TigerSoft New Service

TigerSoft Blog - 5/17/2009/Updated

4/25/2011

TigerSoft New Service

TigerSoft Blog - 5/17/2009/Updated

4/25/2011PROFITABLY TRADING MEXICAN STOCKS

35 Peerless Trades since 1996,

Avg.Gain= 17.7%/trade

$1000 becomes $99947.

PROFITABLY TRADING MEXICAN STOCKS WITH

(1) PEERLESS STOCK MARKET TIMINg: 1915-2011

35 Trades since 1996, Avg.Gain= 17.7%/trade

$1000 becomes $99947.

(2) TIGERSOFT's MEASURES OF

INSIDER BUYING & INSIDER SELLING

|

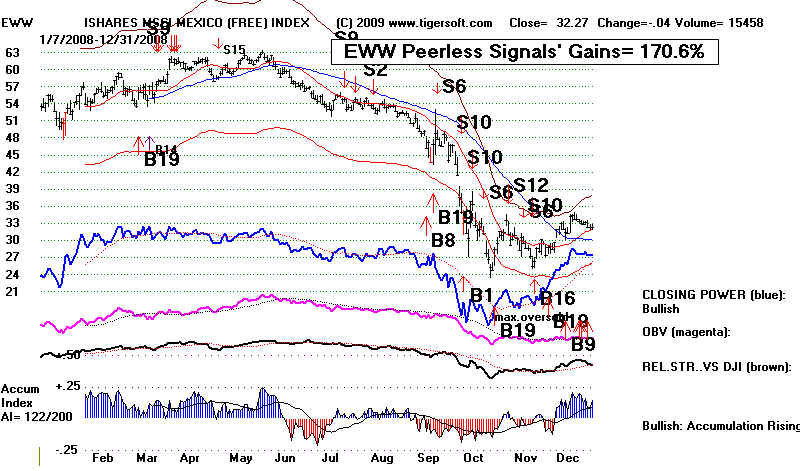

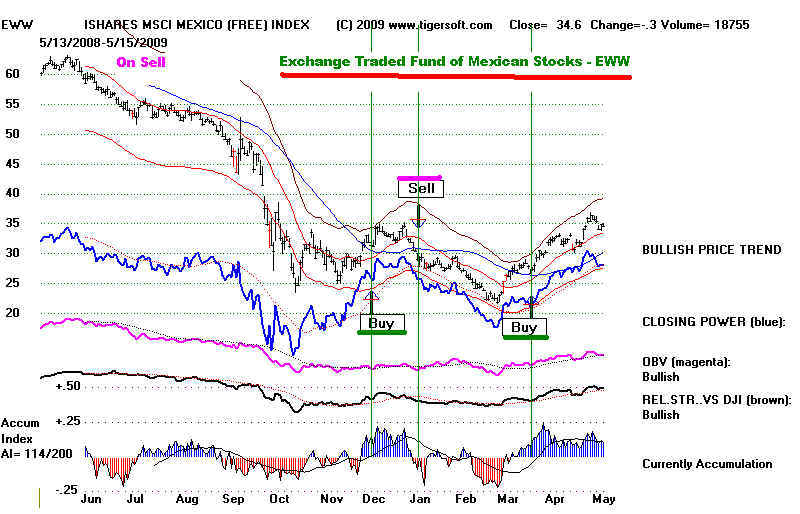

The simplest way to make money in Mexican stocks is to super-impose the Peerless Buys and Sells from the Dow Jones Industrial Average onto a Mexican Exchange Traded Fund, such as EWW, which acts like a mutual fund for Mexican stocks. Its Buys and Sell work very well because of integrated financial markets are around the world.

|

Visit www.tigersoft.com where

we watch Wall Street Insiders' Buying and Selling because it

helps

predict stock prices and the SEC offers little protection for investors from Insider and

Professional price manipulations and predations.

See other TigerSoft materials on insider trading:

Insider Trading as Measured by

TigerSoft

The Confirmed Trend Is Your Friend

Basic TigerSoft's Rules for Profitably

Trading Stocks and Limiting Risks.

How To Know When To Sell Stocks and

When To Buy Safely and ...

MEXICAN STOCKS WITH TIGERSOFT

Stock markets are much the same everywhere in the world. Insiders buy and sell

stock shares before important news is divulged to the general public. At the same time,

professionals rig markets to their own advantage. The working people on the outside

are typically the last to know the news that dramatically affects the prices of their stocks.

Interstingly, iIn Spanish, there seems to be no word for "insider trading". We will

have to invent one.

TigerSoft advises clients to approach the market very simply. First. look at a yearly

price chart to see if the current price is above or below a 50-day moving average. We like

to use 50 days, because it tests well in most markets. If prices are above a rising 50-day

ma, many traders consider the trend to be rising or bullish. If prices are below a falling

50-day ma, then the trend is consider down and bearish. Unfortunately, this is too simple.

There are times when prices are whipped above and below the 50-day ma and a series of

small losses then may follow.

