SAVVY INSIDERS ARE

RIGHT AGAIN!

How TigerSoft Takes Away Their Veil of Secrecy

by William Schmidt, Ph.D.

(Columbia University)

We told

subscribers to Buy most of the stocks shown below. We did this

because they had

"in spades" exactly the same characteristics that explosive

super stocks have

shown in earlier eras. First, they showed intense bulges of

Insider Buying

and Accumulation using TigerSoft's Accumulation Index.

Secondly, their

TigerSoft Closing Power made new highs, before the

stock did; and

then thirdly, the stock made new highs, showing the insiders

and Professions

were correct and were holding the stock tightly and

not selling.

Sometimes insiders do dump shares when the news behind their

buying is

released to the public; hence the old adage: "Buy on rumor and

Sell on

news." TigerSoft traders buy regularly when insiders are buying without

even knowing, in

most cases, what the news is going to be.

EXPLOSIVE SUPER STOCKS:

2009

SAVVY INSIDERS ARE

RIGHT AGAIN!

The study below again shows that TIgerSoft can make

you very nice profits by finding you stocks about to go up a lot.

The method is simple. See the examples below and get our

software for details. Between 1990 and until after the summer

of 2007, the average gains were more than +35% per stock,

assuming a holding period of one year. In 2007, Peerless

warned a bear market was starting. The warnings became

more dire and shrill in 2008 and only ended in March 2009.

TigerSoft's augmented B24s do not require you to buy

at a market bottom, I want to emphasize. The best gains

occur several and even six months after the insider

buying is detected.

The TigerSoft Buy B24 works better

than watching tables of insider buying

statistics for a number of reasons:

1) TigerSoft works great on Chinese and

European stocks,

where there are no insider trading data available.

2) Insiders sometimes sell prematurely when stocks go wildly to

the upside. It is better to use TigerSoft to wait for signs that the advance

is over, since other forces, short sellers, institutions and public

speculators also have roles to play in where and how the stock

moves.

3) Insider buying does not pinpoint when to buy, as

TigerSoft

does. You can see that there are almost no paper losses after

the first TigerSoft Buy B24.

4.) Insiders may not actually buy shares themselves. They may

choose to simply tightly hold their own already considerable

positions and let it to be known to financial consorts that conditions

are improving significantly. So, the absence of selling can be

construed bullishly if TigerSoft shows high levels of Accumulation,

5,) Insiders sometimes sell a portion of very big holding to professional

stock promoters, brokerages and hedge funds with the understanding

that this group will drive the stock up!

6) Big money players who have inside information do not report

their

insider-informed buying or selling to the SEC. In the truest sense of the

word, they are certainly insiders! But if they did report that they bought

because they saw the books, talked to the scientists and salesmen

and had advance knowledge of earnings, splits and mergers, they would,

very likely go to jail. So, it is very important to understand that TigerSoft

spots and picks up on their insider-informed buying and selling. And

when it becomes so significant that it affects other professionals, we

see this, too.

20 MORE GOOD REASONS

TO BUY TIGERSOFT!

Symbol 1st Buy B24

Price Now Comments

Insider Trading

in last 6 months

Price Date

--------------------------------------------------------------------------------------------------------------

AIXG 7.52 4/23/09

16.13

Foreign

NA

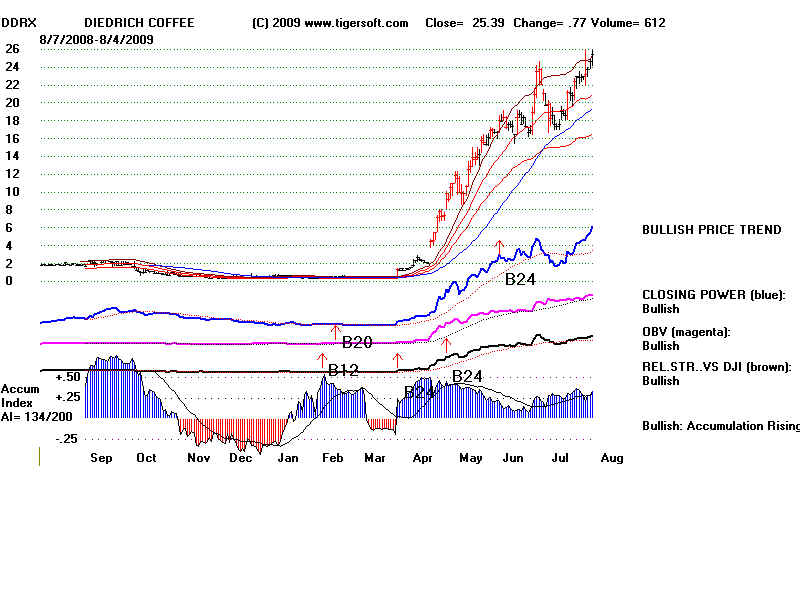

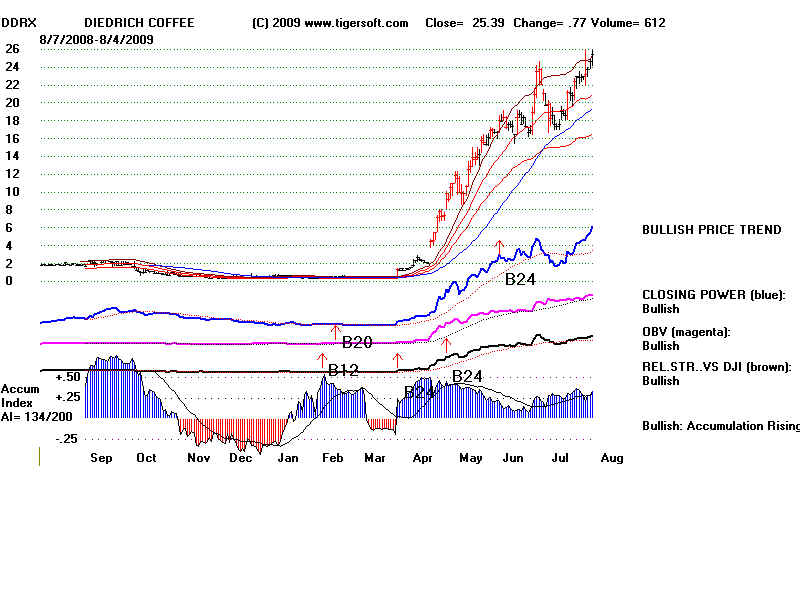

DDRX 1.35 3/30/09

25.39

WOW!

Insider sold 900,000 prematurely

to stock promoters. He still has

1.5 million shares.

