TigerSoft

News Service 11/21/2008 www.tigersoft.com

TigerSoft

News Service 11/21/2008 www.tigersoft.com Phases of A Typical Speculative Stock

1 PUBLIC OFFERING or PUBLIC SELLING PANIC PANIC

2. BASE-BUILDING and INSIDER BUYING

3. TAKE-OFF: PROFESSIONAL BUYING AND SPONSORSHIP

4. TOPPING OUT: HYPE, INSIDER SELLING, PUBLIC BUYING

5. COLLAPSE: PROFESSIONALS' SHORT SELLING, PUBLIC BUYING

6 BAD NEWS: PUBLIC AND INSTITUTIONAL SELLING PANIC

The Examples of DRYS (below) and TASR

by William Schmidt, Ph.D. - author of TigerSoft and Peerless Stock Market Timing.

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

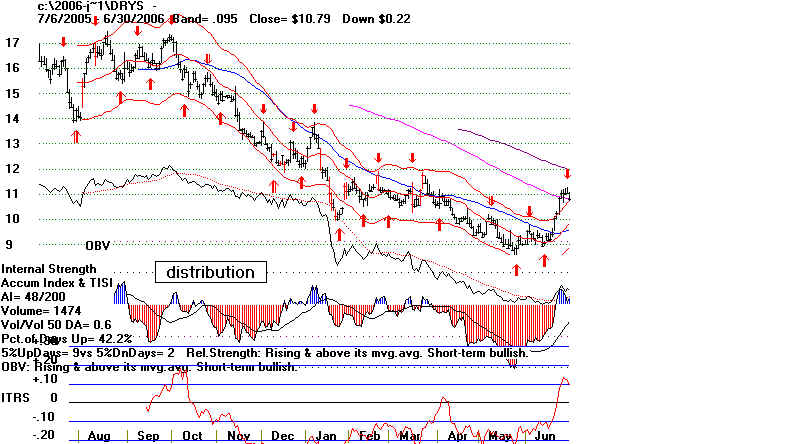

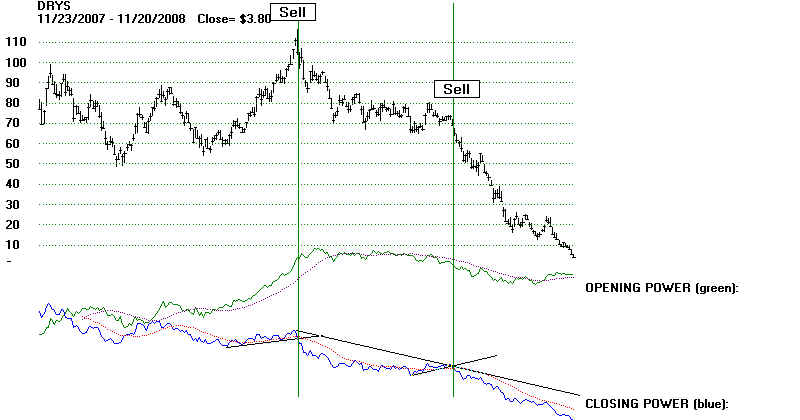

| PHASES of A TYPICAL SPECULATIVE STOCK 1. PUBLIC OFFERING - Often the stock settles back awhile if market is weak. 2. TAKE-OFF and MARK-UP Insider Buying and Flashy, Eye-Catching Advance, Key Borkerage Sponsirship, Professional and Institutional Buying. Public Selling and Skepticism. 3. TOPPING OUT: Insider Selling, Hype and Bullish Publicity, Public Buying 4. COLLAPSE: Public Bargain Hunting Buyers Are Victimized. Professional Short Selling. Institutions Dump 5. BASE RE-BUILDING: Public Panic and Frustration. Short-Term Professional Traders Dominate. by William Schmidt, Ph.D. 1. PUBLIC OFFERING DRYS - 2005 DryShips, Inc. engages in the ownership and operation of drybulk carriers worldwide. The company's fleet carries various drybulk commodities, including coal, iron ore, grains, bauxite, phosphate, fertilizers, and steel products. As of March 14, 2008, it owned and operated a fleet of 46 drybulk carriers comprising 5 Capesize, 31 Panamax, 2 Supramax, and 8 newbuilding drybulk vessels with a combined deadweight tonnage of approximately 4 million tons. The company was founded in 2004 and is headquartered in Athens, Greece. It expaned its fleet from six to 48 vessels with the proceeds from its September 2004 public offering. Recently it has started operating some oil drilling rigs. The stock is clearly a play on world demand for commodities and will rise and fall as they do. Here in this Blog, I only want to show the big swings in a stock like this and how watching the Accumulation Index, 50-day ma, the TIger Closing Power and the Tiger Day Traders' Tool are essential in catching the violent moves up and down. The huge volatility you see here is typcial of speculative stocks whose profits go up and down with the prices of commodities and the swings of the world economy. head and shoulders top below (blue) 50-day ma - mostly red Distribution.  The best trading system for DRYS at this time was based

