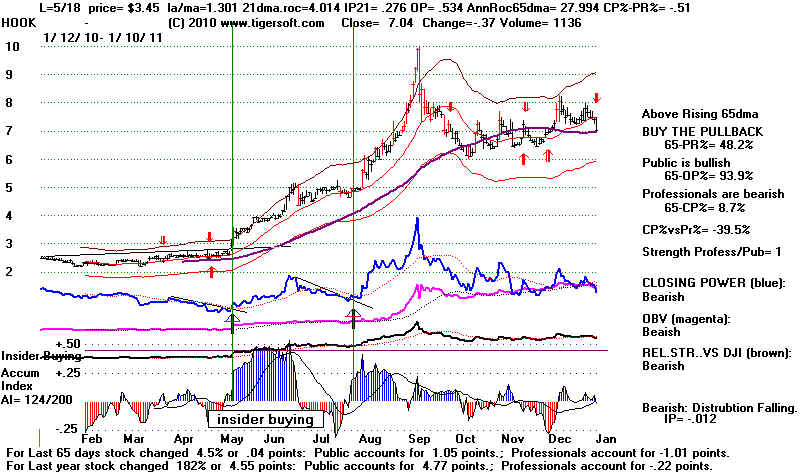

BEST PERFORMING STOCKS OF 2010

and

TIGERSOFT's MODEL of an IMPENDING

EXPLOSIVE SUPER STOCKS

The Importance of Peerless Stock Market Timing

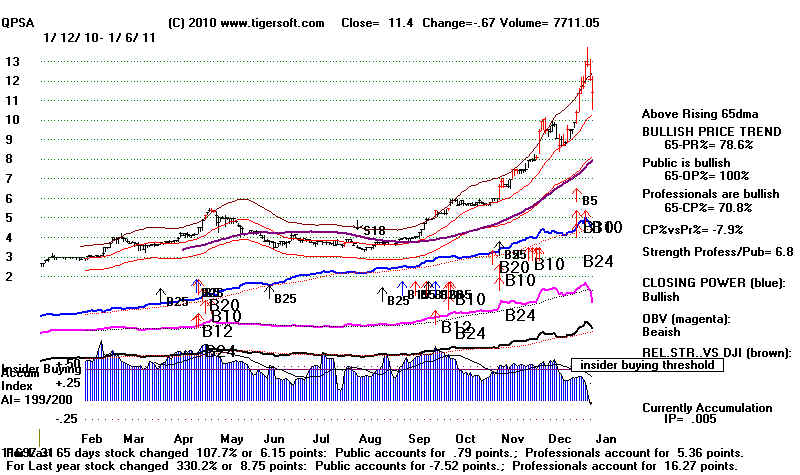

#1 Best Performer of 2010

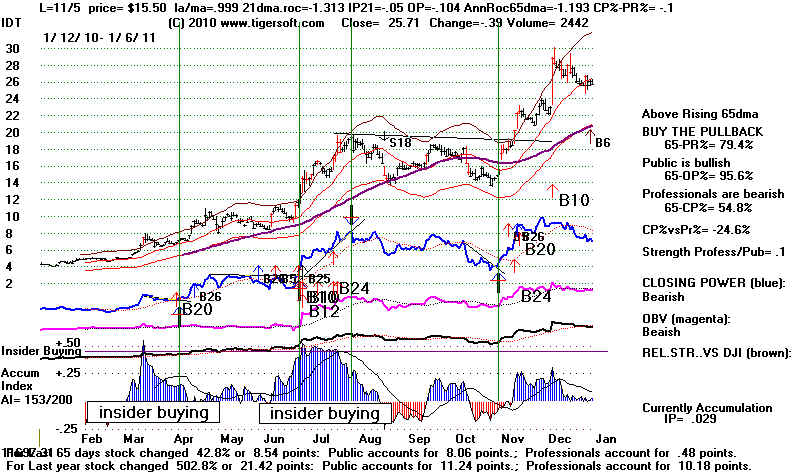

QPSA - Note the massive Insider Buying as measured by TigerSoft's Accumulation Index.

|

Tiger Software

Research on Individual Stocks upon Request: Composite Seasonality Graph |

The second half of 2010 was much better than the first half of 2010.

The Peerless Buy Signal in late June was not reversed. This was

a period when many more speculative stocks took off quite powerfully.

Because of its power at predicting the general market accurately,

we can speculate much more confidently. And with TigerSoft we

we can pick the stocks that are insiders and Professionals are

buying.

PEERLESS AUTOMATIC BUYS/SELLS - 2010

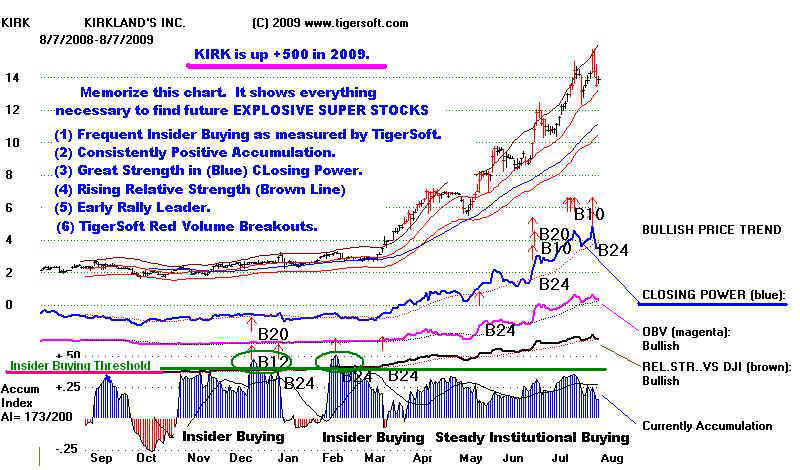

TigerSoft shows us the stocks insiders and professionals are buying.

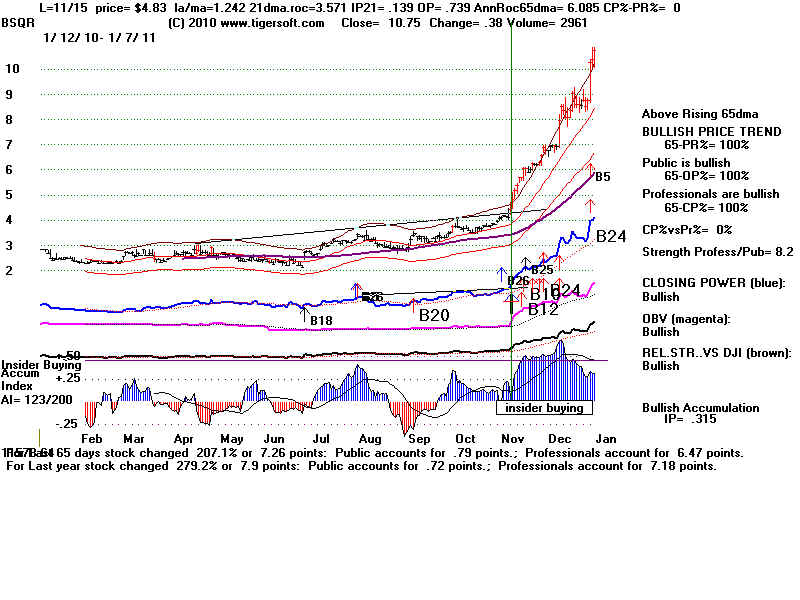

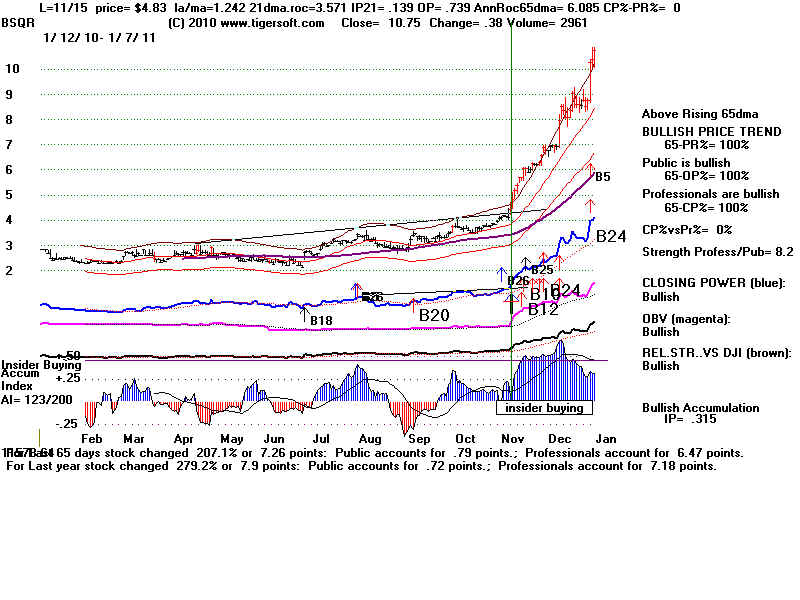

Study the 2009 chart below to see what TigerSoft likes most in finding an

"explosive super stock".

