(C) 2010 William Schmidt, Ph.D.

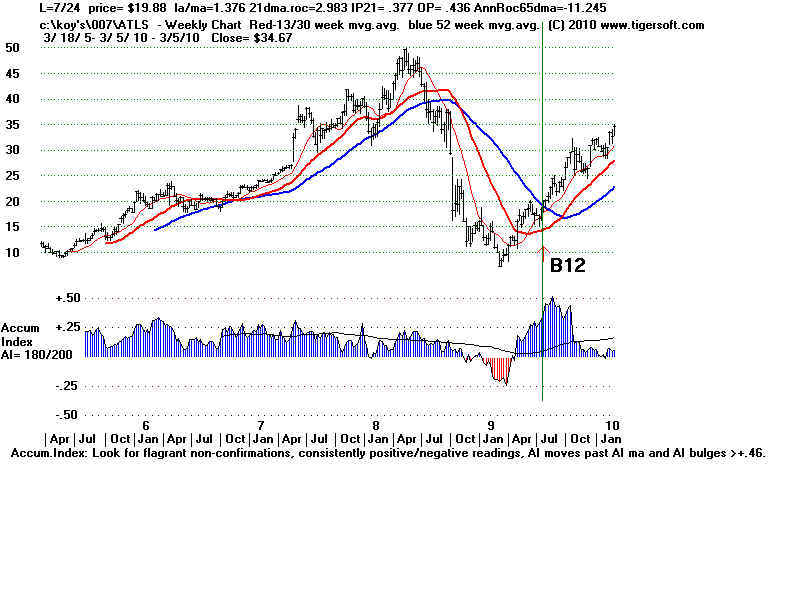

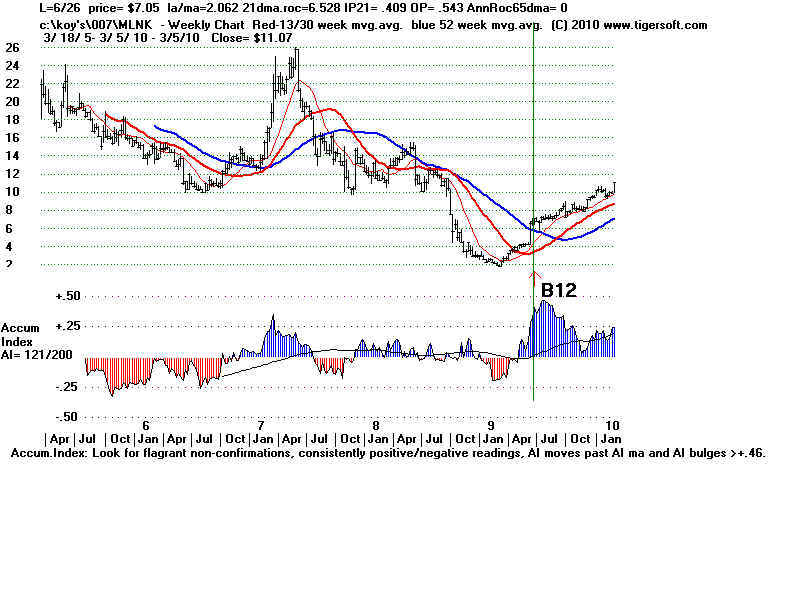

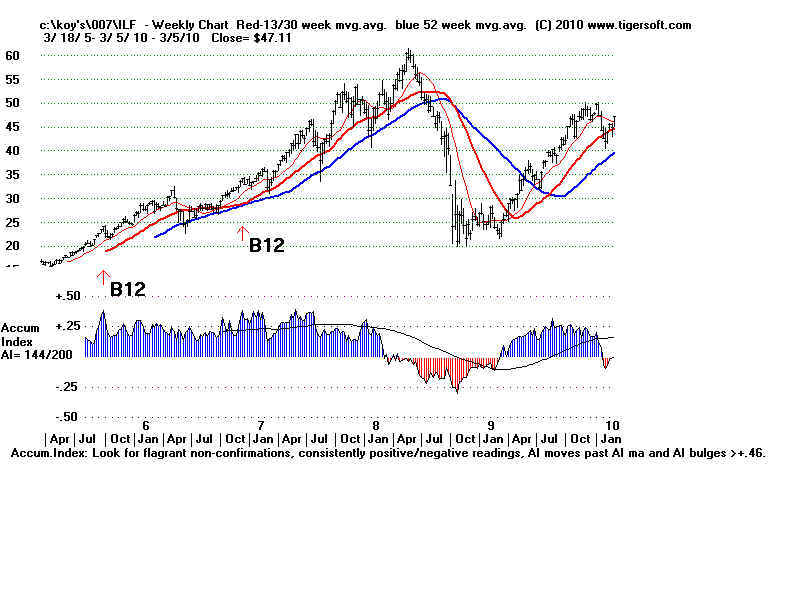

