TigerSoft New Service

TigerSoft New Service

Make Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bubble Stocks Are Going Higher

"Know Thyself." How To Pick and Play Them.

When To Sell A Bubble Stock

by William Schmidt, Ph.D. - Author of TigerSoft and Peerless Stock Market Timing

Our Peerless and TigerSoft programs, signals, Insider Buying and Professional Buying indicators

strongly suggest that the market may now going into a bubble phase and buying climax. This

periodically happens when interest rates are kept low, longer than usual, AND money shifts into

more and more speculative, thinner and thinner stocks after a long advance. Confidence soars

and professionals the public alike sell Blue Chips to buy technology and story stocks that are

moving upwards fast. "Performance or else" dictates it. Wall Street was built on these basics:

profitable manipulation of stock prices, group-think, stories and hype and the need to perform.

The competition among money managers in this environment all but guarantees bubbles from

time to time. After all, their bonuses are derived from their profits using other people's money.

A Long Bull Market often ends in a Bubble -

Example SP-500 Bubble 1995-2000

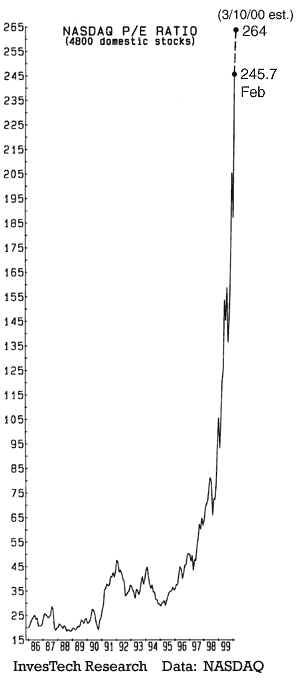

Example NASDAQ Bubble 1999-2000

http://www.itulip.com/naspe.gif

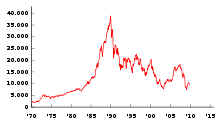

Nikkei 225 |

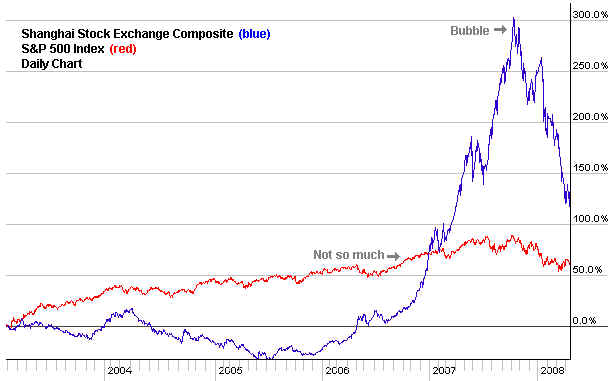

http://www.tradersnarrative.com/wp-content/uploads/2008/04/chinese%20stock%20market%20bubble%202008%20bear%20market.png |

So, we are seeing a highlyu selective new bubble now. Look below at how some stocks

are

screaming

higher and higher in hyperbolic fashion. These are companies new to 99.9% of all

investors.

I

want to point out that this is not a general market bubble. True, the DJI has risen

more than 50%

from

its March 2009 low, but there is precednt for that in a lasting, surging bull market.

Some

examples

are 1933, 1954-1955 and 1957-1959.

After these "super stocks" have been located, the trick here. of course, is to

spot their tops and

not

hold too long. A simple French Curve works in many cases. Draw an

accelerating line through the

recent

bottoms. TigerSoft does that automatically using exponential functions. But

there's much more

than

curve-fitting we can offer. Over the years, TigerSoft has learned a many things

about these

speculatiive

swings upward and how to catch their reversal.

"Know thyself", said Socrates. For one thing, bubble stocks

can keep rising a lot longer than

many investors can hold out and keep away from the party. So, if you know you can

be induced by a very bullish stampede eventually to buy, it is better to buy earlier.

It will then

be easier to sell with a profit when the times comes. Second, use our Peerless. Peerless will

almost certainly give a Sell near the final top. That' what it has been doing since

1981 and

with back-testing, back to 1928. Third, watch TigerSoft's unique tools, the Professional Selling

and the Tiger Closing Power Indicator.

They will almost certainly gives us ample warning

when to sell. See examples in 2000, 2007 and 2008. Our advise, get

TigerSoft and Peerless.

They we will explain all this....

For now, see (2/20/2010) Watch The Pros To Catch

The Tops in "Bubble" Stocks.

