and BEARISH SPECIAL SITUATIONS

Picks from Late July - September 2010

11/4/2010

(C) 2010 William Schmidt, Ph.D.

11/3/2010

The picks here made use of Closing Power

new highs and lows in conjunction with

confirming highs levels of Accumulation

for the buys and recent steadily low levels

for the short sales. Most were simply

picked using the Bullish MAXCP stocks as

Buys and the bearish MINCP stocks for

short sales. Positions were closed out

when the Closing Power violated its trends.

Steeper trendlines were used after a sustained

move. When the Accum Index was very high

a little more opportunity to advance was

given. See the CP trend-break-lines in the

charts below.

It is believed that the best Buys and SHort sales occurred

soon after the new B7s and S7s, which show extreme CLosing

Power divergences from price.

Trading with the market trend using Peerless helps a lot. In the period shown below

there were no Peerless Sells. Short selling had to be nimble. Breaks in a Closing

Power downtrend are shown below as the basis for covering the short sales.

The best buys came soon after a downtrend in Closing Power was broken

following a Peerless Buy. By this rule, the best buying opportunities came

after 7/7/2010 and 9/1/2010. Work down the list and you will some very nice

gains in the stocks below just after these dates. As prices become more

extended in the general market, the quality of new Buys deteriorates. Adding

to positions in the stocks that do the best after a Buy signal usually works

well, especially if you can buy after a minor retreat and another Closing Power

new high.

TOTALS for Special Situations from 7/30/2010 to 9/30/2010

During this time the SP-500 rose from 1101.60 to 1193.55, about 8%.

All 34 Trades. Avg Gain = +10.9%

21 Long Trades. Avg Gain = +12.7%

15 winners' avg. gain = +20.7%

6 losers' avg. loss = - 7.4%

13 Short Sales Avg. Gain = +8.0%

8 winners' avg. gain = +16.5%

6 losers' avg. loss = +5.5%

Regarding long trades, it appears from the data in this study that we can significantly

improve results by not buying the stocks with an AI/200 <140 or an IP21<.22

unless they are testing their lows. as CA was.

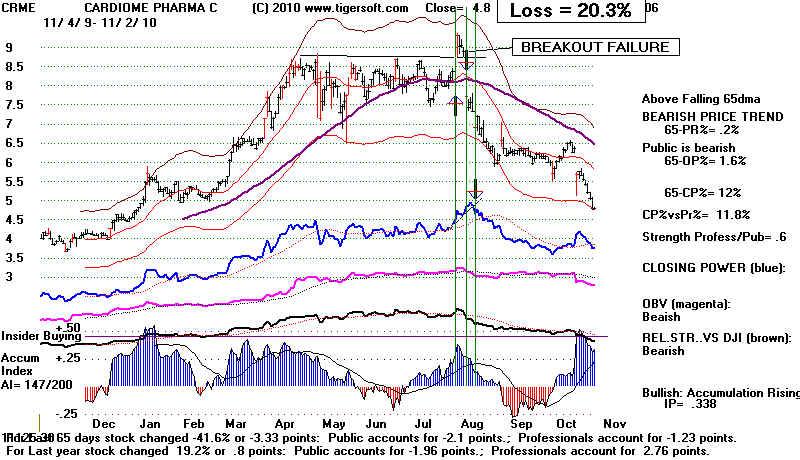

1, LONG 8/5/2010 CRME 9.31 +.57 AI/200=139 (LOW) IP>.36

Loss = -20.3% Watch for false breakouts!

