Some Thoughts on Trading ETFs in The

Current Market Environment.

9/25/2014

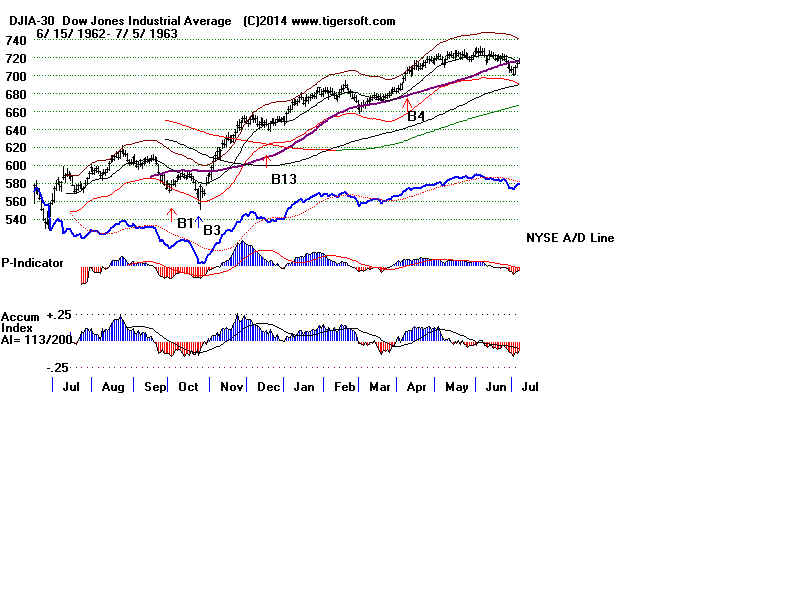

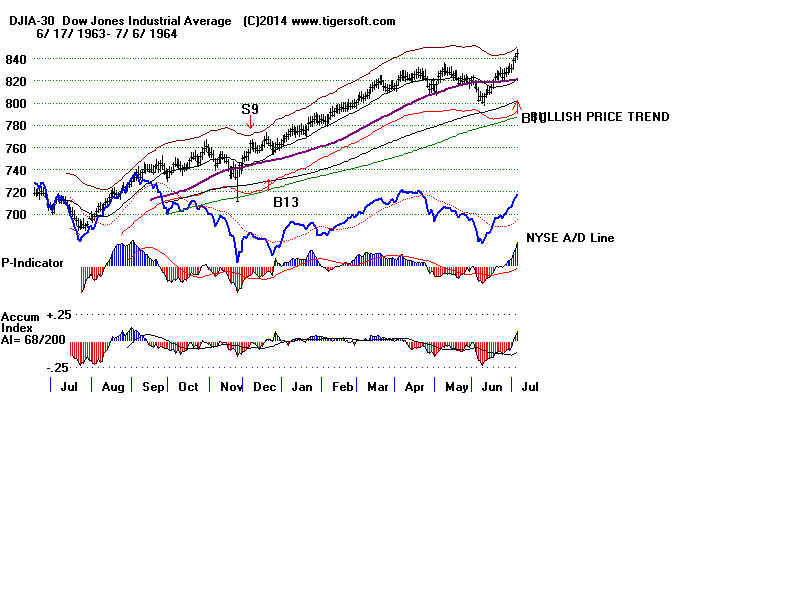

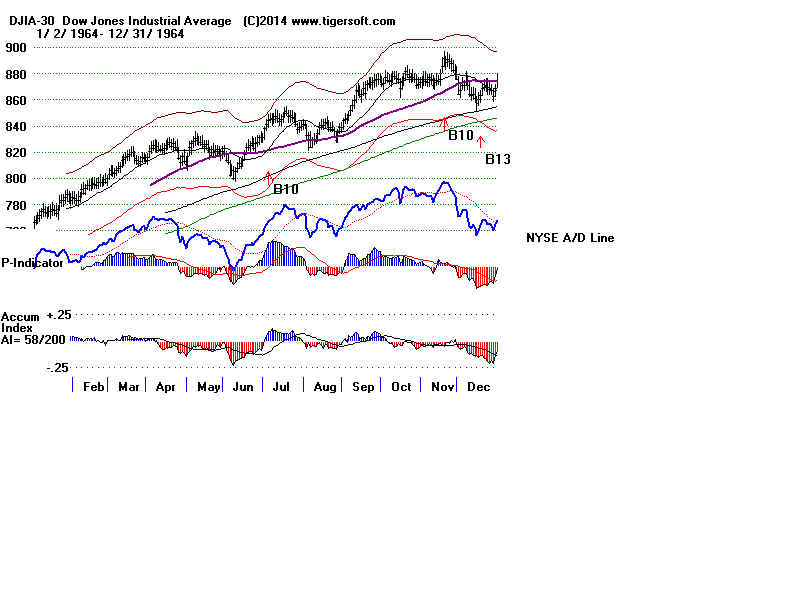

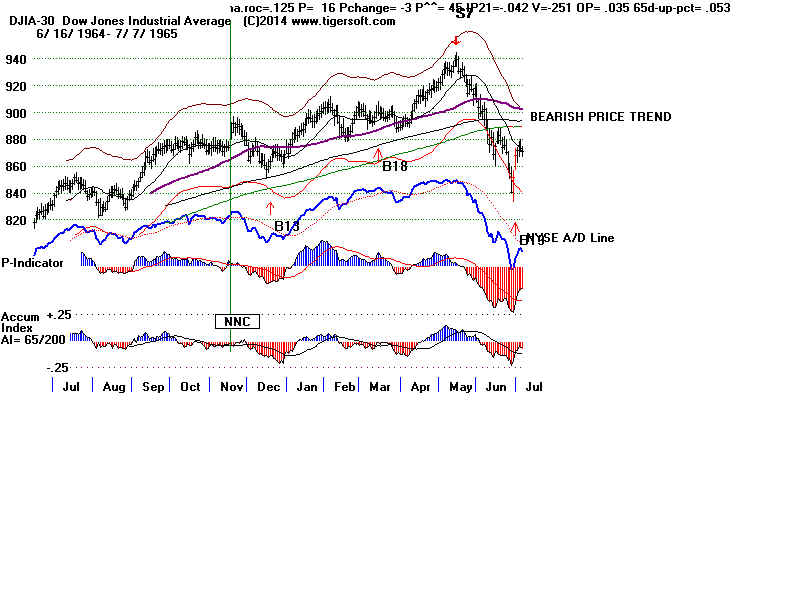

The last two months have not been giving us good orthorox Peerless signals.

I suspect the most important reason is that artificial computerized trading systems

are now using 1.75% bands around the DJI's 21-day ma. We should, too.

Use the same non-confirmations but with narrower bands. Note, too when

a rally fails to reach the upper band. This also signifies weakness.

We want to use narrower bands with all the major ETFS, too.

Bands around 21- day ma

standard improved

current

DIA .030 .015

IWM .045 .03

QQQ .04 .025

SPY .030 .0175

FAS .10 .05

IBB .085 .05

When you read the Hotline, understand my dual position. On the one hand

I am the :"high priest: of the Peerless orthodoxt, as represented by its automatic

signals.: I am expected to present Peerless as it is by many. On the other hand,

Peerless has grown in complexity over the years by adapting to new environments

and taking advantage of new discoveries. So, each day, .I look at what is unusual

about the current market's technicals and back-test it, provided it is unusual and

it has not been studied before.

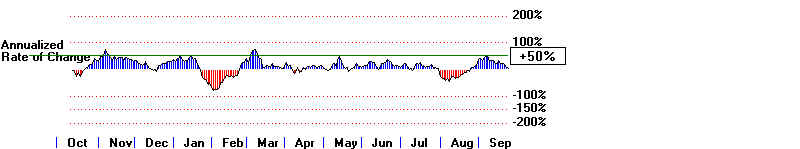

If I were trading ETFs, I would employ the nuances and novel interpretations

in this environment and keep the Peerless orthodoxy in mind as background,

