TigerSoft

News Service 6/5/2009 www.tigersoft.com More

information later today.

TigerSoft

News Service 6/5/2009 www.tigersoft.com More

information later today.The Great 2009 Bull Market

Why Is Wall Street Is Concealing from The Public

The Huge Surge in Low Priced Stocks?

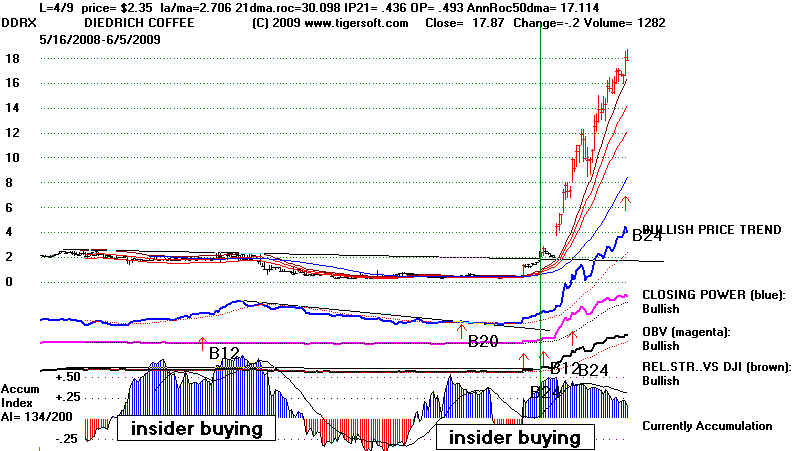

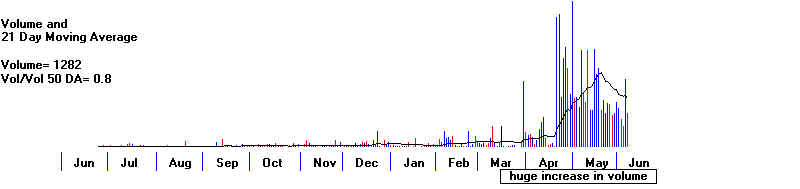

The Lessons of DDRX +3784% in three months!

FIFTY STOCKS ARE UP MORE THAN 400% SINCE MARCH 9th

by William Schmidt, Ph.D.

