TigerSoft New Service

4/27/2010

TigerSoft New Service

4/27/2010Make Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

A GREEK TRAGEDY

Bankers' Hubris Brings Financial Dominoes

To Greece, Europe

and America

SPECULATORS' NOW USE CREDIT DEFAULT SWAPS

TO TRY TO BRING DOWN AN ENTIRE COUNTRY!

THE TROUBLE WITH THE EURO! NO NATIONAL CURRENCY MEANS

ABJECT POVERTY FOR POORER COUNTRIES.

20% UNEMPLOYMENT, CITIZEN ANGER and COMMUNIST RESURGENCE

10-year Greek Bonds in Euros

www.tigersoft.com "Where

Everyone Gets Personal Service." william_schmidt@hotmail.com

PO Box 9491 San Diego, CA 92169 858-273-5900 TigerSoft Blog

Testimonials

About Us :

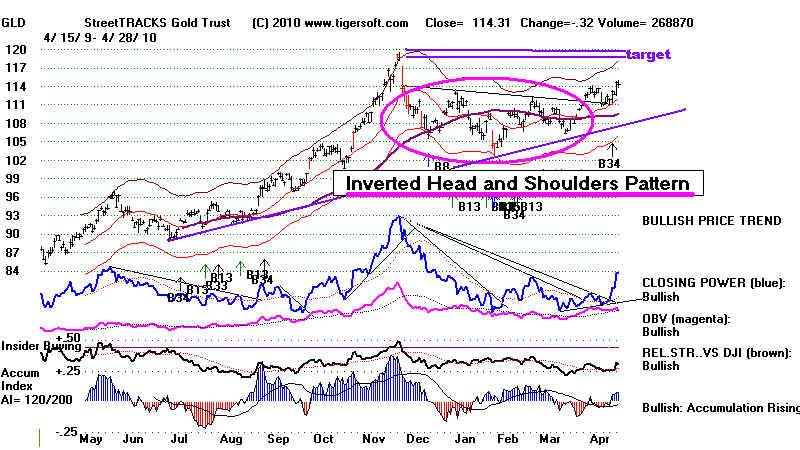

"Gold Is Good"

Gold is on the rise. The fear of an entire country "failing" scares folks out

of all currencies. There is good reason to be afraid of a chain reaction of

"sovereign" countries' debt problems. The could destroy whole countries,

as only a wars or civil wars, used to be able to.

GLD - ETF for Gold

The European Debt problems will almost certainly worsen because

of the ballooning use of unregulated credit default swaps, the absence

of any local currencies and the presence of so many angry, demonstrating citizens

who do not find 10.3% unemployment acceptable. Except for France, the heads

of the Economic Union and all the countries that make it up are afraid of the big banks.

They simply endorse the International Monetary Fund's call for retrenchment and

balanced budgets. They avoid the real problems. They should demand a universal

criminalization of trading in credit default swaps. But they understand the US

would not enforce it.

The heads of each of the EEC countries seem quite intimidated by the big banks.

Except for occasional bouts of rhetoric against Goldman Sachs, they refuse to

address the core issues. Amazingly, a year and a half after the Crash of 2008,

there is still nothing to stop sinister short-selling speculators from driving

Greece and Spain into national bankruptcy, just so they can make a bundle.

Tourists should be flocking to see beautiful Greece, but since prices

are fixed in Euros, the current financial crisis offers no extra incentive

for travelers to visit.

The Dangers of CDS (Credit Default Swaps)

In effect they allow you to buy fire insurance on your

neighbor’s house. This creates an incentive for you to

burn down his house. Worse, where bankers used to only

be able to deny credit, now they can destroy credit

and solvency, too.

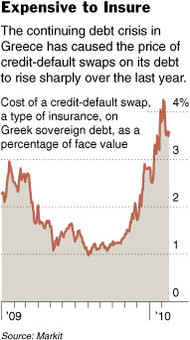

How would do speculators do this? They bet on Credit Default Swaps. Example.

for a mere $282,200 a big bank could have bought insurance on $10 million in Greek

government debt. In February, the same CDS cost $40,000. Now its price is $754,280

for a year's "insurance." Besides Goldman and JP Morgan, the biggest buyers of these

are Credit Suisse, UBS, Societe Generale and Deutche Bank. Specualtors trade these

Credit Default swaps instead of a specifric Greek or Spanish currency, as in the past....

Here is the essence of a lonely US article about the dangers of the Credit Default Swaps.

( http://dealbook.blogs.nytimes.com/2010/02/25/banks-bet-greece-defaults-on-debt-they-helped-hide/ )

"As Greece's financial condition worsened...a little-known company backed by Goldman,

JP Morgan Chase and about a dozen other banks ...created an index that enabled market

players to bet on whether Greece and other European nations would go bust...Last September,

the company, the Markit Group of London, introduced the iTraxx SovX Western Europe index,

which is based on such swaps and let traders gamble on Greece shortly before the crisis.

