A Guide:

Getting the Most out of

The Tiger Nightly HOTLINE

====================================================

Here is what our Tiger

Hotline seeks to do and how we can help your investing and

trading be more profitable.

The Hotline's most important task is researching and predicitng

the general market and the

DJI-30, in particular. What happens to the DJI

usually happens to most other markets around

the world, though we still have to watch for divergences and

unusual strength and weakness.

You will regularly see historical studies of what the market has done

in the past when unusual

circumstances and technicals occur in the present that can be

back-tested. Looking for new

Peerless signals and refining existing signals is a key part of the

Hotline's research.

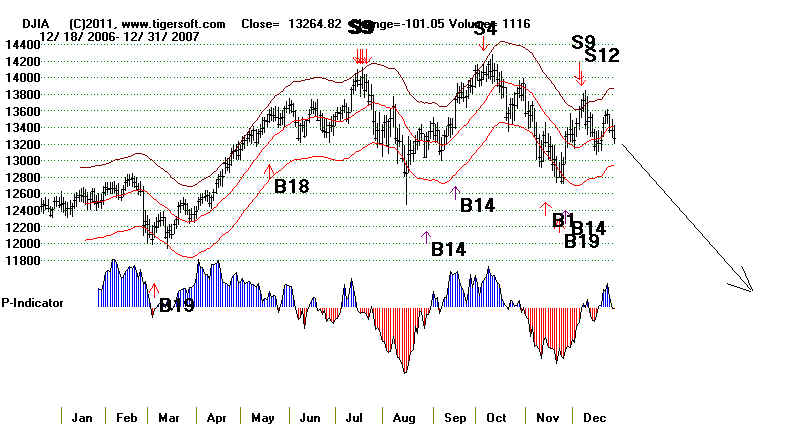

Example: the Sell S9Vs of the Summer of 2010 were researched and first

reported here in

plenty of time for our subscribers to make excellent profits selling

out and selling short.

See the Peerless DJI chart below:

TigerSoft's Hotline helps your investing in a number of ways.

1.) Just below the heading, above the Daily

Hotline are

Background

Studies. These show older charts

of many of

the trading vehicles our investors use most, such as the SPY, SPY

Candlestick charts,

QQQ, Euro and NASDAQ.

The basis for Rules for

trading Closing Power and

the role of the Accumulation Index and

head and shoulders patterns are discussed there.

2.) Usually the headline mentions the current signal.

If not,

the Current DJI chart shows the operative Peerless signal,

a Buy or a Sell. Contradictory signals the same day cancel

each other out. The links to it always appears as

follows:

--> To Key Index and Leading Stock

Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart

NASDAQ

Chart IBB

Chart IWM Chart

3) The next section gives some key technical

statistics on the DJI.

Example:

7/12/11 DJI = 12446.88 la/ma= 1.016 21-dmaROC= .482 P = 343 (+65) IP21=-.071 V=- 23 OP=

.193

------------------------------------------------------------------------------------------------------

Interpretation:

"la/ma=" 1.016 means 1.6% over

the 21-day ma. 1.035 is overbought. .965 is oversold

"21-dmaROC=" .482 means the

21-day ma is rising at an annualized rate of +48.2%. Above +.60

is usually bullish.

Below -.60 is usually bearish. It over takes a 21-dmaROC under +.07 to bring

a break of the 21-dma.

"P =" 21-dma of

NYSE Daily Advances-Declines" This is a key indicator for Peerless automatic

Buys and Sells.

Negative readings with the DJI approaching the upper band are bearish. Positive

with the DJI reaching

oversold are bullish.

"(P daily change)=" Example (+ 100) = P Indicator rose for the day.

Reversals usually show the

daily change of

the P-Indicator confirming the new move.

"IP21 =" Current Tiger's Accumulation Index" This is a key indicator

for Peerless automatic

Buys and Sells.

Negative readings with the DJI approaching the upper band are bearish. Positive

with the DJI reaching

oversold are bullish.

"V ="

21-dma of 85% of Up Volume - 100% of NYSE Down Volume." This is a less important

tool. Volume is

of reduced value because so much volume now takes place off the NYSE.

"OP =" 21-day ma of Tiger's OBV PCt." This is used with Tiger

Automatic Buys and Sells.

Readings above +.50

show over-bought conditions except at the start of bull markets. Negative

readings

with the DJI

approaching the upper band are bearish. Positive with the DJI reaching oversold are

bullish.

4.) Number of MAXCP and MINCP stocks:

A

ratio of 2:1 is bullish. 10:1 is overbought .

This shows the degree to

which Professionals are aggressively net

buyers or new sellers.

