TRADING

GOLD STOCKS

WITH TIGERSOFT STOCHASTICS

by William Schmidt,

Ph.D.

There are times when stocks are up-trending, times when they are down-trending

and times when they are mostly backing and filling, in other words, pausing before they

make up their minds which way they want to go. The direction of a key moving average (ma)

helps tell us a stocks' status. Intermediate-term (2-4 month traders) can use a

50-day ma for this. 50-day is commonly used by technicicans. We actually

prefer

a 65-day ma, So, if the stock is ABOVE its key RISING moving average, the trend

is up and vice verse, namely, if it is BELOW its FALLING moving avergae,

the trend is down. Otherwise, the stock's trend is in doubt.

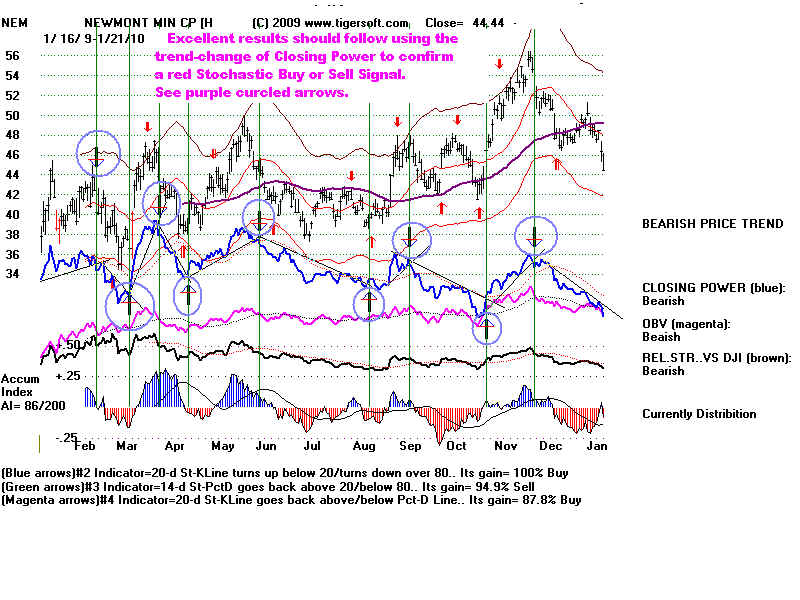

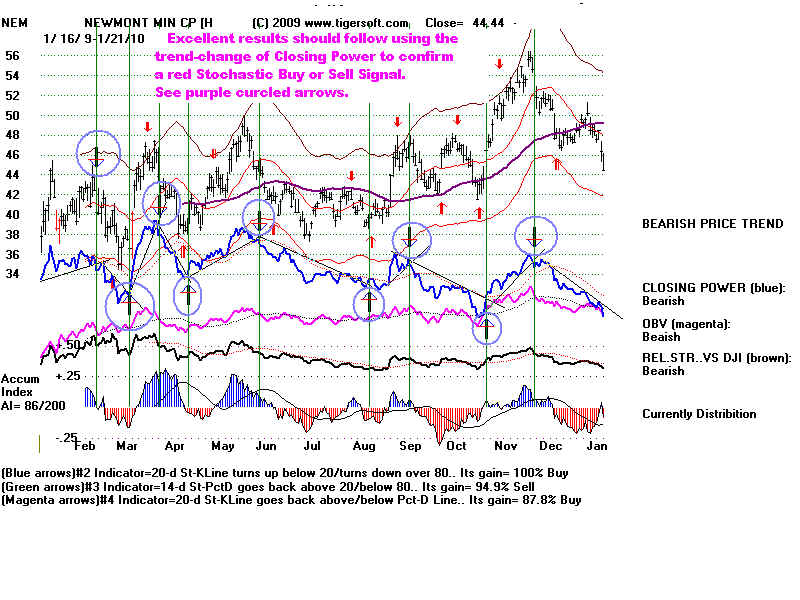

Look at NEM, Newmont, the world's biggest gold mining stock. The stock is clearly

below its rising 65-day ma. So, the uptrend is in doubt until it gets back above the

65-day ma or the 65-day ma turns down. In practice we also use internal strength

indicators

to determine trend. With the Tiger Accumulation Index in negative RED territory

and the BLUE Closing Power in a down-trend, NEM's uptrend is in more doubt.

So, what can a trader do in such situations, when the stock is not in a confirmed trend?

The answer is learn about Stochastics and how Tiger produces very profitable trading

results

using Stochastics.

NEM - Trading Gain = +136.3% Using 20-day Stochastic PctD.