"Such derivatives have assumed an outsize role in Europe’s debt crisis, as traders focus

on their daily gyrations...A result, some traders say, is a vicious circle. As banks and others

rush into these swaps, the cost of insuring Greece’s debt rises. Alarmed by that bearish signal,

bond investors then shun Greek bonds, making it harder for the country to borrow. That, in turn,

adds to the anxiety — and the whole thing starts over again...

"(T)he French finance minister, Christine Lagarde, last week singled out credit-default swaps.

Ms. Lagarde said a few players dominated this arena, which she said needed tighter regulation.

Trading in Markit’s sovereign credit derivative index soared this year, helping to drive up the

cost of insuring Greek debt, and, in turn, what Athens must pay to borrow money...

“It’s like the tail wagging the dog,” said Markus Krygier, senior portfolio manager at

Amundi Asset Management in London, which has $40 billion in global fixed-income assets.

“There is a knock-on effect, as underlying positions begin to seem riskier, triggering risk models

and forcing portfolio managers to sell Greek bonds.” If that sounds familiar, it should. Critics

of these instruments contend swaps contributed to the fall of Lehman Brothers."

( http://dealbook.blogs.nytimes.com/2010/02/25/banks-bet-greece-defaults-on-debt-they-helped-hide/ )

The Lack of A Greek or Spanish

Currency

Makes Matters Much Worse.

There is a big and

important change now. Previously, speculators who were bearish

on the financial safety of a country would sell

short the currency of the weak

country. As these countries' currencies

declined, their economies were boosted by

expanded tourism and exports. Foreign

companies would be attracted by the lower costs of

labor and land in the country. In this way,

there used to be a natural cushion against

utter financial disaster.

But Greece and Spain

now no longer have their own currency. The EURO ended

this and set the stage was set, as never before

- except in war - for a total country

financial collapse. Of course, the the

heads of the Economic Union and the Greek

Premier call "absurd" any talk of

national (sovereign) bankruptcy or the breakup

of the European Economic Union. But

others like myself and the prescient economist

from NYU, Nouriel Roubini, disagree..

Jan 27, 2010 - Roubini: Greece

Bankrupt, Spain Next

Apr 27, 2010 - Roubini:

Saving Greece Won't Work, Debt Crisis to Spread

The problem, as I

see it, is that the situation now can be turned into a tragic death spiral

for an entire nation of millions and millions

of people because of the utterly selfish actions

of unregulated big-bank speculators, now, using

in many cases, free US Fed money.

What are the

dynamics? Now when international corporations see a country in

financial decline and under attack by

credit default swap predators, they back away

because there is no natural protection

against bankruptcy. Bailouts come at a

high price. Greece's official

unemployment rate is now 10.3% In

Spain unemployment

is

above 22%. IMF or central

banker imposed austerity means even fewer jobs and

less of a social safety net. High levels

of civil unrest are now a certainty whenever

the Greek government is appears to be

kowtowing to these bank demands that the

Greek government balance its budget

immediately and cut back its social programs.

The Greek Communist party is making a

comeback.

The media in the

US blame the Greeks and Spaniards for living beyond their

means. But are the poor and unemployed

people there expected to starve while

waiting for private sector jobs to

appear, just so bankers can get still richer?

Banker imposed austerity will crush the

poor in these countries.

"The

Greek “rescue package” is a seriously flawed financial plan.

First, it is conditioned

upon the successful

implantation of a structural adjustment program that contains harsh austerity measures

which will hurt

workers, pensioners and the poor and dismantle an already scant welfare system. Greece

already ranks among the

most unequal societies in the world, with 20 percent of the population living

below the poverty

level, and its social services resemble those of an undeveloped rather than those

of a developed country.

"Further,

the austerity measures of wage cuts, pension reductions and sharp tax hikes will

depress spending and

lead to severe job losses for an economy that is already facing double

digit unemployment

rates. It is estimated that unemployment will increase by an additional 6

percent

because of the EU/IMF

imposed austerity measures and the GDP is expected, according to

official

estimates, to shrink by 4 percent this year and by another 3% in 2011.

"The contraction of the economy will add further to

Greece’s debt problem. In two years from

now,

the debt to GDP ratio will stand at 150 percent....In sum, Greece is being asked to

implement

an

amazingly harsh structural adjustment program which will only make the economy worse off

and

cause

immense human suffering but will still end up with an unmanageable sovereign debt crisis."

