TigerSoft

New Service TigerSoft Blog - 4/26/2011

TigerSoft

New Service TigerSoft Blog - 4/26/2011PEERLESS TRADING OF LATIN AMERICAN

AND BRAZILIAN STOCKS

Using PEERLESS STOCK MARKET TIMING: 1915-2011

Simply super-impose the automatic Buys and Sells from Tiger's

Peerless Stock Market Timing onto the

charts EWZ (Brazil), ILF (Latin America),

EWW (Mexico).

Mexico - $1000 becomes

$99,947 in 15 yrs.

Brazil - $1000 becomes $47,094 in 10

years.

Latin America $1000 becomes $25,042 in 9 years

![]() TigerSoft Makes The Stock Market Simple, Easy Safe Profitable!

TigerSoft Makes The Stock Market Simple, Easy Safe Profitable!

Simply super-impose the automatic Buys and Sells from Tiger's

Peerless Stock Market Timing onto the

charts EWZ (Brazil), ILF (Latin America),

EWW (Mexico)

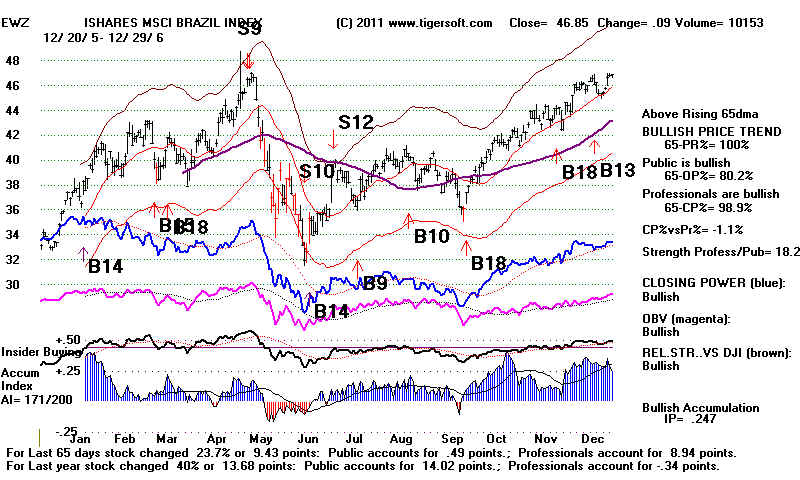

EWZ (Brazilian ETF) - 26 Peerless Trades since 2001,

Avg.Gain= 21.2%/trade.

$1000 becomes $47,094 in

10 years.

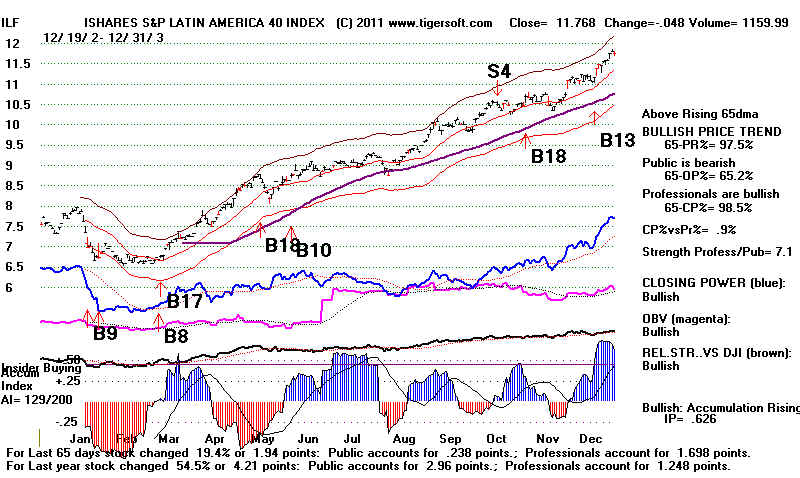

ILF (Latin American ETF) 24 Peerless Trades since

2002,

Avg.Gain= 18.4%/trade $1000 becomes $25,042 in 9 years

EWW (Mexican ETF) 35 Peerless Trades since 1996,

Avg.Gain= 17.7%/trade.

$1000 becomes $99,947

in 15 yrs.

See http://www.tigersoftware.com/TigerBlogs/May-16-2009/index.html

Results conservatively do not include

dividends

and

assume 2% for slippage/commissions

per

round-trip trade.

Results are as of

4/21/2011. No Sell signal occurred there.

EWZ (Brazilian ETF) 26 Peerless Trades since 2001,

Avg.Gain= 21.2%/trade. $1000 becomes $47,094 in 10 years.

