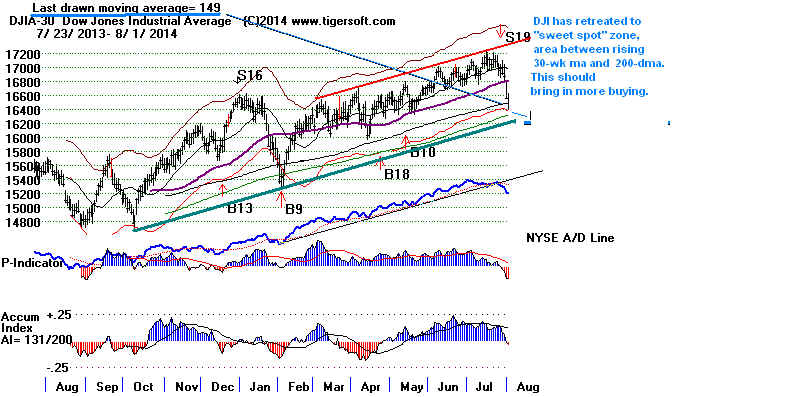

The DJI's IP21 below is well below the

+.23 I like to see on confirmed

new highs which are apt to become breakout-runs.

The New Peerless Buy B20 Still

Looks Good

(It should be posted tomorrow afternoon on the

ESP Page for downloading,

otherwise send check for $75 to William Schmidt, 5970 Gullstrand Street,

San Diego, CA 92122).

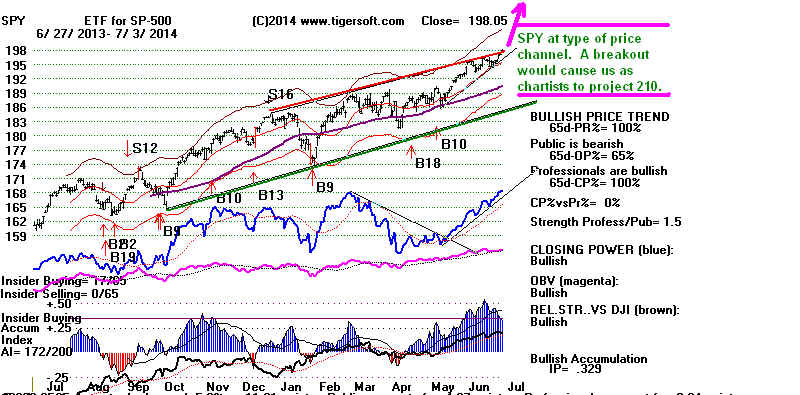

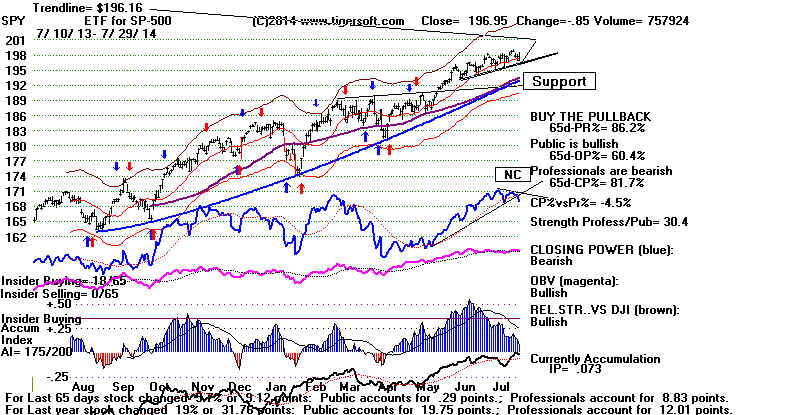

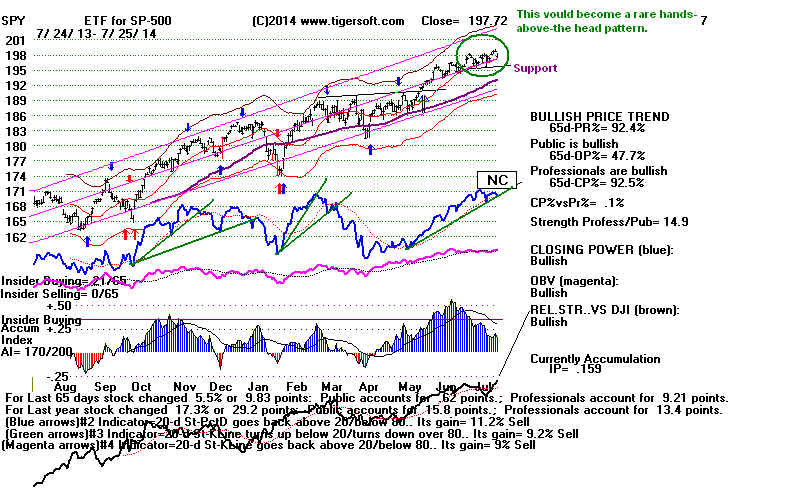

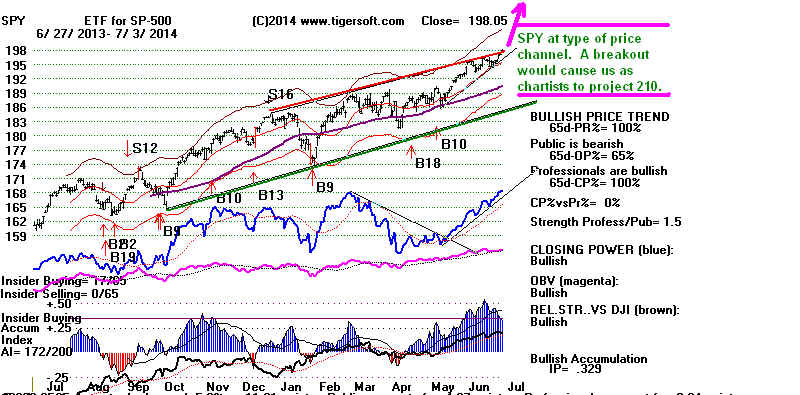

Still no new Peerless Sell and SPY's

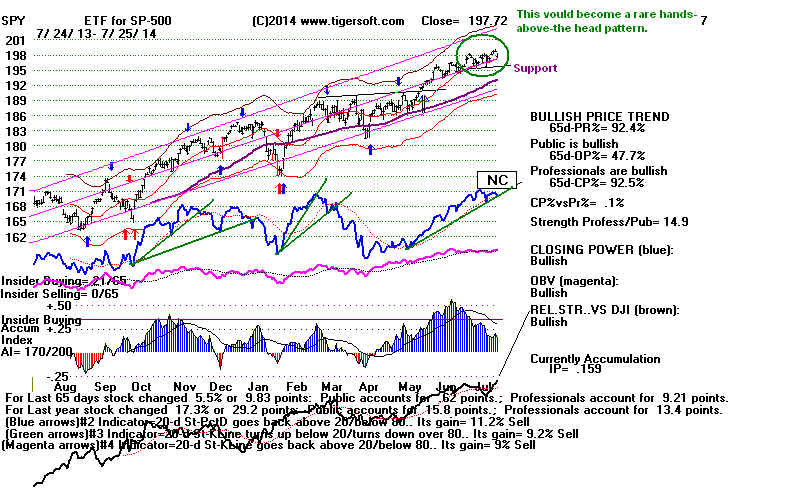

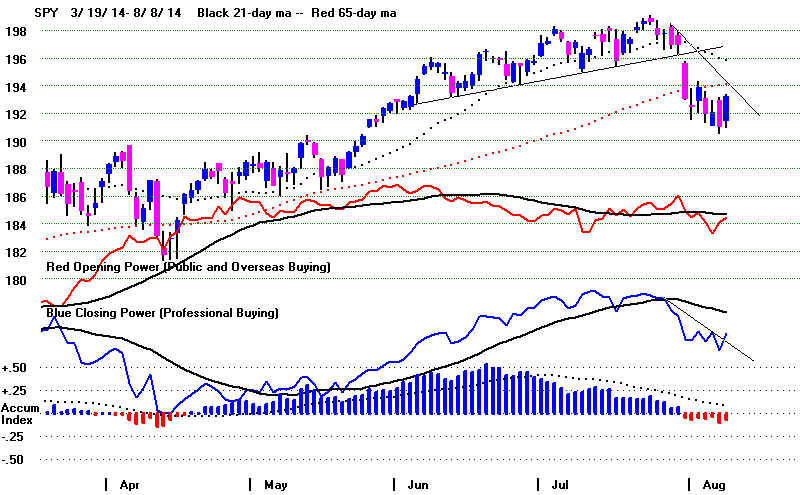

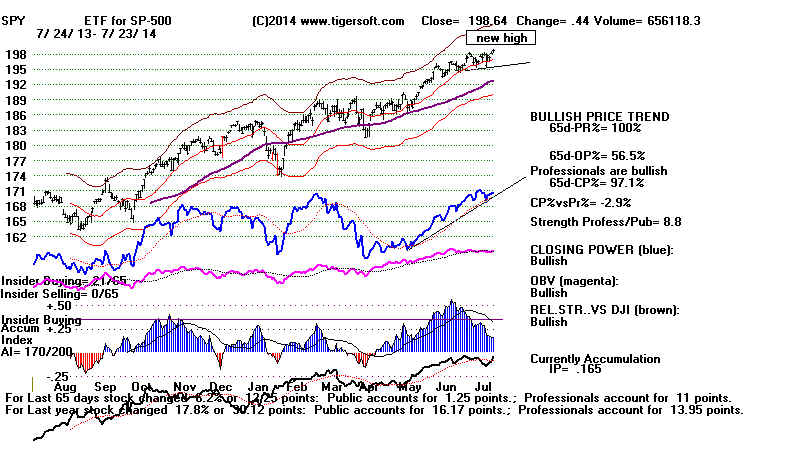

Closing Power uptrend was not violated.

Also important, the the IP21 (Accum. Index) jumped sharply on

Friday. This is important because it weakens the Tiger S9 on SPY and

because a sharply rising IP21 plus excellent momentum could bring a Peerless

Buy B4. It will all depend on whether institutions and Professionals become

September sellers. This remains uncertain as the DJI only rises 42.6% of

the time in the 21 trading days following September 1st. Worse is September's

track record for the 21 trading days after the 3rd. For this segment of time,

the DJI only rises 38.3% of the time! So, we have to avoid being fooled by

the market's behavior for the next two days if it rises.

Only time will tell if Friday's strength will prove to be significantly bullish and

lead to an IP21-based Buy B4 or if Friday's was merely an un-representative

pre-holiday rally before a post-Labor Day swoon. But at the very least,

.

Friday's volume did rise and the market was not un-nerved by threating developments

in the middle-East and the Ukraine.

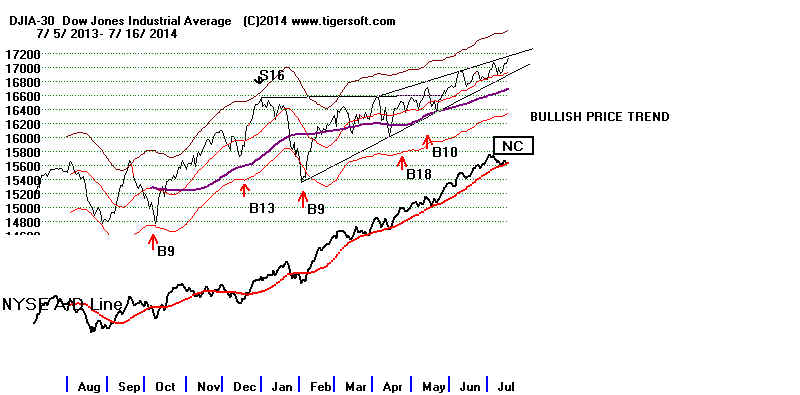

A Take-Off Is Needed.

Now we need a pick-up in upside momentum. The annualized rate of change of

the 21-day ma needs to move up a lot. The DJI will need to surpass the

2.7% upper band without bringing in more institutional selling into strength,

as happened last week.

What is needed now can be seen by studying how close we are to Peerless

Buy B4. A Peerless Buy B4 based on a steep jump in the IP21 could be

shaping up here. But momentum will need to accelerate up and the

IP21 (current Accumulation Index) will need to keep rising and not flatten out.

The IP21 will have to be above +.07, which it is now, and have jumped by +.08

over its levels a week earlier. IP21-based Buy B4s (as opposed to breadth-B4s)

can bring superb DJI rallies even when the internal strength indicators are much weaker

than they are now. For example, B4s appeared on 6/26/1929 with the adjusted P-I

only 115 and the V-I was a -81 with and on 5/28/1942 when the V-I was only +8.

We might want to compare the IP21-based Buy B4s' requirements with

the key values we see now.

Current

Required Key Value

Key Value for Buy B4

based on imporoving IP21

--------------------------------------------------------------------------

1.019

LA/MA must be above 1.027

0.287

OBVPct must be +.32

0.38

The Annualized 21-day ma rise must be above 1.10

-.019 --> .097

IP21 must be +.045 higher than 5 days ago.

.097

The IP21 must be above +.07

---------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->96 +33 MAXCP stocks Bullish MAXCP Stocks (8/29/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 42

-1 MINCP stocks Bearish MINCP Stocks (8/29/2014)

-->

50 +7 New Highs on NASDAQ

13 new lows. Bullish plurality

--> 118

New Highs on NYSE 3 new lows. Bullish plurality

-------------------------------------------------------------------------------------------------------------------------

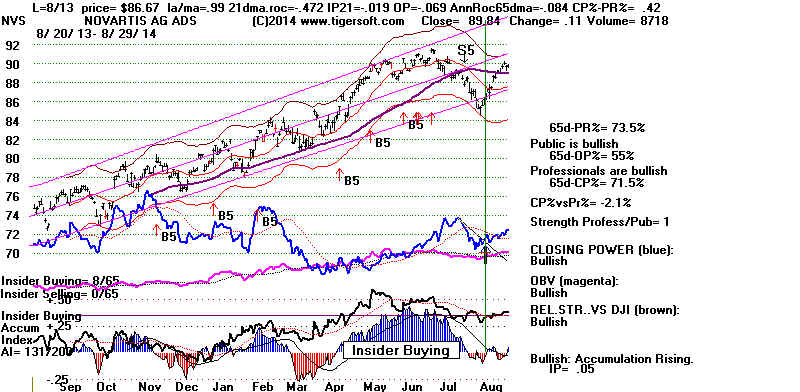

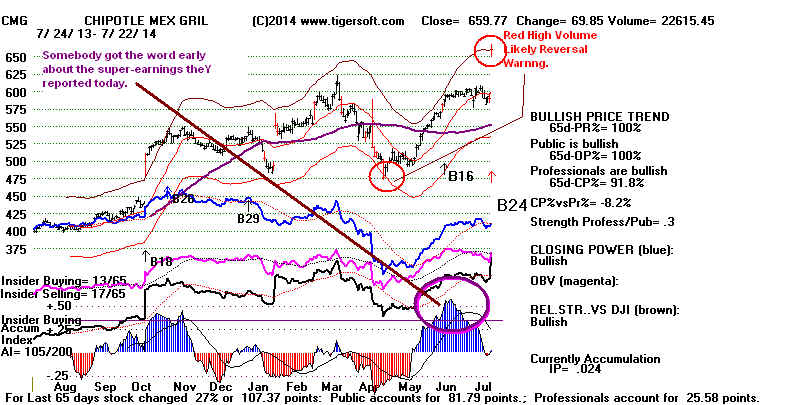

Biotechs Boom

The NASDAQ should get a lift if Biotechs are applauded for yet another drug

break-though. This one by Novartis, which this weekend, announced a 20%

improvement in the treatment of congestive heart failures over existing therapies.

Heart

drug launch could be 'most exciting ever', says Novartis

====================================================================================

OLDER HOTLINES

====================================================================================

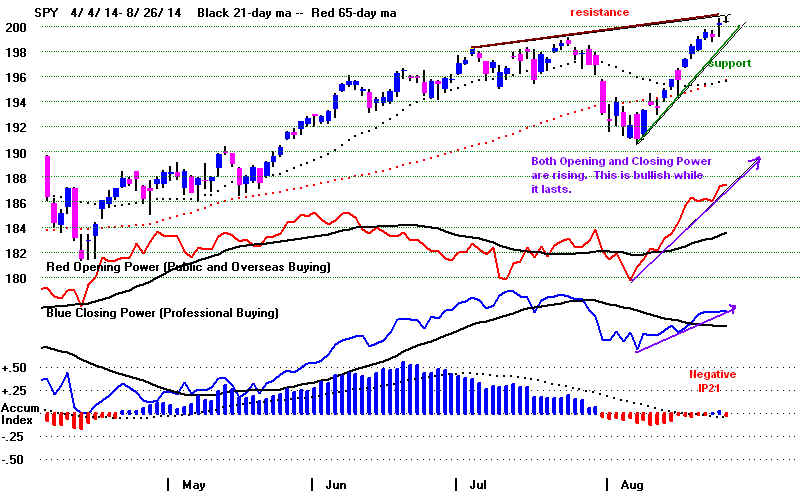

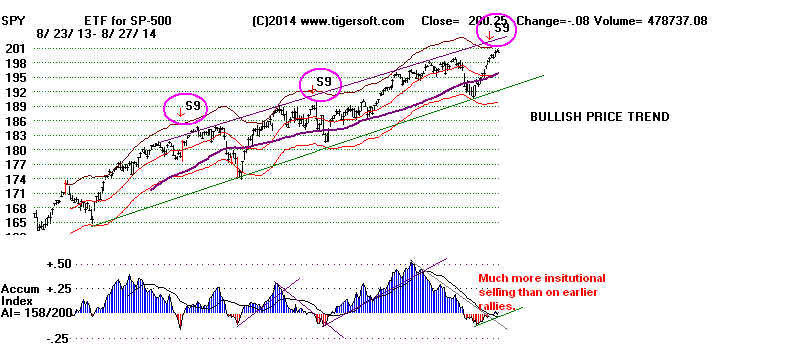

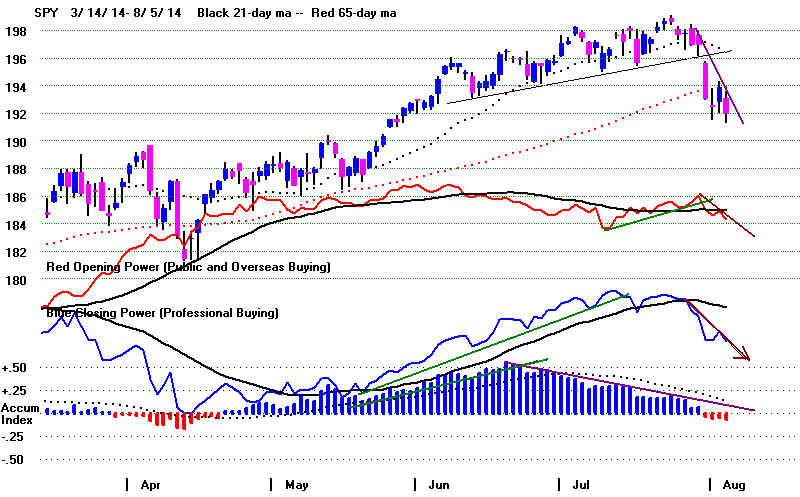

8/28/2014 Still no new Peerless Sell and SPY's Closing

Power uptrend

was not violated. With neither sell signal, I think we have to give the market

a

chance to move higher.

