TigerSoft News Service 5/7/2010 www.tigersoft.com

TigerSoft

News Service 5/7/2010 www.tigersoft.com

Computerized, High

Frequency Trading

Causes

Dangerous Declines and Severe Market Volatility

Look What

Computerized Trading Did in 1987.

Are We Doomed To Repeat 1987?

Where Are The Regulators?

Must They Always Be The

Puppets of Wall Street.

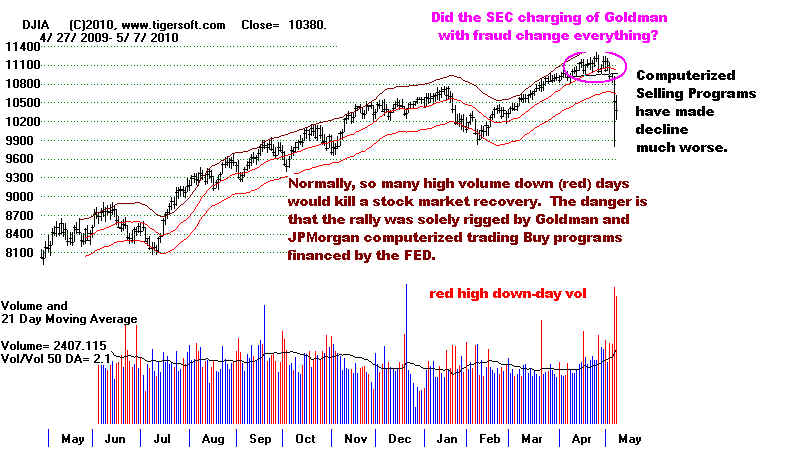

What Goldman's Program Trading Gave Us in 2009,

It Could Take away in 2010.

Is Goldman Sachs Playing

"Hardball" with The Administration?

The market started down immediately after the SEC

announced it was going after

Goldman Sachs for fraud. It is quite possible that

Goldman wishes to show Obama, the Treasury

and the SEC who is really boss. The Fed already

knows. That's is why it has given trillions

( http://seeker401.files.wordpress.com/2009/07/goldman.jpg

)

to Wall Street banks in exchange for toxic and worthless

collateral. The man in charge

of making the SEC's case against Goldman is Robert Khuzami,

a "poacher

turned into

game

warden" who wants the SEC to show it means business after years of

ineffectuality.

Warren Buffet and Goldman's CEO, Lloyd Blankfein

My view has been

that Goldman Sachs has been a key member of the Power Elite that

has been boosting

the market since March 2009. The Fed has been providing the money. Goldman

and JP Morgan have been program-trading stocks

upwards. And the Obama Administration

has been laying off the populist rhetoric and

slipping Wall Street favors under the table.

But now that alliance seems to be breaking up.

Obama's Attorney General has let it slip

that criminal fraud charges will be brought against

Goldman. That could spell big trouble for

the stock market if it's true that the gains for the

last year have been mostly artificial, i.e. they

do not reflect an improving economic outlook. If

Goldman starts using Sell Short programs

as effectively as it has its Buy programs, much of

the last year's market gains are in

jeopardy. But would Goldman really want now to

declare war on the US Governmnet like

it has Greece? That would make the Government

go after it with total vigor and resolve.

More likely, the government will let Goldman off the

hook for what seems like a big fine,

perhaps $100 million, and things will return to

"normal". In return, Goldman will not use its

computerized sell programs and, in return, continue

to get the full support of the Federal Reserve

and not be prosecuted criminally.

In the last few years, high-frequency

100% automated trading has come to dominate ALL

NYSE and NASDAQ trading. This trading is conducted by

Goldman Sachs, Barclay’s Capital,

Wedbush Morgan, Credit Suisse, Deutsche Bank, JPMorgan and

RBC Capital (Royal Bank of

Canada). Goldman is the most active in using this

type of trading for its own account. Such

trading is very lucrative. Look at Goldman's

earnings, $9 Billion in the lat two quarters along.

Automatic computerized

trading now accounts for 20%

to 75% of any given day's trading.

Barrons's provides the

data on the weekly

NYSE buy, sell and arbitrage trading each week

as a percentage of NYSE

volume.

