TigerSoft News Service 5/2/2010 www.tigersoft.com

MARKET WARNINGS:

SOME SERIOUS PROFIT-TAKING IN SPECIFIC STOCKS

Bearish head and shoulders patterns have to be searched

for visually. The computer cannot find these patterns specifically.

But we can save a lot of time by looking for stocks below a 50-day

or a 65-day ma with negative readings from TigerSoft's

Accumulation Index using the Power-Ranker. Traders should short them

and hold them short as hedges against a bigger decline while holding

the highest Accumulation TigerSoft stocks. AA is an example from

2008.

Use these flags:

164 - CRUN50DA - CLose under 50-day ma

204 - FIFYYDN - declining 50-dma

We will provide an initial sorting of good candidates' nightly data.

- BREAK65D.exe - on our on-line data base.

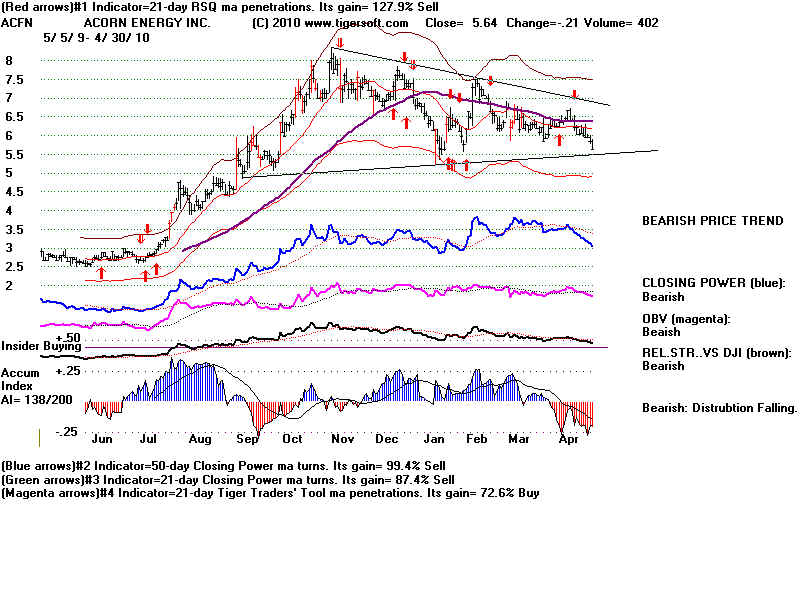

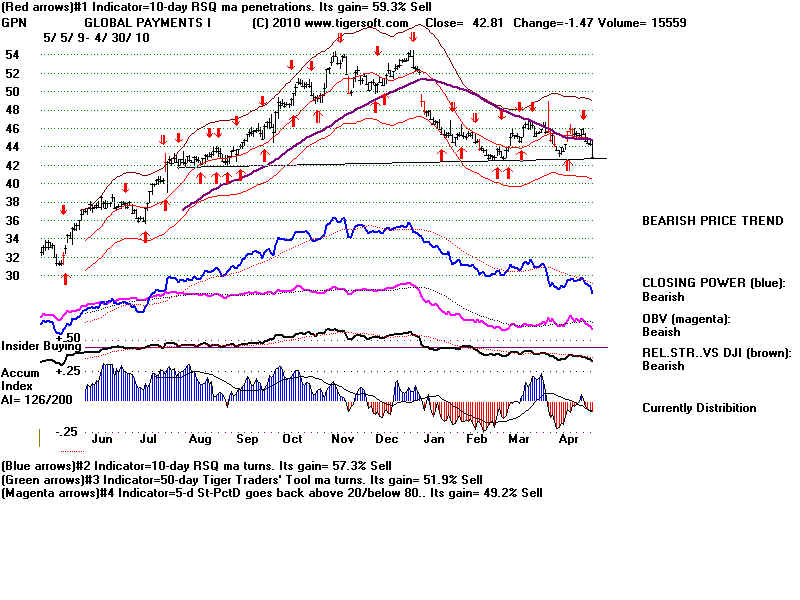

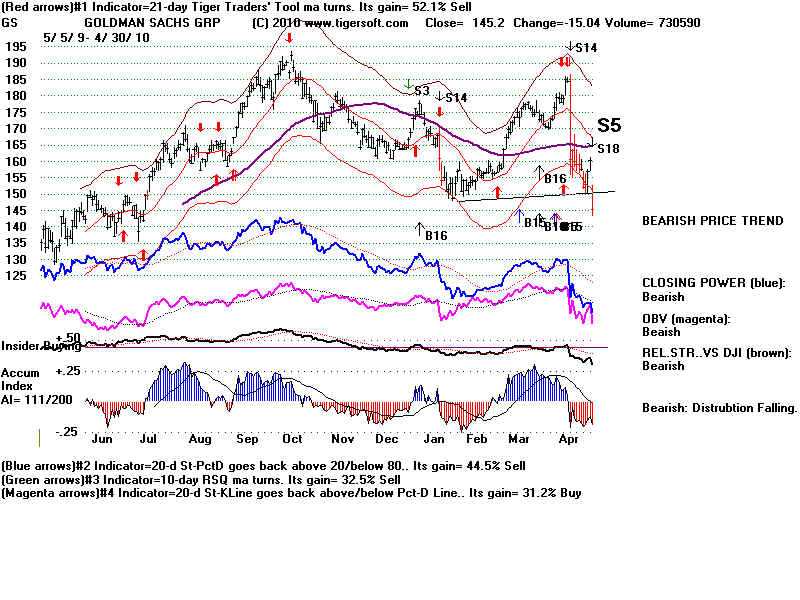

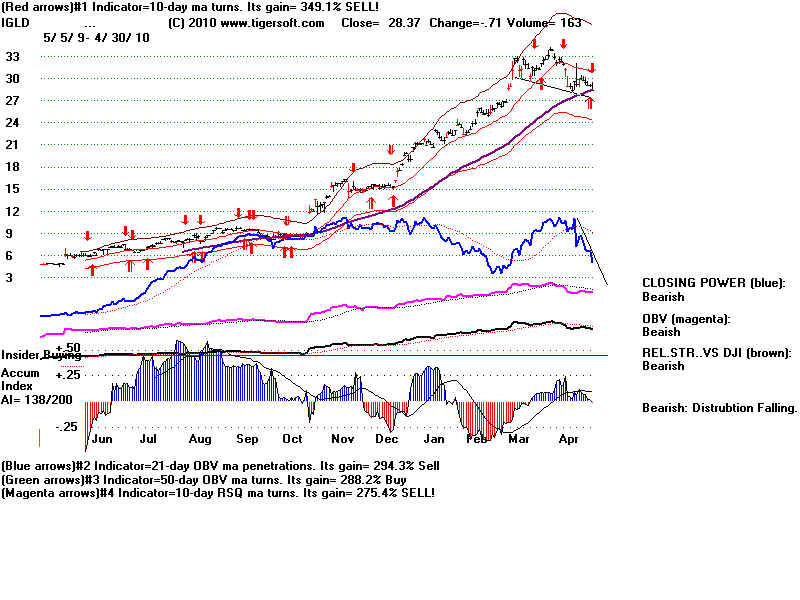

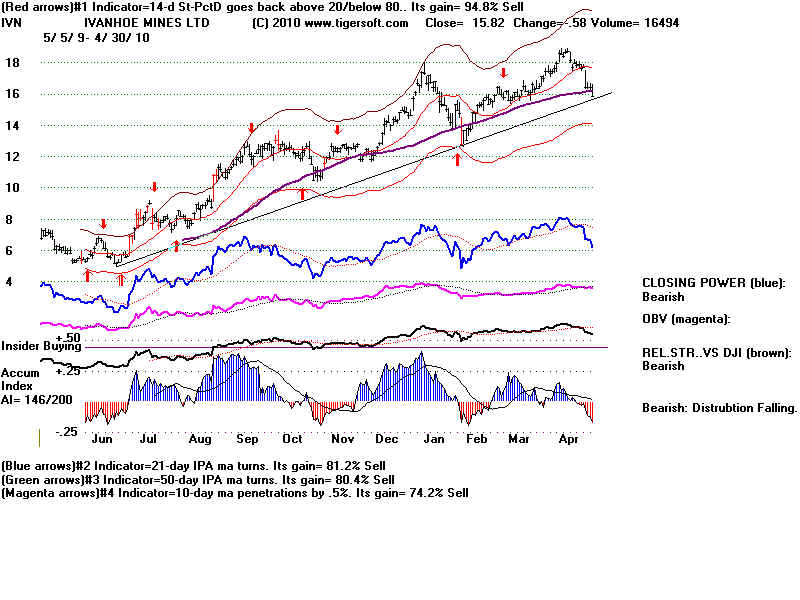

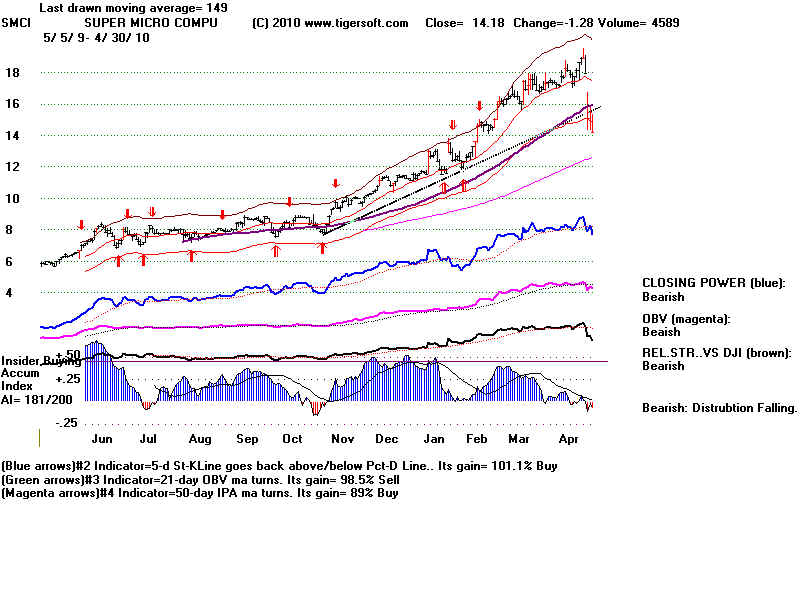

