------------------------------------------------------------------------------------------------------------------------------

Materials

for February 2015 Tiger Software Meeting

(C) 2015 William Schmidt, Ph.D. www.tigersoft.com

-->

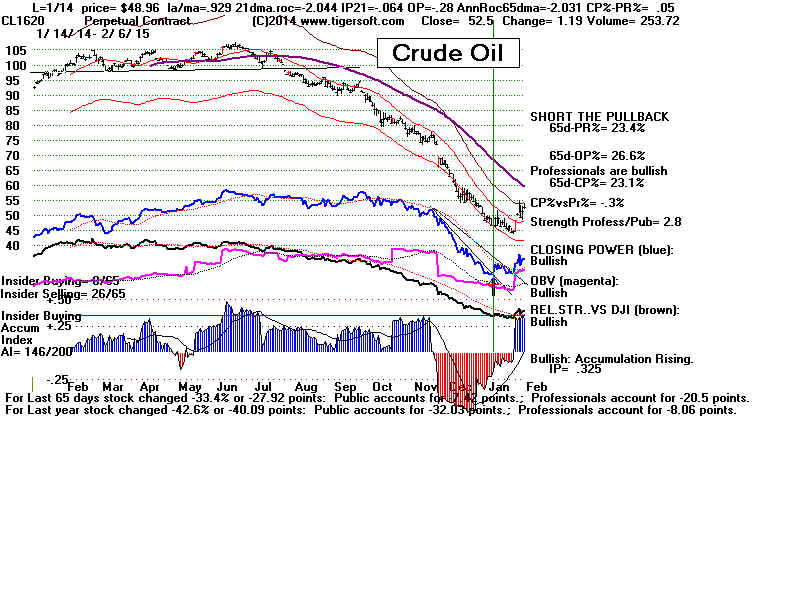

Crude Oil Bottoms.

-->

Reversals by DJI

-------------------------------------------------------------------------------------------------------------------------------

Hi, Tigers!

Let's start February right.

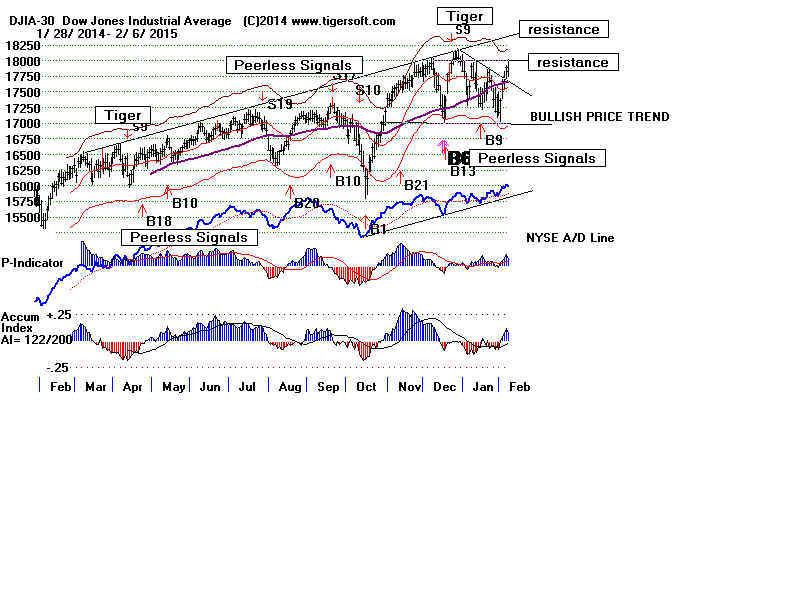

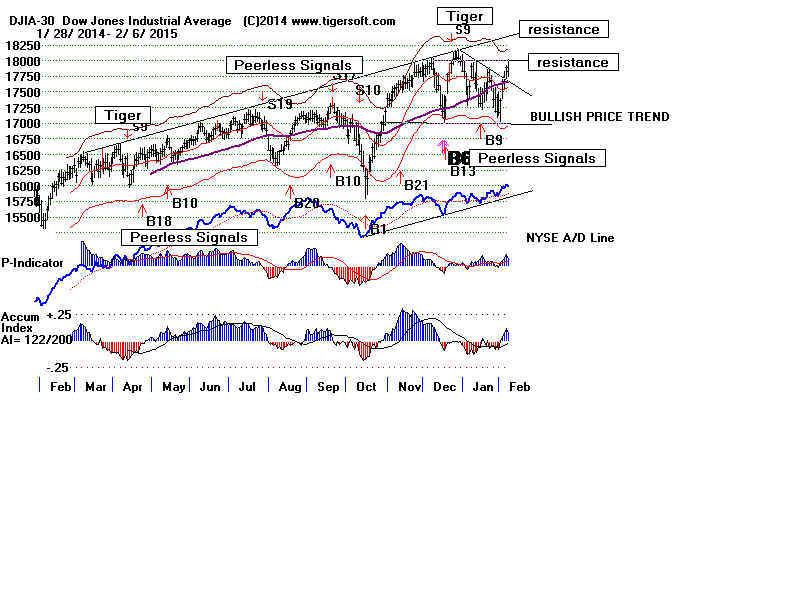

Peerless says the market should go higher with its Buy B9

and rising NYSE A/D Line. It is rare for the market to

turn down without the A/D Line blatantly failing to

keep up with the DJI's advance. And when there is

no such divergence, usually we see a Head/Shoulders

top or the DJI rallies above the 2.1% band with a Accum.

Index negative. That almost happened in December,

but it did not.

February is an up-month 59.2% of the time since 1965.

It averages 0.5%. But in years before a Presidential

Election, in the 21-days after Feb 8th, the DJI is up

83.3% of the time and rises 3.4% on average.

We know years before a Presidential Election, like 2015,

are quite bullish. They have averaged 14%-15% gains. Why?

Because Washington politicians want to keep their cushy jobs

and most voters keep score for at least a couple of years.

But what if the Fed suddenly

raised rates because wages

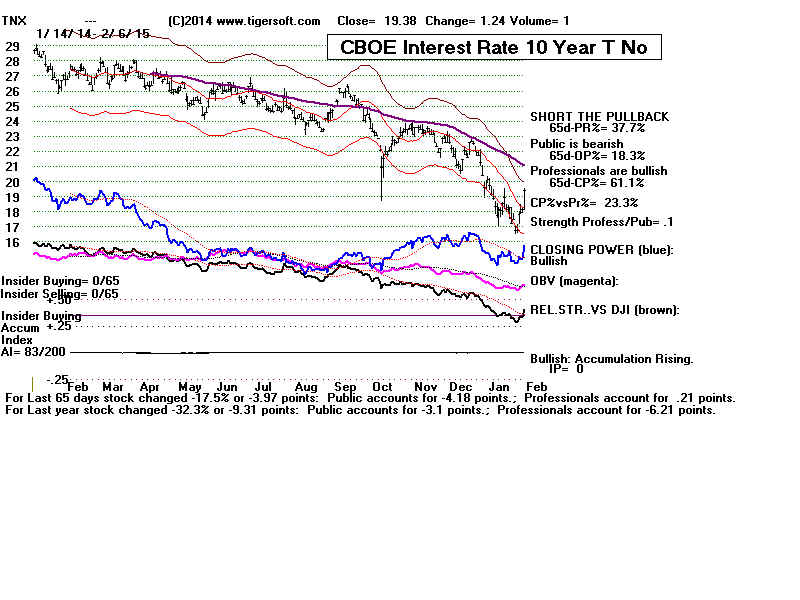

are rising faster than productivity and Job Growth is

now expanding too fast? We must keep an eye on

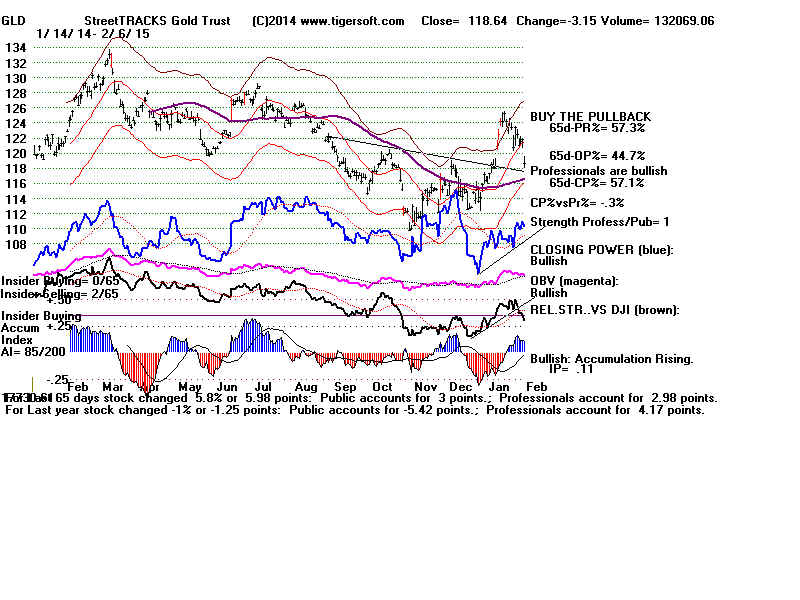

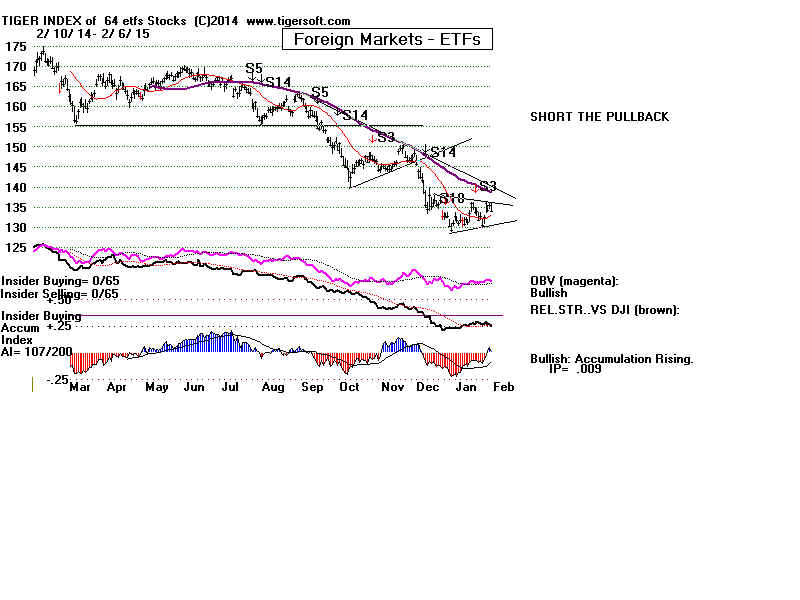

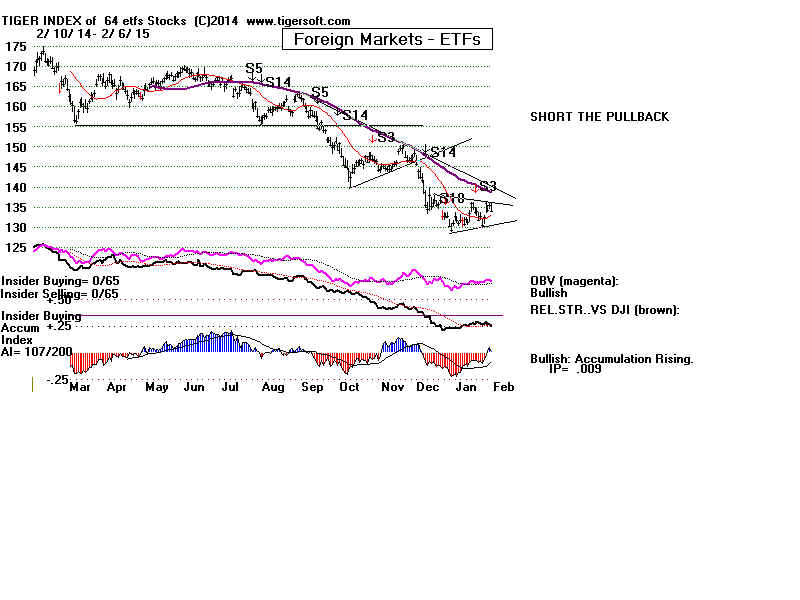

lots of interest rates (TNX), World markets (Foreign ETFs),

Crude Oil and of course Gold. A big rise by Gold very

often leads to Fed tightening and a market top.

