TigerSoft News Service 2/4/2010

TigerSoft News Service 2/4/2010

Will Obama Create Another 1937-Like CRASH?

If Obama Keeps Listening To Self-Serving Bankers,

The Risks of A Severe Decline Are VERY HIGH.

The Lessons of The 1937 CRASH!

Obama, Read Some FDR History!

by William Schmidt, Ph.D.

Author of TigerSoft's Insider Watch Software

http://www.tigersoft.com/--3--/Explanation/index.html

http://www.tigersoft.com/--3--/index.html

Peerless Stock market Timing: 1915-2010

http://www.tigersoft.com/Samples/Charts/index.html

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

Obama Should Read A Little FDR History.

Will Obama Make The Same Mistake That FDR did in 1937?

Sure, I know, Obama now says he is willing to have a fight with banks. He says that he

wants a new tax on frequent trading and wants to ban banks from speculatively trading

for their own account. But really, what are the chances of getting a 2/3 vote out of

the Senate? And if Obama behaves as he did with health care, he won't do much

to twist any arms to get whatever bill the conservative Senate Finance Committee

does come up with. So, the market's weakness today - the DJI was down 268 or 2.61% -

may really be due to other reasons, the primary one being that the economy is failing

to continue to recover, because Obama's fiscal policies are mistakenly deflationary,

at a time when inflation and vastly more government job creation is the only answer.

The lessons of 1937 make that clear. Consumers are tapped out. Banks are not loaning

to businesses. The only way the economy can match the market's snappy recovery,

so that a snap-back in the market does not occur, is if the government coninues to

spend and create a million new jobs for all those lost in the last year. Obama has

just made matterns much worse, by saying he will be cutting back government

spending. That foolish pandering to ignorance may be deadly for the stock market.

Sadly, if Obama had done more reading of US economic history, specifically 1937-1938,

| he would not be making this mistake.

A year ago, Edward Harrison of Roubini Global Associates offered a keen insight into

why Obama would fail America in the area of economic leadership. His natural caution

would give a job-creating stimulus a bad name. Being relatively ignorant of economics

himself, instead of explaining and selling the rationale for Keynesian deficit spending,

his early support for a stimulus would be inadequate, passive and unpersuasive. In time,

he would need a much larger fiscal stimulus. But by the time he realizes his mistake,

his first too-cautious measures will have failed and he will be seen as inconsistent

and his leadership jerky and unsure.

"Bloomberg News is reporting that U.S. state governments will begin cutting spending

in order to meet budgetary constraints as the Obama administration’s transfers

to local government will not be enough to offset reveue shortfalls. These cuts will

offset any federal stimulus, endering the $787 stimulus package recently enacted less

effective,...(So,) the Obama administration is caught in some sort of muddle, trying to

fudge between the calls for fiscal discipline from conservatives and the calls for

stimulus from liberals. ...Obama’s nature to lead by consensus, and he has looked for

an inclusive political and economic strategy since he came to office. However...this

middle path ...will leave no one satisfied. Moreover, taking this middle path on the

economic front — some stimulus but not massive stimulus, some tax cuts but also

some increased spending, increased spending now but tax increases or budget cuts

in a few years - is the worst of all outcomes; the economy will not gain enough traction

to get the desired ‘jump-start’... (Thus, the stimulus will ultimately be seen as ineffective.

(Later, if the Obama Administration later attempts to return to Congress for more of

the same after a failed stimulus bill, it will find a more skeptical response."

WHAT

A STUDY OF 1937-1938 WOULD TEACH OBAMA

In early 1937, FDR wanted to gain back Congressional support from

Southern

Democrats who demanded a balanced budget, So, instead of

listening to the

economist Keynes who advocated deliberate deficit government spending

to

create jobs while the private sector was hoarding money (like banks do

now),

he listened to his Treasury Secretary (Morgenthau) and again publicly

declared for

a balanced budget, just as he had in his 1932 Presidential

Campaign.

Treasury Secretary Morgenthau convinced FDR that private investors

considered

federal deficits dangerously inflationary (remembering Weimar Germany)

and the

eventual taxation they would require would be too unsettling for

private investors

to have sufficient confidence to put their money at risk.