I'm longer-term optimistic first because, swaggery aside, I cannot see the ever-cautious

Obama launching a war with Russia over the eastern-most part of Ukraine,

a faraway land whose Russian-speaking people not surprisingly do not want to be

controlled by a Kiev government that is willing to killing them to keep them loyal.

Secondly, it seldom pays to fight the Fed. They clearly want to prop up the market

and keep rates low. I expect the dividend and NYSE to hold up well in

here.

Respecting SPY's Sell S9 last night, I have suggested on the Tiger Stocks' Hotline

that we take some profits in a few of the NASDAQ stocks that have recently made

nice advances and add some new short sales from among the recent Bearish

MINCP stocks. I've just seen too many September declines not to see the need

to be cautious now.

Bearish September Seasonality

Seasonality will probably limit any rally. Since 1965, the first 10 trading

days of

September have seen the DJI rise only 34.8% of the time.

The market's behavior in September in years of Congressional Elections

since 1946 is worth noting too. When the DJI was in a rising market in

these years, Septembers brought 4 declines and 3 advances. In all types

of markets since 1946, there were 11 declines and only 6 advances.

How The DJI Does in Year of Congressional Elections

since 1946

Aug 31 Sept 31

1946 Market had been falling.

189.2 172.4

1950 Market reversed downtrend in July

216.9 225.4

1954 Rising market

341.3 330.5

1958 Rising market

507.7 532.1

1962 Bear market rally

609.2 578.1

1966 Bear market

788.1 774.22

1970 Rising market

764.58 760.68

1974 Bear market

678.58 607.87

1978 Rising market

876.82 865.82

1982 Rising market

893.3 896.25

1986 Rising market in trading range

1900.2 1767.6

1990 Bear market

2614.4 2452.48

1994 Trading range

3913.4 3843.2

1998 Bear market

7539.1 7842.6

2002 Bear market

8663.5 7591.9

2006 Bull market

11381.2 11679.1

2010 Broad trading range

10009.7 10788.1

2014 Bull market

----------------------------------------------------------------------------------------------

6 up

11 down

---------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->75 +12 MAXCP stocks Bullish MAXCP Stocks (8/28/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 51

+8 MINCP stocks Bearish MINCP Stocks (8/28/2014)

-->

20 New Highs on NASDAQ

25 new lows. BEARish plurality

--> 75

New Highs on NYSE 3 new lows. Bullish plurality

-------------------------------------------------------------------------------------------------------------------------

====================================================================================

OLDER HOTLINES

====================================================================================

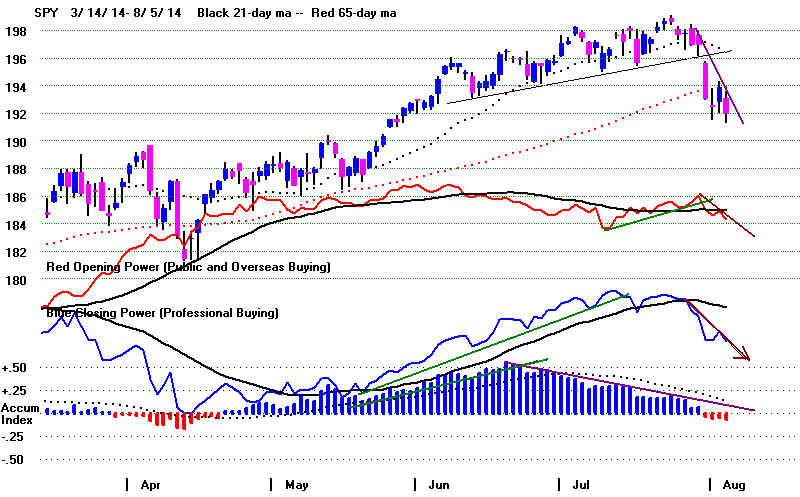

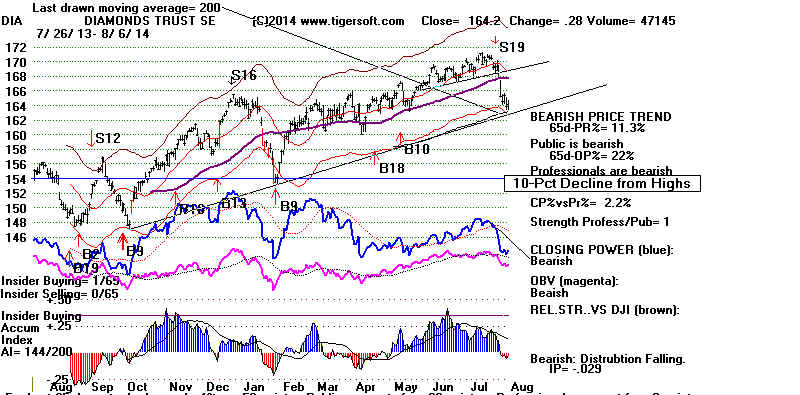

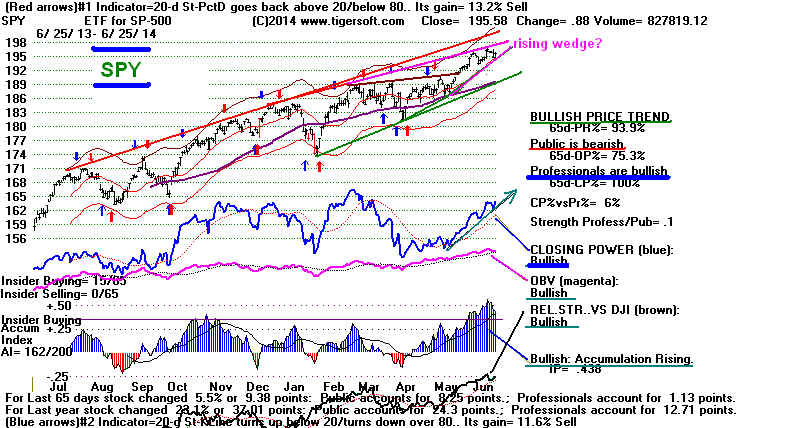

8/27/2014 Consider a break in the Closing Power Uptrend of SPY

a

short-term Sell even if Peerless gives no Sell. A shallower 3%-5% SPY

decline would be typical without a Peerless Sell.

See new SPY Tiger-S9 study below. (This is not a Peerless Sell S9.)

With the major markets' prices so little changed the last day or two,

it's only natural to worry if the loss of momentum here is like a ball that

has been tossed in the air and then stops still for an instant before falling

back down. Peerless actually has a Sell signal for this contingency and it

has not been triggered. I think it's safe to assume volatility will increase

after Labor Day, this coming Monday.

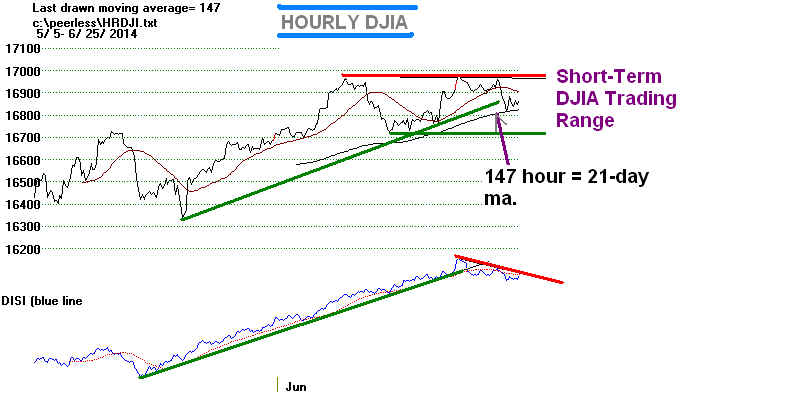

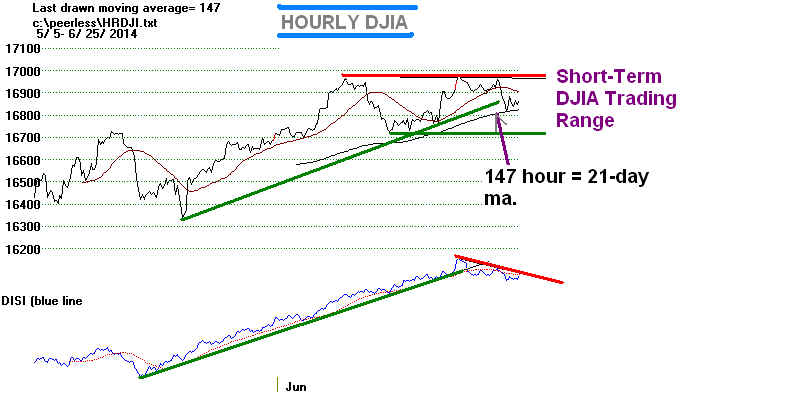

The Hourly DJI's chart shows that short-term traders have

shifted to selling

Note the OBV divergence from its price action recently.

Any Decline Now Should Be Shallow

The DJI keeps avoiding a Sell S9v or Sell S12 by staying away from

the

electrified hot rail, the 3%-3.5% upper band. Though the indexes

seem stalled, there were a healthy margin of 421 more up than down

on the NYSE.

Every day Yahoo publishes the views of another billionaire super-bear. So how

can the market keep rallying? Momentum is king, I think. This is a

bull market

that apparently never corrects. Professional money managers who get out of position

are quickly punished by having prices run away from them if they trade the

major market ETFs. They mostly have become well trained now to "hold" and

"buy all dips". Perhaps, too well trained?!

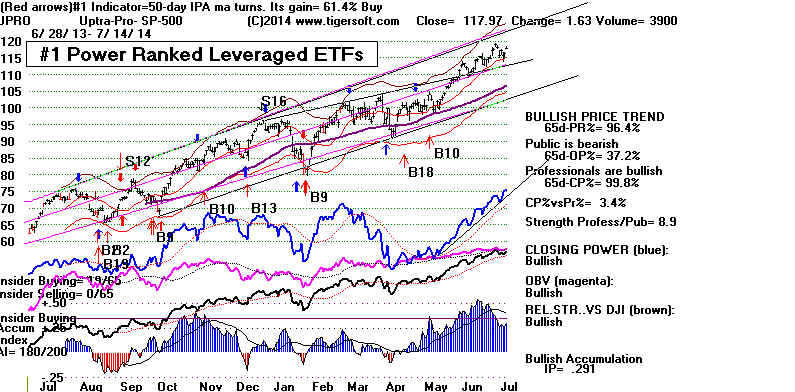

"Can the FED really keep interest rates so low much longer?", you ask.

"Yes" is Janet Yellen's answer looking at the slack in many labor

statistics and

remembering what happened in mid-2008 when the FED failed to foresee the horrible

October debacle that befell the market later that year.

Now we have Europe shifting to an easier set of monetary policies. That's a

big boost for the Dollar. This along with falling oil, gas and food prices "

coupled with a neutral gold price trend, all give the Fed

lots of freedom

to keep rates almost as low as they want for the foreseeable future!

And as we know, the strong Dollar and low interest rates make US NYSE

dividend

stocks very attractive. The latter also invites corporate buy-outs, too, so long

as the DC government chooses not to fuss much over how big and monopolistic

corporations are getting.

These underlying forces remain bullish enough, I think, to limit any

decline

that lies immediately ahead.

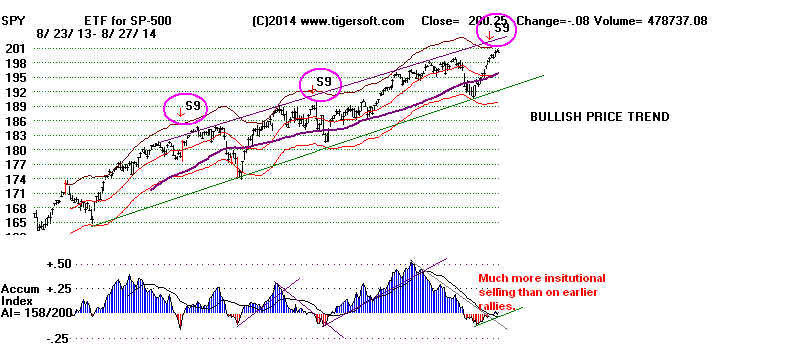

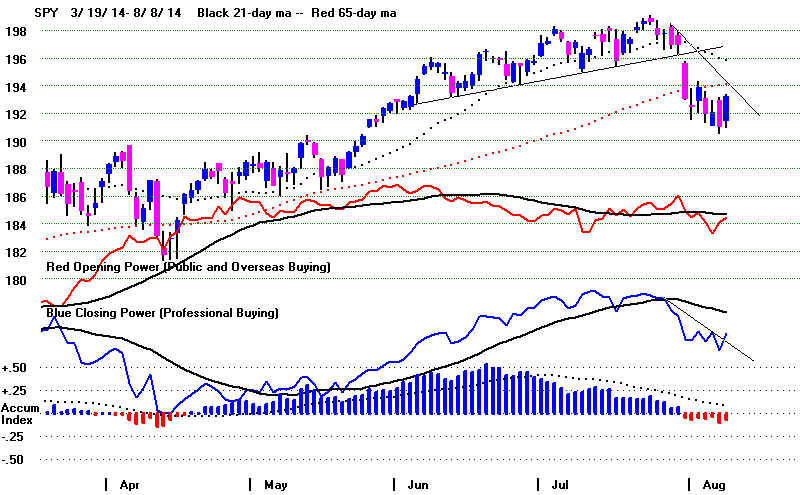

SPY's Negative Accumulation and Closing Power

Non-Confirmation

of the new at 2000 are clearly bearish.

Consider it a short-term Sell if the current Closing Power

Uptrend is violated

even if Peerless gives no Sell. Non-November S9s have produceds very tradeable

declines in 85% of their cases since 1993. See below.

Still, I think we should be concerned. The market could be badly surprised and

all those sellers could become much more aggressive if prices turn down as they often

do in September. Let's consider the most actively traded ETF. SPY has

just produced a TigerSoft "S9", its Accumulation Index was negative a few days

ago with it 2% above its 21-day ma.. Let me look back to 1993, when SPY was created,

and show readers what happened in the past when there were earlier TigerSoft

"S9s".

(Note these are not the same as Peerless S9s.)

TigerSoft S9s: 85% Reliable for SPY, apart from

Novembers.

November TigerSoft S9s did not work out well. The bullish seasonality of

the market turning up in November and rallying in December overcome

November S9s. But the TigerSoft S9s worked out satisfactorily in 17 other

cases and failed only 3 times in the non-November cases. Note that I included

among the successes three instances where the SPY rallied 2-3% and then

sold off 5.5%, 7.4% and 12%.

TigerSoft

S9s 1.5%-3% over 21-day ma

1 May

1993 SPY quickly fell to 1.5% lower band

2 Oct

1993 Quick decline to 1.5% lower band

Nov 1993 decline only back to rising 21-dma and 65-dma

3 Oct

1994 declined in a month to lower 3.5% band.

Nov 1996 SPY rallied from 71.46 to76 and then fell back to rising

65-dma at 72.

4 Oct

1997 SPY declined 10% in a month.

Nov 1999 SPY kept rallying for six more weeks, from 137 to 147.

5

Dec-Jan 1999 SPY 144.18 fell 8% in 2 months.

6 Jul

2000 SPY fell 5% to lower 3.5% band.

Nov 2003 SPY kept rallying for 7 more weeks., from 106.45 to 116.

7 Feb

2004 SPY fell to lower 3.5% band, a 5.8% decline.

8 Jan

2005 SPY fell to lower 1.5% band.

9 Feb

2005 SPY rallied from 119.27 to 122.79

and then fell 7.4%.

10 Jan 2006 SPY only fell to lower 1% band. (failure

#1)

11 Mar 2006 SPY only fell to rising 65-dma, from 129 to 127.5 (failure #2)

12 Jun 2007 SPY fell 3.4% to rising 65-dma.

13 Apr 2008 SPY rose from 138.55 to 143 over next 3 weeks and then fell 12% to 121.

Nov 2009 SPY rose from 111.21 to 114.5 and then fell to 106.66.

14 Jan 2010 SPY fell from 113.33 to 106.66 in a month, This was lower 5.5% band.

15 Jan 2012 SPY rose for 10 weeks without pulling back.

16 Oct 2012 SPY fell 7% to lower 3.5% band

17 Jul 2013 SPY only fell to rising 65-dma (failure #3)

18 Sep 2013 SPY quickly fell 4.5%

19 Dec 2013 SPY rose from 181.70 to 184 and then fell to

175,

20 Apr 2014 SPY quickly fell 3.8%

Aug 2014 ???