but always emphasizing its basic principles of bands, non-confirmations, A/D Line trends

and confirmed breakouts. Most important in catching trends, I would use the Closing

Power trend breaks, especially after non-confirmations or when the trends are extended

and well-tested.

In this environment, it is always necessary to pick the right ETF. Here we want

liquidity, volatility and a history of past successes using CP trend-breaks. We want

also to make allowances for where we are in the bull market's age. Divergences

between the DIA and IWM become severe in the late stages of a bull market. IWM

will make a better short sale at this time than DIA or, perhaps IBB (or BBH_, which has a history

of holding up late into bull markets. .

Professionals Know Best

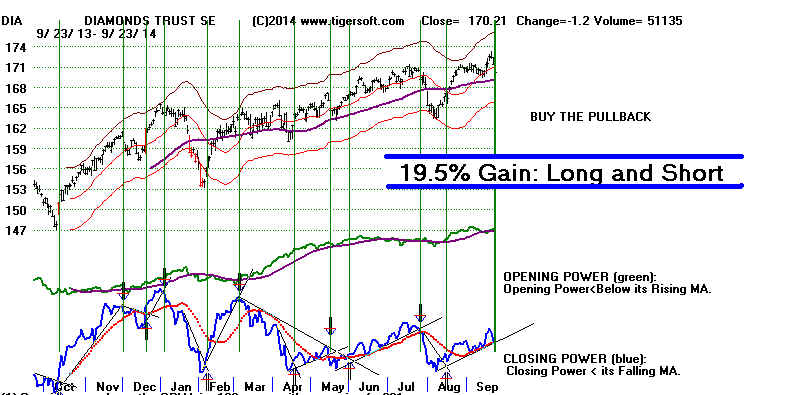

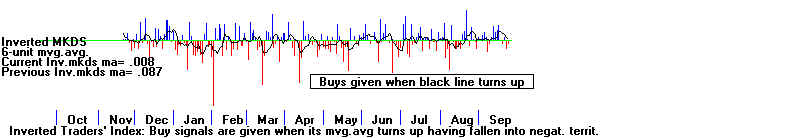

I still like using Closing Power trend-breaks, especially after non-confirmations.

One could take just DIA or expand out to the other ETFs, depending on whether

they are lagging or leading, weak or strong in terms of relative strength and

internal strength readings. There will be whipsaws and you might not draw the

lines exactly like I do, but usually it is the presence of a few bigger trends that

we catch that gives us good gains. DIA is not necessarily the best to trade.

Below are five of the bigger major ETFs found in our DJI-30 data download.

DIA +19.5%

SPY +23.5%

QQQ + 16.3%

FAS + 46%

IWM + 51.3%

IBB + 49.3%