Professional Buying/Selling Power

1999-2010 Charts (in reverse order)

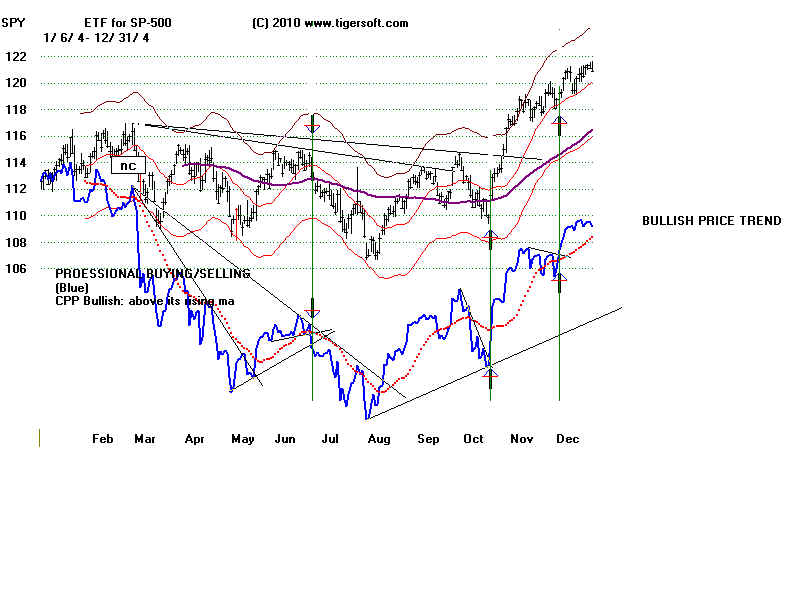

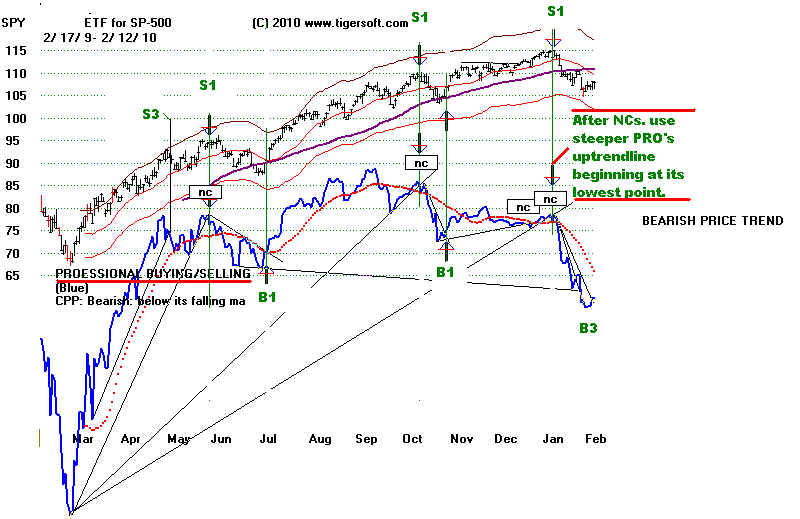

When the TGR-PRO is above its 21-day ma, we usually

can assume the price trend is still up, and vice verse,

but the rules below over-ride this simple approach at

times.