AFTER A RED STOCHASTIC BUY OR SELL,

ACT

ON A BREAK IN THE

TIGER CLOSING-POWER TREND

To be safer when volatility increases, wait for the trend of the Tiger

Closing Power

to

confirm the red Buy or Sell. I have circled in violet where these trend breaks

occurred

in the Blue CLosing Power. Presently, we have a Red Buy, but

the

CLosing Power down-trend has not ended. When it does, we would Buy.

There

are lots of sample charts below to apply this rule to. Buyin and Selling

when

the CLosing Power trend changes in the direction of the red Buy should

achieve

gains regularly and very safely..

STOCHASTICS

STOCHASTICS

Stochastics are statistics. Applied to the stock market, they

have come to mean an

oscillator developed by George Lane.

The Lane K-Stochastic indicator is an oscillator that shows where

the stock is in a specified

period of time. If the stock's range for the last

20 days is 15 to 20, and the

stock is at 19, then the K-Stochastic's

value is 80. At 16, the K-Stochastic value here would be 20.

-

A 3-day moving average of the K-Stochastic

is commonly used.

This is called the Pct-D.

It is used to smooth the K-lines greater

fluctuations. Traders use the the K-Line and Pct-D in a number

of ways:

1. A new price low that is not confirmed by the Stochastics Pct-D

indicator (blue line below) making its own new

low simultaneously is bullish.

2. Similarly, a new price high that is not

confirmed by the Stochastics

Pct-D indicator (blue line below) making

its own new high is bearish.

The chart below has green "X"s marked where there are

non-confirmations.

They can be be judged to give reliable Buys and Sells. A newer version

of Tiger will soon put these "X"s and Trading Range Buys and Sells

- on the screen automatically. The magenta

Arrows below show a different

system. They show the best trading system using the next five rules.

The red arrows in the price area above (NEM) are based on a

20-Day Pct-D dropping back below 80 (SELL) and rising above 20 (BUY).

Presently, when you pull up a chart with Tiger, it automatically tells you

which of the following systems is best, giving you the optimum length

stochastic and telling you which of the next 5 systems is best.

3. The Stochastic-K dropping below 20 and turning

up is often

a good buy. Similarly, the K-Line rising above 80 and turning down is often a

good sell.

4. The Stochastic-K dropping below 20 and moves back above 20

is often a good buy. Similarly, the K-Line rising above 80 and dropping

below 80 is often a good sell.

5. The Stochastic-Pct-D dropping below 20 and turning up is often

a good buy. Similarly, the Pct-D rising above 80 and turning down is often a

good sell.

6. The Stochastic-Pct-D dropping below 20 and surpassing 20 is often

a good buy. Similarly, the Pct-D rising above 80 and dropping below 80

is often a good sell.

7. The Stochastic-K-Line surpasses the Pct-D after both decline below

40 is a good buy. Similarly, the K-Line falling below the Pct-D above 60

is often a good sell.

