TigerSoft News Service 5/17/2010 www.tigersoft.com

The San Francisco Earthquake of 1906

Led To The Stock Market Crash of 1907

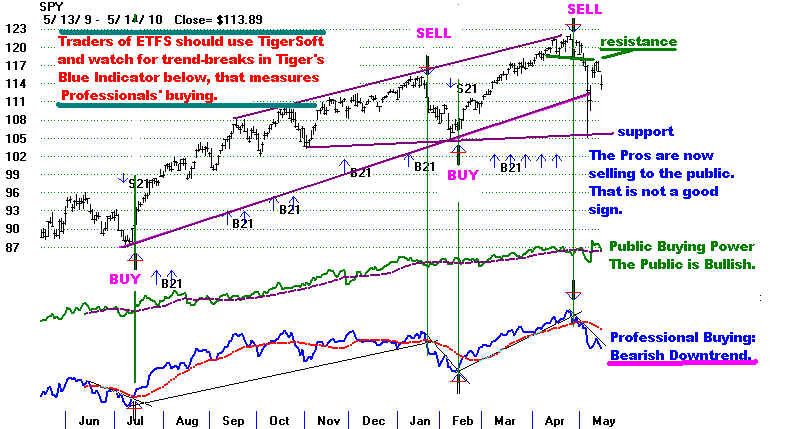

Is This Why Professionals Are Now Selling to The Public?

by William Schmidt, Ph.D.

(C) 2010 www.tigersoft.com

All rights reserved.

Will The Gulf Coast Oil Spill Lead To A New Bear Market in 2010 or 2011?

What if A Hurricane Spreads The Oil even More this Summer?

What if the Oil Keeps Surging out for years and years?

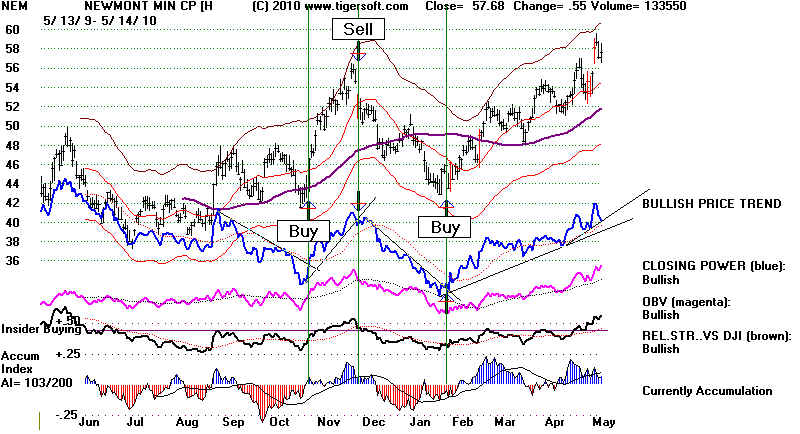

Gold Stocks are

often rally at the end of a bull market.

What if Gold stocks turn down and there is little left to lift

the market?

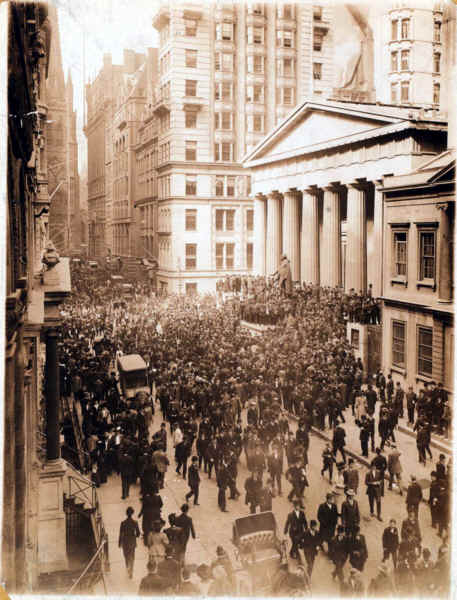

Great 1906 San Francisco Earthquake

5:12 AM - April 18, 1906

The quake itself - foreshock occurred with sufficient force to be

felt widely throughout the San Francisco Bay area. The real

earthquake began 20 to 25 seconds later. Violent shocks and

shaking lasted 60 seconds. The pictures show the damage. The

epicenter was two miles off short. The magnitude was estimated

from 7.7 to 8.3 on Richter scale. Three thousand people died as

over 80% of the city was destroyed by the quake and the

resulting fires. Nearby cities suffered severe damage, too.

Sanra Rosa's entire downtown was destroyed, as was much

of San Jose's. Parts of the San Andreas fault moved as much as

28 feet. Details.

Big

Earthquakes.

At the time San Francisco was America's 9th largest city.

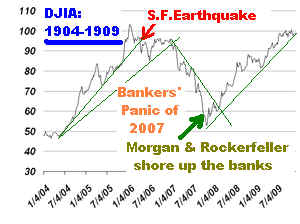

How The Stock Market Reacted

To News of The Earthquake

The stock market had been in a bull market before the Earthquake The DJI was in a consolidation and

pull-back phase. It had ranged between 93 and 103 from December 11, 1905 to the day of the quake,

April 18. 1906. The day before the DJI closed at 96.84. It then fell steadily to 86.45 over the next two

weeks as full reports of the damge came in. After that, it repeatedly tried to rally over the next 8

months but could not take get past 96.75. We can imagine that insurance companies were heavy sellers

of stocks on sttrength, raising cash for the claims that were starting to come in. See these studies

for more details.