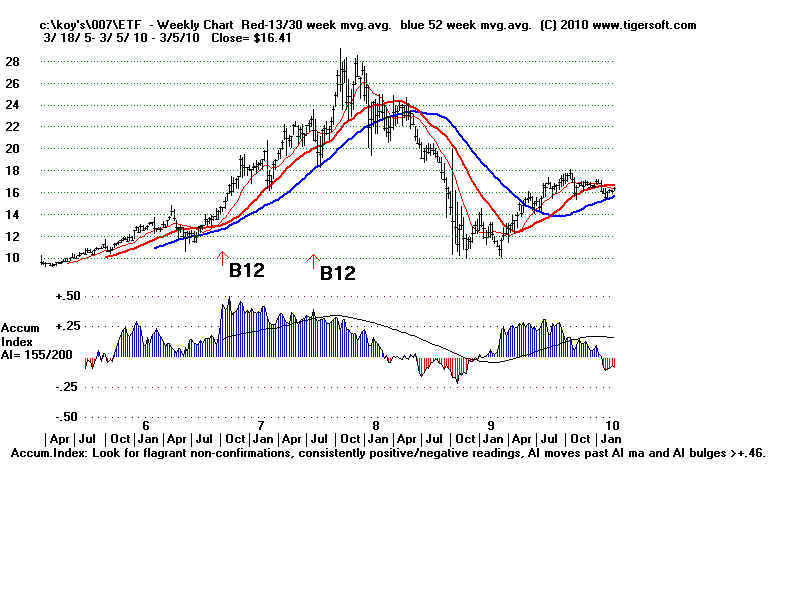

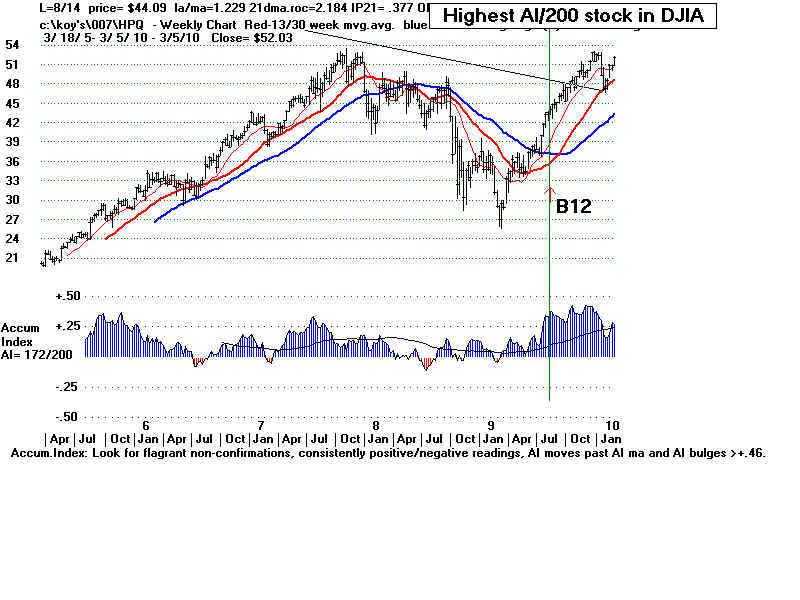

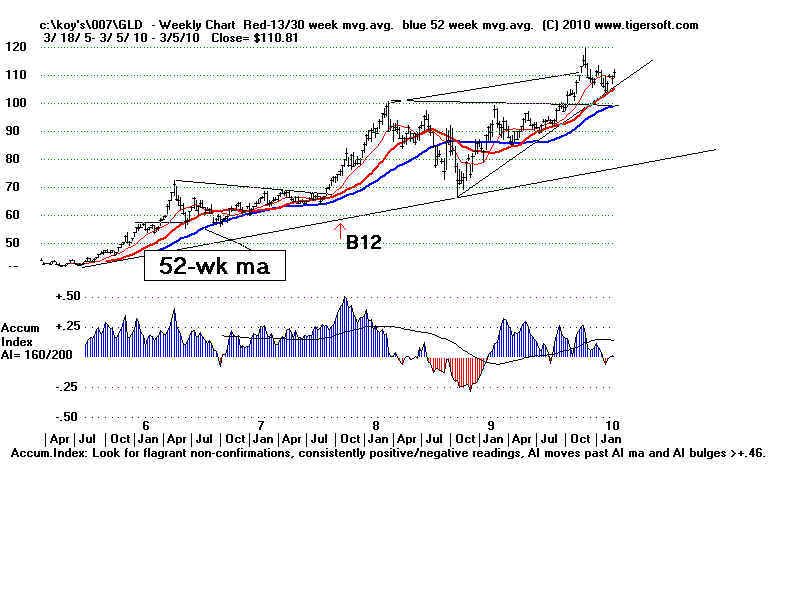

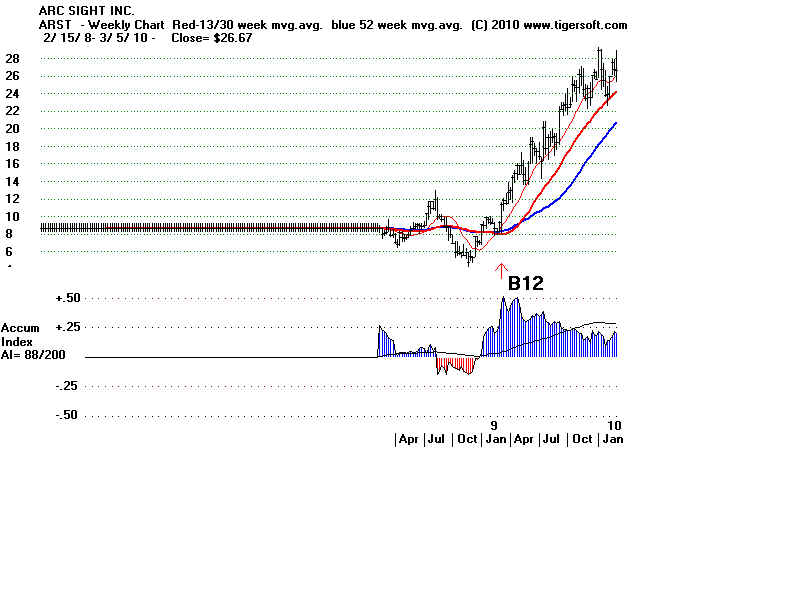