STOCHASTICS

ARE THE BEST TRADING

SYSTEM NOW FOR MOST GOLD STOCKS

They Have Been Very Profitable

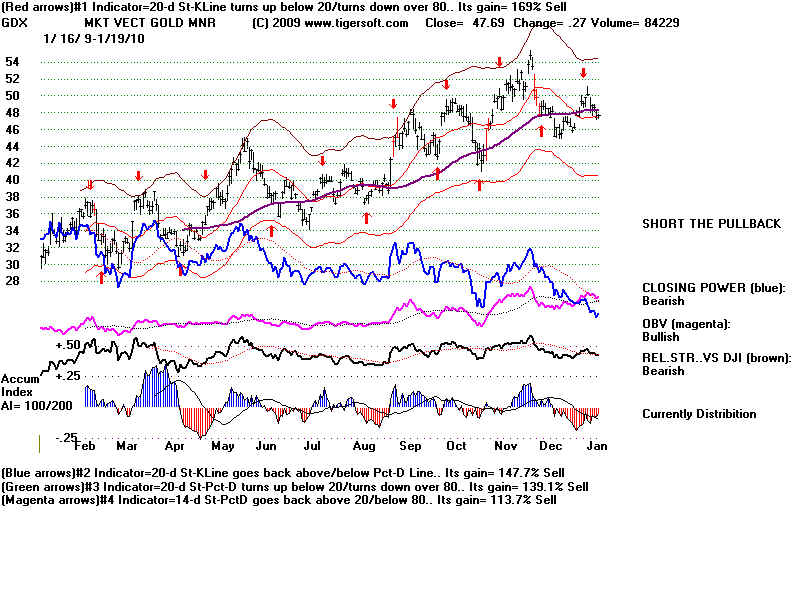

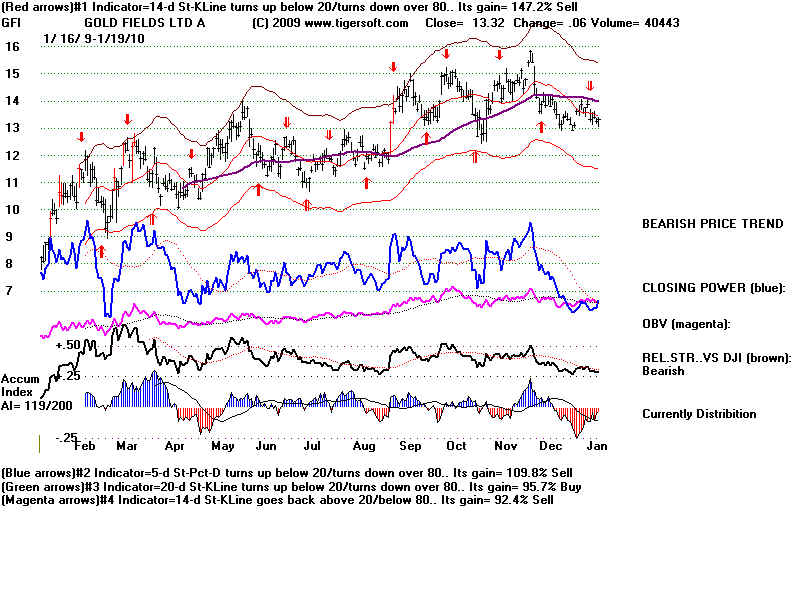

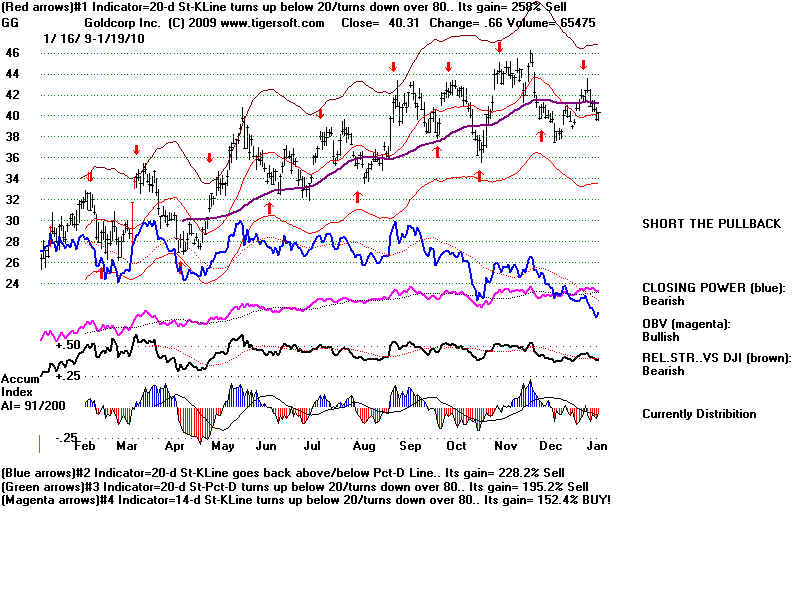

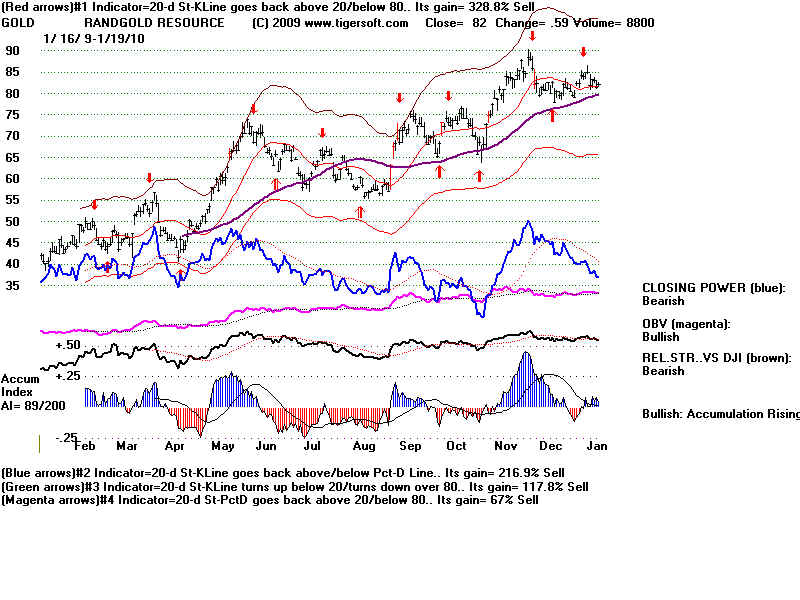

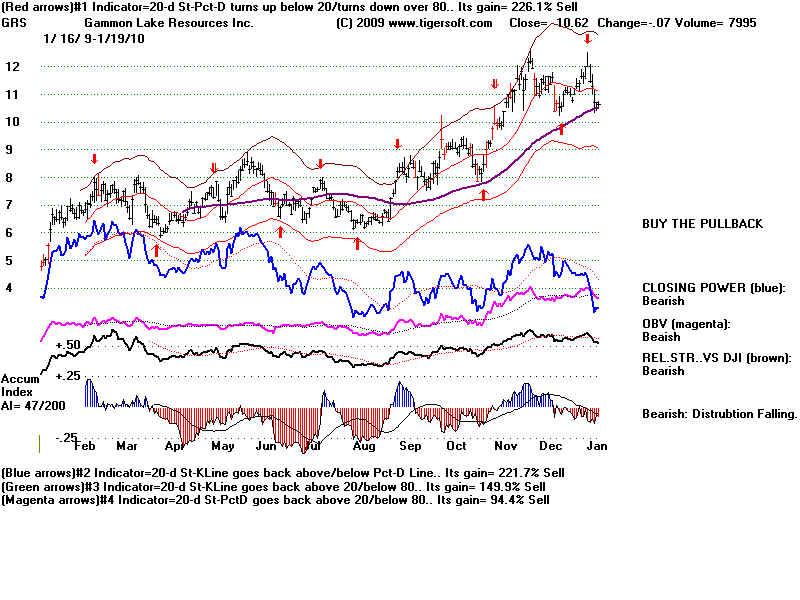

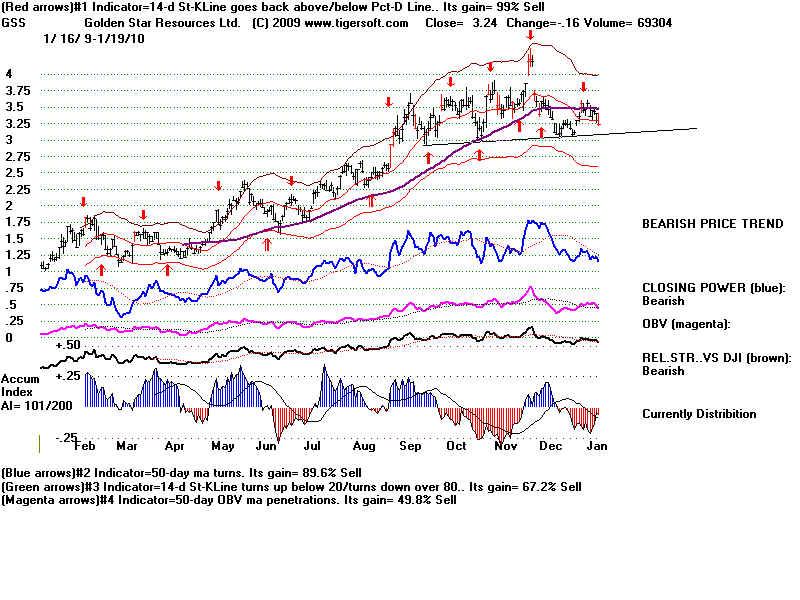

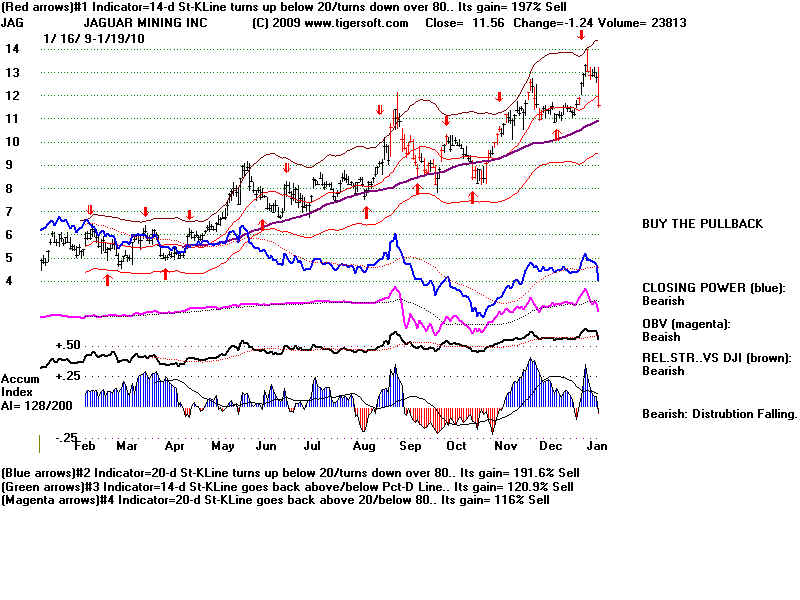

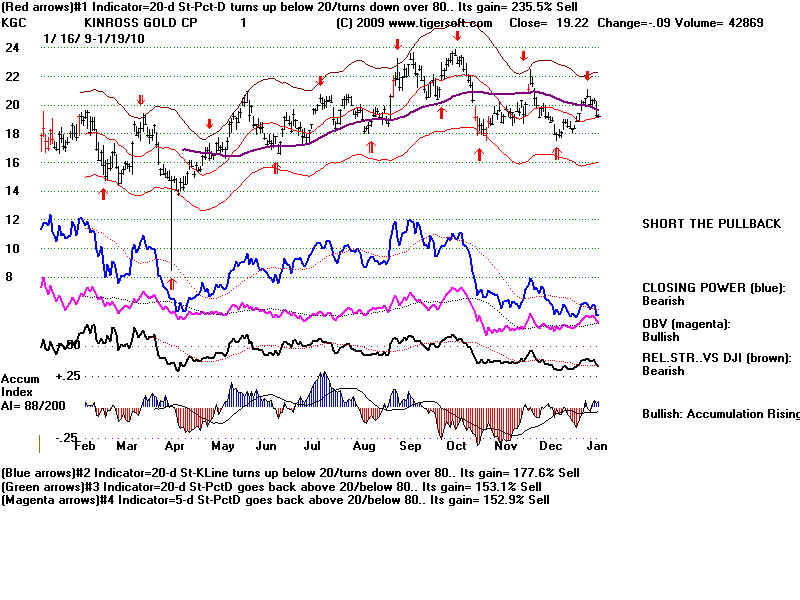

Gold Bullion may be very strong and not be very far off all-time highs,

but most Gold and

Silver stocks are in trading ranges, as defined above. And the best trading system

for

them now is in almost every case a Stochastic. This we know because TigerSoft

automatiucally calculates what the best trading system has been for the last

year

with each stock from among 60 different systems, some trending and some

trading.

The

great gains psted are historical. They show what would have happened if

one

had traded every Buy or Sell, both long and short. A commission of $40 is

allowed for each closed out trade. This also allows for slippage, between the

signal at the end of the day and the actual trade taken the next day.

Will

the next 12 months' trades be as profitable. Probably not. Market conditions

will

change, of course. However, the "personalities" of individual stocks and

the

behavior of most of their traders are more likely to remain much the same, for now.

So,

my judgement, barring dramatic international crises, these stocks will remain

mostly in trading ranges and trade very well with the TigerSoft Optimized Stochastics

Buys

and Sells, especially when the Non-Confirmation Buys and Sells are show.

We

should mention that TigerSoft users presently are shown specifically how to recognize

when

such automatic and optimized signals are apt to fail.

