TigerSoft

News Service 10/31//2008 www.tigersoft.com

TigerSoft

News Service 10/31//2008 www.tigersoft.com Measuring Public versus Professional Buying.

The Six Stages in A Market Cycle.

Predicting The QQQQ Using TigerSoft's

Opening Power, Closing Power and Tiger's

Day Traders' Tool: 1999-2008.

by William Schmidt, Ph.D. - Creator of TigerSoft

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

I believe we can learn a lot from history. Here are

the TigerSoft charts of the QQQQ

since 1999. The

focus is on TigerSoft's Closing Power. Opening Power is more apt to reflect US public

and over-night Asian buying or

selling. This is very often proven wrong. Closing

Power reflects

professional buying or selling

sentiment. It is much more often proven correct. Opening Power

and Closing Power often move in

different directions. The basic idea is that the public tends to

react emotionally to news that may

already be priced into the market. It may be reacting

simply to the fear and greed that

extreme price changes create. It (the public) tends to buy/sell

at the opening or soon afterwards,

having made a decision overnight or early in the day, while

professionals buy/sell more

carefully, later in the day, especially as they accumulate or lay-off

their larger positions and have the

advantage of watching the market all day long. These are

tendencies, not idon-clad rules;

not only may professionals decide to buy at the opening

when they see that as advantageous,

but non-professionals may finally awake to higher "false"

openings and put in

"limit", rather than pre-opening "market", orders.

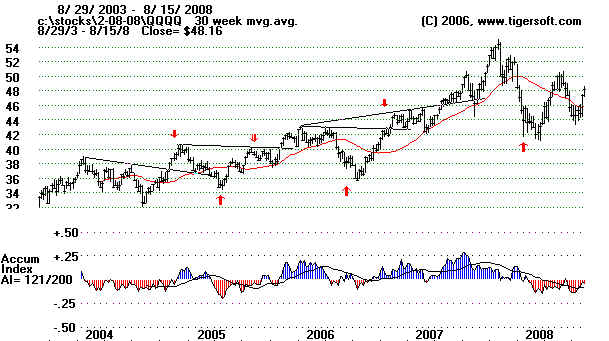

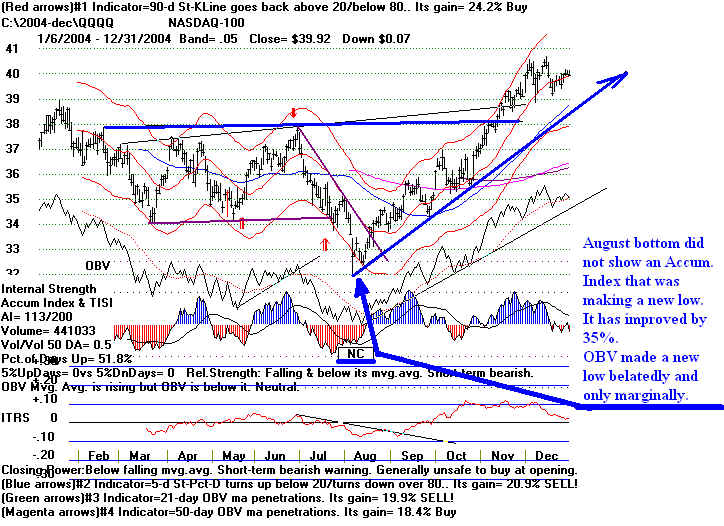

TigerSoft's Accumulation Index

measures a related concept: insider buying or selling.

We want to use all our tools

together. Intense accumulation (readings above +.50) adds bullishness

to a pattern of professional

buying and public selling. Intense distribution (readings below -.25)

adds bearishness to the

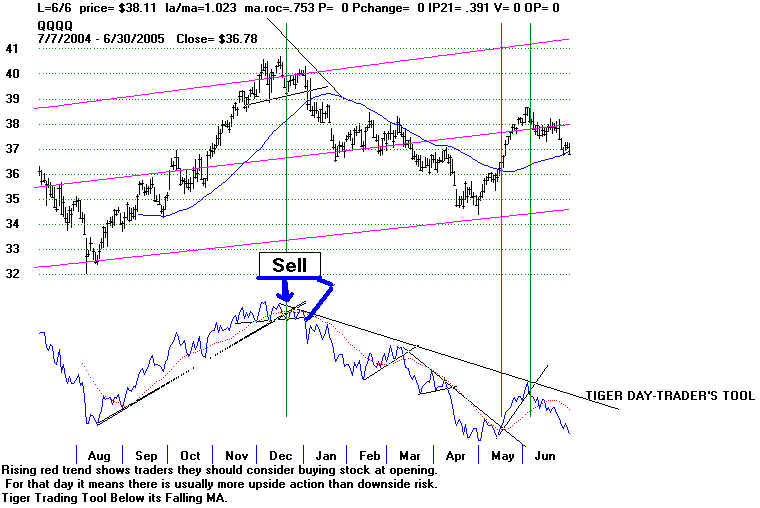

pattern of professional selling and public buying. Similarly, a rising

TigerSoft Day Traders' Tool

adds bullishness to a chart, while its declining trend should suggest

additional bearishness.

Six Stages in A Complete Cycle.

I theorize there are 6 different stages in a stock's or

commodity's rise and fall in a typical price cycle.

As Elliot Wave theorists have

noted, there are cycles within cycles. So a trader may see all 6 stages in

a relatively short period of time,

from days to 3 months. A longer term investor will see these stages play

out very often over an entire year.

Here I want to emphasize intermediate-term trends..

