TigerSoft

News Service 7/26/2010 www.tigersoft.com

TigerSoft

News Service 7/26/2010 www.tigersoft.com WHEN SUMMER

HEAD AND SHOULDERS

PATTERNS FAIL.

by William Schmidt, Ph.D.

See also http://www.tigersoft.com/PeerInst/HS-SellS10/index.html

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

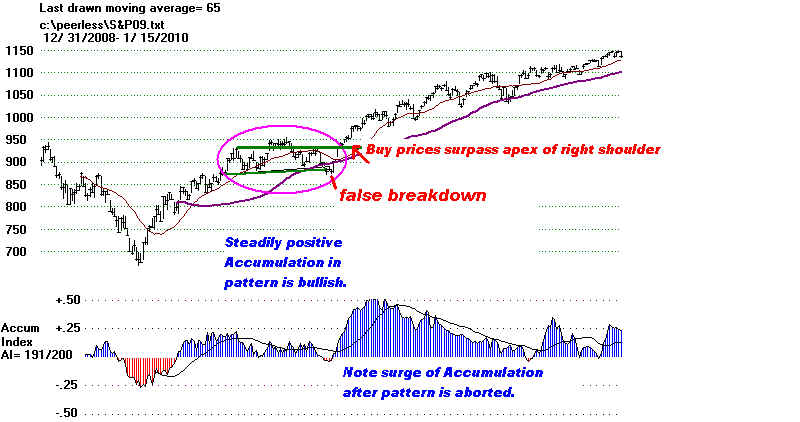

WHEN SUMMER HEAD AND SHOULDERS PATTERNS FAIL. Most traders do not appreciate that a move by the DJI above the apex of its right shoulder is a reliable Buy, especially in Summer, when a seasonal upswing from June lows is fairly common. A lot of advisors tell us to cover short sales then because the head and shoulders pattern thereafter has been destroyed. I would go further than that and say BUY in these cases, but watch the internal strength indicators, Peerless signals and the uptrending NYSE A/D Line. Example: "Technical analysis is not always 100% accurate, so it is important to always place a stop loss in case the pattern fails. I would recommend placing a stop loss at a price just above the second right shoulder. If at any point price moves and closes above the head, then the pattern has failed.

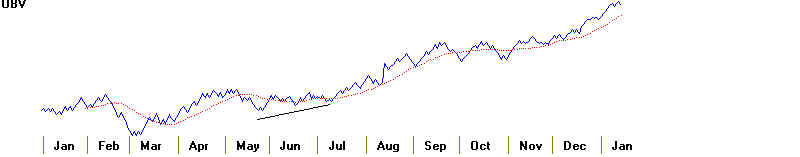

In the three cases shown below, you can see that the accompanying NYSE A/D Line was always

|

|||||||||||||

| |