TigerSoft News Service 3/15/2008

Visit our www.tigersoft.com

TigerSoft News Service 3/15/2008

Visit our www.tigersoft.com

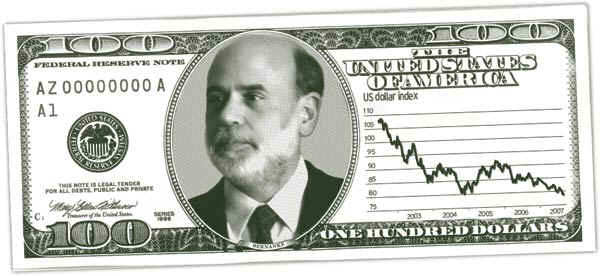

>>> "Yes" - Bernanke is a willing tool of Wall Street's Biggest Banks

at the expense of the American taxpayer.

But Bernanke Is also

A Scapegoat

>>> Was Spitzer Set up and Silenced So He Could Not Criticize

The Fed's "Socialism for Rich Bankers?

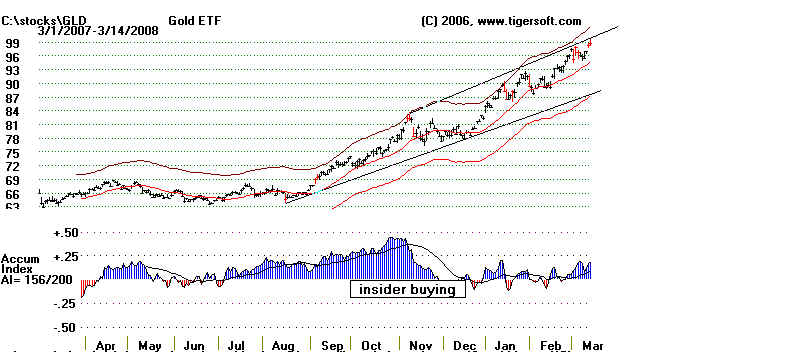

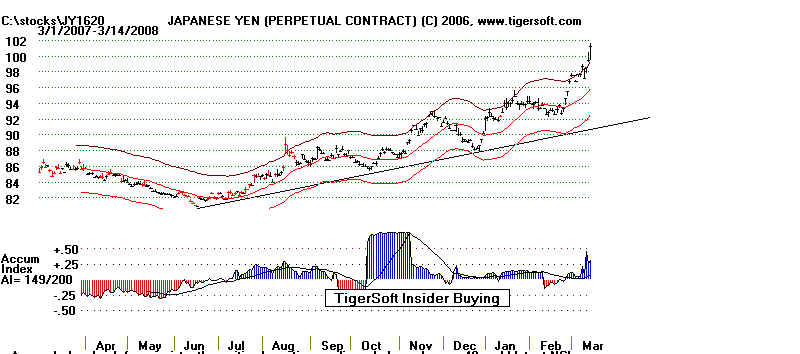

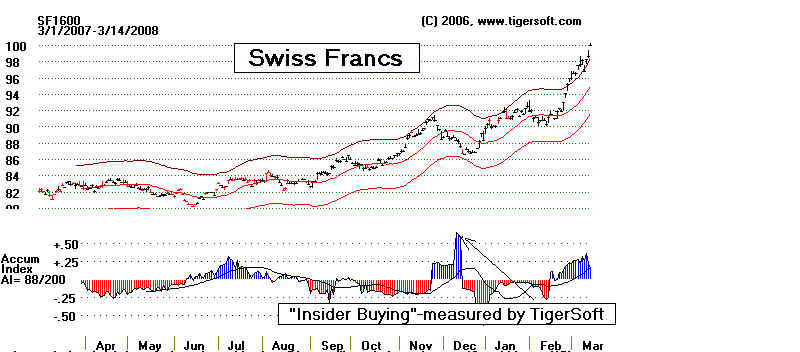

>>> Since late 2005, Bulges from TigerSoft's Accumulation Index in Foreign Currencies

Have Let Us See How Weak The Dollar Was and To Let Our Users

Profit from The Dollar's Decline.

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

Buy and Holding Is Dangerous: See All The Peerless Real-Time Signals: 1981-2008

|

Tiger

Software Helping Investors since 1981

|

The Federal Reserve has now elevated the Greenspan/Bernanke Doctrine of inflating

depressed markets with low interest rate credit to a new high level. Now $400 billion dollars

of Federal Reserve credit, at least, will be provided to key NY banks for their unwanted

mortgage loans The FED has not made it clear what other, if any, standards of need

these banks must present. The FED has also not indicated that there is any quid pro quo

asked of, much less required, of these banks. For example, it is not required that these

banks use this emergency credit to extend credit, in turn, to their own customers.