(

Chronis Polychroniou - http://www.energybulletin.net/node/52830

May 17, 2010)

Organized labor

and their supporters will always fight this. And that reinforces the

death spiral. Civil unrest is

thereby guaranteed. Greece already had one civil

war, after World War II. It does

not need another. But strife and agitation

are inevitable in this economic climate.

This further discourages foreign investment

and causes the flight of private capital.

It would be very tragic if a military dictatorship

resulted. This is such a beautiful

land.

Greek Prime Minister -

George Papandreau

Were it not for these

credit default swaps and the absence of an independent Greek

or Spanish currency, a financial collapse might

now be avoided and a bottom might otherwise

be reached. But Wall Street's Standard

and Poor's cares not a wit about these dynamics.

It gets into the act, the self-reinforcing

free-fall, when it issues as it did today, an all too

obvious and belated, but very public warnings

that the Greek budget deficit has reached

unsafe levels. Who asks the key question?

Exactly, how is such a country to survive

when investors not only pull away but now work

aggressively against the country's efforts

to solve its problems?

Exaggerated?

Because credit default swaps have ballooned so much and yet are so

completely unregulated, we have to depend

solely on big banking firms to tell us what their

role was in bringing about the Financial Crash

of 2008. This is dangerously absurd.

There is too much risk for the countries

involved and too little risk for banks using

huge leverage and being reimbursed

lavishly for using it to the fullest. Absurd?

Of course, but Wall Street banks won't

dare to admit just how pivotal and decisive

their bearish role was in destroying

millions of jobs and retirement dreams.

To my way of thinking, just

allowing credit default swaps to be traded seems

to constitute costly and criminal fraud.

AIG sold them with impunity in quantities it

knew full well it could not possibly

redeem or honor if there was, indeed, a housing

market collapse. That is criminal fraud!

It knew it could not meet the terms of its

contract when it sold the swaps.

And it very dangerous. Speculators bought AIG's

swaps then, just like they are buying

them now, on Greek and Spanish debt, making

the declines in these countries'

economies much worse. In America, the taxpayer

bailed out AIG and the big banks.

If a series of countries fail because of how powerful

these bear raiders are and how weak

investor confidence is, who will make good these

credit default swaps. No one.

So, they are a fraud and should not be sold, even

apart from their cruel consequences.

OIbama's "Raw

Deal"

Bear raids were made illegal in FDR's time. Not in Obama's time. FDR

brought

the "New

Deal" to Americans. Truman fought banks, too, and

campaigned for

a "Fair

Deal". Obama shows every day he is a puppet of

Wall Street. He

gives Americans a "Raw Deal".

His financial reform proposals leaves out all that "

is important. There is no breakup

of banks too big to fail. There is no separation

of normal business and individual banking

from hedge fund trading and speculation.

There is no penalty for rigging markets.

Excessive computerized trading is not

deterred or heavily taxes. Windfall

trading profits are safe. No special tax on this

asocial and dangerous activity by

brokerages. No criminal penalty at the top

of brokerages for fraud, insider trading,

front-running or manipulation of

the markets. Obama proposes that

the Federal Reserve regulate "credit default swaps".

What a joke?! This is the same

agency that created, exaggerated and then refused to

regulate the housing bubble. The

Fed loves big banks. It is made up of bankers.

It happily encourages the manipulation of

markets by big banks by giving them

"free money" for "toxic

collateral".

The NY Times opined:

"DERIVATIVES

are responsible for much of the interconnectedness between banks and other

institutions that made

the financial collapse accelerate in the way that it did, costing taxpayers

hundreds of billions in

bailouts. Yet credit default swaps have been largely

untouched by

financial reform

efforts. This is not surprising. Given how much money is

generated by the

big institutions

trading these instruments, these entities are showering

money on Washington to

protect their profits.

The Office of the Comptroller of the

Currency reported that revenue

generated by United

States banks in their credit derivatives trading totaled $1.2 billion in the

third quarter of 2009. Congressional “reform” plans for credit default

swaps are full of loopholes,

guaranteeing that

another derivatives-fueled financial crisis awaits us"

( http://www.nytimes.com/2010/02/28/business/economy/28gret.html

)

So, these

bear raids and credit default swaps are neither regulated nor outlawed in

Europe or America. Not

surprisingly, an organized international banker run on Greek debt

is under way. It could

very well be successful. It it is, there will be a chain reaction

of short selling of the debts of Spain,

Portugal, Italy, Ireland...and eventually the US!

This is intolerable.

But none of our politicians talk about it. And the media is

silent. What happens when the US stock

market bubble ends and the very same

bankers who are now hugely profiting from the

current artificial bull market turn their

bearish guns loose on the US Stock Market?

If history shows anything, it is how few people,

especially those who enjoy political power

learn anything from it.

References - Greek Civil War: 1944-1949

Greek Protests against Governmental Austerity Measures in 2010