2. LONG 8/5/2010 TGH 28.13 +.43 AI/200=167 IP=.13

Loss = -2.4%

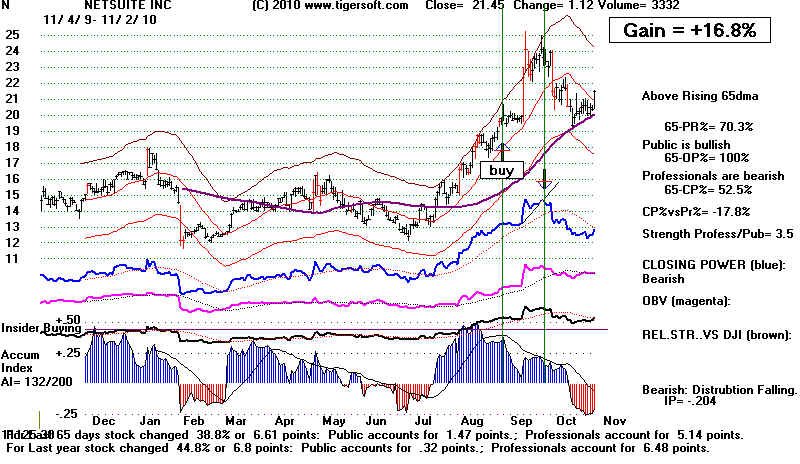

3. LONG 9/1/2010 N 19.58 58 AI/200=139 (low) ip= .35

Gain +16.8%

4. LONG 9/13/2010 ADVS 52.82 .8 AI /200=197 IP> .16 (low)

Loss = -5.9%

5/ LONG 9/24/2010 CHN 32.49 .5 AI/200=153 IP = .20 low

Gain +1.9%

These 5 lost an average of 2% apiece.

====================================================================================