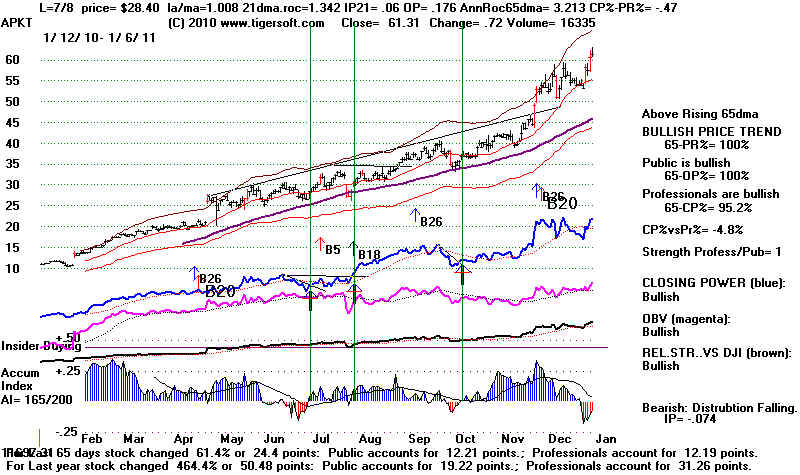

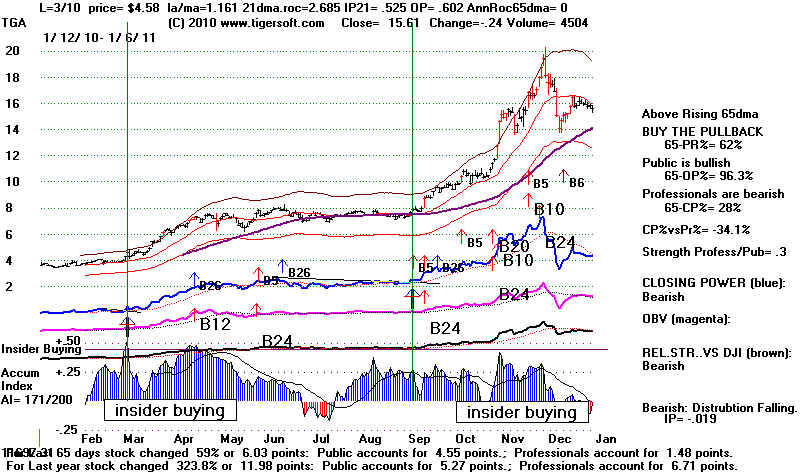

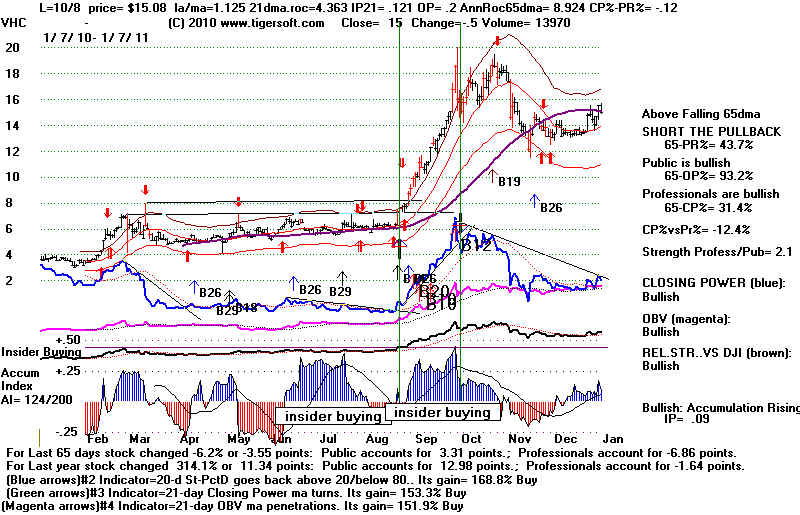

Find the blue Closing Power beneath prices. It should lead prices

upward.

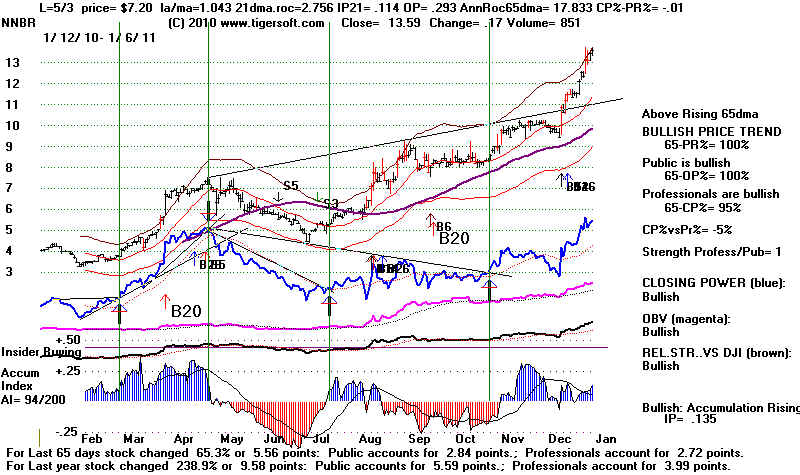

Find at the bottom the Accumulation Index. Look for its tell-tale spikes

of Insider Buying. The Power Ranker lets you quickly search for stocks

with high Accumulation readings and a surging Closing Power that

is leading prices to new highs.

Spikes of High Accumulation Are Very Important To Watch for

In finding each year's explosive super stocks, we thing the single most important predictor,

"tell", harbinger comes from spikes of the Tiger Accumulation Index above the Insider

Buying threshold. New highs made by the Tiger Professional Closing power is also

very important. When we see both Insiders and Professionals buying a stock soon

after a reversing major Buy from Peerless, we know we have found a stock that should

go much higher for typically a year from the first Insider Buying spike. More than

60% of all the stocks that gained more than 200% in 2010, which are shown below,

had these two key characteristics early in their move, as shown by the 2010 charts.

Many others had intense Insider Buying and Professional Buying in late 2009 and

are not shown here, at this point.

Simply buying these stocks when their Accumulation Index surged past a +.40

threshold and holding them until they violate their 30 week ma or selling them

on 1/18/2011 would have meant only 3 losses in the 18 cases sampled below.

15 of the 18 nearly doubled or gained much more. (Random sampling is a good way to

test a proppsition because the results are significant and there is often no time

to provide the data on every case.)

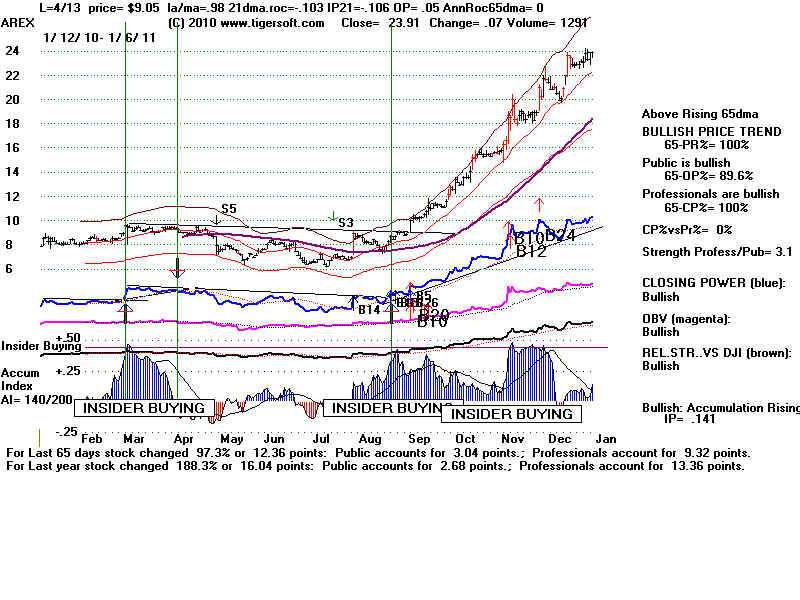

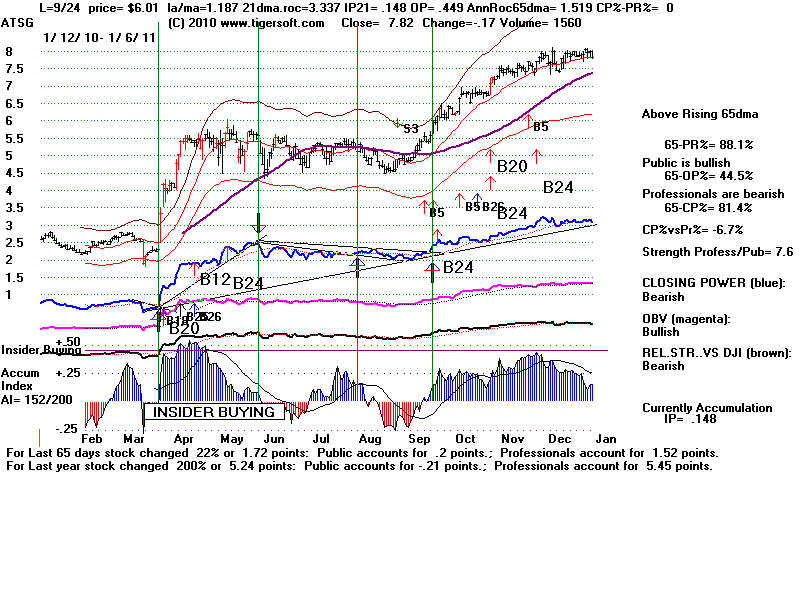

Alphabetical Sampling of Stocks up more than 200%: Stocks A-D

Buying and Holding unless the stock's 65-dma is violated.

Stock 1st Insider Buying 2010 High Violation of Price .

