TigerSoft

News Service 5/1/2008 www.tigersoft.com

TigerSoft

News Service 5/1/2008 www.tigersoft.com OVERPAID CEOs

ARE LOOTING THEIR COMPANIES,

WIPING OUT THE SAVINGS OF THEIR SHAREHOLDERS,

AND MAKING EVERYTHING FROM HEALTH CARE AND

ELECTRONICS TO FUEL AND SNEAKERS

MUCH MORE EXPENSIVE.

by William Schmidt, Ph.D.

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

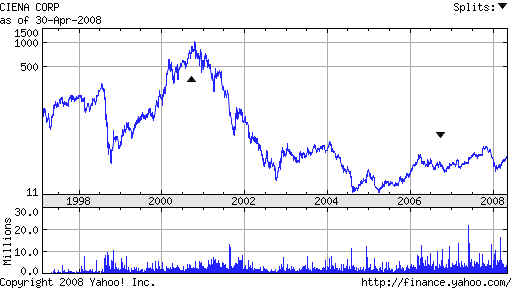

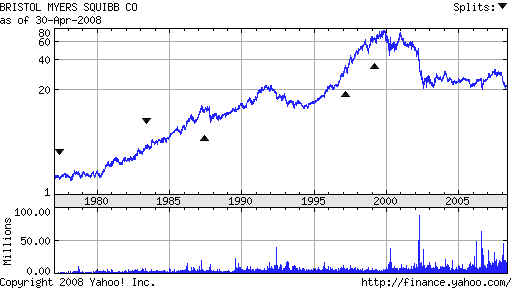

GREEDY and OVERPAID CEOS ARE LOOTING THEIR COMPANIES AND WIPING OUT THE SAVINGS OF THEIR SHAREHOLDERS, NOT TO MENTION THEIR WORKERS AND CONSUMERS!  ( http://www.cartoonstock.com/directory/e/emo.asp ) It's all too easy to find examples of grossly overpaid American CEOs who choose to grab all they can while running their companies into the ground. All you have to do find such companies is look for stocks that are down 50%, 75% or even 90% or more over the last 2-5 years. Seldom are the CEOs who ruined the company and its stock fired. And if they are let go, they typically receive "golden parachute" worth millions. See the examples of Colt, Pfizer, MER, Citigroup, Starwood... You can readily go to Yahoo Finance and see for yourself how much these greedy SOBs are paying themselves for their failures in leadership. To make matters worse, most dumped thousands and thousands of shares of their companies' stocks, which they got as "bonuses", before the bad news came out and dropped their stock even more. See the cases of Citigroup and Washington Mutual. Executive pay and bonuses are only part of the their compensation. The average American worker cannot begin to imagine how plush the world of CEOs is with their company jets, chauffeured cars, corporate townhouses, retreats, apartments, golf club memberships, penthouse seats for ball games, food and catering, butlers and personal assistants. Over the next week or so, TigerSoft will give more examples. This is a problem that shows no signs of going away. CEOs seem to be a special class of humanity, all greed and arrogance. The worse they are for their shareholders, the more they grab all they can! And their Board of Directors are happy to consort in the looting. It's high time Board of Directors automatically have labor representation on their Board. The European experience shows it works. (Google "mitbestimmung" (or co-determination) and translate it. ) Ever Wonder Why US Health Insurance Is So Expensive? Absurdly high health company executive pay is a big part of the problem. There are about 23 big health companies. Using United Healthcare as an example, their CEO was paid about $324 million over a five year period. For the 23 health insurance companies, that's about $7 billion just for just 23 CEOs. If you add in all the Vice Presidents and the "fat cats" on these companies' Boards of Directors, the 5-year cost is probably about $30 Billion just for these companies. If their pay was reduced by 80% in a public national health insurance scheme, that would go a long way toward providing more affordable health care. Let's say a government run health insurance program costs $10,000 for each family. This alone would pay the health insurance for more than 500,000 American families a year. The same argument can be made for the high costs of many others goods and services. See http://blogs.webmd.com/mad-about-medicine/2007/08/ceo-compensation-who-said-healthcare-is.html http://healthcare-economist.com/2006/02/14/united-health-ceo-earned-1248-million-in-2005/   It's clear to most Americans that health insurance profits depend upon reducing the amount of health care provided the millions who are insured and not insuring those who need health care the most. So, when a health insurance CEO gets a "merit" bonus for exceeding profit goals, it's obvious the American health system is not meant to provide health care as much as it is meant to benefit those who run these companies in ways most working people cannot even imagine, so garish and extravagant are these CEOs' life-styles and senses of entitlement.