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

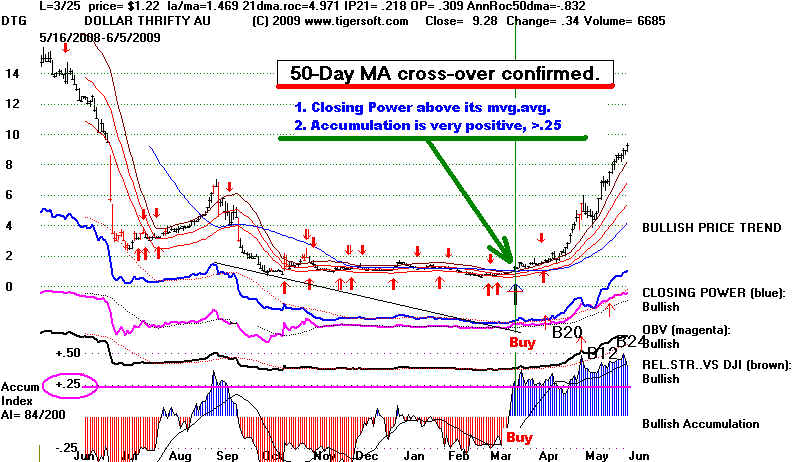

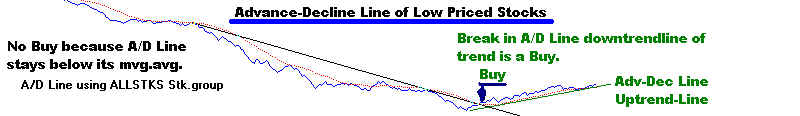

The Great 2009 Bull Market A Huge Surge in Low Priced Stocks   by William Schmidt, Ph.D. There are certainly a lot more low priced stocks now than there were two years ago. That has given us a rare opprtunity to make a lot of money since the market's bottom 61 trading days ago. I produced web pages in the mid 1990s showing how to spot take-offs in low priced stocks. Here is one of the examples from back then. Note the red major Buys, B10 and B24 and the blue spikes of Accumulation up past the second horizontal dotted line. These show insider buying. This is the same approach we use now to find low-priced super stocks. Keep reading and we will show you how well this approach has worked recently, especially when some new tools and signals are used. TigerSoft keeps sharpening its tools, signals and trading techniques so that our users will stay far ahead of other traders. Please see. http://www.tigersoft.com/educate/stks1.htm http://www.tigersoft.com/educate/stks2.htm 1996 - Triplers!   THE GREAT BULL MARKET OF 2009 TigerSoft built a list of more than 250 low priced (under $4) stocks six months ago. The charts below show that since the market bottomed on March 9th, and our Peerless Buy signal on March 10th, this group has had the biggest winners. These are the stocks that have been beaten down the most. They are the ones that will go up the most if this the recession's bottom has been seen. That happens after every steep, multi-year bear market. The best way to time the Buying and Selling of the group as a whole is shown to be watching the Adv-Decline Line of this group. Waiting for a Relative Strength confirmed move past the 50-day ma also worked. The breaking of the OBV Line's downtrendline was a crude volume bullish confirmation. We still do not see positive readings from TigerSoft's Accumulation Index. This is a warning. But we still have three reasons to stay long: 1) This group's A/D Line is still rising; 2) the Relative Strength uptrendline is still intact; and 3) TigerSoft can pick the most accumulated individual stocks and play them individually, as shown further below.

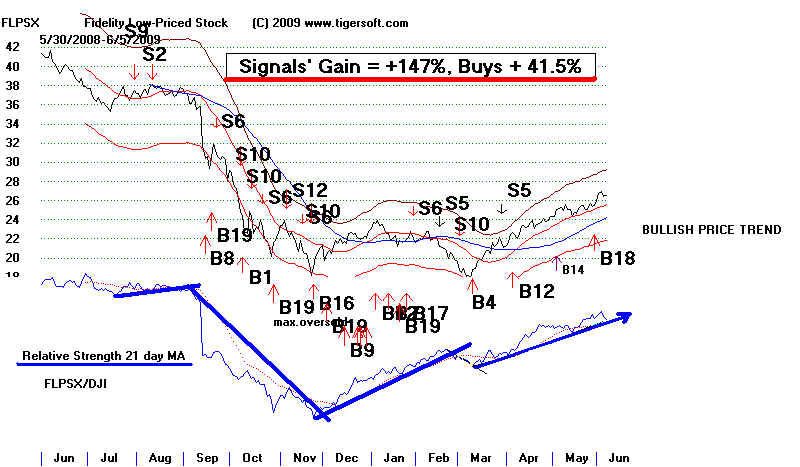

Without TigerSoft's index of low-price stocks, one could get a pretty good idea of the the trend changes in this group by looking at the price behavior of Fidelity's Low Priced stocks, especially if one constructs a Relative Strength Line showing FLPSX divided by the DJI. The chart of FLSPX shows how well our Peerless signals on the DJI work when applied to FLPSX.  Fidelity's Low Priced Stocks' Fund Is Not Even Low-Priced There are significant problems trading any Fidelity fund. They limit or penalize frequent trades. Their management fees are high. This fund is very volatile. At the end of 2007 it was 49. At the bottom a few weeks ago it was 18. It now stands at 26.5. One would have done much better buying a random selection of low priced stocks on March 10th from our low priced list. Most important, these are not low priced stocks. They all range between $10 and $30. Here are their top 10 biggest holdings now:

C:\best2009 Days back= 62 3 / 9 / 2009 - 6 / 5 / 2009 Rank Symbol Name Price Pct.Gain --------- ----------------------------------- ---------- ------------ 1 DDRX DIEDRICH COFFEE 17.87 3784% Diedrich Coffee Inc.28 Executive Park Suite 200 Irvine, CA 92614 http://www.diedrich.com 2 VNDA VANDA PHARMACEUTI 12.9 1532% Vanda Pharmaceuticals, Inc. 9605 Medical Center Drive Suite 300 Rockville, MD 20850 http://www.vandapharmaceuticals.com 3 DTG DOLLAR THRIFTY AU 9.28 1207% Dollar Thrifty Automotive Group Inc. 5330 East 31st Street PO Box 35985 Tulsa, OK 74135-0985 http://www.dtag.com 4 PIR PIER ONE INC 1.96 1206% Pier 1 Imports Inc. 100 Pier 1 Place Fort Worth, TX 76102 http://www.pier1.com 5 ATSG AIR TRANSPORT 2.25 1025% Air Transport Services Group, Inc. 145 Hunter Drive Wilmington, OH 45177 http://www.abxholdings.com 6 BZH BEAZER HOMES USA 2.7 980% Beazer Homes USA Inc. 1000 Abernathy Road Suite 1200 Atlanta, GA 30328 http://www.beazer.com 7 ARM ARVINMERITOR INC 3.72 962% ArvinMeritor Inc. 2135 West Maple Road Troy, MI 48084-7186 http://www.arvinmeritor.com ArvinMeritor, Inc. supplies a range of integrated systems, modules, and components to commercial truck, light vehicle, trailer, and specialty original equipment manufacturers worldwide. 8 SAH SONIC AUTOMOTIVE 10.34 955% Sonic Automotive Inc. 6415 Idlewild Road Suite 109 Charlotte, NC 28212 http://www.sonicautomotive.com 9 AXL AMER AXLE&MFG HLD 2.86 886% American Axle & Manufacturing Holdings Inc. One Dauch Drive Detroit, MI 48211-1198 http://www.aam.com 10 DNDN DENDREON CORPORAT 25.74 875% Dendreon Corp. 3005 First Avenue Seattle, WA 98121 http://www.dendreon.com 11 PNX THE PHOENIX CO IN 1.99 847% 12 PMI P M I GROUP INC 2.81 806% 13 BGP BORDERS GROUP INC 4.34 804% 14 CKEC CARMIKE CINEMAS I 8.63 762% 15 ODP OFFICE DEPOT INC 5.06 757% 16 CHRS CHARMING SHOPPES 4.11 756% 17 COT COTT CP 6.07 731% 18 RAD RITE AID CP 1.74 728% 19 TEN TENNECO INC 8.14 722% 20 SRZ SUNRISE SENIOR LV 2.84 711% 21 OFG ORIENTAL FIN GROU 11.27 693% 22 PWAV POWERWAVE TECHNOL 1.62 604% 23 CMRG CASUAL MALE RETAI 2.5 594% 24 HEB HEMISPHERX BIOPHA 2.73 582% 25 AGEN ANTIGENICS INC. 2.23 575% 26 CNO CONSECO INC 2.56 573% 27 TUES TUESDAY MORNING C 3.57 573% 28 AIB ALLIED IRISH PLC 6.25 564% 29 TRW TRW AUTOMOTIVE HL 9.93 553% " 30 TNL TECHNITROL INC 6.52 551% 31 SMRT STEIN MART INC. 7.66 538% 32 OGXI ONCOGENEX PHARMA 24.98 537% 33 ANPI ANGIOTECH PHARMAC 1.7 529% 34 CENX CENTURY ALUMINUM 6.35 499% 35 VCI VALASSIS COMMUN I 6.81 497% 36 MRNA MDRNA INC 1.397 465% 37 BCS BARCLAYS PLC ADR 18.63 459% ADR trading is misleading 38 BBX BANKATLANTIC BNCP 3.72 455% 39 ENTG ENTEGRIS INC. 3.16 454% 40 PLAB PHOTRONICS INC. 3.93 453% 41 ABG ASBURY AUTOMOTIVE 11.01 445% 42 TIN TEMPLE INLAND INC 13.83 442% 43 XTXI CROSSTEX ENERGY I 4.67 430% 44 BNE BOWNE AND CO 6.65 424% 45 HGSI HUMAN GENOME SCIE 2.82 412% 46 RUTH RUTH'S CHRIS STEA 3.98 410% 47 CWST CASELLA WASTE SYS 3.05 408% 48 MGPI MGP INGREDIENTS I 2.94 406% 49 VM VIRGIN MOBILE USA 4.55 405% 50 FCFC FIRSTCITY FINANCI 5.05 400% The Lessons of DDRX +3784% in three months!

|

||||||||||||||||||||||||||||||||||||||||||||

| |