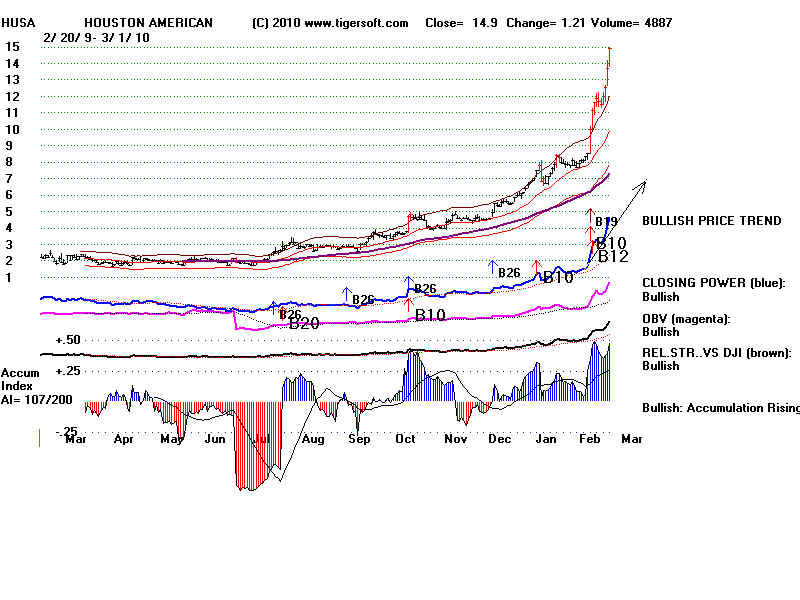

Below see three stocks that

are going up faster and faster now.

They are acting like sirens calling wayward and uninitated investors towards the rocks.

Notice that they have the classic take-offs we identify with explosive super

stocks.

Insiders

Rule The Stock Market. AND

http://www.tigersoft.com/Tigersoft-Explosive/index.html

Yahoo reports that this company has only 3 employees

These show a lot of Blue at the bottom of

charts. This means insiders hold a lot of the

stock tightly. Bigger gains usually occur.

Dips are usually buying opportunities.