See all these SPY charts with TigerSoft

S9s here.

---------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->63 -4 MAXCP stocks Bullish MAXCP Stocks (8/27/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 43

+2 MINCP stocks Bearish MINCP Stocks (8/27/2014)

-->

43 -11 New Highs on NASDAQ

7 new lows. Bullish plurality

--> 101

New Highs on NYSE 1 new lows. Bullish plurality

-------------------------------------------------------------------------------------------------------------------------

====================================================================================

OLDER HOTLINES

====================================================================================

====================================================================================

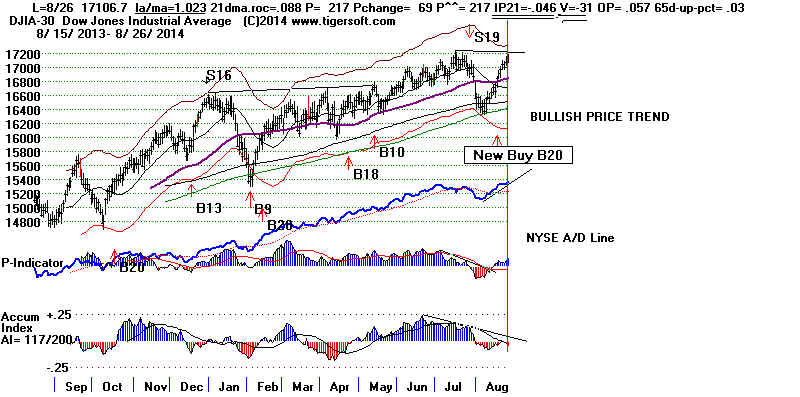

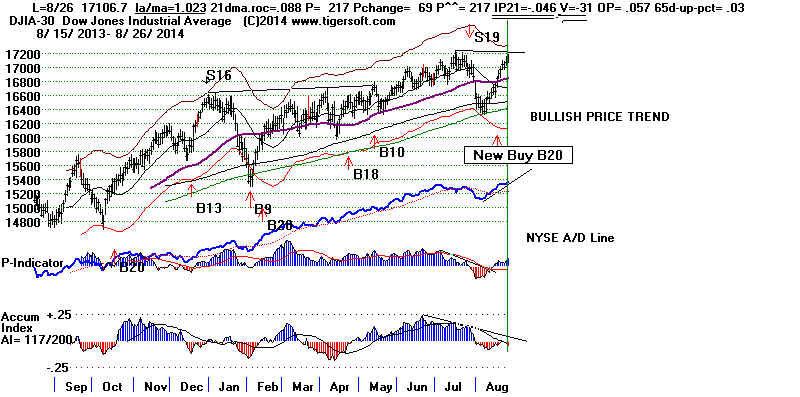

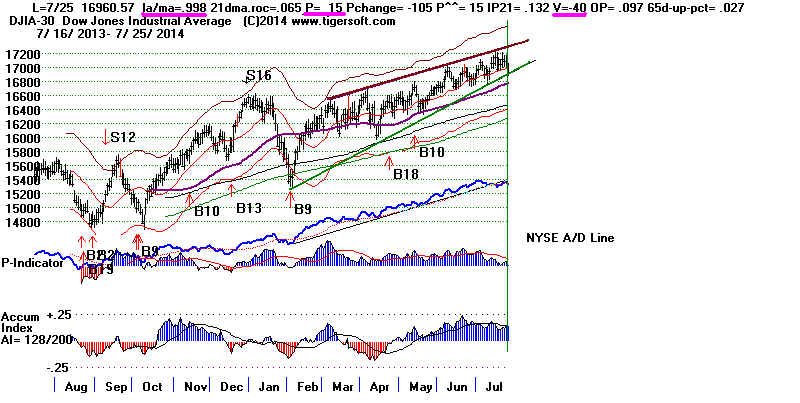

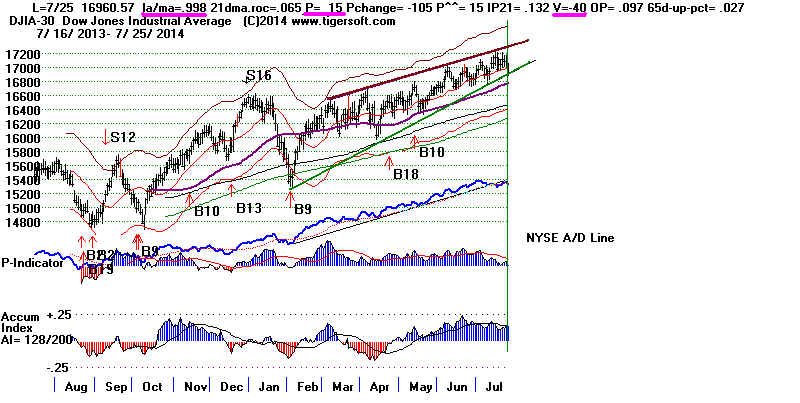

8/26/2014 The DJI is

getting very close to a Sell S12 or a Sell S9V

because it closed 2.3% over the 21-day ma with the both the IP21 and V-I

negative. Breadth remains quite positive, however. Today there were more

than 1000 advancers on the NYSE than decliners. The DJI needs to rally a little

closer

to the upper band for Peerless to give a Sell.

Don't lament the absence of a Sell or the failure to hit the upper band.

This may allow the market to survive this September and rally more substantially

at the end of the year. On the other hand, a DJI rally to 17250 or higher with

the present key values would very likely give a Sell S12.

Still No Clear SPY Breakout

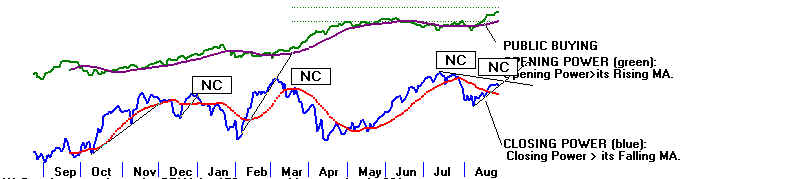

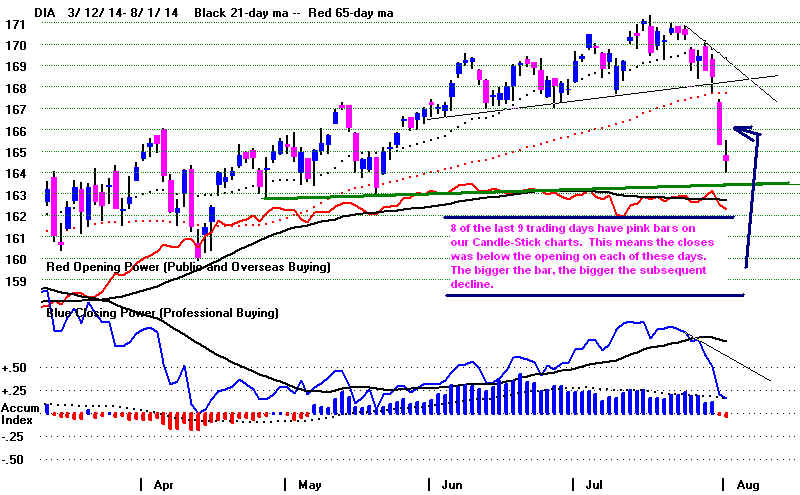

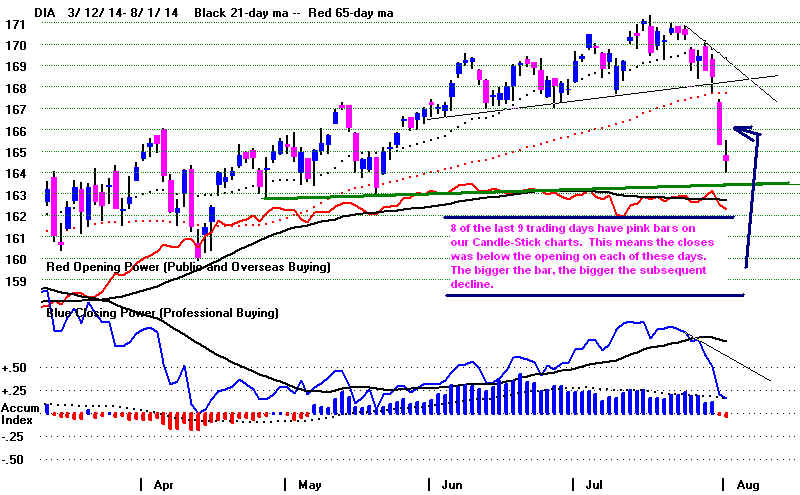

Tiger candle-stick chart shows both Opening and Closing Power are rising.

But Overseas' over-night and Public buying are stronger than US domestic

Professionals' net buying trend. The negative readings from the Accumulation

Index are clear warnings that many institutions are taking profits ahead of

the start of September, the most bearish month of the year.

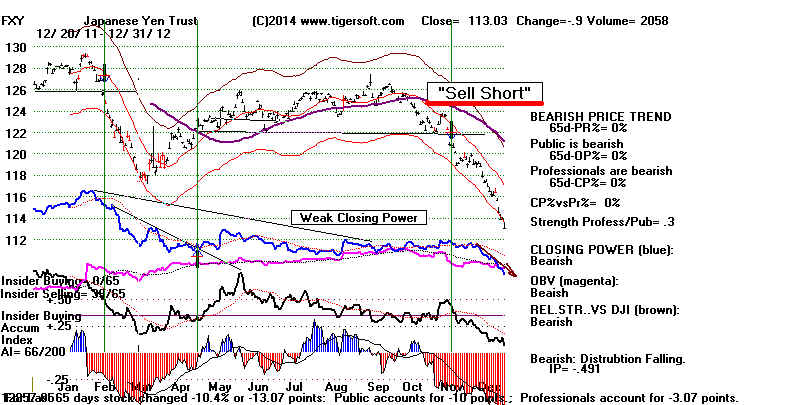

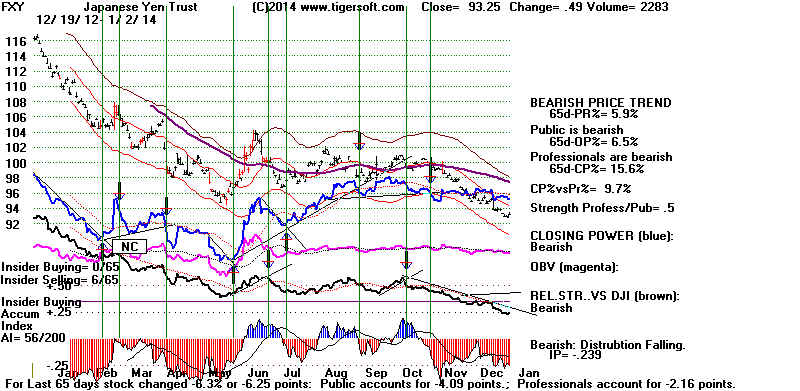

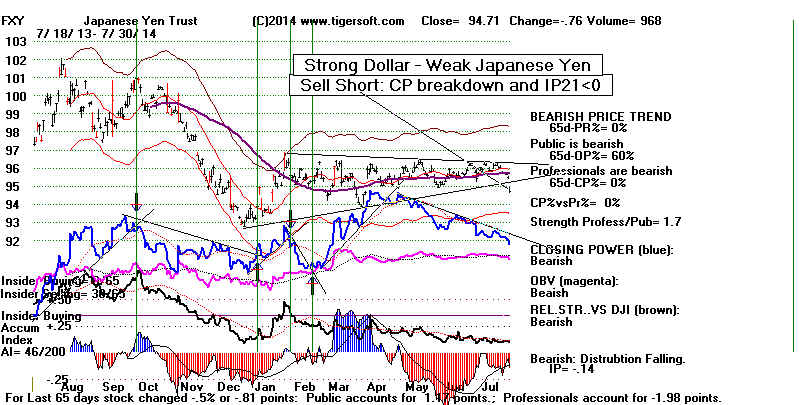

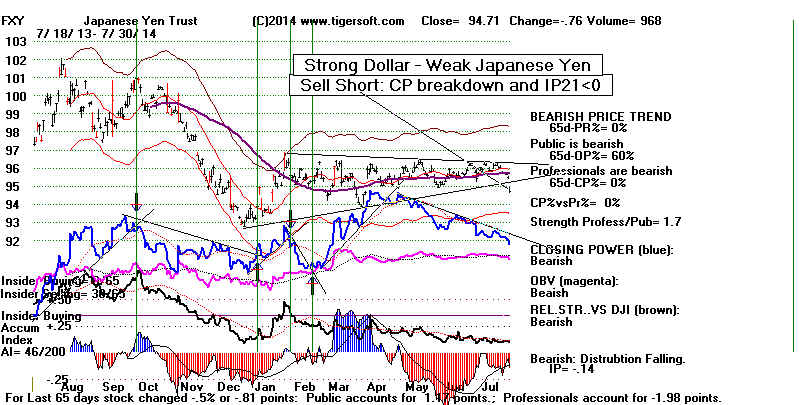

The Impacts of A Strong Dollar:

Higher Stock Prices, Higher Unemployment and

Eventually Another Round of Cuts in US Interest Rates

You'd never know it from Conservatives' loud cries that Obama is setting up

a Weimar or Argentine run on the Dollar, but today the Dollar made a 12 month high.

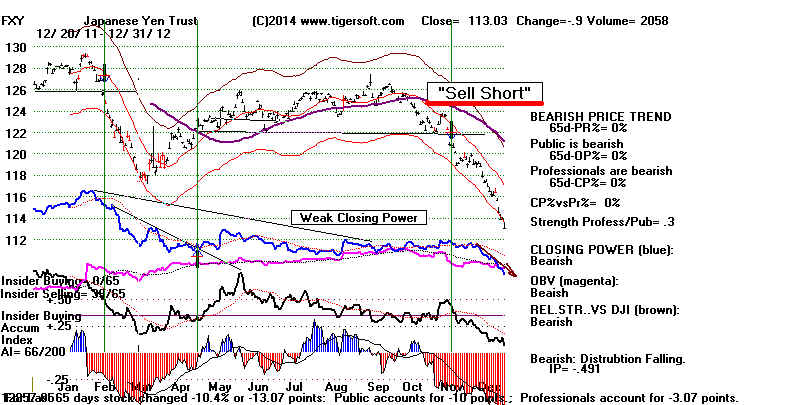

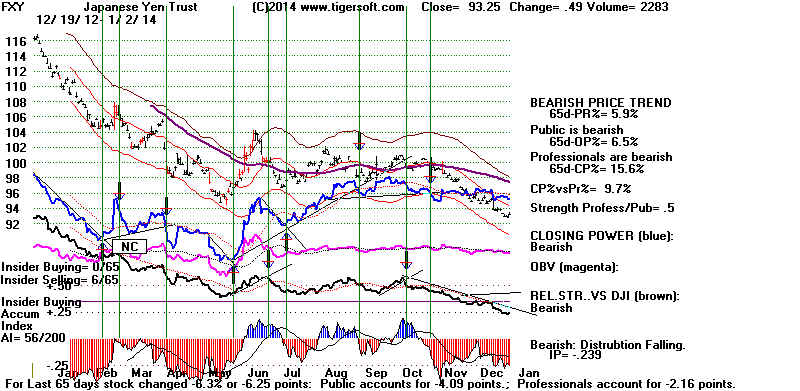

With the EURO testing its 12-month lows and Japanese Yen breaking down again

on heaavy red Distribution now, we can well understand that some of the buying

of US equities now taking is hot international money playing the markets with the

strongest currency. As long as the Europe Union struggles to boost its

weakening

economies with looser monetary policies, the Dollar should keep rising.

These dynamics may breakdown if the FED chooses to prevent the Dollar

from getting too strong. Why would it do this? Because as the the Dollar

rises vis-a-vis other key currencies, imports of manufactured goods will tend

to increase into the US versus exports. The result will be still higher

unemployment in US manufacturing, such as still remains. That will encourage

Yellen and the doves on the FED to pursue looser monetary polcies themselves

in an effort to prevent the economy from stalling out.

.