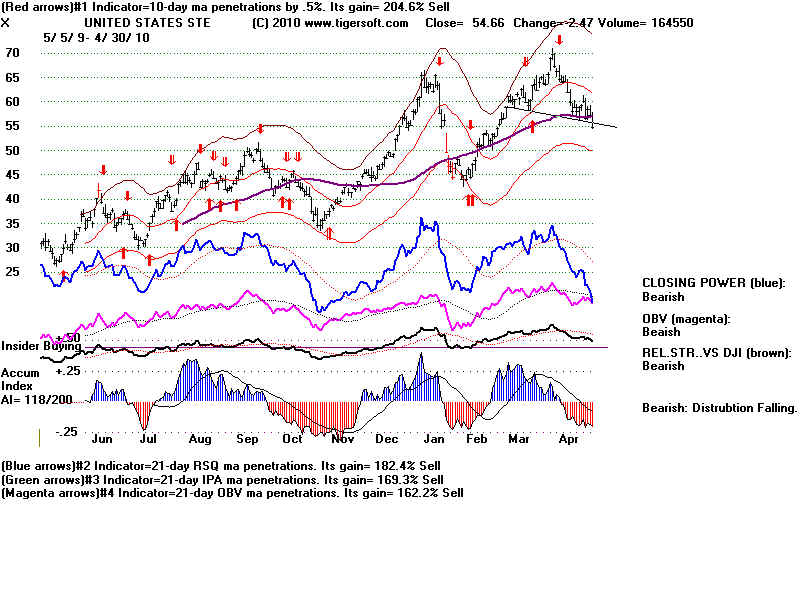

BREAKDOWNS BELOW 65-DAY MA

NEGATIVE TIGERSOFT ACCUMULATION INDEX

DECLINING/WEAK TIGERSOFT CLOSING POWER

PRICE-TREND BREAK

plus

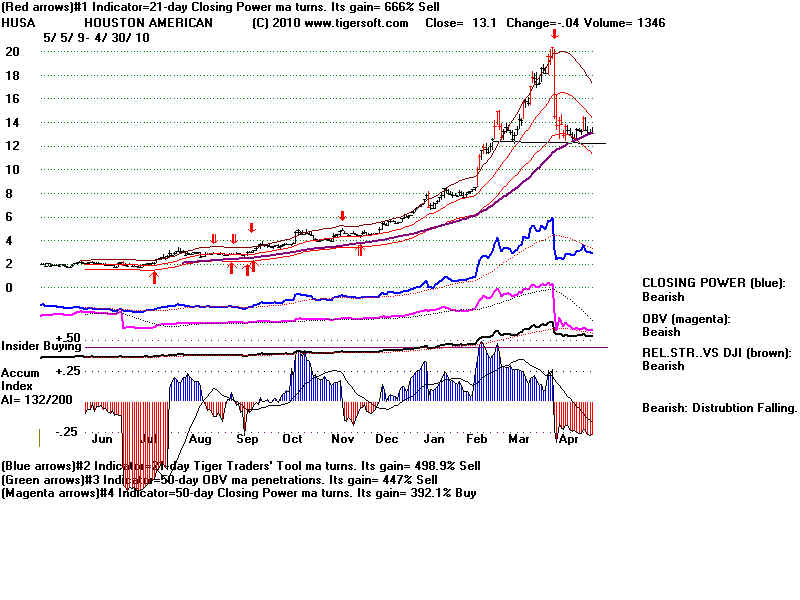

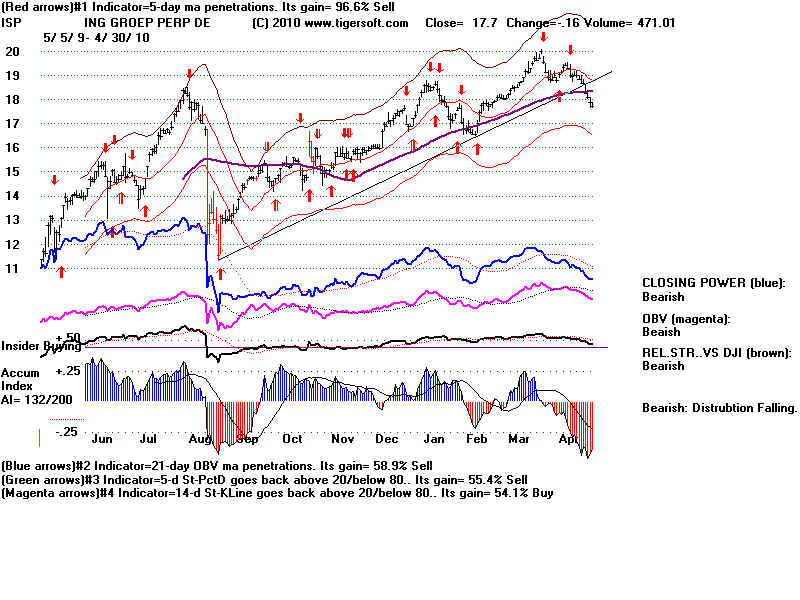

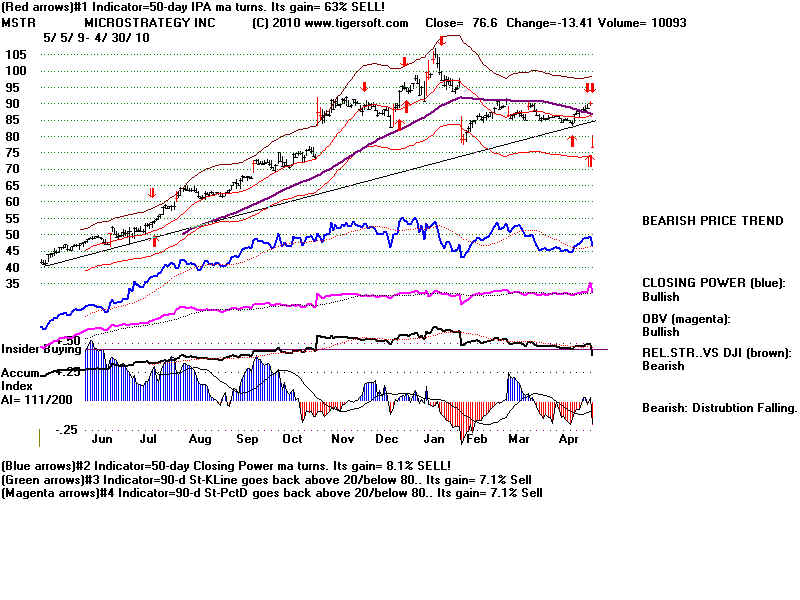

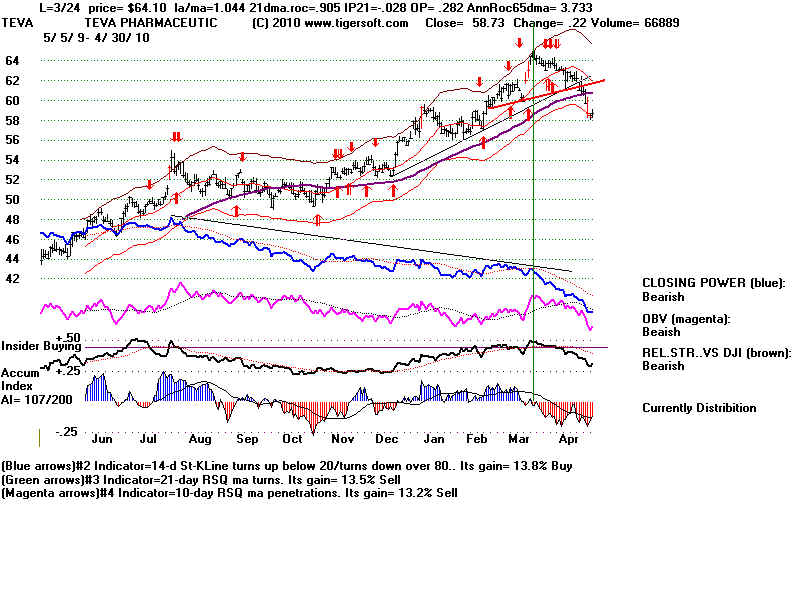

HEAD AND SHOULDERS (14)

