TigerSoft

News Service 12/3/2009

www.tigersoft.com

TigerSoft

News Service 12/3/2009

www.tigersoft.com BERNANKE's CONFIRMATION HEARINGS

"BERNANKE IS THE COUNTRY'S BIGGEST MORAL HAZARD"

WHY DO DEMOCRATS AND OBAMA SO DISREGARD

FED CHAIRMAN'S FAILURES, LIES AND

TERRIBLE TRACK RECORD AT ECONOMIC PREDICTIONS?

HIS BAILOUT OF BANKERS BRINGS FEW NEW JOBS

AND IS DESTROYING THE PURCHASING POWER OF

WHAT POOR WORKING PEOPLE HAVE LEFT!

CLEARLY WALL STREET CONTROLS OBAMA AND THE SENATE DEMOCRATS

ONLY REPUBLICANS, BERNIE SANDERS and A

HANDFUL OF DEMOCRATS LIKE DENNIS KUCINICH

CHALLENGE BERNANKE's CONFIRMATION.

by William Schmidt, Ph.D.

|

Tiger

Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

|

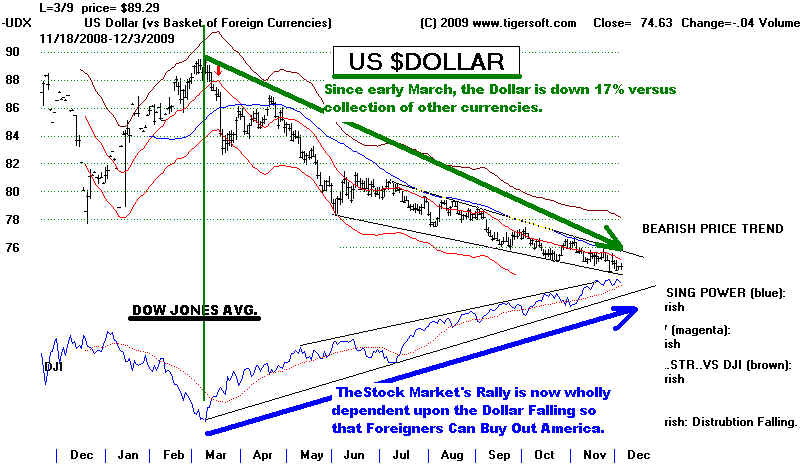

BERNANKE's CONFIRMATION HEARINGS "When I make a mistake I have to pay for it. When banks make mistakes, I have to pay for it, too." by William Schmidt, Ph.D. Without admiting it, Bernanke's economic recovery has been engineered by printing trillions of Dollars and gravely weakening the US Dollar. If it were producing jobs, perhaps that would be a good trade-off. But unemployment is is now estimated to be 17% and rising. Meanwhile, the stock market has risen mainly because "Big Money" is buying stocks, as an escape from the falling Dollar. Annualized, the Dollar is losing nearly 14% of its value. America is now for sale. Not only are the remaining jobs still being exported by "American" corporations, but America is now for sale "Very cheap!" The Senate, by and large, are not sufficiently challenging Bernanke and his bank bailout policies. The cheap money (1/4% at the Fed Discount window) is NOTbeing used by banks to make more loans. It is being used by banks to buy other banks, cavalierly to give out obscene bonuses and speculate in stocks. How does that help Main Street? Does that not just mean another bubble is being created? Who will bear the brunt of the next collapse? Those who can least afford it, as always. Those who had nothing whatsoever to do with causing it. And when the bubble breaks and banks lose money on their stock market trading, will not these same banks want and expect yet another Fed and Treasury handout? Why is no one in Congress demanding that the biggest banks be broken up and Glas Steagall be reinstated. What but more indebtedness and an inflated Dollar does someone on Main Street get out of Bernanke's policies? His smug arrogance exactly matches the exasperating comparable behavior by Wall Street CEOs. WHEN THE STOCK MARKET DEPENDS SOLEY UPON INFLATION, WE ARE IN TROUBLE?  C-Span is superb. I listened to their broadcast of the Bernanke confirmation hearings. As I listened to Bernanke, I was amazed at his refusal to acknowledge any real responsibility in permittng the housing bubble, in not seeking to prevent the dangerous misuse of excessive leverage by the biggest banks and their misrepresentation of the risks in the bundled mortgages they sold. I was dumb-founded by his bold lies. He admitted to no specific mistakes. He would not answer the biggest questions: why were banks aided without conditions on how they use the money and why should banks get help if they will not commit to using the money to make more loans to home owners and small businesses. Last Fall, Bernanke and Paulsom stated this was essential to bring about an econiomic recovery. One item in what he said seemed particularly galling. He disingenuously pretended that it was not a "bailout" to allow Wells Fargo or Bank of America, for example, to use as collateral at the Fed's Dicount Window their most dubious "toxic" housing and consumer mortgages and loans. So many questions were not asked by the pro-Wall Street Democrats. Why, for example, was Goldman Sachs allowed to borrow money at 1/4% from the Fed's Discount Window when they are little more than a glorified hedge fund, do not make commerical or individual loans and have just used all this cheap money to speculate in the stock market. BERNANKE'S PREDICTIONS ARE ALWAYS WRONG At one point, Senator Jim DeMint of SC read for 3 minutes a series of quotes from Bernanke from 2005 to 2008 where he denied there were dangers ahead for the economy or particular banks. With such a terrible track record, why would Obama reappoint and the Senate confirm as Fed Governor someone who has such a terrible record. March 28, 2007: “The impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.” May 17, 2007: “We do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.” Feb. 28, 2008, on the potential for bank failures: “Among the largest banks, the capital ratios remain good and I don’t expect any serious problems of that sort among the large, internationally active banks that make up a very substantial part of our banking system.” June 9, 2008: “The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.” July 16, 2008: Fannie Mae and Freddie Mac are “adequately capitalized” and “in no danger of failing.” "Currently, we don’t think it will get to 10 percent. Our current number is somewhere in the 9s" (These were read into the record by Rep Senator Jim DeMint of SC. They also appear in http://www.amconmag.com/article/2009/sep/01/00012/ See also - http://blogs.wsj.com/economics/2009/12/03/live-blog-bernanke-under-fire-in-the-senate/ )