---------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->67 MAXCP stocks Bullish MAXCP Stocks (8/26/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 41 MINCP stocks Bearish MINCP Stocks (8/26/2014)

-->

54 New Highs on NASDAQ

12 new lows. Bullish plurality

--> 96

New Highs on NYSE 2 new lows. Bullish plurality

-------------------------------------------------------------------------------------------------------------------------

====================================================================================

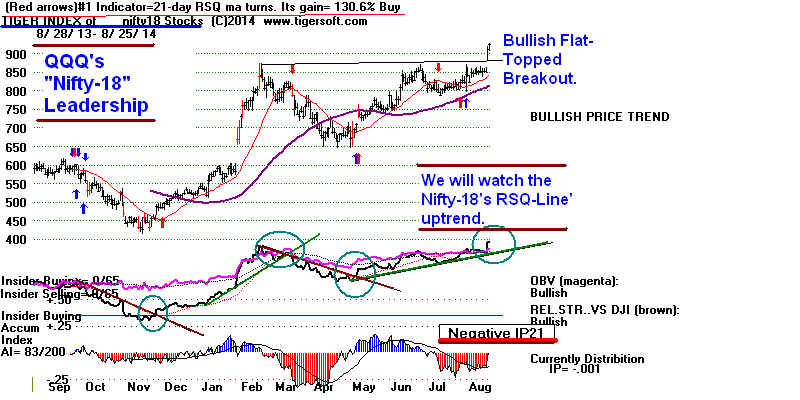

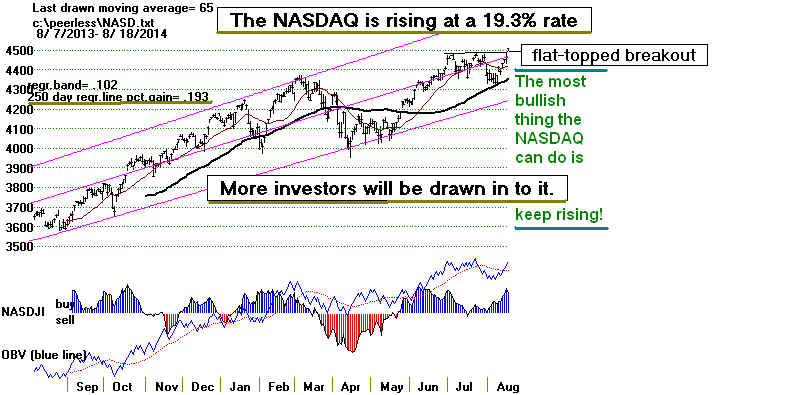

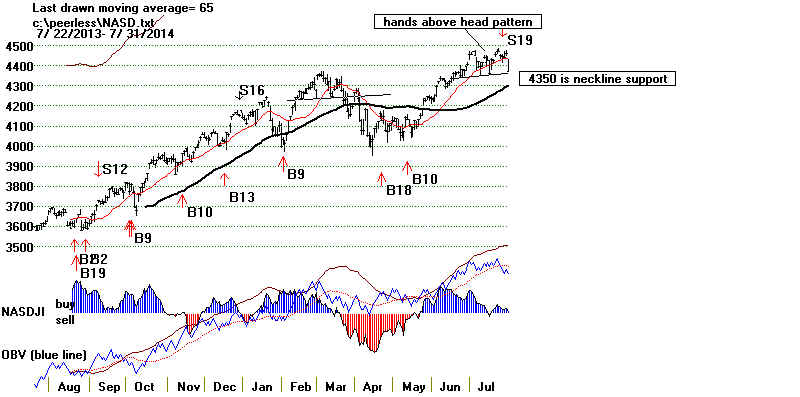

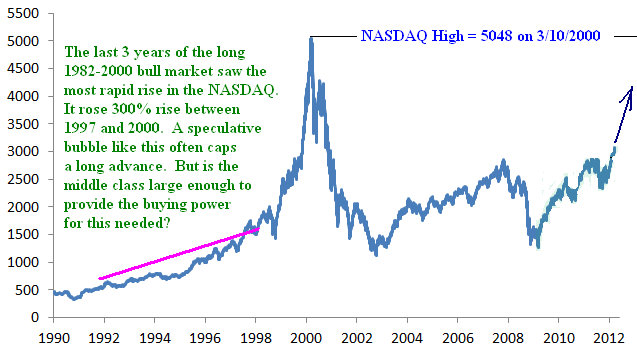

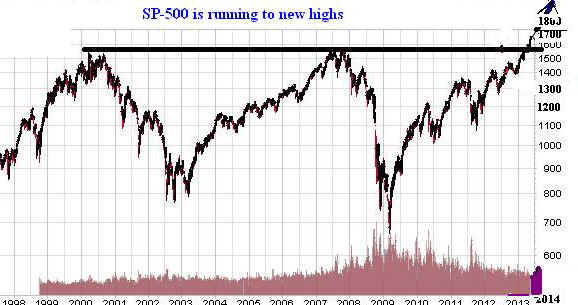

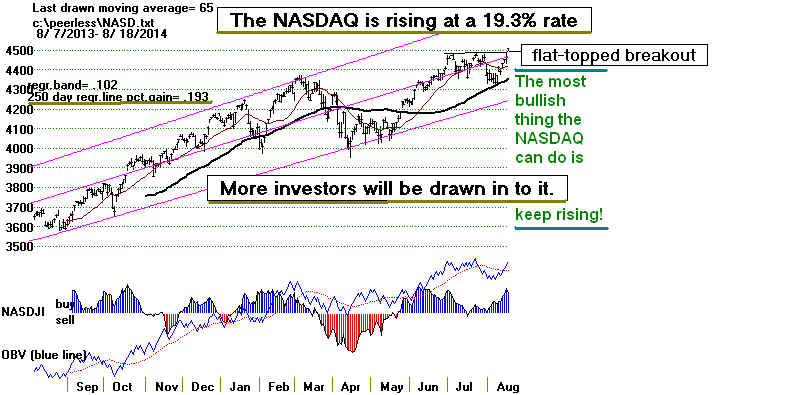

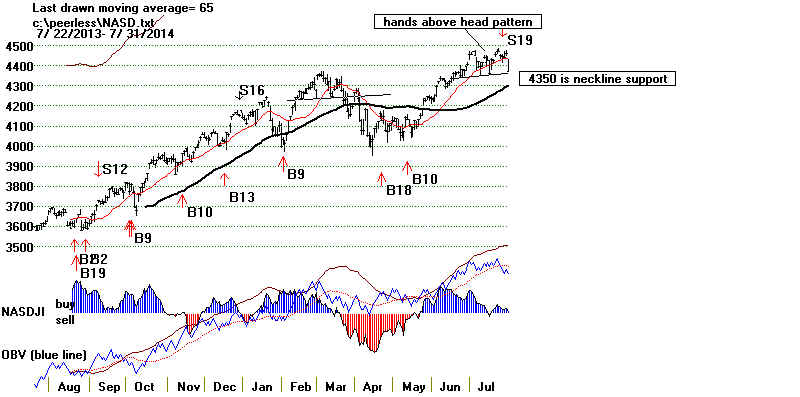

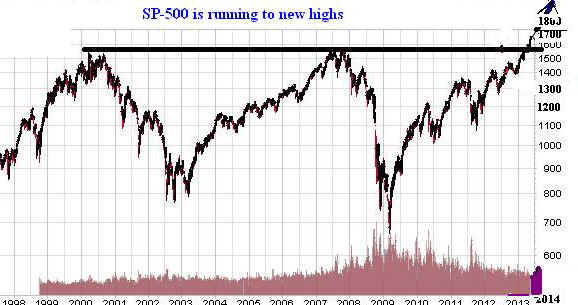

8/25/2014 It was break-out

day for the NASDAQ and QQQ. They are charged

up and seem bound to reach their highs in the year 2000, possibly with or without

any help from the DJI-30.

Reaching their 2000 high closings would still boost the QQQ up more than 15%,

assuming it can get past the round number resistance at 100. At 4556.35, the

NASDAQ now is 498 points (11%) below that target.

The QQQ and NASDAQ are being led by a nifty-18 not unlike the nifty-50 of

late 1972). Each of these nifty-18 are up more than 25% this year:

GMCR, TSLA, MU, AVGO, GILD, SNDK, FB, INTC, FFIV, BRCM,

NFLX, ATVI, AKAM, ALXN, GOLD, MNST, AAPL and EXPE.

See below the Tiger Index of the QQQ's NIFTY-18 and the recent breakout into

all-time high territory. Their Relatuve Strength Quotient based on their index

divided

by the DJI appears to be a great way to watch their momentum swing up and down.

I will report on that regularly here. But we also must note now how their

Accumulation Index is quite negative. Lots of traders and institutions are selling

these stocks on this rally. They are not accumulating. At this late stage in

in the bull market, bulls would like to see internally stronger leadership.

The Market Is Being Led by a Nifty-QQQ-18

Will We Get A September Sell S12 or S9v?

Breadth continues to be bullish, with 700 more up than down on the NYSE today.

Since the market reversed upwards, we have seen 9 of the last 12 trading days

showing 600 more daily NYSE advancers than decliners. And, as I've pointed

put, the new Buy B20 is particularly reliable, always producing a profit at the

time of the next Peerless Sell and seldom showing a paper loss provided the

B20 occurs, as it did here, within 1% of the 21-day ma.

Still, the Buy B20 cannot prevent a Sell signal at the upper 2%-3.5% band.

It may prove significant that the SP-500 could not overcome the selling at 2000.

This could be a warning, as the DJI is now 2.1% over the 21-day ma with a negative IP21

(-.019) and V-I (-43). A DJI jump of 100 points higher from here which does not

improve

these internals will likely bring a Peerless Sell S12. As we know, September

Peerless

Sells are reliably bearish.

That seems to be where we are headed. Going back to 1950, there is a bullish

tendency for the DJI to rise in the week before Labor Day (this Monday)

and the day afterward. Then the bearishness of September often stops a rally.

The

DJI has rallied just 36.2% of the time since 1965 in the 21 trading days following August

31st.

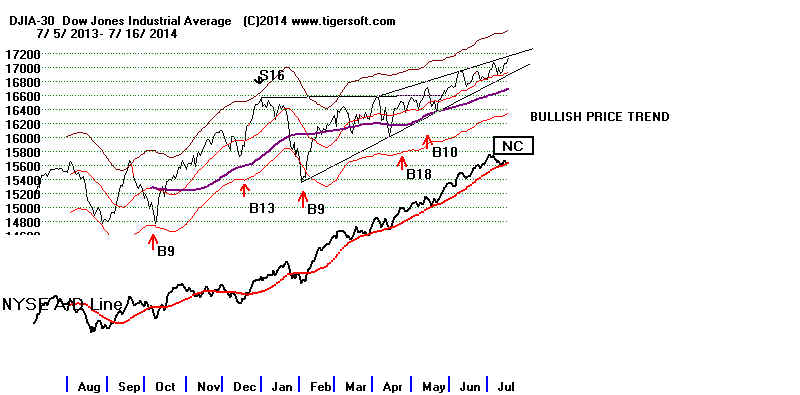

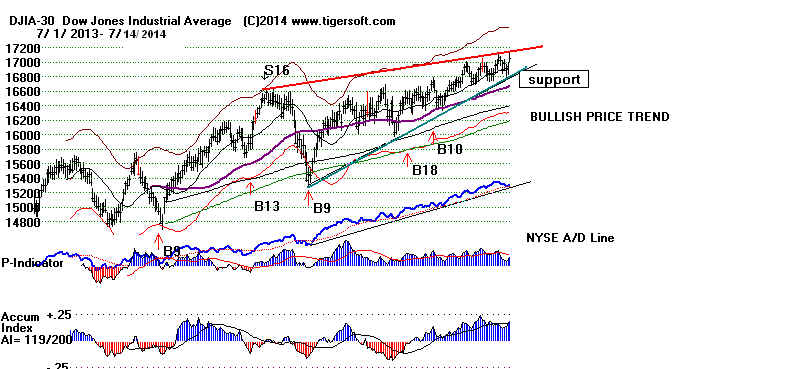

DJIA, Signals and Internals

---------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->66 -2 MAXCP stocks Bullish MAXCP Stocks (8/25/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 56

+19 MINCP stocks Bearish MINCP Stocks (8/25/2014)

-->

68 +28 New Highs on NASDAQ

14 new lows. Bullish plurality

--> 98 +41 New Highs on NYSE 13 new lows. Bullish plurality

--------------------------------------------------------------------------------------------------------------------------

====================================================================================

OLDER HOTLINES

====================================================================================

8/22/2014 The leading

indexes and ETFS, the NASDAQ, QQQ and SPY

cannot seem to get past their rising resistance levels, even though their leaders,

high priced AAPL and GILD are

having no problems continuing to rise.

Weak internals for the DJI now are facing off against the recent very good breadth

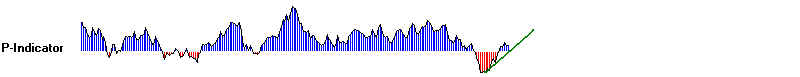

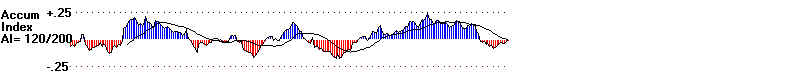

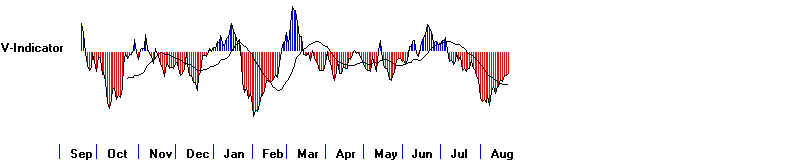

and bullish seasonality. The DJI is 1.7% above the 21-day ma, but the

P-Indicator

stands at only +66 and both the IP21 (-.015) and V-I (-60) are negative. I would

think the market may need to pull back and prepare for another rally into

September. With the Buy B20 and rising Closing Powers, at most, only a shallow

retreat seems likely for the indexes.

---------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->68 -28 MAXCP stocks Bullish MAXCP Stocks (8/22/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 37

-5 MINCP stocks Bearish MINCP Stocks

(8/22/2014)

-->

39 -3 New Highs on NASDAQ

16 new lows. Bullish plurality

--> 47 New Highs on NYSE 12 new

lows.

Bullish plurality

--------------------------------------------------------------------------------------------------------------------------

Seasonailty is bullish now. The DJI has rallied 57.4% of the time since

1965 in the ten trading days after Augsut 24th. Historically,

the market now is much more likely to

rally until a Sell signla in September

or keep on rallying than make a top now

in August.

The Buy B20 is a reliable signal. Seldom are there any paper losses with it

when it occurs within a percent of the 21-day ma. In 10 cases, there were no paper losses.

In the other two cases, the paper losses

were under 2%.

Buy B20s are nice, but the fact remains that it's hard right now to find attractive

stocks to buy. This is a reflection of the low IP21 levels for different major

market

ETFS: But, at least, the Closing Powers are rising:

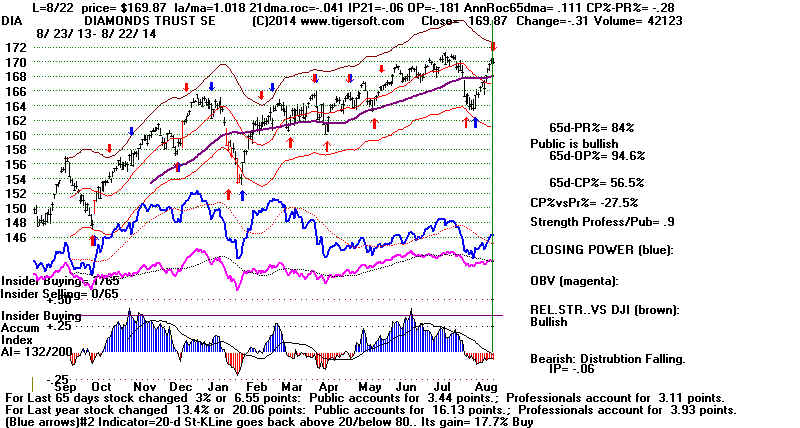

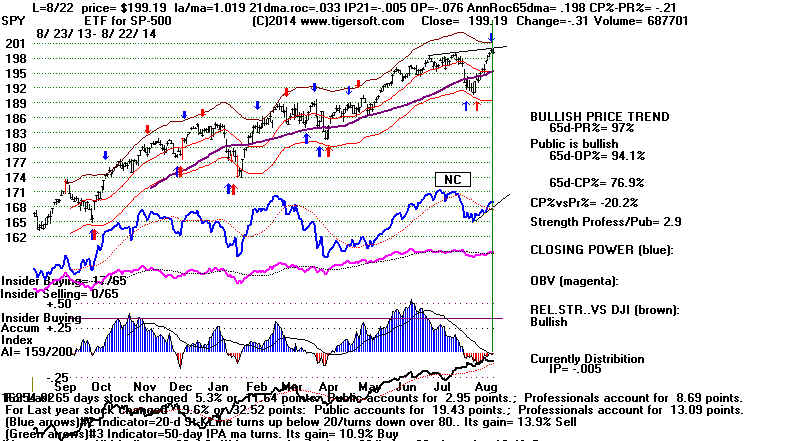

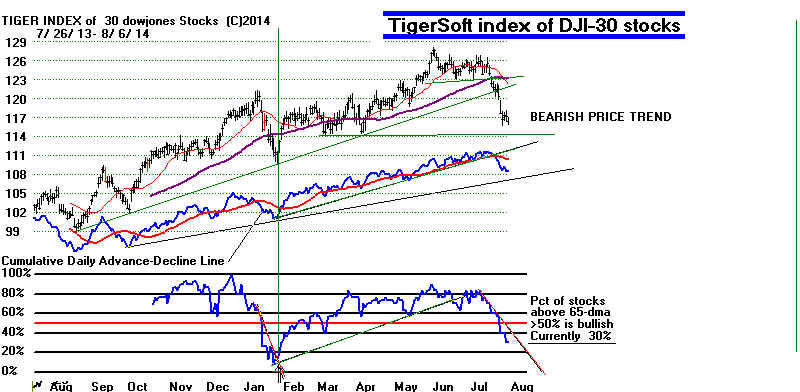

LA/MA IP21 CP%-Pr% CP trend

Automatic Red Signal Chart

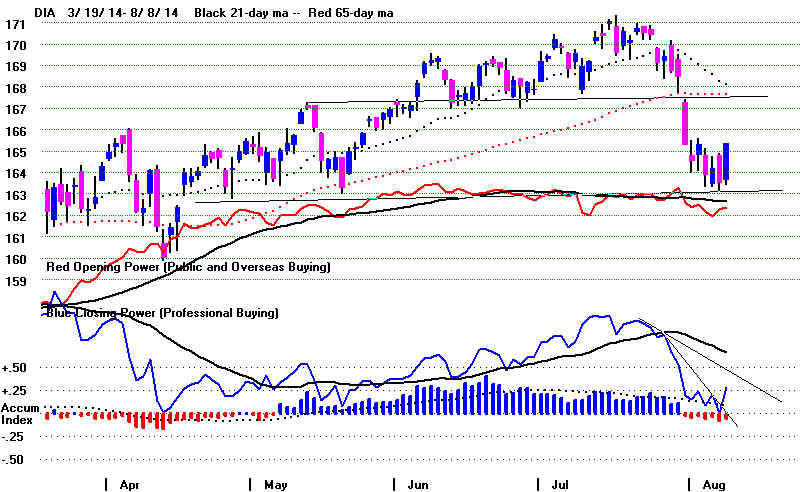

DIA 1.018 -.06

-27.5

UP

New

Red Sell

QQQ 1.027 +.187

0

UP on

Buy

At resistance

SPY 1.019 -.005

-20.2

UP new Blue

Sell At

resistance

IWM 1.018 +.035

+1.9%

UP

on

Buy

Just above rising 65-dma.