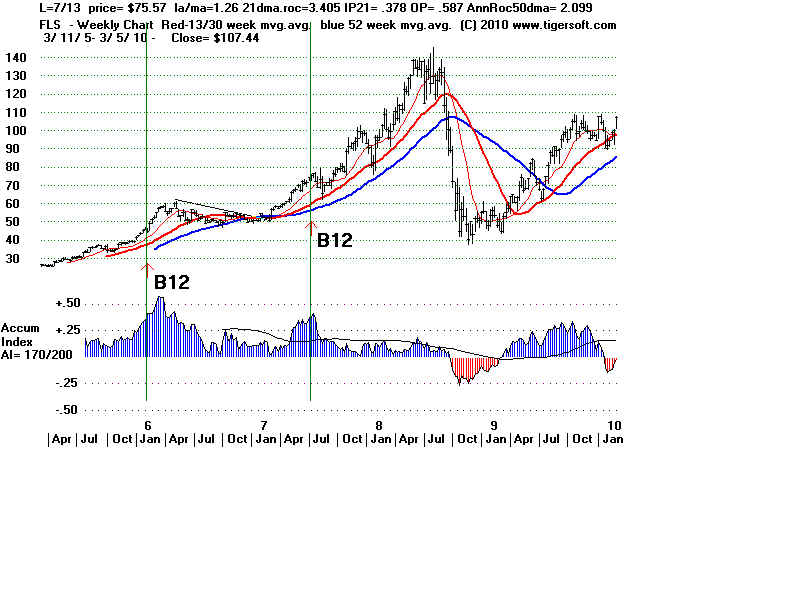

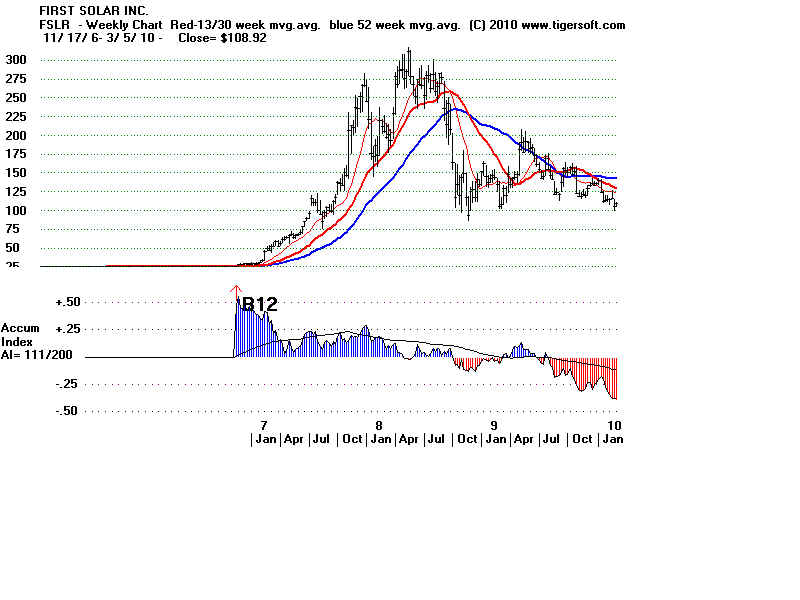

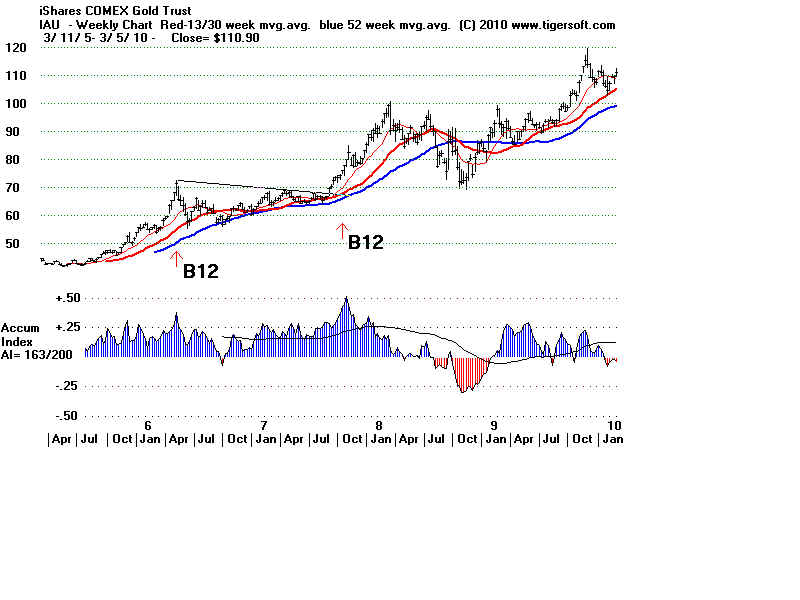

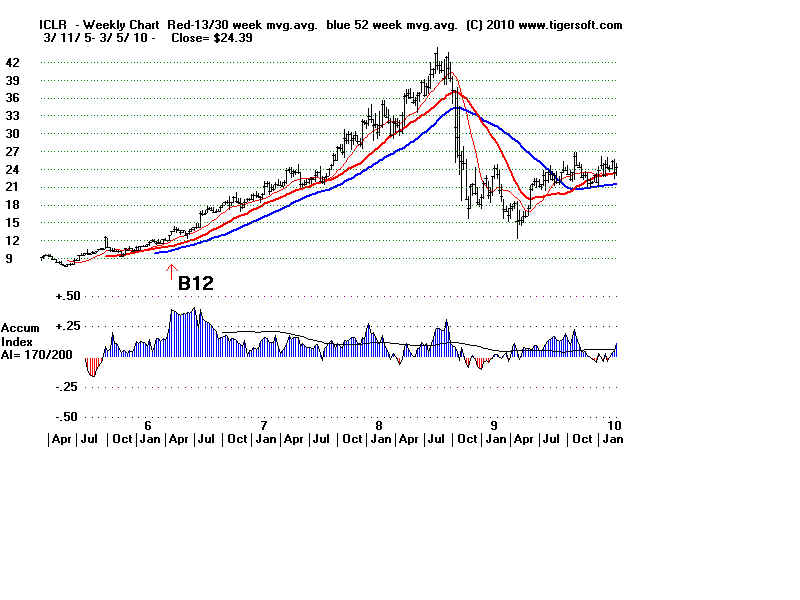