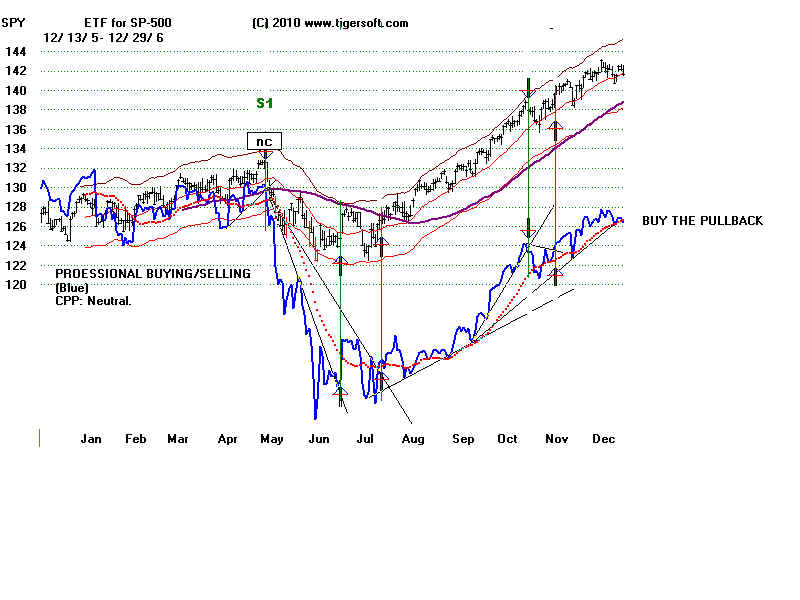

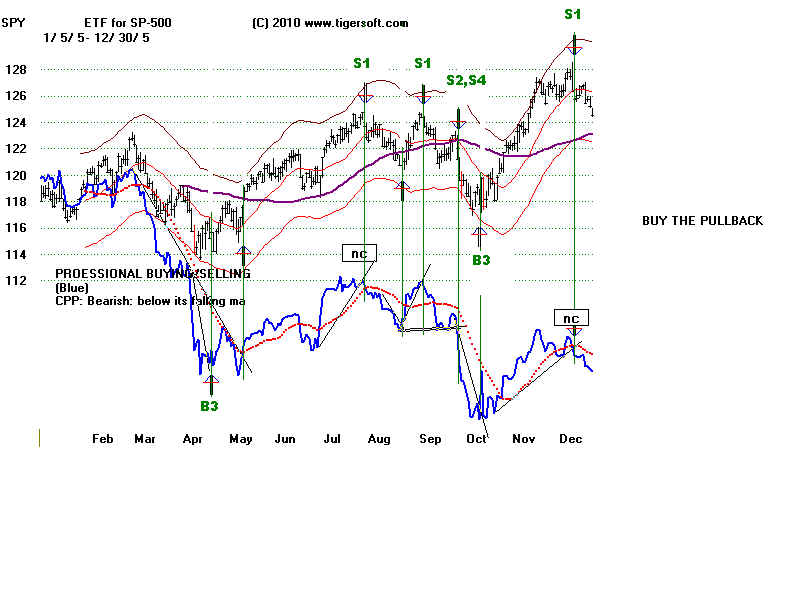