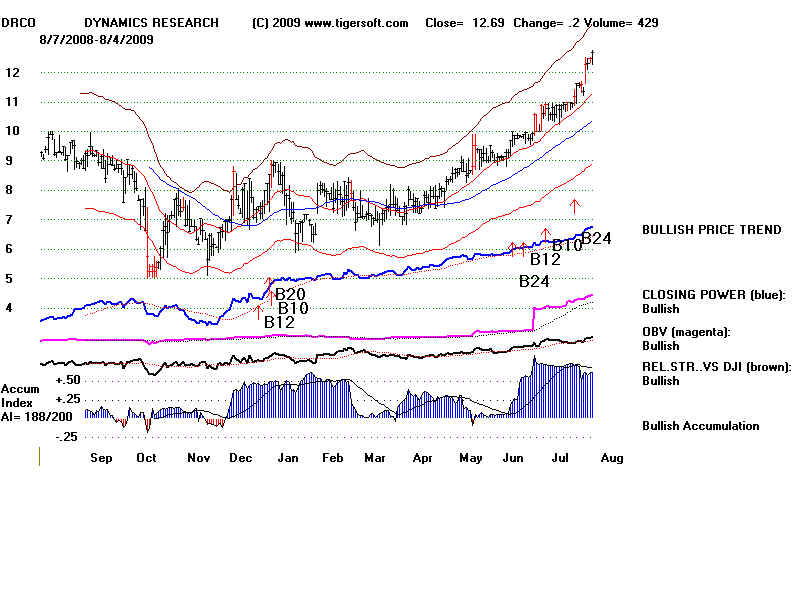

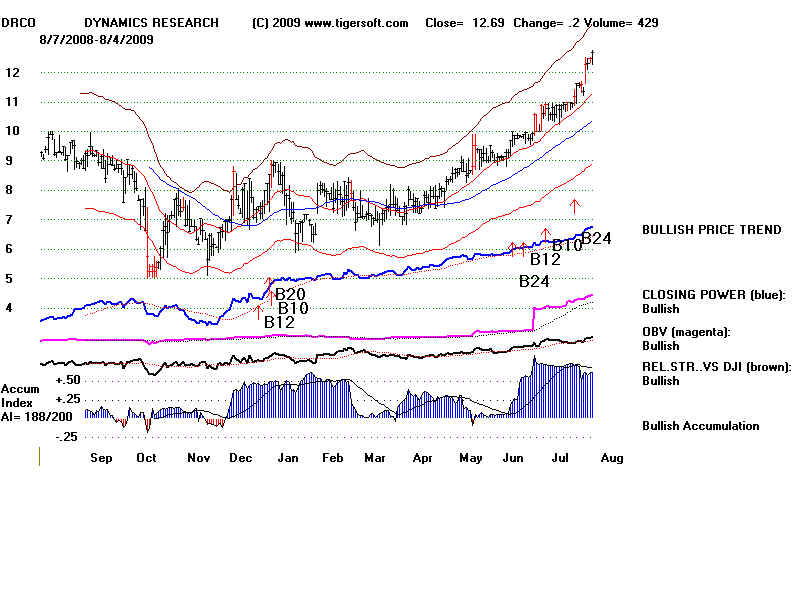

DRCO 10. 7/6/09

12.69

Insiders did no significant selling.

(Net selling was 500 shares. They

own 1.09 million still. That they

are holding tightly is bullish.

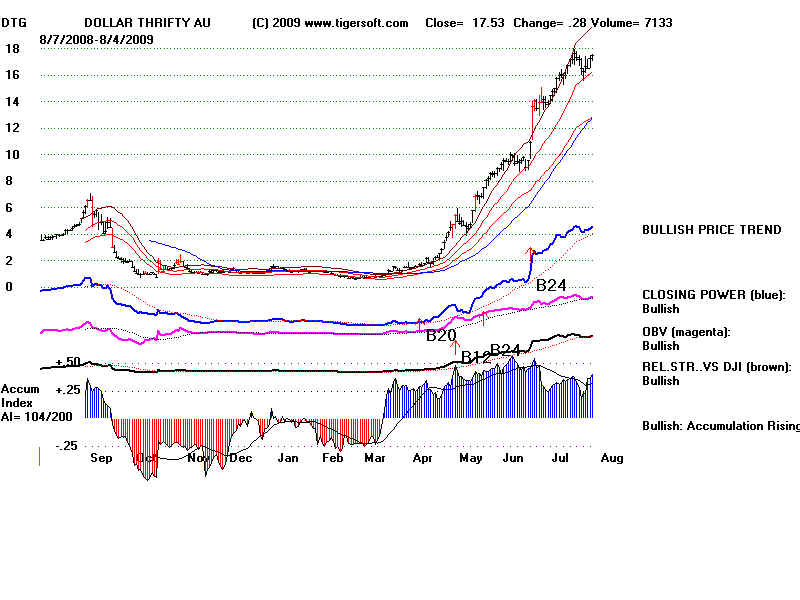

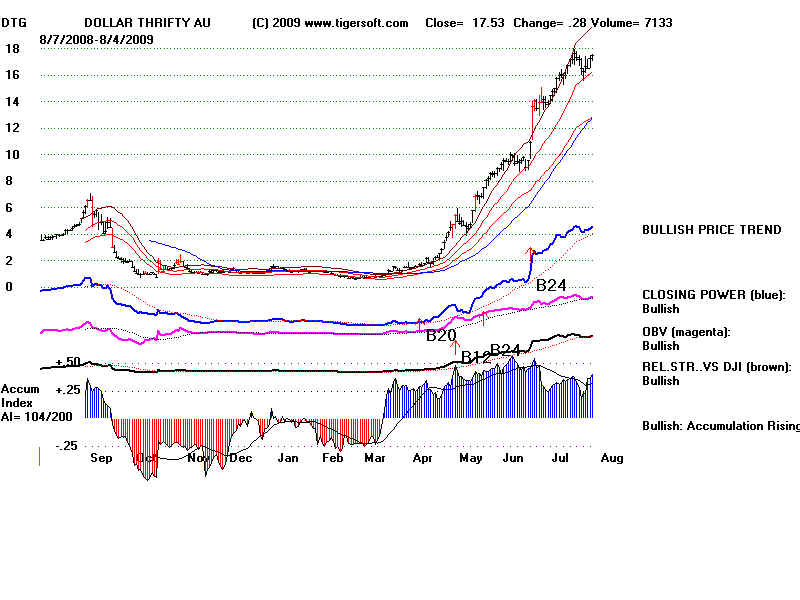

DTG 7.51 5/26/09

17.53

Insiders sold no shares and bought

106,800 shares. Bullishly increasing

their ownership to 3.07 million shares.

ELOY 5.7 4.16/09

9.34

Insiders sold no shares and bought

9,772 shares, increasing their position

to 5.48 million. Bullish!