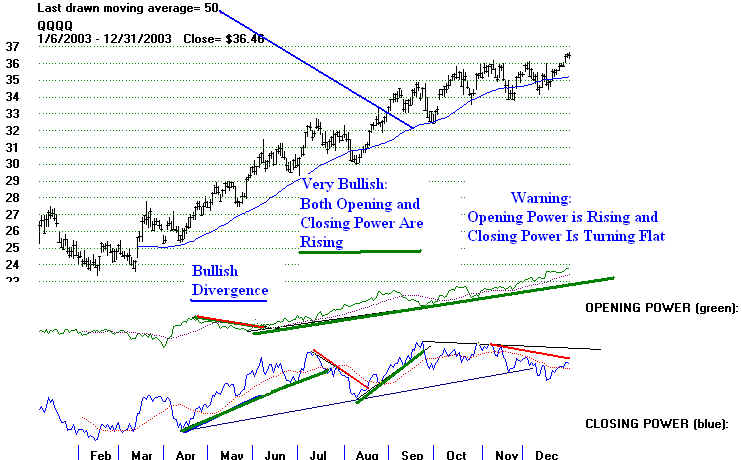

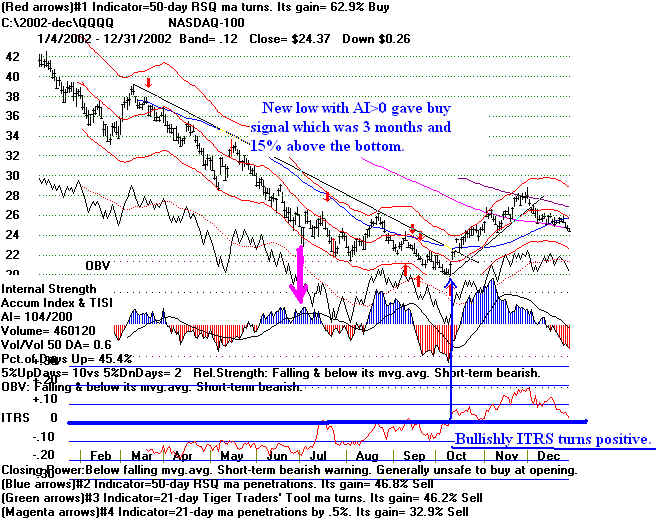

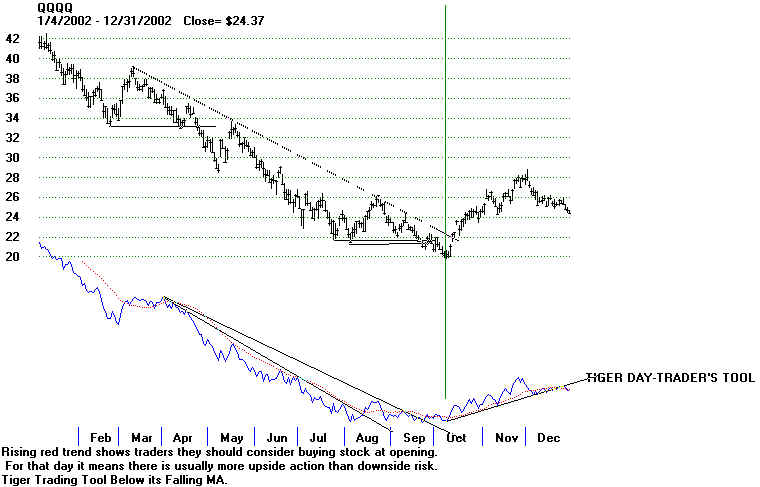

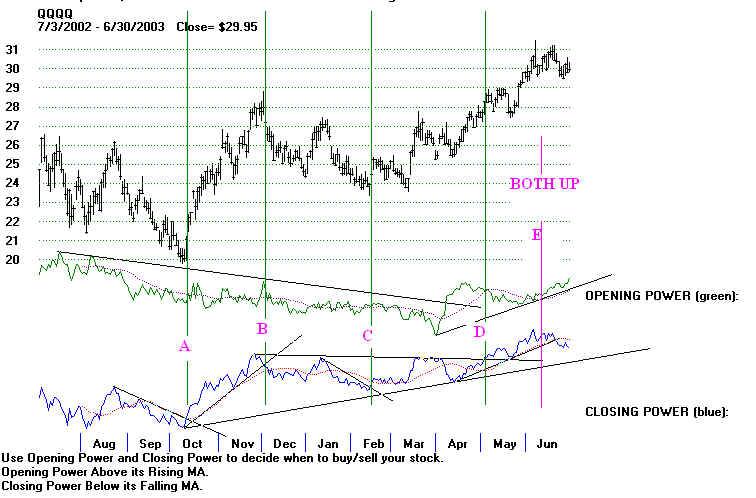

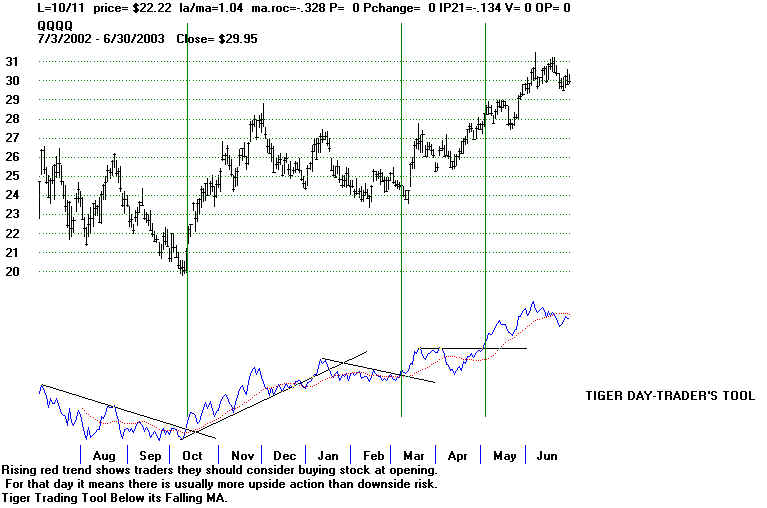

Stage 1 - Professional Accumulation and Public Selling. This is a bullish

divergence. It suggests a bear barket

bottom is being formed. Prices are

beginning to rise from an important bottom. The financial news is bleak,

but this

is the best time to take longer-term positions. Example: Look below at the second

half of 2002 and the first few months of 2003 in the QQQQ

shown below.

Opening Power was declining and Closing Power was rising. This is

a "bullish divergence".

The public is bearish and professionals are

much more bullish.

--------------------- QQQQ 2002-2003 -----------------

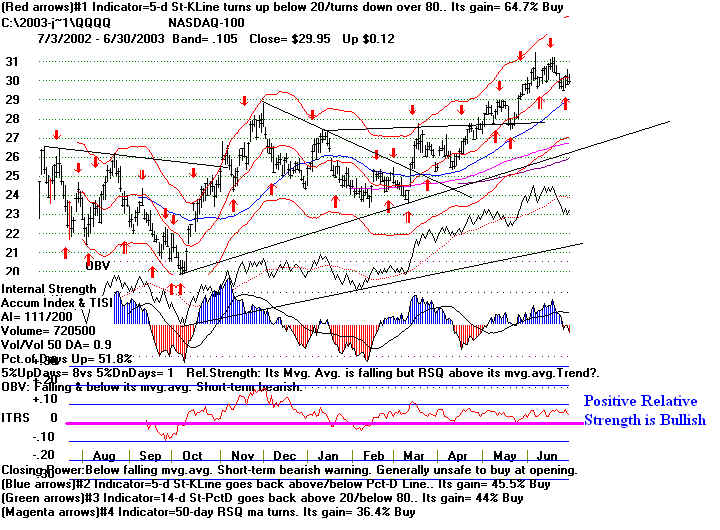

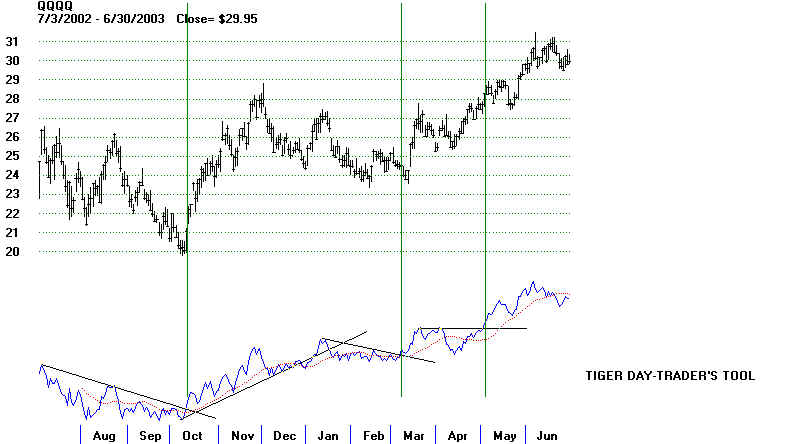

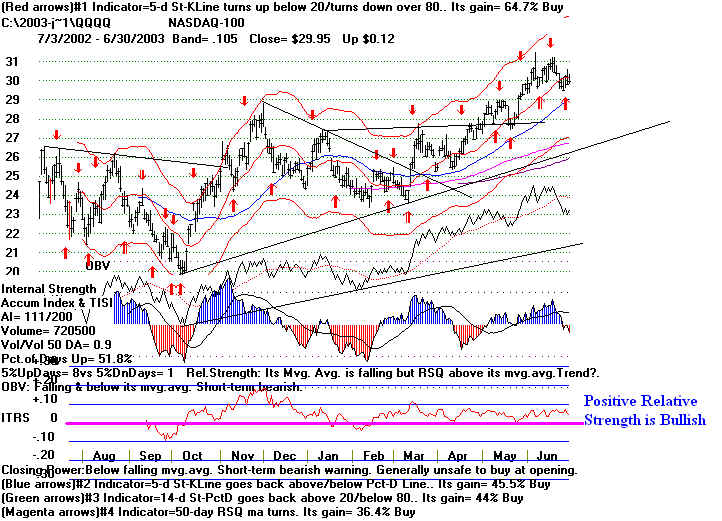

Stage 2 - Prices Advance as

Professionals buy aggressively..

The

public turns from bearish to more neutral on balance.

Opening Power does not rise as steeply as Closing Power.

Example: April to July in 2003, just below. This was a time

when aggressive buying was amply rewarded. (See also

QQQQ, August to December 2006 in charts below.)

----------- QQQQ 2003 ------------

.

.

