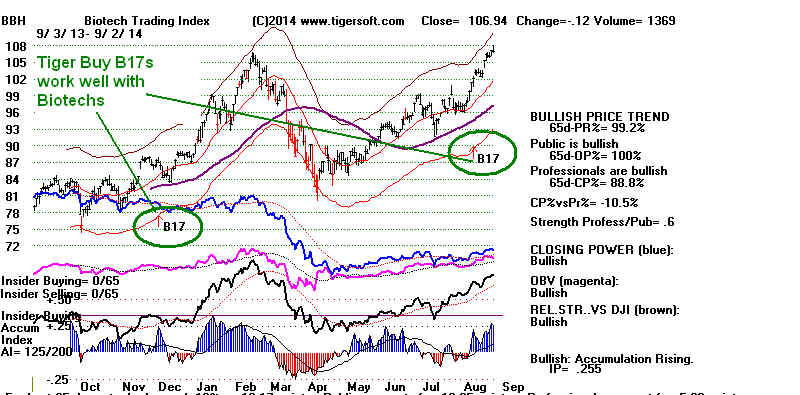

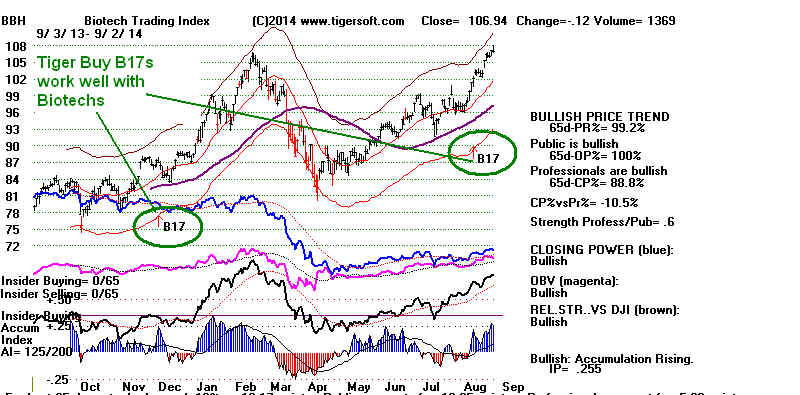

A Study of A Sample of Buy

B17s

in 2014 on

Biotechs

Tiger Buy B17 - Sudden Rise in "IP21",

TigerSoft's Accumulation Index

I spoke today with a former stock broker who has been a regular Tiger customer

and Hotline subscriber for more than thirty years. As the manager of a large

office of stock brokers, his words were most important. His view is that if

someone really wants to make a lot of money in the stock market, he or

she should concentrate on individual stocks. Peerless is great he says,

but we should also be looking for bulges of Insider Accumulation and watching

what Professionals are doing using the TigerSoft's charts.

I was pleased he said this, because I wanted to ask him about the value of

the new research I am doing for this Hotline on the Tiger Buy and Sell

(not Peerless) signals for individual stocks. He was glad to see it. It

would help others.

In this connection, I posted research this weekend of Tiger Buy B19s -

relentless upward momentum signal. I showed that certain accompanying

key values gave these B19s success rates of 80% or higher.

Tonight, I want to post the preliminary results for Tiger Buy B17s -

sudden increases in Accumulation (IP21). You can see the sampling

methodology I used. The success rate here also is close to 80%,

especially, when the Buy B17 occurs while the stock appears to

be innocently sitting in a base. To show this, I want to make a list tonight

of the B17s in the past 11 months with biotechs. I will just go through

the biotechs we have on our data page and show the first 25 B17s.

Sampling this many cases gives us a reliable result. You can readily produce

the B17s exactly like I show here using the commands:

PEERCOMM + Charts-2014 + Daily Stocks + All Stks + Signals1 +

Display User Selected TigerSoft Signal + enter B17 + OK + 2 (right side

of keyboard to go to next stock. Num-lock must be OFF.)