Odell, Kerry A.; Weidenmier, Marc D. (2004), "Real Shock, Monetary Aftershock:

The 1906 San Francisco Earthquake and the Panic of 1907", The Journal of Economic History 64 (4): 1002–1027,

doi:10.1017/S0022050704043062

"San Francisco's $200,000,000 “ash heap” involves complications which will be felt

on all financial markets for many months to come [and] the payment of losses sustained

… represents a financial undertaking of far-reaching magnitude….

(Source: The Financial Times, London July 6, 1906.)

"In April 1906 the San Francisco earthquake and fire caused damage equal to more

than 1 percent of GNP. Although the real effect of this shock was localized, it had an

international financial impact: large amounts of gold flowed into the country in autumn

1906 as foreign insurers paid claims on their San Francisco policies out of home funds.

This outflow prompted the Bank of England to discriminate against American finance bills

and, along with other European central banks, to raise interest rates. These policies

pushed the United States into recession and set the stage for the Panic of 1907."

(Source.)

Eleven months after the Crash, on March 13, 1907, the DJI broke below the low closing of

July 13, 1906 at 85.18. This startred the financial panic of 1907, which took the DJI down to

50 8... The

Panic of 1907

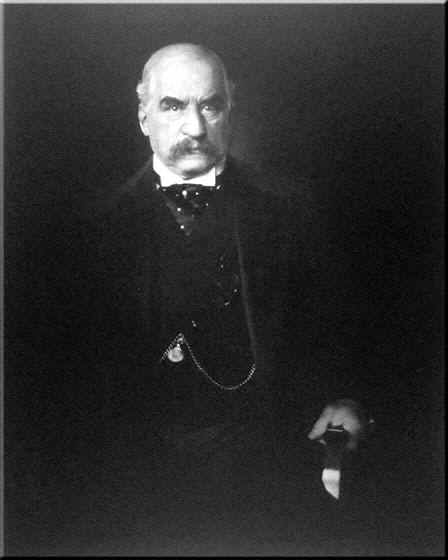

JP Morgan - Rescuer of the Stock Market in November 1907

In late 1906, the Bank of England raised its interest rates to protect the

Pound and keep more funds

in London. Tightening up interest rates brought more selling.

Another factor was the Hepburn Act, which gave the Interstate Commerce Commission (ICC) the power

to set maximum railroad rates. This became law in July 1906.

Railroad stocks were sold off. Union Pacific

—among the most common stocks used as collateral—fell

50 points.

June 1907 - an offering of New York City bonds

failed. This forced the city to consider bankruptcy.

July 1907 - the copper market collapsed.

August 1907 - the Standard Oil Company was fined $29

million for antitrust violations.[10]

In the first nine months of 1907, stocks were lower by 24.4%.[11]

These factor led to the start a new trading range

from 77 to 85, which lasted until Aug 7, 1907, when

the market began a speedier decline to 53 on Nov 14th. There it

double-bottomed on Nov 22, 1907 and

began a steady rally back to 105.53 on Nov 29, 1909. It then lost about 1/2 of what

it had gained from

1907 to 1909.

The details of the

1907 panic are well known. See. http://en.wikipedia.org/wiki/Panic_of_1907

There was no national bank to step in and save Wall Street in 1907. This was done by

a consortium

of bankers led by JP Morgan and by the richest man in America, John D. Rockefeller.

Will The Gulf Coast Oil Spill

Lead To A New Bear Market in 2010 or 2011?

( http://www.nola.com/news/gulf-oil-spill/index.ssf/2010/05/gulf_oil_spill_could_result_in.html )

Law suits and insurance claims related to the BP Oil Spil will surely keep rising.

http://www.nola.com/news/gulf-oil-spill/index.ssf/2010/05/gulf_oil_spill_could_result_in.html

Who will pay for all the damges?

Gulf Oil Spill Disaster: The Trigger of American Economic Collapse

Ten-mile oil plume found beneath surface of Gulf of Mexico

http://www.guardian.co.uk/environment/2010/may/16/gulf-oil-spill-bp

Only two insurance stocks show bearish head and shoulders

patterns now.

TRV shows

bearish head and shoulders.

The Travelers Companies, Inc., through its subsidiaries, provides various commercial and

personal property

and casualty insurance products and services to businesses, government units,

associations, and individuals

primarily in the United States

ORI shows

emerging bearish head and shoulders.

Old Republic International Corporation, through its subsidiaries, engages in insurance

underwriting business.

It operates in three segments: General Insurance, Mortgage Guaranty, and Title Insurance.

The General Insurance

segment provides liability insurance coverages to businesses, government, and other

institutions in transportation,

commercial construction, forest products, energy, general manufacturing, and financial

services sectors in North America

UNM reversed diwbward

very sgarply after BP Destruction of Gulf

They are often rally at the end of a bull market.

What if Gold stocks turn down and there is little left to lift the market?