Wall Street versus Main Street

THE SECURITIES AND EXCHANGE COMMISSION HAS

MISERABLY FAILED

SHORT SELLING MUST BE VERY STRICTLY

LIMITED.

by William Schmidt, Ph.D.

(Taken from TigerSoft's Hotline for 11/18/2008)

The Bush Administration's failure to regulate the financial market

is the

biggest cause for the suffering now being experienced around the world. And it

is VITAL that we point fingers. If we do not know what caused the current disaster,

we cannot hope to have it fixed. The

Australian contained the following editorial:

"ANYONE who believes the US stock market, without a

temporary

ban on short selling, can solve the problems of the financial system

by itself relying on market forces is talking through their own book or

needs to revisit the history of the Great Depression."

Derivatives

and program trading were largely responsible for the 1987 Crash.

Mutual funds sold short SP-500 futures mechanically with computers. There was

no countervailing buyers in the short term, and so markets crashed. Now one

has to wonder how much of the market's weakness is because of how easy it is

for gangs of short sellers to drive prices down, with naked short sales, and short selling

on

down-ticks and the use of highly leveraged, ultra-bearish vehicles used supposedly only

to insure retirement accounts.

Right wing free-market ideologues, like Larry Cutlow, dare to say"Bankruptcies

are as American as cherry pie". How heartless. How cruel. It is

definitely NOT

what America stands for. America represents Hope, Progress and Opportunity.

Fluctuations

are part of capitalism. That's normal. Unregulated finance capitalism

brings

manic bubbles and tragic busts. The lessons of the Great Depression must

be

re-learned. No to know history, is to needlessly make horrendous blunders.

Lazy

C- Bush failed to read the history of the war in Viet Nam. He failed to read

about

the causes of the Great Depression. America deserves and the world

requires

much more!

Our Blog has reported on the failures of the SEC repeatedly. The urgency of

change their is clearer than ever.

TigerSoft Blog - 7/18/2008

- The SEC's Bear Market.

TigerSoft Studies of

Rampant, UnRegulated Insider Trading

6/28/ 2007 Who's

Guarding The Investors' Hen House?. SEC Chairman Cox?

Something a lot worse than the 1987 Crash is what we are

setting up for!

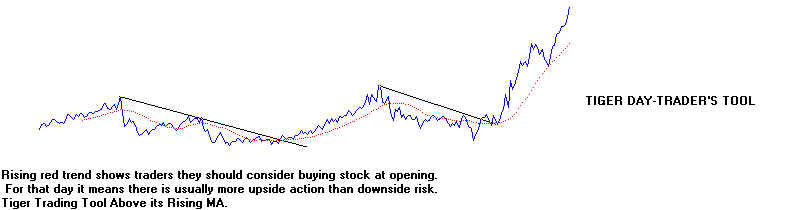

========================= DJI 1987 Crash ====================

30% DJI plunge in 3 weeks!