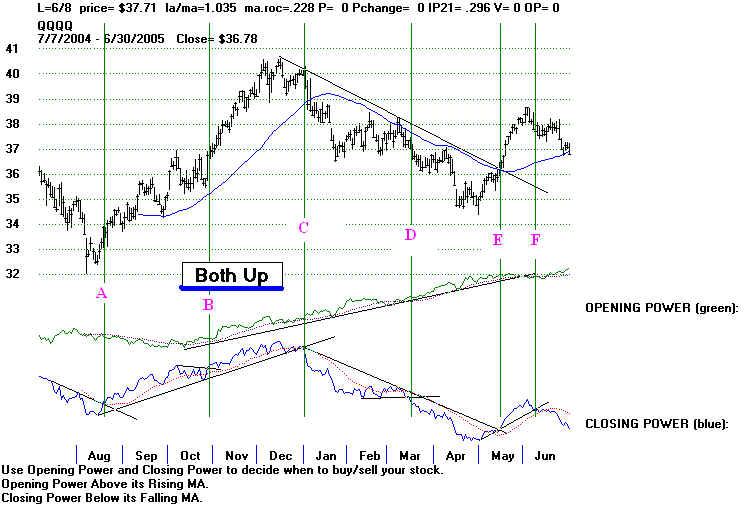

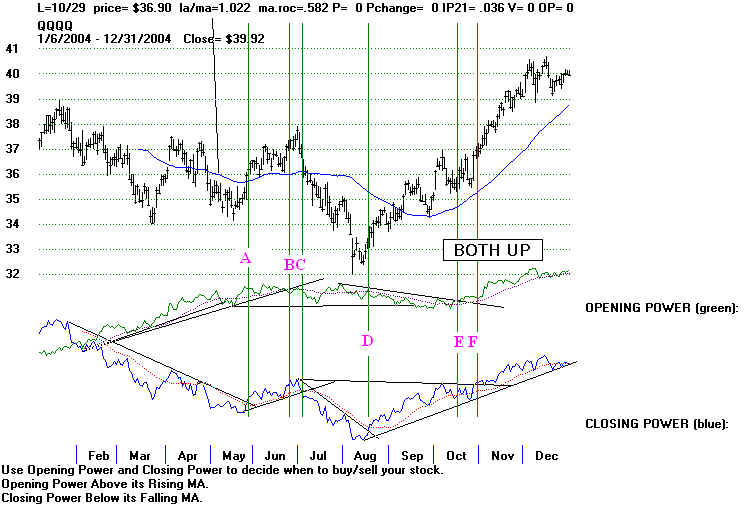

Stage 3 - Prices rise very

quickly as Both Public and Professionals

Are Buying Aggressively. Closing Power

is still rising. though it

may start to turn flat after an extended advance. Opening power is

rising steeply. Shorts are being run in. Prices open higher day

after day and close strongly. This is the most exciting phase in a

bull market. This is the stage when prices rises most steeply.

Examples: In chart above, see

the QQQQ: July 2003-November 2003

and below October 2004-December 2004..

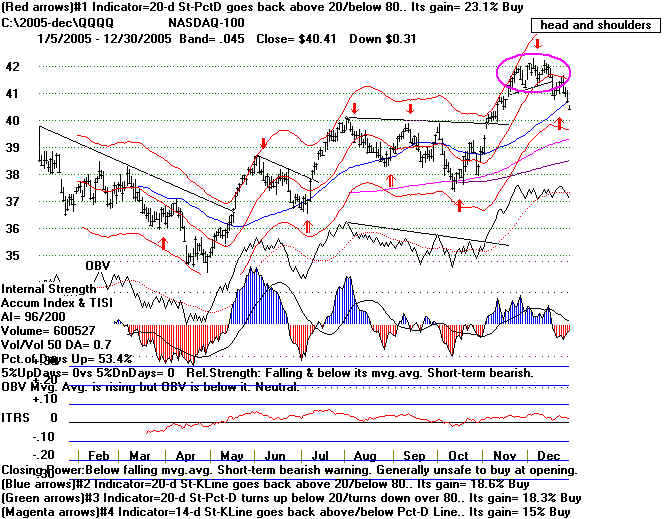

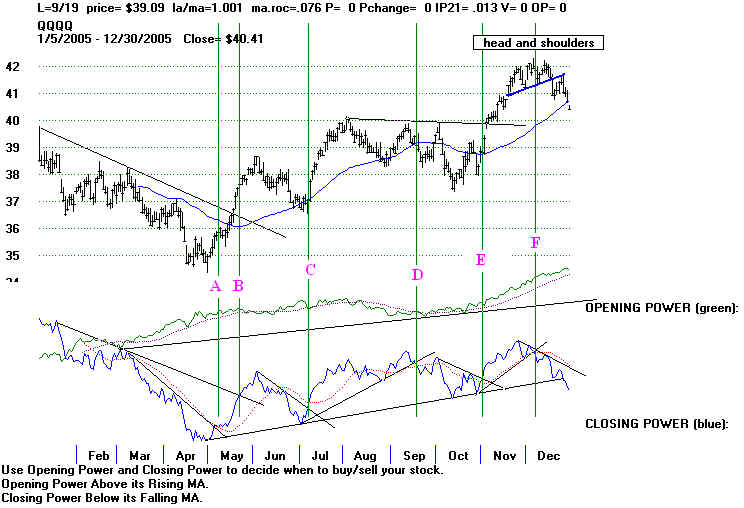

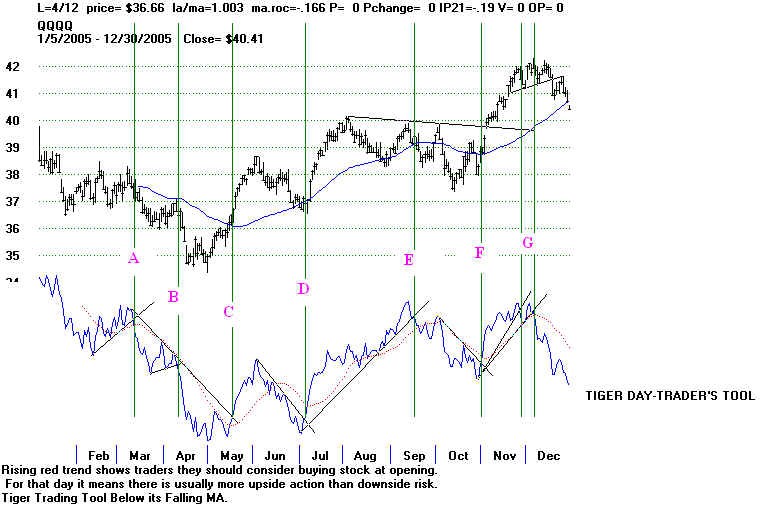

------------------- QQQQ 2004-2005 -------------------

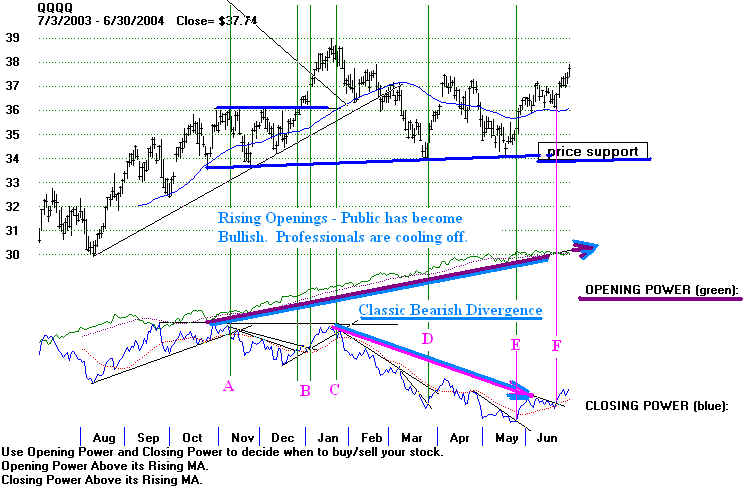

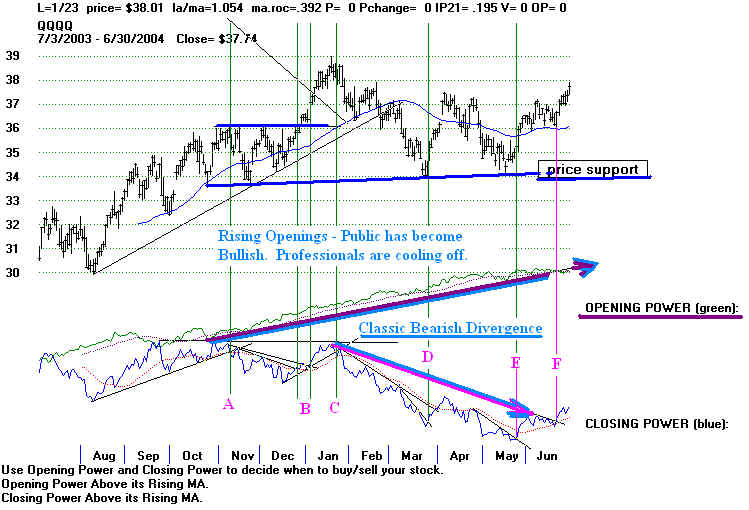

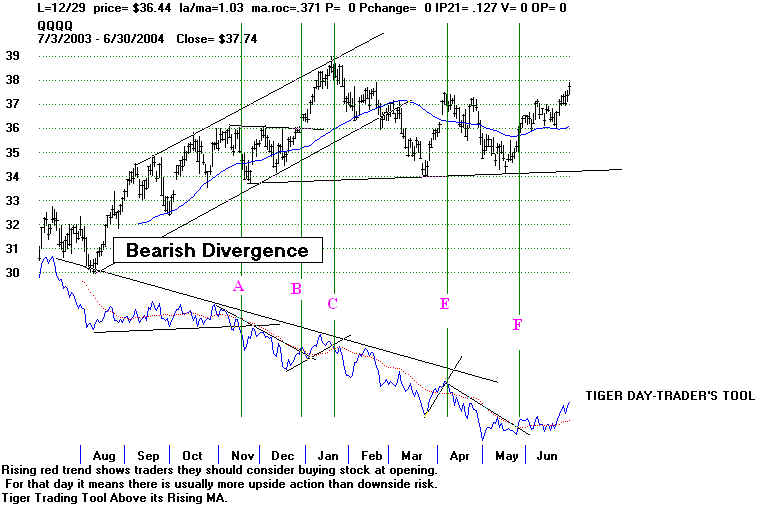

Stage 4 - Professionals Distribute to Public.