The Jobs numbers were so good, many traders thinks this

guarantees the Fed will raise rates this Summer. That

expectation will dampen the markets ability to rise much

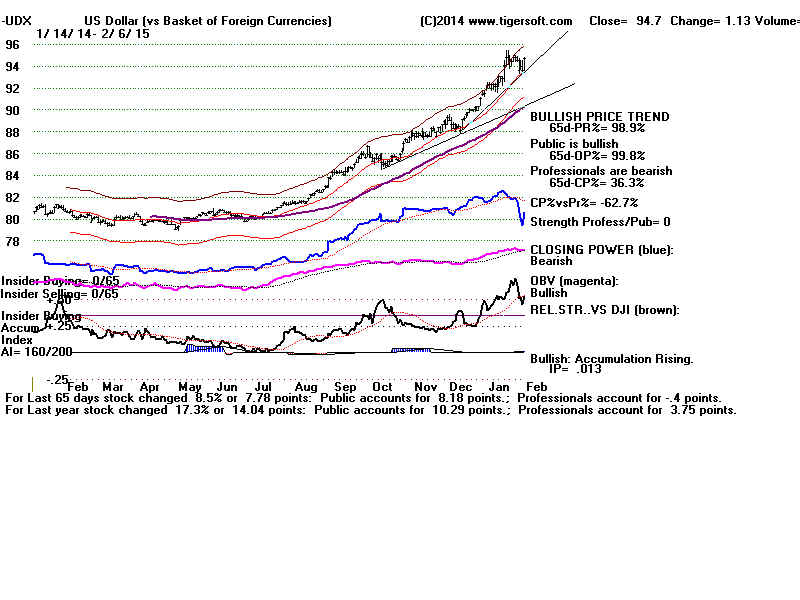

after April, I would think. This is important. A rising Dollar

makes certain groups winners in the stock market

and certain groups losers.

|

As you know, Peerless is on a Buy B9. Historically, its avg gain

on the DJI is +10% at the time of the of the next Peerless Sell.

Median gain is over 7%. January B9s are particularly bullish

as are B9s in the third year of the -year Presidential cycle.

BREAKDOWN of BUY B9 TRADES: 1929-2014

=====================================

No. Date Peerless DJI Pct Paper

Signal Gain Loss

==========================================================

1 19340910 B9 89.3 .038 .029

----------------------------------------------------------------------

2 19341220 B9 99.6 .044 None

----------------------------------------------------------------------

3 19350531 B9 110.64 .198 None

----------------------------------------------------------------------

4 19351213 B9 140.2 .114 .009

-----------------------------------------------------------------------

5 19431108 B9 131.7 .245 .016

-----------------------------------------------------------------------

6 19431117 B9 130.2 .26 .004

----------------------------------------------------------------------

7 19431126 B9 131.3 .249 .013

----------------------------------------------------------------------

8 19440907 B9 143.6 .142 .004

----------------------------------------------------------------------

9 19440914 B9 142.9 .148 None

----------------------------------------------------------------------

10 19450326 B8 152.3 .077 None

----------------------------------------------------------------------

11 19460225 B9 187.2 .135 .006

----------------------------------------------------------------------

12 19461009 B9 163.1 .126 None

----------------------------------------------------------------------

13 19480920 B9 177.4 .07 .007

----------------------------------------------------------------------

14 19481122 B9 176.3 .022 .029

----------------------------------------------------------------------

15 19481129 B9 172 .048 .004

----------------------------------------------------------------------

16 19481201 B9 173.2 .040 None

----------------------------------------------------------------------

17 19501205 B9 225.4 .15 .003

----------------------------------------------------------------------

18 19550117 B9 388.2 .207 None

----------------------------------------------------------------------

19 19581125 B9 540.5 .203 None

----------------------------------------------------------------------

20 19661201 B9 789.95 .124 .005

----------------------------------------------------------------------

21 19670412 B9 844.65 .051 None

----------------------------------------------------------------------

22 19670519 B9 874.55 .063 .031

----------------------------------------------------------------------

23 19740207 B9 828.46 .033 .03

----------------------------------------------------------------------

24 19741009 B9 631.02 .038 None

----------------------------------------------------------------------

25 19750528 B9 817.04 .058 .002

----------------------------------------------------------------------

26 19751209 B9 824.15 .225 None

----------------------------------------------------------------------

27 19761005 B9 966.76 .018 .046

----------------------------------------------------------------------

28 19771206 B9 806.91 -.017 .017

----------------------------------------------------------------------

29 19780223 B9 750.95 .154 None

----------------------------------------------------------------------

30 19781218 B9 787.51 .125 None

----------------------------------------------------------------------

31 19790206 B9 822.85 .077 .008

----------------------------------------------------------------------

32 19801028 B9 932.59 .058 .016

----------------------------------------------------------------------

33 19811023 B9 837.99 .04 .008

----------------------------------------------------------------------

34 19820930 B9 896.25 .179 None

--------------------------------------------------------------- -------

35 19821123 B9 990.99 .067 None

----------------------------------------------------------------------

36 19830124 B9 1030.17 .207 None

----------------------------------------------------------------------

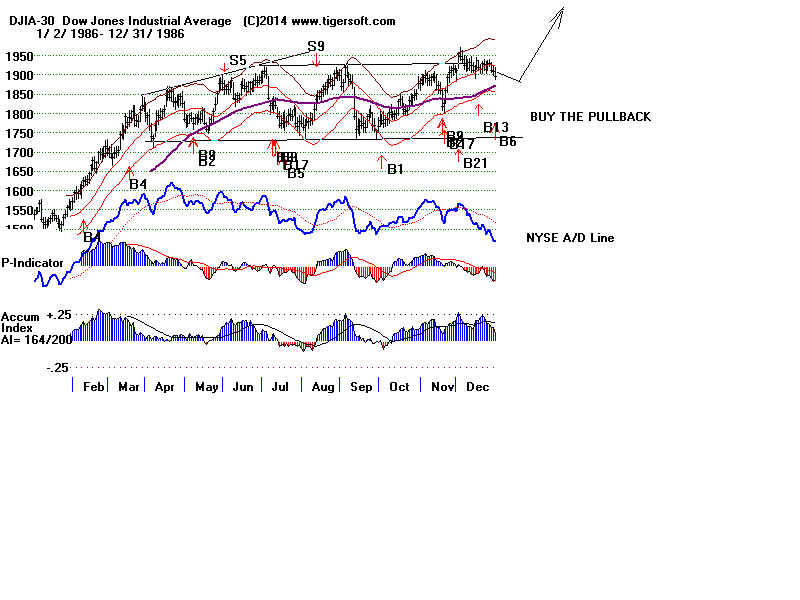

37 19860122 B9 1502.29 .215 None

----------------------------------------------------------------------

38 19860407 B9 1735.51 .052 None

----------------------------------------------------------------------

39 19860711 B9 1821.43 .008 .029

----------------------------------------------------------------------

40 19861118 B9 1817.21 .324 None

----------------------------------------------------------------------

41 19880108 B9 1911.31 .059 None

----------------------------------------------------------------------

42 19880122 B9 1903.51 .063 None

----------------------------------------------------------------------

43 19880325 B9 1978.95 .056 None

----------------------------------------------------------------------

44 19930921 B9 3537.23 .122 None

----------------------------------------------------------------------

45 19960110 B9 5032.94 .103 None

----------------------------------------------------------------------

46 19960410 B9 5485.98 .048 None

----------------------------------------------------------------------

47 19960507 B9 5420.95 .06 None

----------------------------------------------------------------------

48 19961213 B9 6304.87 .087 .005

----------------------------------------------------------------------

49 19970911 B9 7660.98 .034 None

----------------------------------------------------------------------

50 19971219 B9 7756.29 .183 .012

----------------------------------------------------------------------

51 19981001 B9 7632.53 .459 None

----------------------------------------------------------------------

52 19990524 B9 10654.67 .045 .011

----------------------------------------------------------------------

53 20001124 B9 10470.23 .042 .014

----------------------------------------------------------------------

54 20001220 B9 10318.93 .058 None

----------------------------------------------------------------------

55 20010323 B9 9504.78 .183 None

----------------------------------------------------------------------

56 20011101 B9 9263.9 .092 None

----------------------------------------------------------------------

57 20020918 B9 8172.45 .074 .121

----------------------------------------------------------------------

58 20021209 B9 8473.41 .035 .02

----------------------------------------------------------------------

59 20021216 B9 8627.4 .017 .038

----------------------------------------------------------------------

60 20041014 B9 9894.45 .103 .014

----------------------------------------------------------------------

61 20041022 B9 9757.81 .118 None

----------------------------------------------------------------------

62 20050624 B9 10297.84 .124 .008

----------------------------------------------------------------------

63 20060718 B9 10799.23 .148 None

----------------------------------------------------------------------

64 20081223 B9 8419.49 .063 None

----------------------------------------------------------------------

65 20111121 B9 11547.31 .048 .028

----------------------------------------------------------------------

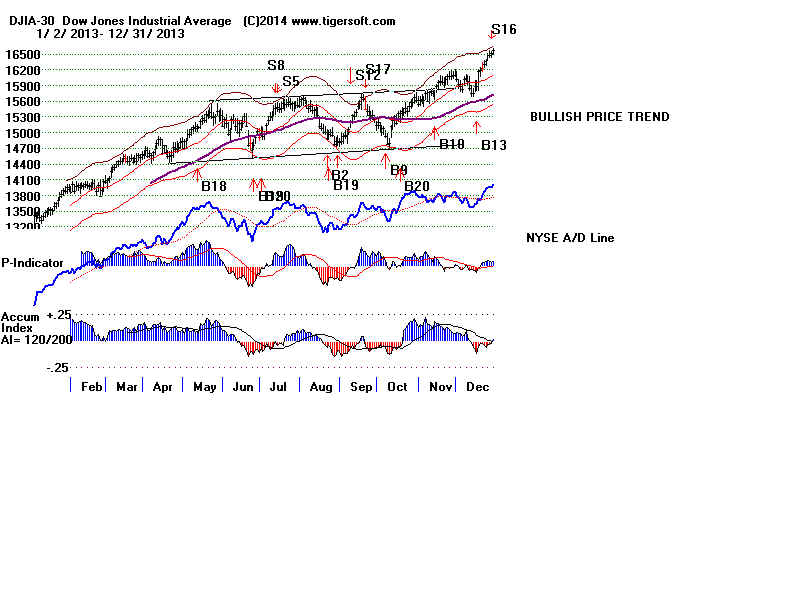

66 20131007 B9 14936.24 .105 .01

----------------------------------------------------------------------

Total N0.= 64 .108 .009

Returns by Size of Gain

-----------------------

No. Pct.of Total

=>.10 30 .455

=>.05 - <.10 18 .273

=>.02 - <.05 14 .212

=>0 - <.02 3 .045

<0 1 .015

--------------------------------------

Total 66 1.0 (100%)