IMPORTANT

The best gainers generally had very

high levels of current Accumulation, "IP" or "IP21",

above +.46. This is the

horizontal line above which our charts indicate "Insider Buying". level

A/200

IP21 Gain

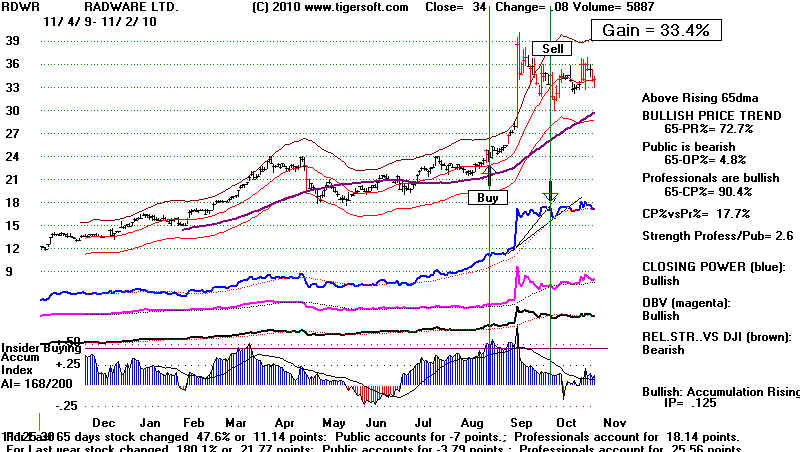

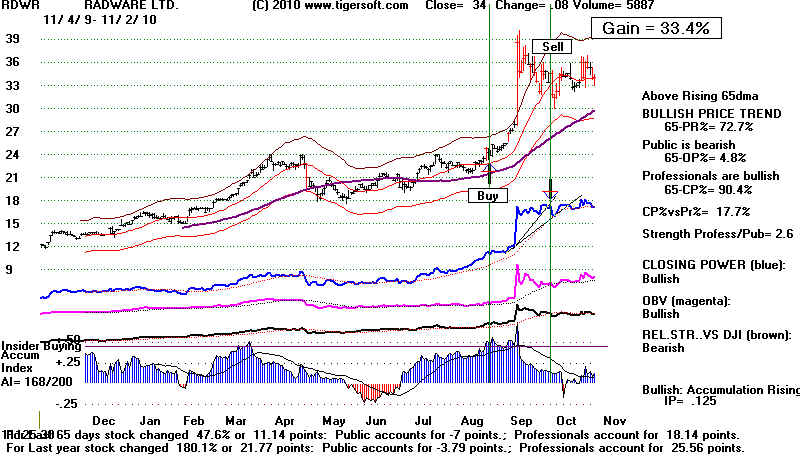

RDWR

171

.56 +33.4%

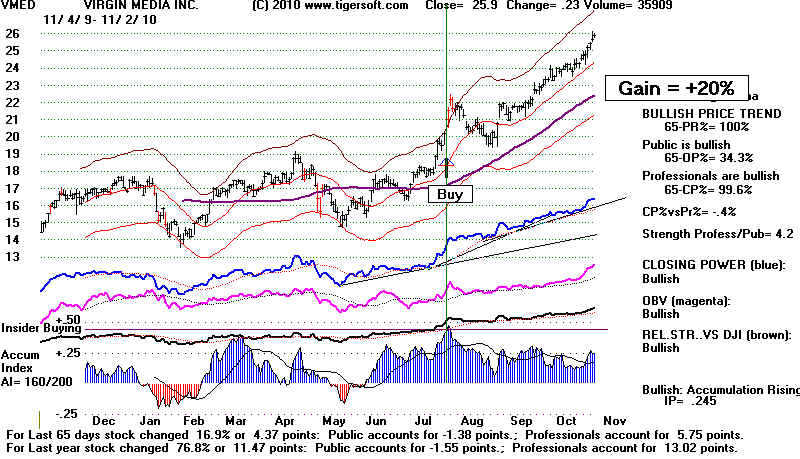

VMED

162

.51 +20.0%

RDWR

171

.56 +33.4%

VRNT

189

.50 +33.4%

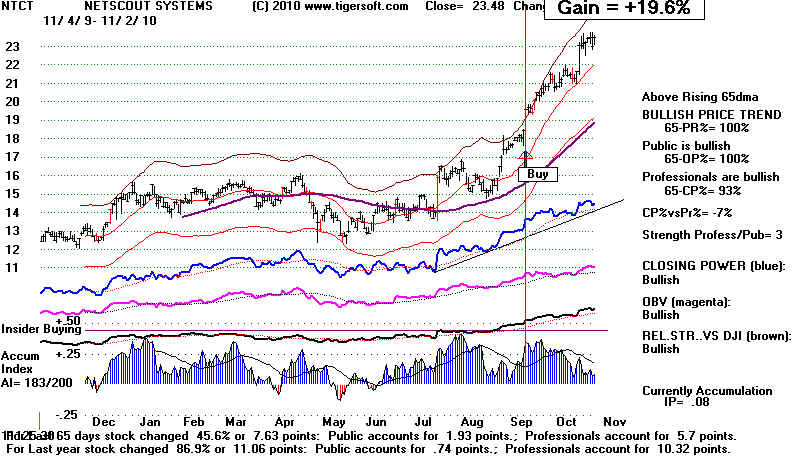

NTCT

182