Prices reach a peak and

Then come under pressure despite public's buying aggressively at the

opening. Professionals are in control. The price decline can be quite

steep. It is usually orderly. Opening Power is still rising,

showing that the Public

thinks all dips are buying opportunities. The earlier advance and good news

have made them bullish even as prices decline. Meanwhile professionals are

selling (distributing) and Closing Power is falling. A "bearish divergence" is

said to exist: the public is buying while professionals are selling. You can see

this bearish divergence in the period January 2005 - April 2005 in the chart

above. Another

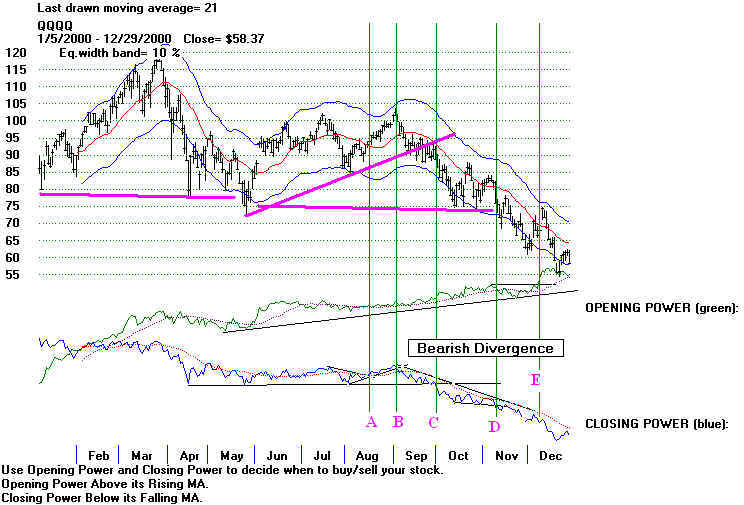

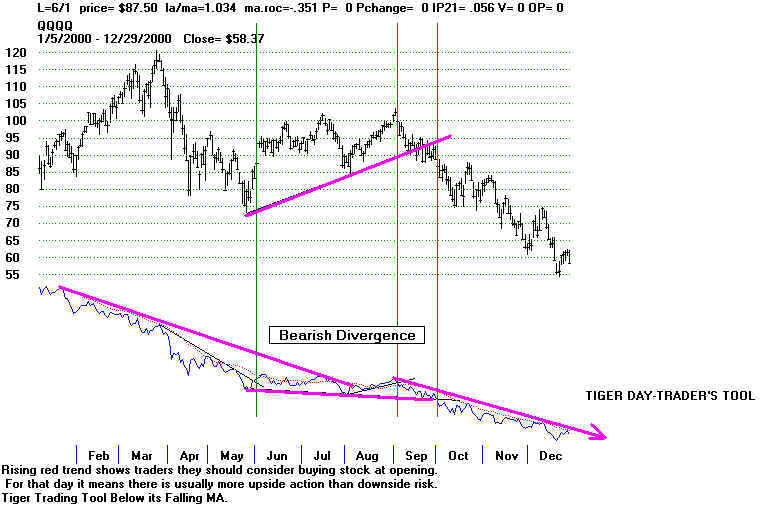

example: QQQQ: September 2000-December 2000.

(below)

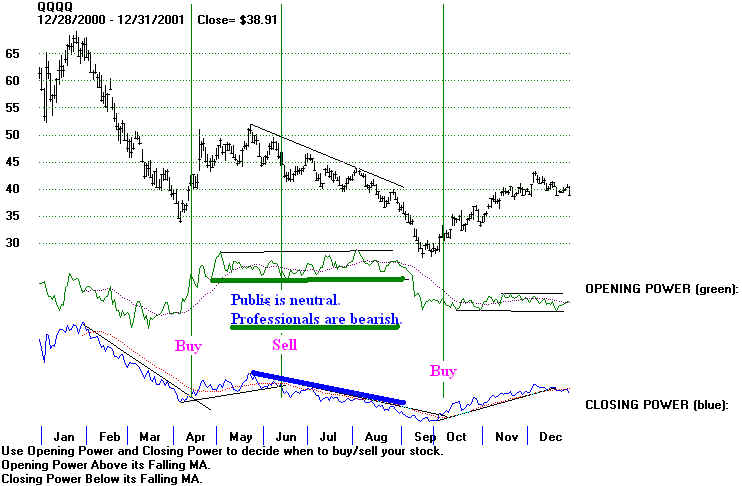

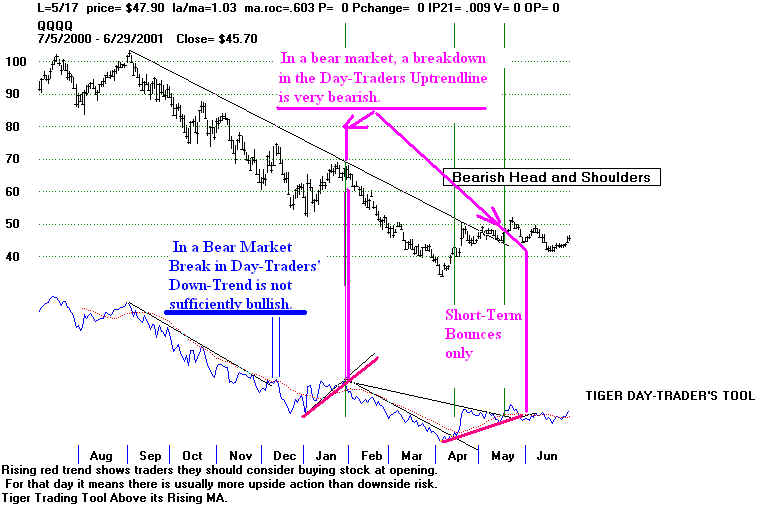

------------------ QQQQ 2000-2001 ---------------

More examples: In chart below, you will see the QQQQ: January 2004-June 2004.

Note that a stage 4 "bearish divergence" is not necessarily followed by Stage 5

Capitulation. As in 2004, the bearish divergence decline may produce only a six

month

or year-long "consolidation, tilted downward" which is eventually followed by Stages 1-4

again. This was the case with the QQQQ from January 2004 to May 2005. It was

also

the case in the period November 2007-December 2007. Both are shown just below.

Generally, if the bearish divergence between Opening Power and Closing Power

lasts under three months, the resulting decline will either be relatively shallow or

relatively quickly over. To spot a reversal, we must watch Closing Power to see when

its downtrend ends and Professionals are ready to buy again.

