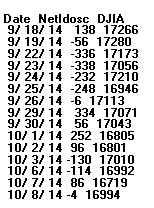

negative territory today despite the rally.

This is bearish for them tomorrow.

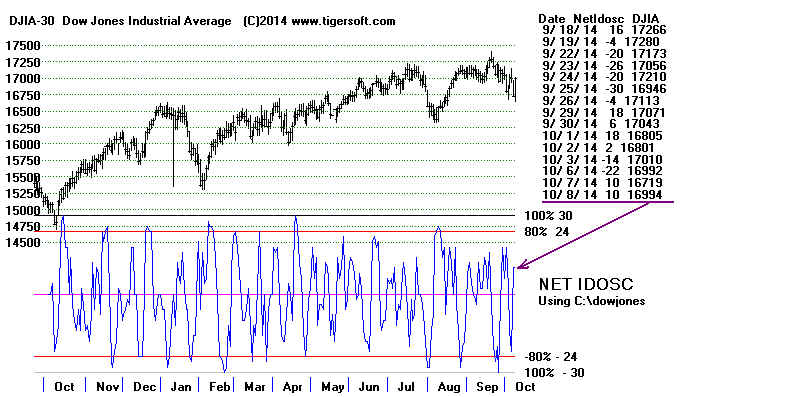

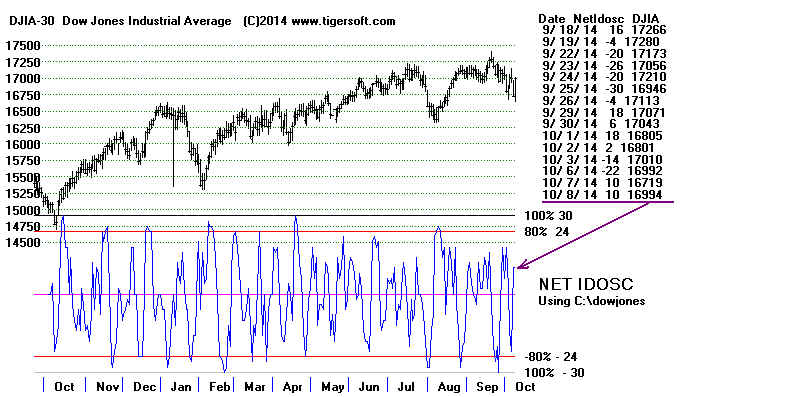

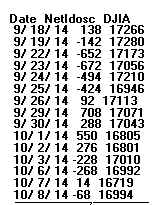

TigerSoft's NET IDOSC

on DJI-30, QQQ,

SP-500 and Russell-1000

(C) 2014 William Schmidt, Ph.D.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

10/8/2014

Prediction for tomorrow, based soly on NID:

NID stayed positive but turned flat despite

DJI's

big decline. This predicts the next day will be slightly

up.

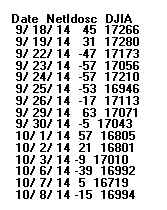

The NID for QQQ, SP-500 anf RSX-1000 fell in

negative

territory today despite the rally.

This

is bearish for them tomorrow.

Interpreting the Net IDOSC as A Day-to-Day Predictor of DJIA

The Tiger Net

Idosc for the DJI only predicts the next day or two in the DJI.

It can be applied

to any directory of stocks, however. Further below are the

NID charts for

the QQQ, SP-500 and Russell-1000.

We follow the

simple rules below. They work best when the DJI appears to be

in a trading

range or locked inside its normal 3.5% bands. Breakouts up or

down can

invalidate these rules.

You must each day

consider:

(1) whether the Net IDOSC rises or falls from the previous day as the DJI does.

By itself, this suggests that the DJI will continue to move in the same direction

another day. This more reliably predicts a rally the next day if the NID is

positive.

It more reliably predicts a decline the next day if the NID is negative.

(2) whether the Net IDOSC moves in a direction contrary to the daily direction of

the DJI.

Net IDOSC for QQQ  |

Net IDOSC for

SP-500 |

Net IDOSC for

Russell-1000 |