Outwardly, All Looked Great and Then The October Crash Came.

On 9/4/1987 the Fed raised the Discount Rate for the first time in more than three years.

It was set at 6.0% by the new Fed Chairman, Alan Greenspan. Greenspan was a stauch believer

in non-regulation by the Federal Gvernment. He had been a staunch supporter of Ayn Rand.

He was sworn in the day the DJI peaked, August 11, 1987. It was Reagan's nomination

of Greenspan in June 2, 1987 that started the June to August rally, This is a good example

of a testablke adage: "buy on the nomination and sell on the confirmation."

The October Crash made Peerless subscribvers and users a lot of money. The

bearish and negative divergences by the uppoer band in early October were easy to

see and undeniable. The S9 and S12 set of signals were the four set of bearish Peerless

sells in 8 months. A long trendline lay just beneath to be broken. And when this

happened, the declining (blue) support line at 2480 would next be violated, domino

style. Instead of making a new high, the DJI would be making new lows. All systems,

computerized and not, would be selling. And they did. Just as we had expected

in our hotline.

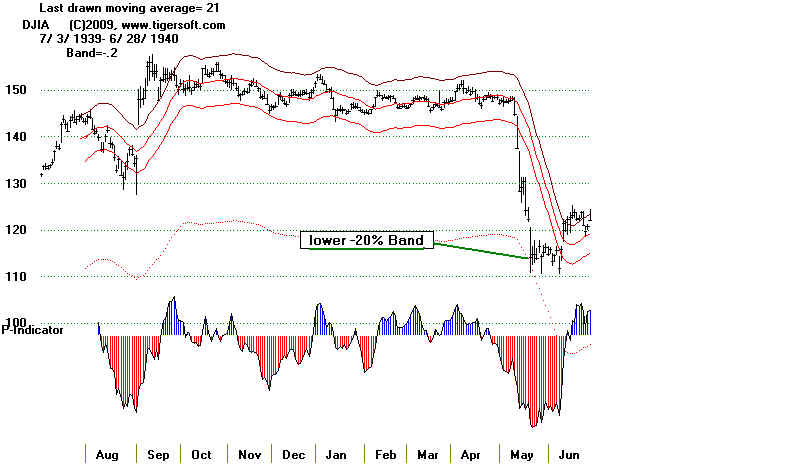

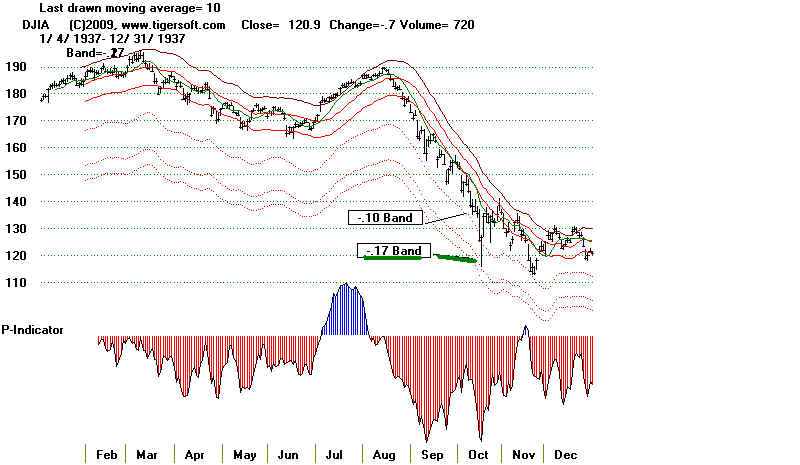

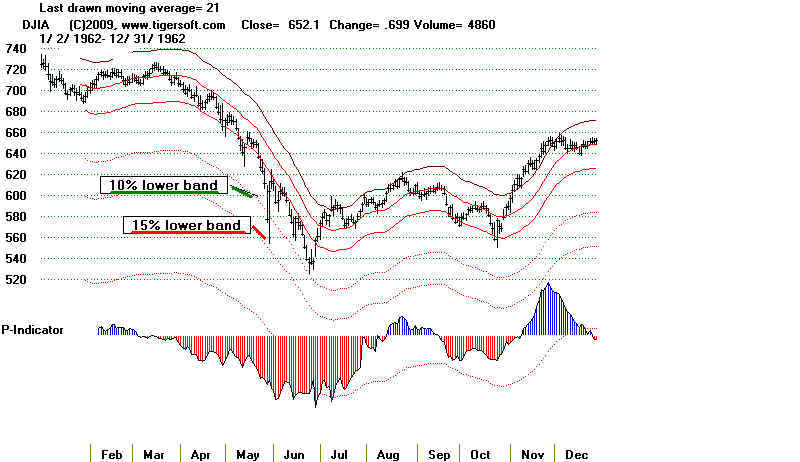

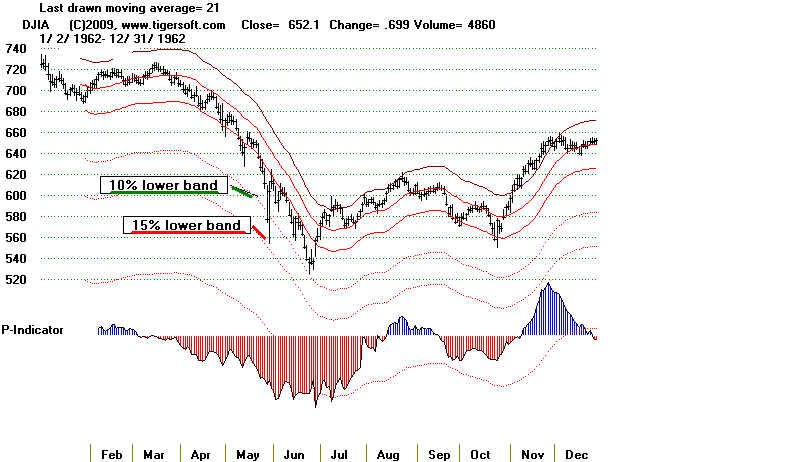

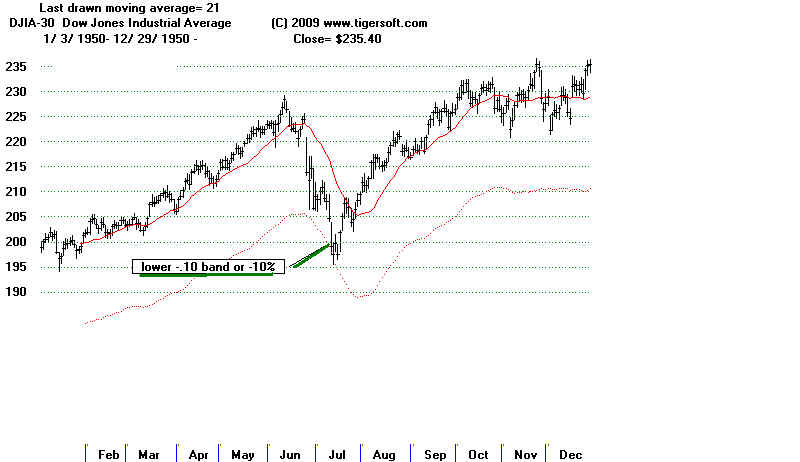

What surprised us was that the DJI broke 2000. That represented a drop by

the DJI more than10% beloiw the 21-day ma, something which had not happened

since 1962. See the charts below the main chart below.

As it turned out, nothing real happened to explain this collapse. Rather brokerage

computerized trading of index options had gone into over-drive. Here was a clear warning

that the financial community left unregulated could bring a terrifying decline in stocks

and wipe out millions of dollars of savings in the accounts of those who did not know

the rules that Peerless could teach. Twenty one years later, in 2008, a new generation

of investors would learn the same lessons: namely that Wall Street cannot be trusted,

left to its own devices it will self-destruct and wipe out the savings of many people

far away, and finally, that Peerless is indispensible.