TigerSoft News Service 3/18/2008

Visit our www.tigersoft.com

TigerSoft News Service 3/18/2008

Visit our www.tigersoft.com

Addendum - 3/20/2008

"Socialism for The Rich"

The Fed Gives A Few Elite Bankers $650 Billion in Unconditional Loans

based on very poor quality collateral. It must be nice!

More and more "respectable" experts are calling the Bush Regime a

government strictly by and for the rich. For years, near-zero regulation

allowed banks to become lax, corrupt and self-indulgent. This created

the housing bubble and the awful decline since. Now the Fed must save

financial markets from their own failures, from customers' defaults and

a general "run" on all stocks, not just banks, is certainly expected of the

FED.

If socialism is needed to save the rich, it's only a matter of time before

working people will rightly demand a piece of the pie, too. And they will

be incensed if right wing politicians call their demands "socialism". The

"free market" is NOT free. It is very expensive to everyone but bankers...

Also - Lessons from The Panic of 2007

by William Schmidt, Ph.D. (Columbia University)

(C) 2008 All rights reserved. Reproducing any part of this page without

giving full acknowledgement is a copyright infringement.

|

Tiger

Software Helping Investors

|

"Freedom for the pike is death for the minnows" JK Galbraith, The Affluent Society.

The FED is now doing exactly what all its many opponents have criticized it for many years.

It is clearly serving the Power Elite, less obviously everyone else. It is printing billions

and billions of dollars and thereby debasing the currency irreparably. "Fixed income folks

be damned." The Fed is now offers a discount window that allows investment banks as

well as money-center banks to borrow billions using only mortgage-based securities.

What a bail out? The FED's action expose how much of American capitalism is utterly

crony-based and entirely dependent upon government hand-outs. Something is fundamentally

wrong when all the job growth this year has come from government employment.

Did the Fed have any choice? Do we want another Depression? Yes, it's not clear

how much choice the FED has when a major stock brokerage, investment bank or bank

suddenly comes to it and says "help us" or "we must shut our doors and not honor our

commitments? And that is what Bear Stearns told the Feds over the weekend.

But the Feds loans are unconditional. So, Americans have no assurance that these

these loans ever will trickle down to working people or prevent a further financial collapse.

There is nothing to prevent the banks from increasing executive pay. There is nothing

to guarantee Americans that these same bankers won't make the same mistakes again

and again. And then come back for more hand-outs from the Fed.

Bear Stearns was sacrificed for the good of the financial market, say the clever pundits.

But it's taxpayer money that will be used in these bailouts by the Fed to save banks AND the Fed's loans and

bailouts are unconditional. It is major FED failure that banks are not obliged to make more loans to

homeowners or show that they have learned anything from their excessive loans (40:1 factoring is not safe!)

to other banks making unsound loans.

My Complaint

There's no guarantee the Fed's actions will work. $650 billion of the $900 billion dollars worth of FED

reserves set aside for rescue has now been expended. What happens if home prices keep falling? And that's

very likely. Housing prices in 2005 were vastly bloated. The FED allowed zero-down housing loans and

a look-the-other-way qualifying process. Why should they be trusted now? It makes no sense. The FED is

trying somehow to prevent the punctured balloon from losing all its air and becoming a shriveled-up heap

on the floor. ( The figure of $650 billion was offered by Kudlow, CNBC on 3/18/08. )

If we have not seen a bottom in housing prices, the FED will have to eat all these mortgages it is letting

its favored banks use as collateral so they don't default. Actually, it's the taxpayer who will. Then the

Fed will print lots more of its funny money. The dire effects of the the collapse of the Dollar will be felt

for many years, just as the Bush-Cheney subsidizing private contractors in Iraq will. A trillion dollars here.

A trillion dollars there. It all adds up. Perhaps, the FED has $20 billion now in Gold. That's not nearly

enough to create even a modicum of confidence. We better learn Chinese..

The regulatory system must prevent the stupid, greedy, fraudulent and bad faith loans and risk taking. Not

to do this gives the bank license to be thoroughly corrupt. It allows and encourages predatory lending to the

broad public and extravagant subsidizing of the undeserving well-connected. In this unregulated arena

bankers become crooks. Arrogance and incentives all push them in this direction. They readily indulge in

insider trading. Their salaries are obscenely underserved. And if they are not stopped, penalized and jailed,

in a few years these same crooks will be doing the same thing all over again. And they will be making political

campaign contributions to gain immunity and special favors.

