TigerSoft

News Service 3/29/2008 www.tigersoft.com

TigerSoft

News Service 3/29/2008 www.tigersoft.com TigerSoft Insider Watch TigerSoft Automatic Buys/Sells on Stocks Peerless Stock Market Timing

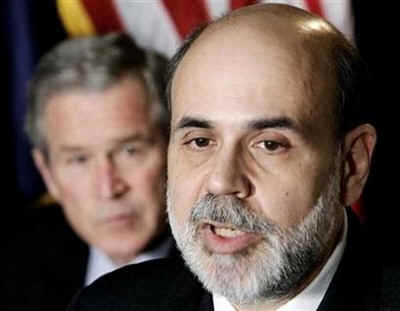

Bernanke Keeps Giving The Banks Money.

US Stock Market Is in Trouble. Look for important Peerless Announcement very soon.

===================================================================================

===================================================================================Bernanke Keeps Giving The Banks Money.

The Banks Are Now Hooked on The Fed's Milk.

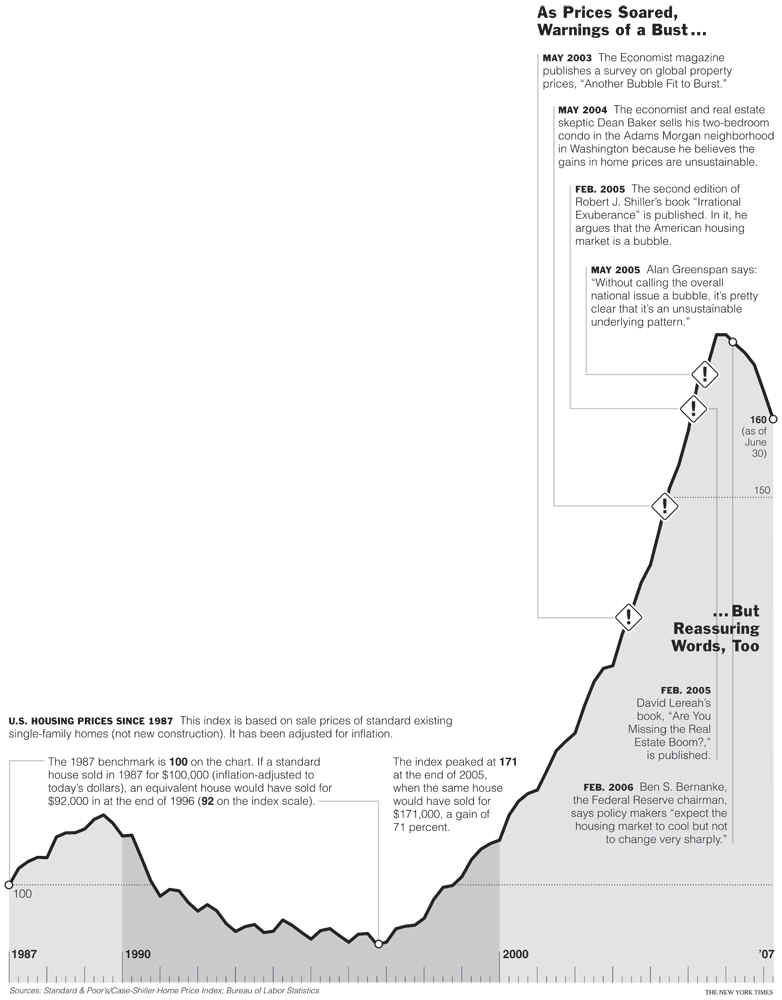

Home Prices Must Go down further, as the FED's demands that the bank's

Tighten up their Lending Policies They are still very, very high.

-------------------------------- by William Schmidt, Ph.D. ----------------------------------------

A $100 billion here, $50 billion there. It starts to add up. I'm speaking of the

reserves the Fed has used to support commercial banks and now investment banks. Like

Bush who stubbornly keeps spending hundreds of billions of US tax payer dollars so

he won't have to admit publicly his attack on Iraq was a monstrous failure, Bernanke

keeps loaning US elite banks ten, then twenty five and now fifty to a hundred billion

per month.

Today, March 28th, the Fed announced it would have $50 billion more available

on April 7th and April 21st. These auctions would continue until October, conveniently

just before the Presdiential Election in November. The banks put up questionable

mortgage backed securities, and in return for paying 2.5% interest they get more

freshly printed greenbacks.

"The Fed has been holding auctions every two seeks since December to provide short-term

loans to commercial banks. It started with auctions of $20 billion, then pushed the level to $30 billion,

and in early March raised the auction amount to $50 billion as the credit shortage grew more severe.

In announcing the move to $50 billion last month, the Fed said it would continue the auctions for

at least the next six months, unless credit conditions show they are no longer needed."

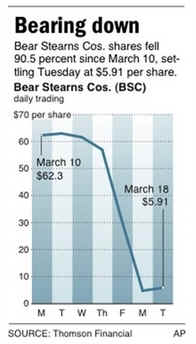

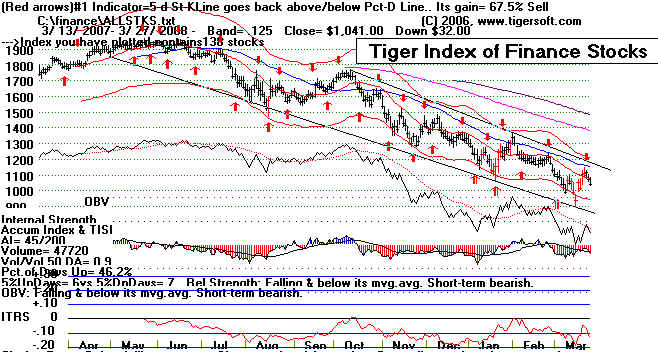

The bank stocks are still in great difficulty. Here are the TigerSoft charts of

Goldman Sachs (GS) and the TigerSoft chart of all financial stocks.

------------------------------ Goldman Sachs ----------------------------------

------------------------ Tiger Index of All Finance Stocks -------------------------

NOW THE ELITE BANKS ARE DEPENDENT ON FED LOANS

The Fed gives banks cash for their questionable mortgage securities. Small wonder

that the banks love this deal. It used to be that banks were wary of seeming needy.

But now investment banks like Goldman Sachs, Lehman Brothers and Morgan Stanley.

Banls averaged $550 million in daily borrowing, for the week ending March 26, from the

Fed's discount window, compared with $81 million the previous week. What will it be

next week as the rate of mortgage loan defaults keeps rising?

The Fed has been criticized by Congress for allowing the bubble to develop by being

lax in its oversight of subprime lending. Now as the Fed takes steps to require banks

to demand that borrowers set aside money to pay taxes and insurance and to only make

loans for proven income from sources other than the home's value, one wonders

how many new buyers will qualify until prices come way down.

Housing Prices Have Barely Started A Long-Over-Due Need To Correct. Below

is a key graph provided by the NY Times.

(Source: http://www.nytimes.com/imagepages/2007/09/23/weekinreview/20070923_BAJAJ_GRAPHIC.html )

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|