Inflation was only 3.6% in 1937. Despite this, FDR fully accepted

the premise

that private capital was the primary source of jobs in the US, despite

its utter failure

in the 1930s. He acquiesced in Morgenthau's notion that the stock

market

had dangerously begun to bubble because it had almost quadrupled

between

FDR's Innaugration and March 1937. He warned that another 1929

Collapse

might happen unless fiscal austerity was shown by the Government and

the

"speculative bubble" of 1933-1937 was pierced. As it

turned our, this was terrible advise.

WPA Murals in Cincinnati and

Cleveland. Were They A BoonDoggle?

Hardly. For 73 Years, travellers have stopped and looked and admired them.

FDR's 1937 Budget did sharply cut back spending programs. WPA artists

no longer

created beautiful murals and photographers no longer recorded the lives

of

Southern working men. Wilderness camps for young men to shape new

public parks

and fight forest fires were all cut back. Soon, there was another

sharp jump in

unemployment, a drop in business confidence and a disastrous market

decline.

The economy disastrously fell over a new cliff. Unemployment

jumped from 14.3%

to 19.0% in 1938.

Manufacturing lost 3 years of gains and sropped back to 1934 levels.

But FDR was was not an ideologue. In 1938, FDR saw his mistake

and began spending

programs again without heeding short-term budget constraints.

He listenened to Keynes

not his Treasury Secretary or conservative Democrats. The

market roared back

despite bleak international news. In February 1938,

Congress passed a new AAA bill

which authorized crop loans, crop insurance against natural disasters,

and gave large

subsidies to farmers who cut back production. On April 2, 1938,

Roosevelt sent a massive

new spending program to Congress. $3.75 billion was then split

between PWA, WPA,

and various relief agencies. Other

appropriations raised the total to $5 billion of new

government spending early in 1938. The economy then turned around and

recovered.

( Source: http://en.wikipedia.org/wiki/Recession_of_1937%E2%80%931938

)

"In the fall of 1937, an economic recession struck the American economy.

Although not as severe as a depression, the recession was worsened by

Roosevelt’s unwillingness to spend money, as the government at

that time was already millions of dollars in debt. The economic

downturn caused a rift within the Roosevelt Administration; some of FDR’s advisors,

like his Secretary of the Treasury, Henry Morgenthau, Jr.,

urged

him to balance the budget and abandon the course of great government expenditure as had

been taken earlier,

while another group, headed by Harry Hopkins of the WPA, urged Roosevelt to unbalance the

budget by

running a deficit and increasing government spending. Although

the former group believed that balancing

the budget would increase spending in the private sector, the latter faction was backed up

by the already- -proven-successful policies of John Maynard Keynes. Keynes,

who attributed the 1937 recession to

the American economy’s lack of preparation for an increase in investment (as public

relief programs helped

more Americans get on their feet again, investment and spending altogether increased),

had, up to that point,

theorized on the effictiveness of government spending in

reversing a depression and making up for the lack of

investment in the private sector of business .... Keynes, who

also believed that copious government expenditure would cause a re-stimulation of the

economy, had a large impact on both Roosevelt and the

advisors who helped coach him out of the recession of 1937, and although FDR was at first

reluctant to spend

more money in order to rebound from the events of 1937, he eventually recognized the need

for more

government expenditure, as called for by Keynes. Thus, in March

1938, Roosevelt announced a plan for a

new federal outlay agenda, which, within the course of just months, would help to

significantly improve

America’s economic situation..." ( Source:

http://harwich.edu/depts/history/HHJ/Clark.html

)