Last July, as the market was leaping upwards, computerized

trading amounted to 75% of all NASDAQ trading, of which

Goldman accounted for 90%. Last

July, I wrote: "Goldman now trades

much more aggressively for its own account, as principals,

far more than any

other brokerage or investment bank. The current ratio of trading for

themselves as

opposed for clients is 5:1, among the very highest on Wall Street."

Last year

the code for Goldman's computerized trading was

stolen by a Russian who had worked

for them.

Imagine what might have happened if this Russuan programmer had sold

the code to some country that wanted to destroy America.

Wall Street tell us that their

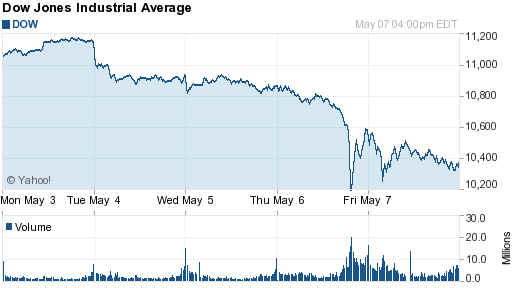

trading provides liquidity and depth to the market. Thursday's

volatility shows how fraudulent such a defense is.

Clearly rhere is real danger in their uncontrolled

high frequency computerized trading. on Thursday, the

DJIA fell 700 points in 10 minutes! At

that point it was down almost 1000 points intra-day,

9.997%, from the previous day's close. A week

of this type of action will wipe all the gains of the last

year.

Last week's computerized trading

and downside volatility are very worrisome. Does

Goldman think the US market is on very weak underpinnings?

If they can send it up, then

why can't they send it down the same way? And who will want

to buy in a market with

so much volatility. Thursday's decline was not due just to

a "trading glitch". If it had been,

the market would have risen Friday. Instead it fell

another 140.

Besides their magnitude, speed and

ubiquity, the central trading issue here is that these high

frequency computerized buy and sell programs are often

"pile-on programs". The computers don't

care what caused the initial move in the first place.

It could be a news event or it could be an

error in an order hand-entered, which says sell billions

instead of millions of dollars of stocks.

The computers don't care. They just trade and

reinforce the trend. The danger here, of course,

is that they usually exaggerate market moves, very

dangerously and totally recklessly. And

in the process, they quickly destroy investor confidence.

That affects retirement accounts,

business confidence and thus jobs for working people on

Main Street.

Where are the regulators? No

where! For years and years, the regulators have just done

whatever the biggest Wall Street firms want, as when

Goldman saw a bear market coming in mid

2007 and prevailed upon Securities Exchange Commisoner Cox

to allow short sales on downticks

for the first time since the Depression. In June

2007, the SEC bowed to pressure from Goldman

Sachs and suddenly allowed short selling on down-ticks and

stopped policing the requirement that

shares first be borrowed before they were sold short.

From 1934 to 2007, selling short on

down-ticks and naked short selling had been banned because

of how pernicious rigged selling by

bear raiders had been between 1929 and 1933. In

the New Deal era is was appreciated that

Wall Street could not be allowed to run wild.

Businesses would be bankrupted if big organized

Wall Street bear raiders were free to create panic and

ruin.

The computer programs often buy and sell

automatically when prices rise or fall a certain amount

or trade past a certain price level. trading firms

have computers that are programmed to automatically place

buy or sell orders based on a variety of things that happen

in the markets. Clearly, allowing this

relatively new type of computerized trading gives the

fastest firrms an advantatge. But that removes

human conrols. And the end result is a sharp increase

in downside volatility when days are already

down a lot. We should have learned the dangers of

allowing this trading from the October 1987

experience, but de-regulation and the domination of

"regulators" by the biggest Wall Street firms

have made matters much worse.

Some circuit breakers do

exist. These were instituted after the 1987 crash, but they were very weak,

did nothing to limit the growth of computerized trading and

, worked only for a limited amount of time during

the day and only went into force when the DJI was down more

than 10%. Worse, there is no halt in trading

in the last hour and a half unless the market is down 20%.