.47 +19.6%

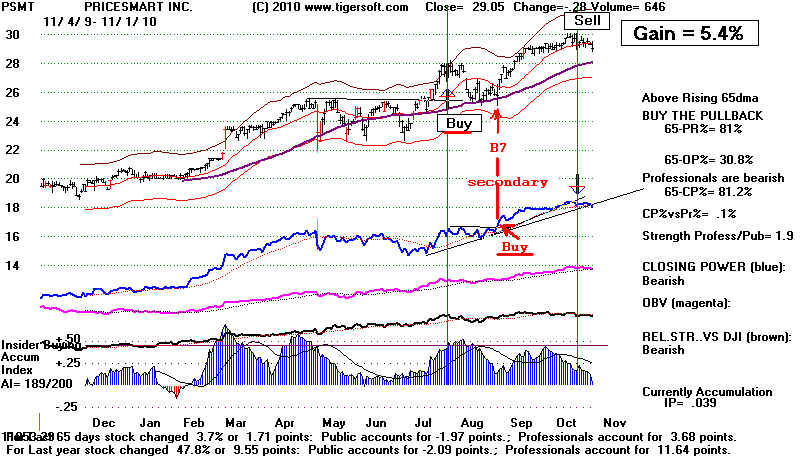

PSMT

189

.45

+5.4%

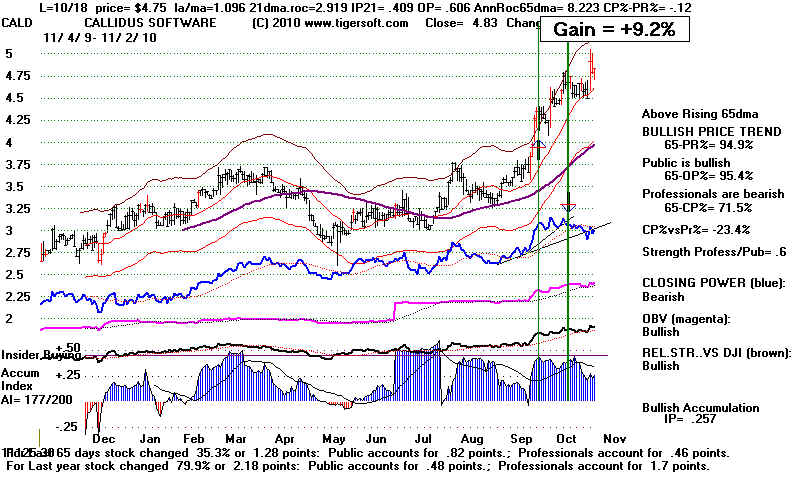

IRS

175

.45

+9.2%

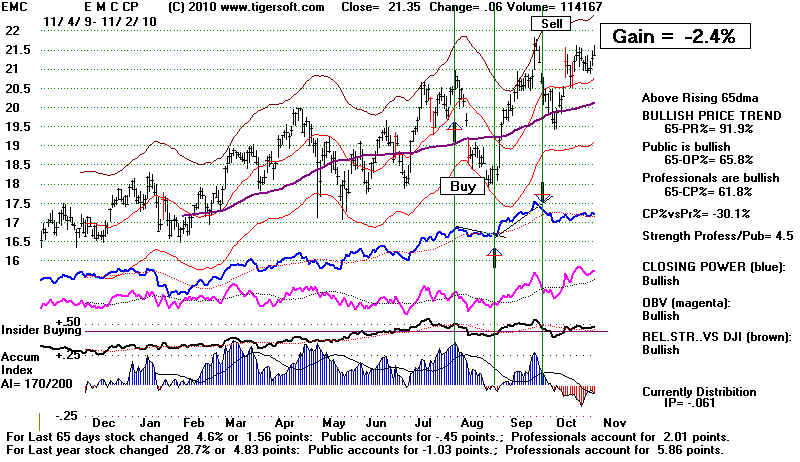

EMC

175

.36

-2.4%

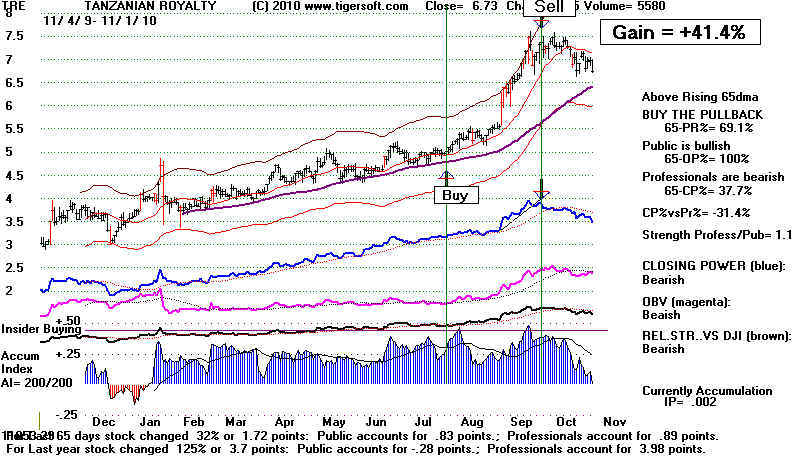

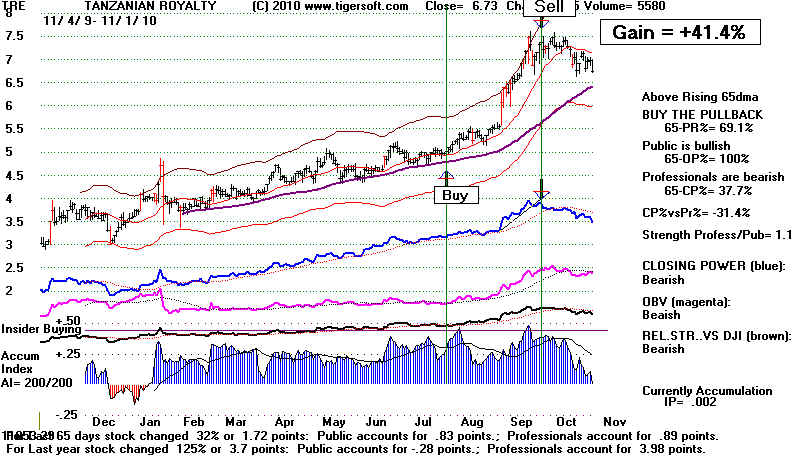

TRE

172

.32

+41.4%

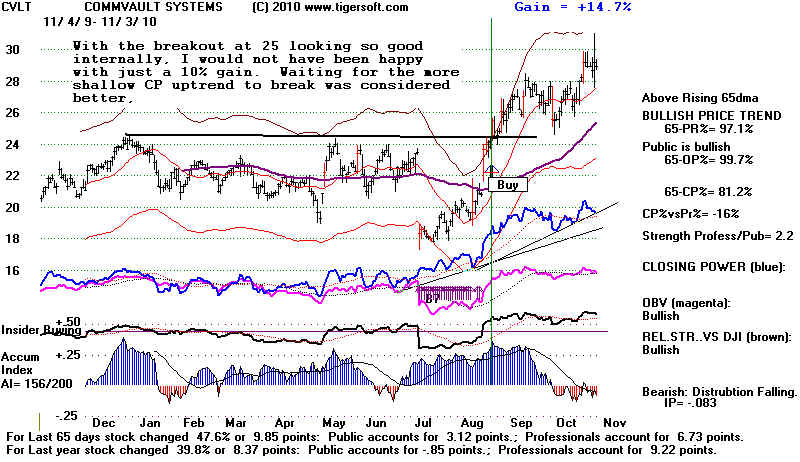

CVLT

161

.31

+14.7%

EZCH

189

.31

-2.3%

====================================================================================