Table 1

Buy B17s in Biotechs:

November - August 2014

la/ma 21-dma

Price

Next Low

Next High

ROC

---------------------------------------------------------------------------------------------------------------------------

ACAD

4/23/2014 .941

-2.261

20.55

18.05

26.61 5 months later. Success

ACHN 11/22/2013

1.174

2.112 3.07

4.12 in six weeks. Success

ACOR 6/5/.2014

1.102 1.165 34.96

18.45

Loss

ACRX 11/13/2013

1.034 - .518

7.82

-------- 12.69 in two months

Success

ACST

11/27/2013 .688

-5.18 1.20

------- 1.50 in 6 weeks

Success

AEGR

1/8/2014 1.074

1.092

73.23 56.54

Loss

(At falling 65-dma resistance. Avoid these.)

AFFX

12/23/2913 1.066 1.414

8.85 7.90

9.75

Success

AFFY

12/27/2013 .946

-.142

0.79

-----

1.18 in 5

days Success

AGEN

12/11/2013 .993

.093 2.54

------

5.10 in 19

weeks Success

ALNY

5/19/2014 1.077

.972

58.26

------

70 in a month

Success

ALXN

12/23/2013 1.051

.921 130.90

------

183 in 2 months

Success

AMAG

1/15/2013 .988

-.123

22.99

19.97

Loss

(Just bekow 65-dma resistance. Avoid these.)

AMED

6/27/2014 1.247 2.404

17.46 15.49

22 in 5 weeks

Success

(Best to wait for a pullback and CP hook up when stock spikes up like this.)

AMGN 12/9/2013

1.000 .31

113.99

129 in 3 months Success

AMRI

12/23/2013 .959 -1.234

20.31

-------

2o in 3 months

Success

ANAC

12/9/2013 1.236 3.945

16.98

--------

22.75

Success

ANIK

11/27/2013 1.111 2.438

34.30 ---------

39. in 6 weeks

Success

AOLS

11/19/2013 1.015 -.134

0.27 ---------- .40 in

2 months

Success

APDN

11/12/2013 .935 -2.144

0.11

---------- 0.19

in one month Success

APH

4/28/2014 1.018

.506 94.73

.............. 104.9 in 5

months Success

ARIA 1/28/2014

1.146 1.777

8.04 6.88

9..23

n 3 weeks Success

(Dangerous because IP21 was -.074 with stock 14.6% over 21-dma)

ARNA 1/15/2014

1.224 3.536

7.31 6.0

(7.97)

Success

(Just below 65-dma resistance. Avoid these.)

ARQL 2/19/2014

.96 -1.535

2.22

1.30

Loss

ARRY 12/2/2014

1.065 1.694

7.31 5.80

Loss

(Just below 65-dma resistance. Avoid these.)

ARWR 7/31/2014 1.058 -.933

12.65 ----

15.90

Success

ASTM 11/29/2013 1.198

2.283

4.35 (.3.4)