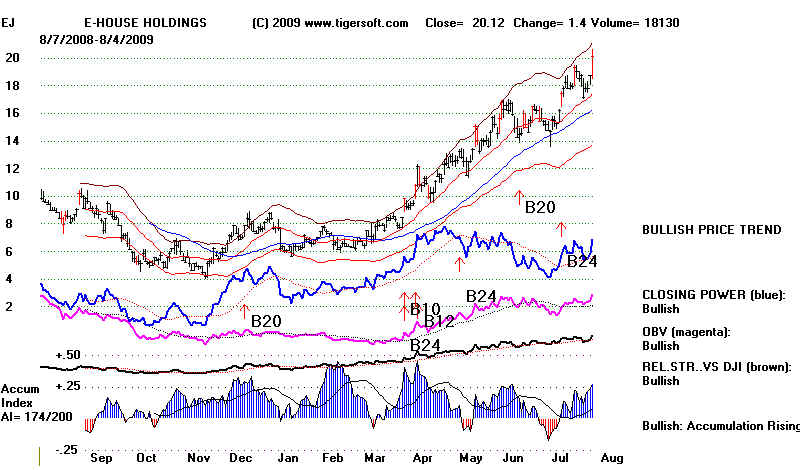

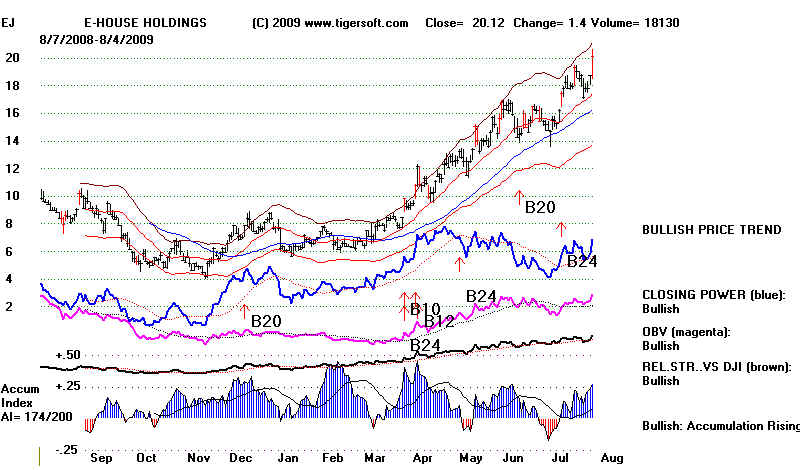

EJ 13.26 5/8/09

20.12

NA - Chinese Stock

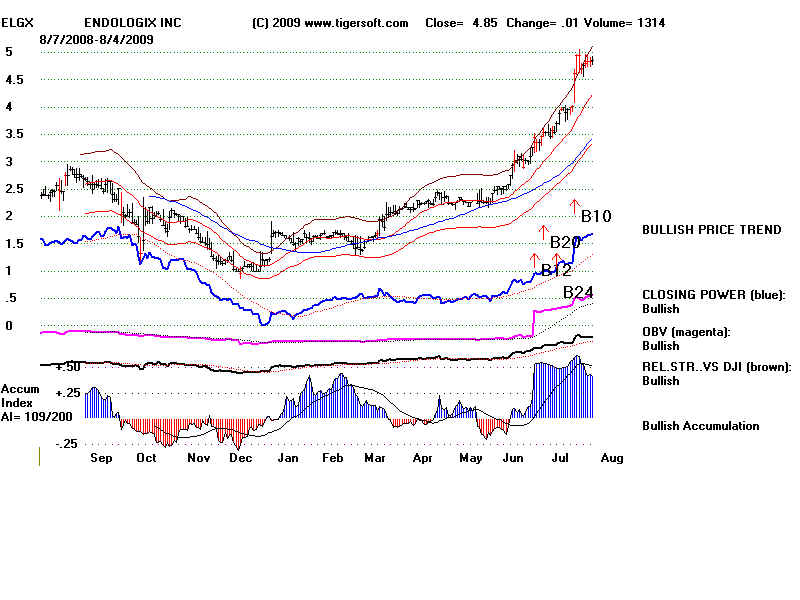

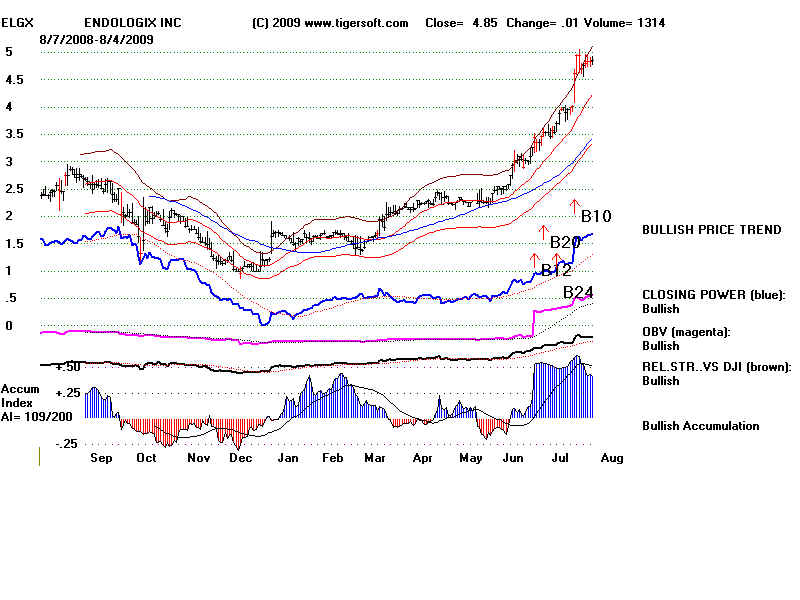

ELGX 3.7 7/13/09

4.85

Insiders sold 5,000 but still own

8.85 million. It is bullish that they

are holding tightly.

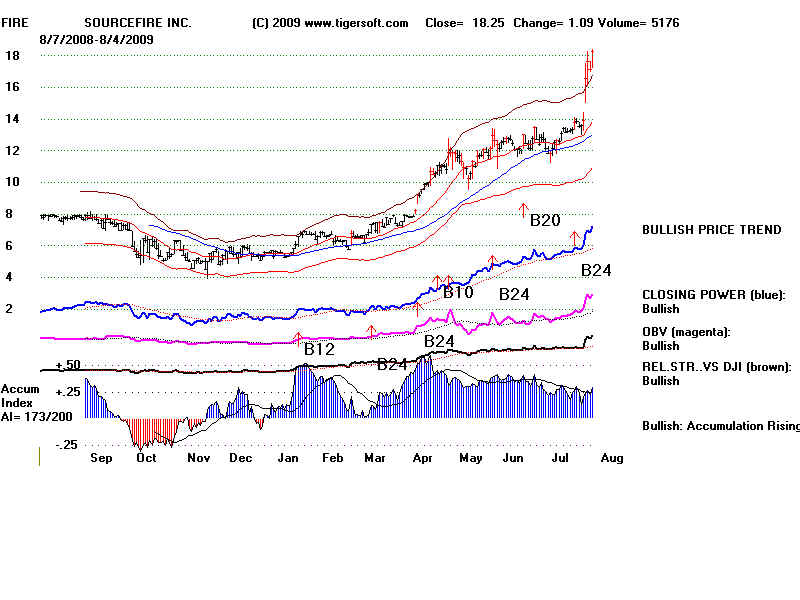

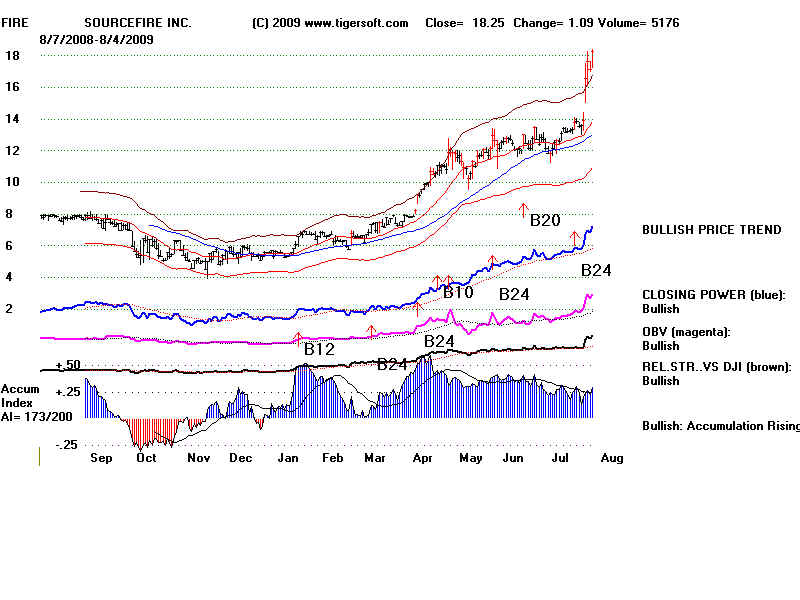

FIRE 7.26 3/12/09

10.25

Insiders sold 2,689,290 and bought

none, leaving them still with 10.02 million.