HEDGE by Buying the Bullish MAXCP Stocks

and Shorting the

Bearish MINCP Stocks. The value of this can easily be tested by looking

at the older Hotlines'

Bullish and Bearish stocks and compare their performance.

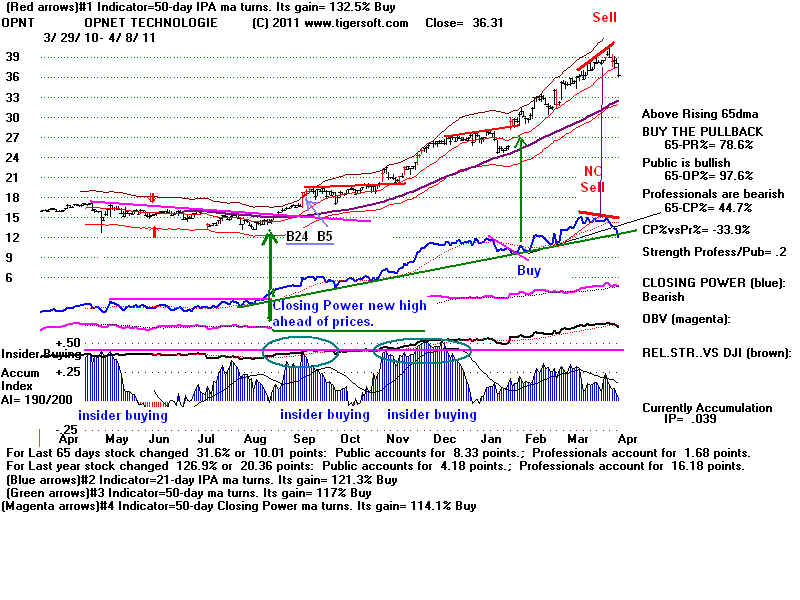

5.) Bullish MAXCP Stocks Link

- These are the most bullish stocks I

can find

each evening. They

mostly come from stocks showing high Accumulation

(Insider Buying) and Closing

Power new highs (Professional Buying)

. Try to buy these on price breakouts above flat,

well-tested resistance and when

their Closing Powers turns

back up after a test of support. Note Buy signals,

red high volume and gaps,

which confirm the breakout.

Take profits when Closing

Power fails to confirm a new high and then breaks its

steep uptrernd-line.

Closing Power

uptrendlines will let you safely stay aboard

the strongest stocks while

you let your profits run. The degree to which they rally

depends a lot on general

market conditions, whether the market is starting a new

move or is already in a

trading range. Adjust your goals accordingly.

Buying:

Watch for a Bulge of

Accumulation and then buy on the next Closing Power's

turn back upwards. Use CP trendlines here. Selling:

Take profits when Closing Power

fails to confirm a new high

and then broke its steep uptrernd-line.

Buying: After a big advance and sell-off to the 65-dma, look for a

successful test of

support, such as a testing of

the rising 65-dma, and then a CP turn upwards or a CP

breakout above its

well-tested resistance. See SIMO

below.

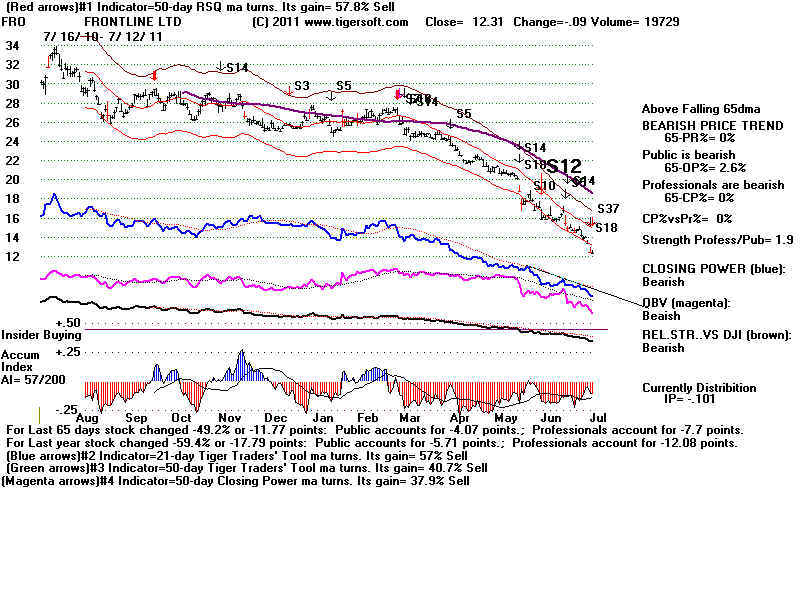

6.) Bearish MINCP Stocks Link - These are the most bearish stocks I can find

using the Tiger Power Ranker

with MINCP and NEWLOWS stocks each evening. They

mostly show heavy red

Distribution and Closing Power new low. Try to sell short

these on price breakdowns

below flat, well-tested support and when their Closing

Powers turns back down after

a test of resistance. Draw Closing Power downtrendlines on

these stocks to see when to

cover. The degree to which they fall only partly depends

a lot on general market

conditions, i.e. whether the market is starting a new move or

is already in a trading

range. Many of these bearish MINCP stocks will go down even in

an up-market.