6.9

Success

ASTM 8/14/2014 1.023 .146

3.34

4.2

Success

AVEO 2/19/2014 1.040 1.694

1.85

1.1

Loss

AVXL 1/22/2014 1.274 4.804

0.37

0.60

Success

AVY 2/10/2014 .988 -.196

49.06

52.05 Trading range 6 months.

BBH 12/9/2014 1.027 1.253

87.01

106

Success

BCLI 1/2/2014 1.20 1.133

0.19

0.37

Success

BCRX 12/17/2013 1.09 1.532

6.48

12.0 in 1 month

Success

BDSI 11/21/2014 .924 -1.933

4.46

10.0 in 3

months Success

BDSI 8/5/2014 .972 -.393

12.63

16.5 in 1 month

Success

BHRT 11/20/2014 .951 0

.01

.08 in 4 months

Success

BIB 1/10/2014 1.134 2.002

166.72

188

Success

BIOF 11/12/2014 1.78 .60 ------

1.78

9 in 6 months

Success

BIOF 7/11/2014 .92 -2.247

6.23

13.0 in 6 weeks

Success

BMRN 12/26/2013 1.005 -.151

69.73

84 om 2 months

Success

BOTA 11/12/2013 .998 .122 ------

3.90

7 in 3 months

Success

BSTC 1/17/2013 1.1 1.34

------- 24.35

27.8 in 2 months

Success

BTX 12/2/2014 1.079 1.637 --------

4.12 3.3

Loss

CBLI 12/6/2013 .906 -1.222

1.23 1.00

Loss

CBM 4/23/2014 1.11 2.363

22.14 17.6

Loss

CRRX 3/17/2014 1.065 1.334

7.45

Loss

CCXI 1/6/2014 1.11 1.978

6.06

8.2 in 10 weeks

Success

CDXS 1/6/2014 1.054 .26

1.45

2.25 in 10 weeks

Success

CELG 4/30/2014 1.032 .621

73.51

96 in 4 months

Success

CEMP 12/23/2014 1.029 .609

13.10

15 in one month

Success

CERS 1./3/2014 1.085 .371

6.63

7.9 in 6 weeks

Success

CGEN 11.26/2014 1.015 -.071

10.20 8.0

14.25 in 4

months

Loss

(This B17 took place with stock at falling 65-dma)

CLDX 1/14/2014 1.161 2.74

27.65

33.0 in 6 weeks

Success

CLVS 12/2/2013 1.165 2.643 -----

62.99 51

92 in 4

months

Loss

(Waiting for the next CP hook up would have worked well here.)

CMXI 12/2/2013 1.352 4.318 ------

.55

.67 in three days

Success

CORT 11/15/2013 1.104 1.516 -----

1.92

4.49 in 5 months

Success

CRIS 11/26/2013 1.031 -3.568 -----

2.50

3.6 in 6 days

Success

CRL 12/9/2013 1.023 .821

52.88

62 in 3 months

Success

CRMD 9/3/2013 .984 -.053

2.20

3.1 in 6 days

Success

CSBR 12/12/2013 1.193 3.196

1.26

1.62 in 1 month

Success

What do losses have in common?

For one thing, 6 of the 12 cases show a 21-day ANN-ROC between

1.09 and 1.70.

Table 2

Buy B17 Losses in Biotechs:

November - August 2014

la/ma 21-dma

Price

Next Low

Next High

ROC

---------------------------------------------------------------------------------------------------------------------------

ACOR

6/5/2014 1.102

1.165

34.96 18.45

Loss

AEGR

1/8/2014 1.074

1.092

73.23

56.54

Loss

(At falling 65-dma resistance. Avoid these.)

AMAG

1/15/2013 .988

-.123

22.99

19.97

Loss

(Just below 65-dma resistance. Avoid these.)

ARQL

2/19/2014

.96 -1.535

2.22

1.30

Loss

ARRY

12/2/2014

1.065 1.694 7.31

5.80

Loss

AVEO 2/19/2014

1.040 1.694 1.85

1.1

Loss

BTX 12/2/2014

1.079 1.637

4.12

3.3

Loss

CBLI 12/6/2013

.906

-1.222

1.23

1.00

Loss

CBM 4/23/2014

1.11

2.363 22.14

17.6

Loss

CRRX 3/17/2014 1.065

1.334

7.45

Loss

CGEN 11/26/2014 1.015

-.071

10.20

8.0 14.25 in 4 months

Loss

CLVS 12/2/2013 1.165

2.643

62.99

51 92 in 4 months

Loss

Additional Successes to atudy:

CTIC 12/17/2014 .908 -1.008 1.023 1.71

4.` in 6 weeks

CTIX (2 cases)

CUR (2 cases)

CURE (best to wait for CP to hook up at rising 65-dma)

CVM

CYTK

DNDN

DRTX (best to wait for CP to hook up at rising 65-dma)

(Just below 65-dma resistance. Avoid these.)