Theshold Price 30-week ma as of 1/18/2011

(AI>.40)

----------------------------------------------------------------------------------------------------------------------

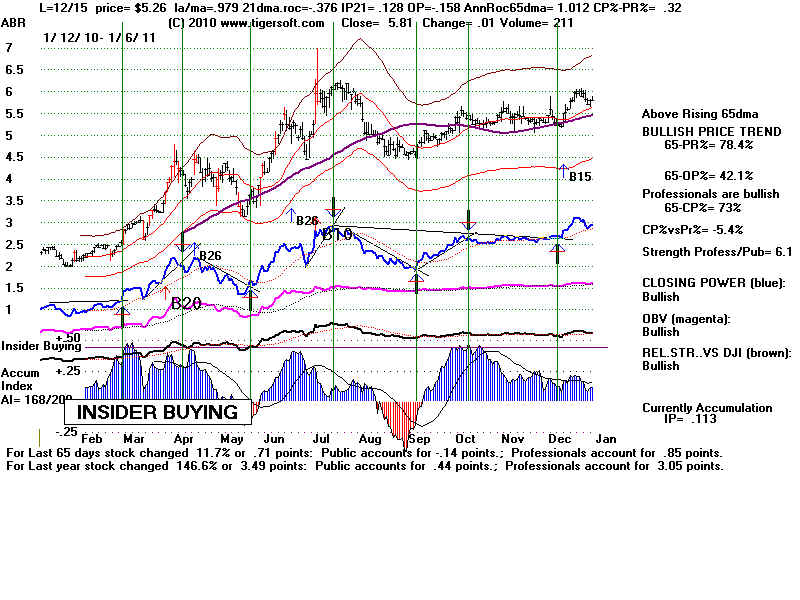

ABR 3/8/2010 2.84 7 - 7/13 none 5.98

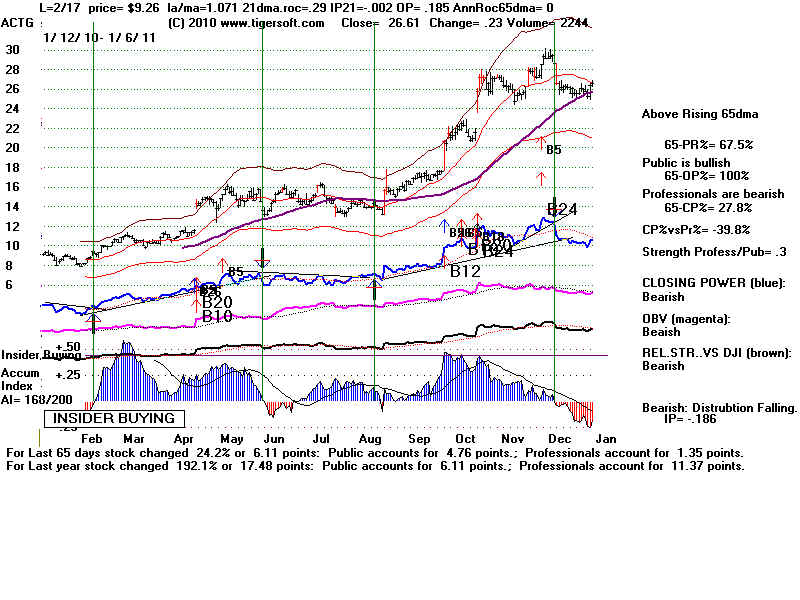

ACTG 3/8/2010 10.97 30 - 12/7 none 25.94

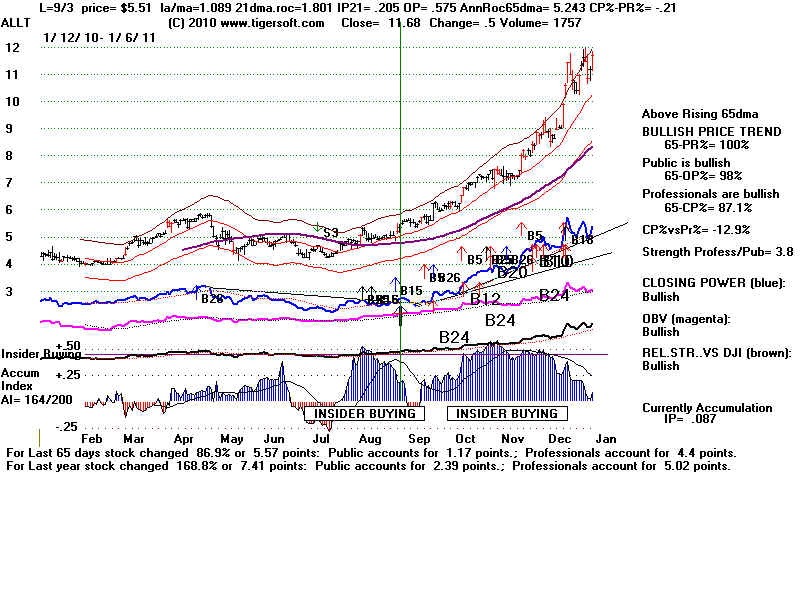

ALLT 8/4/2010 4.86 11.9 - 8/4 none 11.64

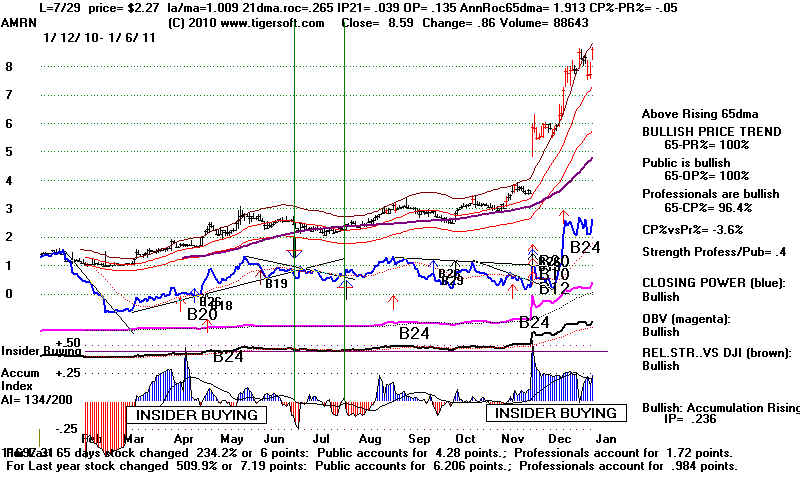

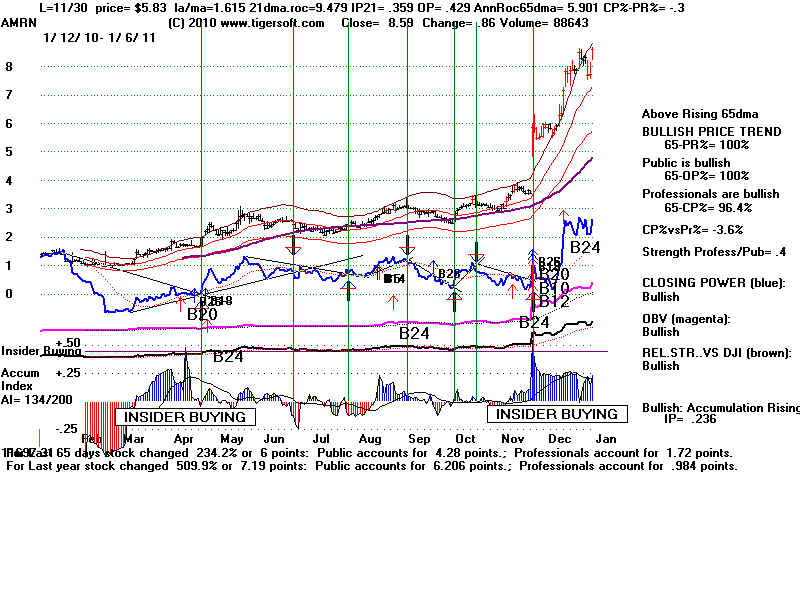

AMRN 4/16/2010 1.73 8.55 - 12/29 none 8.2

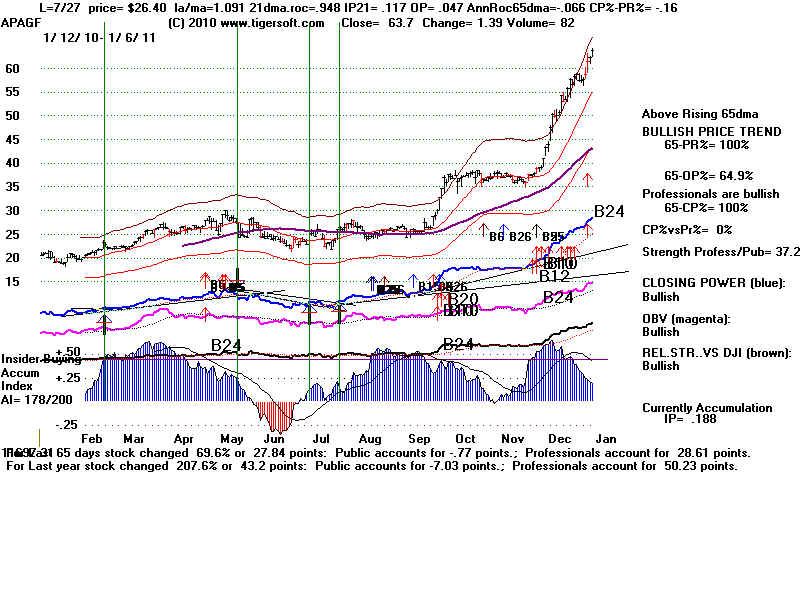

APAGF 2/23/2010 23.20 58.79 - 12/28 none 57.55

AREX 3/10/2010 9.5 23.8 - 12/21 yes (5/6/2010 - 7.97)