------------------------------------ QQQQ 2003-2004

-------------------------------------------

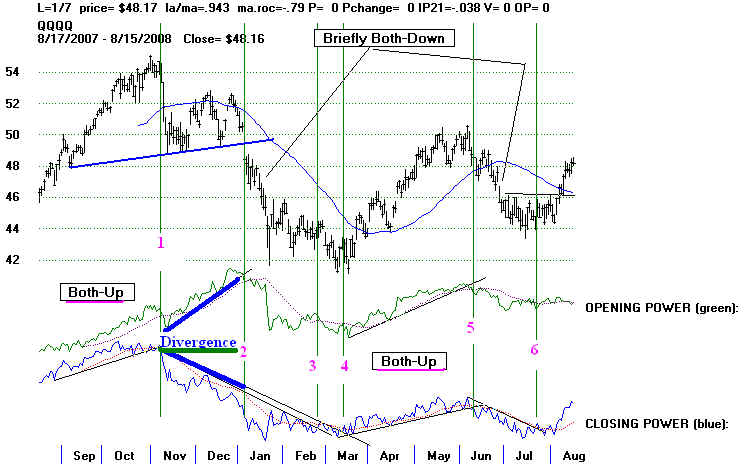

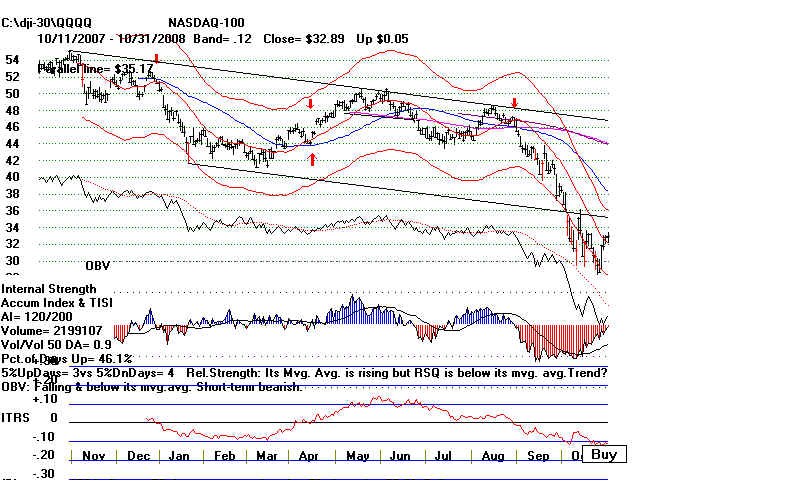

------------------------------------ QQQQ 2007-2008

-------------------------------------------

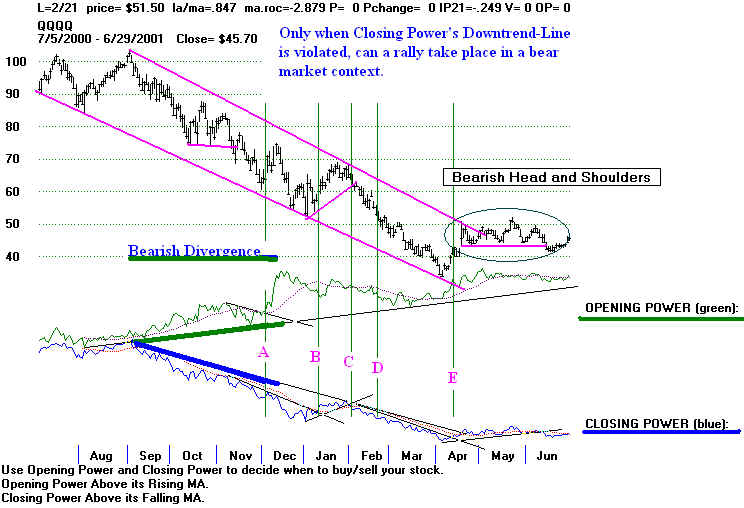

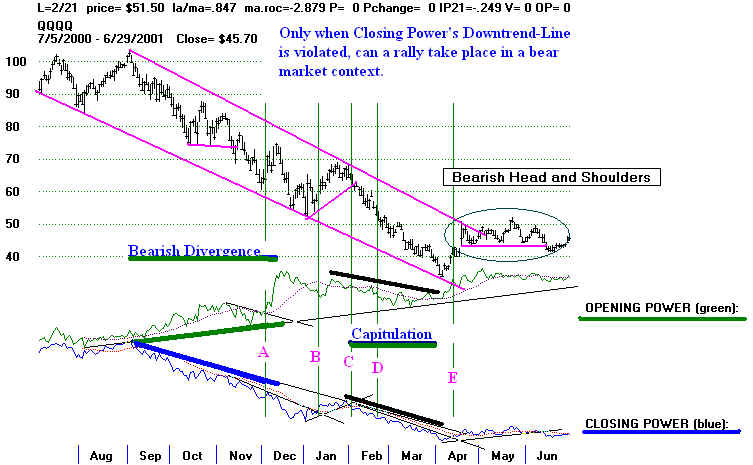

Stage 5 - Prices break down from a top. Professionals

Selling is steady and

the Public gradually has turned from Bullish to Neutral. Opening Power breaks its

uptrend

and turns flat, while Closing Power's decline worsens. This normally leads to a

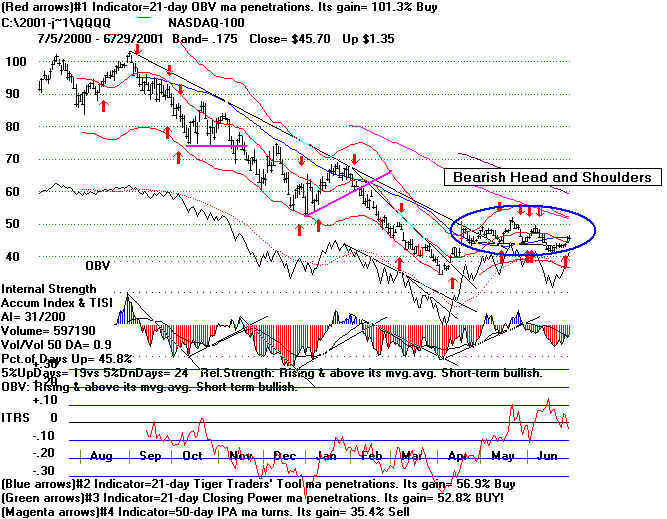

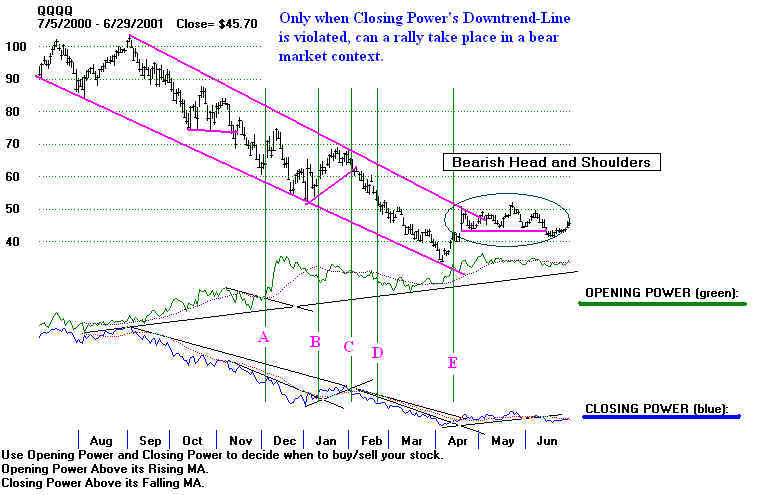

Stage 6 capitulation phase. Example: QQQQ: April 2001-August 2001.

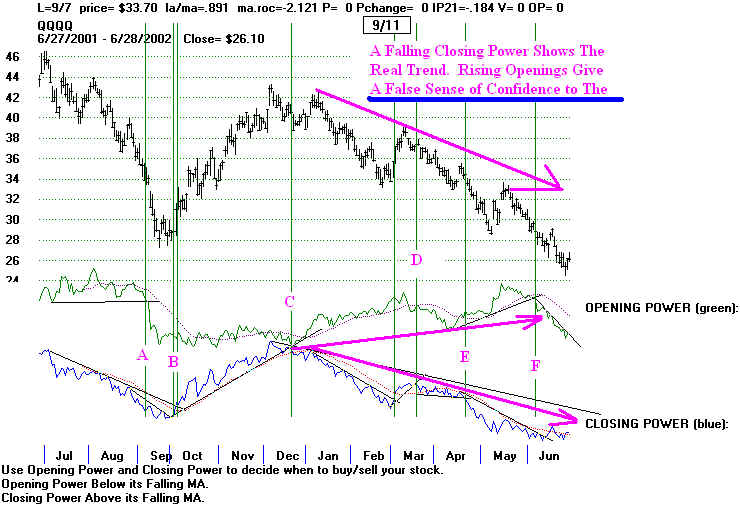

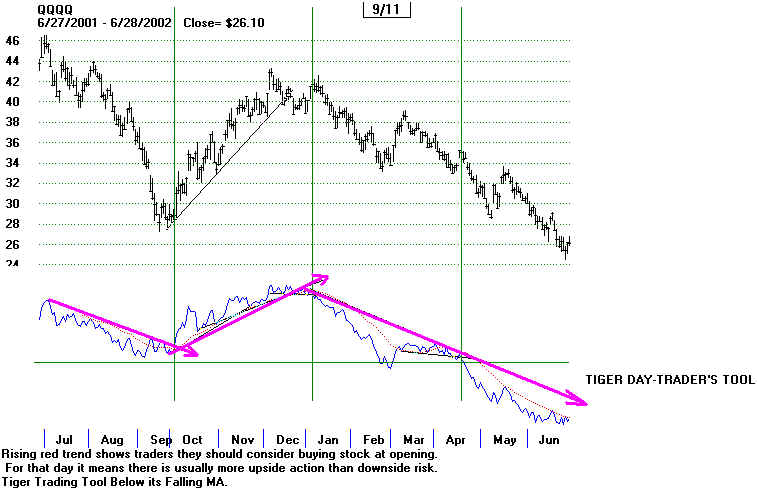

------------------- QQQQ 2001 -------------------

Stage 6 - Prices fall very

quickly. Professionals Selling (Closing Power is declining)

is matched by Public Selling (Opening Power is declining.)