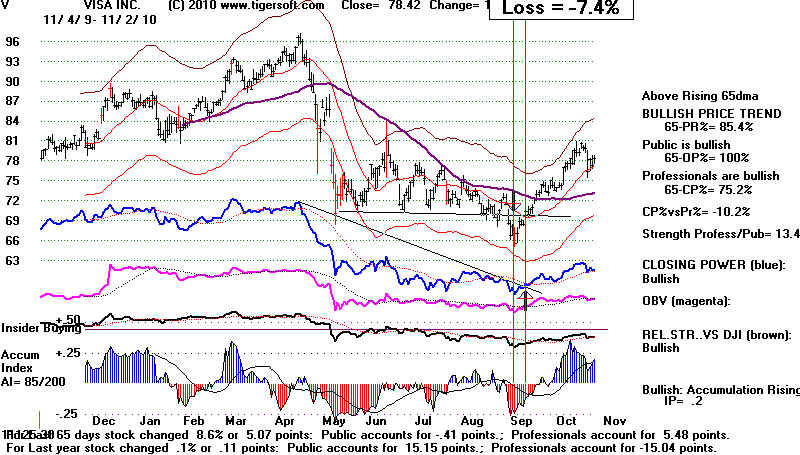

It was not a good idea to short a stock that gas recently

received a Buy B7.

SHORT 9/13/2010 V 65.48 -2.61 97 IP<-.20

Loss = -7.4% There was an

August B7 just before what proved to be

a false breakdown.

One other conclusion from this is that penetrations of the 65-dma after a

Buy B7

or S7s. Look at the many examples

below. See paricularly VRNT and CHN.

Also: Use

success tests of rising 65-day ma when CP downtrend broke.

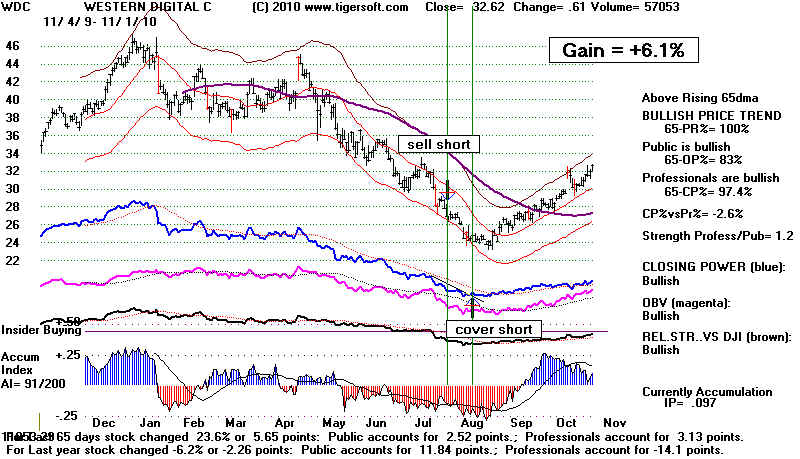

short 7/30/2010 WDC 26.39 -.58 AI/200= 96

Gain +6.1%

S7s

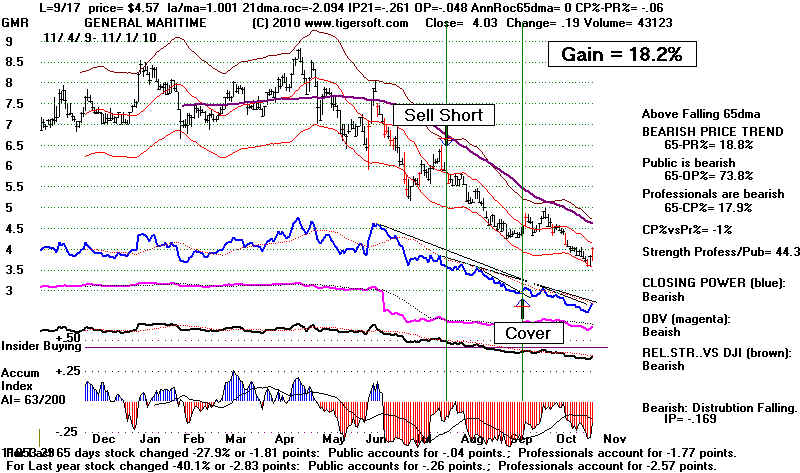

short 7/30/2010 GMR 5.59 -.25 AI/200= 94 IP= -.13

Gain +18.2%

no S7s.