====================================================================================

OLDER

HOTLINES

====================================================================================

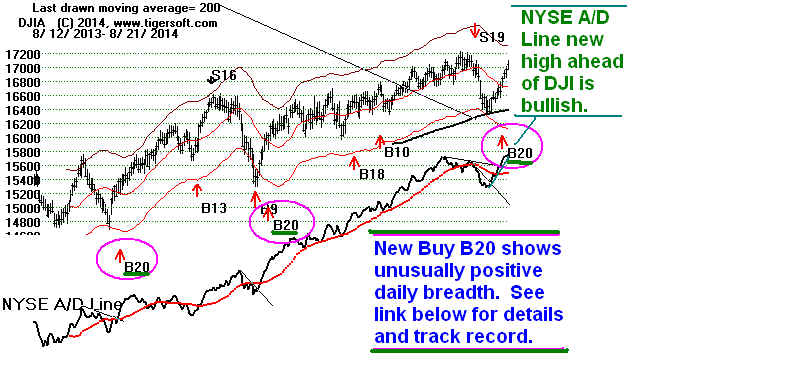

8/21/2014 The DJI is

approaching the 2.5% band with the V-I

and IP21 negative. A minor retreat here would not be surprising.

The Hourly DJI's OBV (DISI) is losing momentum. It led the rally,

now it is weakening.

I dummied in numbers with the DJI up variously 50, 100 and 150

points for tomorrow, but Peerless did not give a new Sell. There

are two explanations.

Septembers are much more dangerous than late Augusts and Breadth

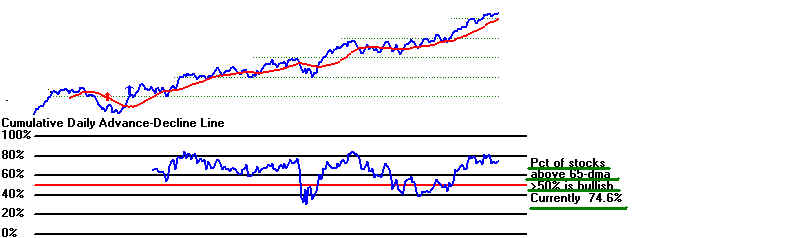

now is excellent. The A/D Line usually produces Sells by not confirming

a DJI new high. Right now, it is the other way-around. The excellent

breadth brought a new Buy B20 a few days ago. Its fine track record

over a meaningful number of cases makes it worth trusting, I think.

A top is most likely to be made, if at all, in September.

The A/D line and the various key ETFs' Closing Powers keep rising,

thereby dumbfounding those who trusted the super-bearish articles Yahoo

and others put on-line, liberally dropping the names of the billionaires and

market gurus who were sure the market was about to plunge.

I guess it still might, I think that it is September and October that we have

to worry about. Since 1965, the DJI has risen 60% of the time over the

10 trading days after August 21st.

September Peerless Sells Are What We

Must Worry About.

By itself, this B20 would not prevent a Peerless Sell at the upper

band. But this is a bullish time of year. In on-going Bull markets,

most market

tops wait until September to be made, even when a Sell occurs in August.

There have been 15 successful September Peerless Sells, 7 of

them

coming in the first nine days. There have been only 3

successful late August

Peerless Sells, In just as many cases, the Augusr Sell

did not "kick in"

until it was reinforced by a September Peerless Sell.

Late-August/September Market Tops

in On-Going Bull Markets

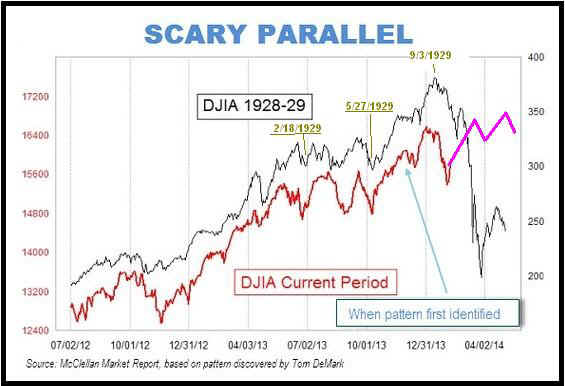

1929 - Aug 28 Sell S12 - DJI rallied

until September 3 and famous Sell S9-Crash!

1935 - Sept 9 - Sell S2 - 3.3% DJI drop to next

Peerless Buy

1943 - Sept 20 - Sell S2 - 7.1% DJI drop to next Peerless Buy

1946 - Sept 9 - Sell S13 - 5.2% DJI drop to next Peerless

Buy.

1951 - Sept 17 - Sell S4 - 5.3% DJI drop to next Peerless

Buy.

1955 - Sept 20 - Sell S8 - 5.3% DJI drop to next Peerless

Buy.

1967 - Sept 14 - Sell S7 - 7.5% DJI drop to next Peerless

Buy.

1975 - Aug 29 Sell S9/S12 - DJI rallied until September 4 when S9 brought 5.2% DJI

decline to next Buy.

1976 - Sept 24 - Sell S1 - 4.2% DJI drop to next Peerless

Buy.

1978 - Sept 8 - Sell S12 - 12.7% DJI drop to next Peerless

Buy.

1979 - Aug 22 - Sell S8 - DJI rallied until September 20 and S7 which brought 9.5% DJI

decline to next Buy.

Exception 1987 - Aug 26 - Sell S4 brought DJI drop of 5.2% on

next Peerless Buy.

1991 - Sept 5 - Sell S1 - 4.0% DJI drop to next Peerless Buy.

1994 - Sept 2 - Sell S1 - 2.3% DJI drop to next Peerless Buy.

Exception 1999 - Aug 20 - Sell S9 - 9.7% DJI drop to next

Peerless Buy.

2007

- Sept 19 - Sell S2 - 6.2% DJI drop to next Peerless Buy

Exception 2011 - Aug 30 - Sell S12/S9 - 7.8% DJI drop

to next Peerless Buy

2012

- Sept 19 - Sell S8 - 5.6% DJI drop to next Peerless

Buy

---------------------------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

--> 96 +3 MAXCP stocks Bullish MAXCP Stocks (8/21/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 42

-11 MINCP stocks Bearish MINCP Stocks

(8/21/2014)

-->

42 New Highs on NASDAQ

16 new lows. Bullish plurality

--> 79 New Highs on NYSE 5 new

lows.

Bullish plurality

-----------------------------------------------------------------------------------------------------------------------------------

The New Buy B20

The new Buy 20 has a very good track record. In fact, it it better than I thought.

It works quite well even when the DJI is farther away from the 21-day ma

than I mentioned last night, provided the DJI is not in, or close to being in,

a bear market. See notes on the Buy

B20 signals for more details.

Forgetting the current bullish seasonality, just on its own merits, I think we

have to accord a Buy B20 to the recent

very good breadth. I will work on

the programming, the paper loss details for the signal and some other Tiger

(not Peerless) signals' refinements and then place the update on the "

Elite Stock Professional Page in a few days. (Others wanting it can email me.

The charge is the usual $75.).

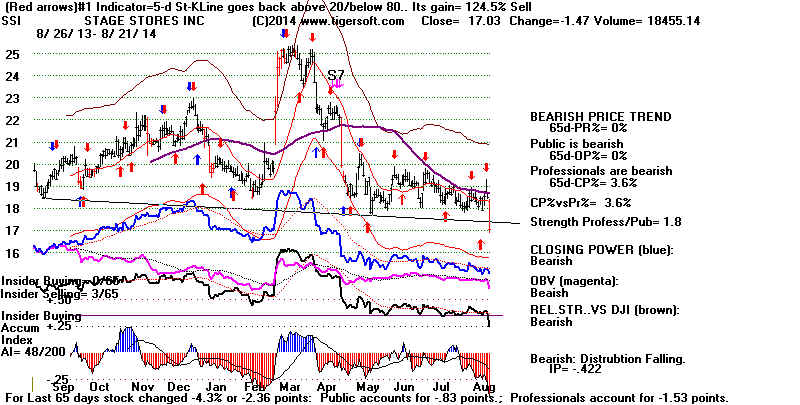

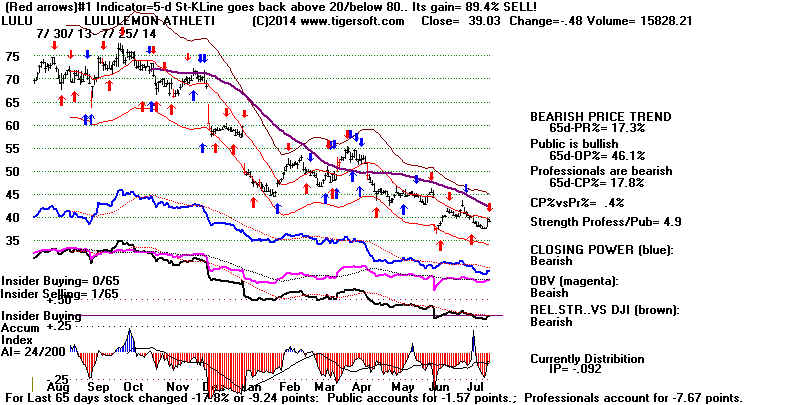

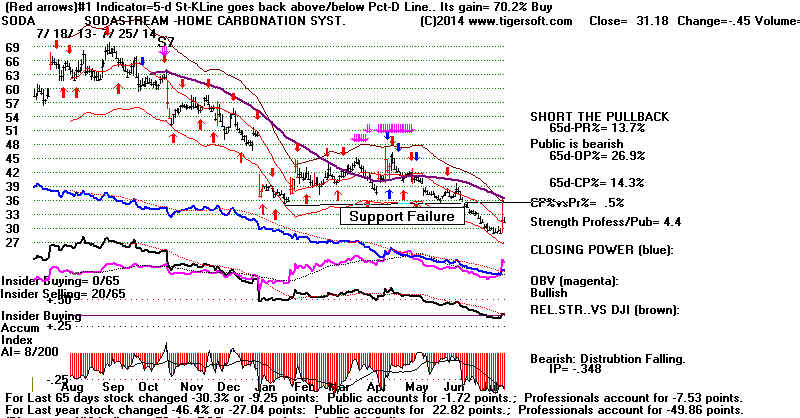

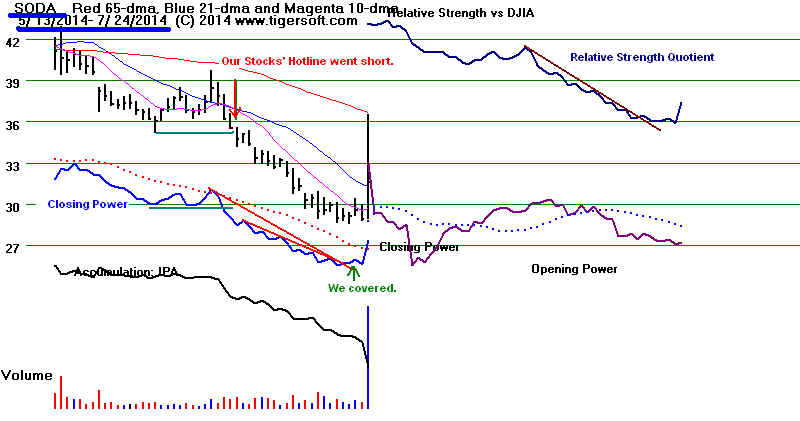

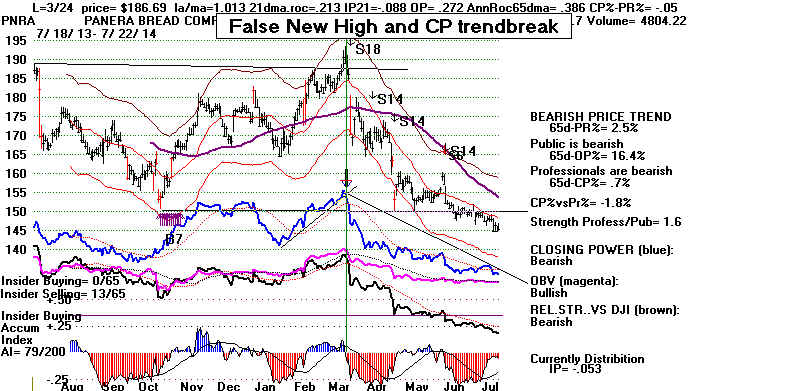

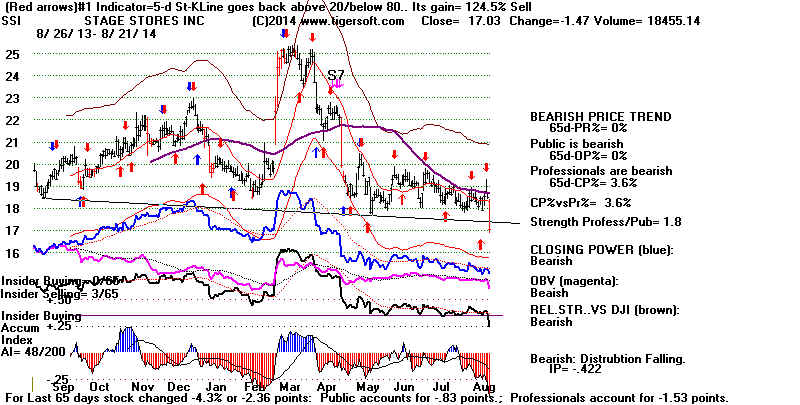

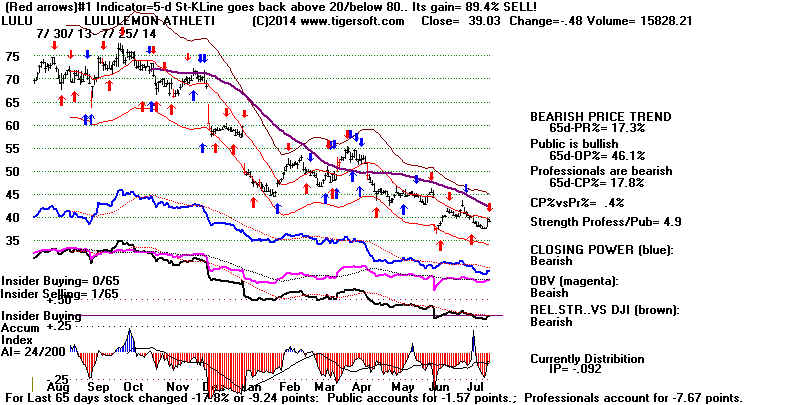

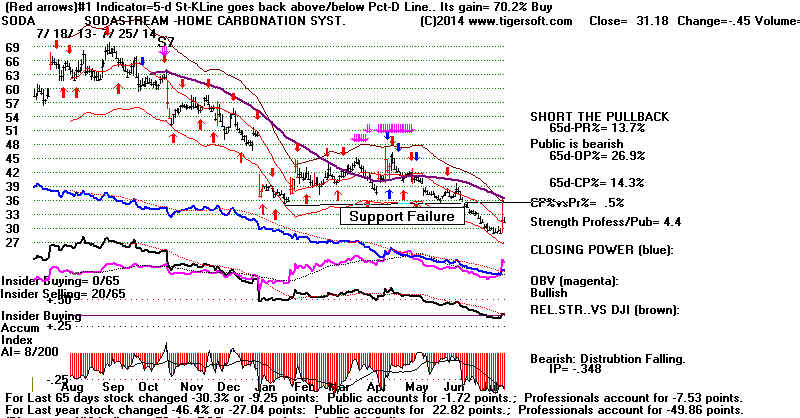

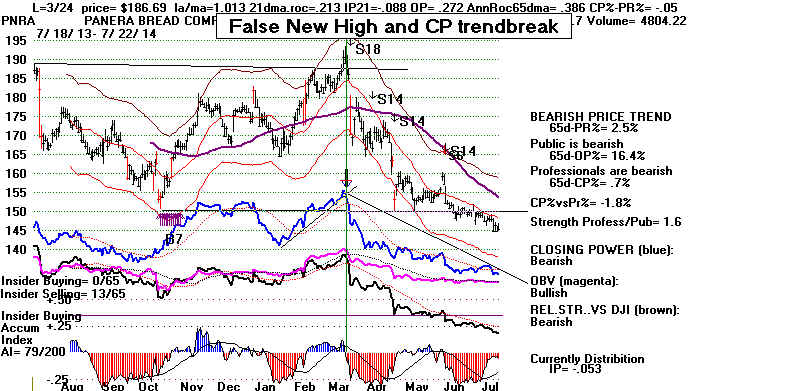

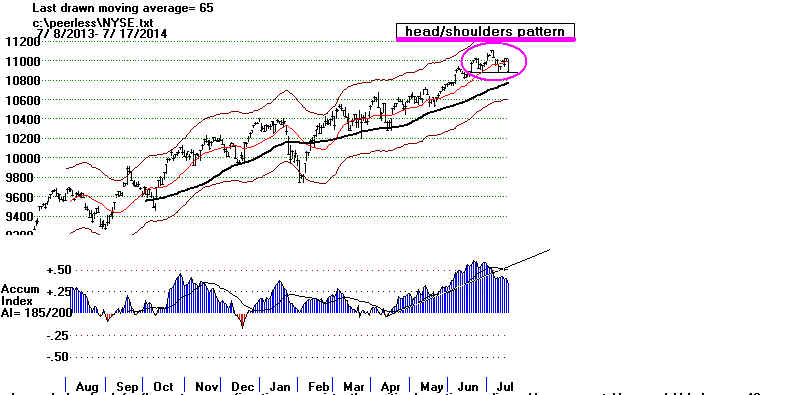

Classic Heavy Red

Distribution and

Flat Bottomed, Well-Tested Support Failure

If there were many stocks that looked as bad as this stock does now,

we would be great trouble. Fortunately, there are not very many,

except others in the Retail Sector. Analysts blame poorer than expected

earnings, I blame the very weak technical pisture here, especially the

utter absence of any Insider or Professional buying. This is a big head and

shoulders pattern that has just been completed. The oattern is 7-8 poijts high.

This produces a minimum downside target of 10-12.