8/31/2010 8.7 23.8 - 12/21 no 24.86

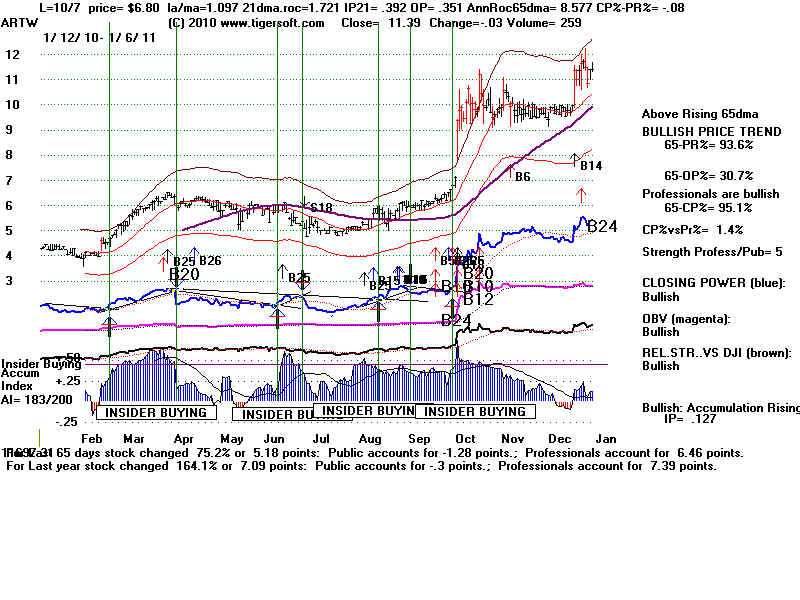

ARTW 3/3/2010 5.01 11.9 - 12/30 no 11.72

ATSG 4/1/2010 4.17 8 - 12/10 no 7.9

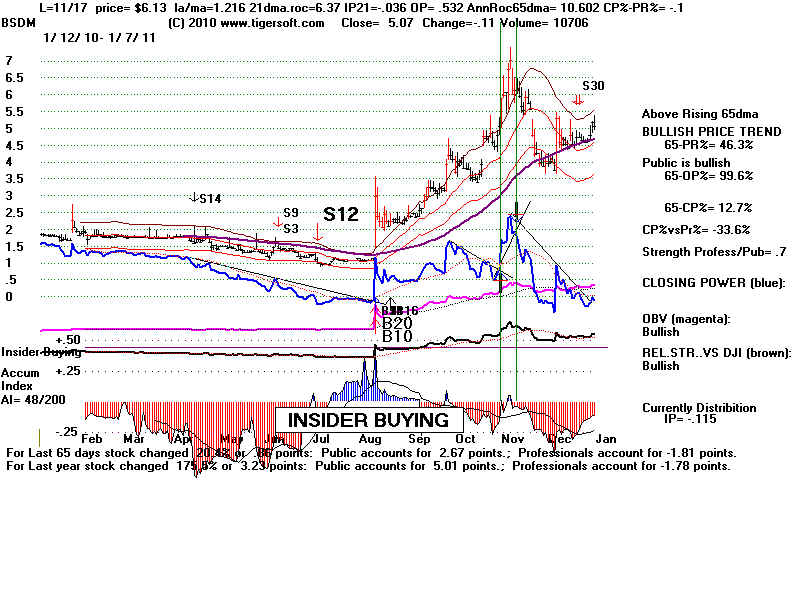

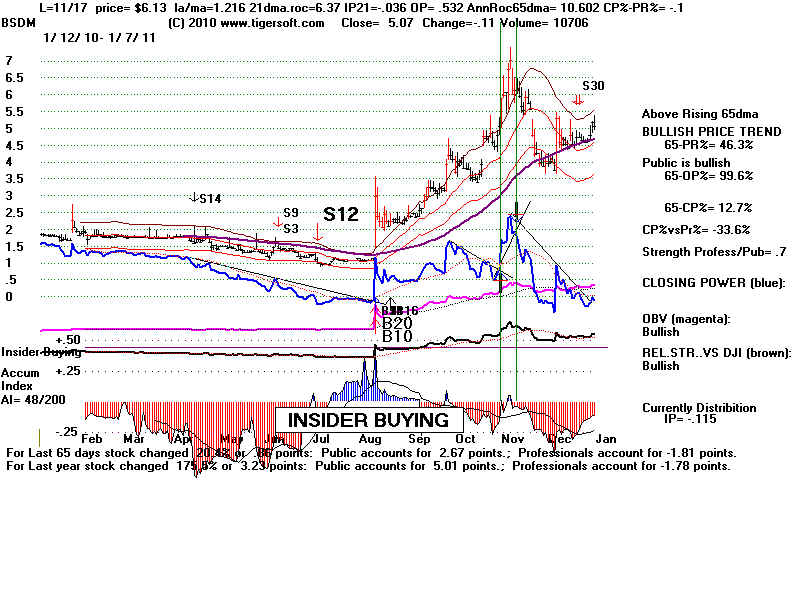

BSDM 8/18/2010 2.97 7.3 - 11/2 no 4.63

BSQR 8/6/2010 3.45 9.1 - 12/27 no 8.76

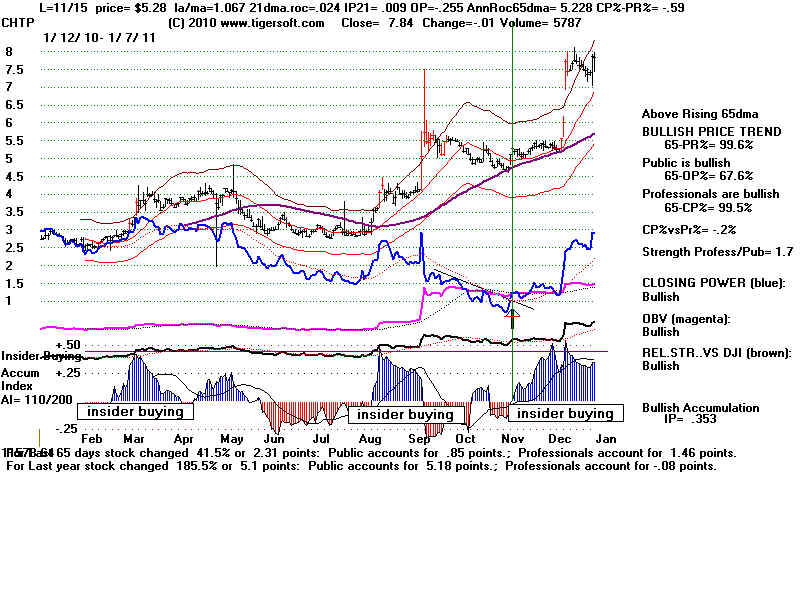

CHTP 3/15/2010 3.34 2.8 - 7/6 yes (6/8/2010 - 2.87)

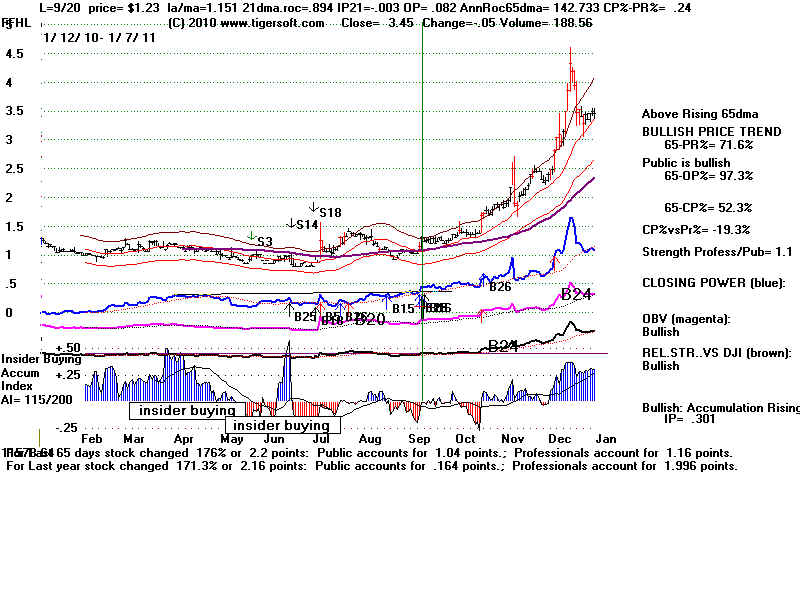

8/23/2010 4.24 8.1 - 12/27 no 7.5

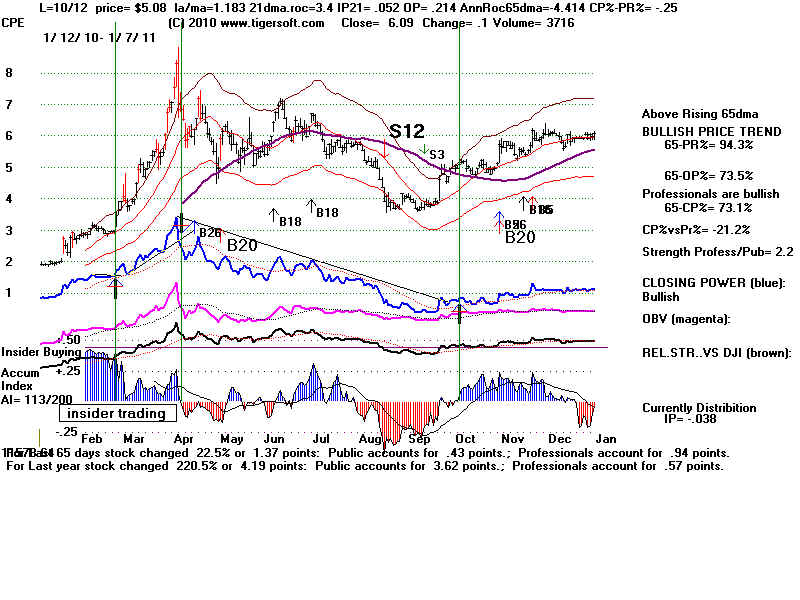

CPE 1/20/2010 1.93 8.5 - 4/13 yes (8/20/2010 - 4.6)