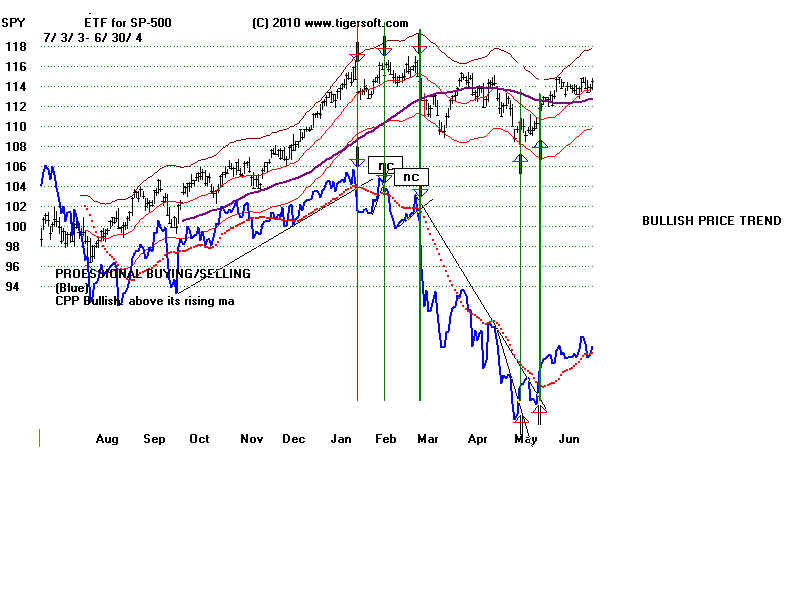

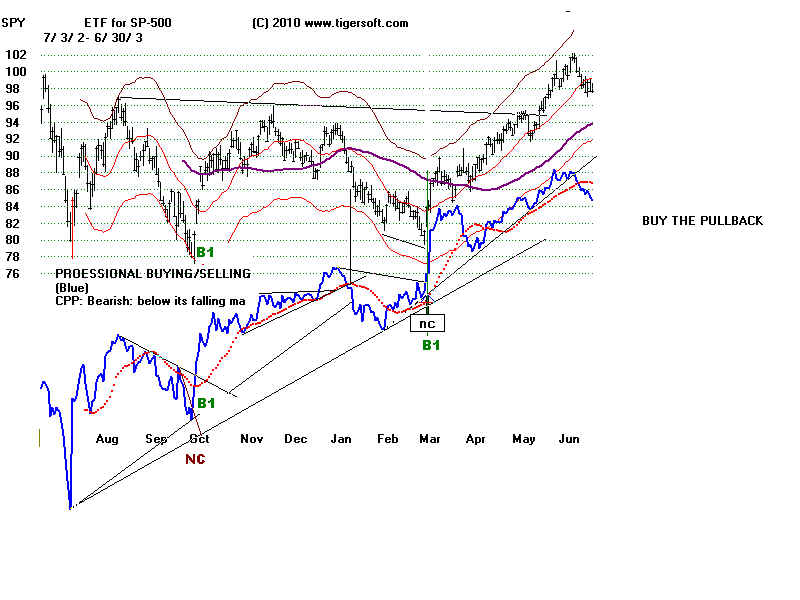

Rules to BUY:

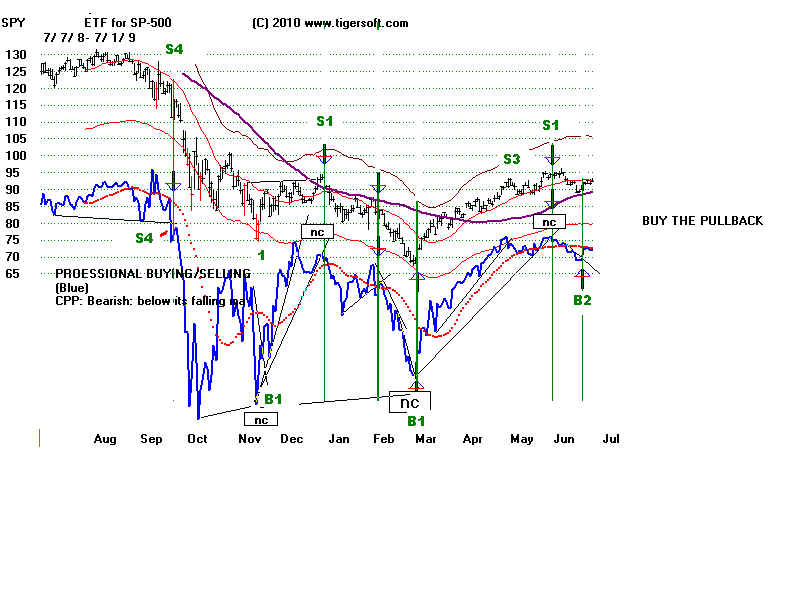

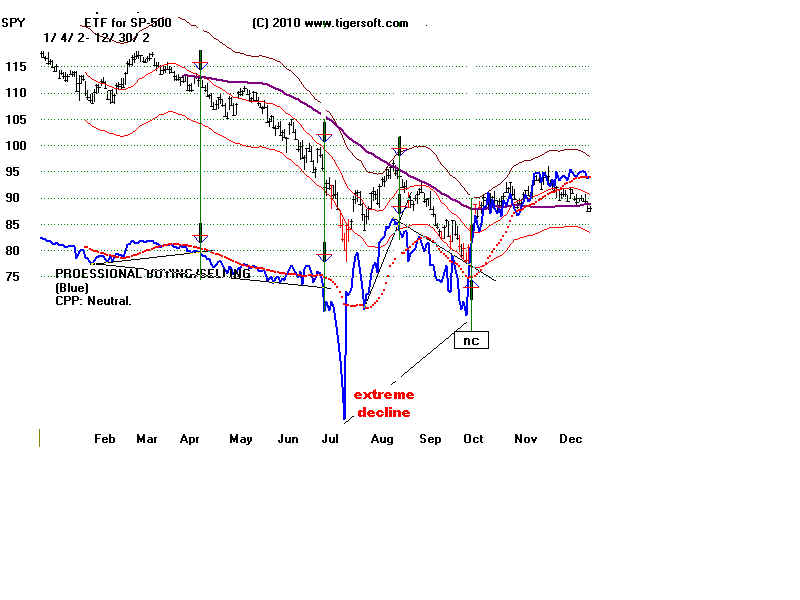

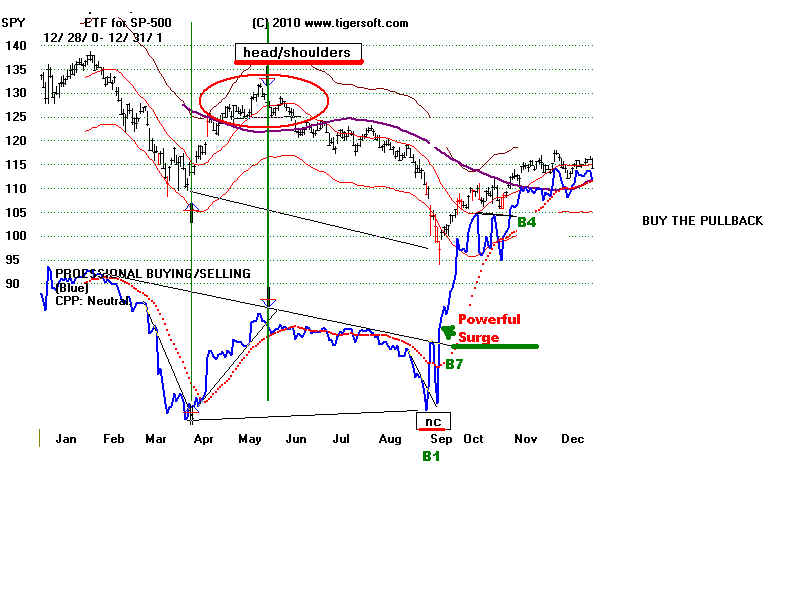

1) Buy on TGR PRO downtrend break following PRO NC

Examples: March 2009, November 2008, March 2003

2) Buy on TGR PRO downtrend break as prices test the rising 65-dma

Examples: June-July 2009

If the 65-dma is falling, the test is apt not to be successful. Examples: Nov 2007

3) Buy on break on severe TGR PRO downtrend-break.

Without a TGR PRO NC, this may only bring a rally to declining 21-dma.