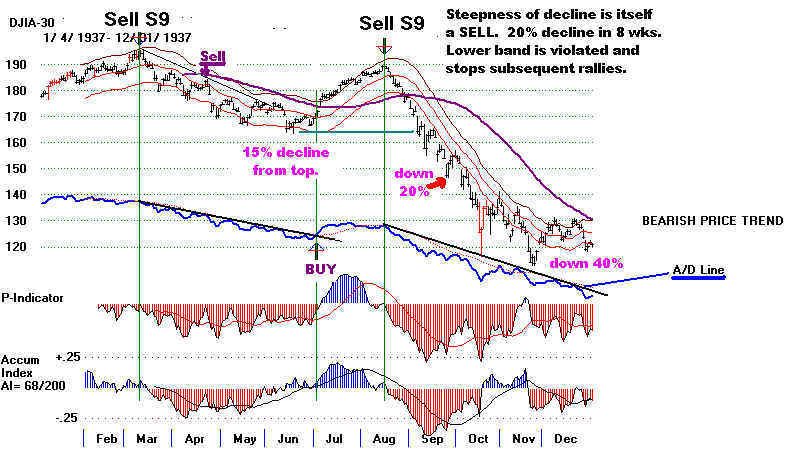

The stock

market felll 40% in the Fall of 1937. This was the second biggest six-month

decline in stock market history. The decline took place in

only 14 weeks. Keynesians

say FDR's policy choices caused this second Depression and

stalled the 1930s' recovery.

Of course, gathering war clouds in Europe and Asia also

worked to unsettle the stock

market. Asian markets for American goods were badly

disrupted when China was

brutally attacked by Japan on July 10, 1937. This quickly

led to Japan's attack on

Shanghai in August 1937and continual warfare until l945. In

Europe, Hitler was

militarily

preparing for the Anschluss Österreichs (the German

annexation of Austria)

and then the German take-over of Czechoslovakia in March 1938 and

October 1938, respectively.

Peerless Sell S9s Mark Tops in 1937

While a

world war is not on the horizon, the Obama Administration says the

chances for

an attack by Al Qieda in the US are high. But this is not where the

eerie

parallels between now and 1937 are.

OBAMA

IS MAKING THE SAME MISTAKES FDR DID IN 1937

The danger

centers on Obama's shifting away from a progressive jobs-creation

agenda to

placing higher priority in fighting wasteful spending and a "pay-as-you-go

fiscal

policy. Obama seems to believe he must be still more conciliatory to

his party's

conservatives, especially the fiscal Conservatives in his party. Liberals

and

Progressives he feels he can disregard. So, despite criticisms from liberals like

Nobel

prize-winning Krugman, Obama is now talking about a spending freeze

on

non-military spending. This is dangerous orthodox budget balancing in the middle

of a near

Depression. He is again accepting Bankers' ideology as omniscient

and not

self-serving. His Wall Street advisors still rule him. He is too inexperienced

to see how

badly he is being served. In college, he should have studied some

American or

European history somewhere along the line. European governments

everywhere,

from 1929 t0 1932, made the Depression worse by following this approach.

Hoover was

no better in the US.

BANKERS'

SELF-SERVING NONSENSE

I wrote my

dissertation at Columbia about the FINANCIAL ORTHODOXY approach's

failure in

England's "locust years, 1919-1940. The English economist. JM Keynes,

had warned

that this fiscal ideology, laudable as it sounds, was suitable only when

private

economies were strong and jobs plentiful. Balancing the budget, at all costs,

and a

"make- the-pips's squeak" cutting back of government expenditures was

proven

wholly inadeuate and dangerous in the 1930s, though is was the othodoxy

and view

put forth by bankers worldwide, the Bank of England, Chancellors of the

Exchequer.

Chancellors, I showed in my dissertation, also wanted to limit the chances of any

spending minister

becoming too popular and thereby challenging the Chancellor's

normally

pre-ordained rise to the Premiership. It was this orthodox balance-the-budget,

cut government

spending and make the Dollar strong that was always, ALWAYS,

the view

set forth and advocated by US Treasury Secretaries to Presidents,

Republicans

or Democrats. "Defend the pound."Or "Defend the

Dollar" in the US.

Fear

inflation. Government is a barren whore. Only private-for-profit jobs are

real.

Maintain

the Pound (or Dollar) as the most important international currency. Secure

London or

New York as then center of international finance.

For big

bankers in New York and London, this orthodioxy was and is clearly

a

self-serving set of arguments. It is propaganda to defend the richest class

and deny others a

chance to rival them. Among the hidden agendas, not the least

imprtant, was

that bankers wanted to make their debtors pay back their loans in

deflated (worth

more) dollars.