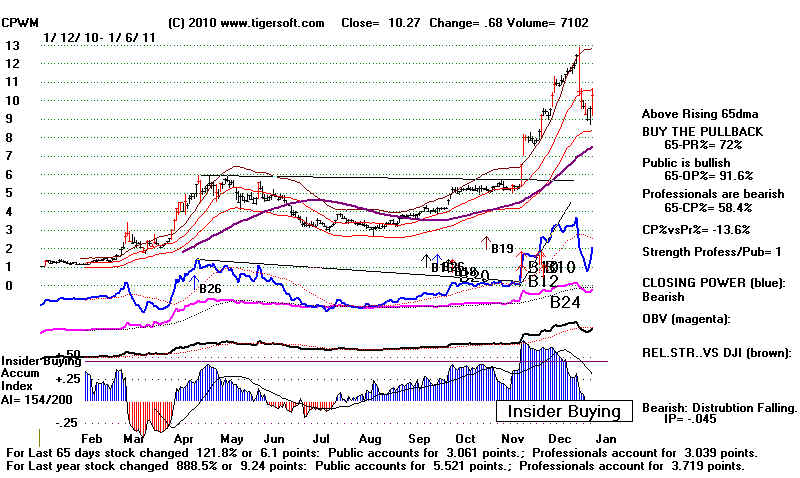

CPWM 4/30/2010 5.43 5.75 - 5/13 yes (8/16/2010 - 3.05)

10/7/2010 5.22 12.75 - 12/29 no 9.71

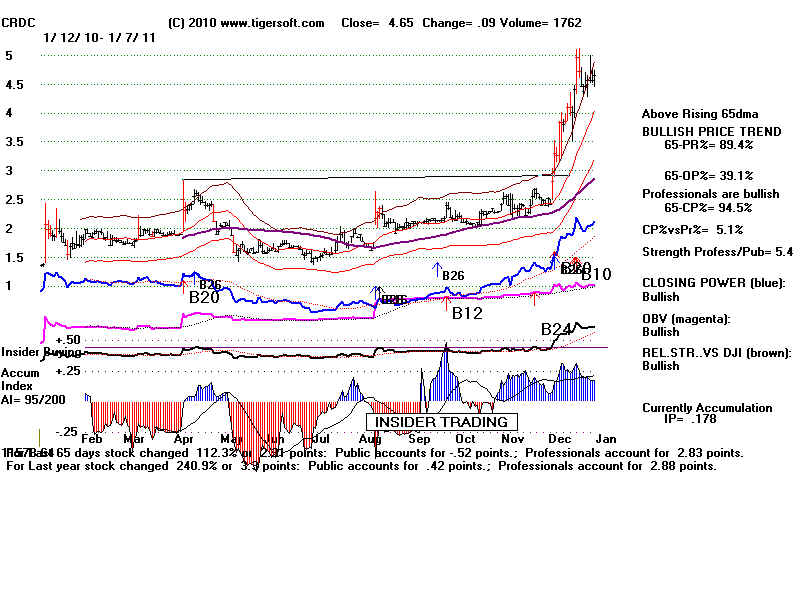

CRDC 10/1/2010 2.18 5.1 - 12/28 no 4.38

DGSE 4/9/2010 2.65 4.75 - 11/11 no 4.28

When should these stocks be sold?

Our back-testing shows that except for 2008, since 1990, gains of +36% were obtained

simply by holding such quaified stocks for a year. IBut insiders and professionals can

make mistakes and be wrong. Bear markets have to be protected against. Using Sell

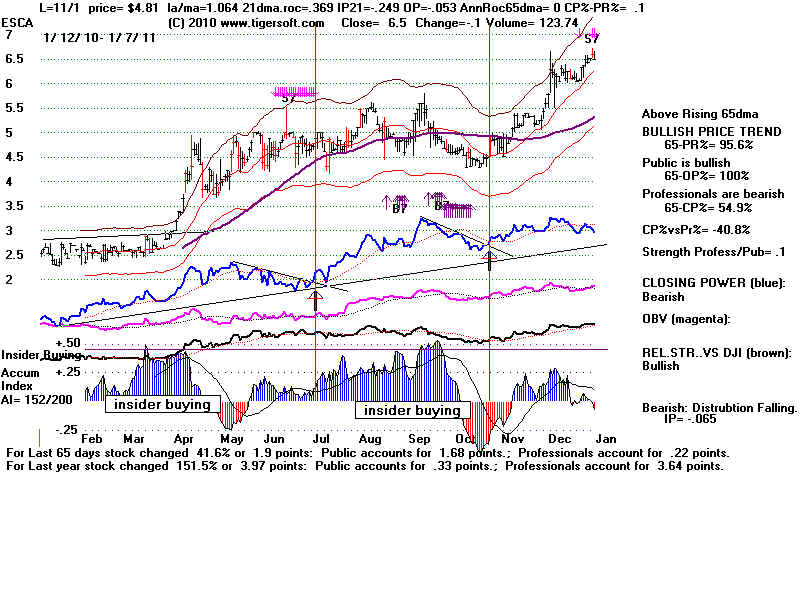

Stops below a long term moving average is a necessary precaution. That is what we

show above by noting when a stock falls below its 30-week ma.

Protecting against very big losses by using the Buys and Sells from our Peerless

Stock Market Timing also works well year after year. Just below are the reversing Peerless

trades for 2010. The chart of the DJIA with these signals is shown above. The gains

here are based on the trades being made at the opening the day after the Peerless

Buy or Sell. $10,000 is assumed to be the initial investment with all proceeds then

being re-invested after allowing $40 per round trip trade for commission and slippage.

Reversing Peerless Automatic Signals on Long Side only

Buy B17 2/9/2010 Sell S5 5/5/2010

Buy B5 5/6/2010 Sell S9 6/16/2010

Buy B8 6/30/2010 open

Alphabetical Sampling of Stocks up more than 200%: Stocks A-D

Trading with reversing Peerless Automatic Signals on the Long Side only.

Stock Buy Sell S5 Buy B5 Sell S9 Buy B8 1/18/2011 Trading

5/5/2010 5/6/2010 6/16/2010 6/30/2010 Gain

----------------------------------------------------------------------------------------------------------------------------------------

ABR 3/8/2010 2.84 4.04 4.05 5.08 5.19 5.98 +108%

ACTG 3/8/2010 10.97 14.34 13.79 15.62 14.24 28.92 +201%

ALLT 8/4/2010 4.86 -- -- -- -- 11.64 +177%

AMRN 4/16/2010 1.73 2.24 2.13 2.67 2.47. 8.75 +468%

APAGF 2/23/2010 23.20 27.64 25.92 23.96 23.48 66.05 +210%

AREX 3/10/2010 9.5 8.65 7.92 8.13 6.92 24.86 +239%

ARTW 3/3/2010 5.01 5.97 6.2 6.0 5.92 12.3 +159%

etc...

2010's Biggest Gainers Days back= 249

1/12/2010 - 1/6/2011

Rank Symbol Price Pct.Gain

--------- -----------------------------------------------------------------------------

1 CPWM 10.27 897%

Cost Plus Inc. 2010 employees

200 4th Street

Oakland, CA 94607

United States - Map

Phone: 510-893-7300

Fax: 510-893-6418

Website: http://www.costplus.com

Cost Plus, Inc., together with its subsidiaries, operates as a specialty

retailer of casual home furnishings and entertaining products in the

United States

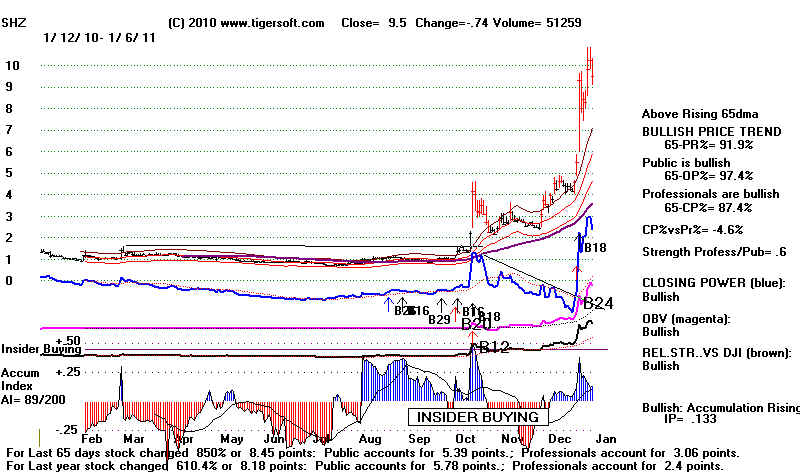

3 SHZ 9.5 619% China Shen Zhou Mining & Resources, Inc. Website: http://www.chinaszmg.com

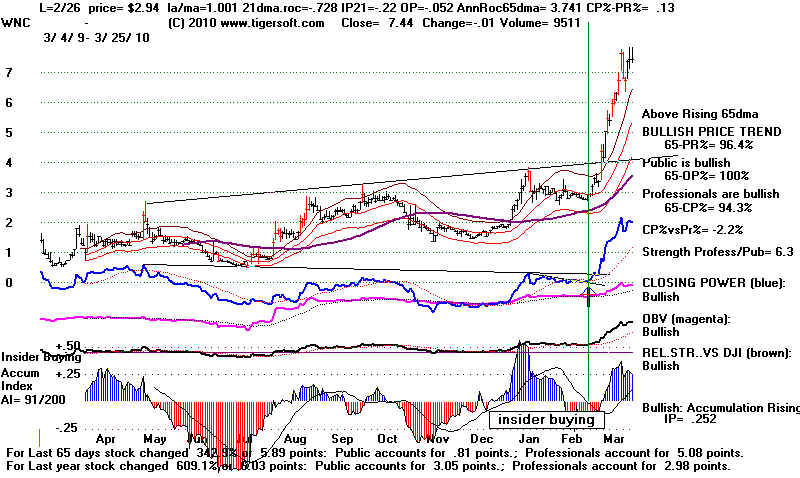

13 WNC 12.11 286% Wabash National Corp. 1600 employees 1000 Sagamore Parkway South Lafayette, IN 47905 United States - Map Phone: 765-771-5310 Fax: 765-447-9405 Website: http://www.wabashnational.com Wabash National Corporation engages in the design, manufacture, and marketing of standard and customized truck trailers and related transportation equipment primarily in North America.