on the trends of the The best trading system for DRYS at this time was based

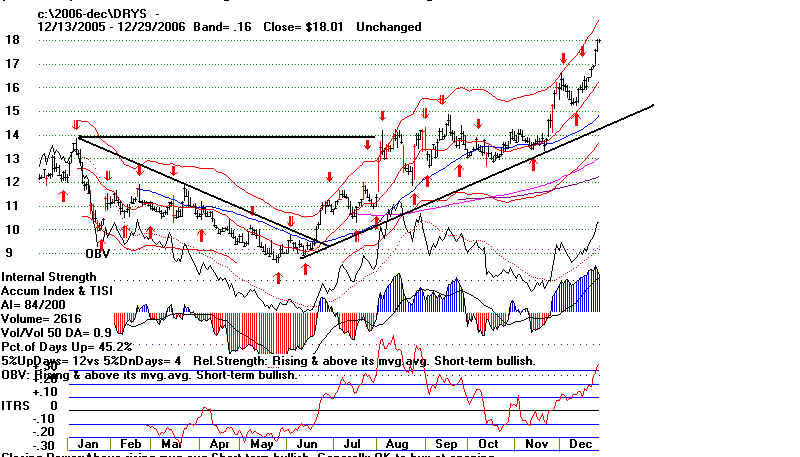

on the trends of the TigerSoft Closing Power. DRYS - 2005 - 2006 Professionals dominate the stock in this period with short-term Buys and Sells. But 50-day ma is violated to upside and Accumulation Index turns positive. After a big drop, this is bullish. But there is still lots of overhead supply from the buyers at 20 a year earlier.  DRYS - 2006

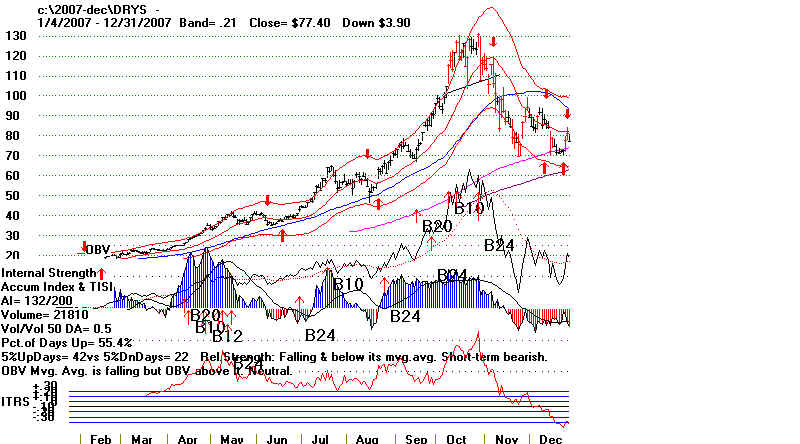

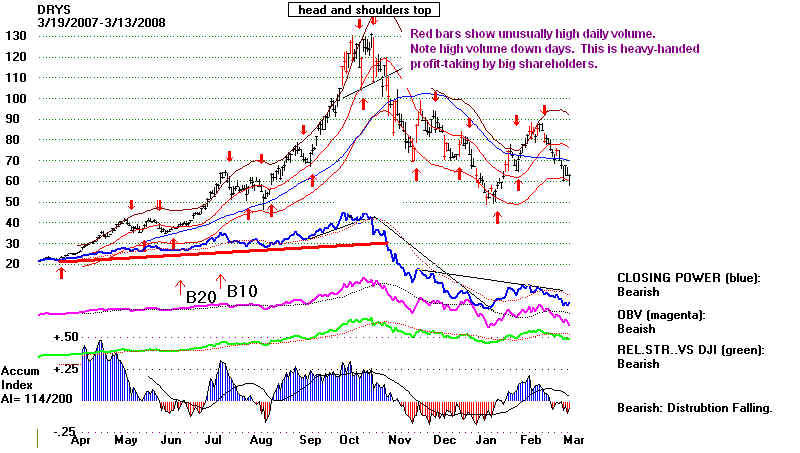

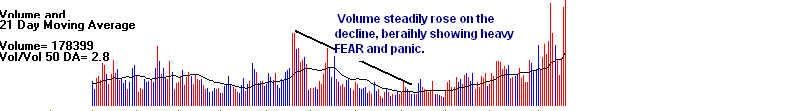

DRYS - 2006Professionals continue to dominate the stock in this period with short-term Buys and Sells.  2. TAKE-OFF DRYS - 2007 This stock surged past the earlier 25 high. Now eveyone had a profit. No one new where to sell and take profits. Aggressive accumulators came into the stock around 30. Note the huge bulge of blue from TigerSoft Accumulation Index. The stock quadruples in quadruples in six months.  3. Topping Out DRYS - 2007-2008 After quadrupling. DRYS forms a classic head and shoulders pattern between 105 and 131. It is distinctly bearish when it drops below the neckline of this pattern. The blue 50-day ma turns down and the Accumulation Index changes to red, which is bearish. The stock tries to find support at its rising 30-week at 70, but must drop to 50 to find enough buyers to rally.  4. COLLAPSE Warning signs appeared aplenty in mid 2008 that the stock was in trouble: 1) May 2008 high was below the high of 2007. 2) Price support at 62 was violated in September. 3) Prices quickly fell below the normal lower band in September. 4) OBV maked confirming new lows as price fell. 5) Tiger's Accumulation Index drops below -.25 (the level considered "insider selling"). After recovering, it dropped below its black ma. 6) The relative strength ITRS indicator makes new lows in September bearish below -.30. 7) Tigersoft's Day Traders' Tool diverged downward from the stock's upward price action in the first half of 2008. 8.) We would use breaks to the downside of the Closing Power uptrends as points to Sell Short given so many bearish cconsideration.  Heavy downside volume.  TheTiger Day Traders' Tool diverged downward from the rallying prices in the first half of 2008. This extreme divergence warned of wxtreme price weakness ahead. (This tool is our creation and is explained in the Help routines of the software.)  TigerSoft's Closing Power's trend-breaks offer excellent points to trade. Since the stock was showing so much weakness, we would be especially interested in Sells on breaks in the uptrends of the Closing Power, to the point even of going short.  |

| |