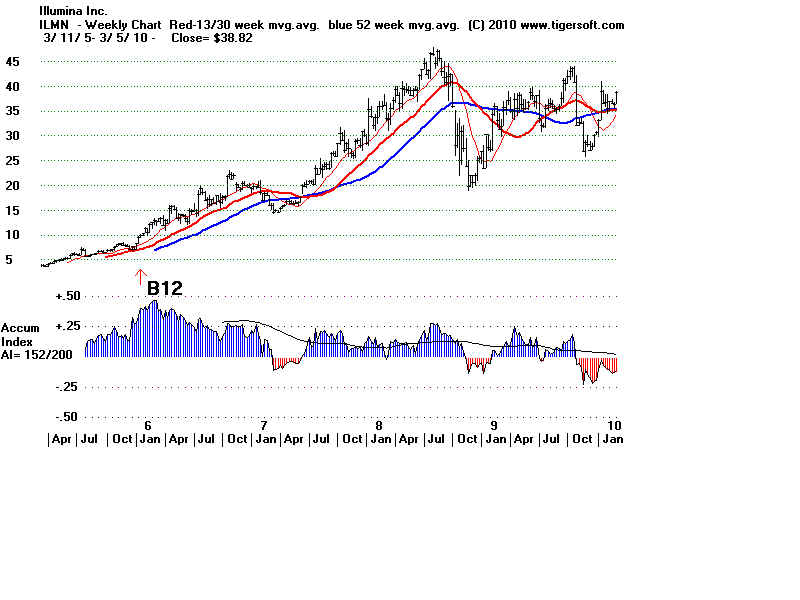

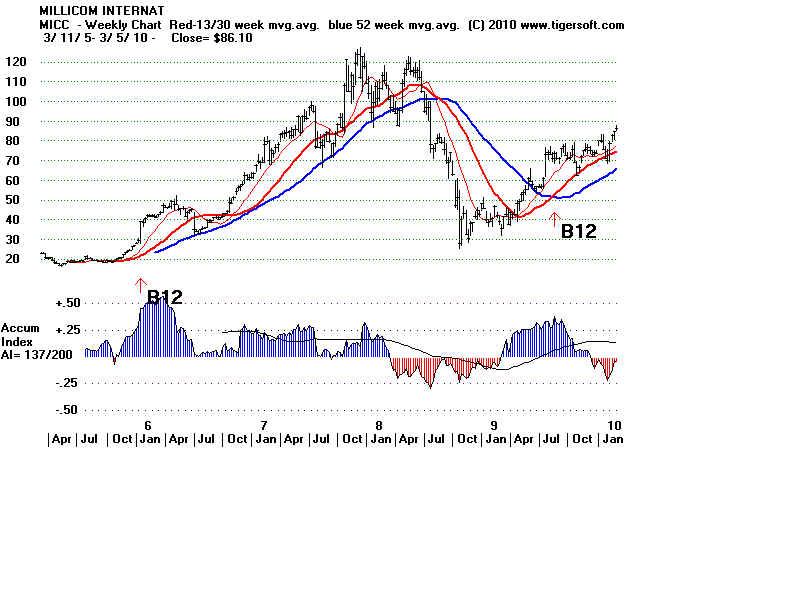

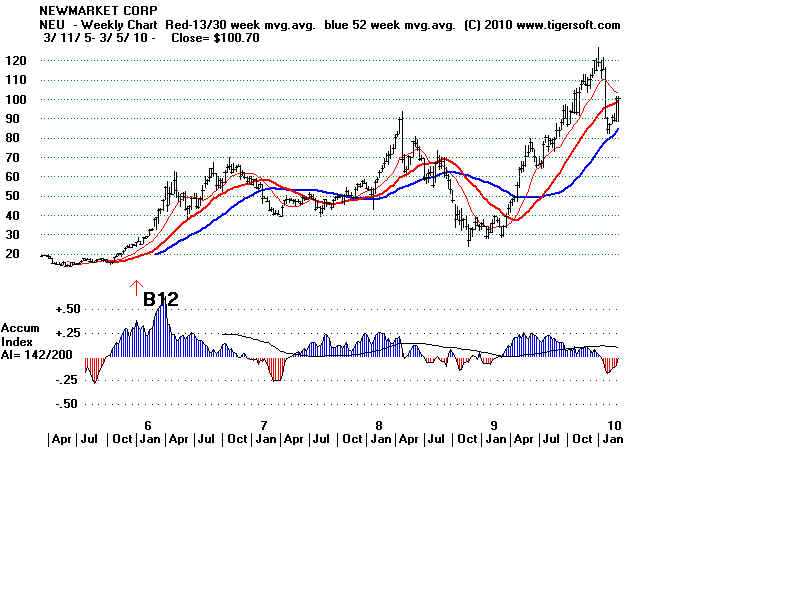

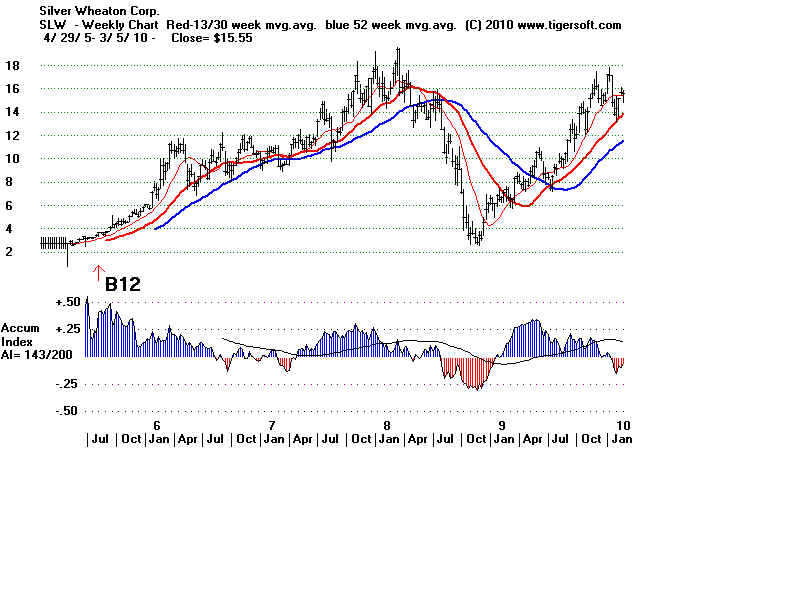