16 PPO 44.01 273%

Polypore International Inc. 1900 employees

11430 North Community House Road

Suite 350

Charlotte, NC 28277-1591

United States - Map

Phone: 704-587-8409

Fax: 704-587-8796

Website: http://www.polypore.net

Polypore International, Inc., a technology filtration company,

develops, manufactures, and markets microporous membranes used in

separation and filtration processes.

17 SMTX 3.39 268%

SMTC Corp. 1500 employees

635 Hood Road

Markham, ON L3R 4N6

Canada - Map

Phone: 905-479-1810

Fax: 905-479-1877

Website: http://www.smtc.com

SMTC Corporation provides advanced electronics manufacturing services

to original equipment manufacturers (OEMs) worldwide.

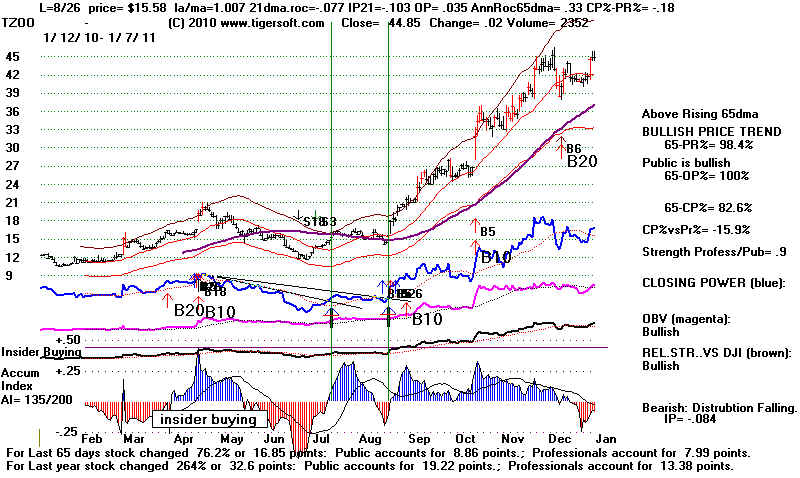

18 TZOO 44.83 265%

Travelzoo Inc. 121 employees

590 Madison Avenue

37th Floor

New York, NY 10022

United States - Map

Phone: 212-484-4900

Fax: 212-521-4230

Website: http://www.travelzoo.com

Travelzoo Inc., an Internet media company, publishes travel

and entertainment offers from various travel and entertainment

companies in North America and Europe.

Entropic Communications, Inc., a fabless semiconductor company,

engages in the design, development, and marketing of systems

solutions to enable connected home entertainment. It offers home

networking chipsets based on the Multimedia over Coax Alliance

standard; high-speed broadband access chipsets; integrated circuits

that simplify and enhance digital broadcast satellite services;

and silicon TV tuner integrated circuits.

22 NFLX 177.99 239%

Netflix, Inc. 1893 employees

100 Winchester Circle

Los Gatos, CA 95032

United States - Map

Phone: 408-540-3700

Fax: 408-540-3737

Website: http://www.netflix.com

Netflix, Inc. provides online movie rental subscription

services in the United States.

23 NNBR 13.59 238%

NN Inc.

2000 Waters Edge Drive 1776 employees

Suite 12

Johnson City, TN 37604

United States - Map

Phone: 423-743-9151

Fax: 423-743-2670

Website: http://www.nnbr.com

NN, Inc. engages in the manufacture and supply of metal bearing

components, plastic and rubber components, and precision metal

components for bearing manufacturers worldwide. The company's Metal

Bearing Components segment offers precision steel balls for

anti-friction bearings manufacturers; steel rollers, such as

tapered rollers and cylindrical rollers; and precision metal retainers

for roller bearings for use in various industrial applications.

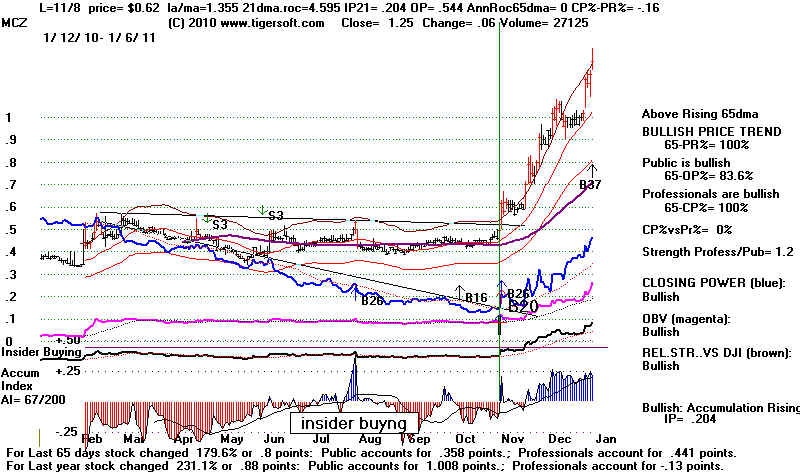

24 CRDC 4.56 237% Cardica Inc. 47

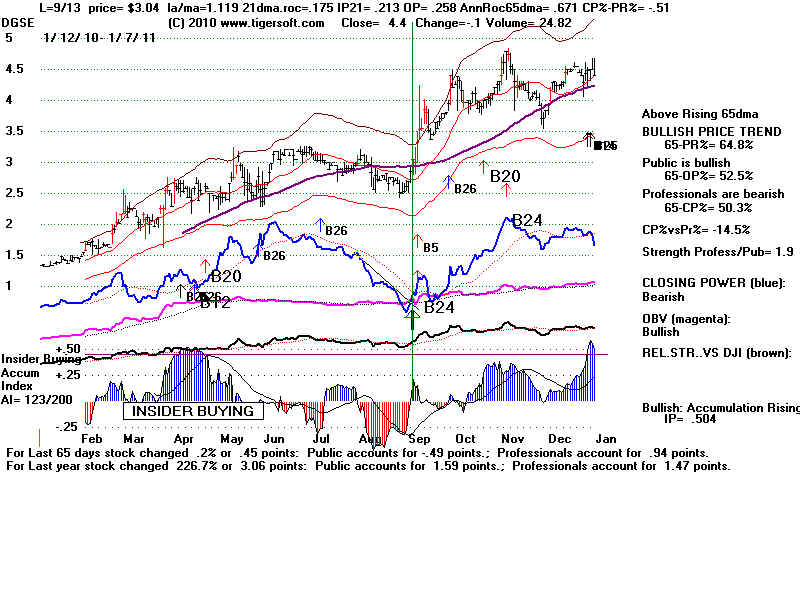

employees Cardica, Inc. designs and manufactures medical devices for cardiac and other surgical procedures based on its proprietary stapling and cutting technology. 25 MCZ 1.25 236% Mad Catz Interactive Inc. 246 employees Mad Catz Interactive, Inc. engages in the design, manufacture, marketing, and distribution of accessories for videogame platforms, the personal computers (PC), and iPod and other audio devices. Its products include videogame, PC, and audio accessories, such as control pads, video cables, steering wheels, joysticks, memory cards, light guns, flight sticks, dance pads, microphones, car adapters, carry cases, mice, keyboards, and headsets 26 DGSE 4.5 235% DGSE Companies Inc. 81 employees 11311 Reeder Road Dallas, TX 75229 United States - Map Phone: 972-484-3662 Fax: 972-241-0646 Website: http://www.dgse.com DSGE Companies, Inc., together with its subsidiaries, buys and sells jewelry, bullion products, and rare coins in the United States. Air Transport Services Group, Inc., through its subsidiaries, provides aircraft, airline operations, and other related services primarily to the shipping and transportation industries. ========================================================================== ========================================================================== 44 NOVA 11.98 199% 45 NBIX 7.52 198% 46 GGAL 15.55 196% 47 TRS 20.17 193% 48 ACTG 26.61 191% 49 CHTP 7.85 186% 50 ICH 4.3 186% 51 WSTL 3.72 186% 52 CVGI 17.33 185% 53 NXTM 24.98 185% 54 SIMG 7.78 184% 55 PKOH 22.58 182% 56 BSDM 5.18 181% 57 JOBS 52.49 180% 58 HYC 9.11 175% 59 SOFO 13.9 174% 60 ALLT 11.68 173% 61 CROX 16.75 171% 62 FFHL 3.5 171% 63 CSII 11.64 170% 64 INSW 8.51 170% 65 MBWM 8.87 169% 66 ITMN 38.93 167% 67 NEWS 11.19 167% 68 MSB 36.19 165% 69 ARTW 11.39 164% 70 ATML 13.08 164% 71 LCAPA 64.52 161% 72 ESCA 6.6 160% 73 MDM 6.21 158% 74 PROV 7.19 158% 75 GRT 8.41 156% 76 ABR 5.81 150% 77 MPAA 12.98 149% 78 MBI 12.55 148% 79 ZQK 5.34 147% 80 WAVX 4.09 146% 81 SFI 8.1 145% 82 KOG 6.25 144% 83 SOMX 3.41 143% 84 JSDA 1.28 141% 85 HUSA 18.7 139% 86 MEAS 28.66 139% 87 ACAS 7.86 138% 88 MGH 2.37 137% 89 MNDO 2.49 134% 90 FRG 10.45 133% 91 MERC 7.66 128% 92 PZG 3.73 128% 93 ONCY 6.34 123% 94 GMO 5.97 121% 95 BEE 5.58 120% 96 APL 23.78 106% 97 SLW 34.19 102% 98 MRVC 1.77 100% |

CHTP |

CPE

2 XOMA 6.78 848%

This was a reverse stock split and should not be counted.