(Added: 3/20/2008 from Nightly Hotline) Will Their Gamble Backfire?

Confidence in the Fed is going to start slipping badly if their big gamble here

does not pay off. The Fed has now used up much of its ammunition, too early.

If anything like a normal market had existed, the DJI today would have been able to

follow-through and get up to its 2.5% upper band. Instead, the rally was abruptly halted

at its steep downtrend. Now one must wonder if the FED has wasted $650 billion?

True, they had to do something. But, it looks to me that they have tried to stop the

decline too early. Housing prices are still inflated by the zero-down buying binge.

The mortgage market is a trillion dollars' market. The FED can't stop this market

from going where it needs to. And Congress won't either. Iraq has wasted a trillion

dollars. The Treasury is bare. I think that the stock market needs naturally to correct

after a five year run. The FED can't hold it up, except artificially and temporarily

at these levels.

The Fed naturally does not want to become the center of attention in a Presidential

Election Year. But its recent actions may backfire and threaten its independence. The

Fed clearly want to hold things together until Bush is safely out of office. Next year,

it will have no ammunition left at the rate its going. In proceeding as it is, the Fed is going

to become a political target, because its actions look corrupt, JPM favoring and partisan.

Why didn't they just buy the mortgages from the banks, instead of letting banks

use them as collateral? The banks are being treated like royalty. And the Fed imposes

no conditions on the banks. They can make as many, or as few ,loans as they wish

to homeowners now. They are 100% free to make the same mistakes all over again.

The appearance of corruptness in the banks' bailout just amplifies the popular distrust

with Bush and Cheney's use hundreds of billions from the US Treasury to benefit private

contractors in Iraq. This will bring much more public controls of the Fed, Wall Street will

not like this. Foreigners will surely start to slow down their loans dramatically to a

country perceived to be so corrupt. Harsh? Confidence is a matter of perception. And the

declining US market will be seen as proof of the corruption. This means bad things for

US stocks and the US Dollar. "Foreign buyers of 10-year Treasury Notes ('indirect bidders')

plummeted to 5.8%, from an average 25% over the last eight weeks, which is a certifiable

disaster."

Finally, "Socialism" for the rich is, of course, a misnomer. Socialism

aims at democratically-controlled

public ownership of the means of

production. What we see now is magnificently massive corruption

that benefits only a few.

Am I ranting. Here is what you hear from well-respected people

about these one-sided bailouts.

Willem Buiter, a former Bank of England Policy Maker.

"Still, some economists said, the Fed may encourage risky behavior by

backstopping financial

institutions. Willem Buiter, a London School of Economics professor and former Bank of

England

policy maker, called the Fed's move ``socialism for the rich, which is both inefficient

and morally

objectionable.

"The recent bailout (and yes, bailout - that is how the Nightly Business Report

called it) is just

another example of capital extraction from the tax payer. I ain't no bandaid, but as far

as I can tell

here is how the game goes.

Guy X puts all his money on red 23. Black 12 comes up.

Wait, we can't afford for Guy X to go bankrupt! So let's all chip in to help a man

out who is down on his luck.

"Can someone answer this question for me? Why is risk only transferred from company

to company

to company and, then finally, the taxpayer? Can't we force risk exposure on the

INDIVIDUALS

that performed these transactions? If Alan Schwartz from Bear Stearns wants

socialism to save his

company, it seems to me only justified to seize his personal property to ensure the Great

Leap Forward

- right? (/mild sarcasm).

( http://www.dailykos.com/story/2008/3/15/23529/9310/902/477090

)

Jim Rogers: 'Abolish the Fed'

"Federal

Reserve Chairman Ben Bernanke should resign and the Fed should be abolished as a way to

boost the falling dollar and speed up the recovery of the U.S. economy, investor Jim

Rogers,

CEO of Rogers Holdings, told CNBC Europe Wednesday. Asked what he would do if

he were

in Bernanke's shoes, Rogers, who slammed the Fed for pouring liquidity in the system and

accepting

mortgage-backed securities as guarantees, said: "I would abolish the Federal Reserve

and I would resign."