The Greenspan legacy on monetary policy was breaking from the Taylor Rule to provide easy money, and thus inflate bubbles. Not only did you continue that policy when you took control of the Fed, but you supported every Greenspan rate decision when you were on the Fed earlier this decade. Sometimes you even wanted to go further and provide even more easy money than Chairman Greenspan. As recently as a letter you sent me two weeks ago, you still refuse to admit Fed actions played any role in inflating the housing bubble despite overwhelming evidence and the consensus of economists to the contrary. And in your efforts to keep filling the punch bowl, you cranked up the printing press to buy mortgage securities, Treasury securities, commercial paper, and other assets from Wall Street. Those purchases, by the way, led to some nice profits for the Wall Street banks and dealers who sold them to you, and the G.S.E. purchases seem to be illegal since the Federal Reserve Act only allows the purchase of securities backed by the government. On consumer protection, the Greenspan policy was don’t do it. You went along with his policy before you were Chairman, and continued it after you were promoted. The most glaring example is it took you two years to finally regulate subprime mortgages after Chairman Greenspan did nothing for 12 years. Even then, you only acted after pressure from Congress and after it was clear subprime mortgages were at the heart of the economic meltdown. On other consumer protection issues you only acted as the time approached for your re-nomination to be Fed Chairman. Alan Greenspan refused to look for bubbles or try to do anything other than create them. Likewise, it is clear from your statements over the last four years that you failed to spot the housing bubble despite many warnings. Chairman Greenspan’s attitude toward regulating banks was much like his attitude toward consumer protection. Instead of close supervision of the biggest and most dangerous banks, he ignored the growing balance sheets and increasing risk. You did no better. In fact, under your watch every one of the major banks failed or would have failed if you did not bail them out. On derivatives, Chairman Greenspan and other Clinton Administration officials attacked Brooksley Born when she dared to raise concerns about the growing risks. They succeeded in changing the law to prevent her or anyone else from effectively regulating derivatives. After taking over the Fed, you did not see any need for more substantial regulation of derivatives until it was clear that we were headed to a financial meltdown thanks in part to those products. The Greenspan policy on transparency was talk a lot, use plenty of numbers, but say nothing. Things were so bad one TV network even tried to guess his thoughts by looking at the briefcase he carried to work. You promised Congress more transparency when you came to the job, and you promised us more transparency when you came begging for TARP. To be fair, you have published some more information than before, but those efforts are inadequate and you still refuse to provide details on the Fed’s bailouts last year and on all the toxic waste you have bought. And Chairman Greenspan sold the Fed’s independence to Wall Street through the so-called “Greenspan Put”. Whenever Wall Street needed a boost, Alan was there. But you went far beyond that when you bowed to the political pressures of the Bush and Obama administrations and turned the Fed into an arm of the Treasury. Under your watch, the Bernanke Put became a bailout for all large financial institutions, including many foreign banks. And you put the printing presses into overdrive to fund the government’s spending and hand out cheap money to your masters on Wall Street, which they use to rake in record profits while ordinary Americans and small businesses can’t even get loans for their everyday needs. Now, I want to read you a quote: “I believe that the tools available to the banking agencies, including the ability to require adequate capital and an effective bank receivership process are sufficient