XOMA Ltd., a biopharmaceutical company, engages in the discovery,

development, and manufacture of therapeutic antibodies to treat

inflammatory, autoimmune, infectious, and oncological diseases.

2 XOMA 6.78 848%

This was a reverse stock split and should not be counted.

XOMA Ltd., a biopharmaceutical company, engages in the discovery,

development, and manufacture of therapeutic antibodies to treat

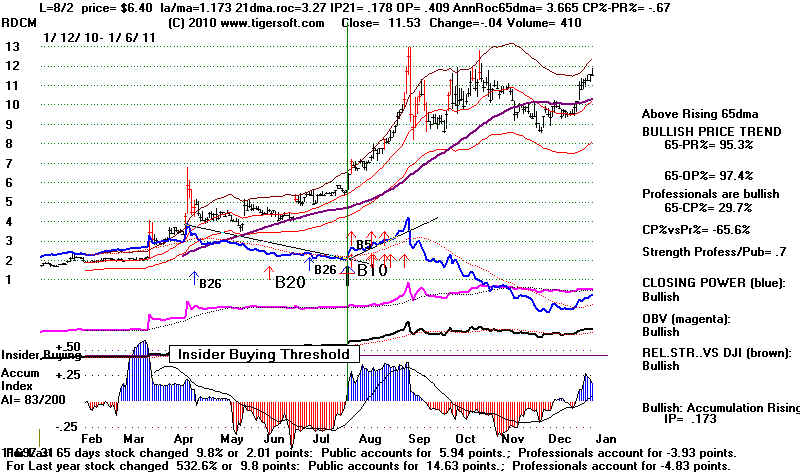

inflammatory, autoimmune, infectious, and oncological diseases. 4 RDCM 11.53 566%

Radcom Ltd. 96 employees

24 Raoul Wallenberg Street

Tel Aviv, 69719

Israel -

4 RDCM 11.53 566%

Radcom Ltd. 96 employees

24 Raoul Wallenberg Street

Tel Aviv, 69719

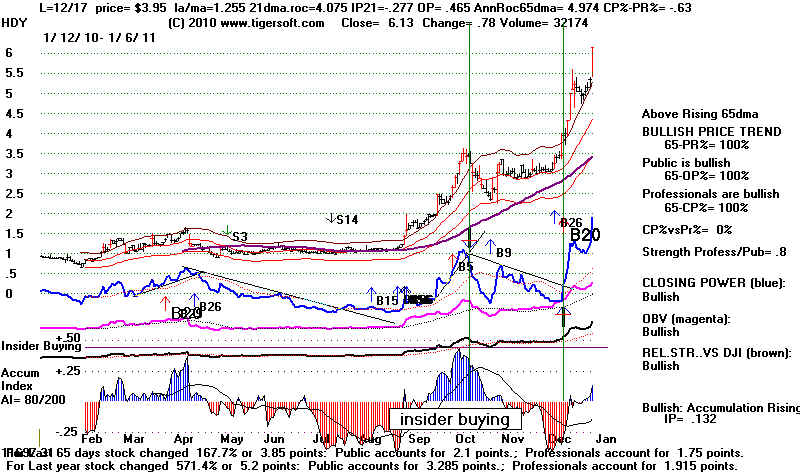

Israel -  5 HDY 6.13 559%

Hyperdynamics Corporation 20 employees

12012 Wickchester Lane

Suite 475

Houston, TX 77079

United States -

5 HDY 6.13 559%

Hyperdynamics Corporation 20 employees

12012 Wickchester Lane

Suite 475

Houston, TX 77079

United States -  6 AMRN 8.59 513%

Amarin Corporation plc

First Floor Block 3

The Oval Shelbourne Road Ballsbridge

Dublin, 4

Ireland -

6 AMRN 8.59 513%

Amarin Corporation plc

First Floor Block 3

The Oval Shelbourne Road Ballsbridge

Dublin, 4

Ireland -  7 IDT 25.71 499%

IDT Corporation 1100 employees

520 Broad Street

Newark, NJ 07102

United States -

7 IDT 25.71 499%

IDT Corporation 1100 employees

520 Broad Street

Newark, NJ 07102

United States -  8 APKT 61.31 466%

Acme Packet, Inc. 529 employees

100 Crosby Drive

Bedford, MA 01730

United States -

8 APKT 61.31 466%

Acme Packet, Inc. 529 employees

100 Crosby Drive

Bedford, MA 01730

United States -  9 QPSA 11.4 330%

9 QPSA 11.4 330%

11 VHC 15.5 318%

VirnetX Holding Corp 12 employees

5615 Scotts Valley Drive

Suite 110

Scotts Valley, CA 95066

United States -

11 VHC 15.5 318%

VirnetX Holding Corp 12 employees

5615 Scotts Valley Drive

Suite 110

Scotts Valley, CA 95066

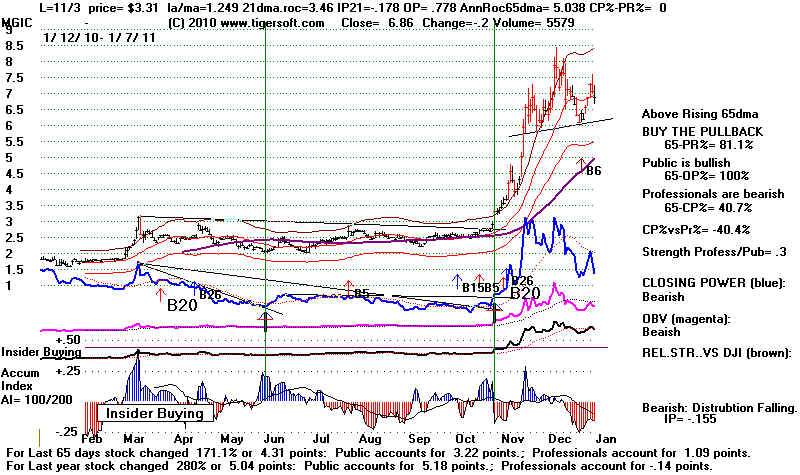

United States -  12 MGIC 7.06 287%

Magic Software Enterprises Ltd.

5 Haplada Street 397 employees

Or Yehuda, 60218

Israel -

12 MGIC 7.06 287%

Magic Software Enterprises Ltd.

5 Haplada Street 397 employees

Or Yehuda, 60218

Israel -

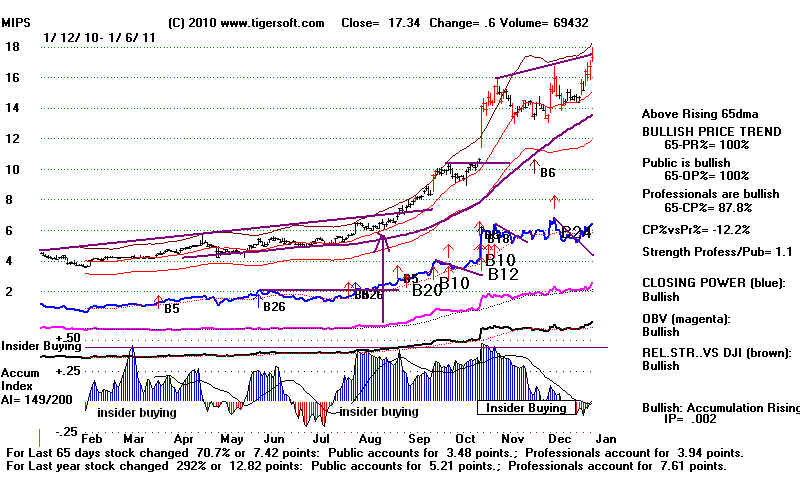

15 MIPS 17.34 283%

MIPS Technologies Inc. 141 employees

955 East Arques Avenue

Sunnyvale, CA 94085

United States -

15 MIPS 17.34 283%

MIPS Technologies Inc. 141 employees

955 East Arques Avenue

Sunnyvale, CA 94085

United States -

19 BSQR 10.37 263%

BSQUARE Corp. 220 employees

110 110th Avenue NE

Suite 200

Bellevue, WA 98004

United States -

19 BSQR 10.37 263%

BSQUARE Corp. 220 employees

110 110th Avenue NE

Suite 200

Bellevue, WA 98004

United States -

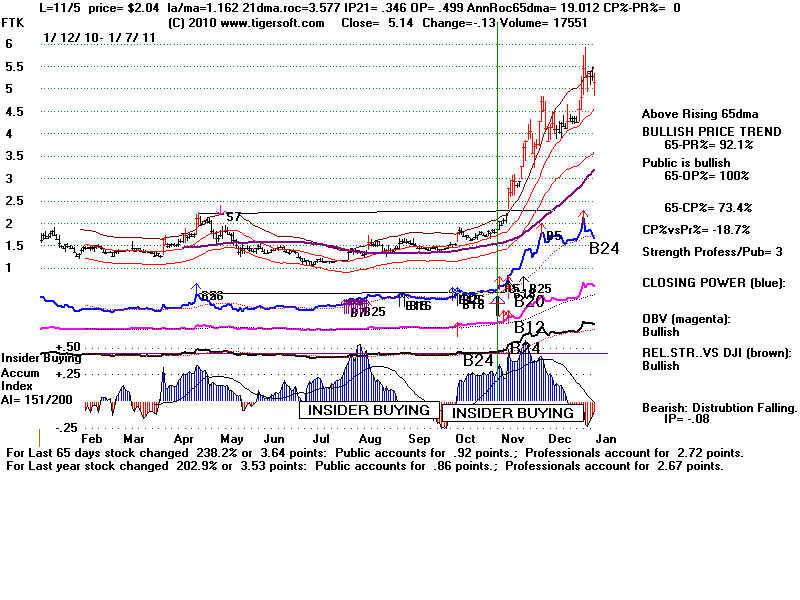

27 FTK 5.27 227%

Flotek Industries Inc. 329 employees

2930 West Sam Houston Parkway North

Suite 300

Houston, TX 77043

United States -

27 FTK 5.27 227%

Flotek Industries Inc. 329 employees

2930 West Sam Houston Parkway North

Suite 300

Houston, TX 77043

United States -  28 AKRX 5.72 226%

Akorn Inc. 329 employees

2500 Millbrook Drive

Buffalo Grove, IL 60089

United States -

28 AKRX 5.72 226%

Akorn Inc. 329 employees

2500 Millbrook Drive

Buffalo Grove, IL 60089

United States -  29 LDSH 49.21 224%

Ladish Co. Inc.

