TigerSoft's Elite Stock Professional Report 2/29/2008 - (C) 2008 Wm. Schmidt, Ph.D. Abbreviations: price versus 50 day ma AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 A = above U = Under (Bearish) SS = Sell Short BO = Breakout

-------------------------------------------------------------------------

---- BUYS:----

AI/200 Symbol Close IP21 High/OBV Confirm ITRS

------------------------------------------------------------------

153 DBA - Corn, Wheat, Soybeans, Sugar ETFs

183 DBC - Commodities-ETF 37.15 -.55 IP21=.45 OBV near NH. ITRS=.26

D-fund will pursue its investment objective by investing in a

portfolio of exchange-traded futures on the commodities comprising

the index, or the index commodities. The index commodities are light,

sweet crude oil, heating oil, aluminum, gold, corn and wheat.

179 SID 37.39 -.88 IP21=.20 ITRS=.41 OBV at NH running.

Companhia Sider?rgica Nacional (CSN) primarily operates as an integrated

steel producer in Brazi ... No long term chart available.

Buy on pullback below 34.

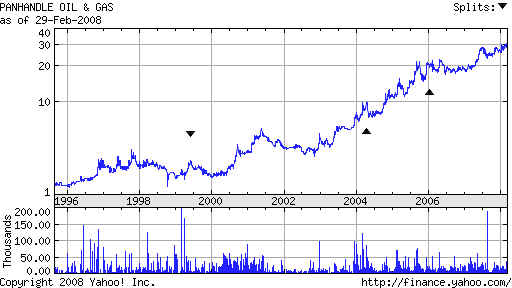

165 PHX Panhandle Oil and Gas 30.49 +.49 .35 at 12 mo high OBV-NC ITRS=.20

183 DBC - Commodities-ETF 37.15 -.55 IP21=.45 OBV near NH. ITRS=.26

D-fund will pursue its investment objective by investing in a

portfolio of exchange-traded futures on the commodities comprising

the index, or the index commodities. The index commodities are light,

sweet crude oil, heating oil, aluminum, gold, corn and wheat.

179 SID 37.39 -.88 IP21=.20 ITRS=.41 OBV at NH running.

Companhia Sider?rgica Nacional (CSN) primarily operates as an integrated

steel producer in Brazi ... No long term chart available.

Buy on pullback below 34.

165 PHX Panhandle Oil and Gas 30.49 +.49 .35 at 12 mo high OBV-NC ITRS=.20

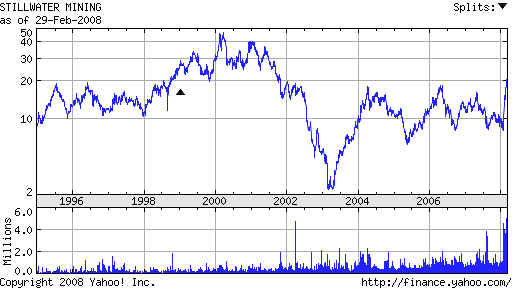

69 SWC Stillwater 20.53 +.67

at NH and OBV confirms. B12 B20

Stillwater Mining Company engages in the development,

extraction, processing, refining, and marketing of palladium,

platinum, and associated metals in Montana, the United States.

Please see my Blog about platinum.

http://www.tigersoftware.com/TigerBlogs/02-24-08/

69 SWC Stillwater 20.53 +.67

at NH and OBV confirms. B12 B20

Stillwater Mining Company engages in the development,

extraction, processing, refining, and marketing of palladium,

platinum, and associated metals in Montana, the United States.

Please see my Blog about platinum.

http://www.tigersoftware.com/TigerBlogs/02-24-08/

16.5 had been high.

16.5 had been high.

---- SHORT SALES: ----

Stock Close AI/200 IP21 OBV Confirming --------------------- ------- ----- ---------------- ACMR 8.57 +.02 93 -.30 yes at NL confirmed by OBVCACB 10.16 -.23 60 -.35 yes at NL

CBEY 16.39 0.43 93 OBV at NL

LNET 9.31 -.30 91 IP21= -.40 yes at low.

See Blog to be done 3/2/2008 --

Mostly stocks above their rising 50-day ma are listed here. BF= below falling 50-day ma

Positive Accumulation Consistency for the last year.