to allow the agencies to minimize the systemic risks associated with large banks. Moreover, the agencies have made clear that no bank is too-big-too-fail, so that bank management, shareholders, and un-insured debt holders understand that they will not escape the consequences of excessive risk-taking. In short, although vigilance is necessary, I believe the systemic risk inherent in the banking system is well-managed and well-controlled.” That should sound familiar, since it was part of your response to a question I asked about the systemic risk of large financial institutions at your last confirmation hearing. I’m going to ask that the full question and answer be included in today’s hearing record. Now, if that statement was true and you had acted according to it, I might be supporting your nomination today. But since then, you have decided that just about every large bank, investment bank, insurance company, and even some industrial companies are too big to fail. Rather than making management, shareholders, and debt holders feel the consequences of their risk-taking, you bailed them out. In short, you are the definition of moral hazard. Instead of taking that money and lending to consumers and cleaning up their balance sheets, the banks started to pocket record profits and pay out billions of dollars in bonuses. Because you bowed to pressure from the banks and refused to resolve them or force them to clean up their balance sheets and clean out the management, you have created zombie banks that are only enriching their traders and executives. You are repeating the mistakes of Japan in the 1990s on a much larger scale, while sowing the seeds for the next bubble. In the same letter where you refused to admit any responsibility for inflating the housing bubble, you also admitted that you do not have an exit strategy for all the money you have printed and securities you have bought. That sounds to me like you intend to keep propping up the banks for as long as they want. Even if all that were not true, the A.I.G. bailout alone is reason enough to send you back to Princeton. First you told us A.I.G. and its creditors had to be bailed out because they posed a systemic risk, largely because of the credit default swaps portfolio. Those credit default swaps, by the way, are over the counter derivatives that the Fed did not want regulated. Well, according to the TARP Inspector General, it turns out the Fed was not concerned about the financial condition of the credit default swaps partners when you decided to pay them off at par. In fact, the Inspector General makes it clear that no serious efforts were made to get the partners to take haircuts, and one bank’s offer to take a haircut was declined. I can only think of two possible reasons you would not make then-New York Fed President Geithner try to save the taxpayers some money by seriously negotiating or at least take up U.B.S. on their offer of a haircut. Sadly, those two reasons are incompetence or a desire to secretly funnel more money to a few select firms, most notably Goldman Sachs, Merrill Lynch, and a handful of large European banks. I also cannot understand why you did not seek European government contributions to this bailout of their banking system. From monetary policy to regulation, consumer protection, transparency, and independence, your time as Fed Chairman has been a failure. You stated time and again during the housing bubble that there was no bubble. After the bubble burst, you repeatedly claimed the fallout would be small. And you clearly did not spot the systemic risks that you claim the Fed was supposed to be looking out for. Where I come from we punish failure, not reward it. That is certainly the way it was when I played baseball, and the way it is all across America. Judging by the current Treasury Secretary, some may think Washington does reward failure, but that should not be the case. I will do everything I can to stop your nomination and drag out the process as long as possible. We must put an end to your and the Fed’s failures, and there is no better time than now."

|

| |