WHEN TO SELL AN EXPLOSIVE SUPER STOCK

7/17/2009

(C) 2009 William Schmidt, Ph.D. www.tigersoft.com

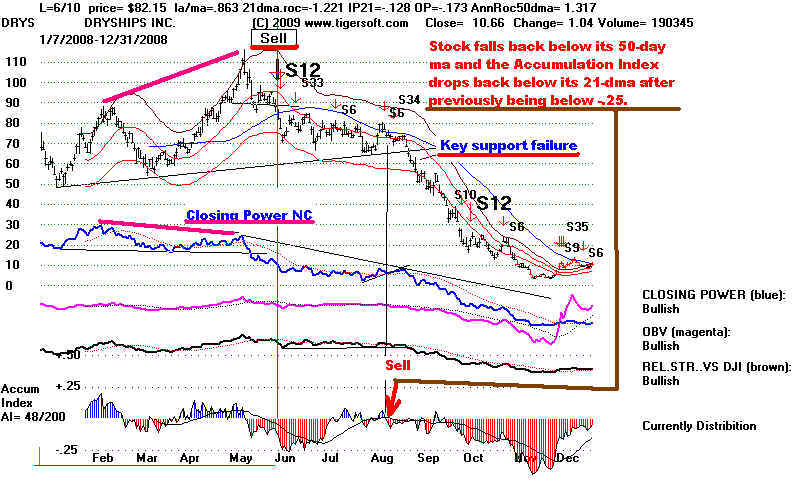

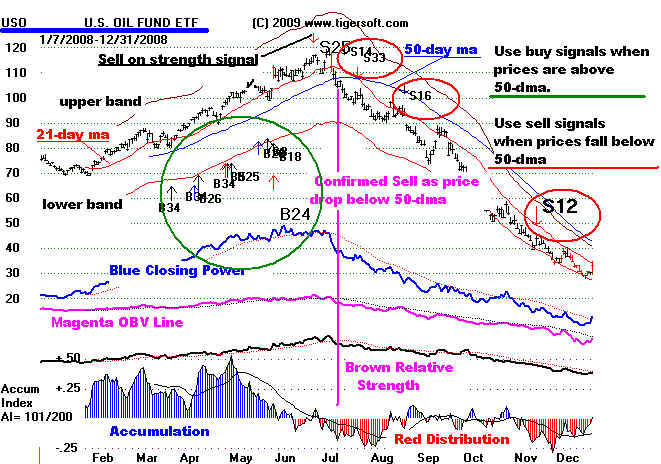

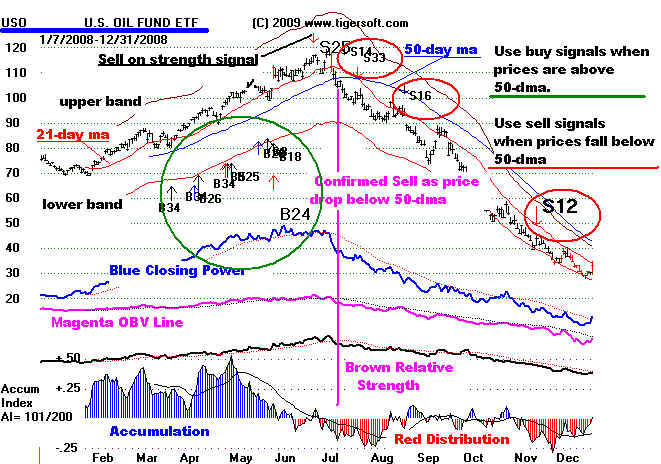

Sample 2009 TigerSoft Chart.

Note that the right side of the charts are unavoidably cut off.

WHEN

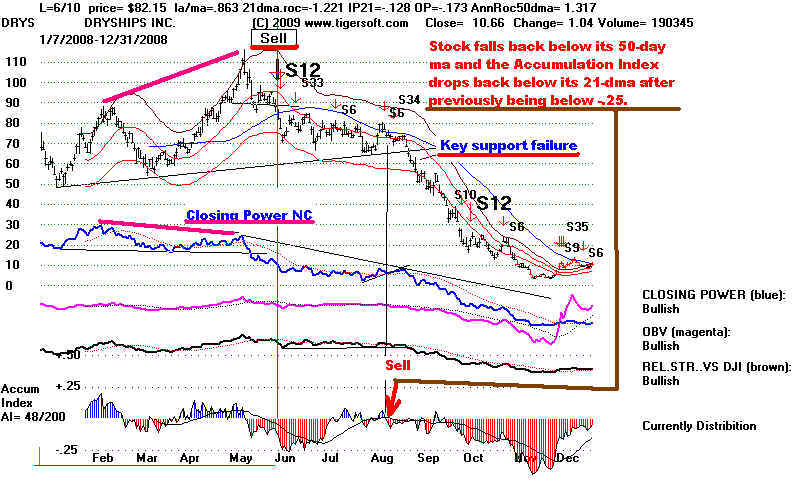

TO SELL: The Case of DRYS

Let's review the most important set of conditions

that should cause you take profits,

and sell an "explosive super stock".

Take the case of DRYS. This is an extreme case.

The stock had risen from 30 to 130 in 7 months.

The first clue of a top was (red) high

volume "churning" as the stock rose

past 110. This should have made us suspicious

that the stock was being pushed up past 100 to

run in shorts, who were already down a

lot of money. TigerSoft's price bars turn red

when there is usual volume. Breakouts

often bring red price bars. Such red bars

are usually bullish. Bearish, on the other

hand, are red price bars not taking place on a

breakout but occurring after an extended

advance. The decisive event causing us to sell

is the breaking of the 50-day ma with

the Closing Power in a downtrend and below its 21-day

ma along with the Accumulation

Index no longer positive.