KIRK 3.46 3/19/09

15.4

WOW

Insiders sold 1,500,000 and bought 10,000.

leaving them still with 8.51 million.

KONG 5.86 4/13/09

13.03

NA - Chinese Stock

LAD 6.96 6/4/09

13.01

Insiders bought 10,000, increasing what

they own to 3.75 million. Bullish.

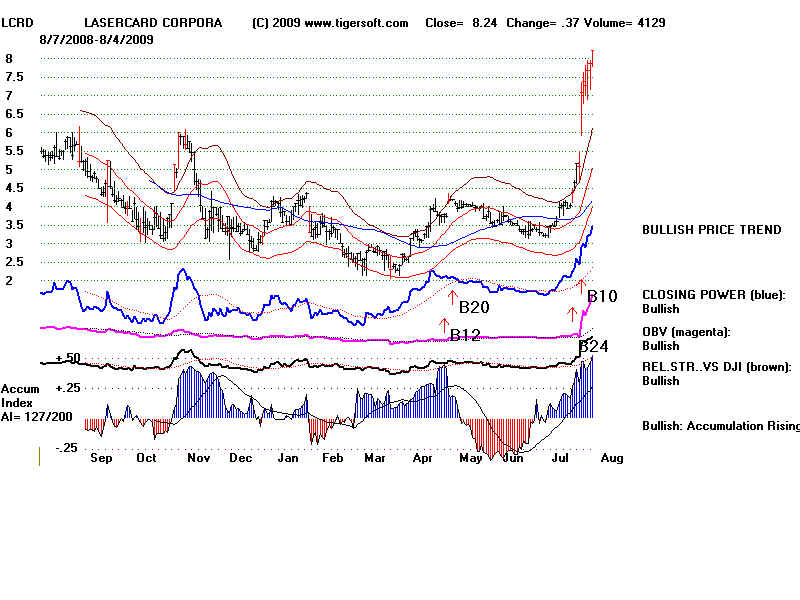

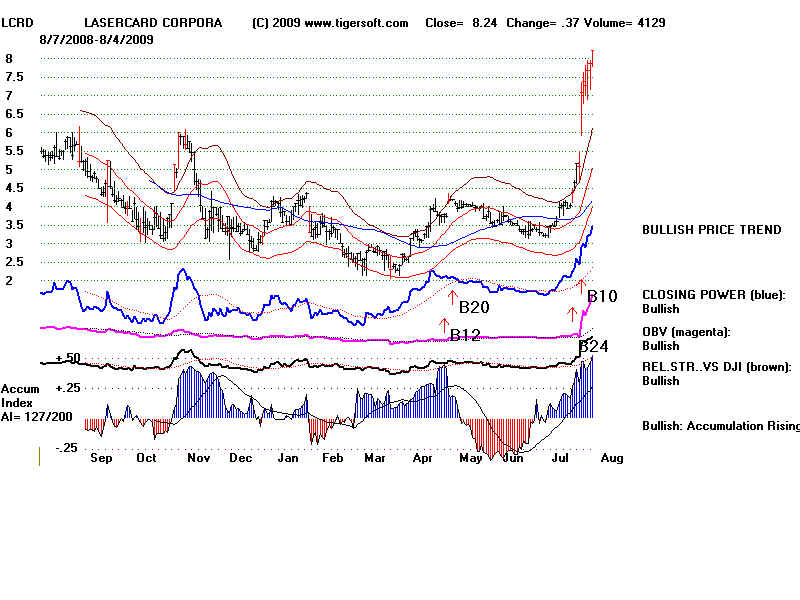

LCRD 4.4 7/22/09

8.24

Insiders bought 18,200, increasing what

they own to 1.9 million. Bullish.

NWK 3.54 3/24/09

6.15

Insiders bought 437,800 shares and

sold none, Bullish

To be continued.....