Considering how

Obama has, despite his public rhetoric, given bankers hundreds

of billions of

taxpayers' dollars in TARP, always allowed the outlandish bonuses

to their

executives and then has [ermitted to stand the sixty-five billion more in AIG

counter-party

payments which Obama's Treasury Secretary-To-Be tried for months

to conceal from

the public, so noxious was the deal, So, I am not surpised now,

in the slightest

that Obama is completely failing the American people again as he

promotes and

falsely legitimizes the bankers' self-serving, budget-balancing orthodoxy

The obvious

problem with this approach now and in the 1930s was that economic

fear was

too high. Confidence in main steet was too low. Private banks and investors

hoarded or

speculated their money and savings. They did not put anywhere near

adequate amounts

money to work in businesses that would create jobs. And so

high umemployment

persisted. That bankers never questioned themselves and

their smugly

self-serving orthodoxy suggests they are not worthy of any government

money. A

national. goverment-owned bank could not help but improve the economy

at far less cost.

"Greedism" must be ended.

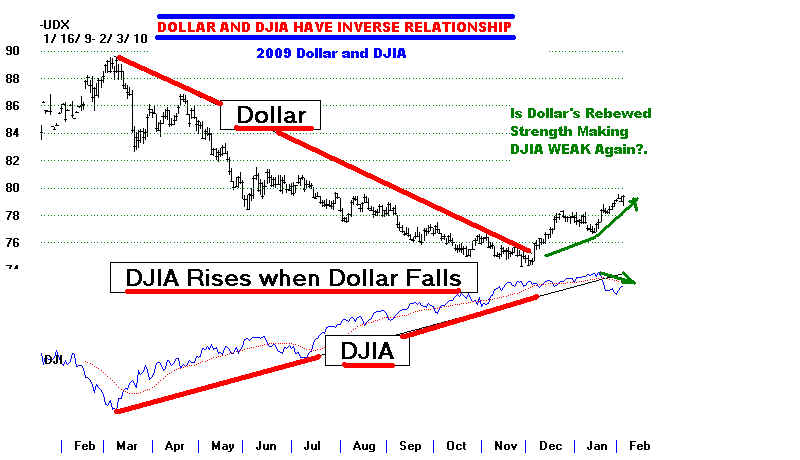

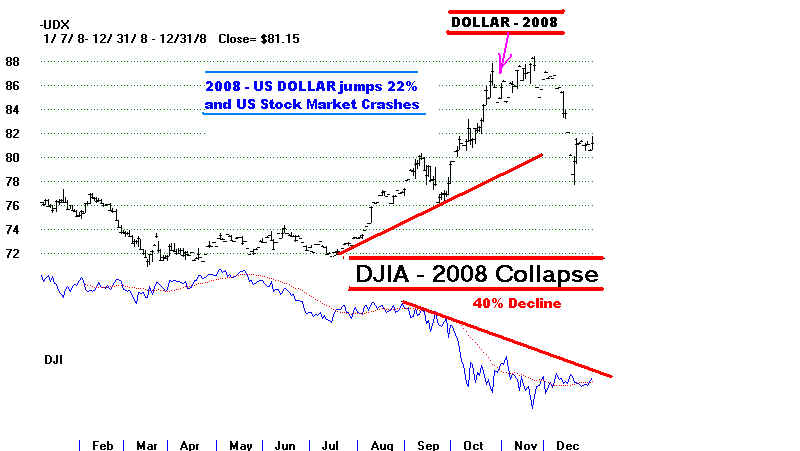

That defending

the Dollar as bankers want to an extreme is dangeorus for the

economy AND the

US Stock Market. See the inverse relationship between the

Dollar and the

Stock Market in 2008 and 2009. how the stock market has gone d

----- DOLLAR'S 2008 RISE ACCOMPANIED BY

US STOCK MARKET COLLAPSE-----

----- DOLLAR'S 2009

DECLINE ACCOMPANIED BY US STOCK MARKET RALLY-----