There is no indication that the FED has asked for, or demanded, any details from these

banks as to how they got into their current predicament. Apparently, the FED is not concerned

with how reckless the banks lending policies were. So, these banks could again make

loans to connected customers like Bush's Carlyle Group on the basis of 20 times presented

collateral. In other words, the $400 billion credit is a simply a 100% unconditional bail out

for well-connected, inner circle banks.

I wrote a dissertation about British Chancellors of the Exchequer. All Chancellors

since 1873 have been schooled in the advise given by Walter Bahehot, a sagacious writer

about the workings of the (unwritten) English Constitution and money markets in crisis and not.

In a financial crisis, he argued that the Bank of England should expand credit.

"A panic, in a word, is a species of neuralgia, and according to the rules

of science you must not starve it. The holders of the cash reserve must be ready . . .

to advance it most freely for the liabilities of others."

( http://www.imf.org/external/pubs/ft/fandd/1999/12/books.htm )

But to avoid a "run on the banks" in the first place, or making a panic worse, he counseled:

1. Only lend against good collateral to avoid losses for taxpayers at a later date.

2. Lend at sufficiently high interest rates to avoid the facility being used too

freely by greedy bankers motivated by short-term profits.

3. Make very public the availability of central bank offerings (loans). so as

to avoid the appearance of impropriety or favoritism.

I would say Bernanke is violating each of the last three principles. (1) He is now accepting

mortgages which the rest of the market won't touch! (2) Borrowing now for an inner circle bank is

very cheap, hardly challenging. (3) The $400 billion credit is not available to everyone or

even all banks. It goes to a few favored clients. There is no guarantee that the FED will

disclose the loans it does make. And the Fed is making these loans unconditionally!

Bernanke's Financial Philosophy and Its Failures

Bernanke has long said the Fed's unnecessarily tight monetary policies contributed mightily to the

coming of the Depression. In November 2002 when he was only a Fed Governor, he argued that the Fed

should prevent a deterioration of the economy by acting preemptively. It should offer fixed term loans to banks

at Zero or very low rates with the banks putting up a "wide range of private assets, including, among others,

corporate bonds, commercial paper, bank loans and mortgages deemed eligible as collateral."

"The U.S. government has a technology called a printing press that allows it to produce as many

U.S. dollars as it wishes at essentially no cost,'' Bernanke said. ``A determined government can

always generate higher spending and hence positive inflation. Sufficient injections of money will

ultimately always reverse a deflation....".

(Source: http://seekingalpha.com/article/46497-can-the-bernanke-put-lift-gold-sharply-higher )

Corruption That Equals The Looting of The US Treasury by Bush's Private War Contractors

It is a myth that Bernanke's policies are helping home-owners. At least $400 billion has been

provided BANKS, and only an elite inner circle of banks. They extended credit to other financial

institutions like Bear Stearns and Carlyle using 40:1 (I read in the San Diego Union today) and

20:1 factoring in the case of Bush Senior's Carlyle Group. How would you like to be able to buy stock

and only put 5% down AND get a guarantee of safety from the Federal Reserve? That is exactly

what Citibank, Bank of America and others have gotten.

Was Spitzer Hooked by the Banks, who were letting any would-be crusader know:

"Push Me and I'll Push You back"

Was Spitzer Silenced So The FED Banker-Bailout Could Proceed without His Criticism?

Personally, I have to suspect the very same banking crooks that are looting the Treasury

with Bernanke's help are involved in the Elliot Spitzer affair. Not that Spitzer doesn't deserve

all he gets. I must have "Your Cheatin Heart" in Karaoke thirty times. But did bankers

get the FBI to trap Eliot Spitzer for paying $4,300 to a hooker? Spitzer's other passion was going

after the criminal activities of the biggest NY banks: their "front-running", insider trading,

self-serving housing appraisals and stock recommendations, excessive pay, gouging of the

less educated. This is so big; the truth will come out. But one red flag is the fact that the

amount of Spitzer money transfers that got the bank to alert the FBI was only $5,000. My

bank, Wells Fargo, tells me that they won't even go after someone who writes a bad check

unless it's over $10,000.