Returns by Year

---------------

No. Avg.Gain Pct.of Total

Pres. Election Years 20 .07 .303

Year after Pres.El.Yr. 10 .094 .152

Mid-Term Election Yr. 22 .124 .333

Year before Pres.El.Yr. 14 .146 .212

----------------------------------------------------------------------

Total 66 .108 1.0 (100%)

Returns by Month

----------------

No. Avg.Gain Pct.of Total

January 6 .142 .091

February 4 .099 .061

March 3 .103 .045

April 3 .05 .045

May 5 .084 .076

June 1 .123 .015

July 2 .077 .030

August 0 0 0

September 8 .1 .121

October 9 .118 .136

November 11 .145 .167

December 14 .089 .212

--------------------------------------------------------

Total 66 .108 1.0 (100%)

Returns by Day of Month

-----------------------

No. Avg.Gain Pct.of Total

-------------------------------------------------------

1-10 22 .101 .333

11-20 20 .111 .303

21-31 24 .112 .364

-------------------------------------------------------

Total 66 .108 1.0 (100%)

|

The A/D Line is pointing up. 10-year rates are way below 2%.

What could possibly go wrong? US Austerity? Terror? Greek

default of govt. debts to world's bankers, including those in

US? Rise in rates? Euro meltdown?

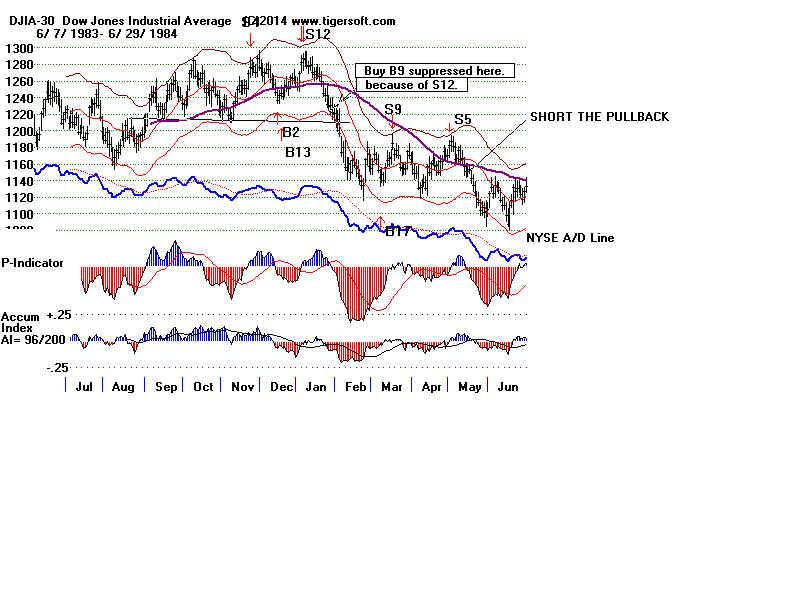

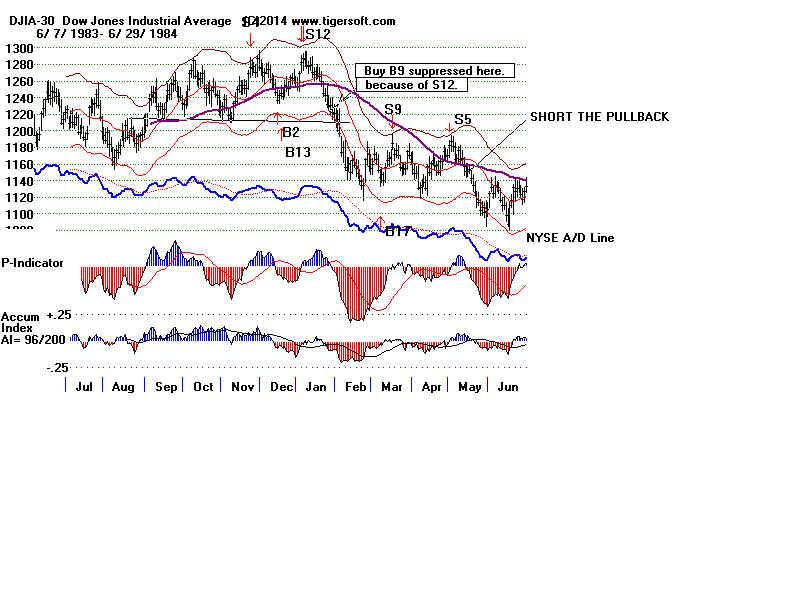

A rising A/D Line did not prevent the bull market of 1975-1976

from turning into a bear market for 15 months. The FED's

high rates, higher gasoline prices and Jimmy Carter's

federal budget austerity caused this. Or the DJI from falling 17%

from January to July 1984.

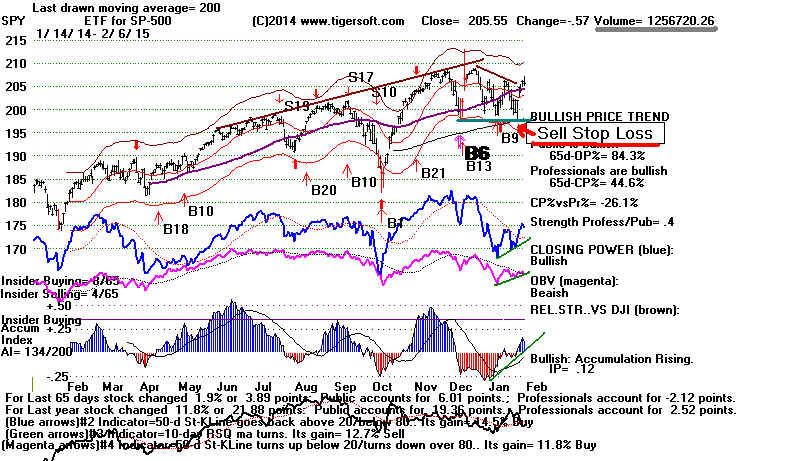

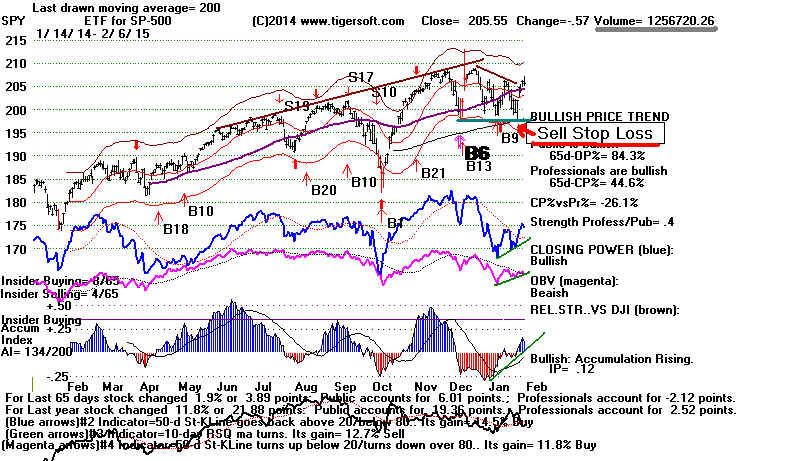

---> We are now seeing increasing draw-downs if we wait for the

Closing Power to "clinch" Peerless Buys on the key ETFS. Same

thing with waiting for IDOSC, CCI, 5-day ANROC turns up. Best to

just act on Peerless Buy and use a stop 3.5% below the Buy B9 signal

or any well-tested horizonatal support below the 200-day ma support.

See the paper losses above. SPY offered a perfect well-tested

support to use at its still rising 200-day ma.

---> The DJIA has been in a trading ranges recently. Lengthy DJI trading ranges

this long

and much longer have occurred many times in the past. The best examples are:

Flat Trading Ranges and Outcomes:

1928-2015

length

----------------------------------------------------

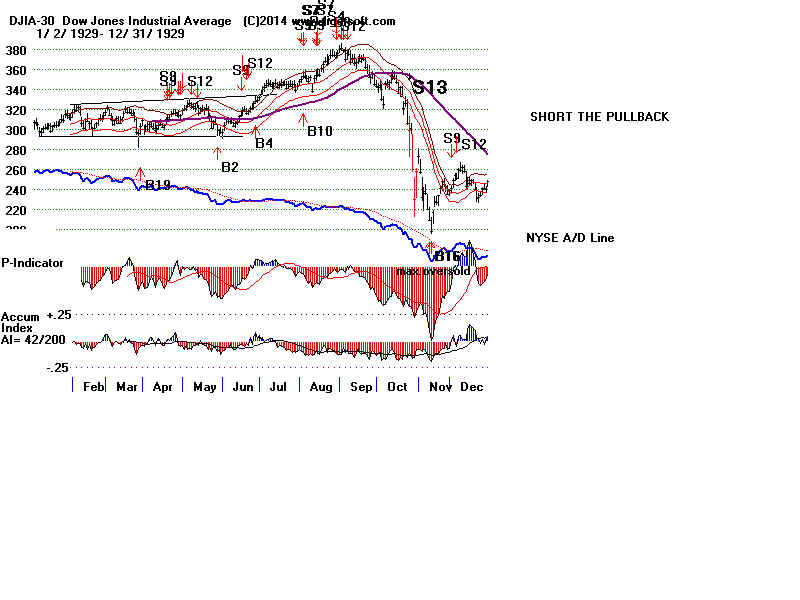

1929 6 months' 25% advance, then utter collapse.