This is the capitulation or

panic stage. The condition of "Both-Down" is exists. Example:

See QQQQ:

February 2001-March 2001 below. At the very least, a relief counter-trend recovery

follows.

------------------- QQQQ 2000-2001 -------------------

When you look at the charts below keep in mind the the longer term cycle that played out.

==================================================================================

Background on The QQQQ

The QQQQ (Nasdaq-100) peaked in March 2000 at 120. By September 2001, it had

fallen to 28.

The attack of 9/11 brought on a

selling climax. Within this 18 months, there was a temporary bottom

at 75 in May 2000. (This

first leg down was the breaking of the internet bubble.) The next leg down

to prices down 50% from 75 to a

bottom at 38 in March 2001. The third leg down took the QQQQ

to 28 in September 2001.

After a counter-trend rally lasting 3 months, the QQQQ fell steadily to

a bottom at 20 in October 2002.

All through the long bear market, the public was generally buying

the Openings until May 2002.

Only as the QQQQ was nearing its bottom did Opening Power start to

fall. Professionals, judging

from the mostly falling Closing Power, remained bearish until October. At that

point they recognized the bottom

much more quickly than the public.

--------------------- QQQQ since 2004 ---------------------------------------------

This is a

simplification of reality, of course. But sensing where a stock, commodity or index

is in the cycle

will help you understand what is

happening and how and why the market reacts differently at various times

to the same news.

This theory will become another book eventually. The concepts are

needed now, so

I am publishing them in a limited

way now, to Tiger Elite Subscribers.

Trading Tactics Applied to The QQQQ

Chronlogically.

Consider these trading tactics:

Closing

Power Trend-Breaks Upwards is Bullish

Downwards is Bearish.

Closing Power Breakouts above earlier peaks that are nearly flat

is Bullish.

Closing Power Breakdowns

below earlier peaks that are nearly flat is Bearish.

When Closing Power has been declining for some time,

it is very bearish when Opening Power breaks down.

When

Closing Power has been rising for some time, it is very bullish when Opening Power breaks

out.

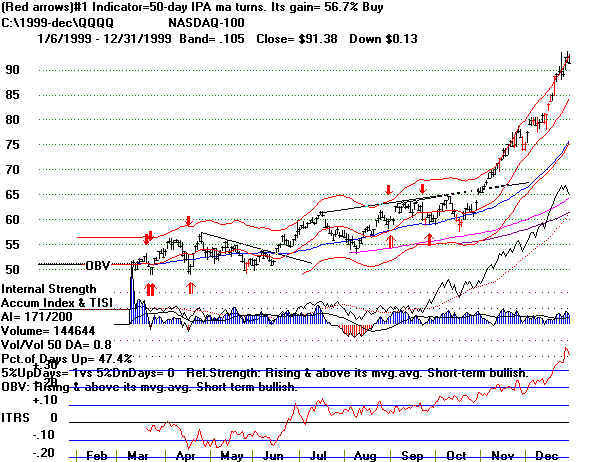

QQQQ 1999

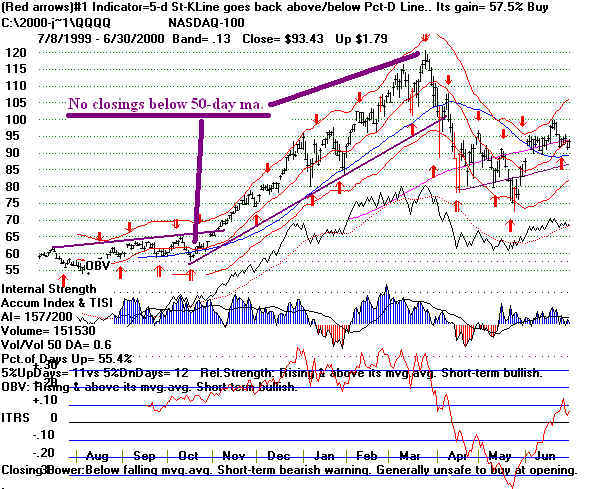

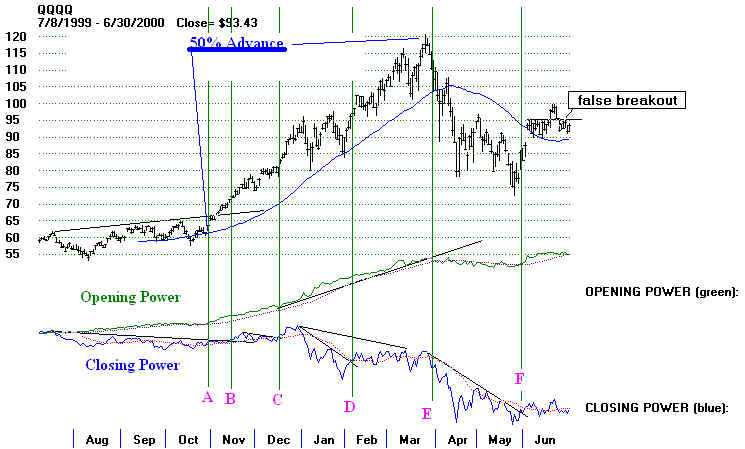

QQQQ 1999-2000 (1)

50% advance...

QQQQ 1999-2000 (2)

(A) Both Opening and Closing Power are rising. Can be very bullish.

(B) Closing Power

breaks out over its flat resistance. Opening Power rising. Bullish.

(C) Closing Power

breaks out over its flat resistance. Opening Power rising. Bullish.

(D) Closing Power

breaks out over its declining resistance. Opening Power rising. Bullish.

(E) After 10 week period when

Closing Power was declining and Opening Power was

falling, it is bearish when the Opening Power breaks its uptrendline.

(F) Closing Power surpasses

its downtrendline while Opening Power is flat to rising.

Bullish.

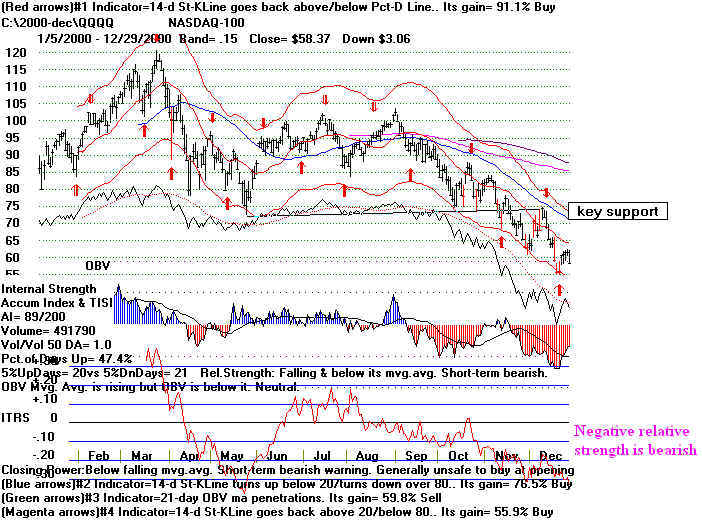

QQQQ 1999-2000 (3)

Prices Doubled from July 1999 to March

2000,

while Tiger Day-Traders' Tool was falling. This was

an early warning of the coming bear market. When

prices top out, they must come down a long ways.

QQQQ 2000 (1)

QQQQ

2000 (2)

Note how

in April 2000, both Opening and Closing Power are falling.

This is quite bearish. This condition is called "BOTH-DOWN".

(A) Closing Power surpasses its

downtrendline while Opening Power is flat to rising.

Bullish.

(B) Closing Power

breaks its uptrend. Opening Power is flat. Bearsh.

(C) Closing Power

breaks down below its flat support. Thought Opening Power

is rising, Closing Power proved correct. Bearish. Consider bearish context.

(D) Closing Power

breaks down. So does Opening Power. Bearish.

(E) After 10 week period when

Closing Power was declining and Opening Power was

falling, it is bearish when the Opening Power breaks its uptrendline.

(F) Opening Power upside

breakout in context of declining Closing Power is

misleading. Bearishly Closing Power rules.