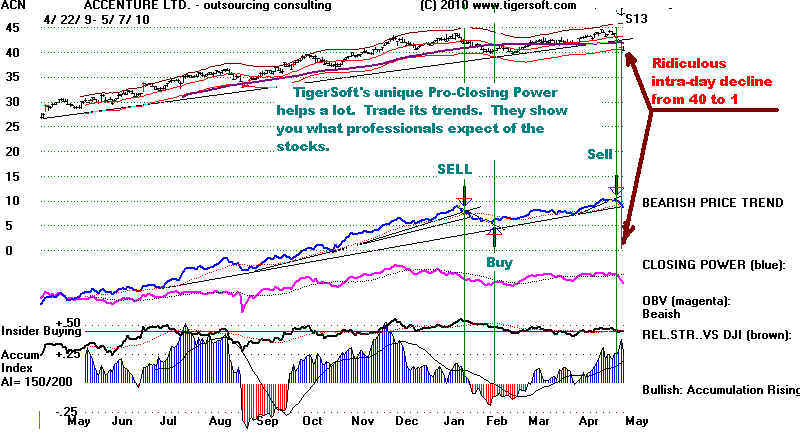

The regulators have clearly failed

the small invetsor again. In one egregious case on

Thursday, Accenture

went from $40 to $0.01 in a couple minutes.

One solution to high frequency trades would be to tax them. That would stop this

parasitic trading that

enriches big borkerage firms at the expense of the public. Not surprisingly,

Wall Street's latest Treasury

Secretary, Tim Geithner, opposes it and Obama is silent.

Putting

a few more speed bumps to slow rapid declines down a but is about all we can expect,

until

Obama chooses to act as a

leader instead of being a puppet and follower of his Wall Street

advisors.

I am not the only one to come the conclusion that computerized program trading

should be abolished.

"(P)rogram-trading, now known as

“high-frequency” trading, serves no purpose

but to line the pockets of the program-trading firms at the expense of the millions of

other investors participating in the market...

"Investigations after the October 19, 1987 crash revealed that what would have

been a normal down day in a correction that had begun in August was turned into the

heart-stopping, portfolio destroying 1987 crash by uncontrolled automated waves of

sell-programs that flooded in from program-trading firms and overwhelmed the market.

As their ‘portfolio insurance’ protective stops were successively hit the

automated sell

orders came so fast on top of each other at ever lower prices that market-makers

could not match them up with buyers. Very quickly there were no buyers anyway, and the

decline just plunged into a dark bottomless hole.

"..(A)fter 1987 curbs were placed on program-trading to try to rein it in. The curbs

called for the market to be closed for cool-off periods if the Dow fell a certain number

of

points in a day. But, as a result of lobbying by Wall Street, those curbs were watered

down

and mostly eliminated along with the uptick rule."

(Sy Harding http://blogs.forbes.com/greatspeculations/2010/05/08/program-trading-needs-to-be-banned/

)

High Frequency Trading Is

Prolifferating

Visit

the office of Tradeworx in New Jersey.

