Carlyle Group:

How To Get Rich with The Right Connections

Critics of the

Bush family have long maintained that the secretive Carlyle Group, which runs and

owns much of Carlyle Capital, is a virtual Who's Who in

Washngton political power: George Bush, Sr.,

James Baker, his Secty. of State, James Carlucci, Reagan's

Secty.of Defense and Bush Jr.'s Budget Advisor,

Darman have all sat on Carlyle's board of directors and had

a stake in the company. Critics assert that

this company has dangerously close connections with the Bin

Ladens and have profited inordinately from

the war in Iraq. This is the type of company

that has grown fabulously because of its political connections.

In 2003, when one combines all the companies like US Marine

Repair and United Defense Industries

that the Carlye Group owns, Carlyle is the 11th largest US

military contractor. (Source: Lucky Twice",

Forbes, December 8, 2003.)

Now when times

get tough, this is the type of company the FED will not allow to fail. That

Bush Sr. has

some large and undisclosed stake in the Carlyle Group seems

almost certain. How can Bush Jr. not

want to help his Dad? Won't Bush Jr. profit some day

from his dad's holdings? Privatization has certainly

made these potential conflicts of interest much more more

egregious. Welcome to "Crony Capitalism" or

as Jim Rodgers calls it: "Socialism

for the rich". See the Carlyle Group's website.

THE FED GUARANTEES PRIVATE BANKERS AGAINST RISK!

"Have

some bonds you don't like or are going against you? Don't worry. The FED will take

them

off your hands and give you US Treasury Bonds."

It's now earmarked $400 billion for that. This is truly

a US government out of control! The Washington

Post mocked them today: "Pretty

soon you'll be able

to

walk into any Federal Reserve bank and hock that diamond brooch you inherited from Aunt

Mildred."

The FED will print money just as it pleases for

whomever it pleases. Sure, Wall Street types will

tell us: "This is for all of us if it prevents a

melt-down."

The scope and

scale of this baleout is unprecedented. Perhaps, it shows how very severe the

credit problems are. Or perhaps, the bailout shows how corrupt, predatory and dedicated to

protect the rich and influential, the Federal

Government and the FED have become. Some

have estimated the FED will have to burn $1 trillion

dollars before this is all through. That's

because the severe credit crunch is not over.

Tthere will have to be more meltdowns. Look at

Bear Stearns' chart.

WHAT HAPPENED IN .FEBRUARY.

"(T)he

real problem began in late February, as several of Wall Street's biggest investment banks

prepared to close their books for the quarter

and realized they were looking not only at big declines

in profit from issuance of new stocks and bonds

and fees from mergers and acquisitions, but also another

round of write-offs in the value of their

holdings. In response, the banks began to hunker down, instructing

their trading desks to raise margin

requirements for hedge funds and other customers, requiring them, in

effect, to post more collateral on their heavy

borrowings.

"Thus began a

chain reaction in which hedge funds began selling what they could -- largely

mortgage-backed securities guaranteed by Fannie

Mae, Freddie Mac and Ginnie Mae -- to raise the

cash to meet their new margin calls. That wave

of forced selling drove down the price of those bonds,

which prompted more margin calls and more

forced selling. By the end of last week, the interest rate

spread on those securities -- the difference

between their yield and that of risk-free U.S. Treasury bonds --

had jumped four, five, even 10 times the normal

rate. "Among those

caught up in the vicious cycle were hedge funds run by such blue-chip names as KKR

and Carlyle Group, along with Thornburg Mortgage, a big mortgage lender. News of their troubles

swept through Wall Street, heightening the

sense of panic, as did rumors that Goldman Sachs was about

to post big losses and Bear Stearns was about

to run out of cash. Meanwhile, Lehman Brothers announced

that it would lay off 5 percent of its staff in

what was viewed by many as a first installment of a consolidation

that would eventually eliminate 20 percent of

the jobs on Wall Street. Analysts began to warn that

financial-sector losses from mortgages,

commercial real estate, failed takeover loans and other

bad gets could reach as high as $1

trillion."

(Quoted from - http://www.washingtonpost.com/wp-dyn/content/story/2008/03/11/ST2008031103060.html?hpid=sec-business

)

Bear Stearn is still in free-fall

MY BIGGER CONCERN

While I fear for

the US Dollar and those on fixed incomes, my biggest concern is less Carlyle's sense

of entitlement and their drive for profits at the taxpayer's

expense than the vested interest this

company has in war and military aggression.

Peace is not profitable for them. And their latest failing

with mortgages, shows they are not really equipped to make

money except by using their connections

to policy makers. (I want to add somethng else.

Things are not well, but I can find no evidence supporting

the wild assertion that the Carlyle Group has bought up

nearly all the US bullet makers? But these

are the fears created by military privatization and crony

capitalism.)