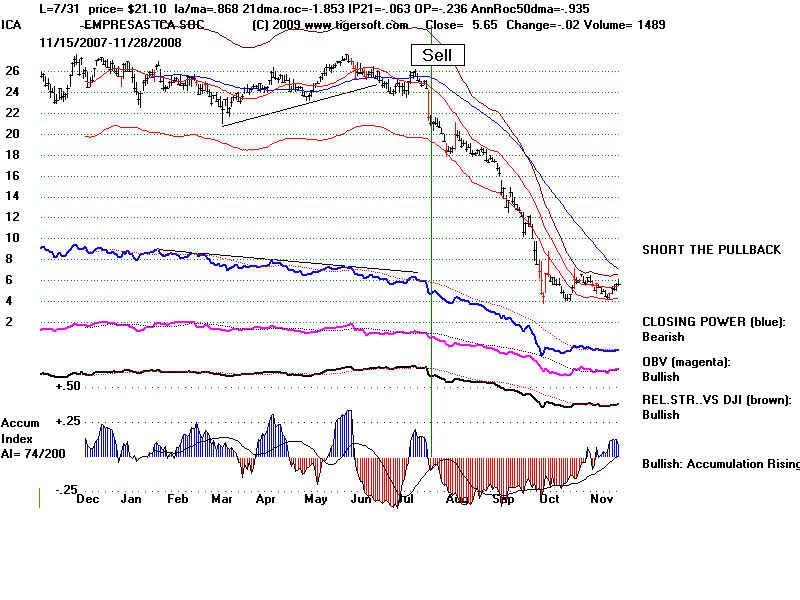

To prevent such whipsaws, TigerSoft has created two new measures of insider buying or

selling, to confirm price moves above or below the 50-day ma. These are TigerSoft's

proprietary Closing Power and Accumulation Index, Both indicators are normally required to

confirm a price move above or below its 50-day ma.

TigerSoft's Closing Power is our way of measuring Professional and Institutional Buying and Selling.

When this indicator is rising and above its own moving average, the Closing Power can confirm

a move by prices above its 50-day ma. When Closing Power is falling and is below its own

moving average, a move by the stock below its falling 50-day ma is considered confirmed and

much more bearish.

TigerSoft's Accumulation Index is our way of measuring Professional and Institutional Buying

and Selling. When this indicator is rising and above its own moving average, the Accumulation

Index can confirm a move by prices above its 50-day ma. When the Accumulation Index is falling

and is below its own moving average, a move by the stock below its falling 50-day ma is considered

confirmed and much more bearish.

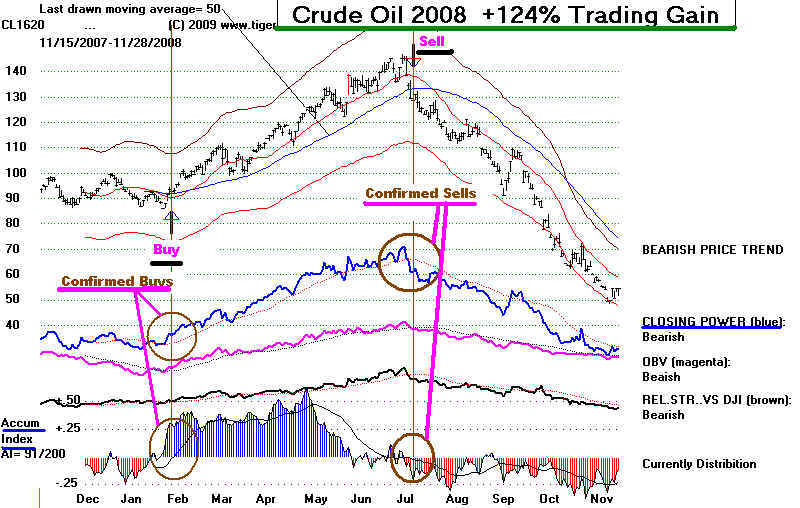

You can readily see this in work in 2008 and 2009. Look first at Crude Oil. (Commodity Contract)

.

Crude Oil 2008-2009

chart to be shown here.

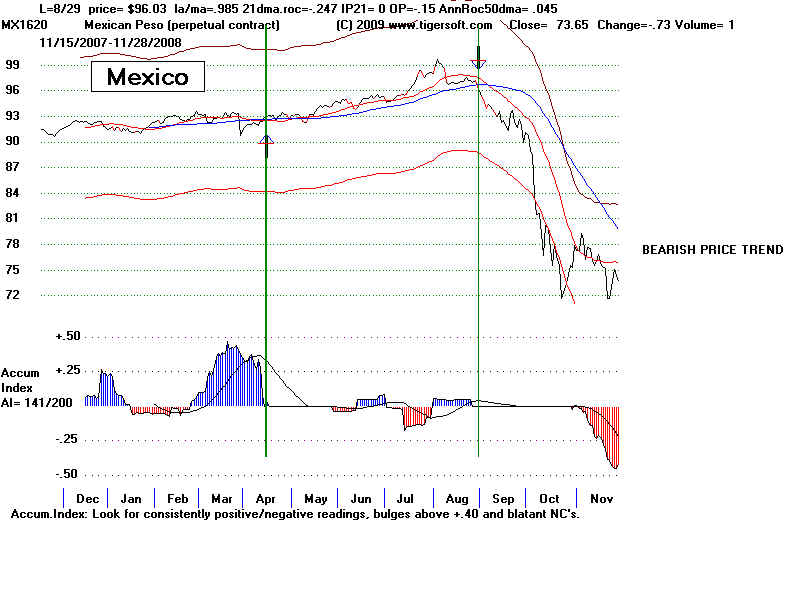

Mexican Peso

|