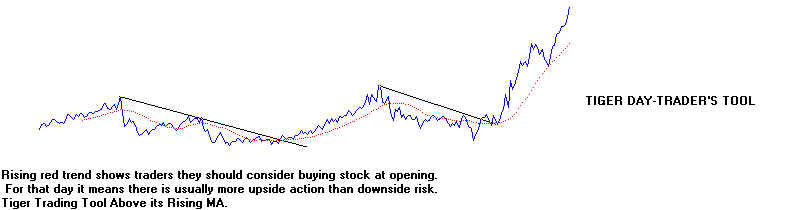

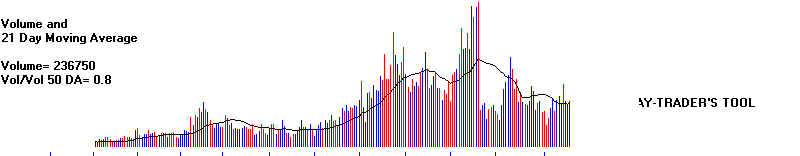

Selling Short Has Been Made Too Easy

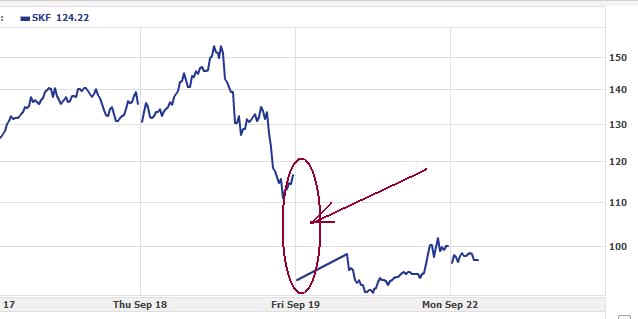

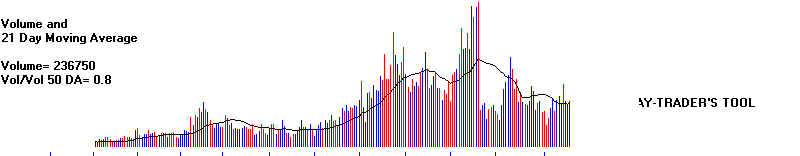

Look at the Ultra-Short ETF for Financials - SKF. It can be margined.

Its trading volume has surged. Each time SKF is bought, more short sales

are put out on financial stocks. And now down-ticks may be sold short without

even borrowing any stock. These ProShares are regulated by the exchanges.

But they are very dangerous to America. No one challenges them! No one

in Obama's entourage seems to see how much Exchange Traded Short Funds

are exaggerating price moves, to the detriment now of millions of Americans

and the whole Global Economy. SKF was started in February 2007, the top

for bank stocks. on 2/1/2007, Washington Mutual was 45. It is no bankrupt.

In the DJI-30, Citicorp was 54.73. It is now 7.

BEAR RAIDS

"A trader's attempt to force down the price of a particular security by

heavy selling or short selling.

In the case of short selling, the trader then makes

a profit by buying the stock cheaply to cover the short position. Bear raids

are often carried out by large groups of traders together, since an individual

trader might not have a large enough trade to influence

market price

significantly.

( http://www.investorwords.com/444/bear_raid.html

)

"A bear raid is a type of stock market strategy, where a trader

(or group of traders)

attempts to force down the price of a stock to cover a short position. This can be

done by spreading negative rumors

about the target firm, which puts downward

pressure on the share price. This may be a form of securities

fraud. Alternatively,

traders could take on large short positions themselves, with the large volume of

selling causing the price to fall, making the strategy self perpetuating."

( http://en.wikipedia.org/wiki/Bear_raid

)

The economic and financial ramifications of a felling stock are very clear.

The company cannot raise needed investment capital with new offerings of stock.

New projects are stopped cold. The management of the company feels the pinch

from shareholders and starts laying off people to control costs. Other companies

may decide not to work in partnership with the company that seems to be faltering,

judging from its falling stock. Bear raids, therefore,

have lasting effects! And if

they can drive a company out of business, the bear raiders never even have to

buy back their shares.

All this was fully appreciated by 1934 when Congress created the Securities

and Exchange Commission and made participating in a "bear raid" a crime.

See JK Galbriath's The

Great Crash

See Jesse Livermore's Reminiscences

of a Stock Operator

They have made short selling too easy. The Securities Exchange Commission

could care less. The man who runs it is a Bush "free-market"

ideologue who does not

believe in anything but bare-bones regulation of Wall Street. See Chistopher Cox,

a Fox in the Wall Street Hen House. Cox even bowed to Wall Street pressures in

July 2007, three weeks before the 2007-2008 Crash began, and struck down the

74-year old ban on short sales on down-ticks that had been in place since 1934. That

ban and the ban on naked short sales, which the SEC has lifted de facto, were set in

place by Congress and FDR, in the aftermath of the Crash and Depression to prevent

widespread and very pernicious bear raids by Wall Street gangs who also organized

the spreading of false rumors to bring down stock prices and destroy companies and jobs.

Read about Jesse

Livermore's nefarious Wall Street operations.

UltraShort ProShares ETFs had a rationale, of course. They were instituted

to let traders and investors hedge against beg declines. But the tail is now

wagging the dog. The market's are being pushed to extremes by the ease

with which traders can employ them.

SKF has a flat top. It may, indeed, next

breakout. That means many more financial

stocks may fall still further. I am no friend of bankers, but this extra pressure

on them is artificial and pernicious. This madness is not being challenged.

The SEC is clearly in cahoots with the gunslingers on Wall Street that

have pushed these vehicles. The inmates run the asylum. No one from

Obama's group mentions the dangers of these SHORT ETFS. Until they

are banned, why would the market not go to even more of an extreme.

|

TigerSoft

News Service 11/19/2008 www.tigersoft.com

TigerSoft

News Service 11/19/2008 www.tigersoft.com