5481 South Packard Avenue

Cudahy, WI 53110

United States -

29 LDSH 49.21 224%

Ladish Co. Inc.

5481 South Packard Avenue

Cudahy, WI 53110

United States -  30 AXTI 10.37 220%

AXT Inc. 1091 employees

4281 Technology Drive

Fremont, CA 94538

United States -

30 AXTI 10.37 220%

AXT Inc. 1091 employees

4281 Technology Drive

Fremont, CA 94538

United States -  31 LCRY 11.43 216%

LeCroy Corp. 418 employees

31 LCRY 11.43 216%

LeCroy Corp. 418 employees  32 CPE 5.99 215%

Callon Petroleum Co. 72 employees

32 CPE 5.99 215%

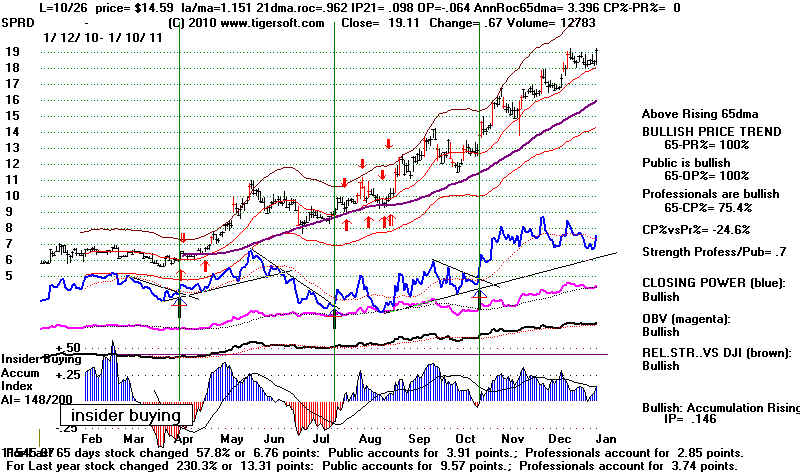

Callon Petroleum Co. 72 employees  33 SPRD 18.32 215%

Spreadtrum Communications Inc. 682 employees

33 SPRD 18.32 215%

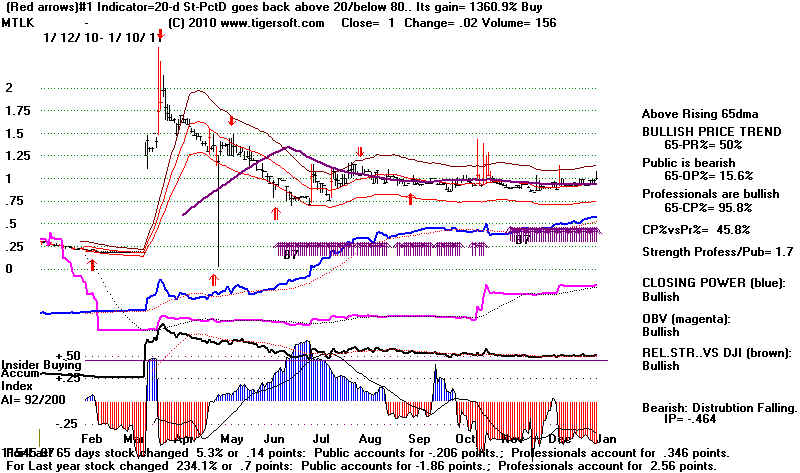

Spreadtrum Communications Inc. 682 employees  34 MTLK .941 213%

Metalink, Ltd.

34 MTLK .941 213%

Metalink, Ltd.  35 APAGF 63.7 210%

Apco Oil & Gas International Inc. 21 employees

35 APAGF 63.7 210%

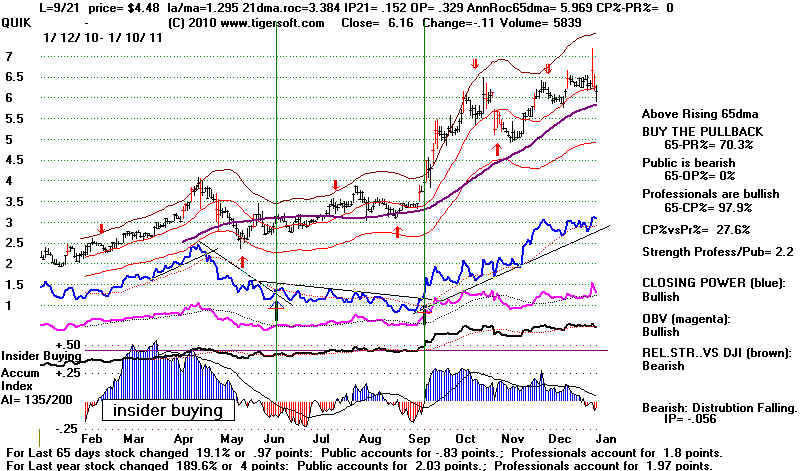

Apco Oil & Gas International Inc. 21 employees  36 QUIK 6.65 207%

QuickLogic Corp. 84 employees

36 QUIK 6.65 207%

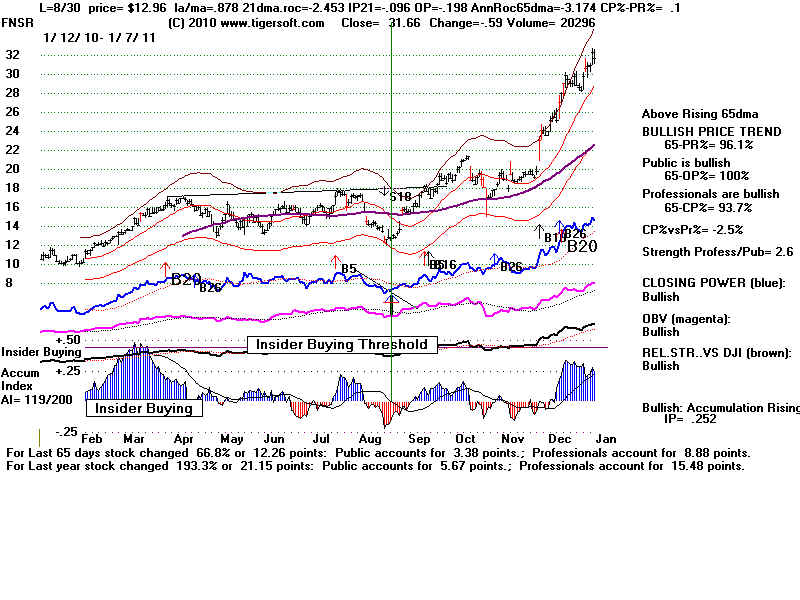

QuickLogic Corp. 84 employees  37 FNSR 32.25 206%

Finisar Corp. 6,893 employees

37 FNSR 32.25 206%

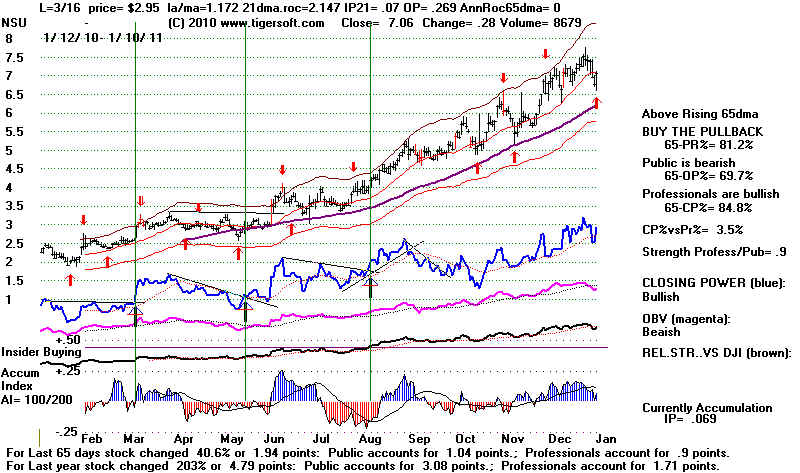

Finisar Corp. 6,893 employees  38 NSU 6.96 206%

Nevsun Resources Ltd.

38 NSU 6.96 206%

Nevsun Resources Ltd.  39 GENT 7.03 205%

Gentium S.p.A 67 employees

39 GENT 7.03 205%

Gentium S.p.A 67 employees  40 AREX 23.91 203%

Approach Resources, Inc.45 employees

40 AREX 23.91 203%

Approach Resources, Inc.45 employees  41 ATSG 7.82 203%

Air Transport Services Group, Inc. 1730 employees

41 ATSG 7.82 203%

Air Transport Services Group, Inc. 1730 employees  42 NCT 6.66 201%

Newcastle Investment Corp.

42 NCT 6.66 201%

Newcastle Investment Corp.  43 HOOK 7.48 200%

Craft Brewers Alliance, Inc. 302 employees

43 HOOK 7.48 200%

Craft Brewers Alliance, Inc. 302 employees