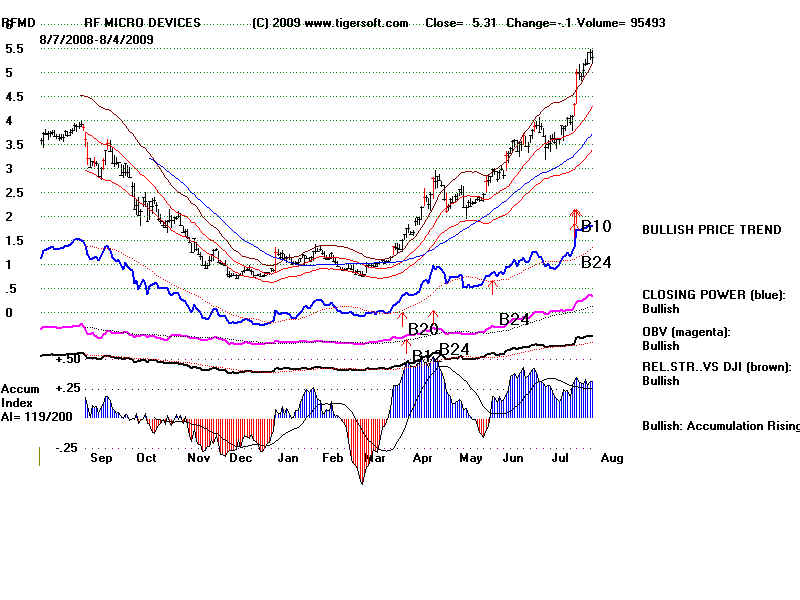

RFMD 2.8 4/22/09

5.31

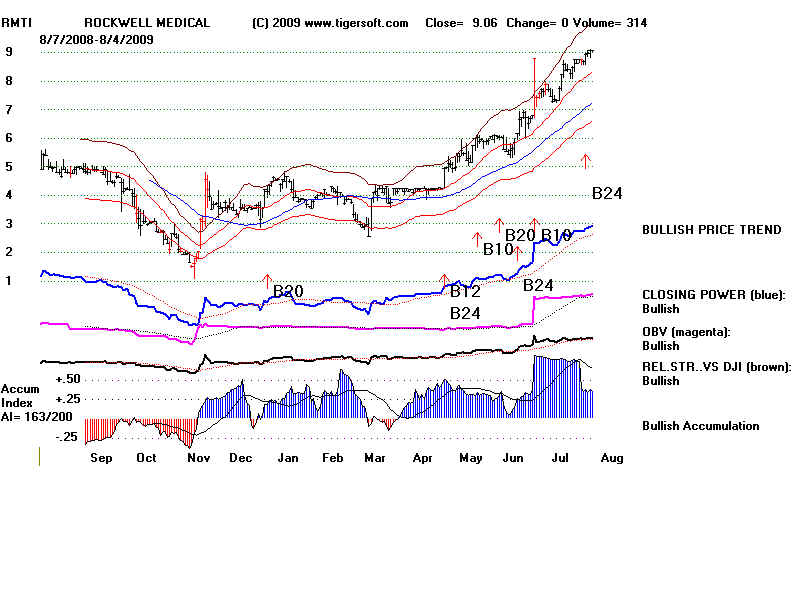

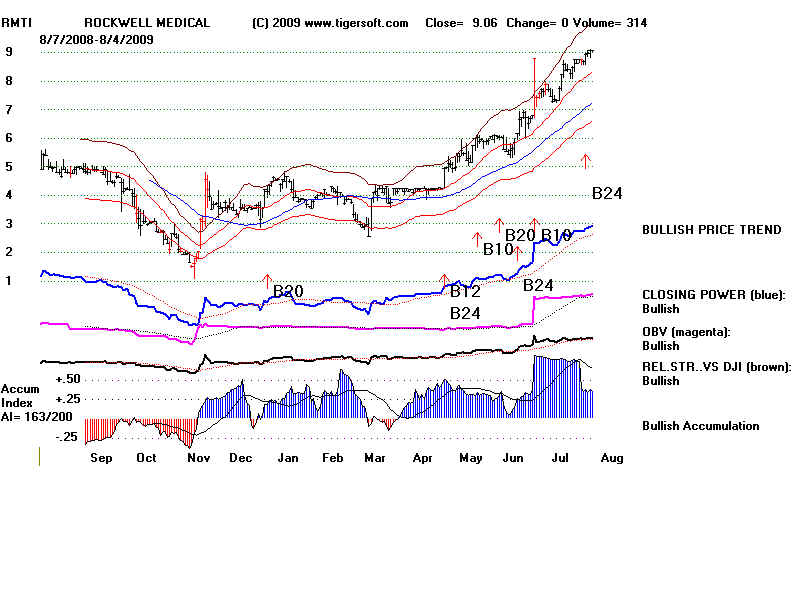

RMTI 6.16 6/16/09

9.06

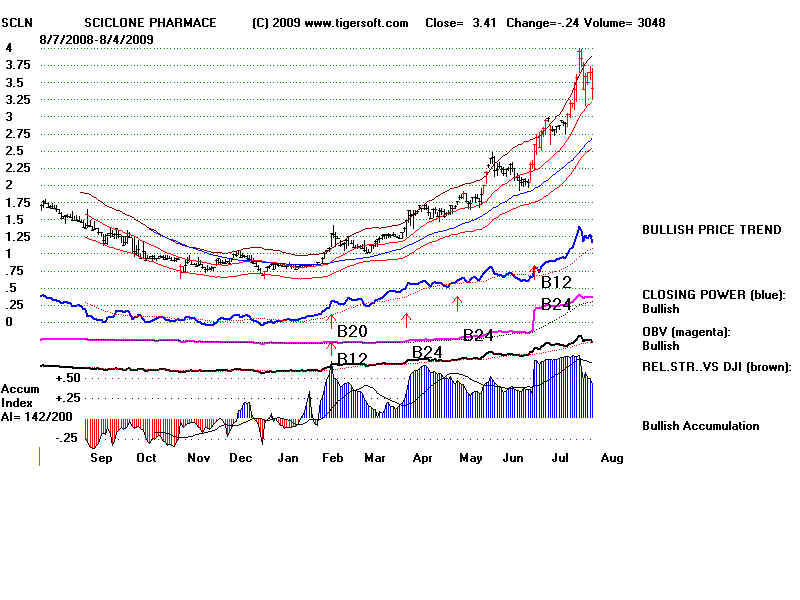

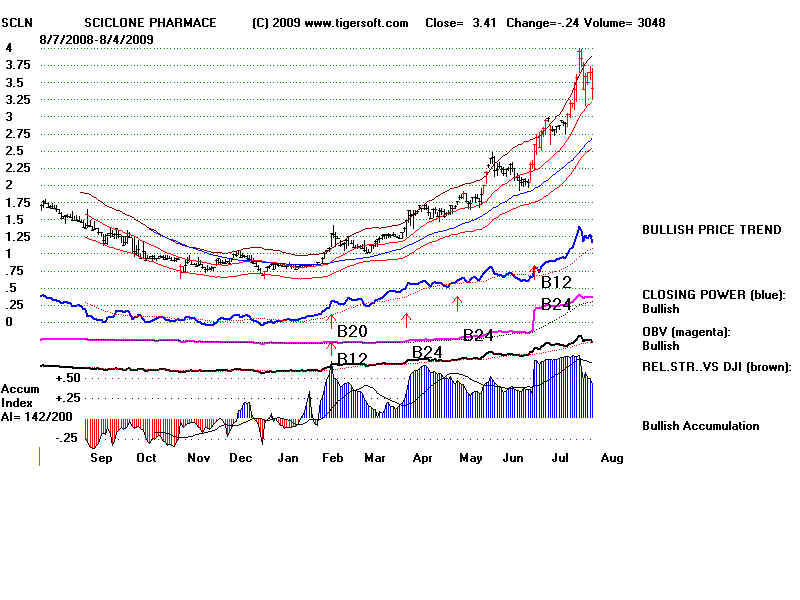

SCLN 1.49

4/3/09

3.41

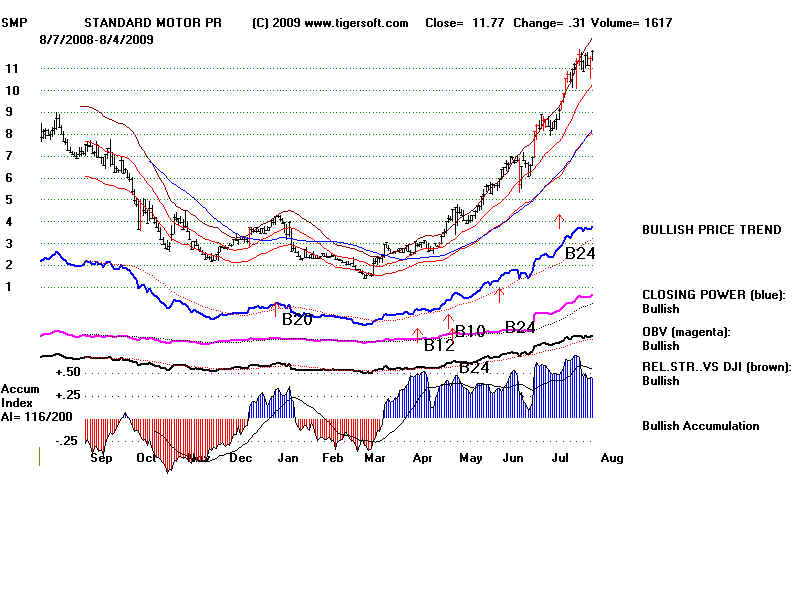

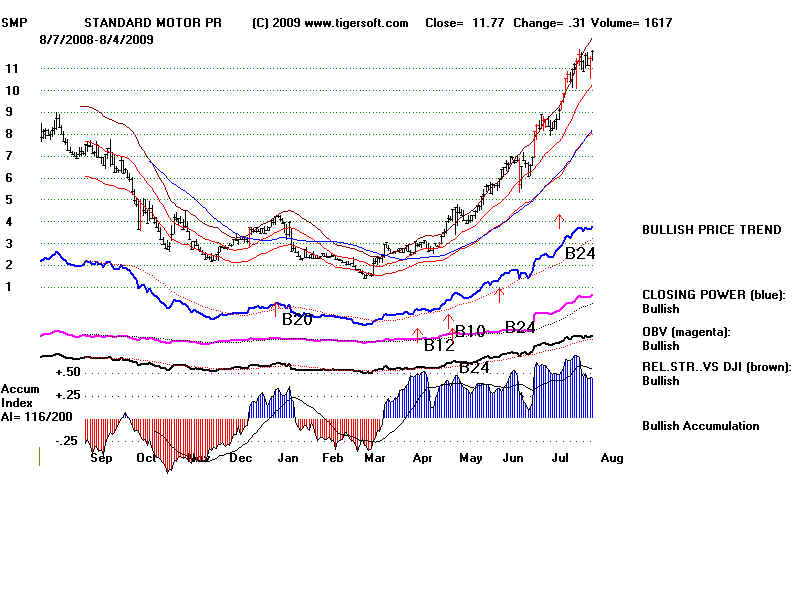

SMP 4.55 5/5/09

11.77

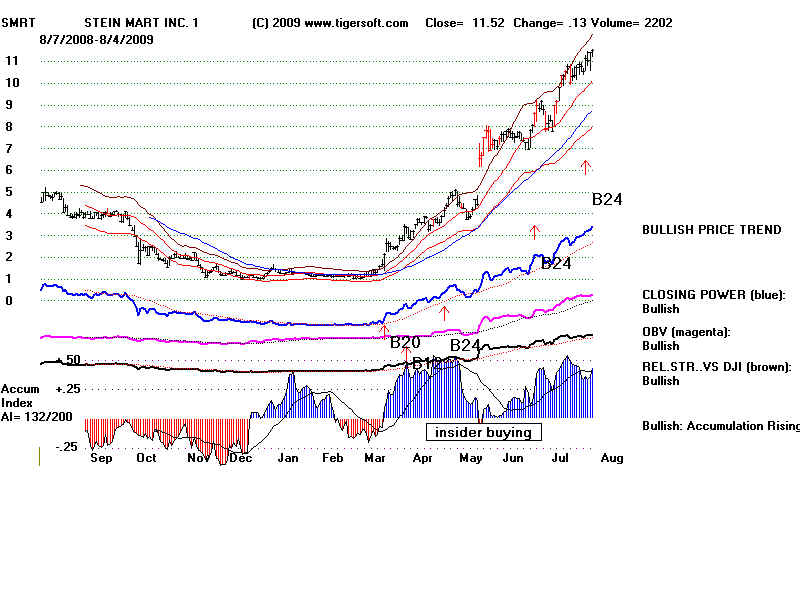

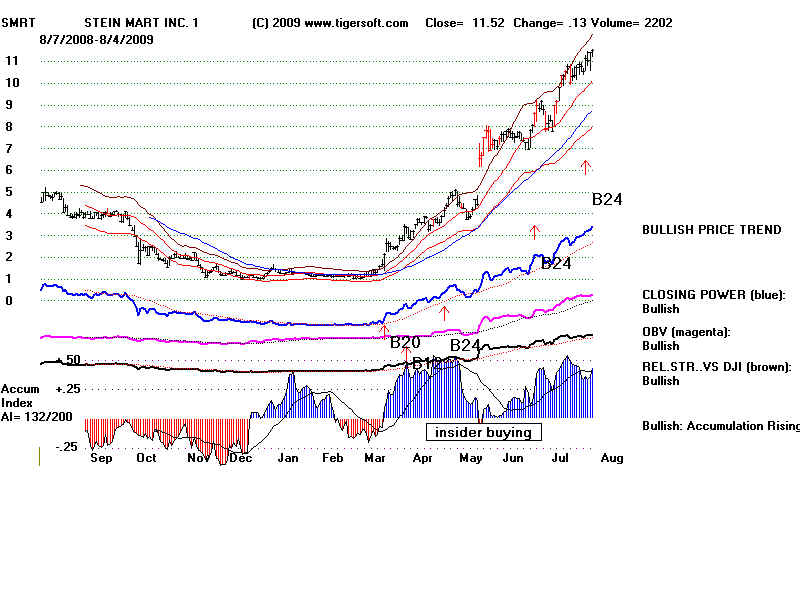

SMRT 4.15 4/29/09

11.52

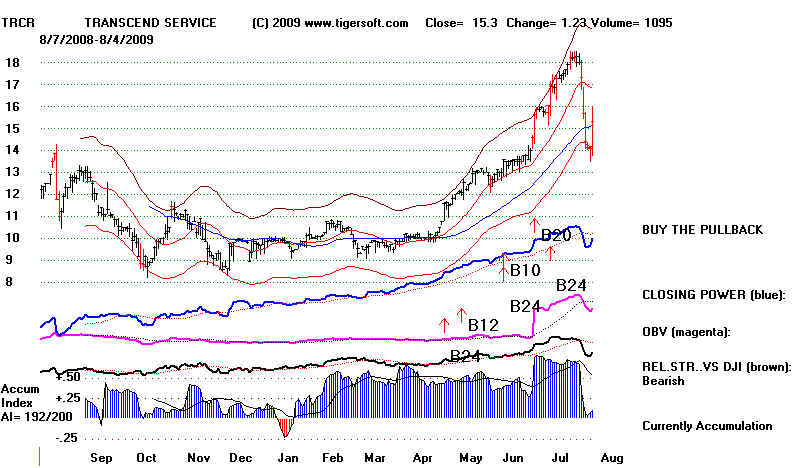

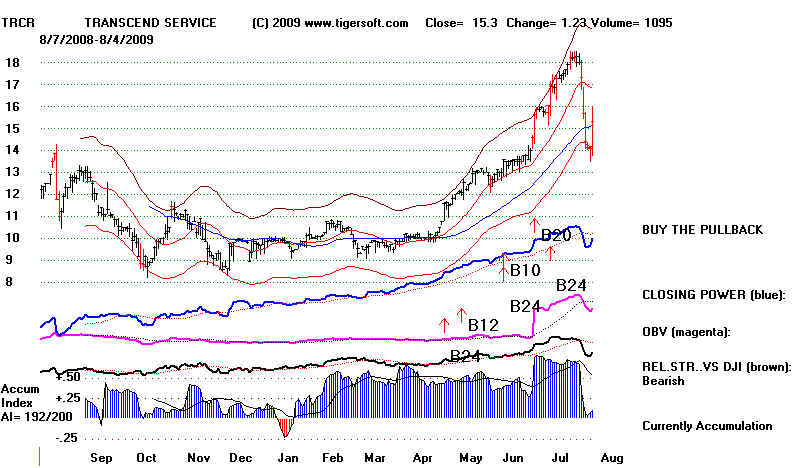

TRCR 11.59 4/29/09

15.3

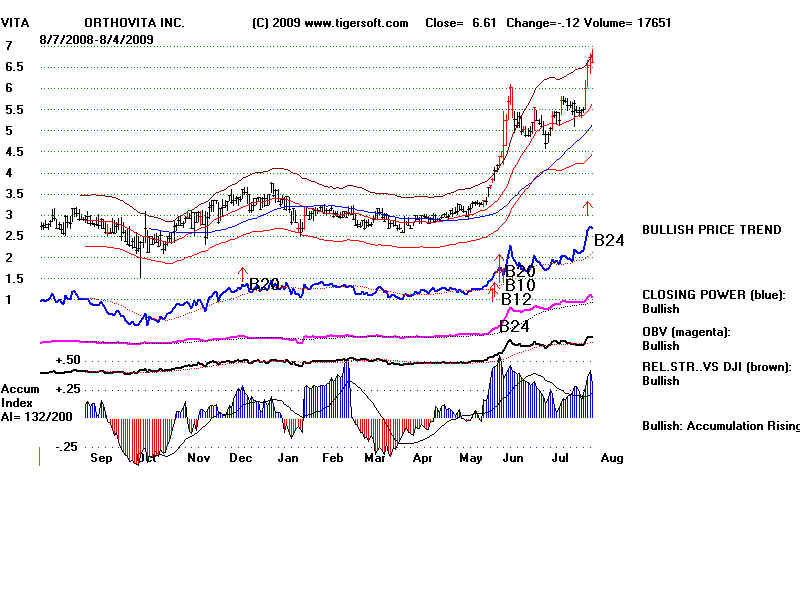

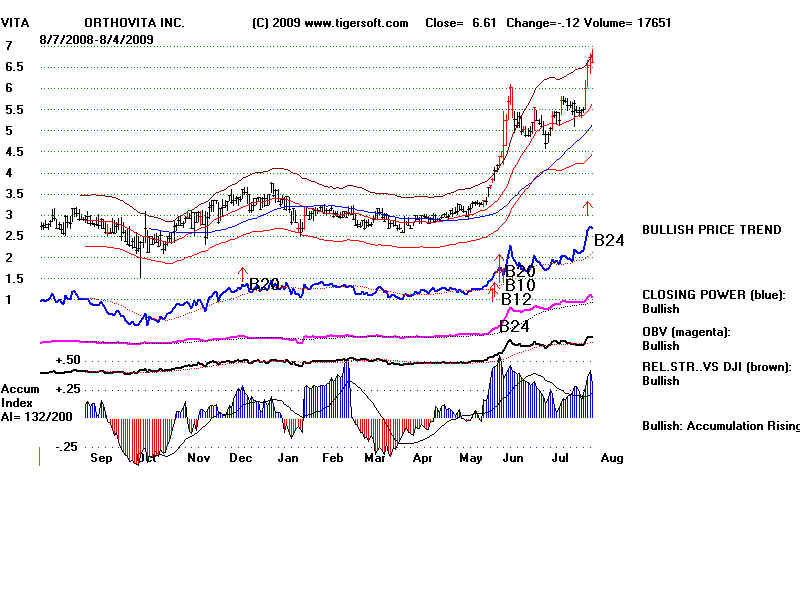

VITA 3.85 6/1/09

6.61

Tiger recommended DDRX at 7 on TigerSoft Elite Stock Professional Service.

We were late but the stock has still tripled.

45% Owned by Insiders: http://finance.yahoo.com/q/mh?s=DDRX

Biggest Holders:

| FINANCIAL & INVESTMENT MANAGEMENT GROUP LTD |

358,330 |

6.55 |

$440,745 |

31-Mar-09 |

| DIMENSIONAL FUND ADVISORS INC |

158,680 |

2.90 |

|

Heechen sold 900,000 shares on April 17th, 2009 - off the open market to groups we

cannot

discover, The sale still left him with 1.5 million shares. Those who bought

the stock have

been driving it higher and higher. All the short sellers have lost money and are

under great

pressure ot cut their losses.

================================================================================