QQQQ 2000 (3)

| QQQQ 2000--2001 (1)  QQQQ 2000--2001 (2)  QQQQ 2000--2001 (3)

QQQQ 2001--2002 (1)  QQQQ 2001--2002 (2)  QQQQ 2001--2002 (3)  |

| QQQQ 2002 (1)  QQQQ 2002 (2)  QQQQ 2002 (3)  |

|

QQQQ 2002-2003 (1)  QQQQ 2002-2003 (2)  QQQQ 2002-2003 (3)  |

QQQQ 2003 (2)

QQQQ 2003 (3)

QQQQ

2003-2004 (1)

QQQQ 2003-2004 (2)

QQQQ 2003-2004 (3)

QQQQ 2004 (1)

QQQQ 2004 (2)

QQQQ 2004 (3)

QQQQ 2004-2005 (1)

QQQQ 2004-2005 (2)

QQQQ 2004-2005 (3)

QQQQ 2005 (1)

QQQQ 2005 (2)

QQQQ 2005 (3)

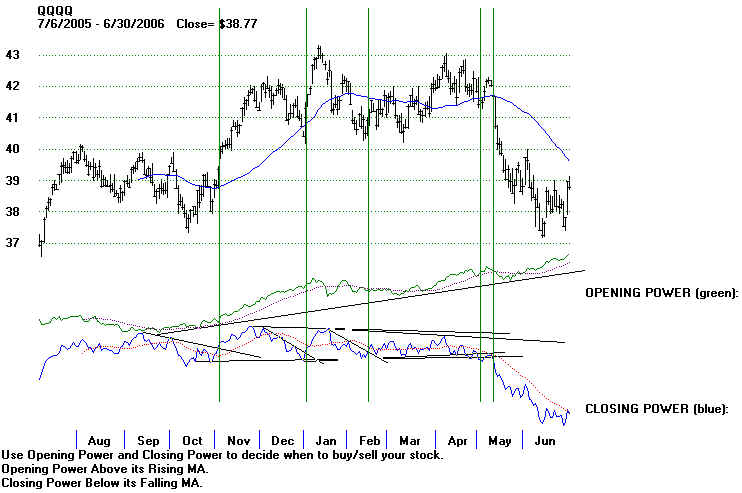

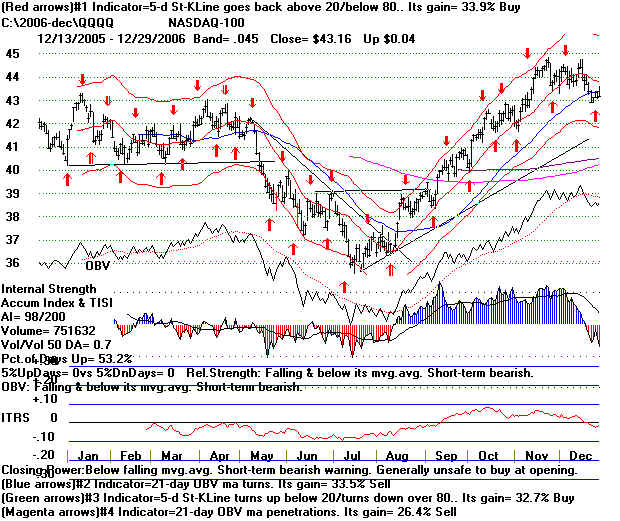

QQQQ 2005 -2006 (1)

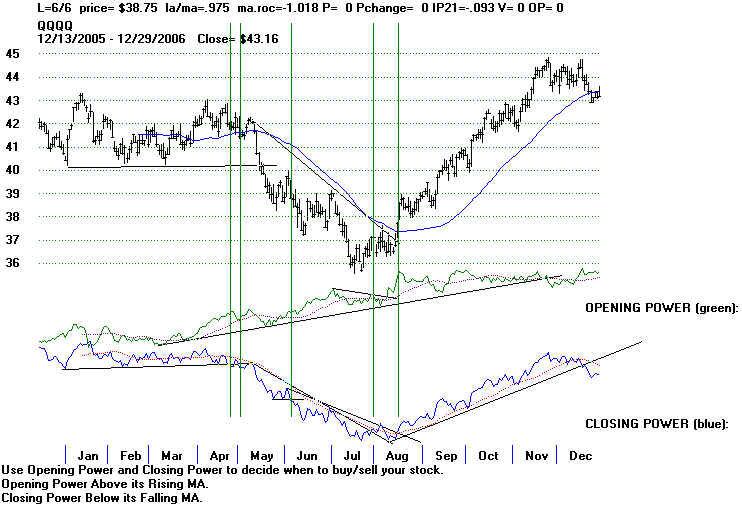

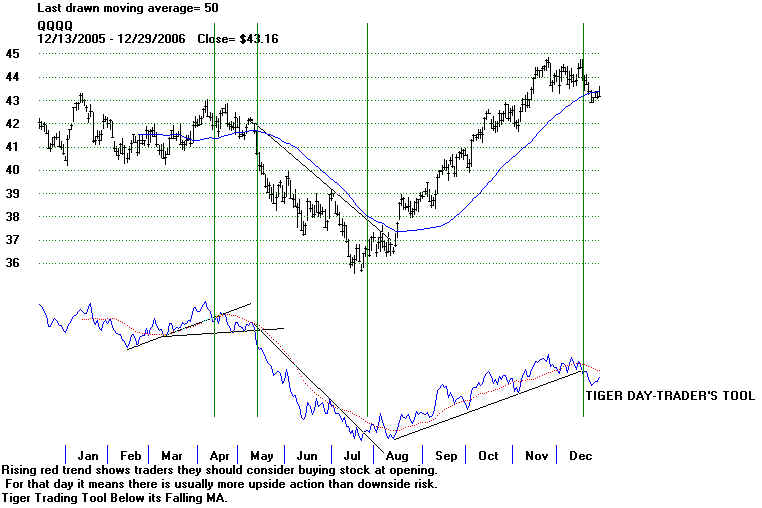

QQQQ 2005 -2006 (2)

See the mildly bearish divergence from November 2005 to April 2006.

QQQQ 2005 -2006 (3)

QQQQ 2006 (1)

QQQQ 2006 (2) Bearish Divergence is seem from April 2006 to

Augusat 2006.

QQQQ 2006 (3)