Peerless Automatic Buys and Sells

Produce Very Big Profits

for A Trader of EWZ, the ETF for Brazilian Stocks

2001-2011

Trade Dates Signals EWF Pct. Gain $1000

Becomes

---------------------------------------------------------------------------------------------------------------------------------------------------------

1 3/ 23/ 1 BUY 14.3 4.1% 1021

1 5/ 17/ 1 SELL 14.9

----------------------------------------------------------------------------

2 9/ 19/ 1 BUY 9.33 38.3% 1393

2 2/ 26/ 2 SELL 12.91

----------------------------------------------------------------------------

3 7/ 24/ 2 BUY 8.35 -32.3% 916

3 10/ 15/ 2 SELL 5.66

----------------------------------------------------------------------------

4 11/ 13/ 2 BUY 7.04 24.7% 1125

4 1/ 6/ 3 SELL 8.78

----------------------------------------------------------------------------

5 1/ 22/ 3 BUY 7.8 81.2% 2017

5 10/ 15/ 3 SELL 14.14

----------------------------------------------------------------------------

6 11/ 3/ 3 BUY 14.3 20.6% 2392

6 2/ 11/ 4 SELL 17.25

----------------------------------------------------------------------------

7 5/ 18/ 4 BUY 13.14 29.3% 3047

7 9/ 2/ 4 SELL 17

----------------------------------------------------------------------------

8 10/ 14/ 4 BUY 18.3 20.1% 3601

8 12/ 28/ 4 SELL 21.99

----------------------------------------------------------------------------

9 4/ 21/ 5 BUY 22.45 106.9% 7379

9 5/ 5/ 6 SELL 46.45

---------------------------------------------------------------------------

10 6/ 15/ 6 BUY 35.35 10.6% 8018

10 6/ 30/ 6 SELL 39.12

---------------------------------------------------------------------------

11 7/ 18/ 6 BUY 36.8 20.8% 9529

11 1/ 5/ 7 SELL 44.47

----------------------------------------------------------------------------

12 3/ 2/ 7 BUY 43.84 55.6% 14639

12 7/ 17/ 7 SELL 68.22

----------------------------------------------------------------------------

13 9/ 25/ 7 BUY 71.25 10.5% 15897

13 10/ 15/ 7 SELL 78.8

----------------------------------------------------------------------------

14 11/ 14/ 7 BUY 83.85 2% 15901

14 12/ 6/ 7 SELL 85.55

----------------------------------------------------------------------------

15 3/ 7/ 8 BUY 80.78 -6.5% 14562

15 3/ 24/ 8 SELL 75.59

----------------------------------------------------------------------------

16 7/ 8/ 8 BUY 81.76 -2% 13993

16 7/ 23/ 8 SELL 80.2

----------------------------------------------------------------------------

17 9/ 15/ 8 BUY 57.8 8.9% 14960

17 9/ 22/ 8 SELL 62.95

----------------------------------------------------------------------------

18 10/ 8/ 8 BUY 37 2.2% 15000

18 10/ 21/ 8 SELL 37.84

----------------------------------------------------------------------------

19 11/ 21/ 8 BUY 29.36 37% 20264

19 1/ 6/ 9 SELL 40.25

----------------------------------------------------------------------------

20 1/ 21/ 9 BUY 35.14 2.2% 20314

20 1/ 29/ 9 SELL 35.93

----------------------------------------------------------------------------

21 2/ 17/ 9 BUY 36.4 -6.1% 18680

21 2/ 27/ 9 SELL 34.2

----------------------------------------------------------------------------

22 3/ 12/ 9 BUY 36.66 52.7% 28151

22 6/ 9/ 9 SELL 55.98

----------------------------------------------------------------------------

23 6/ 23/ 9 BUY 50.7 46.9% 40809

23 10/ 21/ 9 SELL 74.51

----------------------------------------------------------------------------

24 11/ 9/ 9 BUY 77.04 -2.7% 38891

24 11/ 13/ 9 SELL 74.96

----------------------------------------------------------------------------

25 1/ 22/ 10 BUY 67.97 -1.3% 37638

25 6/ 16/ 10 SELL 67.14

-----------------------------------------------------------------------------

26 6/ 30/ 10 BUY 61.83 27.1% $47094

26 4/ 21/ 11 SELL 78.6

------------------------------------------------------------------------

N= 26 Avg.Gain= 21.2% $1000 becomes $47,094

Peerless Automatic Buys and Sells

Produce Very Big Profits

for A Trader of ILF, the ETF

for Latin American Stocks

2002-2011

ILF (Latin American ETF) 24 Peerless Trades since 2002,

Avg.Gain= 18.4%/trade

$1000 becomes $25,042 in 9 years

2002-2011

Trade Dates Signals ILF Pct. Gain $1000

Becomes

---------------------------------------------------------------------------------------------------------------------------------------------------------