LONG 7/30/2010 PSMT 28 +.66 AI/200=187 IP>.45

Gain +5.4%

There was a timely B7 on subsequent test of rising 65-dma.

LONG 7/30/2010 TRE 5.1 +.09 AI/200=172 IP>.30

Gain +41.4%

There were early June B7s

LONG 8/2/2010 VMED 22.15 +.62 AI/200=162 IP>.50

Gain +20.0% No B7s

LONG 8/4/2010 EMC 20.82 +.35 AI/200=175 ip>.35

Loss = -2.4%

There were numerous B7s in May-June and in August

The August B7s made the CP breakout then on the pullback a very good buy.

LONG 8/5/2010 CRME 9.31 +.57 AI/200=139 (LOW) IP>.36

Loss = -20.3%

The false breakout above 9 was very bearish. Many Pros were trapped by it.

CARDIOME PHARMA CORP Announces Its Co-Development Partner, Astellas

Pharma US., Inc. Suspends Patient Enrollment In The ACT 5 Study Of KYNAPID

(vernakalant hydrochloride) Injection

Thursday, 21 Oct 2010 07:55am EDT

There were misleading B7s in August on the pullback.

LONG 8/5/2010 TGH 28.13 +.43 AI/200=167 IP=.13

Loss = -2.4%

There were no B7s. There was a Sell S7 in July.

S7

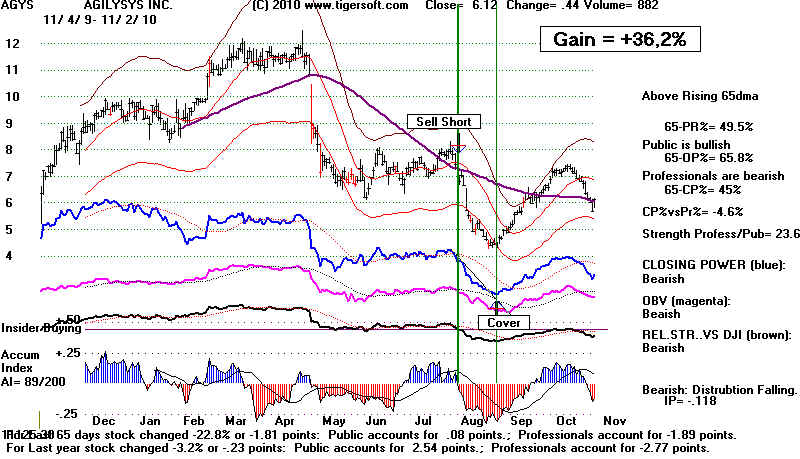

short 8/6/2010 AGYS 6.8 -.19 AI/200=81 IP= -.10 IP21 JUST BROKE BELOW tisi

Gain +36.2%

There were S7s in Jan-Feb.

short 8/9/2010 KLIC 6.68 -.11 AI/200=122 IP< -.25

Gain +16.6% Note the timely S7s.