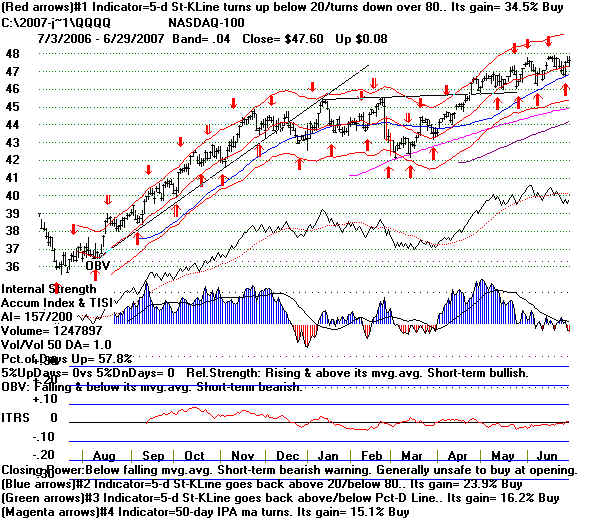

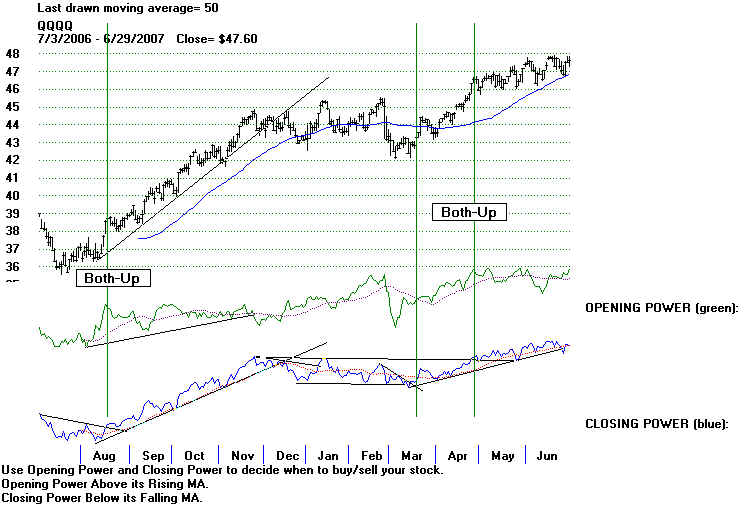

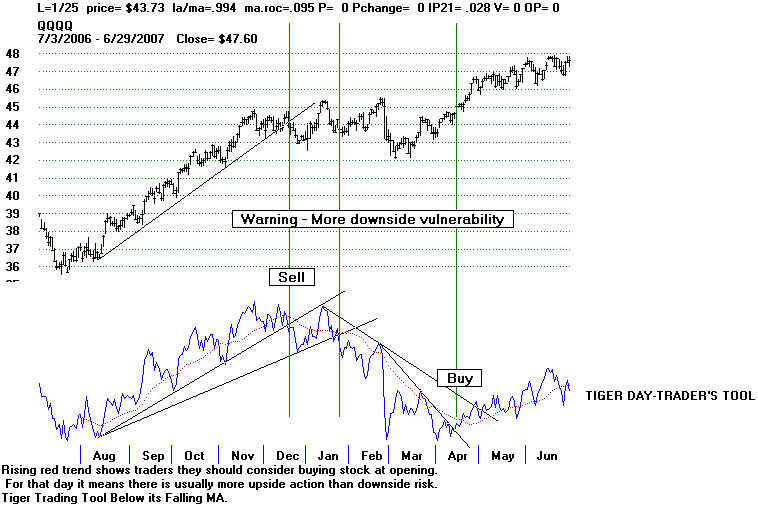

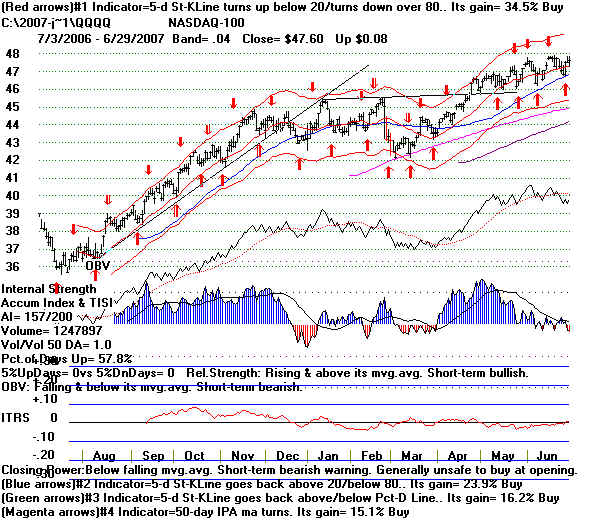

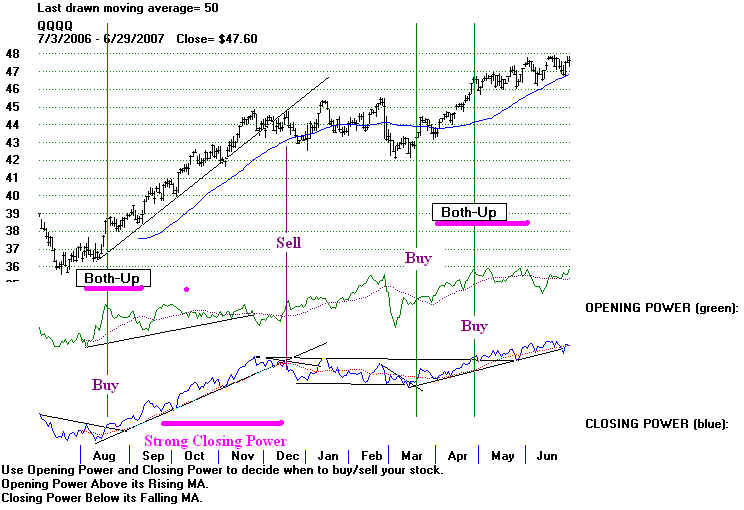

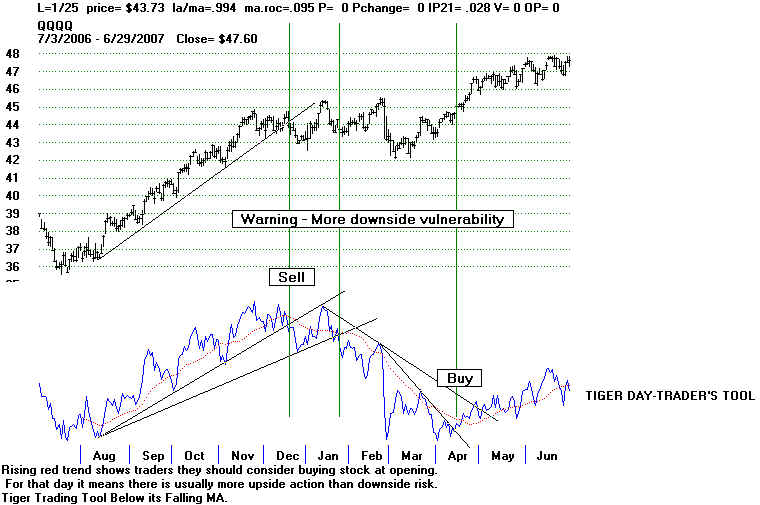

QQQQ 2006-2007 (1)

QQQQ 2006-2007 (2)

QQQQ 2006-2007 (3)

QQQQ 2007 (1)

QQQQ

2007 (2)

QQQQ 2007 (3)

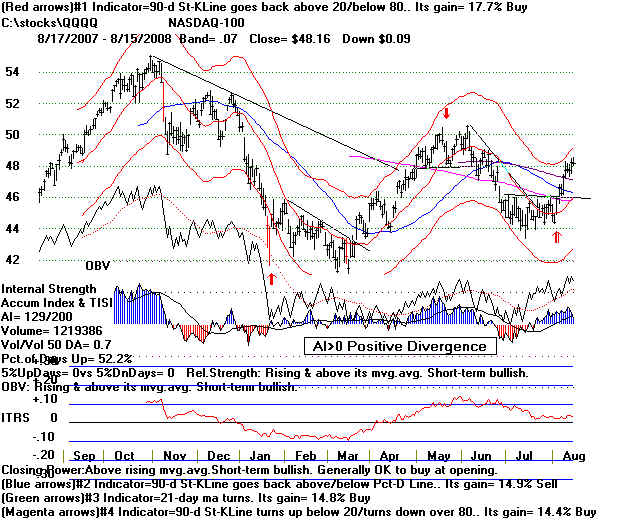

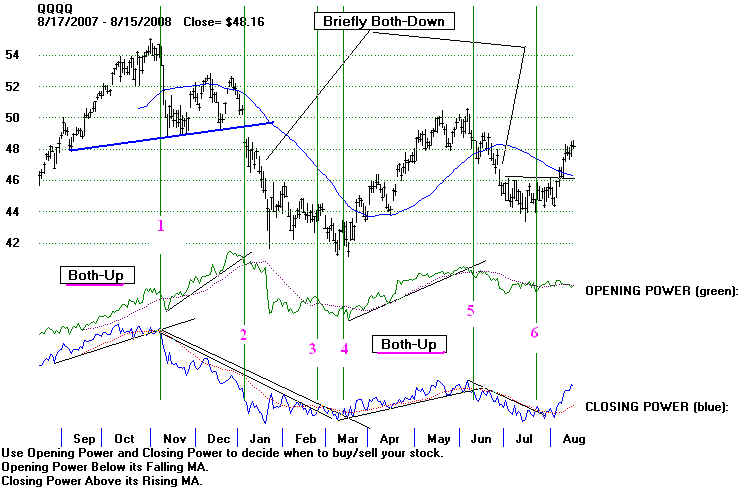

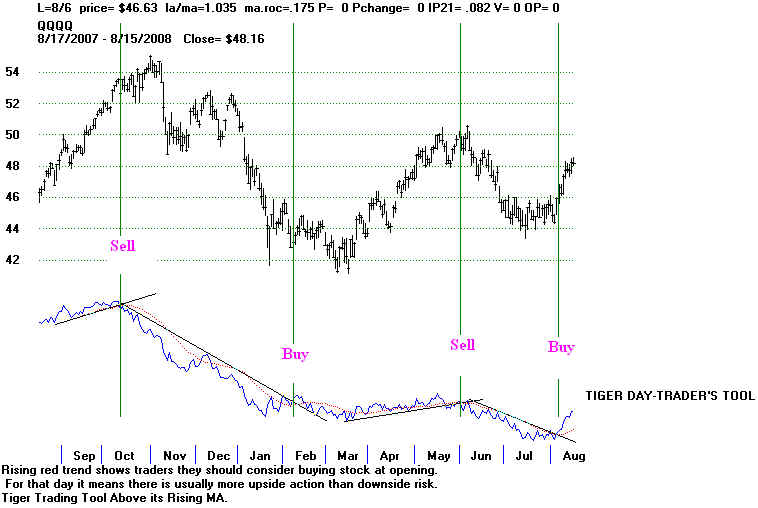

QQQQ 2007 -2008(1)

QQQQ 2007 -2008(2)

QQQQ 2007 -2008(3)

QQQQ - 2008

QQQQ 2008 (1)

QQQQ 2008 (2)

QQQQ 2008 (3)