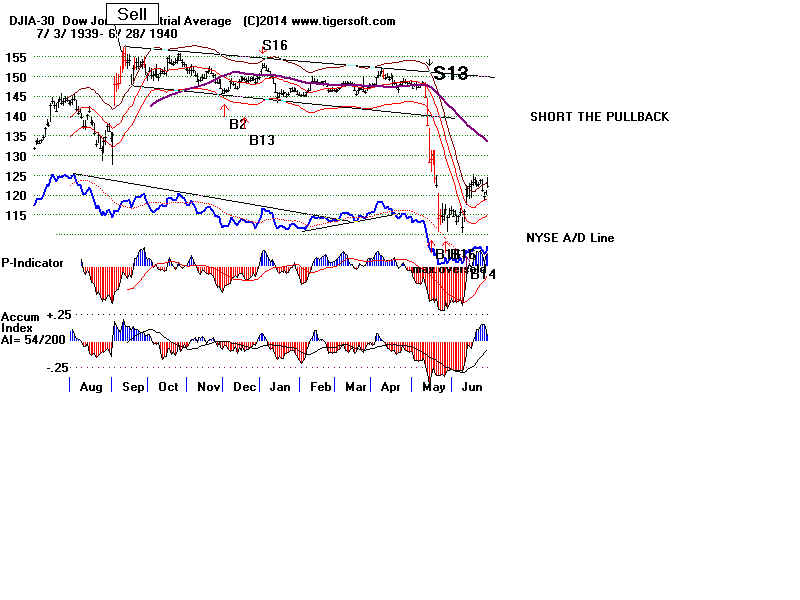

1939-1940 8.5 months 25% bear market.

1956-1957 19 months 19.5% decline

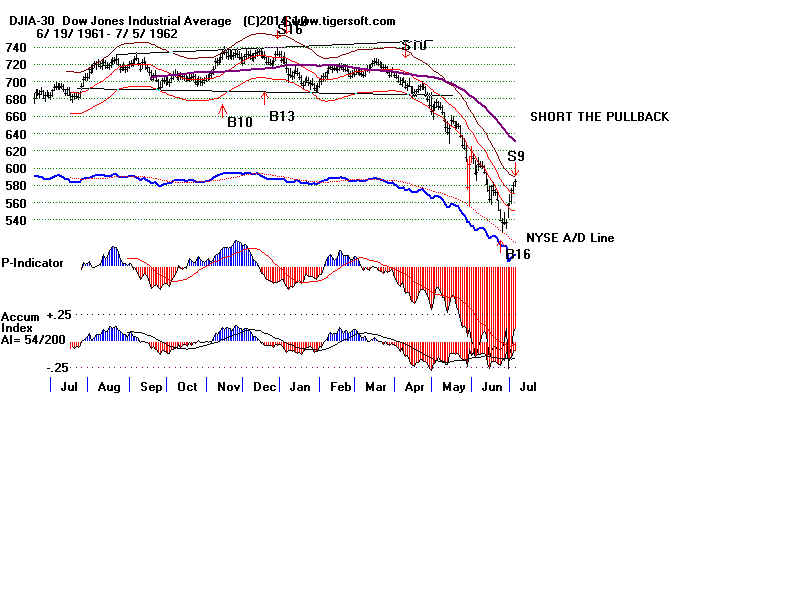

1961-1962 9 months 26% decline

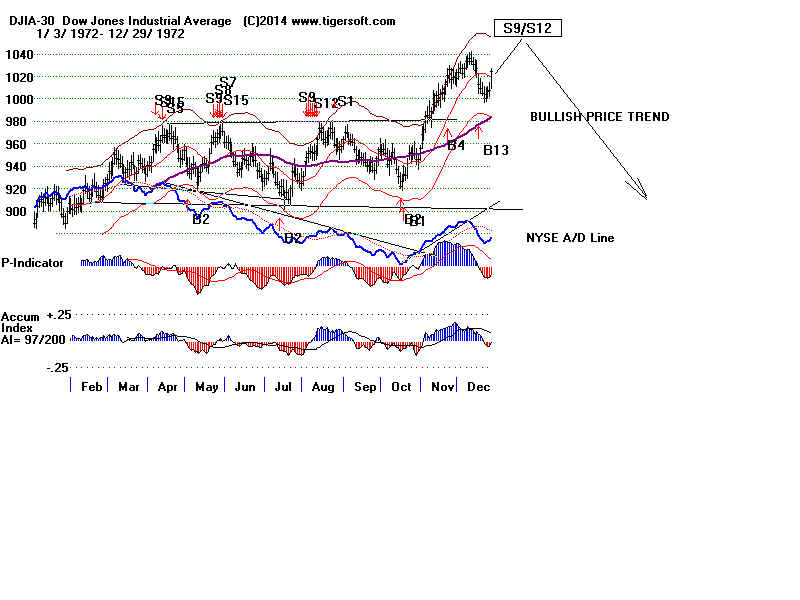

1972-1973 8 months 15% advance and long bear market.

1976-1977 11 months bear market for 15 months.

1980-1981 9 months bear market for 15 months.

1986-1987 10 months 40% advance and October 87 Crash.

2013 6 months 10% advance and zig-zags higher.

How might we TRADE major market ETFs within this range, while it lasts. In the past,

I have emphasized the

Hourly DJI,

Closing

Power trend-breaks especially after CP NCs.

automatic

5-day Stochastic Buys/Sells,

CCI

6-day

Inverted Traders' Index.

A/D Line

short term trends.

Good

reversals from support begin with 3:1 advances to

declines ratio on NYSE

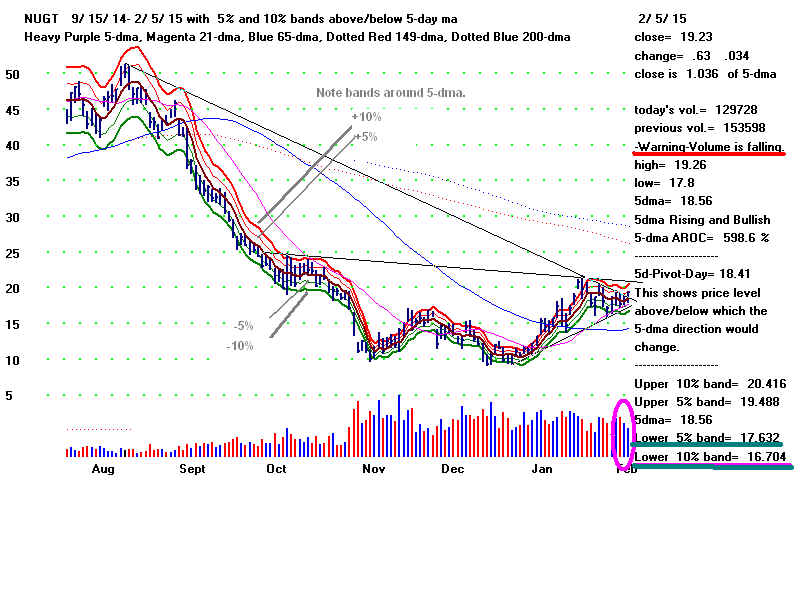

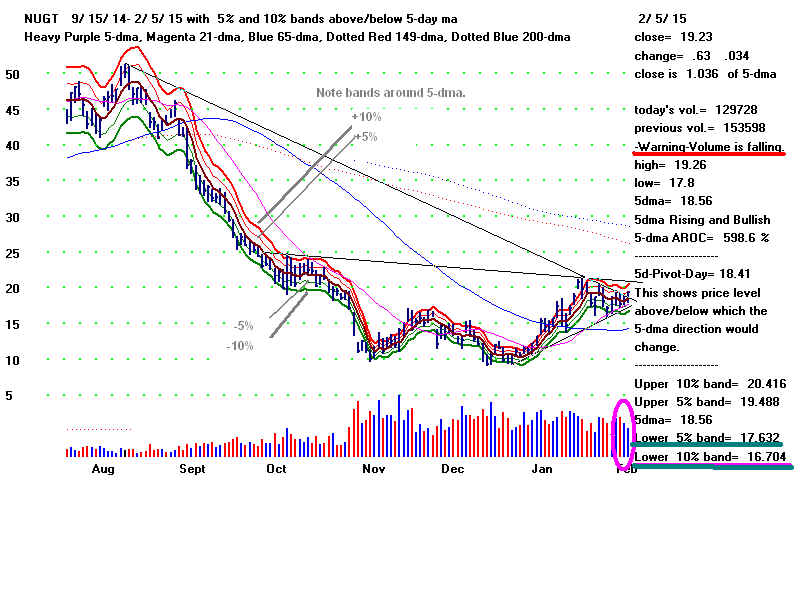

---> I want now to introduce at the meeting New TigerSoft charts.

These charts show the TigerSoft 6-Month Price, Volume,

5-day mvg.avgs and bands. Let me show some ways to trade

the more volatile ETFs, like NUGT, with the new 6-month charts

and the AROC (annualized Rate of Change) of the 5-day ma.

---> The new charts let you see resistance, support and breakout

levels more clearly, I think you will agree.

---> We want to watch for failures of daily volume to confirm

daily advances to the upper bands.

---> We should consider using two sets of Buy orders, one

at the lesser lower band and one at the lower band. These

targets are shown on the new six month price chart.