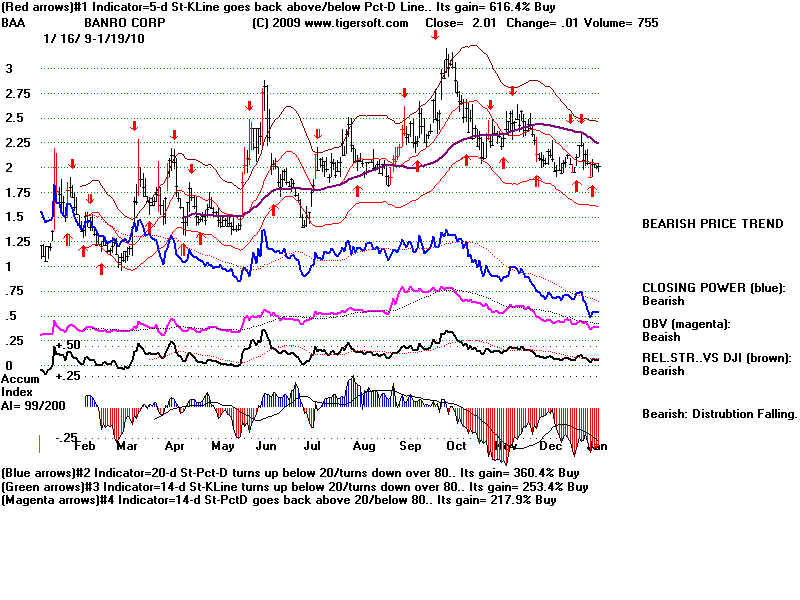

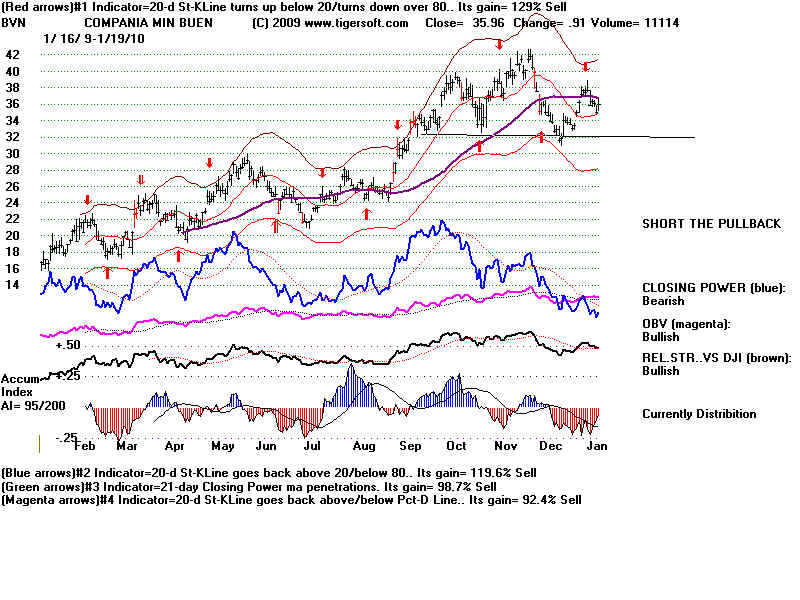

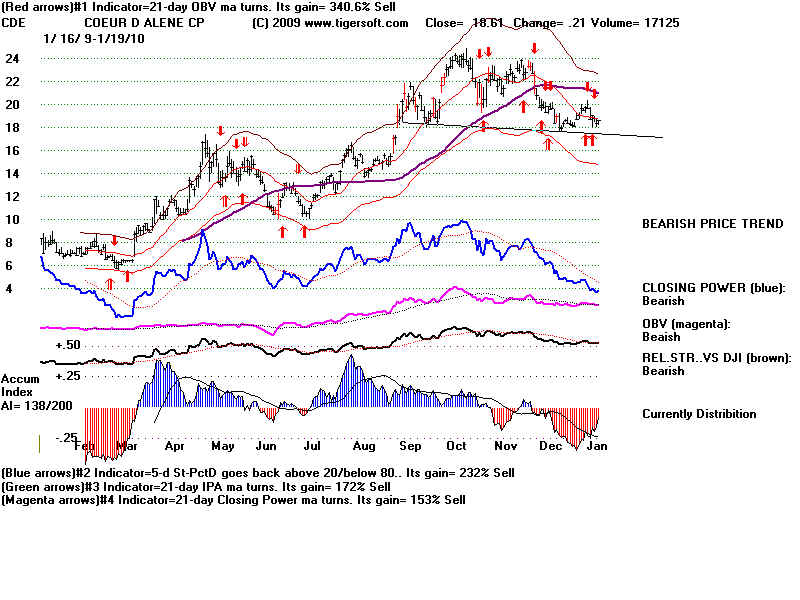

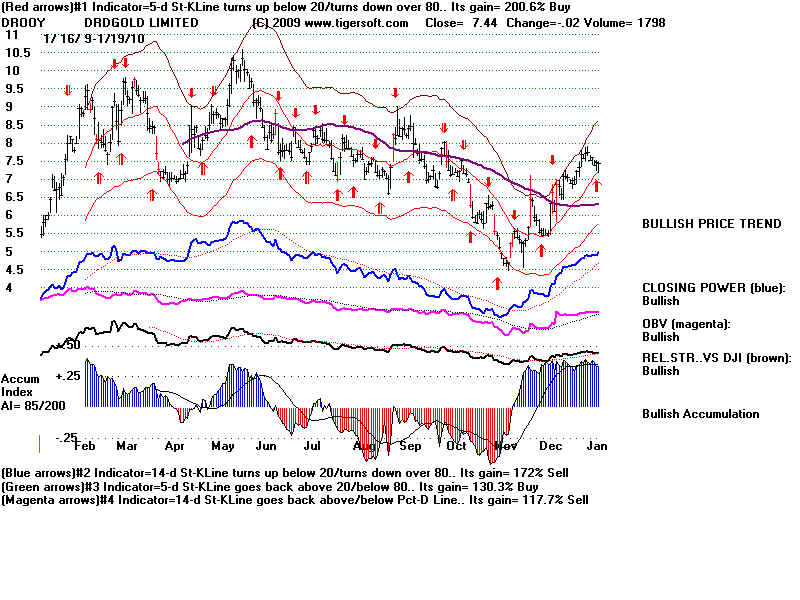

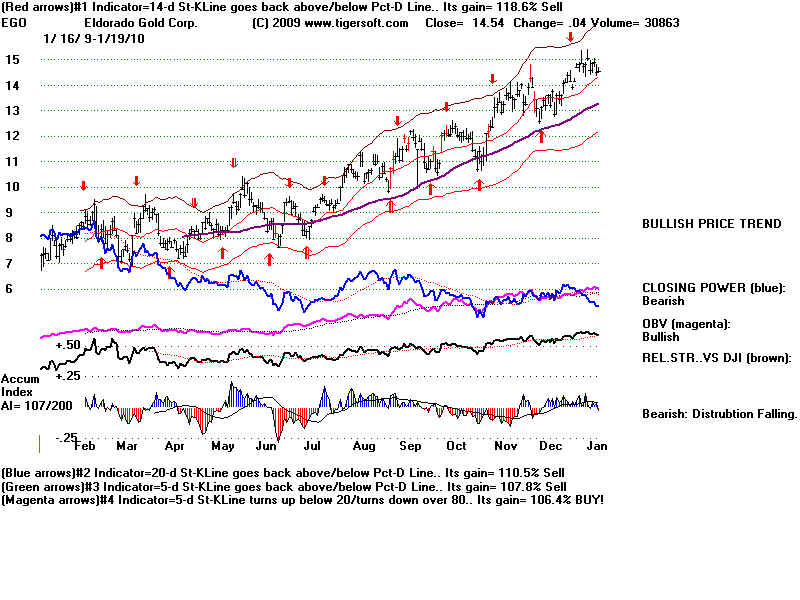

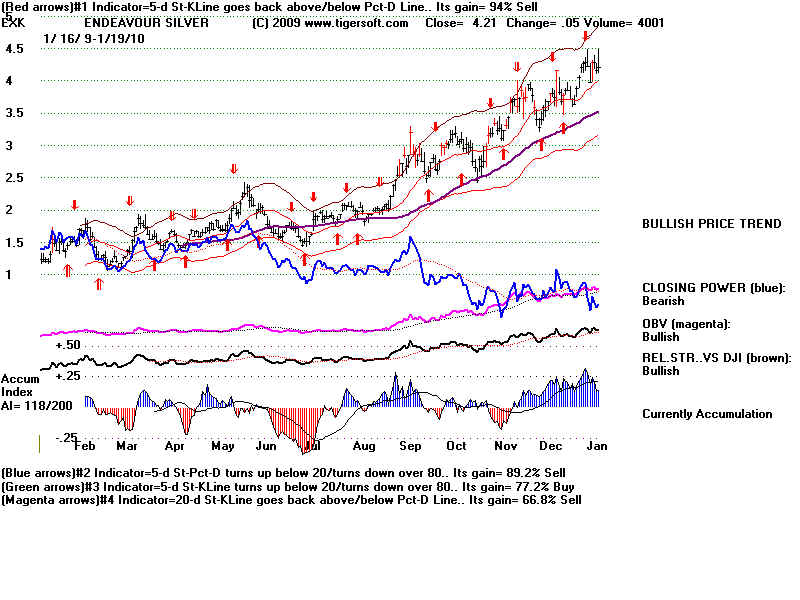