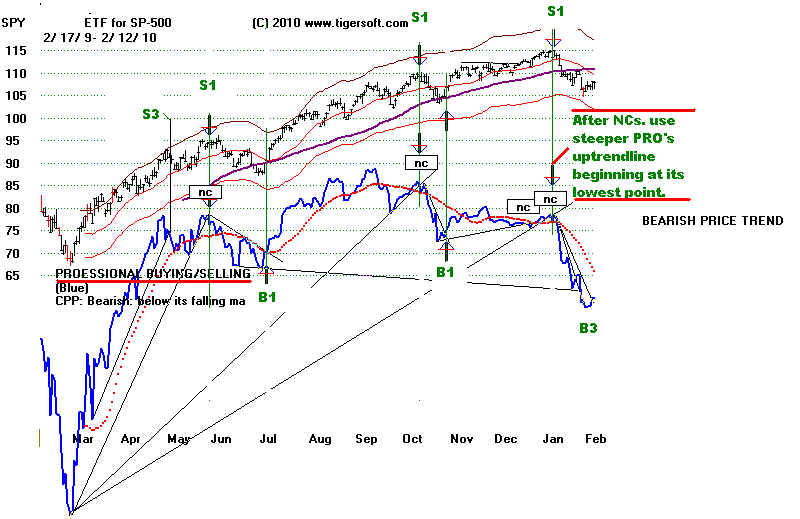

Examples: Feb 2010, Oct 2008

4) Buy on breakout in horizontal TGR PRO resistance-line.

Examples: November 2001

7) Buy on very unusual surge by TGR PRO above its downtrend.

Examples: Oct 2001

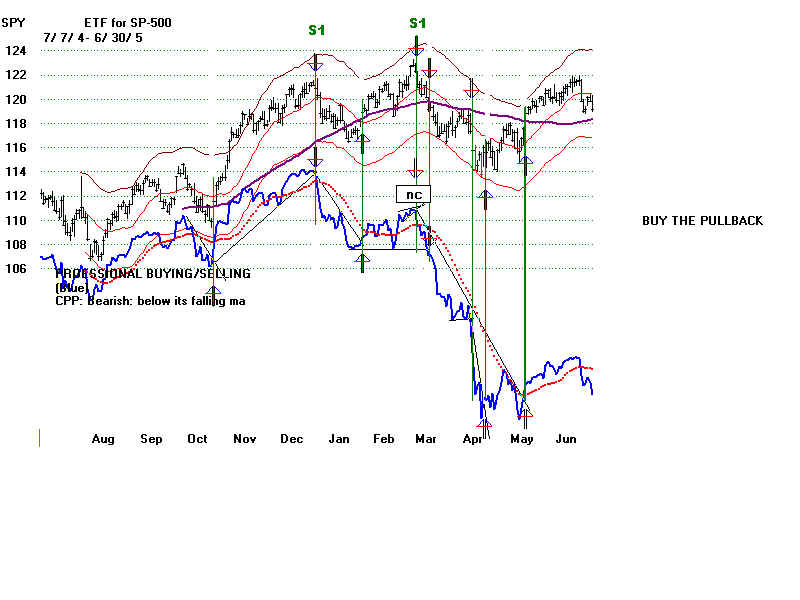

Rules to SELL:

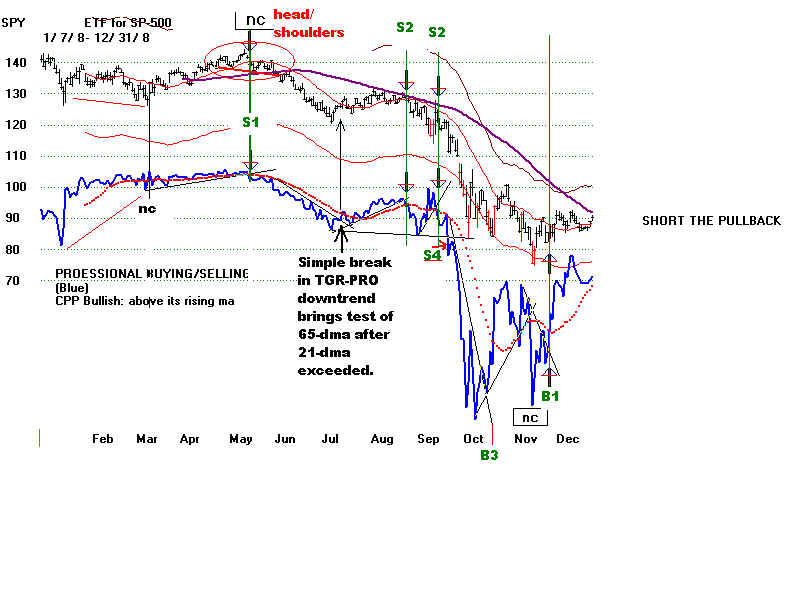

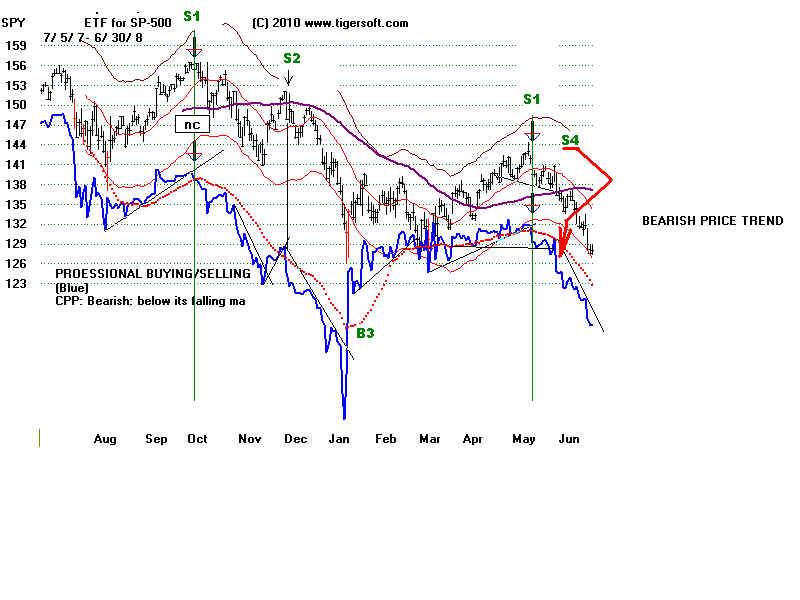

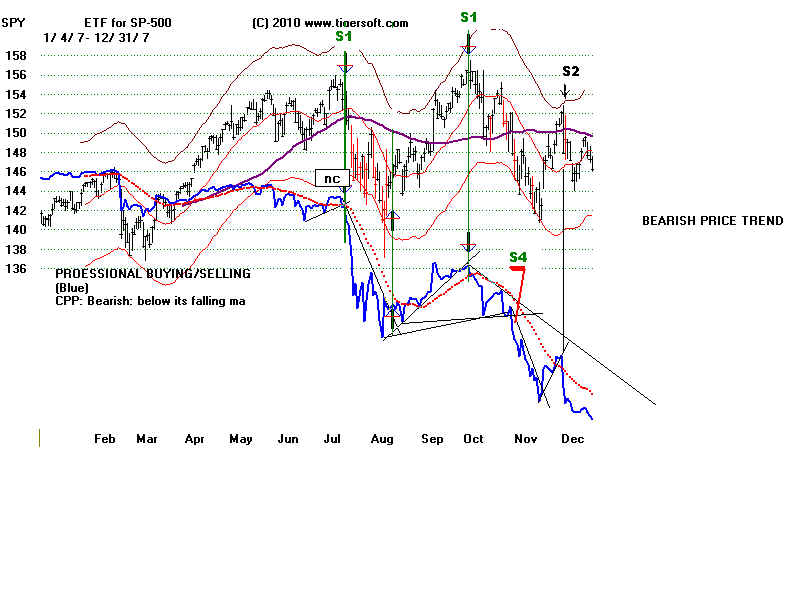

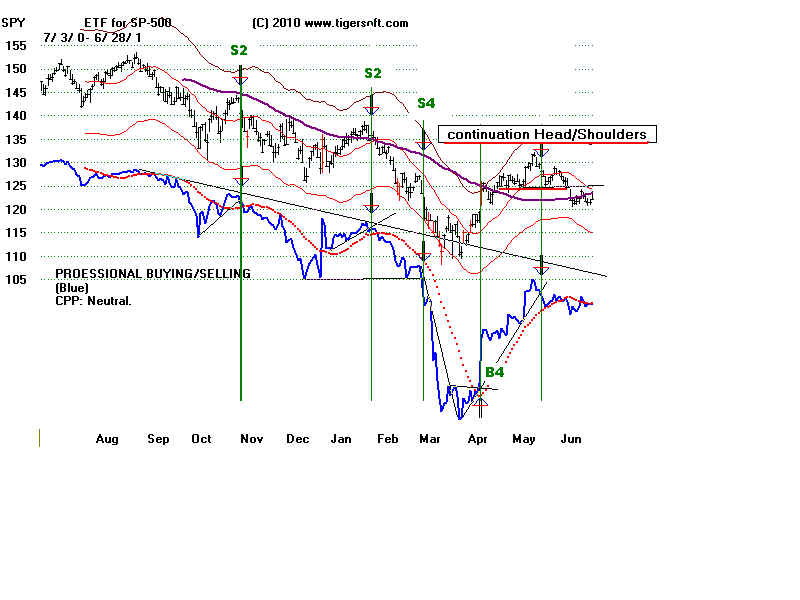

1) Sell on TGR PRO

uptrend break following PRO NC

Examples: June 2009, October 2009, Jan 2009, May 2008, October 2007, July 2007,

June 2007

If there is a flat topped breakout, give

prices more opportunity to advance.

Example: No Sell in December 2009

2) Sell on TGR PRO uptrend break as prices test the rising 65-dma

Examples: December 2007

