3/8/2010 Study

17 of 20 brought gains of more than 15%, usually much more.

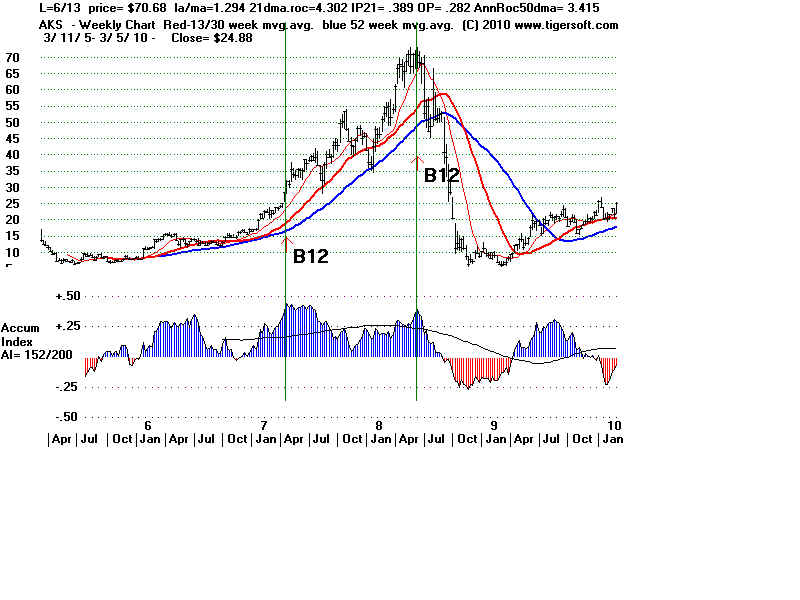

Where the Buy occurred after a long advance, there was much more likelihood

of a loss or a pullback for 3-6 months before a profit could be obtained.

Examples: AKS, AZO (2)

But not always. Examples: A, AAPL, ABX, AMAG, AUXL (5)