| High Frequency Trading Is Prolifferating Visit the office of Tradeworx in New Jersey. ( http://finance.yahoo.com/news/Speedy-New-Traders-Make-Waves-nytimes-3183816332.html?x=0&sec=topStories&pos=7&asset=&ccode= ) "Here, inside the humdrum offices of a tiny trading firm called Tradeworx, workers in their 20s and 30s in jeans and T-shirts quietly tend high-speed computers that typically buy and sell 80 million shares a day. But on the afternoon of May 6, as the stock market began to plunge in the “flash crash,” someone here walked up to one of those computers and typed the command HF STOP: sell everything, and shutdown. Across the country, several of Tradeworx’s counterparts did the same. In a blink, some of the most powerful players in the stock market today — high-frequency traders — went dark. The result sent chills through the financial world. After the brief 1,000-point plunge in the stock market that day, the growing role of high-frequency traders in the nation’s financial markets is drawing new scrutiny. Over the last decade, these high-tech operators have become sort of a shadow Wall Street — from New Jersey to Kansas City, from Texas to Chicago. Depending on whose estimates you believe, high-frequency traders account for 40 to 70 percent of all trading on every stock market in the country. Some of the biggest players trade more than a billion shares a day. These are short-term bets. Very short. The founder of Tradebot, in Kansas City, Mo., told students in 2008 that his firm typically held stocks for 11 seconds. Tradebot, one of the biggest high-frequency traders around, had not had a losing day in four years, he said. But some in Washington wonder if ordinary investors will pay a price for this sort of lightning-quick trading. Unlike old-fashioned specialists on the New York Stock Exchange, who are obligated to stay in the market whether it is rising or falling, high-frequency traders can walk away at any time. While market regulators are still trying to figure out what happened on May 6, the decision of high-frequency traders to withdraw from the marketplace is under examination. Did their decision create a market vacuum that caused prices to plunge even faster? “We don’t know, but isn’t that the point? How are we ever going to find out what’s going on with these high-frequency traders?” said Senator Edward E. Kaufman, Democrat of Delaware, who wants the Securities and Exchange Commission to collect more information on high-frequency traders. “Whenever you have a lot of money, a lot of change, little or no transparency, and therefore, no regulation, you have the potential for a market disaster,” Senator Kaufman added. “That’s what we have in high-frequency trading.” Some high-frequency traders welcome the closer scrutiny. “We are not a no-regulation crowd,” said Richard Gorelick, a co-founder of the high-frequency trading firm RGM Advisors in Austin, Tex. “We were all created by good regulation, the regulation that provided for more competition, more transparency and more fairness.” But critics say the markets have become unfair to investors who cannot invest millions in high-tech computers. The exchanges offer incentives, including rebates, which can add up to meaningful profits for high-volume traders as well. “The market structure has morphed from one that was equitable and fair to one where those who get the greatest perks, who have the speed, have all of the advantages,” said Sal Arnuk, who runs an equity trading firm in New Jersey. High-frequency traders insist that they provide the market with liquidity, thus enabling investors to trade easily. “The benefits of the liquidity that we bring to the markets aren’t theoretical,” said Cameron Smith, the general counsel for high-frequency trading firm Quantlab Financial in Houston. “If you can buy a security with the knowledge that you can resell it later, that creates a lot of confidence in the market.” The high-frequency club consisting of 100 to 200 firms are scattered far from the canyons of Wall Street. Most use their founders’ money to trade. A handful are run from spare bedrooms, while others, like GetCo in Chicago, have hundreds of employees. Most of these firms typically hold onto stocks for a few seconds, minutes or hours and usually end the day with little or no position in the market. Their profits come in slivers of a penny, but they can reap those incremental rewards over and over, all day long. What all high-frequency traders love is volatility — lots of it. “It was like shooting fish in the barrel in 2008. Any dummy who tried to do a high-frequency strategy back then could make money,” said Manoj Narang, the founder of Tradeworx. A quiet man with a quick wit and a boyish enthusiasm, Mr. Narang, 40, looks like he came out of central casting from the dot-com era. Wearing jeans, a gray T-shirt and a New York Yankees hat, he takes a seat in front of his computer terminal and quietly answers questions about his business, glancing occasionally at the Yankees game in one of the windows on his PC. After graduating from M.I.T., where he majored in math and computer science, Mr. Narang bounced around Wall Street trading desks before starting Tradeworx in the late 1990s. At the time, Wall Street was at the beginning of a technological evolution that has changed the way stocks are traded, opening a variety of platforms beyond the trading floor. The Tradeworx computers get price quotes from the exchanges, decide how to trade, complete a risk analysis and generate a buy or sell order — in 20 microseconds. The computers trade in and out of individual stocks, indexes and exchange-traded funds, or E.T.F.’s, all day long. Mr. Narang, for the most part, has no idea which stocks Tradeworx is buying or selling. Showing a computer chart to a visitor, Mr. Narang zeroes in on one stock that had

recently been a winner for the firm. Which stock? Mr. Narang clicks on the chart to bring

up the ticker symbol: NETL. What’s that? Mr. Narang clicks a few more times and

answers slowly: “NetLogic Microsystems.” He shrugs. “Never heard of it,”

he says. If high-frequency traders crave volatility, why did Tradeworx and others turn off their computers on May 6? Mr. Narang said Tradeworx could not tell whether something was wrong with the data feeds from the exchanges. More important, Mr. Narang worried that if some trades were canceled — as, indeed, many were — Tradeworx might be left holding stocks it did not want. Now that the dust has settled, however, he has mixed feelings. “Several high-frequency trading firms that I know about stayed in the market that day,” he said, “and had their best day of the year.” |