"Bush stands in line to profit handsomely from his

son's war making. The former president is on

retainer

with the Carlyle Group, the largest

privately held defense contractor in the nation. Carlyle is run

by Frank

Carlucci, who served as the National Security advisor and Secretary of Defense under

Ronald Reagan.

Carlucci

has his own embeds in the current Bush administration. At Princeton, his college roommate

was Donald

Rumsfeld.

They've remained close friends and business associates ever since. When you have friends

like this,

you don't

need to hire lobbyists.. Bush Sr. serves as a kind of global emissary for Carlyle. The ex-president

doesn't

negotiate arms deals; he simply opens the door for them, a kind of high level

meet-and-greet. His

special

area of influence is the Middle East, primarily Saudi Arabia, where the Bush family has

extensive

business

and political ties. According to an account in the Washington Post, Bush Sr. earns around

$500,000

for each

speech he makes on Carlyle's behalf. One of the Saudi investors lured to Carlyle by Bush was the

BinLaden Group, the construction

conglomerate owned by the family of Osama bin Laden. According to an

investigation by the Wall Street Journal, Bush convinced Shafiq Bin Laden, Osama's half

brother, to sink

$2 million

of BinLaden Group money

into Carlyle's accounts. In a pr move, the Carlyle group cut its ties

to the

BinLaden Group in

October 2001." (Source: http://www.counterpunch.org/stclair05222004.html

)

Jim Rogers: 'Abolish the Fed'

Jim Rogers: 'Abolish the Fed'

Federal Reserve Chairman Ben Bernanke should resign and the Fed should be abolished

as a way to boost

the falling dollar and speed up the recovery of the U.S. economy, investor

Jim Rogers, CEO

of Rogers Holdings, told CNBC Europe Wednesday. Asked what he

would

do if he were in

Bernanke's shoes, Rogers, who slammed the Fed for pouring liquidity in the system

and accepting

mortgage-backed securities as guarantees, said: "I would abolish the Federal Reserve

and I would

resign".... Rogers reminisced of the 1970s, when the Fed printed money to avert a

recession,

boosting inflation and then forcing interest rates to more than 20 percent to keep a lid

on

price rises.

"No country in the world has ever succeeded by debasing its

currency," he said. "That's

what this man is

trying to do. He's trying to debase the currency as a way to revive America. It has

never

worked in the

long term or the medium term." For rest of interview this morning -

http://www.cnbc.com/id/23588079

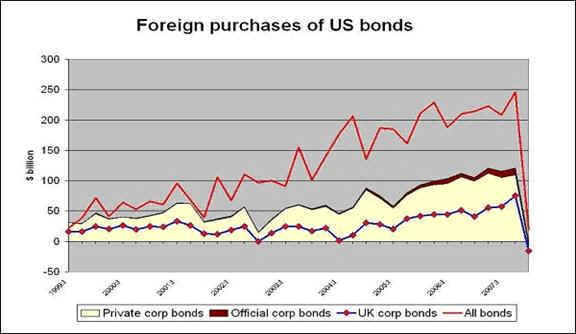

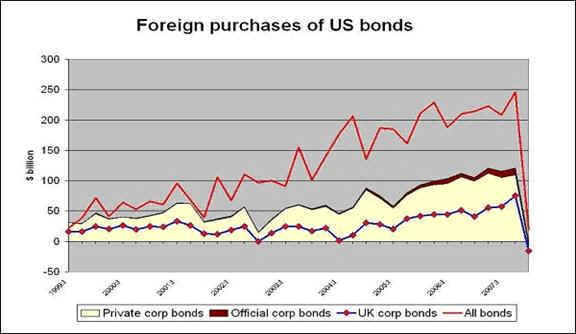

Who Will Buy US Bonds with Dollar Falling 11.4%/yr

and Accelerating

Read this

when you have time:

http://www.financialsense.com/fsu/editorials/willie/2008/0116.html

A Key Part of The Carlyle's Conglomerate

Is Going Bankrupt.

Banks Let Carlyle Borrow $20 Billion

Using only $970 Million.

Carlyle Capital

Corp, Ltd is about to go bankrupt. It has defaulted on $16.6 billion of debt and

failed yesterday to meet new margin calls of more than $400

million. The fund was established in August 2006

with about $709 million from Calyle owners and $300 million

more raised in a public stock sale. That

capital

was

taken to banks who let it borrow 20 times this amount for the purpose of buying mortgages.

Specifically,

Citigroup, Bank of America, Merrill Lynch and

Deutsche AG loaned Carlyle $20 billion to buy mortgage debt

issued by Fannie Mae and Freddie Mac. Carlyle

bought at least "$22.7

billion in long-term securities with

$21.2

billion in short-term loans."

This is not just

a shock to the well-connected investors who created the fund, the fear is that the

liquidators

will throw $16 billion in mortgage securities on a weak market.