If this happened, "we don't have anybody printing money, we

don't have inflation in the land, we

don't have a collapsing U.S. dollar," he told "Squawk Box Europe."

"No country in the world has ever succeeded by debasing its currency," he said.

"That's what this

man is trying to do. He's trying to debase the currency as a way to revive America. It has

never

worked in the long term or the medium term....The Fed's move to accept risky collateral is

not part

of the central bank's business, he added. "What

is Bernanke going to do? Get in his helicopter

and fly around the world and collect rents? That's absurd," Rogers said.

"Listen, investment banks

have been going bankrupt since the beginning of time. If people make mistakes -- if you

bail out

every investment bank that gets in trouble, that's not capitalism, that's socialism for

the rich," he said.

The weakest financial institution is Fannie Mae, in Rogers'

opinion, "but all of them have problems."

( http://www.cnbc.com/id/23588079/site/14081545

)

Jim Grant - NY Times

""Now comes the bill for that binge and, with it, cries for even greater federal

oversight and protection.

Ben S. Bernanke, Mr. Greenspan’s successor at the Fed (and his loyal supporter during

the antideflation

hysteria), is said to be resisting the demand for broadly lower interest rates. Maybe he

is seeing the light that

capitalism without financial failure is not capitalism at all, but a kind of socialism for the rich."

( http://bigpicture.typepad.com/comments/2007/08/capitalism-with.html

)

Times of London - :the threat is now insolvency, not

illiquidity.

"If it looks like a bail-out, and sounds like a bail-out, it is a bail-out. But

“capitalism without failure

is like religion without sin. It doesn’t work”, says Carnegie Mellon professor

Allan Meltzer. Guarantee

lenders against failure and they will lend and lend and lend, diverting resources to

ill-conceived ventures,

driving down productivity and living standards."

There are four problems with all of this: 1) "bad news overwhelms good."

2) "T"he Fed is a tiny player

in the mortgage market. The $200 billion of mortgages Bernanke will be taking on are a

drop in the

ocean that is the $11 trillion mortgage market. And he has only another $400 billion in

Treasury

notes to play with - if he is willing to have these mortgages make up his entire stock of

assets.

3) "So long as house prices continue falling, the value of mortgages will continue

falling. The Fed

can’t do much to stop that decline, and we seem to have a long way to go before house

prices

reach some bottom, unsold houses are absorbed, and the market turns up." 4)

Long term

home loan rates and credit for mortgage buyers are now higher and tighter than when the

Fed

started lowing the Discount rate and extending credit very liberally to banks.

( Source: http://business.timesonline.co.uk/tol/business/columnists/article3558527.ece

)

Bob Chapman

"The dollar has clearly been

abandoned and foreigners are starting to bail from dollar-denominated

assets in droves. This is where bailouts, and the hyperinflationary destruction of

the dollar that comes

with them, are leading us, along with miniscule bond rates caused by continual flights to

"security" as

everyone flees in terror due to rapidly deteriorating market conditions caused by subprime

fallout,

over-leveraged speculation, fraudulent lending and borrowing, lack of oversight,

transparency and

confidence, frozen credit markets, an out-of-control money supply, profligate borrowing

and spending,

as well as an economy destroyed in less than two decades by globalization, free trade,

off-shoring,

outsourcing, unrestrained illegal immigration, insane wars for profit and the rampant

inflation and

unemployment that come from a completely, totally and malevolently mismanaged economy

thanks

to the reprobates and sociopaths that run the Fed and our government."

( http://theinternationalforecaster.com/item.php?topicId=2&articleid=233

)

More plebe discussion of rule by the power elite.

http://reddit.com/r/reddit.com/info/6buh4/comments/

http://conservatard.wordpress.com/2008/01/11/bush-onomics-101-the-poor-will-always-support-the-rich/

http://www.freedomworks.org/informed/issues_template.php?issue_id=2921

http://obrag.org/?p=492

"The Fed's cherry picking will

reveal the identities of their fellow elite insiders within the various

components of the financial industry, such as banks, investment banks, broker-dealers,

pension plans,

insurance companies, hedge funds, etc. They will be forced to reveal these insiders

because they, and

all the remaining central banks around the world, are not even close to being big enough

to bail out the

entire system. They will only be able to bail out their crucial insiders within the

troubled financial system,

if they are lucky. Bear Stearns was a primary US government bond broker and was

greatly intertwined

with many other institutions in the system in terms of counter-party exposure.