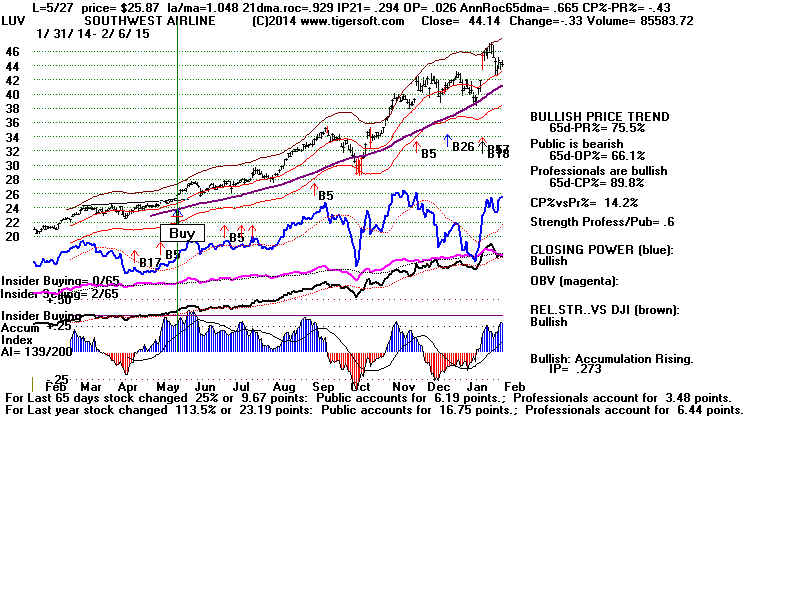

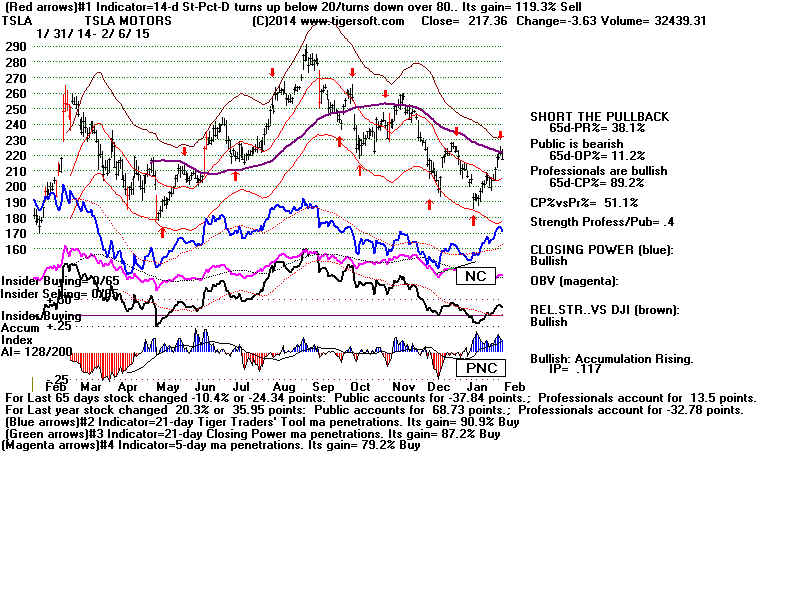

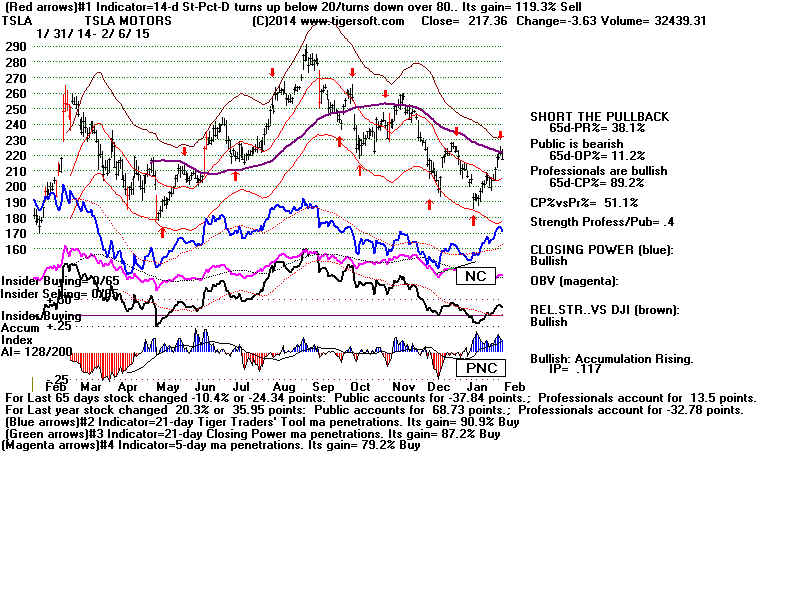

With Peerless on a Buy, how can we find proditable long-side trades

and also find good short sales to hedge with. Watch the CLosing Power

for NCs, trend-breaks and the 65-dma, too. Professionals usually know first.