The chart above

shows that a complex distribution top pattern emerged over 100.

The criss-crossing necklines were soon violated. Very

significantly, the (blue) Closing

Power broke its uptrend. Realize that after a

long period when both Opening and

Closing Power are rising, as was true for much of 2007 with

DRYS, we can often see

the top quite clearly by watiching for the Closing Power to

break its uptrend. The public

(judging from the rising Opening Power) is still bullish.

But the professionals who had

been buying changed their minds. They shifted

to selling after the opening; they had

a lot of profits to take.

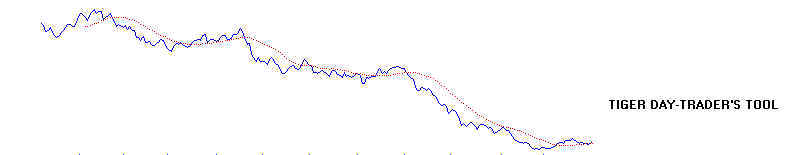

There were additional warnings that DRYS should be

sold. Below a small, but

bearish, head and shoulders top has been circled in

the stock's Closing Power.

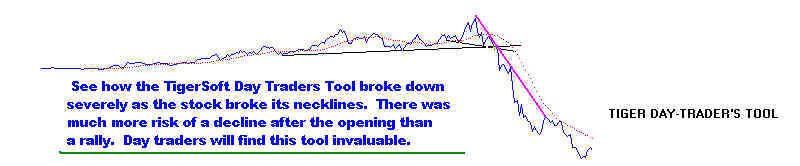

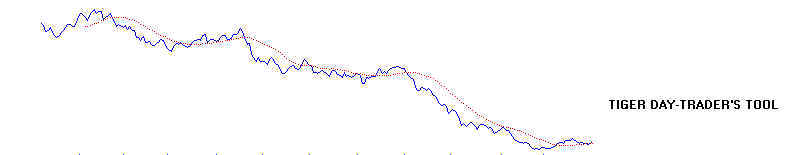

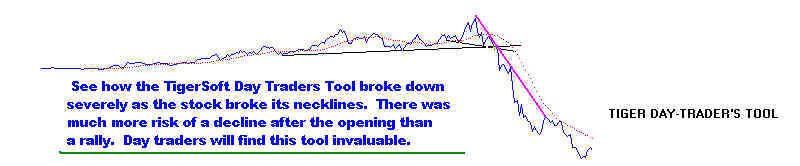

In addition, the TigerSoft Day Traders' Tool quickly

fell to new 12 month lows after

the stock broke its 50-day ma. This shows how

much more downside action there

was after the opening than upside trading. The

Day Traders' tool plots the cumulative

difference between the day's high minus the opening

with the day's opening minus

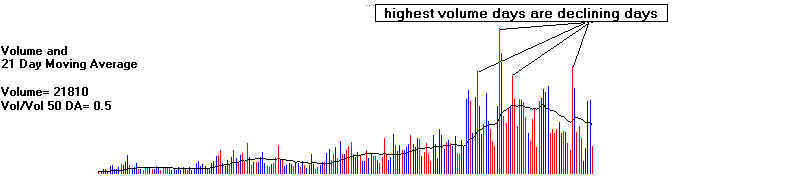

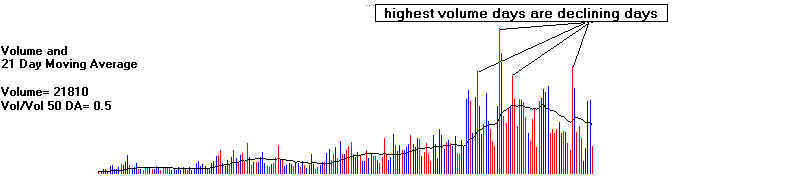

the low. And there were more bearish

signs. Volume was heaviest on down days as

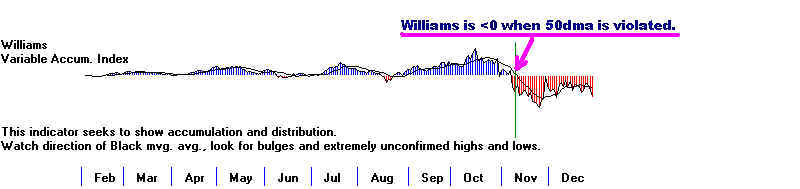

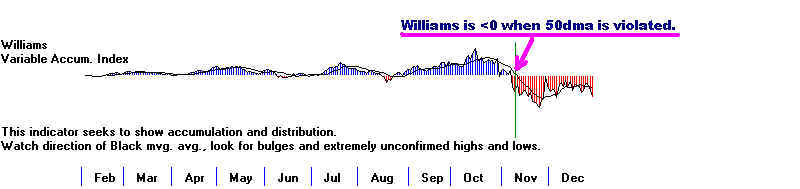

the top formation was made. The Williams

Oscillator was quite negative as the stock

violated its 50-day ma. Finally, consider how

far and fast the stock had risen in less

than a year. There was very little technical

support as prices started to fall.

The

temptation is enormous to buy back at lower prices a stock in which one has

made a lot of money. But look

at the warning signs a stock usually gives if it has

not safely bottomed. DRYS

illustrates this. Look at all the warning signs it gave

that the decline was not over.

By the end of the year the stock had fallen from 110

to below 10, losing more than 90%

of its value. Simply waiting for a confirmed move

over the 50-day ma would have saved

people here a lot of money.