Just because a stock is already down a

lot, do not dismiss it as a short sale.

Shorting FRO above at 13 in July would still have gained you 66% more by

the end of

2011. See its chart below.

7.)

TIGER INDUSTRY STRENGTH

Being long the

strongest stocks in or ETFs representing

the strongest industries helps you make

money less stressfully

and much more easily. The bearish

MINCP stocks in the

weakest industries usually work out well

as short sales.

Click on the links to the industries where you see

the

Date in Red and the following link:

7/12/2011 ===> See Key Peerless

TigerSoft Index Charts: Industry Groups and ETFs

EXAMPLE ======= 7/12/2011 =======

.

Pct of Stocks over

65-dma - Daily Change

7/12/2011

7/5/2011

6/27/2011

6/20/2011

6/13/2011

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

B Bond Funds

92%

93% +1%

90% -1%

85% +1%

88% -4%

B REIT Stocks

86%

82%

32% +5%

68% +13%

59% +4%

B Biotech (XBI and IBB)

71%

86% +7%

50%

+7%

50%

57%

S Utility Stocks

69% +8%

76%

51% +4%

57% +8%

44% +4%

S Auto Stocks

66%

65%

-6%

54%

14% +6%

19%

-3%

S Gaming Stocks

64%

64%

29% --7%

29% +8%

14%

S Industrial Materials

55% +5%

58% +1%

30% +9%

20% +4%

22% +1%

S Food Commodities

55%

46% +4%

27% -9%

36% +9%

55%

B QQQ-100 stocks

53% -5%

62% -2% 33% +8%

25% +8%

28% -1%

B Retail stocks .

50% +4%

41% +5%

27%

23%

14%

B Gold Stocks

50% +14%

30% +12%

8% +2%

10%

14% +7%

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

S DJI-30 stocks

47% -3%

60% +10%

13% +2%

23%

23% +3%

highest AI = CVX AI/200=184

S SP-500 stocks

47% -4%

66% +11%

31% +5%

31% +5%

25% +1%

S Finance Stocks

42% +1%

48%

-5%

32% +8%

30% +6%

21%

+7%

B Transportation Stocks 41% -2%

47% -3%

26% +4%

17% +1%

11%

-2%

B Oil stocks

37% -38%

47% +11%

17% +1%

12% -6%

16% -10%

S Green Stocks

32% -4%

44%

17%

12%

11% -5%

S Homebuilding Stocks

25% -4%

42% -4%

33% +12%

13%

+5%

4%

S Foreign ETFs' Stocks

18%

-3%

44% -9%

10%+2%

3%

10% -5%

S Chinese Stocks

18% -2%

28% +1%

14% +2%

7%

7% -5%

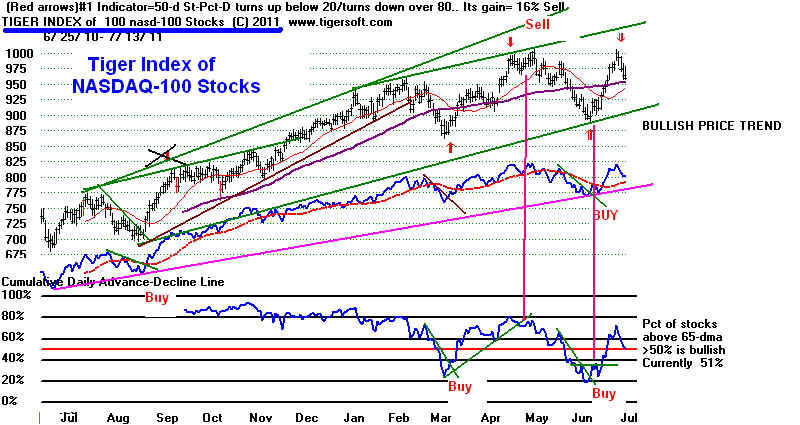

8) TigerSoft Industry and Sector Charts.