Tiger recommended this between 10-11 on TigerSoft Elite Stock Professional Service

Insiders own 11%... Institutions own 54%

Minimal insider buying:

3000 shares acquired on March 6, 2009 Richard Covel, Officer.

| 2-Jun-09 |

COVEL RICHARD A

Officer |

1,288 |

Direct |

Sale at $9.01 - $9.09 per share. |

$12,0002 |

14000 shares acquired in March by James Regan, officer

| 10-Jun-09 |

BABBITT GEORGE T

Director |

2,400 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 10-Jun-09 |

KAMES KENNETH F

Director |

2,400 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 10-Jun-09 |

AGUILAR FRANCIS J

Director |

2,400 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 10-Jun-09 |

MCCAUSLAND CHARLES P

Director |

2,400 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 10-Jun-09 |

STAVROPOULOS NICKOLAS

Director |

2,400 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

| RUTABAGA CAPITAL MANAGEMENT, LLC |

882,078 |

9.07 |

$6,386,244 |

31-Mar-09 |

| DIMENSIONAL FUND ADVISORS INC |

607,157 |

6.24 |

$4,395,816 |

31-Mar-09 |

| KENNEDY CAPITAL MANAGEMENT, INC. |

497,113 |

5.11 |

$3,599,098 |

31-Mar-09 |

| AXA |

339,683 |

3.49 |

$2,459,304 |

31-Mar-09 |

| VANGUARD GROUP, INC. (THE) |

236,925 |

2.44 |

$1,715,337 |

31-Mar-09 |

| RENAISSANCE TECHNOLOGIES, LLC |

200,600 |

2.06 |

$1,452,344 |

31-Mar-09 |

| HEARTLAND ADVISORS INC. |

1,253,558 |

12.89 |

$9,075,759 |

31-Mar-09 |

| Janney Montgomery Scott LLC |

179,298 |

1.84 |

$1,298,117 |

31-Mar-09 |