I'm betting the Feds would not have noticed Spitzer's escapades without the help from the bankers

he was challenging. The Feds claim that they picked up on his cash payments through routine checking

for money laundering and then wire-tapped the receiver, which they then learned was an "escort agency".

Pretty bizarre. What are the odds of both stories breaking simultaneously? The prosecution of

Spitzer was managed with staffers from the Public Integrity Section of the Department of Justice,

which is the home of the Bush Administration officials who targeted Democrats, like the

former Governor of Alabama. See 60 Minutes Story.

What Will The Fed Do When It Uses Up All Its Ammunition?

This policy, so far, is not working. Banks are not lending more money and the prices of housing

continues to drop even though the FEDs this week agreed to offer $400 billion to key banks who wished

to use as collateral not "safe" US Govt. debt, but home mortgages! Maybe this largesse will work.

But this is a big gamble. They are guaranteeing mortgages bought in many cases after real estate

prices had been rising for a decade. And they are dealing with a market that probably needs to

correct. The DJI had risen a record 55 months in a row without a 10% decline. They are

clearly using their ammunition up early and in a far-from-defensible position. The failure

of the FED will make matters much worse. It heightens the sense of panic each time they

take a new desperate measure and it fails. Bernanke forgets that the markets are irrational.

The FED is Now Bush's Scapegoat: The Limits of Monetary Policy

The FED is being set up as the scape goat for the coming recession. Monetary policy

cannot solve the problems of maldistribution of wealth and under-consumption caused by

the decline in real wages in America since 1971. It does not address the near total exporting

of high-paid manufacturing jobs and many better paying service jobs.

Bernanke pretends to be omnipotent. He fails to see how devastating is the US failure

in its $3-$7 trillion dollar war to seize Iraqi oil. The accompanying Trillion Dollar loss,

plundering and exhaustion of the US Treasury by Bush's cronies at Halliburton and

Carlyle have not only brutally unbalanced the US Budget, it has shown the world how

corrupt and dishonestly run the American government is. What's worse, it has turned

much of the rest of the thinking world against America. When the US needs cooperation,

and it will, it will get a cold suspicious "NO". So, monetary policy is a smoke screen.

It is a a diversion. It creates a scapegoat to take the public eye off the high crimes and

guilt of the Administration of George Bush and their role in causing the coming deep recession.

A Disastrous Decline in The Dollar.

It is certainly true that Bernanke utterly neglects the disastrous effects his easy money and

bailout policies are having on the Dollar and hence on the international banking system and

international trade. He seems not to appreciate how heavily dependent international trade is

on the Dollar and reasonable Dollar stability. His study of the 1930s in this respect is not relevant.

The US Dollar was not then at the center of international trade and not the most important reserve

currency in the world. Presently, all OPEC sales of oil are made in Dollars. If that policy

suddenly changes, and it will almost certainly soon, oil prices will rocket up even more in the US

and the Dollar will plunge like never before. This will wipe out the savings of millions of poorer

Americans. Those on fixed incomes will never recover. And don't hold your breath for the Dollar's

decline to boost US manufacturing sales. Those US plants left long ago. What will happen

is that millions of American workers will have their jobs controlled from board rooms far overseas.

The insights offered here are meant to help you understand where the stock market is headed

if there is no change of policy. Fortunately, TigerSoft shows its users what to buy and sell

based on TigerSoft's invention in 1981, the TigerSoft Accumulation Index. Bulges of (blue)

accumulation are the signs we watch for. They represent smart, big-money insider buying.

Read our blogs to understand what the mainstream media will not tell you. And use our

software to to make big money.

----------------------------- The

Dollar's Decline Is Dangerously Accelerating ----------------

Bulges from the Tiger Accumulation Index in foreign currencies have

allowed us to see clearly that insiders knew the US Dollar would drop sharply.

We spotted very intense accumulation at the end of 2005 with the EURO

at 116. The chart below shows massive and intense insider buying using

the TigerSoft Accumulation Index. Note the readings over +.40. The EURO

was then near 120. It is now 157. The EURO is now up more than 30%

from when we spotted the tell-tale signs that insiders were betting against the

US Dollar.. Our users have made a lot of money by getting this alert. They

have bought foreign ETFs, Gold, Silver, Oil stocks and commodities.

EURO -2006

US DOLLAR

- 3/14/2008

The EURO is now Very Strong

Up Goes The Japanese Yen

Swiss Bankers Are Happy.

TigerSoft has been recommending Gold and Silver since

September 2008