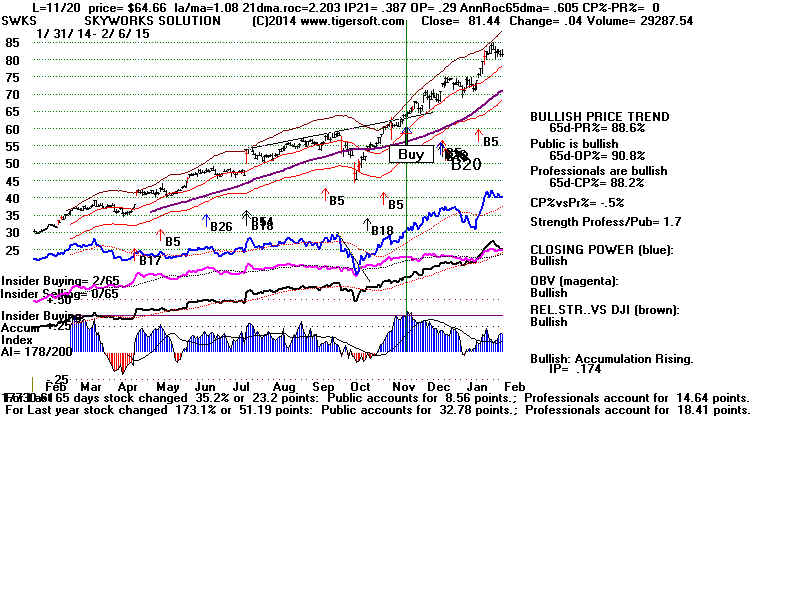

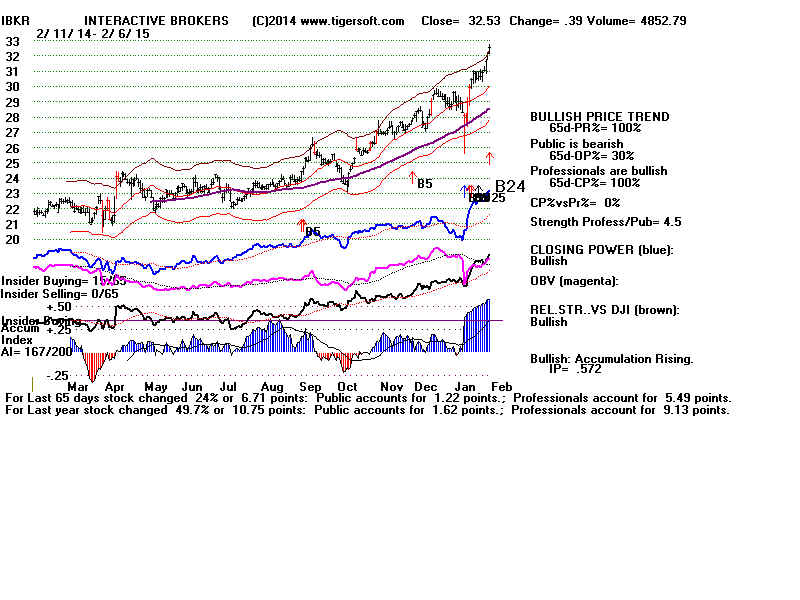

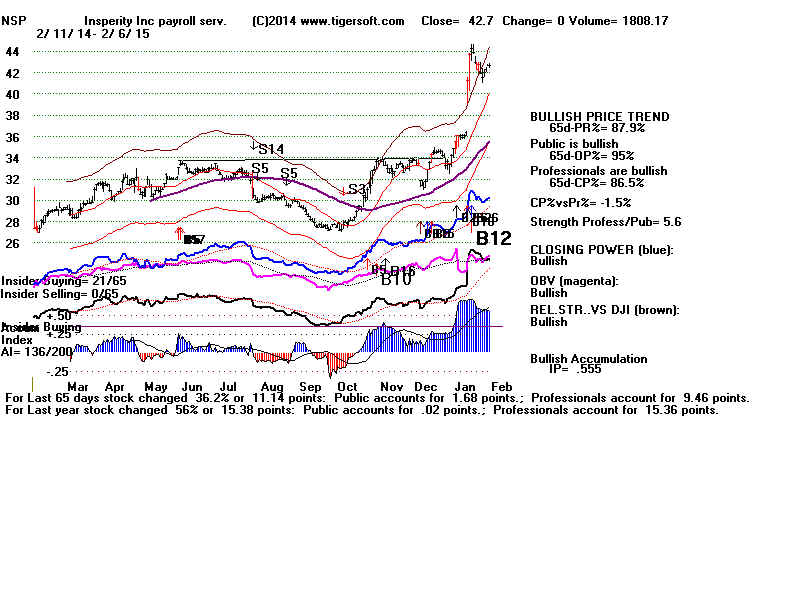

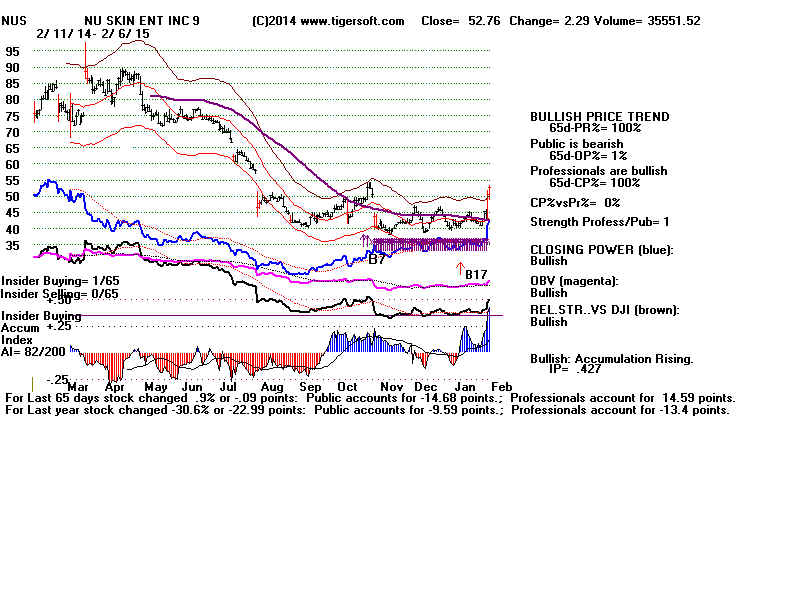

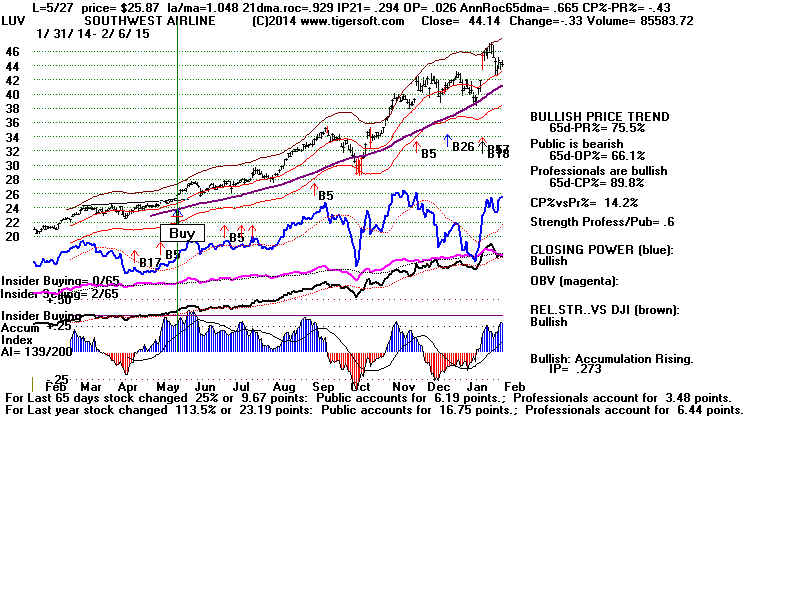

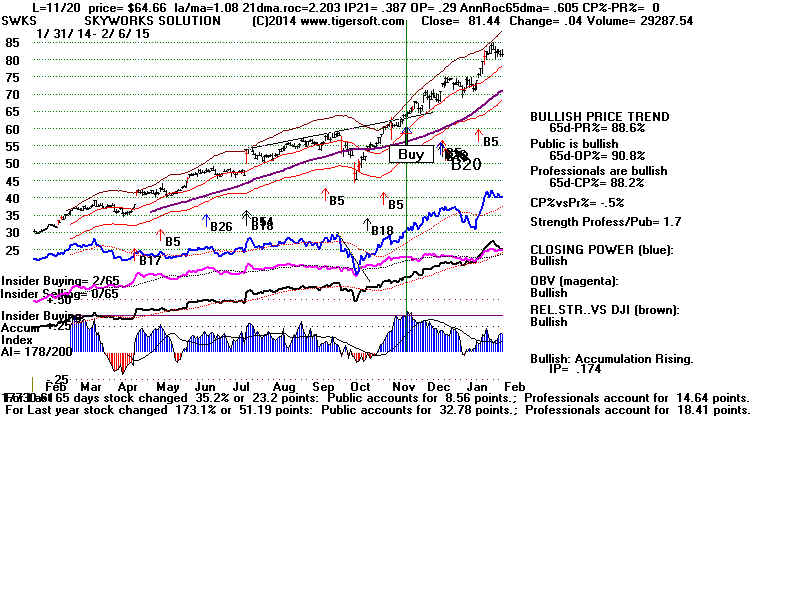

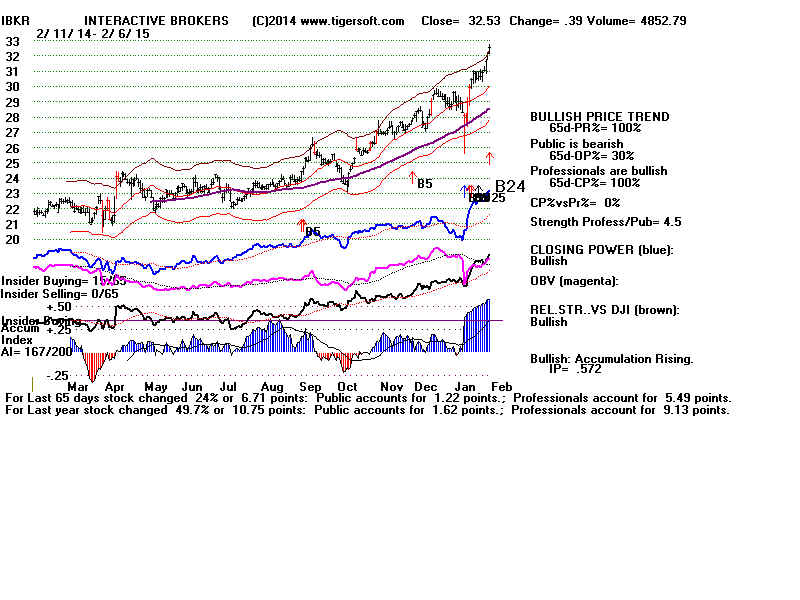

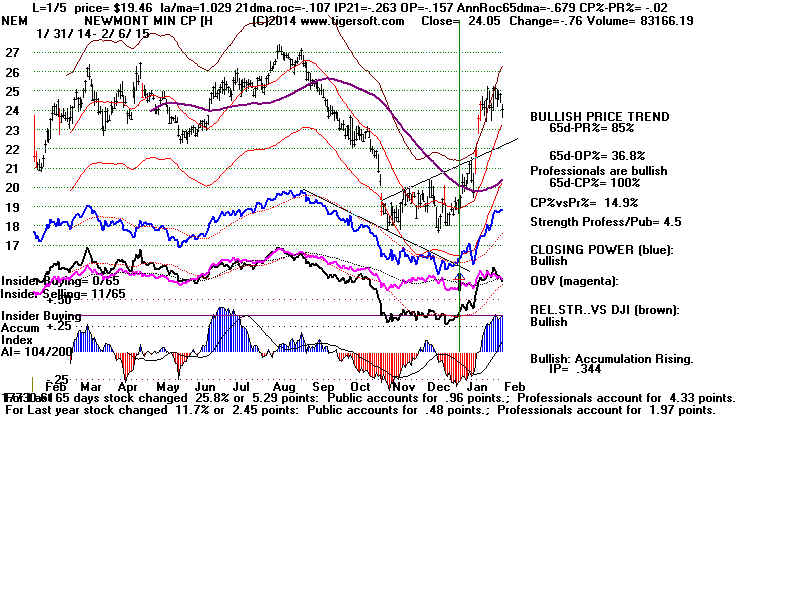

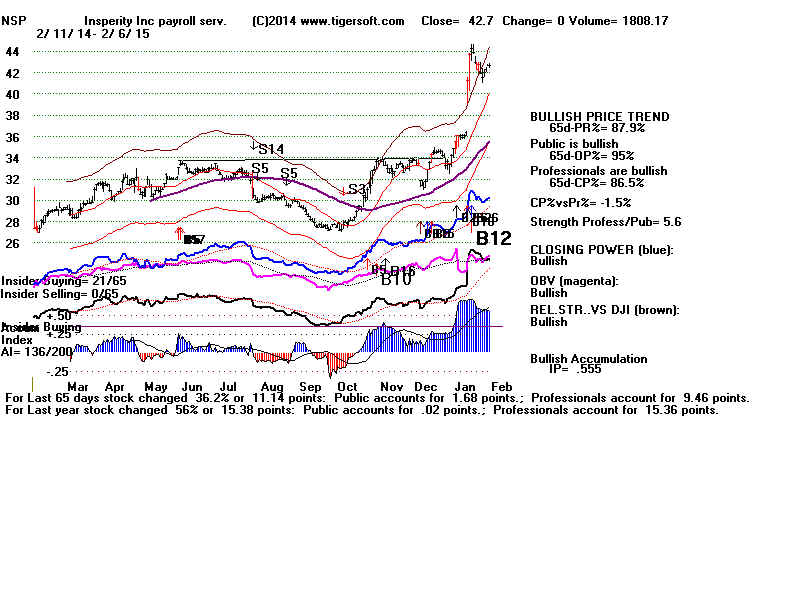

---> In newer bull markets and when the ratio of NASDAQ new highs

to new lows is greater than the ratio of NYSE new highs to new lows,

we like to find Tiger B10s, B12, B17s, B20s, B24s, B25s, B26s. These show

insider buying and confirming relative strength.