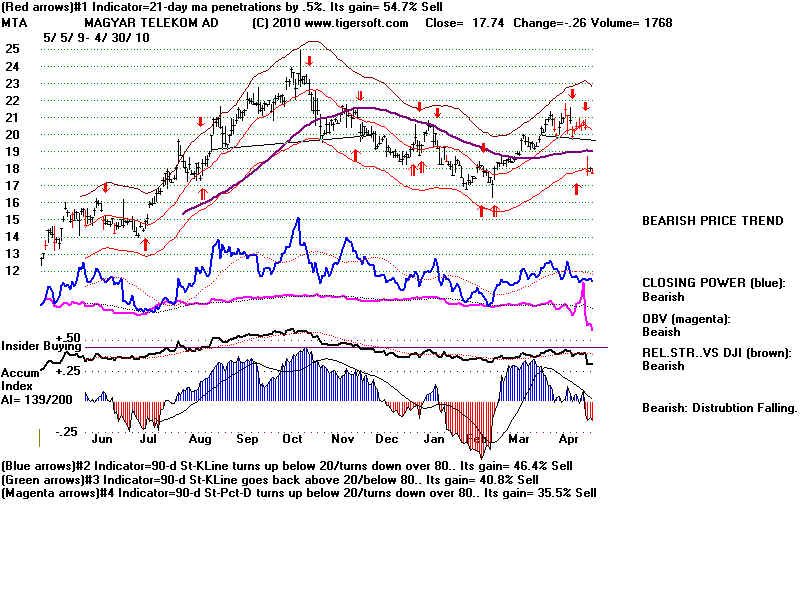

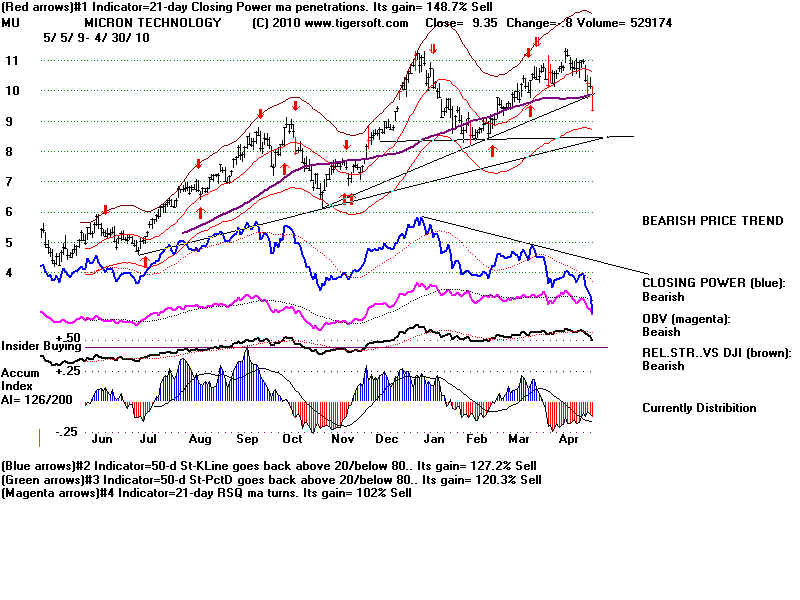

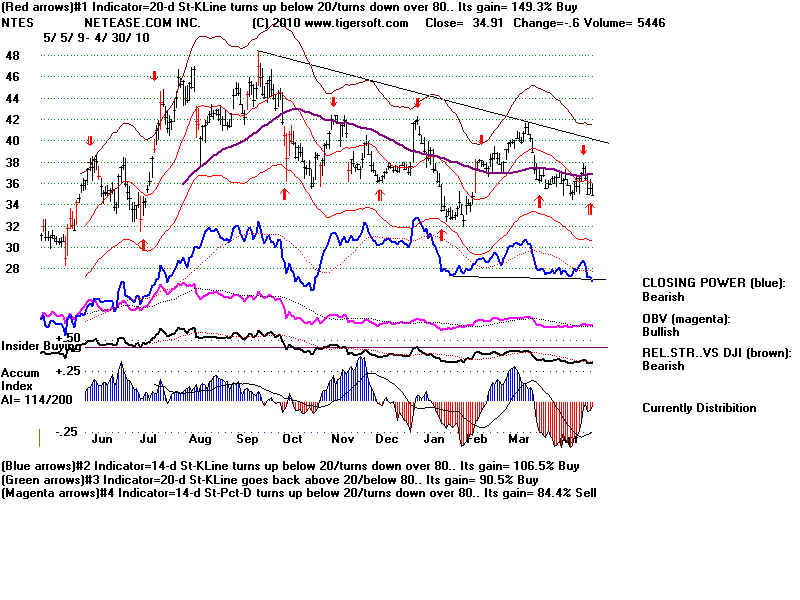