And that may bring new margin calls and

possible bankruptcies on Wall Street. No wonder the

Fed is loosening its purse strings and has offered to

guarantee $400 billion in mortgage loans. But the

residential default rate on homes (and cars and businesses

and hedge funds) keeps rising.

Carlyle

Capital is, or was, a hedge-fund run by the Carlyle Group. The parent company had to lend

it $200 million recently. Carlyle Capital was very

important and very visible. The

parent, Carlyle Group,

employees, partners and advisers run Carlyle Capital,

control its board and own 17 percent of the stock.

Most of the other big investors in Carlyle Capital are also

investors in Carlyle Group funds. Carlyle Capital's

expected profits were meant to finance the Carlyle Group's

deals and investments elsewhere. The parent

company Caryle Group manages $75 billion in investments

that range from military contracts to donuts.

"(T)here's the annual management fee of 1.75

percent of equity paid by the investors of Carlyle Capital

to the Carlyle Group.

That's a guarantee of $15 million. Add to that the incentive fee if the fund earns more

than an 8 percent

return on equity, which is not much of a stretch when you're working with 96 percent

leverage.

The incentive fee for

the first half of 2007 came to $4.7 million.... And for what? Borrowing $21.2 billion from

Wall Street

broker-dealers at 5.3 percent and using it to buy asset-backed securities that yield 6.5

percent.

How hard can that

be?", they thought.

(Source: http://www.sfgate.com/cgi-bin/article.cgi?file=/c/a/2007/09/09/BU89RVHIH.DTL&type=business

)

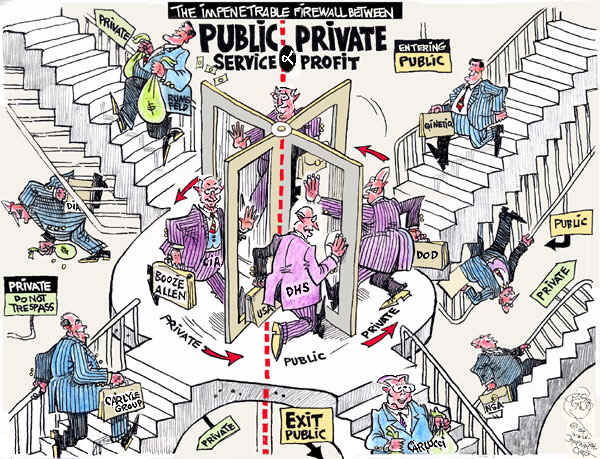

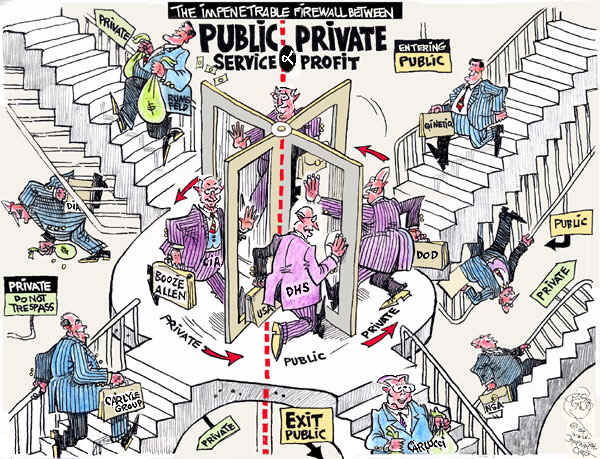

Now the parent Carlyle Group needs some

financial aid. On March 8th, it was reported that the Carlyle

Group intneds to acquire the $2 billion government

contracting business of consulting giant Booz Allen Hamilton,

one of the biggest suppliers of technology and personnel to

the U.S. government’s spy agencies. That

company has gathered in many privatized functions of the

CIA.

Booz Allen employs more than 10,000 Top Secret Cleared

Personnel.

"(A)mong the many services Booz Allen provides to intelligence agencies, according to

its Website,

are war-gaming –

simulated drills in which military and intelligence officials test their response to

potential

threats like terrorist

attacks – as well as data-mining and analysis of imagery and intelligence picked up

by

U.S. spy satellites, the design of

cryptographic, or code-breaking, systems (an NSA specialty) and

“outsourcing/privatization strategy and planning.” The company’s 2007

annual report spells out several

other areas of expertise,

including “all source analysis,” an intelligence specialty managed by the CIA

and

the Office of the Director of

National Intelligence (DNI) that draws on public sources of information, such

as foreign newspapers and

textbooks, to add texture to data gathered by spies and electronic surveillance."

(Source: http://www.corpwatch.org/article.php?id=14963

)

|

TigerSoft

News Service 3/13/2008 www.tigersoft.com

TigerSoft

News Service 3/13/2008 www.tigersoft.com

Jim Rogers: 'Abolish the Fed'

Jim Rogers: 'Abolish the Fed'