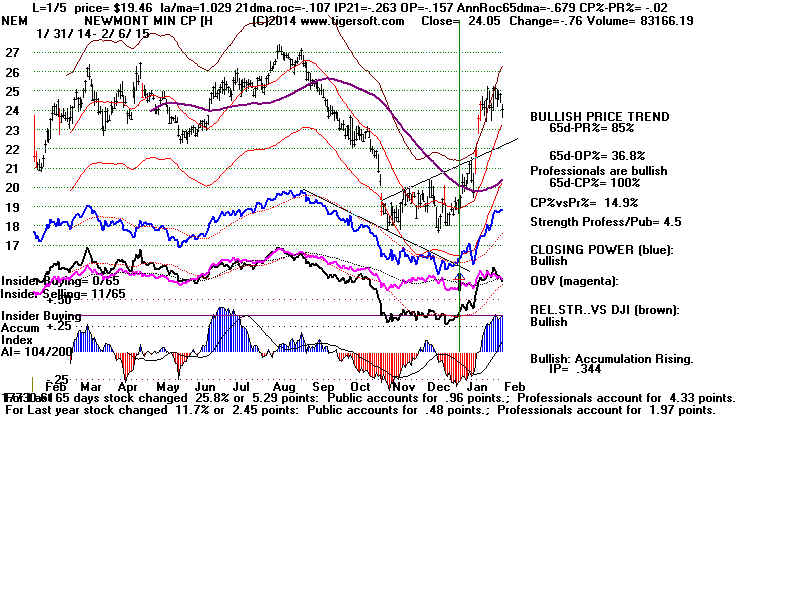

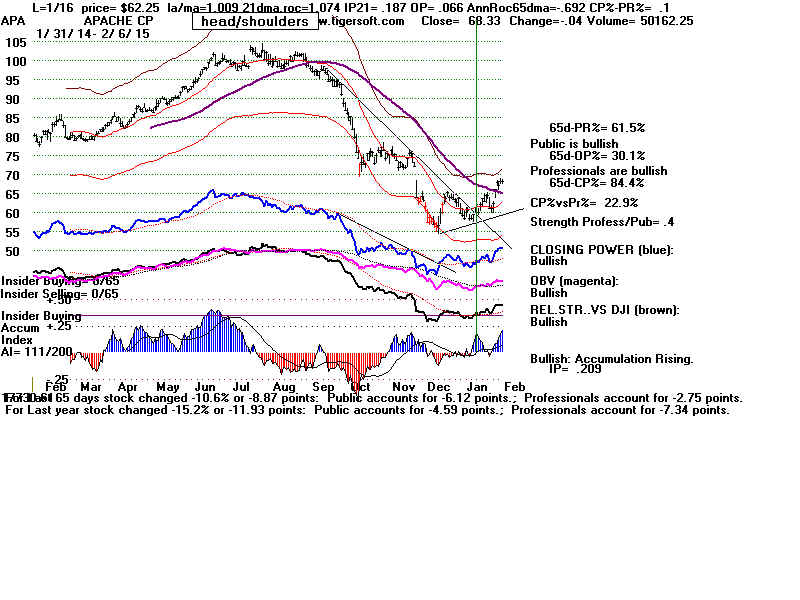

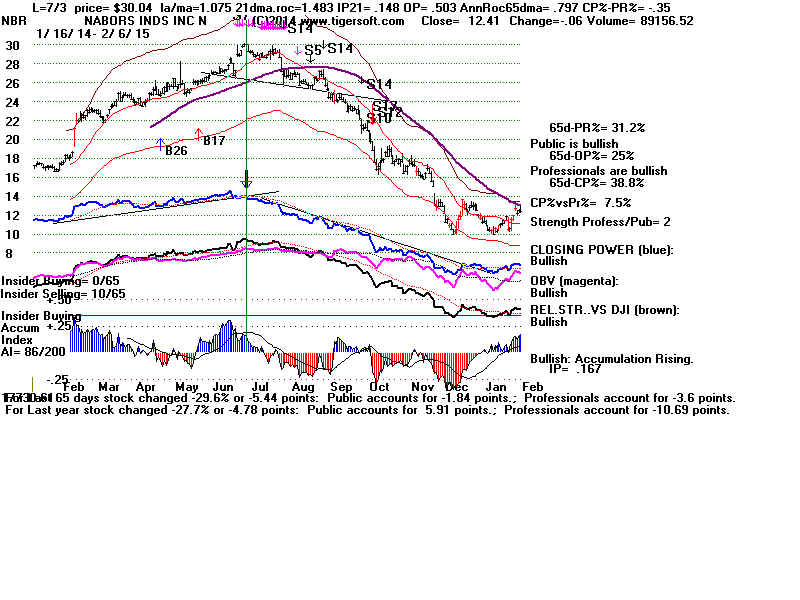

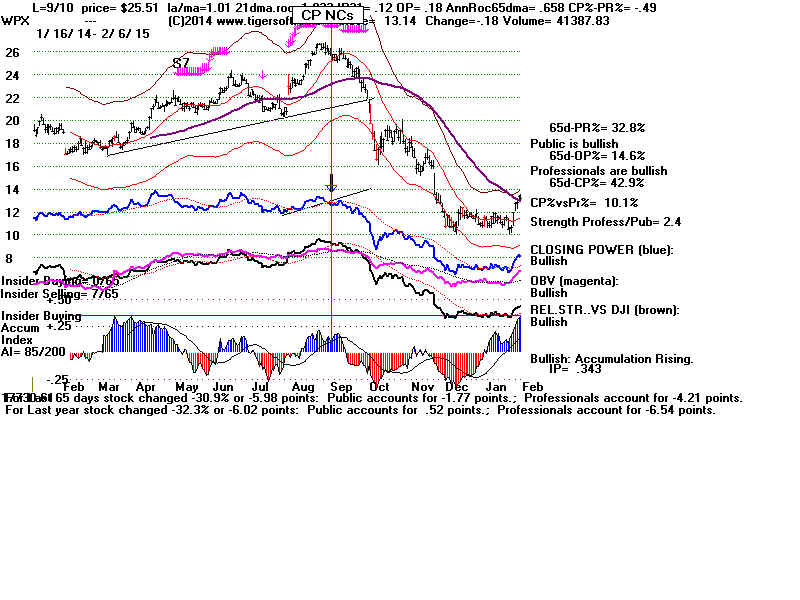

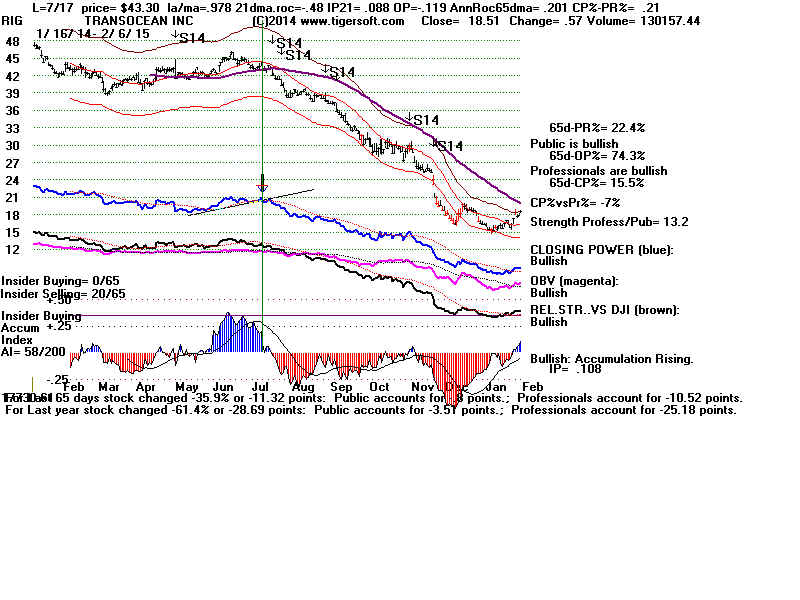

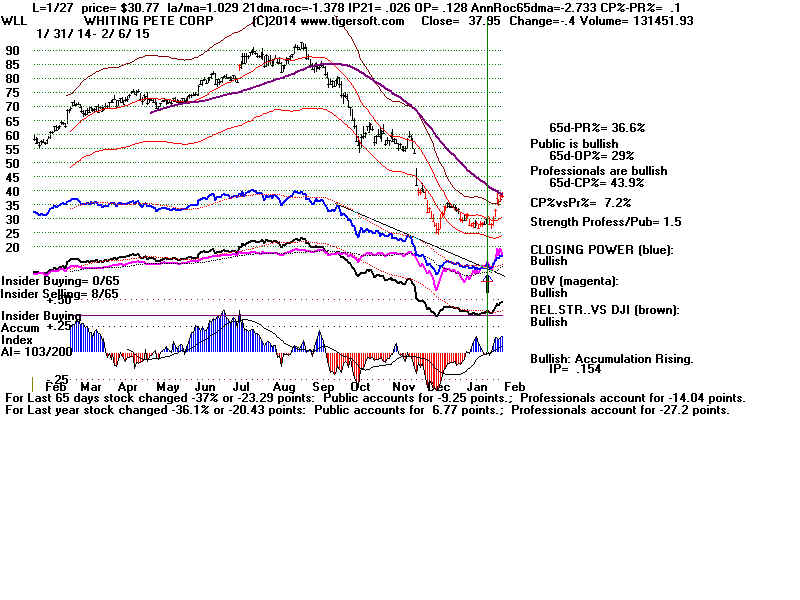

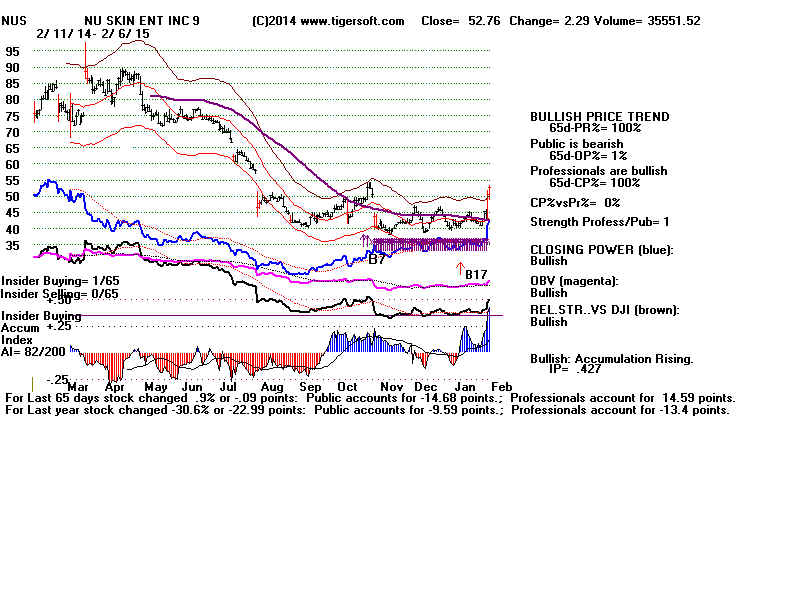

---> What are deeply over-sold stocks that break their Closing Power?

See how Closing Power has called

many Crude Oil bottoms. We do

our homework on the Hotline to make it payoff for subscribers.

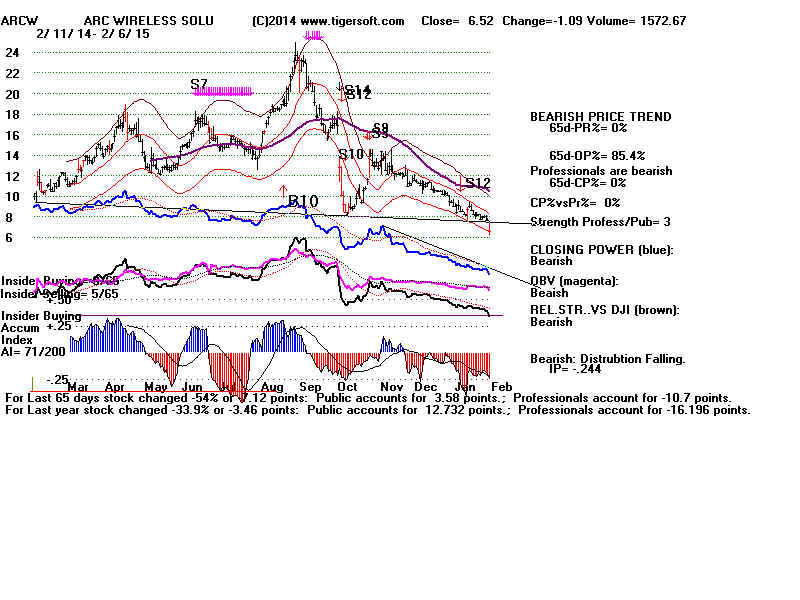

--> What are deeply over-sold stocks showing simple price trend-breaks?

---> What are stocks showing new Stochastic short-term Buys at support

and showing improving internals? Tiger easily lets you find these stocks

using the Flaging of Stochastic-Buys and Sells.

---> What are the strongest trending stocks now?

Stocks up the most over

a specified time period.

Use Old Power Ranking for x number of days.

Bullish MAXCPs

Power Rank the MAXCPs.

Weekly New Highs

Run weekly flag program and look for recent weekly B12s.

Which are the some of the stocks that have gone the longest

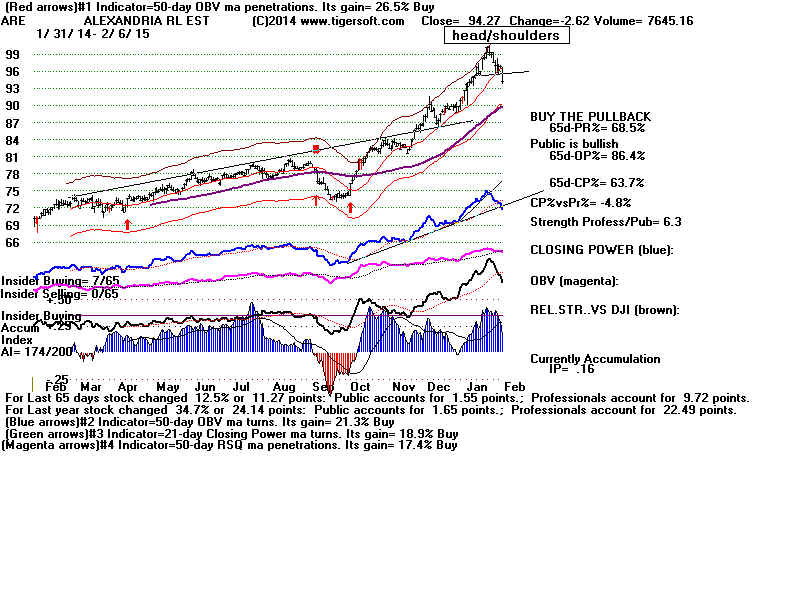

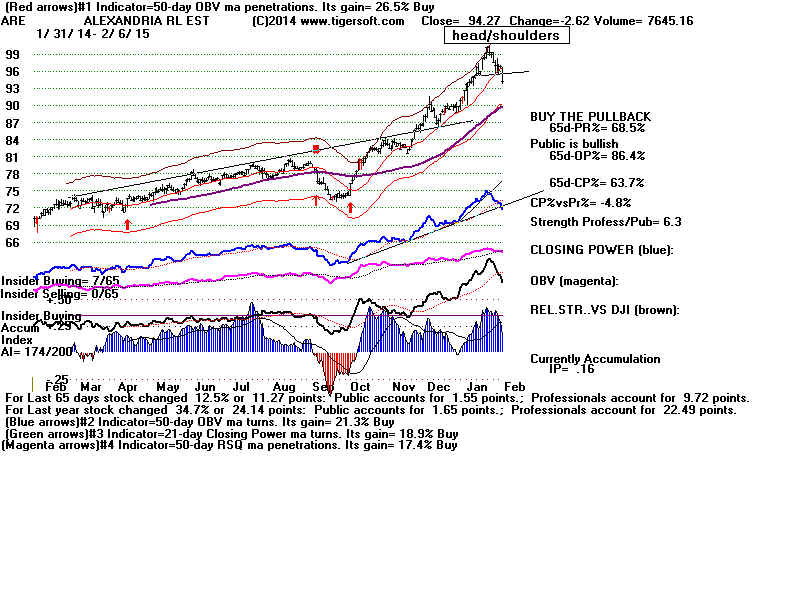

without a correction below their 65-dma? Or even their 21-day ma.