1 7/ 24/ 2 BUY 7.43 -12.1% 859

1 10/ 15/ 2 SELL 6.534

2 11/ 13/ 2 BUY 6.938 12.5% 950

2 1/ 6/ 3 SELL 7.81

3 1/ 22/ 3 BUY 6.98 50.4% 1410

3 10/ 15/ 3 SELL 10.502

4 11/ 3/ 3 BUY 10.7 16.2% 1610

4 2/ 11/ 4 SELL 12.436

5 5/ 18/ 4 BUY 10.57 19% 1884

5 9/ 2/ 4 SELL 12.58

6 10/ 14/ 4 BUY 13.28 20% 2224

6 12/ 28/ 4 SELL 15.944

7 4/ 21/ 5 BUY 16.244 95% 4293

7 5/ 5/ 6 SELL 31.688

8 6/ 15/ 6 BUY 24.956 9.5% 4619

8 6/ 30/ 6 SELL 27.344

9 7/ 18/ 6 BUY 26.088 25.5% 5708

9 1/ 5/ 7 SELL 32.75

10 3/ 2/ 7 BUY 32.28 41.5% 7967

10 7/ 17/ 7 SELL 45.7

11 9/ 25/ 7 BUY 46.442 9.8% 8590

11 10/ 15/ 7 SELL 51

12 11/ 14/ 7 BUY 50.94 4.3% 8794

12 12/ 6/ 7 SELL 53.172

13 3/ 7/ 8 BUY 49.85 -2.2% 8431

13 3/ 24/ 8 SELL 48.79

14 7/ 8/ 8 BUY 50.98 -1.5% 8144

14 7/ 23/ 8 SELL 50.262

15 9/ 15/ 8 BUY 38.89 7.6% 8601

15 9/ 22/ 8 SELL 41.85

16 10/ 8/ 8 BUY 26.55 0% 8435

16 10/ 21/ 8 SELL 26.57

17 11/ 21/ 8 BUY 21.56 34% 11138

17 1/ 6/ 9 SELL 28.9

18 1/ 21/ 9 BUY 24.95 1.2% 11049

18 1/ 29/ 9 SELL 25.25

19 2/ 17/ 9 BUY 25.1 -6.9% 10076

19 2/ 27/ 9 SELL 23.39

20 3/ 12/ 9 BUY 24.94 44.5% 14363

20 6/ 9/ 9 SELL 36.05

21 6/ 23/ 9 BUY 33.08 41.2% 19993

21 10/ 21/ 9 SELL 46.71

22 11/ 9/ 9 BUY 47.78 -1.2% 19368

22 11/ 13/ 9 SELL 47.24

23 1/ 22/ 10 BUY 44.33 2.5% 19478

23 6/ 16/ 10 SELL 45.47

24 6/ 30/ 10 BUY 41.42 30.5% $25,042

24 4/ 21/ 11 SELL 54.08

------------------------------------------------------------------------

N= 24 Avg.Gain= 18.4%/Trade $1000 becomes $25,042

BRAZIL ETF - EWZ - 2006

Peerless Buys and Sells Superimoposed.

Brazil ETFs

- iShares MSCI Brazil ETF (EWZ). EWZ is the largest non-U.S. single-country ETF with $9 billion in assets under management. The fund covers mostly large-cap stocks and includes some of Brazil’s most prominent name brands.

- Global X Brazil Mid Cap ETF (BRAZ). Recently launched, BRAZ is the first ETF that tracks mid-cap Brazilian companies. Mid-caps are focused on internal consumption, whereas large-caps have more ties with the global economy.

- Market Vectors Brazil Small-Cap ETF (BRF).

Brazil’s small-caps have proved to be steady and substantial performers while the

global markets faltered with recent short-term events. BRF has a 30% weighting in the

consumer sector and less than 1% in energy. The composition of BRF is a stark contrast to

EWZ.

- EGS INDXX Brazil Infrastructure ETF (BRXX). BRXX includes 30 stocks that are involved in the development and maintenance of Brazil’s infrastructure.

- ProShares Ultra MSCI Brazil (UBR). UBR “seeks daily investment results, before fees and expanses, that correspond to 200% of the daily performance of the MSCI Brazil Index.”

- ProShares UltraShort MSCI Brazil (BZQ). BZQ is a 200% inverse ETF. It should be noted that the fund is best used for short-term moves and tracks the daily movements of the underlying index.

Latin American ETF - EWZ - 2003

Peerless Buys and Sells Superimoposed.

Save The Amazon Jungle