====================================================================================

OLDER HOTLINES

====================================================================================

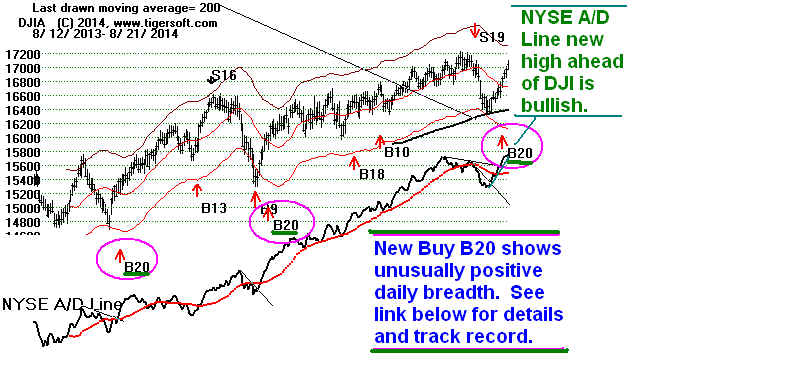

8/20/2014 The Closing

Powers are rising. So, is the NYSE A/D Line and

the US Dollar, thereby giving the Fed more freedom to keep

interest rates low.

(This also invites shorting the weak Japanese Yen ETF, FXY).

New and Relevant Peerless Research Tonight

The unusually positive breadth we have seen on this recovery has a reliably bullish

track record. Don't sell too quickly. The DJI should reach the upper band.

See below how positive the track record of a new Buy signal is. It is based

simply on looking back over any 8 trading days' period and counting the

number of the days in this period that the ratio of NYSE advancers to decliners

is better than 2.5:1. When there are 4 or more such days, it is a bullish

sign.

There are a lot fewer cases of this than I expected. Testing shows the trading

results can be further improved by requiring the DJI's LA/MA

(close divided by 21-dma) to be between .982 and 1.007.

Good results are also generally seen if one allows these signals to occur

down to an LA/MA of .96. An LA/MA above 1.007 often also works, but too

often there subsequently is a pullback from the upper band, thereby making

signals this high up off the 21-day ma more likely to be un-timely. As a

measurement of real and underlying market strength, a high percentage of

these signals are very good. (More on this tomorrow night.)

Historical Cases of New Signal (not yet

numbered)

Date

Gain La/Ma

65-day pct change

of

at time of

Buy

next

Signal

Peerless

Sell

---------------------------------------------------------------------------

8/10/1933 +1.8%

1.005

+.264

9/21/1938 +13.1%

1.000

+.174

2/2/1939 +3.5%

.989

-.056

5/29/1947 +8.9%

1.004

-.045

7/20/1950 +24.7%

.994

-.035

7/27/1950 +25.7%

1.004

-.030

11/9/1950 +14.0%

.996

+.052

long period of time no signals

7/16/2010 +4.4%

.996

-.093

10/5/2011 + 10.6%

.985

-.130

7/1/2013 +3.3%

.996

+.027

2/13/2014 +6.0%

1.005

+.016

8/18/2014 open

1.006

+.023

More on this signal tomorrow night. One thing that should be mentioned is

that this is also a good signal even when one expands the bands that I've

used above. .

---------------------------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

--> 93 MAXCP stocks Bullish MAXCP Stocks (8/20/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 53 MINCP stocks Bearish MINCP Stocks (8/20/2014)

-->

37 New Highs on NASDAQ

23 new lows. Bullish plurality

--> 92 New Highs on NYSE 9 new

lows.

Bullish plurality

-----------------------------------------------------------------------------------------------------------------------------------

Bull Market and Low Interest Rates Predictably

Increase The Urge To Merge

A big semi-conductor, IRF, is being bought out. Mergers

are a major bullish

force for now. And they very often come in bunches in a particular industry.

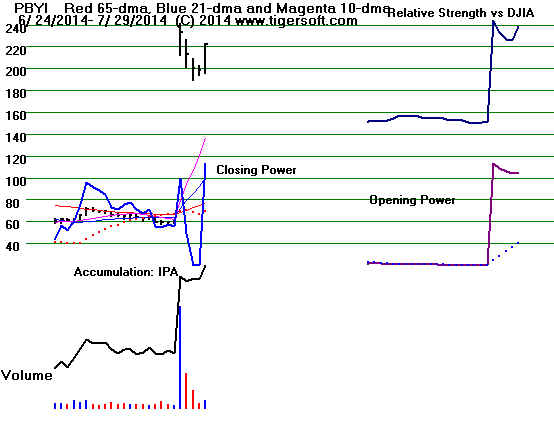

My guess is that semi-conductor ISIL (chart below) will get a sympathetic bounce

here, at the very least. See how its chart shows a recent bulge of intense

Accumulation (IP21>+ .375). By classic Tiger Closing Power theory, this makes

the stock a good one for traders to buy when its Closing Power's downtrend-line

is broken and the CP hooks back up. This shows us that Professionals are again

becoming aggressive buyers of the stock along with Insiders.

Compare ISIL's chart with APA's similar chart. APA has made a very big

discovery of oil in Australia. Special situations like this are very attractive

now. The news on ISIL gives it additional reasons to be bullish.

- Intersil (ISIL) Launches Power Management Integrated CircuitZacks(Tue,

Aug 19)

- Intersil Announces Single-Chip Display Power and LED

Driver for SmartphonesGlobeNewswire(Mon, Aug 18)

- INTERSIL CORP/DE FinancialsEDGAR

Online Financials(Fri, Aug 15)

Closing Power Downtrend-Breaks

after A Bulge of Insider Buying

Intersil - Another Semi-Conductor Buy Out Play?

Apache Oil - Rising despite falling Crude and Gas Prices.

Warning about One-Day Surges of 20%

or More

My inspection of thousands of

charts for 2014 convinces me that it is much more

common for a stock that rises 20%

or more in one day, to pull-back than

to continue to surge. But

wait for the Closing Power to hook down.

These rules would apply now to

SLXP, which was mentioned here last night.

SLXP hopes to benefit by moving

off-shore to escape US taxation. Doing this

increases neither tax-paying

investor confidence nor tax-paying customer appeal.

Such "side-stepping" may

also be made more difficult by Congress in the

not-too-distant future.

====================================================================================

OLDER HOTLINES

====================================================================================

8/19/2014 Look

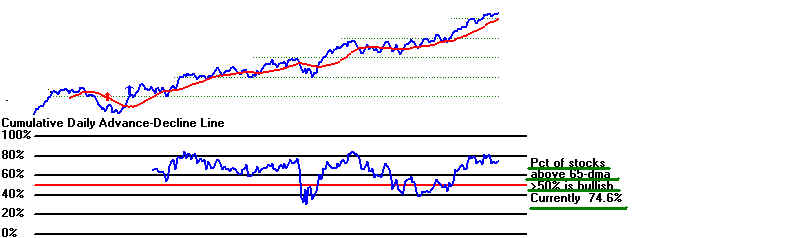

at the NYSE A/D Line soar. It has reached its 12-month

highs way ahead of the DJIA. I would think any retreat now will be minor.

As long as the Closing Powers for the key ETFs are rising,

I think there's a good chance the NASDAQ will see 5000 and the SP-500

will challenge 2000 this Fall. Such round numbers make good headlines

and are seen as a way to bring new money into the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------------------------

The next two weeks have a strongly upward seasonal bias. Since 1965,

the DJI has risen 63.8% of the time on the 10 trading days following

August 19th.

NYSE breadth did weaken a little today. The ratio of advancers to decliners

was still better than 3:2. Since August 8th, 7 of the last 9 days have seen

more

than 1992 NYSE advancers. I will test such numbers tomorrow night and

see how close we are to a Buy B4. This Peerless Buy is based on a sudden

big improvement in the A/D Line. It can signal a new leg up in a long bull

market. See June of 1987 for example.

The A/D Line is very closing to making a new high. Usually tops in September

and October occur with the A/D Line lagging. This strength in the A/D Line,

of course, owes a lot to Janet Yellen's "dovishness" as head of the Fed.

Since we

do not now see rising gold, oil or commodity prices, she will probably be in a

strong position to keep rescuing the market when it starts to succumb to profit-taking

and bearish fears. Speculators have been cautious and somewhat slow to appreciate

just how wedded she is to low interest rates. If the SP-500 and NASDAQ can get

past their round number barriers, we may yet see a wild and climactic, vertical ascent,

not because the economy is getting stronger, but precisely because it is not, and

folks therefore need a better way to make more money.

--> 78

MAXCP

stocks Bullish MAXCP Stocks (8/19/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 54

MINCP stocks Bearish MINCP

Stocks (8/19/2014)

-->

58 New Highs on NASDAQ

23 new lows. Bullish plurality

-->104 New Highs on NYSE 12 new

lows.

Bullish plurality

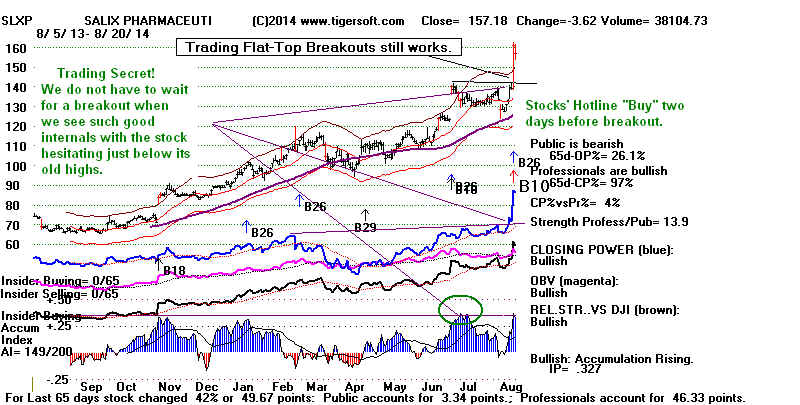

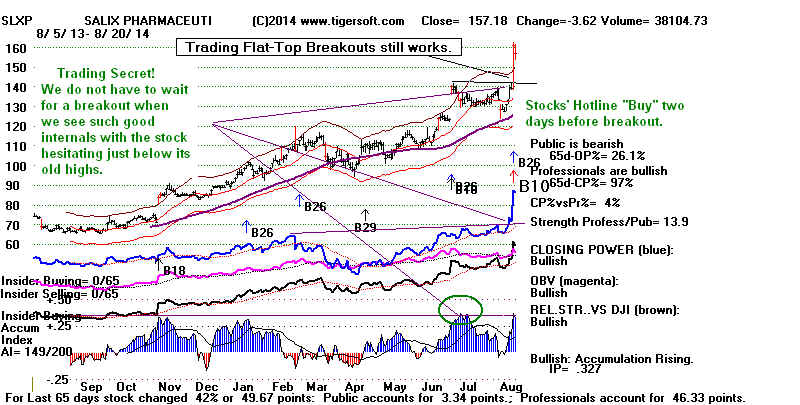

SLXP (below) Seems To Be A Classic Flat-Topped

Breakout:

1) Multiple Buy Signals

2) Red High Volume Breakout.

2) Very High Accumulation even before the breakout.

4) Closing Power new high.

5) Relative Strength new high.

The Public are not buyers here. That should make a new Closing Power uptrend

work well once it is established. If a new buyer for the company enters the

picture, the stock will really take-off.

SALX's 20% run-up today shows the virtue still of looking for stocks at

flat topped resistance with relatively high Accumulation. If

after breaking

out, such stocks stall at their upper bands with red high volume, churning and

reversal days, they probably should be sold when their Closing Power uptrends

are broken. 2014 has had an abormally high number of big 20% jumpers that

quickly faded. This is especially true in low priced stocks with

relatively

weak Closing Power and Accumulation. I see no reason to be a

"buy and

holder" at this late point in the bull market.

====================================================================================

OLDER HOTLINES

====================================================================================

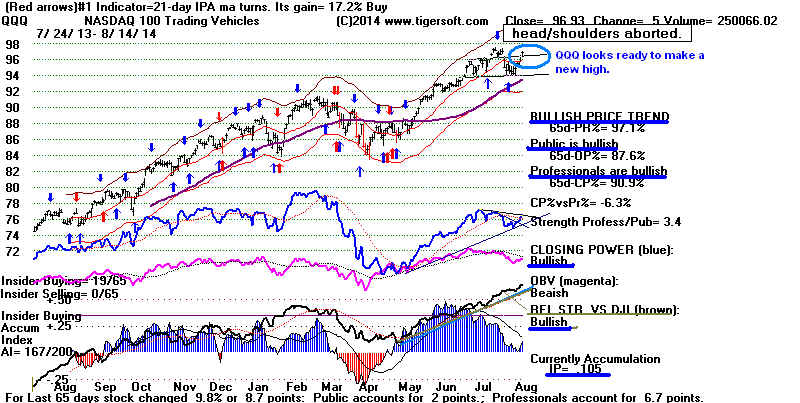

8/18/2014 Lots of

Bullish Technical Signs. We should be

flexible here. The NASDAQ is now breaking above flat, well-tested

resistance. It could be on its way to challenge its high just above

5000 way back in the year 2000. Peerless was also on a Sell Signal

back then. So long as the key ETFs' Closing Power trends are up,

expect higher prices. This speed of this reversal is bound to cause

some grief among short sellers.

Yellen's Definition of "Full Employment"

The FED remains a very bullish force. We've seen many cases when

the FED has quickly intruded and prevented an incipient market decline from

getting much worse. Just a few "hints" about the need to keep

rates low until the employment picture is better does the job. And now

if rates are not raised until Janet Yellen's definition of "full

employment"

is reached, the bull market could continue much longer than folks expect.

The change that Yellen brings to the Fed in this respect is all-important.

See

http://www.moneynews.com/Economy/Federal-Reserve-Janet-Yellen-Full-Employment-Jobs/2014/05/20/id/572269/

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------------------------

--> 48

-24 MAXCP

stocks Bullish MAXCP Stocks (8/18/2014) Bullish

plurality

Highest A/I 200 DJI-30 Stock - CAT

--> 95

+41 MINCP stocks Bearish MINCP

Stocks (8/18/2014)

Retail Stocks with Multiple Pot-Holes of Insider Selling

AEO, EXPR, CHS,

ASNA, SSI, ANN

Sharp declines Friday by DDS (Dillards) and JWN (Nordstroms)

-->

28 New Highs on NASDAQ 22 new lows. Bullish

plurality

--> 45 New Highs on NYSE 13

new lows. Bullish plurality

The Bullish Technical Signals

That Traders Must Be Able To Spot

The Peerless Sell was a weak signal. That was our best clue that a

reversal could come. But there were many others. They must be factored

in if we want to trade aggressively and avoid some big losses by being short

in violent up-drafts that often come late in a bull market.

For the fifth time in the last 7 days, there were more than twice

as many advancers on the NYSE as decliners. Orthodox Peerless users

should know that we could be getting a Buy B4 soon. This is based on a

dramatic improvement in either NYSE breadth or the IP21.

But even if we do not get a Buy B4 signal, there have been lots of technical signs

recently that have suggested a spirited rally. Whether you're looking at

individual stocks, ETFs or indexes, know that a reversal upward can take

place when:

1) The DJI rallies up from or back above its rising 200-day

ma with a big

move and excellent breadth.

2) Earlier bulges of Accumulation (above +.375) tell us that Closing

Power downtrends are usually reliable Buy signals. See the many

ETF's IP21 bulges in July and recent CP trend-breaks. SPY, IWM, DIA, QQQ

etc.

3) The rising 65-day is closed above with the P-Indicator or IP21 positive.

DJI and QQQ show examples of

this.

4.) Broken well-tested resistance (neckline in H/S patterns) should reverse

the next rally. When instead prices quickly get back above the H/S neckline

and the 65-dma resistance, at a minimum, expect a short-covering rally.

This seems to be developing now in MDY.

5.) The apex of the right shoulder in the current head shoulders pattern

is broken above. This appears to have happened, for example, with QQQ

and very important stocks like AAPL and CAT.

6.) The DJI, SP-500 or NASDAQ make breakouts above well-tested resistance.

That is what NASDAQ is doing now.

Look for A Reversal back Upwards

by Oil Stocks

Keep an eye on APA (Apache, which has just discovered a very large deposit of

oil in Australia). It is holding at its rising 65-dma and shows a recent bulge of

Accumulation. By our Closing Power rules, any CP hook back up will be a

good buy signal.

====================================================================================

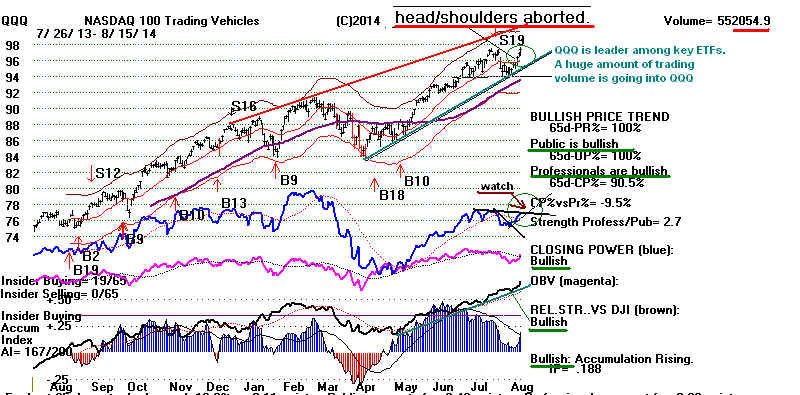

8/15/2014 The

QQQ seems ready to make new highs now, but DIA and

MDY are still below key resistance. This is not strange or without precedent.

In the final stage of the 1994-2000 bull market, performance driven funds ran

up QQQ and BBH a long ways in the three months after the DJI topped out.

The low interest rates now add an additional complication as NYSE dividend stocks

continue to hold up well now even as other consumer-based groups, like Retail

stocks, show signs of starting a new leg down. Biotechs also have the appeal

of not being directly dependent on the economic cycle.