http://theinternationalforecaster.com/item.php?topicId=2&articleid=233

----------------------------------------------------------------------------------------------------------------------------

The Panic of 1907: Lessons Learned from the Market's Perfect Storm (Hardcover)

by Robert

F. Bruner (Author), Sean

D. Carr (Author)

Banker J. Pierpont Morgan

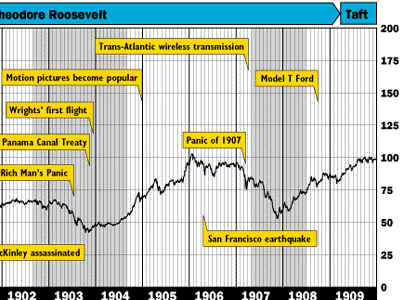

DJI - 1902-1909

From 1814 to 1914, the United States saw 13 banking panics—of these, the panic of

1907

was

among the worst. The 1907 Crash was created by a

perfect storm of negative financial forces:

Some

would add Franklin Roosevelt's public humiliation of "trusts"

"Business consolidators" and

their

Wall Street advisers were creating large, new combinations through mergers and

acquisitions,

while

the government was investigating and prosecuting prominent executives...The public’s

attitude

toward business leaders, fueled by a muckraking press, was largely negative."

1) Stock Market and Real Estate Speculation: the DJI doubled between October 894 and

January 2006.

"Inadequate safety buffers. In the late stages of

an economic expansion, borrowers and creditors

overreach in their use of debt, lowering the margin of safety in the financial

system."

2) San Francisco earthquake (1906) Much of the real estate of San Francisco was insured by

companies in

London. Payouts to San Francisco drained money from the U.K., which raised interest rates

there and

in the U.S.

3) Bank of England decision to slow the flow of gold to the U.S/

4) A reckless scheme to corner the stock in United Copper which made clear the close

connections

between banks, trusts and brokers.. The October decline began following the collapse of

United

Copper share prices.

5) Absence of a central banking authority.

6) Plunging stock values March 2007 and then October 2007

7) Injured loan collateral values

8) A general loss of confidence. Undue fear.

9) Checks not honored.

10) Run on Banks: October 21, 2007

Knickerbocker Trust Company, Trust Company of America, and Lincoln Trust Company

11) NY verged on bankruptcy.

12) Financial ruin

( See http://bigpicture.typepad.com/comments/2007/11/the-panic-of-19.html

)

The situation was saved by an individual, J.P. Morgan, provided the leadership and

liquidity

to the banking system, the City of New York, and the New York Stock Exchange, He

brought

together leading financiers and banks to halt the decline. He threatened the shorts

with ruin. US

Treasury Secretary George B. Cortelyou announced his formal support for Morgan, offering

to

provide $25 million dollars in additional liquidity during the crisis.

( See http://www.npr.org/templates/story/story.php?storyId=14004846

)

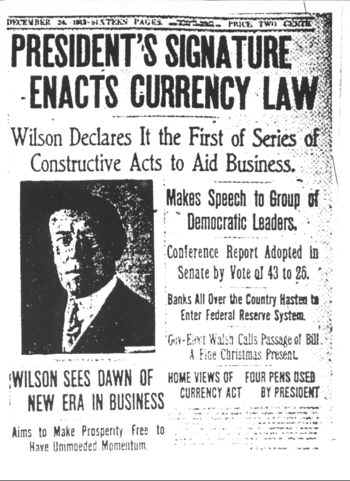

Banking chiefs, led by J. P. Morgan, later met at the Jekyll Island Club off the Georgia

coast

to concoct the central-banking scheme that became the Federal Reserve Act of 1913.

The

Federal Reserve Act of 1913 gives the authority the Fed the power to create money.

Critics say

the only money mentioned in the Constitution was based on gold, silver (and slaves).

The

founding fathers did not want the US to fall under the control of a secret consortium of

central

bankers

and dominant international banks.