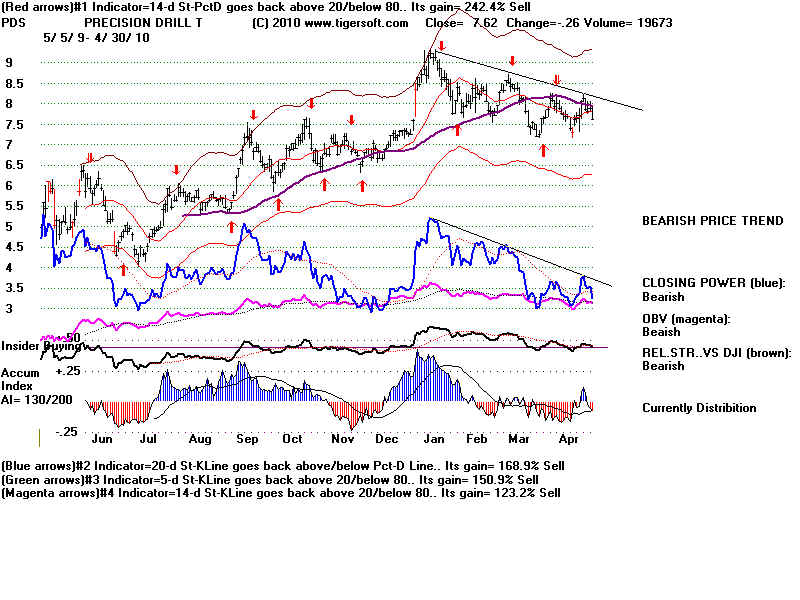

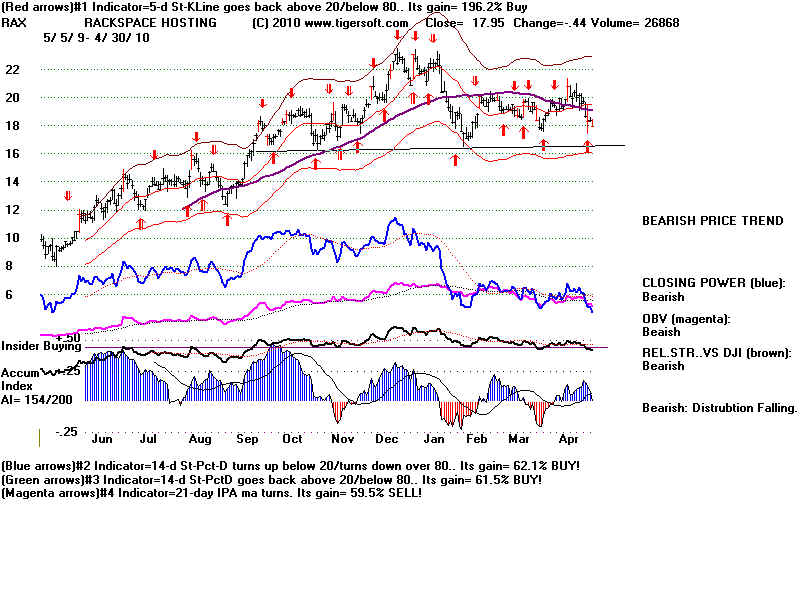

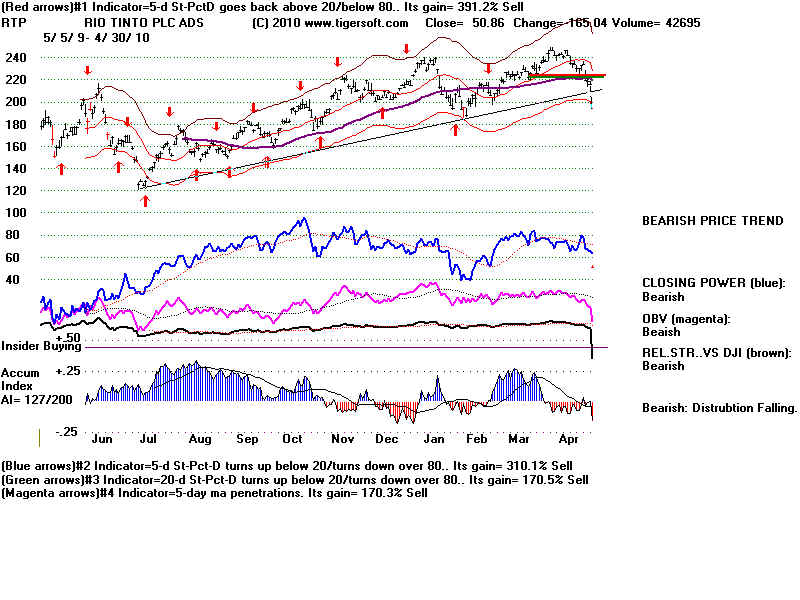

BUCY, IGLD, HUSA, MA, MSTR, MTA, RAX,