Friday's downturn owed to misconstrued reports that Russia and Ukraine were

on the verge of war. Since these fears were over-exaggerated, I would think the

markets will rise strongly on Monday. In this way, the market keeps eating

away

the over-head supply of stock.

It will help, as I've said, to emphasize sectors now. Peerless is based on and

predicts

the DJI best. So, it's still approriate that Peerless has not yet reversed the

Sell S19.

The market does usually gets a seasonal boost as it goes into September. But be

careful.

Despite the low interest rates, there are many more bearish looking MINCP stocks

than bullish looking MAXCPs.

Retail stocks were hurt on Friday as Dillards and Nordstrom's fell sharply.

Many of them show steady insider selling. Shorting some of them now seems a good way

to stay hedged while being long QQQ.

COMBINATIONS

I had lunch last week with a professional boxer. I asked him what was the biggest

difference between a Pro and an Amateur. He said many things. But what made

an impact on me, was how a Professional Boxer learns and practices combinations.

Ever since then, I've been thinking about how Tiger's major Buy signals combine

in different situations. And I've now examined 2000 charts to better understand

how the Buy B10-B12-B20-B24 combinations.

This weekend's study of biotechs is cautious. It concludes that we must trade

these now with new Tiger rules (linked to below), rather than trying to find some

big winners and holding tightly. What's also dismaying now is the absence

of good biotechs now with fresh major Buy signals.

New Study Today - Trading Tactics

for Biotechs Using Major Tiger Buy Combinations,

This makes use of Closing Power Hooks, Red High Volume Reversals at Upper Band

and Head/Shoulders tops. For much more information (theory, trading tactics and

examples), get TigerSoft's new Explosive Super Stocks.

-----------------------------------------------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart

SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------------------------

--> 48

-24 MAXCP

stocks Bullish MAXCP Stocks (8/15/2014) Bullish

plurality

It's hard to see a sector pattern right now

among the leading Bullish MAXCPs.

That begs the question of whether bullish special situations are enough to lead

prices

much higher.

Highest A/I 200 DJI-30 Stock - CAT

--> 95

+41 MINCP stocks Bearish MINCP

Stocks (8/15/2014)

Retail Stocks with Multiple Pot-Holes of Insider Selling

AEO, EXPR, CHS,

ASNA, SSI, ANN

Sharp declines Friday by DDS (Dillards) and JWN (Nordstroms)

-->

28 New Highs on NASDAQ 22 new lows. Bullish

plurality

--> 45 New Highs on NYSE 13

new lows. Bullish plurality

====================================================================================

OLDER HOTLINES

====================================================================================

Give The Market More Chance To Advance

8/14/2014

The market keeps eating away the over-head supply of stock and refuses to

sell-off. Usually, a close back above a rising 65-dma is bullish. That

is what the SP-500

has just done. Usually, a close above a tentative head/shoulders pattern's right

shoulder

apex is bullish. That is what QQQ has accomplished today.

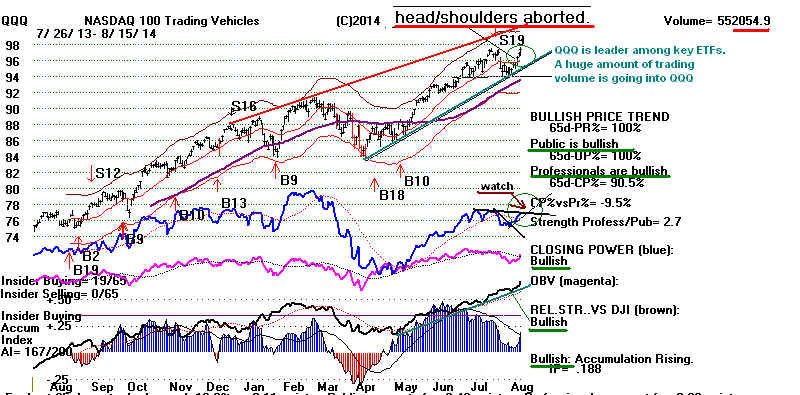

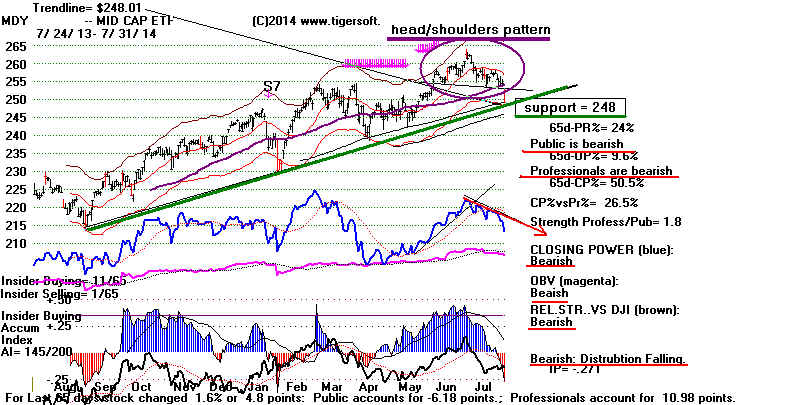

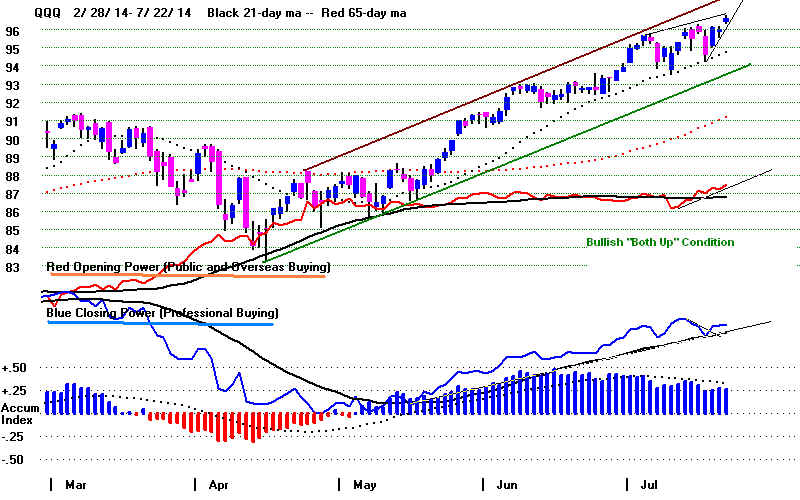

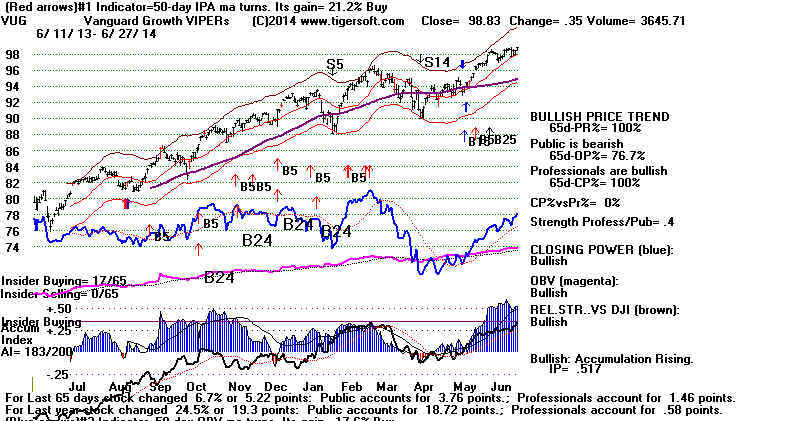

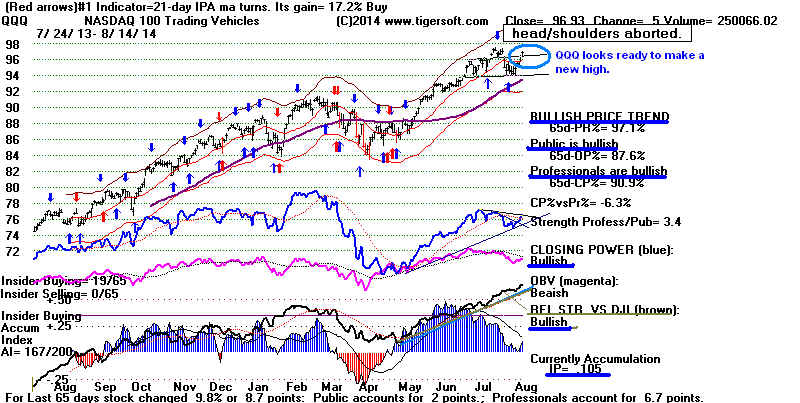

Both Professionals and The Public Are

Bullish Now on QQQ.

The DJI May Continue To Lag QQQ

The weak Peerless S19 on the DJI has not been reversed.

Rather I would say it has

been "suspended" in dererence to the obvious short-term bounce we have seen

up off the DJI's rising 200-day ma. In addition, we know from the period Janary-

March 2000, that the QQQ can rally very strongly even with a more powerful

Peerless Sell S9 is in place in the final stages of a bull market.

Given the length of the current bull market 's rise without as much as a 10% correction,

it is probably best to trust the Professionals's skepticism of the advance and stay

short a few of the Bearish MINCP stocks.

The bullishness in SPY and QQQ has to tempered because we

note that the DJIA and DIA

are not back above their flat 65-dma resistance and because MDY

(representing the mid-caps)

has only just reached its 65-dma and the neckline resistance of its classic head/shoulders

pattern. But as long as the short-term Closing Powers keep rising, I would stay

bullish QQQ and SPY. Keep in mind that Friday's have produced daily gains

59.6%

of the time over the last year for SPY.

Gold (GLD) has not had a big surge, thereby warning us of a

market top. It is the same level

it was a year ago, 6 months ago and also 3 months ago. In addition, Oil prices are falling again.

This puts money in the pocket of consumers. The yield on 10-year

Treasuries is again under

2.4%. Food prices continue to drop, judging by looking at DBA.

This, too, makes it harder

for the Hawks in the FED to argue that inflation (apart from in stocks) is a big

enough

threat to raise interest rates.

Watch AAPL...

Let's watch AAPL (below) to see if it can keep rallying, thereby destroying its

potential head/shoulders. A jump in AAPL next would likely cause a burst of

short-covering in it and also in QQQ.

And Biotechs

We see now a handful of bigger biotechs like AMGN and GILD lifting QQQ.

The Ebola crisis will likely intensify public and private investment in biotechs.

Let's watch the upswings in FBIOX and BBH to see if they continue and if this

bullishness then spreads to smaller biotechs. Look for more on specific biotechs

this

weekend. It should be noted now that our broadly based Tiger Biotech Index has

out-performed the DJI by 25% over the last 50 trading days.

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 72

-2 MAXCP

stocks Bullish MAXCP Stocks (8/14/2014) Bullish

plurality

It's hard to see a sector pattern right now

among the leading Bullish MAXCPs.

That begs the question of whether bullish special situations are enough to lead

prices

much higher.

Highest A/I 200 DJI-30 Stock - CAT

--> 54

-23 MINCP stocks Bearish MINCP Stocks

(8/14/2014)

--> 29 New Highs on NASDAQ 27 new lows. Bullish

plurality

--> 48 New Highs on NYSE 11

new lows. Bullish plurality

====================================================================================

OLDER HOTLINES

====================================================================================

8/13/2014 The DJI

moved up 91 on the best breadth so far in this 4-day rally

up from the rising 200-day ma. Low interest rates continue to be an elixir for

many, many dividend stocks. But now the market's rally will start facing much

keener resistance. It should will take more than higher openings to advance

the market. The recovery must now get past the selling by NY based institutions

and professionals at the classic short-term resistance levels now presented.

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 74

+17 MAXCP

stocks Bullish MAXCP Stocks (8/13/2014) Bullish

plurality

It's hard to see a sector pattern right now

among the leadin Bullish MAXCPs.

That begs the question of whether bullish special situations are enough to lead

prices

much higher.

Highest A/I 200 DJI-30 Stock - CAT

--> 66

+2 MINCP stocks Bearish MINCP Stocks

(8/14/2014)

--> 32 New Highs on NASDAQ 23 new lows. Bullish

plurality

--> 46 New Highs on NYSE 17

new lows. Bullish plurality

Distribution Is Still Apparent

I noticed that of the 38 Russell-1000 stocks that were up by more than 5% in the last

4 days, a majority, 20, have negative Accumulation Index readings (IP21). If

the rally's

leaders are facing so much distribution, can it keep going? I think the answer is

"YES" because it is the the Dark Pool buying in the major market ETFs which

is most doing the heavy lifting in here; in effect, the derivatives' tail is quite ready

to wag

the dog, the rest of the market. But now we will see just how determined the

boosters of ETFs really are.