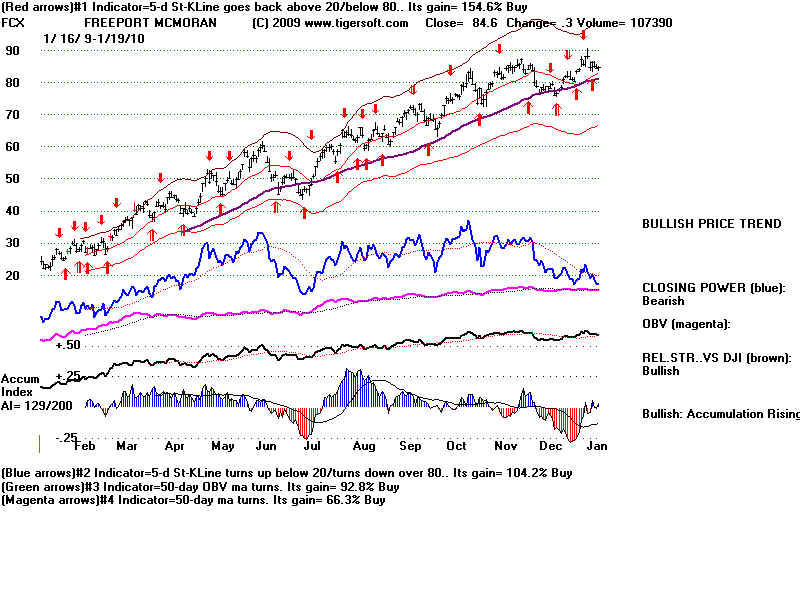

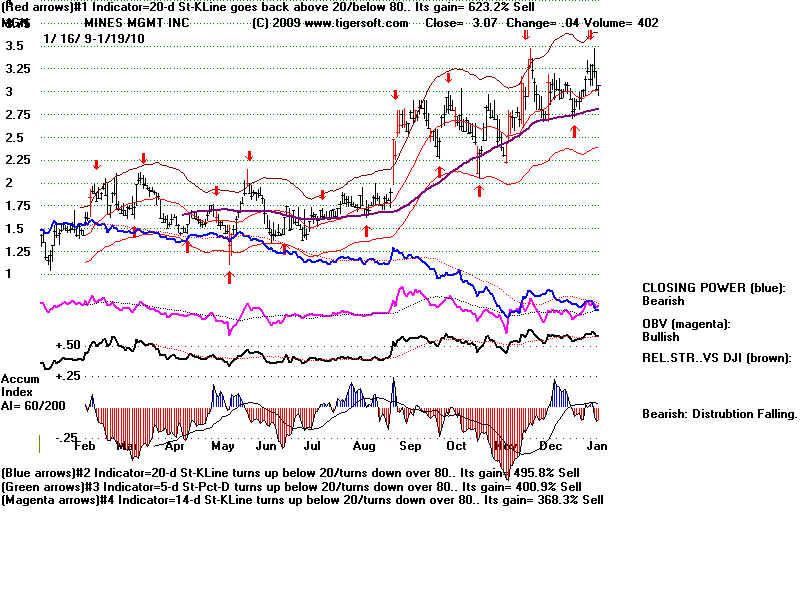

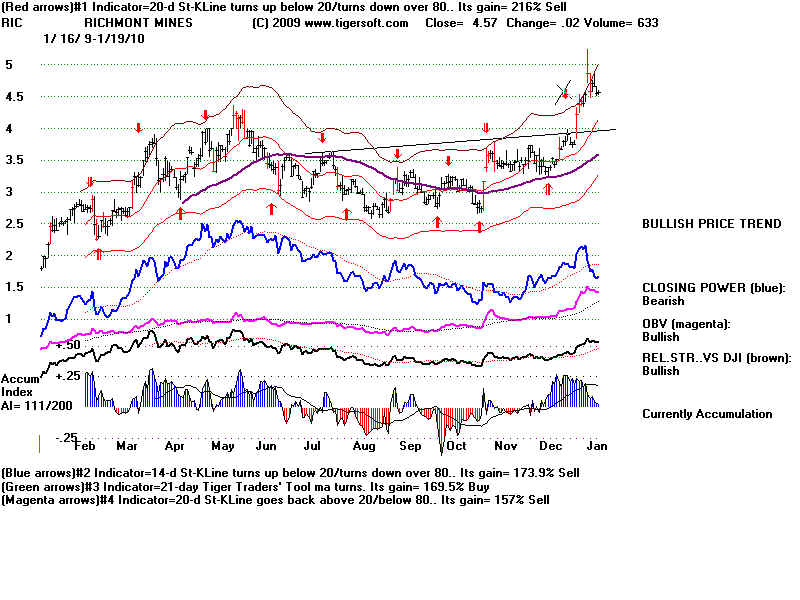

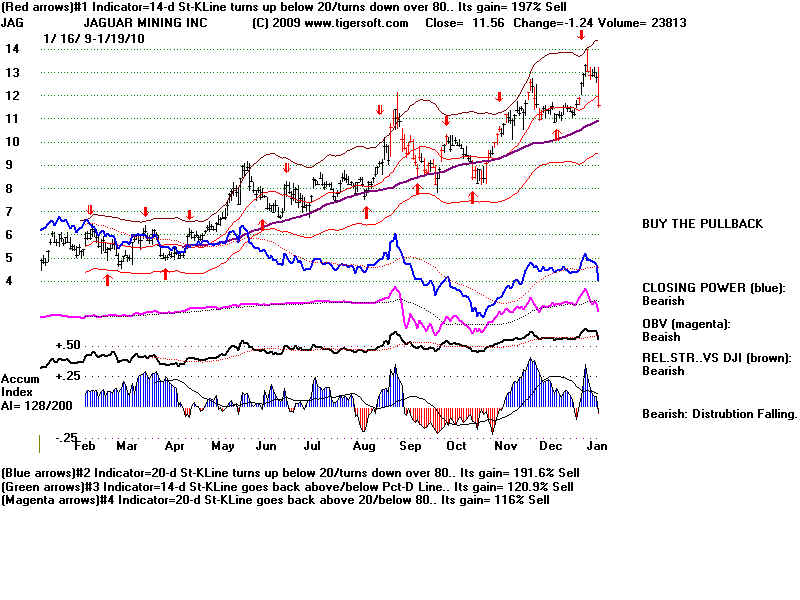

The

first line of each Gold stock chart below shows the best system's trading

gains, optimum Stochastics trading system and the current Buy or Sell status of each

stock. The Power-Ranker lists these for easier study.

|

TigerSoft

News Service 1/20/2010 www.tigersoft.com

TigerSoft

News Service 1/20/2010 www.tigersoft.com