The Federal Reserve Act

(Source: http://en.wikipedia.org/wiki/Federal_Reserve_System

)

In

1863, as a means to help finance the Civil

War, a system of national banks was instituted by the National Currency Act. The banks each had the power to

issue standardized national bank notes based on United States bonds held by the bank. The

early national banking system had two main weaknesses: an "inelastic" currency;

and a lack of liquidity.[2]

During the last quarter of the 19th century and the beginning of the 20th century the

United States economy went through a series of financial panics.[2]

A particularly severe panic in 1907 provided the motivation for renewed demands for

banking and currency reform.[3]

The following year Congress enacted the Aldrich-Vreeland

Act which provided for an emergency currency and established the National Monetary Commission to study banking and

currency reform.[4]

| The chief of the bipartisan National Monetary Commission was financial

expert and Senate Republican leader Nelson Aldrich. Aldrich set up two

commissions — one to study the American monetary system in depth and the other,

headed by Aldrich himself, to study the European central-banking systems and report on

them.[4]

Aldrich went to Europe opposed to centralized banking, but after viewing Germany's banking system

came away believing that a centralized bank was better than the government-issued bond

system that he had previously supported. Centralized banking was met with much opposition

from politicians, who were suspicious of a central bank and who charged that Aldrich was

biased due to his close ties to wealthy bankers such as J.P.

Morgan and his daughter's marriage to John D. Rockefeller, Jr. Aldrich fought for a private bank with little government influence, but conceded that the government should be represented on the Board of Directors. Most Republicans favored the Aldrich Plan,[5] but it lacked enough support in the bipartisan Congress to pass.[6] Progressive Democrats instead favored a reserve system owned and operated by the government and out of control of the "money trust", ending Wall Street's control of American currency supply.[5] Conservative Democrats fought for a privately owned, yet decentralized, reserve system, which would still be free of Wall Street's control.[5] The Federal Reserve Act passed Congress in late 1913 on a mostly partisan basis, with most Democrats in support and most Republicans against |

|

| The primary motivation for creating the Federal Reserve was to address banking panics (bank runs). The Federal Reserve briefly describes the circumstances that led to its creation, the purpose for creating it, and functions of the system in The Federal Reserve in Plain English:[12]

The purpose and functions of the Federal Reserve include:[12][13]

[edit] Addressing the problem of bank panics

Bank runs occur because banking systems are usually fractional reserve lending institutions and do not have enough cash in reserves to give to all of their depositors simultaneously. Bank runs can lead to a multitude of social and economic problems. The Federal Reserve was designed as an attempt to prevent this from occurring. How the Federal Reserve addresses the problem of bank panics is described in The Federal Reserve System - Purposes and Functions:[14]

[edit] Lender of last resortThe Federal Reserve has the authority and financial resources to act as “lender of last resort” by extending credit to depository institutions or to other entities in unusual circumstances involving a national or regional emergency, where failure to obtain credit would have a severe adverse impact on the economy.[15] Through its discount and credit operations, Reserve Banks provide liquidity to banks to meet short-term needs stemming from seasonal fluctuations in deposits or unexpected withdrawals. Longer term liquidity may also be provided in exceptional circumstances. The rate the Fed charges banks for these loans is the discount rate (officially the primary credit rate). In making these loans, the Fed serves as a buffer against unexpected day-to-day fluctuations in reserve demand and supply. This contributes to the effective functioning of the banking system, alleviates pressure in the reserves market and reduces the extent of unexpected movements in the interest rates.[16] [edit] Central bankIn its role as the central bank of the United States, the Fed serves as a banker's bank and as the government's bank. As the banker's bank, it helps to assure the safety and efficiency of the payments system. As the government's bank, or fiscal agent, the Fed processes a variety of financial transactions involving trillions of dollars. Just as an individual might keep an account at a bank, the U.S. Treasury keeps a checking account with the Federal Reserve through which incoming federal tax deposits and outgoing government payments are handled. As part of this service relationship, the Fed sells and redeems U.S. government securities such as savings bonds and Treasury bills, notes and bonds. It also issues the nation's coin and paper currency. The U.S. Treasury, through its Bureau of the Mint and Bureau of Engraving and Printing, actually produces the nation's cash supply; the Fed Banks then distribute it to financial institutions.[17] [edit] Federal fundsFederal funds are the reserve balances that private banks keep at their local Federal Reserve Bank.[18][19] These reserve balances are the "reserves" in "federal reserve", hence the name of the system. The purpose of keeping funds at a Federal Reserve Bank is to have a mechanism through which private banks can lend funds to one another. This market for funds plays an important role in the Federal Reserve System as it is what inspired the name of the system and it is what is used as the basis for monetary policy. Monetary policy works by influencing how much money the private banks charge each other for the loaning of these funds. [edit] Balance between private banks and responsibility of governmentPrivate banks are regulated by the government. This means that there are some restrictions on what private banks are allowed to do. The Federal Reserve is the specific part of government that regulates the private banks. [edit] Government regulation and supervisionThe Board of Governors is the part of the Federal Reserve System that is responsible for supervising the private banks. How the system is regulated is described by the Federal Reserve:[14]