199 DUC 11.02 -.20 ITRS=.14 IP21=.07 H=11.02

198 KTEC Key Techn 35.31 -.58 ITRS=.10 IP21=.25 H=38.8

198 TRNS 7.43 +.50 ITRS=.12 IP21=.35 H=8.03

191 KEQU 17.78 -.22 ITRS=.10 H=20.74

194 BCF Burlingtom Coat Fact 17.20 -.51 Fll back from 12-month high.

193 BBL 64.30 -2.13 just above flat/decl 200-day ma Very Strong OBV H=78.36

192 PBR 117.75 -7.52 OBV strong...IP21=.14 ITRS=.21

This has flat resistance at a set of 4 tops at 119-120. At rising 21-dma

186 IGE Natl Resources 131.75 -5.07 IP21=.50 OBV very strong... H=138.63 Red Sell.

184 SVT Servotronics 19.35 -.05 IP21= .25 OBV is very strong ITRS=.65 H=20 thin

183 RIG 140.51 IP21=.15 ITRS=.14 H=150. OBV is lagging.

183 DBC - Commodities-ETF 37.15 -.55 IP21=.45 OBV near NH. ITRS=.26

179 SID 37.39 -.88 IP21=.20 ITRS=.40 OBV at NH running.

178 ADRE Emerg.Mkt 52.25 IP21=.25 ITRS=.08 H=60.1 just above at falling 50dma

177 ISYS

24.34 -.06 H=28 Recent bulge of Accum, Strong OBV ITRS=.17

177 JLN

8.00 -.15 at falling 200-day ma.

177 BBNK

21.35 -.09 recent bulge of Accum. Very weak OBV at 50-dma

***177 HCH

165.52 -3.98 Thursday's high at 170 was confirmed by strong OBV and

IP21>.70

***177 GSG

58.41 -.75 near NH PBV confirmed. IP21=.25 ITRES=.22

175 MOS

111.30 -1.70 Reached upper band. Falling back. IP21=.10 Hot group.

173 FCX

100.86

-5.71 H=120 OBV NH

.. looks like right shoulder.

***173 NGT

28.47 +.19 H=29 Recent bulge of Accum. IP21=.35 OBV very

strong. Thin

173 EBIX

76.00 +1.00 Weak OBV IP21=.60

ITRS=.20 Testing H=77.62

172 DNR

31.89 -.78 IP21=.20 OBV at NH ITRS=.28 Back to the old

highs.

170 DBE Power Shares Energy 38.57

-.18 OBV at NH... IP21=.37

ITRS=.20

170 AZS Ariz Star Res

18.28 -.12

previous bulges of accumulation and IP21>.50 . Very thin.H=19.5

167 GGB

32.77 -1.04 34.5=H Strong OBV IP21=.15

167 CF *fertilizer

122.08 -4.14 131=H OBV confirmed high. IP21=.19 ITRS=.30

166 ATW

93.09 -5.26 105=H OBV is strong. IP21=.13

164 EWZ Brazil

83.53 -4.67 H=88.77 OBV is strong IP21=.15. False breakout.

==================================================================================

===================================================================================

======= At New High or Close ========-

Necessary conditions

AI/200>140

IP21 (Current Accum.)>.25

AI/200=>140

confirming OBV

Itrs>.05

There are very few stocks that

meet this conditions.

Bearish = NNC - S9 - IP21 on new Stock

high closing.

IP21 bulge - over 45

AI/200

Symbol

Close IP21

NH High/OBV ITRS

-------

-------- -----

------

---------------- -----------

141 AGT

Apollo Gold 0.68

CPS

Buy out

165

PHX

Photoectron Corp 30.49 +.49 .35 at 12 mo high

OBV-NC ITRS=.20

new issue SD

37.64

69

SWC

Stillwater 20.53 +.67

at

NH and OBV confirms. B12 B20

16.5

had been high.

VLNC VLNC

3.67

+.16

=======================================================================

Table 4 ======= BUY B12 at 12 mo highs ========

AI/200 should be at least 100.

DBA ETF=Commodity 41.56 -.73 IP21=.48 NH yes

SWC Stillwater 20.53 +.67 at NH and OBV confirms. B12 B20

16.5 had been high.

Best - short Only Stocks also with an IP21<-.09 and over $5.

AI/200

With the market down already 8% from its highs and a new red

Buy signal from the NASDAQ, I post only the stocks here that

a considered "bearish" among the stocks that have recently made

a new lows. We would also want to look at high volume new lows,

because these might be special situations.

There is good evidence that the stocks when an AI/200 score less

than 62 are weaker. Tax loss selling is now a bearish factor for

them.

======================= Bearish and New Lows ============================

AI/200 should be below 62 here. Stoch should be below 21-day ma.

Stock Close AI/200 IP21 OBV Confirming

--------------------- ------- ----- ----------------

BONT 5.72 15 -.14 yes

ETM 11.17 17 -.25 yes

CSGS 11.35 34 -.12 yes

AGYS 12.67 11 -.22 yes

NSM 16.47 26 -.21 yes

BYD 21.09 37 -.25 yes

XING 6.62 27 -.04 yes

C 23.71 12 -.04 yes

See bearish charts shown on Blog for March 2,2008