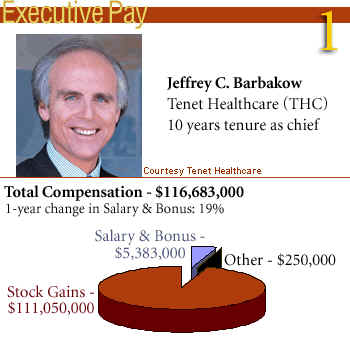

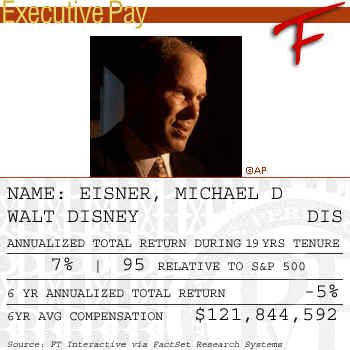

Today, the NY Times re-ran an article, "Millions for (CEO) Moochers" that first appeared in 2004. The average CEO of a major corporation is paid $10.8 million a year. The company's Board of Directors approve this pay, so that they, too, can get a piece of the corporate pie. Consultants are then hired to show that such pay is necessary. The purity of their greed is quite amazing. It's a throw-back to the Gilded Age of Monopolies, Robber Barons, no unions and the 50-hour work week. It's not surprising that real wages for American workers have been declining since 1971.  "While Disney artists bring their imaginations to life through animation, Disney executives are living a lifestyle that animators can’t even begin to imagine. The Wall Street Journal recently reported that Disney chief executive Bob Iger received a 7% pay increase in 2007 for a total financial compensation of $27.7 million. According to the company’s proxy statement, the breakdown is as follows: $2 million salary, which remained the same as 2006; a $13.7 million bonus, which was a decrease from his $15 million bonus in ‘06; stock awards totaling $7.9 million, and $740,000 for personal air travel, security and a car benefit. Other Disney execs who earned healthy sums were CFO Thomas Staggs ($9 million), General Counsel Alan Braverman ($7.9 million), executive vp of human resources Wesley Coleman ($2.7 million) and executive vp for corporate strategy Kevin Mayer ($2.6 million)." ( http://www.cartoonbrew.com/disney/the-salaries-of-disney-execs ) We start by looking at an articles written in 2005. I have added relevant materials that were found on the internet. In 2005, Michael Brush of MoneyCentral.MSN wrote: (Source: http://moneycentral.msn.com/content/p125120.asp ) "Consider Michael Ovitz. Although stockholders sued, the one-time Hollywood superagent gets to keep the $140 million he was paid for 14 months of work as president at Walt Disney breach its responsibilities in awarding the huge severance package. While the Ovitz payout may have been legal, it's the type of corporate behavior that costs investors millions of dollars every year. And it's not just a few spendthrift companies throwing good dollars after bad leaders. We scoured corporate regulatory filings and found plenty of examples of overpaid underachievers in executive suites. Ultimately, we came up with a list of the five most overpaid bad chief executives..." I want to make clear that I could just as easily have taken up the "obscene executive payouts" at Warner Music. or ex-Disney boss Michael Eisner's fantasyland pay of $285 million for running his company nearly into the ground, with earnings falling 63% from 1996 to 2004. GARY SMITH'S RECENT INSIDER SELLING

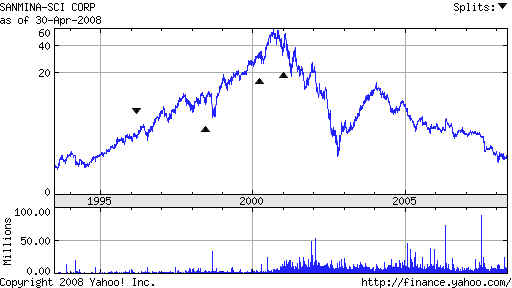

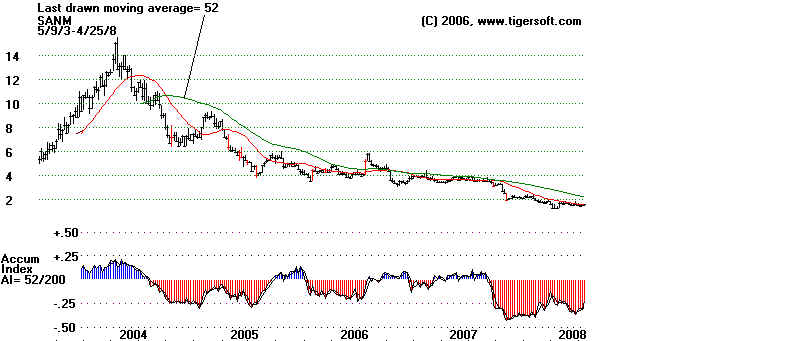

* Indicates shares held indirectly

collected $26.4 million during the past four years while Sanmina shares fell 78%. The bulk of Sola's pay came in the form of a performance bonus of $19.9 million, paid for hitting one recent quarter's targets. "According to a blog post by Business Editor Bolaji Ojo, posted on EETimes, Jure Sola of Sanmina-SCI Corp. is holding tightly to his job despite a litany of problems. The market in which Sanmina-SCI plays today is not the one Sola started out leading in 1991." More

than 16 years after assuming the position of chairman and CEO, Jure Sola of Sanmina-SCI is

holding tightly

chairman and founder, $13.1 million a year over the past four years (2005), even as Sun's shareholders lost 76% of their money. Since then, the stock has gone nowhere and is under heavy red Selling distribution and insider selling..   Shares of supermarket

chain Albertson's Shares of supermarket

chain Albertson's fell 39% over the past four years. Despite this dismal record, Albertsons CEO and Chairman Larry Johnston collected a total of $76.2 million in that time. Education College: Stetson University BBA ' 72 $105 Million Dollar Man Larry Johnston, Albertsons Inc. former CEO, will get a multimillion-dollar "golden parachute" when the Boise grocery chain is sold to SuperValu Inc. and its buyout partners. Here's what Johnston will

receive in cash, stock, health and other benefits, along with income tax reimbursements "Albertsons

CEO Larry Johnston's $8 million raise in 2005" Aug 4, 2006 ...

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||