| Barclays Global Investors UK Holdings Ltd |

159,451 |

1.64 |

$1,154,425 |

31-Mar-09 |

| PENN MUTUAL LIFE INSURANCE CO |

149,298 |

1.54 |

$1,080,917 |

31-Mar-09 |

====================================================================================

=====================================================================================

==================================================================================

====================================================================================

14% owned by insiders. 60% by institutions

| 14-May-09 |

THOMPSON SCOTT L

Officer |

50,000 |

Direct |

Acquisition (Non Open Market) at $4.44 per share. |

$222,000 |

| 13-May-09 |

THOMPSON SCOTT L

Officer |

100,000 |

Direct |

Purchase |

N/A |

| PRESCOTT GROUP CAPITAL MANAGEMENT, L.L.C. |

2,147,400 |

9.90 |

$2,490,984 |

31-Mar-09 |

| MSD CAPITAL, L.P. |

1,805,800 |

8.33 |

$2,094,728 |

31-Mar-09 |

| Evercore Asset Management, LLC. |

1,599,310 |

7.37 |

$1,855,199 |

31-Mar-09 |

| DIMENSIONAL FUND ADVISORS INC |

1,375,581 |

6.34 |

$1,595,673 |

31-Mar-09 |

| PAR CAPITAL MANAGEMENT, INC. |

1,249,191 |

5.76 |

$1,449,061 |

31-Mar-09 |

| Barclays Global Investors UK Holdings Ltd |

968,910 |

4.47 |

$1,123,935 |

31-Mar-09 |

| PRICE (T.ROWE) ASSOCIATES INC |

2,231,640 |

10.29 |

$2,588,702 |

31-Mar-0 |

===================================================================================

38% owned by insiders. 39% by

institutions.