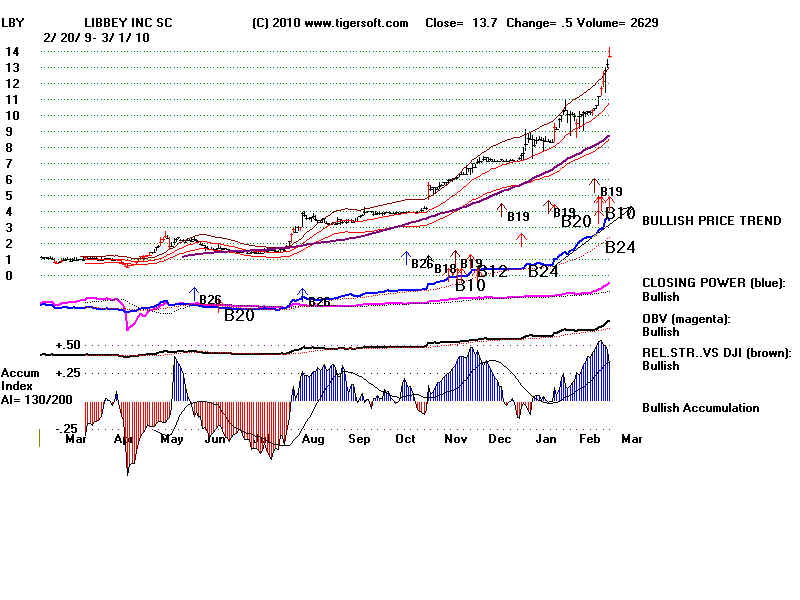

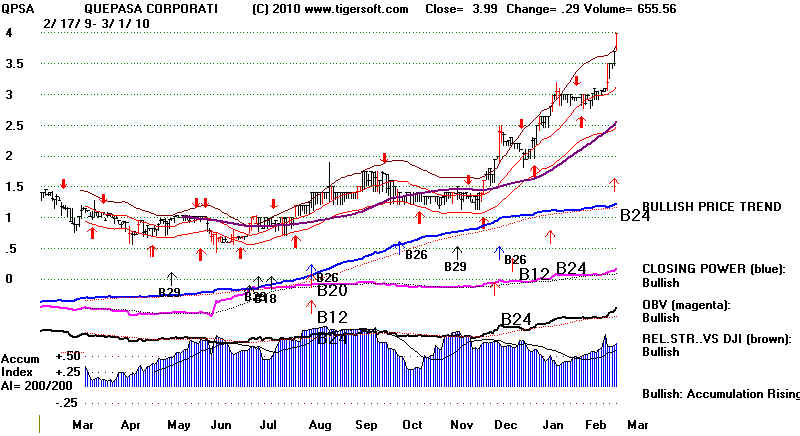

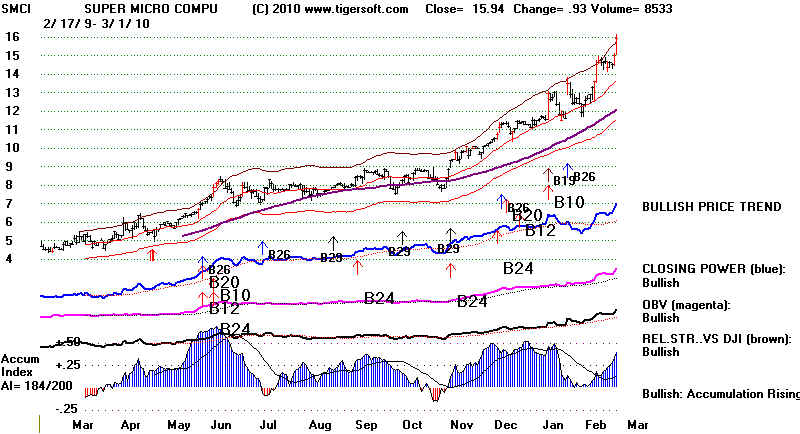

Here are 12 stock-ideas to research and

do dilligence on. As you can see, they show

a lot of Blue Accumulation and their CLosing

Power Line is confirming their new highs.

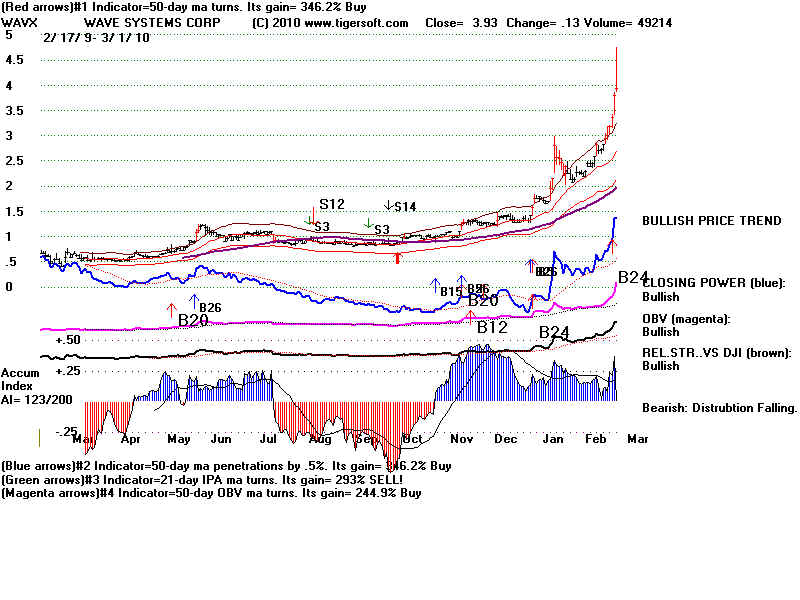

BITS 8.49 +.46 AI/200=200 Breakout IP21>.25 CP=NH All Bullish

QPSA 3.99 +.29 AI/200=200 Breakout IP21>.25 CP=NH All Bullish

Stocks with Very High AI/200 Scores:

HEIA 38.89 +1.79 AI/200=175 Breakout IP21>.50 CP=NH All Bullish

SMCI 15.94 +.93 at upper band...AI/200=184 IP21>.35 CP=NH All Bullish

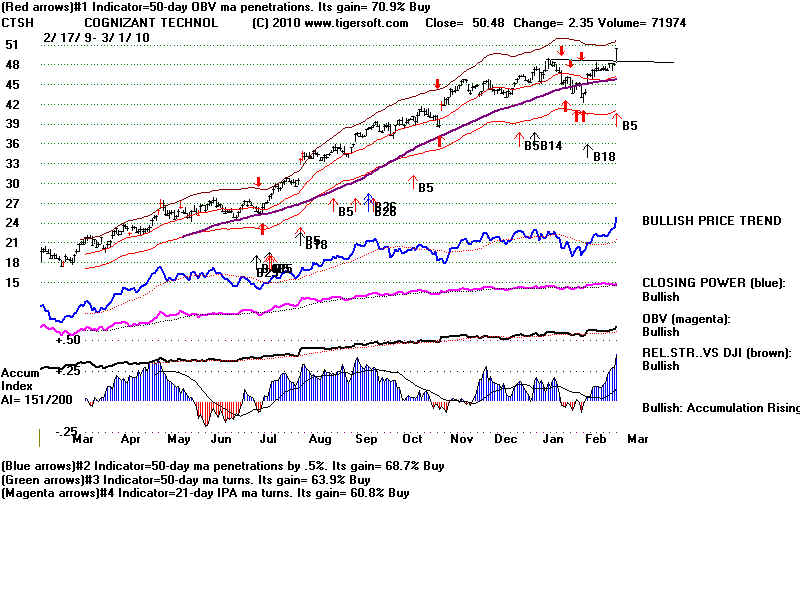

CTSH 50.48 +2.35 AI/200=151 IP21>.35 CP=NH All Bullish

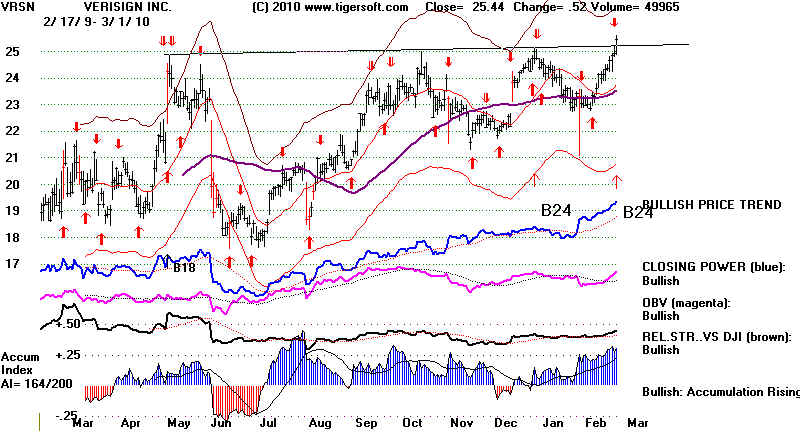

VRSN 25.44 +.52 AI/200=164 IP21>.30 CP=NH All Bullish

ALTR 25.03 +.60 AI/200=152 IP21>.30 CP=NH All Bullish

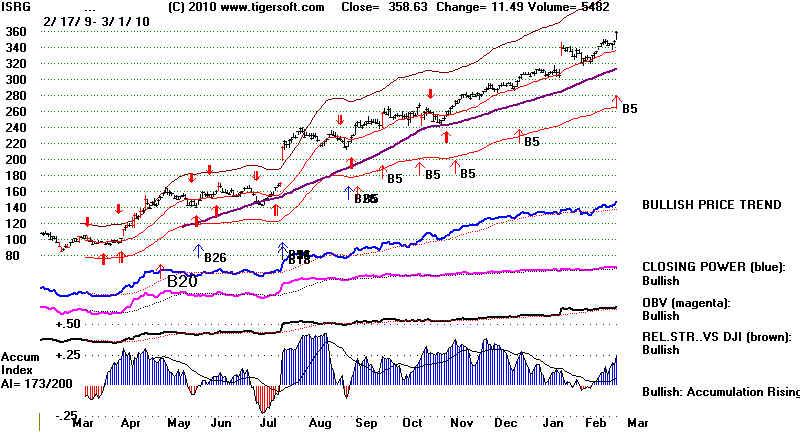

ISRG 350.63 +11.49 AI/200=173 IP21>.25 CP=NH All Bullish

FFIV 58.25 +2.45 AI/200=170 IP21>.30 CP=NH All Bullish

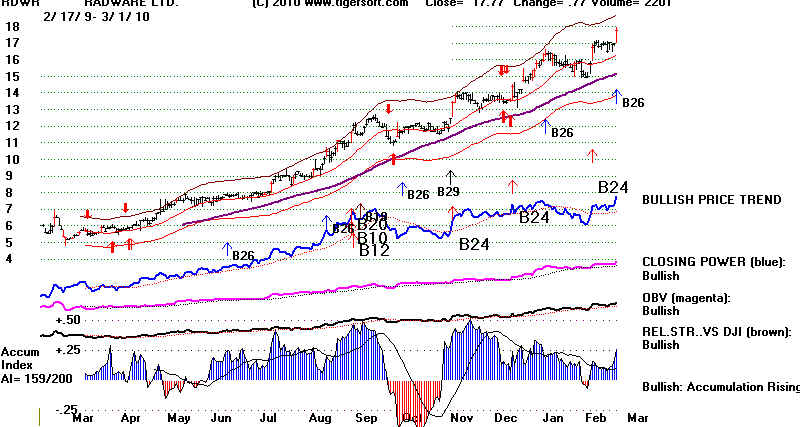

RDWR 17.77 +.77 AI/200=159 IP21>.25 CP=NH All Bullish

CREE 69.71 +1.88 at upper band...AI/200=157 IP21>.35 CP=NH All Bullish

WBMD 43.84 +.76 at upper band...AI/200=165 IP21>.30 CP=NH All Bullish