On the same page that shows the Industry Rankings, we post the Tiger Indexes of

key sectors and stocks

making up an Industry. Our program wights each stock by

average trading price

times volume. These Tiger Industry charts highlight the

Advance-Decline Line

for these groups and show the percentage of stocks above

the 65-day ma.

Draw the trendlines on these charts, not just of prices, but for the

its A/D Line and the

percentage of stocks above the 65-day ma.

Here are two examples:

First the NASDAQ-100 or QQQ and second Auto Stocks.

Trade the price and

internal strength trendlines, the automatic Buys and Sells, especially

after the A/D Line

fails to confirm a move.

The Actual Nightly Hotline pulls all these factors together

and discusses the operative Peerless signal and what

it

might take to reverse it.

9) The operative Peerless signal, example combined Sell S9/S12,

is very important.

The last and operative Peerless signal

appears among each day's Hotline's charts and

is specified as

text, near the top of the narrative or in the heading.

Many traders simply

work with the Peerless signals, buying a major market ETF on

and buy and selling

only on a Sell. This has a great track record.

Multiple Peerless Sell

signals tell us to Sell, Sell Short and avoid all long commitments,

especially if a

well-tested support level like 12500 is violated, as we saw in 2007. On the

other hand, Peerless

Buy signals provide an overall trading strategy, in that when we

are on a Buy, and even

more so when there are multiple Buys, we have to expect higher

prices even when a

decline is occurring. The Peerless Buys' track records should give us

the confidence we might

need to buy on this weakness, especially when the Tiger

Closing Power breaks

its downtrend and Professionals resume their buying..

The first thing we want to do when there is a new

Peerless signal, is to check out the

link in the Hotline to

that particular signal's history. Here we see how powerful in

history, back to 1929,

the signal is. How has it worked out in a rising market? In a

a bear market? At

this time of year? In the 4-year Presidential cycle? Are the current

key Peerless statistics

(la/ma, ann-roc, P-I, IP21, V-I, Opct) within the normal range

for this signal?

If there are enough cases, how does the signal work out when the

key Peerless indicators

were quite comparable? Should we be prepared for a paper loss?

How large? How often do

they occur? Are there past cases that seem quite similar?

Or is this a case that

is very different?

10) Within an on-going uptrend, there are minor declines and trading range

tops.

Traders should, I think, use the Closing Power trends to see these

short-term reversal points. Pay most attention to breaks in extended,

well-tested

CP trendlines when the CP has

not confirmed a move and when prices have just

tested support or resistance.

The Closing Power charts on key ETFs,

SPY, QQQ, IWM, FNA, TNA and

DIA are vital. See how the CP trendbreaks predict significant price

trend changes.

There are links to these each night. Often their charts

appear on the Hotline Page.

11) Historical

Parallels and Seasonality are

emphasized in TigerSoft

hotlines. TigerSoft,

more than others, looks at the 4-year Presidential

cycle. It works.

Peerless uses it. And as a trained historian and ex- political

economist, this cycle offers

us a lot.

12) Earlier Hotlines appear underneath the current one. Links

to even earlier hotlines

going back to 2009 can also be found on

the Hotline Page.

13) Political Economy.

It helps to be very cynical,

too. Most stocks

are owned and dominated

by the very wealthy, most of the time. 1999-2000 was an

exception. Public

buying and speculation ruled many tech stocks.

To see how the market

will likely move, we seek to anticipate the futures perceptions

of the very wealthy

about investing, profits and the market. Consider our Hotline

an antidote to the

mainstream media, which is full of useless and even misleading

news stories. The

conservative media's touting of silver all the way down from

48 to 20 is as

disturbing as it is typical. At best, its purpose is to sell copy. At

worst, it is to dupe

the public into buying when the insiders the media represents

want to sell.

Thus, it plays up the dramatic, the personal, the scary and the sensational.

This is the reason,

when professionals often are buying when the headlines are

bleakest and selling

when everything seems rosiest.

Tiger's Blog and Hotline show the importance of political economy.

There is a lot of

evidence that Obama has reinforced, not changed, the

control by, of

and for the American Plutocracy. That is a key reason

the stock

market has done so well, despite high unemployment and widespread

mortgage defaults

on Main Street.

Only Tiger's

Hotline has the Peerless back-tested Buys and Sells

of 74 years

experience. I've been writing a Hotline since 1986.

Our Closing and

Opening Powers are unique. I believe our

unique

perspectives will show you how Wall Street really works

and how to make

money like the Pros do....

Ask questions, too. The answers

we provide to you, may also help others.

william_schmidt@hotmail.com