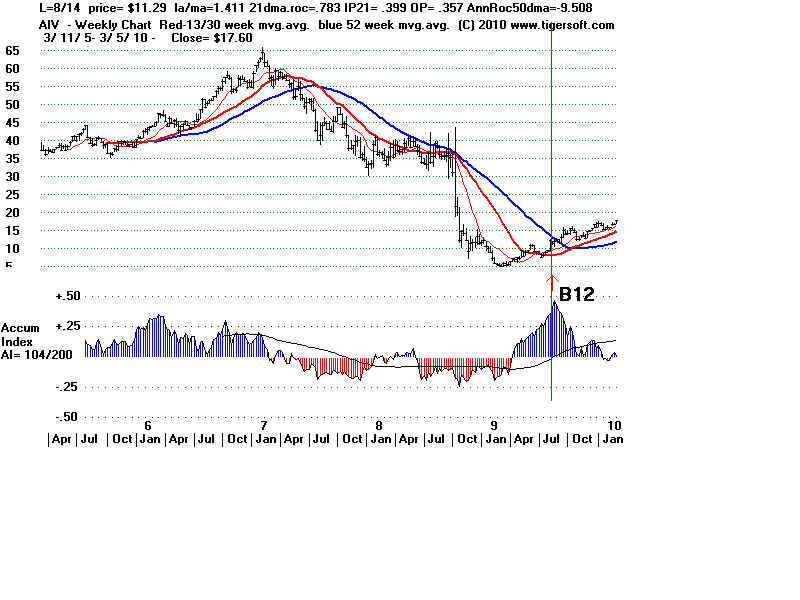

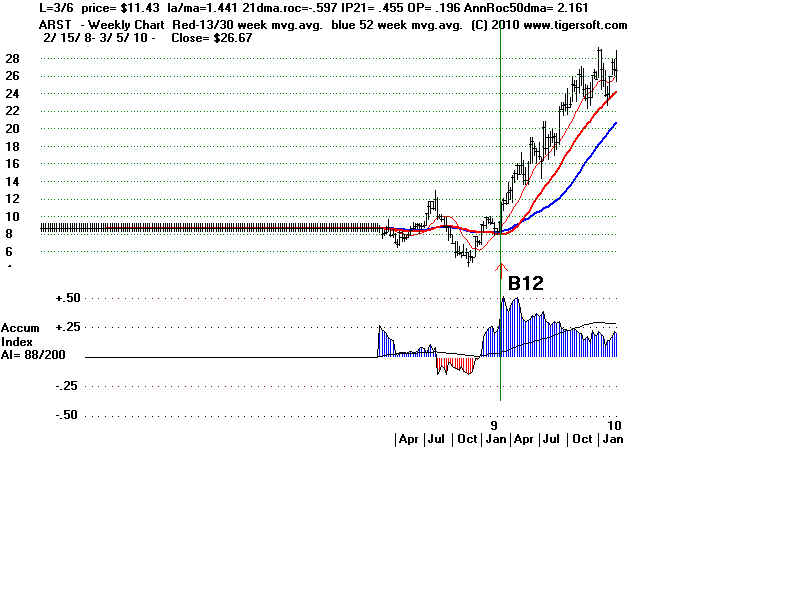

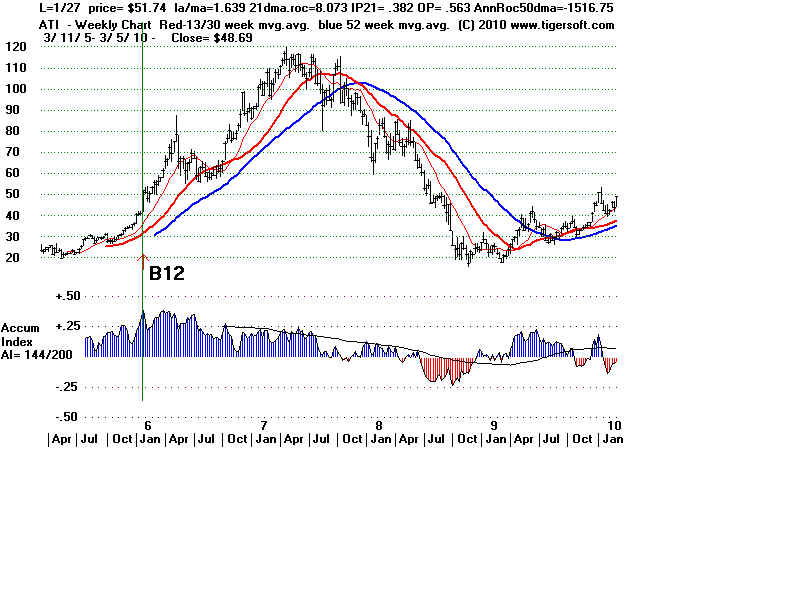

Where the Buy occurred in a base or not much above price levels

from a year ago, the AI Bulge Buy was most reliable and also produced

much bigger gains. Examples: A(2nd instance), AA, AAPL (2nd instance),

ACL, ADBE, AEM (2 cases), AIV, AKS, ALXN, ARST, ATI, ATVI (12)

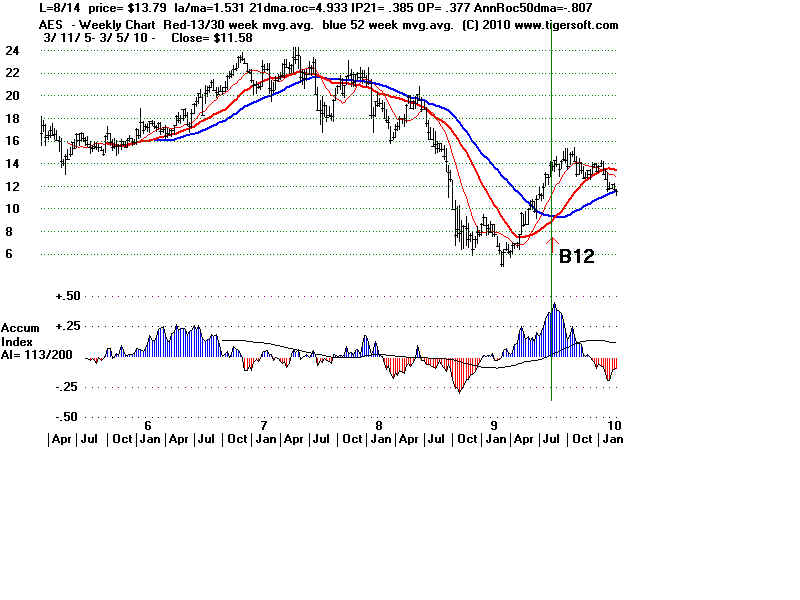

Apparent failures when not over-tended: AES (1)