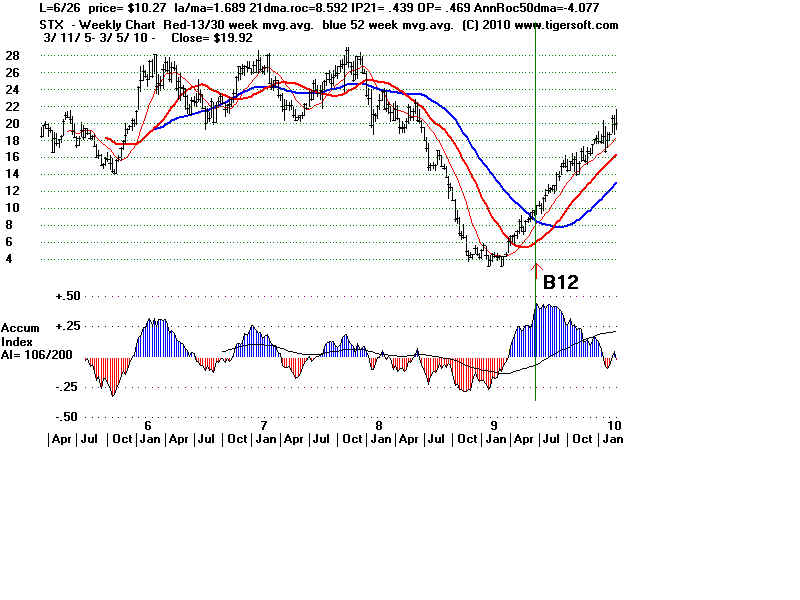

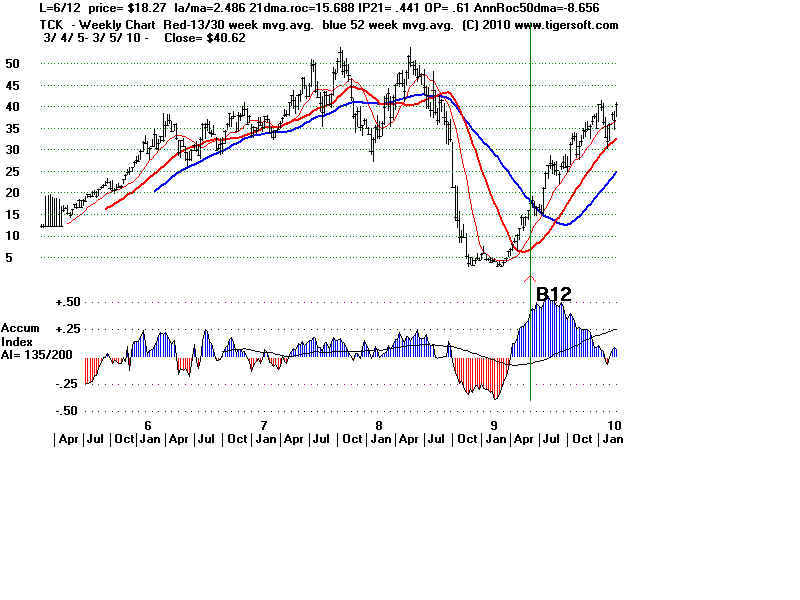

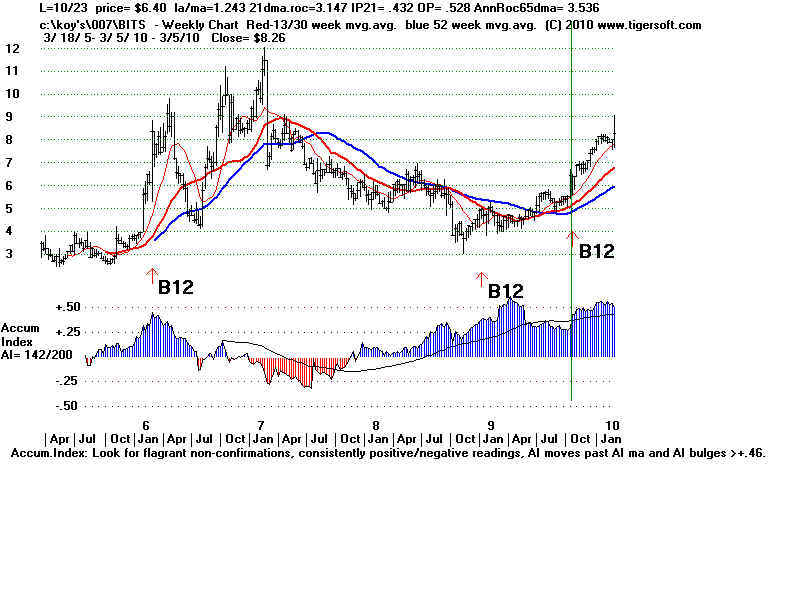

Study these cases. See how they keep rallying up off the rising 13-wk and

30-wk mvg. avgs after a Buy B12 launching.

These new Weekly Buy B12 were reliably very profitable.

Bold red 30-wk ma - If prices are over-extended, it is often useful to

SELL when 30-wk ma is violated, especially if Accum Index is negative.

Blue 52 week ma. This is KEY SUPPORT. It must not fail or turn down.