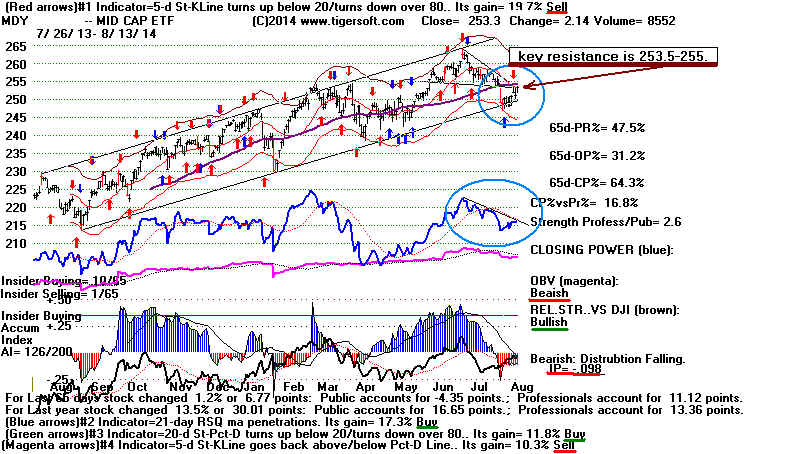

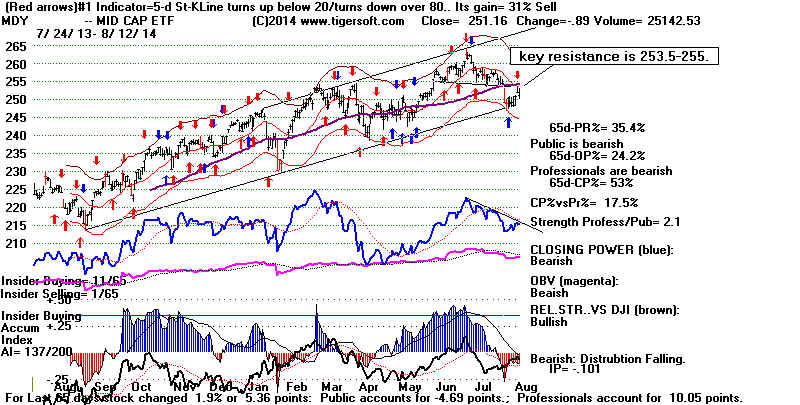

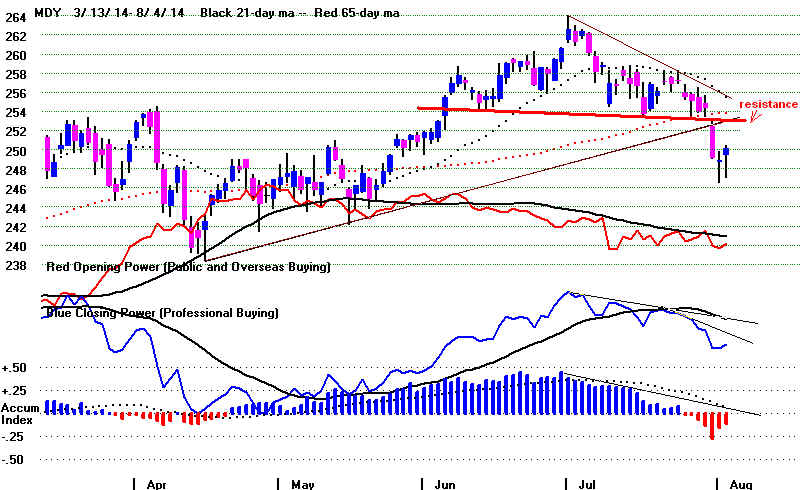

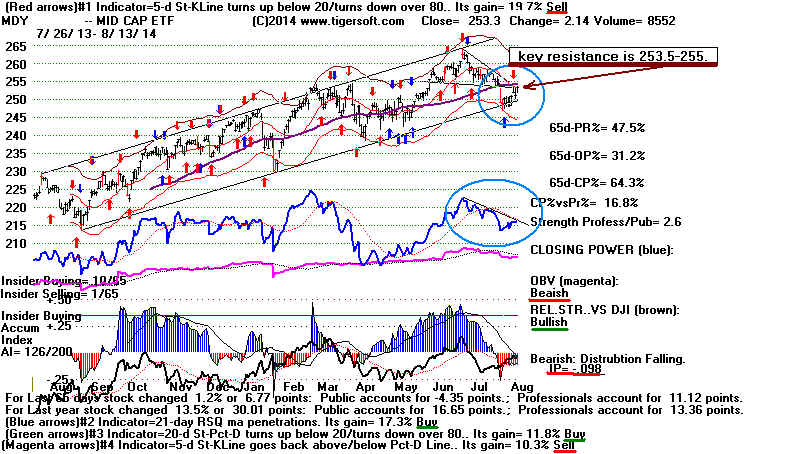

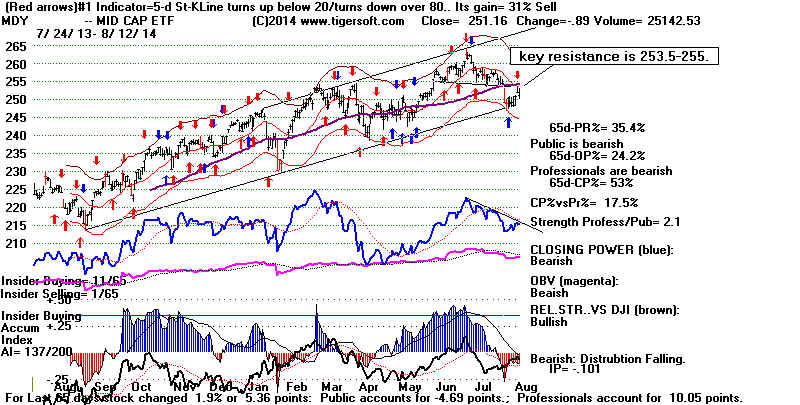

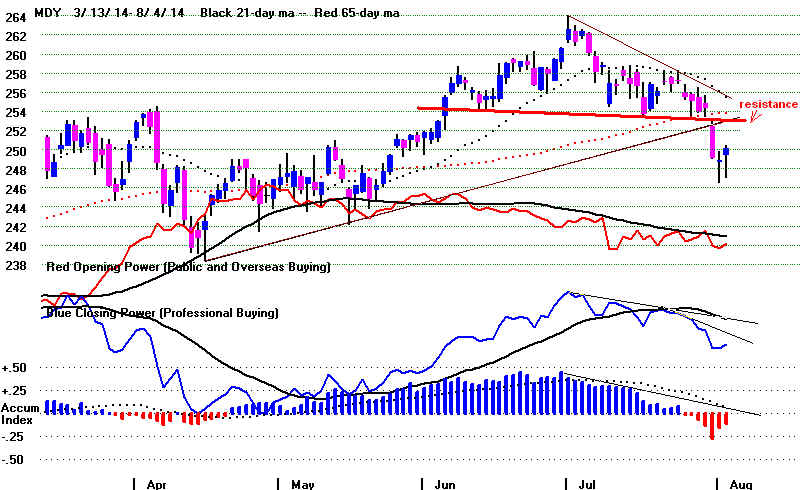

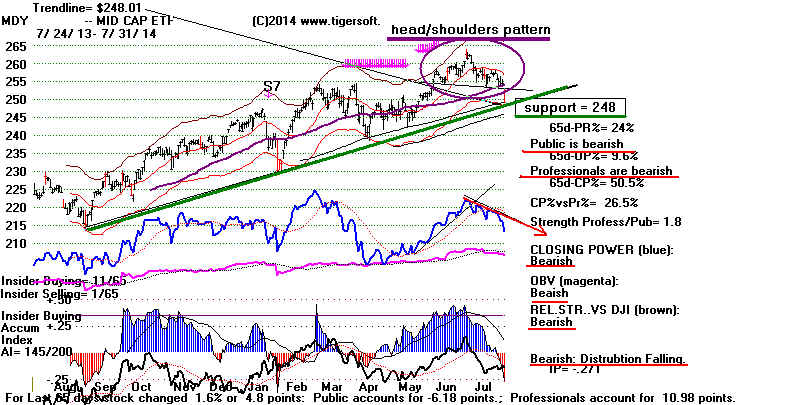

Over-Head Resistance Now Facing the Key ETFs

MDY 253.3 Even though its volume is the lowest of the

ETFs, this is arguably the most

important ETF now. It has formed a classic head and shoulders pattern. And now

it has rallied

up to the combined resistance of (1) its neckline, (2) its its 65-dma, (3) its

price-downtrendline

and (4) its falling Closing Power. A breakout here above so much nested resistance

at

255 combined with its Closing Power rising up past its down-trendline should be quite

bullish and give it a new start, I think, especially considering the very high level of

Accumulation

it showed in June. But if it reverses back down from here, prices could break their

year-long

uptrend and all the institutions that bought above 260 will have to make the key decision:

"Do they want to cut their losses or "double-down"?

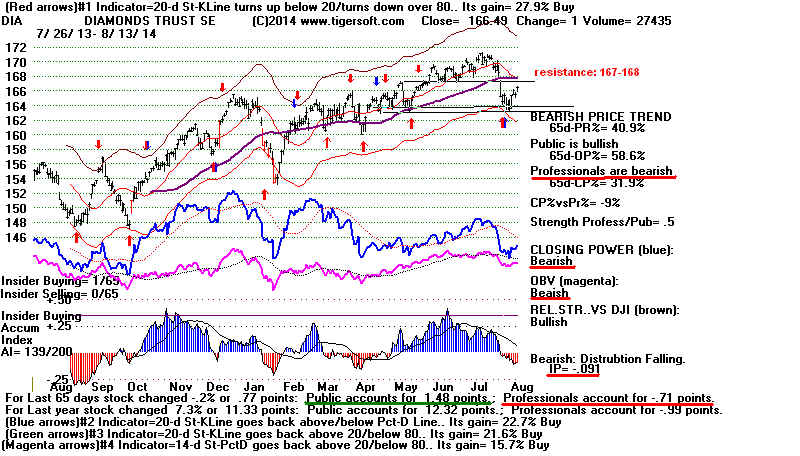

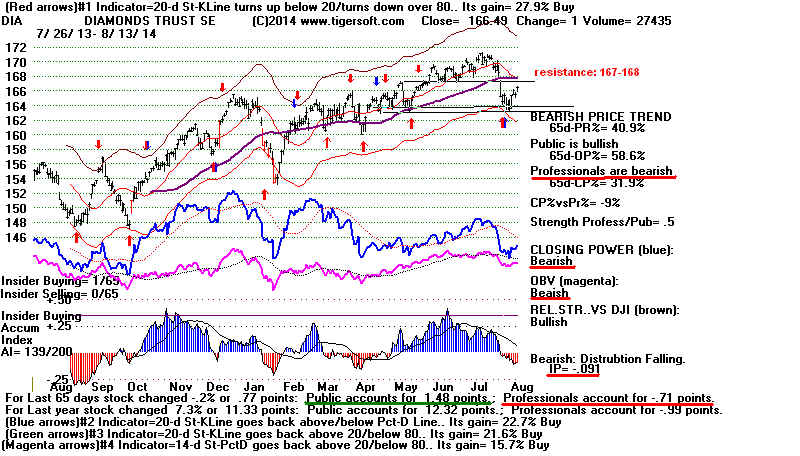

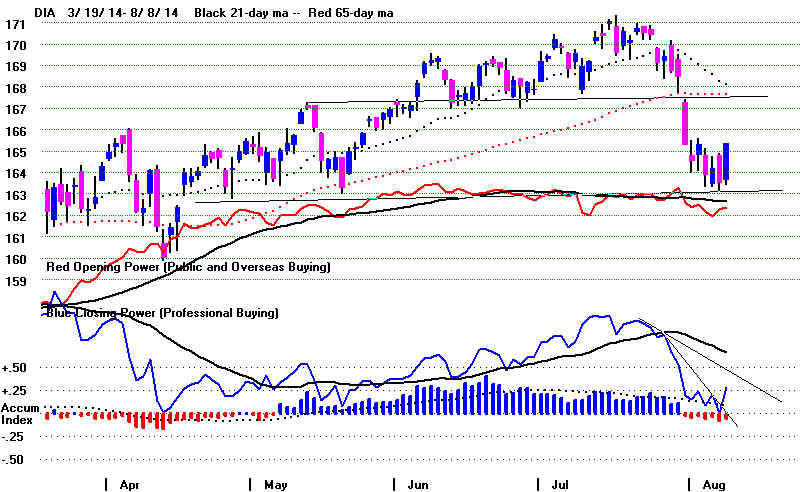

DIA 166.49

Resistance here from a right shoulder apex and the 65-dma will be

keenest between 167 and 168, only

1% away. Our Tiger chart shows that IP21= -.091.

The 100-day Closing Power is

lagging Opening Power. This means that the

Public is net bullish, but

Professionals are still net bearish. All the DIA's optimized

short-term Stochastics remain on

Buys for the present. We must give the DIA

more opportunity to keep rising.

QQQ

96.43 Watch to see if the QQQ can destroy its bearish looking head/shoulders

pattern by

rallying above its theoretical right shoulder apex. Given all the earlier

Accumulation, I

would think that the QQQ should then quickly jump to new highs,

even if DIA and

MDY do not breakout. In the case of the QQQ, it will particularly

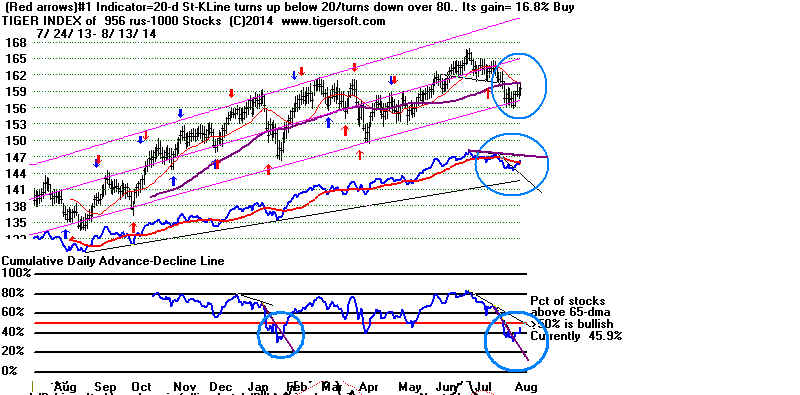

bullish if the

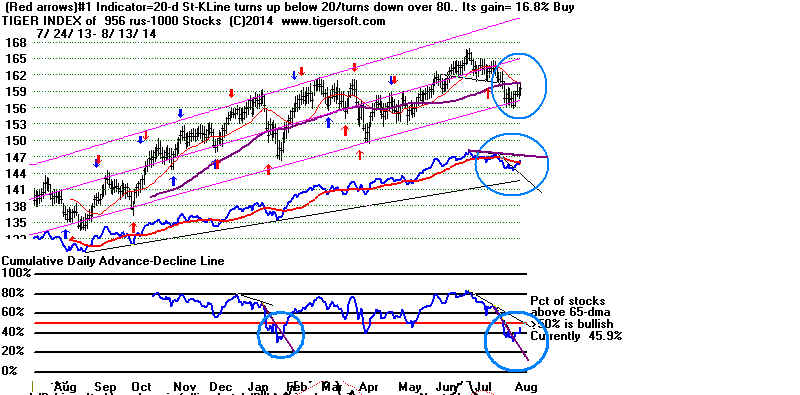

Tiger chart of the Russell-1000 (shown below) can also get past

its 65-dma and

have its A/D Line downtrend be broken.

TigerSoft Chart of Russell-1000

====================================================================================

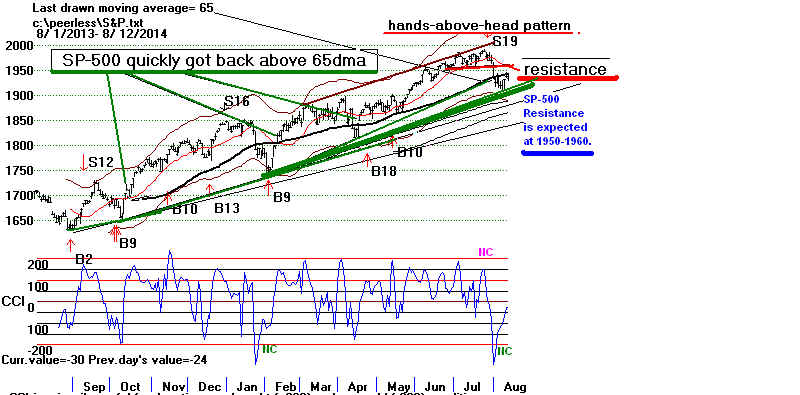

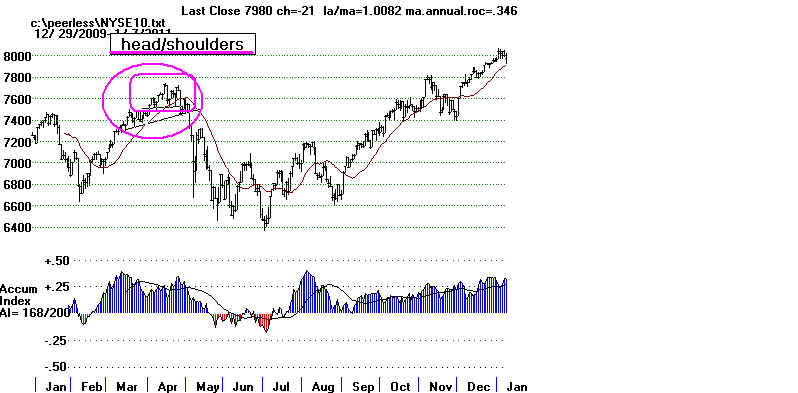

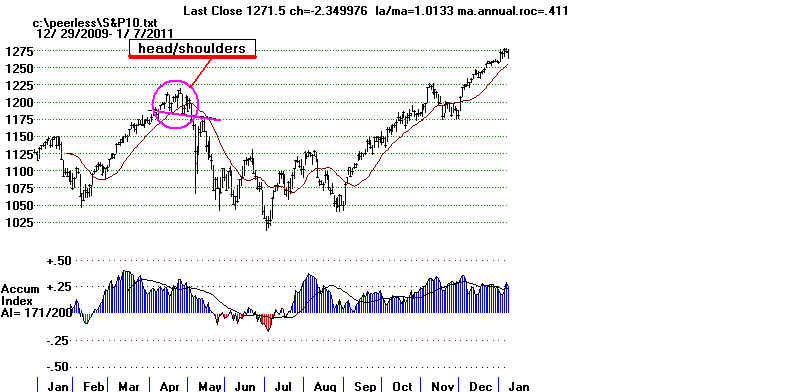

8/12/2014 The Peerless Sell S19 is un-reversed. But S19s are not powerful

sell signals, only averaging 3.4% at the time of its reversal. (1971 is an

exception;

there a bearish DJI head/shoulders pattern also unfolded.)

The DJI has now rebounded up from its rising 200-day ma. In the last few years,

such rebounds have each continued higher and been profitably traded on the long side.

Word is getting out that the FED is in no position to stop supporting the market.

Leading economists are now calling the current US economy a "secular

stagnation".

This, they say, is not self-correcting. And with government frozen, real economic

growth is not foreseen.

http://www.econ.brown.edu/fac/gauti_eggertsson/papers/Eggertsson_Mehrotra.pdf

http://krugman.blogs.nytimes.com/2014/05/07/three-charts-on-secular-stagnation/?_php=true&_type=blogs&_r=0

So, even though there is no Buy signal, I have suggested covering most short sales

and going long a few bullish special situations. The rebound statistics suggest the

odds are a little better than even that the DJI will directly recover back to its 2.5%

band.

But we can watch the various markets' progress as they challenge resistance levels

overhead. Today's decline did not end at the day's lows. Buyers have not

exhausted

their capital yet.

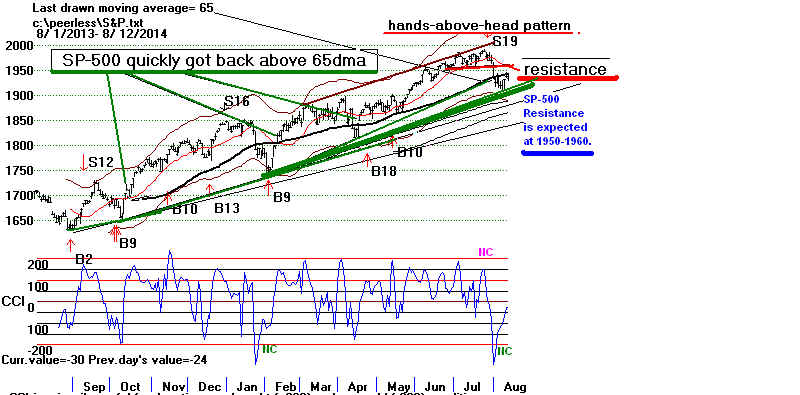

To do this, we will see the SP-500 quickly get back above its 65-dma, just like it

has on three other occasions this past year. If it can do that, it should rally to

1950-1960.

-----------------------------------------------------------------------------------------------------------------------------------------------------

> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

--> 57

+2 MAXCP

stocks Bullish MAXCP Stocks (8/12/2014)

Highest A/I 200 DJI-30 Stock - CAT

--> 64

+23 MINCP stocks Bearish MINCP Stocks

(8/12/2014) Bearish plurality

--> 28 New Highs on NASDAQ 33 new lows. Bearish

plurality

--> 25 New Highs on NYSE 17

new lows. Bullish plurality

-----------------------------------------------------------------------------------------------------------------------------------------------------

Index Benchmarks To Watch

It is in the NASDAQ that we may see the biggest advance provided it

can destroy its potential head/shoulders pattern by surpassing 4450.

See below how it rose sharply up for two more weeks when it got past

the potential resistance of a right shoulder apex in February 2014.

Our Tiger Index of the Russell-1000 (actually only 956) stocks shows

the key A/D Line downtrend that must be broken to boost this index

up past the resistance of its purple 65-dma. We will report on it each

night until its emergent pattern becomes clearer.

The Midcaps' ETF - MDY - shows the technical problems with this advance

most clearly. See its classic head/shoulders pattern. The neckline of the

pattern has already acted as resistance. To make a bigger move higher,

watch to see if MDY's Closing Power can break its downtrend. Since there

was previously a bulge of intense Accumulation, such a CP breakout

above its downtrendline will be quite bullish, especially if MDY can get

back above its 65-dma.

====================================================================================

OLDER HOTLINES

====================================================================================

8/11/2014 The Peerless Sell S19 is un-reversed. That suggests that

the current DJI rally may not get past the 65-day ma without a re-testing of the

lows of early last week. However, I have shown rebound statistics which set the

odds of a direct recovery back to the 2.5% upper band (about 4% higher than now)

at slightly better than 50%.

In addition, let's recall that there have been three recent very good rallies

up off the DJI's rising 200-day ma in the last two years. Their key values were

comparable to now. In fact, as you can see below in Table 1, the P-I daily change

was

higher Friday on its rebound than on any of the three recent successful

"bounce-days".

Moreover, on the three earlier bounces up off the rising 200-day ma, the

V-I was lower as was the 65-day pct change. So, more of a recovery should

not come as a surprise, though I think we have to consider the key ETFs one by

one.