|

Tools of monetary policyThere are three main tools of monetary policy that the Federal Reserve uses to influence the amount of reserves in private banks:[34]

In order to address problems related to the subprime mortgage crisis, two new facilities have been created. The first new tool, called the Term Auction Facility, was added on December 12, 2007. It was first announced as a temporary tool[40] but there have been suggestions that this new tool may remain in place for a prolonged period of time.[41] Creation of the second new tool, called the Term Securities Lending Facility, was announced on March 11, 2008.[42] The main difference between these 2 facilities is that the Term Auction Facility is used to inject cash into the banking system whereas the Term Securities Lending Facility is used to inject treasury securities into the banking system.[43] [edit] Open market operations

Open market operations put money in and take money out of the banking system. This is done through the sale and purchase of U.S. government treasury securities. When the U.S. government sells securities, it gets money from the banks and the banks get a piece of paper (I.O.U.) that says the U.S. government owes the bank money. This drains money from the banks. When the U.S. government buys securities, it gives money to the banks and the banks give the I.O.U. back to the U.S. government. This puts money back into the banks. The Federal Reserve education website describes open market operations as follows:[35]

A simpler description is described in The Federal Reserve in Plain English:[12]

[edit] Repurchase agreements

To smooth temporary or cyclical changes in the monetary supply, the desk engages in repurchase agreements (repos) with its primary dealers. Repos are essentially secured, short-term lending by the Fed. On the day of the transaction, the Fed deposits money in a primary dealer’s reserve account, and receives the promised securities as collateral. When the transaction matures, the process unwinds: the Fed returns the collateral and charges the primary dealer’s reserve account for the principal and accrued interest. The term of the repo (the time between settlement and maturity) can vary from 1 day (called an overnight repo) to 65 days.[44] [edit] Federal funds rate and discount rate

The Federal Reserve System implements monetary policy largely by targeting the federal funds rate. This is the rate that banks charge each other for overnight loans of federal funds, which are the reserves held by banks at the Fed. This rate is actually determined by the market and is not explicitly mandated by the Fed. The Fed therefore tries to align the effective federal funds rate with the targeted rate by adding or subtracting from the money supply through open market operations. The late economist Milton Friedman consistently criticized this reverse method of controlling inflation by seeking an ideal interest rate and enforcing it through affecting the money supply since nowhere in the widely accepted money supply equation are interest rates found.[45] The Federal Reserve System also directly sets the "discount rate", which is the interest rate that banks pay the Fed to borrow directly from it. This rate is generally set at a rate close to 100 points above the target federal funds rate. The idea is to encourage banks to seek alternative funding before using the "discount rate" option.[46] Both of these rates influence the prime rate which is usually about 3 percentage points higher than the federal funds rate. Lower interest rates stimulate economic activity by lowering the cost of borrowing, making it easier for consumers and businesses to buy and build, but at the cost of promoting the expansion of the money supply and thus greater inflation. Higher interest rates slow the economy by increasing the cost of borrowing. (See monetary policy for a fuller explanation.) The Federal Reserve System usually adjusts the federal funds rate by 0.25% or 0.50% at a time. The Federal Reserve System might also attempt to use open market operations to change long-term interest rates, but its "buying power" on the market is significantly smaller than that of private institutions. The Fed can also attempt to "jawbone" the markets into moving towards the Fed's desired rates, but this is not always effective.[citation needed] |

,