S7 S7

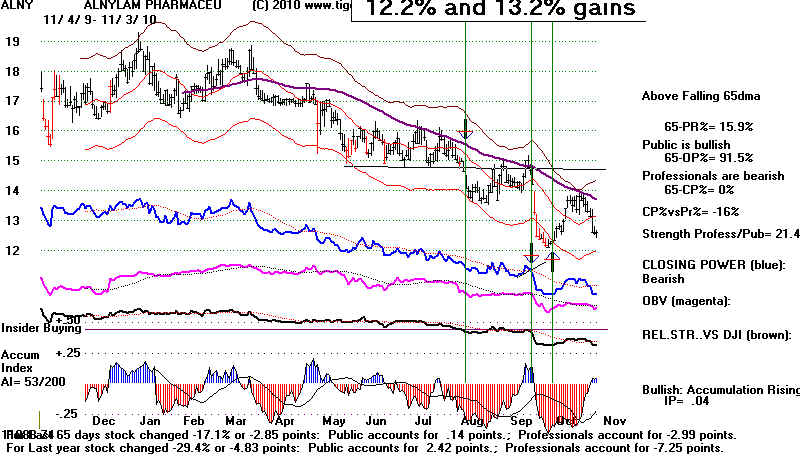

short 8/11/2010 ALNY 14.06 -.58 AI/200=69 IP<-.30

Gain +12.2% and later 13.2% gains. Note broken support at 14.75

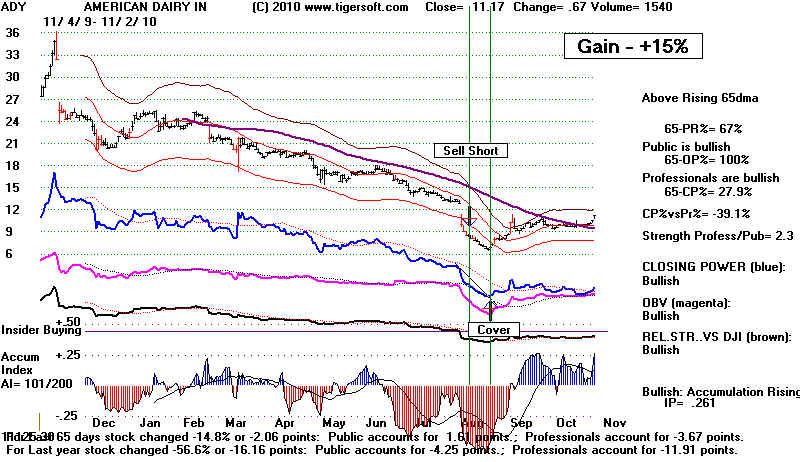

short 8/13/2010 ADY 8.13 -.36 AI/200=94 IP<-.30

Gain +15.0%

LONG 8/20/2010 NTAP 40.53 -.17 AI/200=159 IP =.23

Gain +21.7%

Excellent Buy B7s on pullbacks in May and August.

c

short 8/20/2010 MHS 34.26 -.07 AI/200=70 IP<-.25

Loss = -0.7%

LONG 8/20/2010 RDWR 23.13 -.07 AI/200=174 IP> .35

Gain +44.8%

Perfect mid August B7.