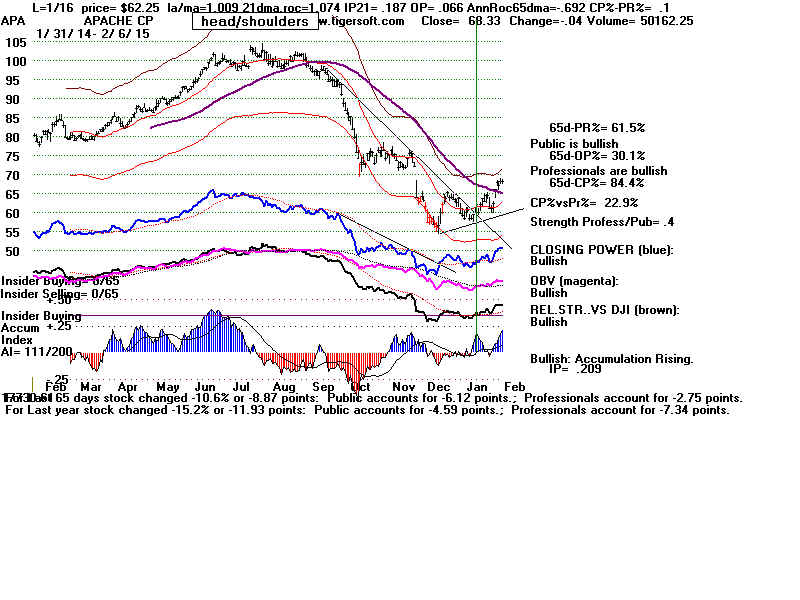

Use HISTB19 flags. But be careful if they break their Closing Power

uptrend or form head/shoulders, especially if they are over-extended.

---> Which are the stocks now showing the biggest recent bulges of insider and

Professional buying? These often lead to rallies that last, at least, another

6 months. Use the Downloads from TigerSoft - HIGHIP21 (Current high

IP21) and ACCUMVER (past IP21s). The first group shows intense insider

Buying right from a screeniong of all 6000 stocks? Look at the VHIP21

high Accum low priced stocks. From these we want red high volume

breakouts above flat resistance. Ideally, they will also have gaps

and multiple bulges of intense Accum.

---> The big jump in jobs would seem to bring closer the date when the

Fed will raise rates, even though the Dollar is already very strong. The Big

Banks love the prospects of an even stronger Dollar. Trade FAS on the upside.

---> Over-extended stocks eventually top out. All this sounds

easy enough, but

let's look back at how strongly uptrending stocks in the past have topped out,

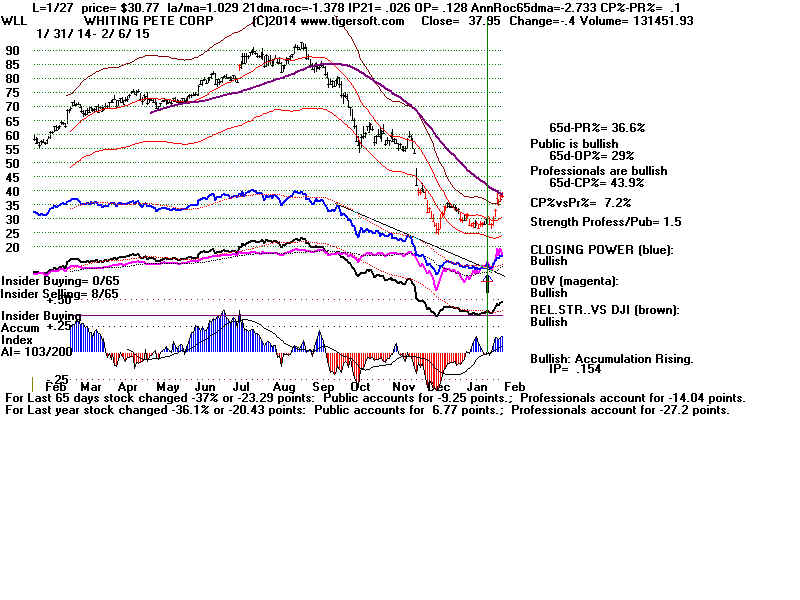

even when they started off the year in powerful uptrends. See new books

on Explosive Super Stocks and Killer Short Sales. Look at the SP-500 stocks

down the most for the 100 days.

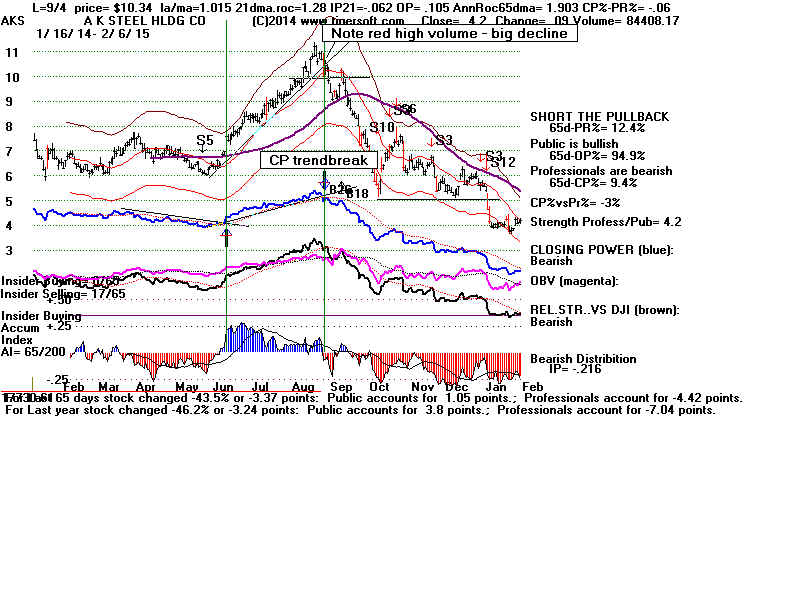

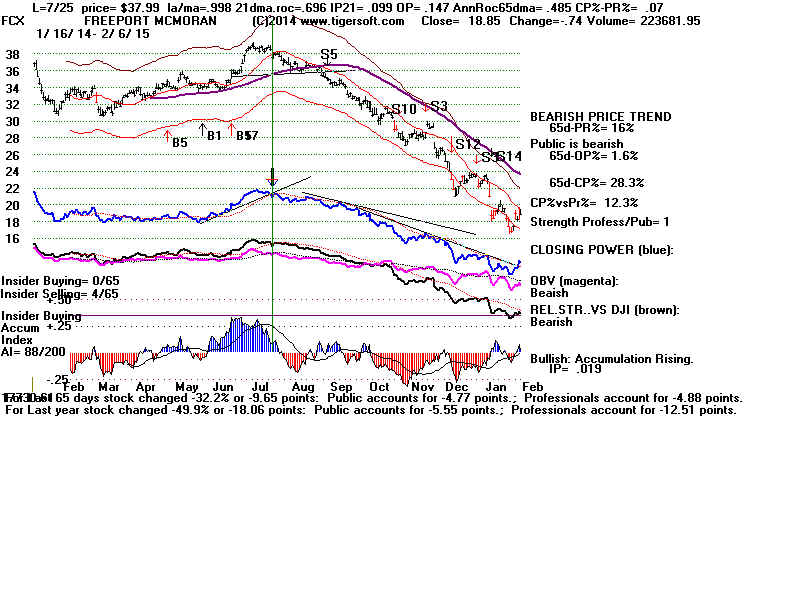

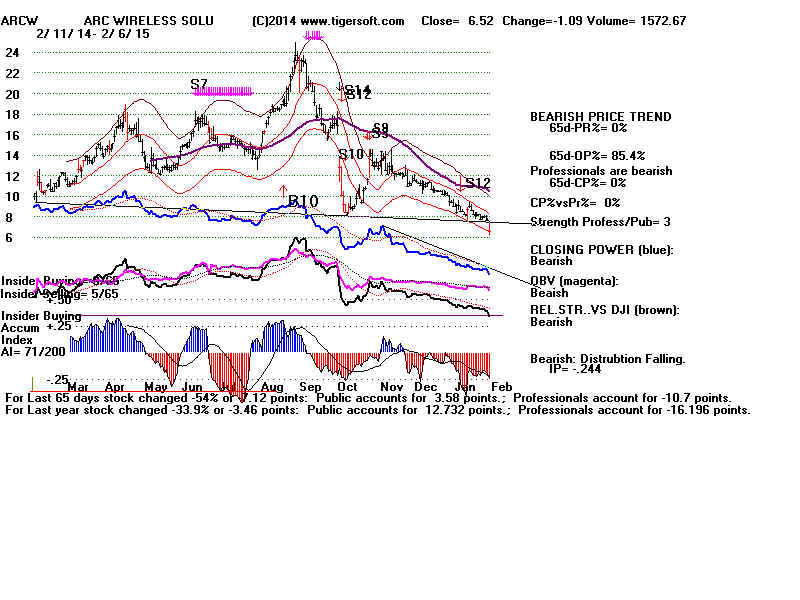

----> And if we want to hedge by selling short some of the most BEARISH

MINCP stocks, how long do we need to wait for the bullish "January effect"

on weak stocks to wear off?

-

Come and join us this Saturday. We'll make it worth your while.

Free San Diego Tiger Users' Group Meeting

Saturday,

Feburary. 7th 12:45 - La Jolla Coco's

There'll be plenty to talk about. I hope you can come.

It should be real fun to bring all our experience and knowledge

together to solve some of the key questions we all have about

investment survival in an age when Wall Street seems to

have so many advantages.

See you Saturday. Best wishes to all.

Bill