RIG, RTP, TEVA, WLT, WNI, WLT, X

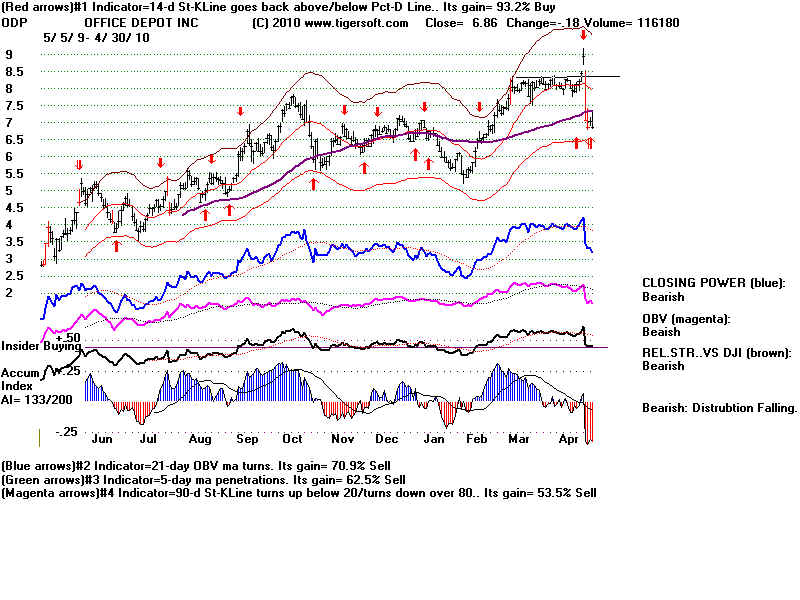

FALSE PRICE BREAKOUTS

ODP, TEVA

ENERGY STOCKS

ACFN, PDS