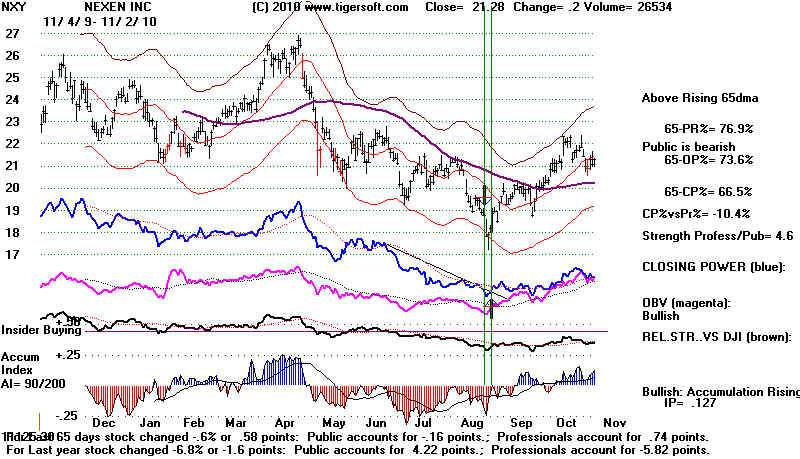

short 8/24/2010 NXY 17.81 -.94 AI/200=65 IP<-.30

Loss = -5.9%

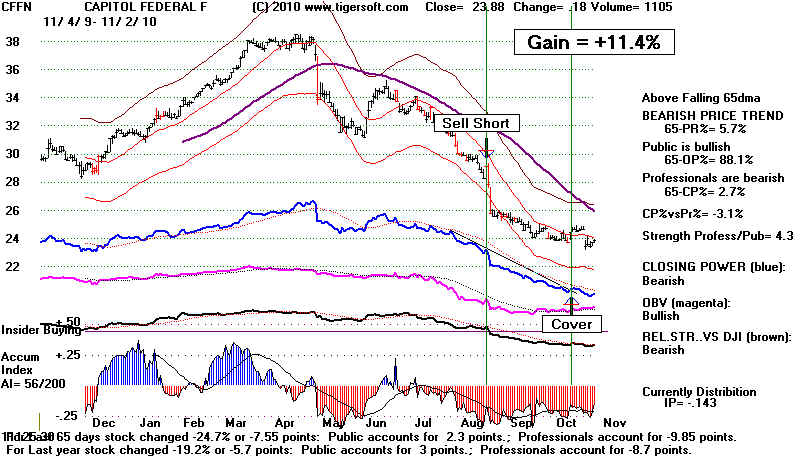

short 8/25/2010 CFFN 27.14 -1.95 AI/200=76 ip< -.30

Gain +11.4%

LONG 8/26/2010 CA 18.13 -.02 AI/200=132 (low) ip=.11 (low)

This stocks was bought on a test of its lows.

Gain +29%

LONG 8/27/2010 RDWR 25.27 +1.44 AI/200=171 IP>.55

Gain +33.4%

Perfect B7 in August

LONG 8/27/2010 CVLT 25.5 +1.34 AI/200=161 IP>.30

Gain +14.7%

SHORT 8/30/2010 JMP 5.76 -.21 AI/200= 66 IP = -.20

Loss = -6.2%

S7

LONG 9/1/2010 N 19.58 58 AI/200=139 (low) ip= .35

Gain +16.8% June B7s

LONG 9/3/2010 VRNT 24.43 .48 AI/200=189 IP= .50

Gain +33.4% Numerous B7s0 June - Aug

SHORT 9/7/2010 CHBT 10.65 -1.55 AI/200= 91 IP<-.25

Gain +11.9% S7s

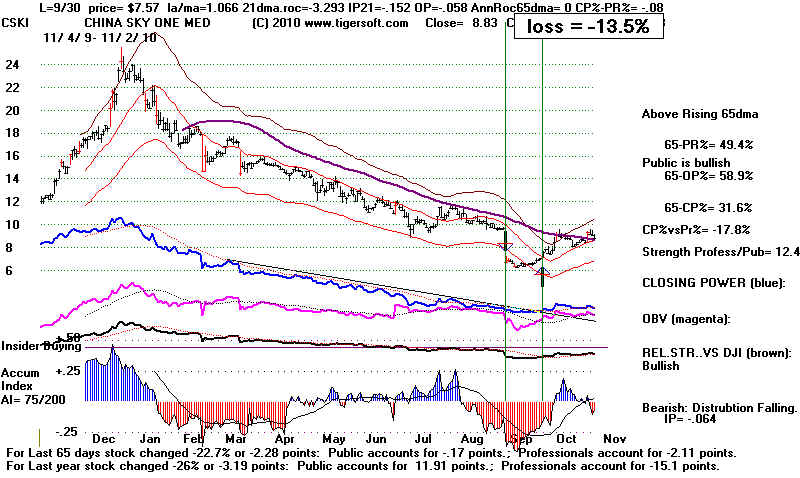

SHORT 9/7/2010 CSKI 6.67 -3.015 AI/200=91 IP<-.25

Loss = -13.5%

SHORT 9/10/2010 COMV 6.2 -.27 AI/200= 80 IP<-.25

Loss = -9.7%

SHORT 9/13/2010 V 65.48 -2.61 97 IP<-.20

Loss = -7.4%

There was an August B7 just before what proved to be a false breakdown

LONG 9/13/2010 ADVS 52.82 .8 AI /200=197 IP> .16 (low)

Loss = -5.9% Perfect May B7s

LONG 9/15/2010 EZCH 25.78 .87 AI/200=189 IP> .30

Loss = -5.9% June B7

SHORT 9/17/2010 CDZI 9.64 -.36 AI/200= 69 IP<-.35

Loss = -6.4%

LONG 9/20/2010 NTCT 19.56 1.12 AI/200=182 IP> .45

Gain +19.6% B7

SHORT 9/24/2010 ALNY 13.27 -.95 AI/200= 97 IP<-.06

Gain +7.2%

LONG 9/24/2010 CHN 32.49 .5 AI/200=153 IP = .20 low

Gain +1.9% Perfect May-July B7s

Stock was certainly a Buy in July!

Look at the Closing Power and Accumulation.

It was mentioned on the Hotline at this time as a Buy.

LONG 9/30/2010 IRS 14.79 .2 AI/200= 175 IP = .45

Gain +9.2% Perfect June-July B7s

LONG 9/30/2010 VRNT 29.55 3.76 AI/200=194 IP=.35

Gain +10.3% See chart above.

===============================================================