3) Sell on break on steep TGR PRO uptrend-break.

It is often better not to start line at bottom but instead use uptrendline running

through later dips. These may bring only

minor retreats to a rising 21-day ma.

Examples: May 2009

4) Sell on break in horizontal TGR PRO support-line.

This support-line must go through at least 2, but preferably 3

bottoms.

Examples:

September 2008. June 2008, March 2001

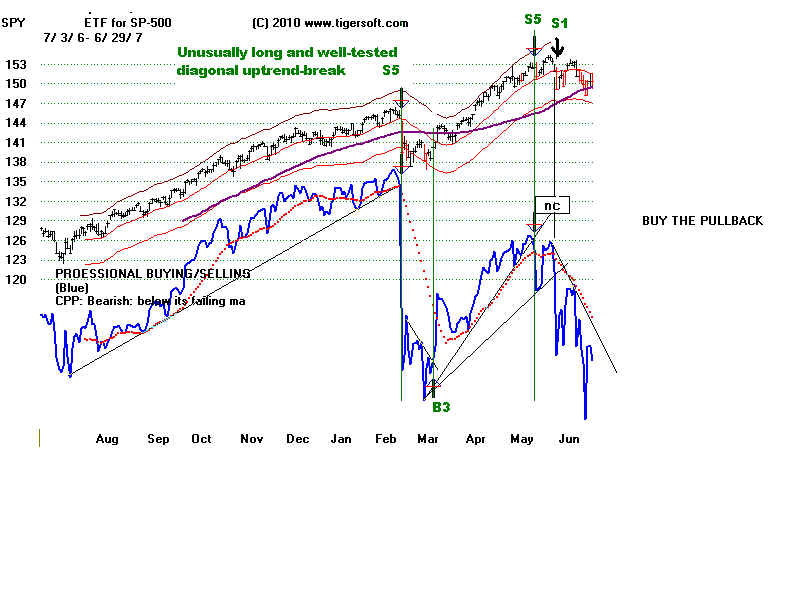

5) Sell on break in unusually long and well-tested diagonal TGR PRO

uptrend break.

Examples: May 2007, Feb 2007