INSDIERS have sold 1.998,270 shares in last 6

montths!

| FMR LLC |

2,192,391 |

8.39 |

$15,960,606 |

31-Mar-09 |

| PRICE (T.ROWE) ASSOCIATES INC |

1,597,675 |

6.11 |

$11,631,074 |

31-Mar-09 |

| DIKER MANAGEMENT, LLC |

1,533,638 |

5.87 |

$11,164,884 |

31-Mar-09 |

| CHESAPEAKE PARTNERS MANAGEMENT CO INC./MD |

1,204,105 |

4.61 |

$8,765,884 |

31-Mar-09 |

| Clearbridge Advisors, LLC |

946,070 |

3.62 |

$6,887,389 |

31-Mar-09 |

Barclays Global Investors UK Holdings Ltd

|

591,665 |

2.26 |

$4,307,321 |

31-Mar-09 |

======================================================================================

=====================================================================================

Very steady Insider Buying from March to

May 2009 - 4.454,590 shares!

| 5-Jun-09 |

DEBOER SIDNEY B

Officer |

1,000 |

Direct |

Purchase at $7.94 per share. |

$7,939 |

| 10-Jun-09 |

CAIN SUSAN O

Director |

3,571 |

Direct |

Statement of Ownership |

N/A |

| 1-May-09 |

GLICK WILLIAM L

Director |

10,274 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 1-May-09 |

GLICK WILLIAM L

Director |

2,000 |

Direct |

Purchase at $3 per share. |

$6,000 |

| 1-May-09 |

HUGHES CHARLES R

Director |

10,274 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 1-May-09 |

HUGHES CHARLES R

Director |

1,000 |

Direct |

Purchase at $3.22 per share. |

$3,220 |

| 1-May-09 |

WAGNER A J

Director |

3,000 |

Indirect |

Purchase at $2.92 per share. |

$8,760 |

| 1-May-09 |

WAGNER A J

Director |

10,274 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 1-May-09 |

BECKER THOMAS R

Director |

11,130 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 1-May-09 |

BECKER THOMAS R

Director |

3,000 |

Direct |

Purchase at $2.95 per share. |

$8,850 |

| 30-Apr-09 |

GLICK WILLIAM L

Director |

3,660 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 30-Apr-09 |

HUGHES CHARLES R

Director |

3,660 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 30-Apr-09 |

WAGNER A J

Director |

4,026 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 30-Apr-09 |

BECKER THOMAS R

Director |

4,832 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 30-Apr-09 |

KELLER MARYANN

Director |

4,392 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 1-Apr-09 |

DEBOER SIDNEY B

Officer |

16,000 |

Direct |

Option Exercise at $1 per share. |

$16,000 |

Insider have bought 19.200 shares in last 6 months and sold none.

| 8-Jul-09 |

DEVINCENZI ROBERT THOMAS

Officer |

23,328 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 8-Jul-09 |

PRICE-FRANCIS STEPHEN D

Officer |

7,069 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 2-Jun-09 |

DEVINCENZI ROBERT THOMAS

Officer |

1,787 |

Direct |

Disposition (Non Open Market) at $3.56 per share. |

$6,361 |

| 24-Mar-09 |

KURITA ANDREW Y

Beneficial Owner (10% or more) |

1,000 |

Direct |

Purchase at $2.70 per share. |

$2,700 |

| 10-Mar-09 |

KETTLE HILL CAPITAL

MANAGEMENT, LLC

Beneficial Owner (10% or more) |

1,200 |

Indirect |

Purchase at $2.50 per share. |

$3,000 |

| 23-Feb-09 |

KURITA ANDREW Y

Beneficial Owner (10% or more) |

5,000 |

Direct |

Purchase at $2.75 per share. |

$13,750 |

437,800 shares bought by insiders in last 6 months

| 24-Apr-09 |

KOPP LEROY C

Beneficial Owner (10% or more) |

40,000 |

Direct |

Purchase at $4.14 per share. |

$165,600 |

| 23-Apr-09 |

KOPP LEROY C

Beneficial Owner (10% or more) |

40,000 |

Direct |

Purchase at $4.18 per share. |

$167,200 |

| 27-Jul-09 |

STILSON JAMES D

Officer |

1,785 |

Direct |

Disposition (Non Open Market) at $5 per share. |

$8,925 |

| 27-Jul-09 |

CHURCH BARRY D

Officer |

13,809 |

Direct |

Sale at $5.10 - $5.11 per share. |

$70,0002 |

| 27-Jul-09 |

BRUGGEWORTH ROBERT A

Officer |

3,245 |

Direct |

Disposition (Non Open Market) at $5 per share. |

$1 |

| 13-May-09 |

PRIDDY WILLIAM A

Officer |

10,000 |

Direct |

Purchase at $2.10 per share. |

$21,000 |

| 8-May-09 |

VAN BUSKIRK ROBERT M

Officer |

25,000 |

Direct |

Sale at $2.50 per share. |

$62,500 |

| 8-May-09 |

CHURCH BARRY D

Officer |

6,000 |

Direct |

Sale at $2.55 per share. |

$15,299 |

| 7-May-09 |

RUDY SUZANNE B

Officer |

19,812 |

Direct |

Automatic Sale at $2.36 - $2.48 per share. |

$48,0002 |

| 7-May-09 |

VAN BUSKIRK ROBERT M

Officer |

25,000 |

Direct |

Sale at $2.47 per share. |

$61,749 |

| 6-May-09 |

STILSON JAMES D

Officer |

109,125 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 6-May-09 |

NEAL JERRY D

Officer |

158,750 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 6-May-09 |

CREVISTON STEVEN E

Officer |

248,000 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 6-May-09 |

PRIDDY WILLIAM A

Officer |

178,625 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 6-May-09 |

CHURCH BARRY D

Officer |

39,625 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 6-May-09 |

VAN BUSKIRK ROBERT M

Officer |

178,625 |

Direct |

Acquisition (Non

Open Market) at $0 per share. |

N/A |

| 6-May-09 |

BRUGGEWORTH ROBERT A

Officer |

470,100 |

Direct |

Acquisition

(Non Open Market) at $0 per share. |

N/A |

| 6-May-09 |

RUDY SUZANNE B

Officer |

39,625 |

Direct |

Acquisition (Non Open Market) at $0 per share. |

N/A |

| 6-May-09 |

CHURCH BARRY D

Officer |

3,600 |

Direct |

Sale at $2.38 per share. |

$8,568 |

| 5-May-09 |

STILSON JAMES D

Officer |

14,500 |

Direct |

Sale at $2.36 per share. |

$34,220 |

| 1-May-09 |

PRIDDY WILLIAM A

Officer |

25,000 |

Direct |

Purchase at $2.17 - $2.18 per share. |

Insiders Bought 20,500 shares in last 6 months and sold 60,263

Since they already owned 2.89 million, this was not significant.

http://finance.yahoo.com/q/it?s=rmti

Insiders Bought 19.625 shares in last 6 months and sold 60,263 none

Since they already owned 17.32 million, that they were not selling is significant.

Looks like the shorts have been piling onto SCLN.

Here is the data (keep in mind it is 2 weeks old and shorts probably have over 2 million

shares by now)...

June 15th, 2009 = 282,495 shares short

June 30th, 2009 = 405,027 shares short

July 15th, 2009 = 1,747,375 shares short

July 30th, 2009 = <not yet updated>

Link: http://www.nasdaq.com/aspxcontent/shorti...

11,277 shares bought by insiders in last 6 months. 1,200 have been sold.

Insiders already owned 4.4 million. This is bullish.

Insiders own 16,84 million shares. There was no insider buying or selling in the last

6 months.

=================================================================================

======================================================================================

100,000 shares were purchased by insiders. None were sold.

They already owned 9.8 million shares.

|

TigerSoft News Service 8/4/2009

www.tigersoft.com

TigerSoft News Service 8/4/2009

www.tigersoft.com