SIGNALS ON NEM: 1987-2010

(C) 2010 www.tigersoft.com

TigerSoft Sell S9 signals use TigerSoft's invention, the Accumulation Index

in relation to price highs and lows. Our software explains the relationship.

The formula for the Accumulation Index is available to software purchasers

who sign a non-disclosure statement. It was invented by William Schmidt

in 1981, It has never been accurately copied or properly used by

its plagiarizers.

39 were good or OK signals, 7 bad signals

84.8% of the automatic "Sell S9" signals on NEM brought either a 2 month

hesitation or a decline of as much as 50%. Trade NEM's calls and puts or

buy and sell the stock outright.

If you look closely, you will see that the Accumulation Index often

turns negative before a big decline and positive before a big rally.

It represents insider and professional buying and selling.

"Insiders always know" ahead of the rest of us. Why trade by

emotion which professionals can manipulate, when you can trade

as they do.

This is only one of a number of reliable automatic Buys and Sells

which TigerSoft uses. Also watch the direction of the TigerSoft

Closing Power.

The charts, year-by-year are shown below

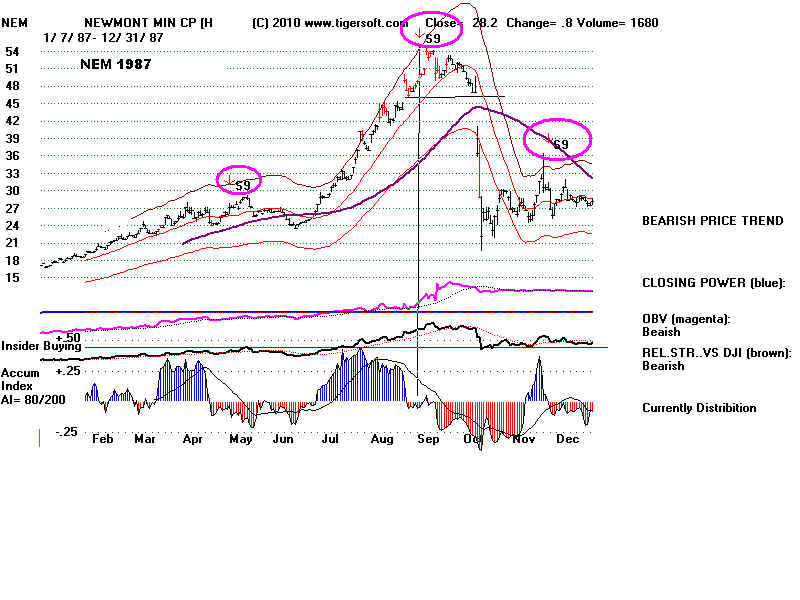

1987 3 OK, one brought decline from 50 to 24 (50-24)

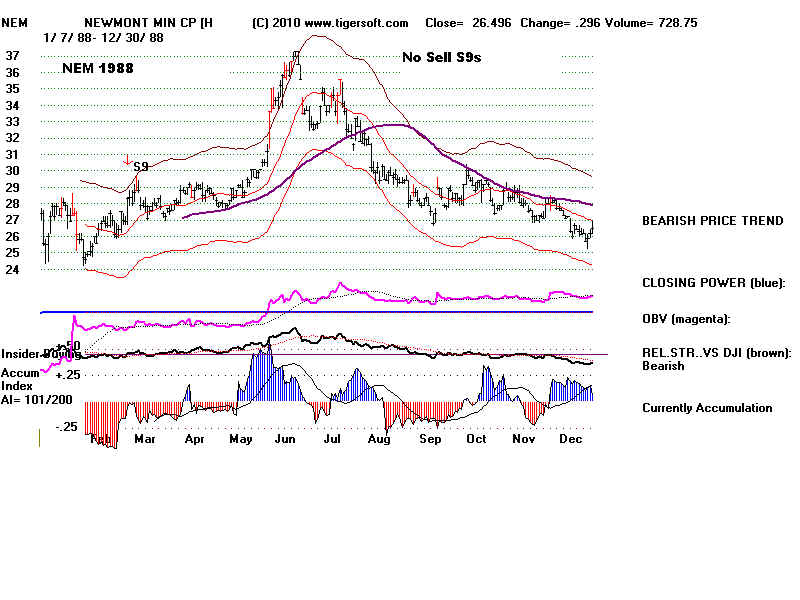

1988 1 OK - 2 month hesitation predicted.

1989 2 OK

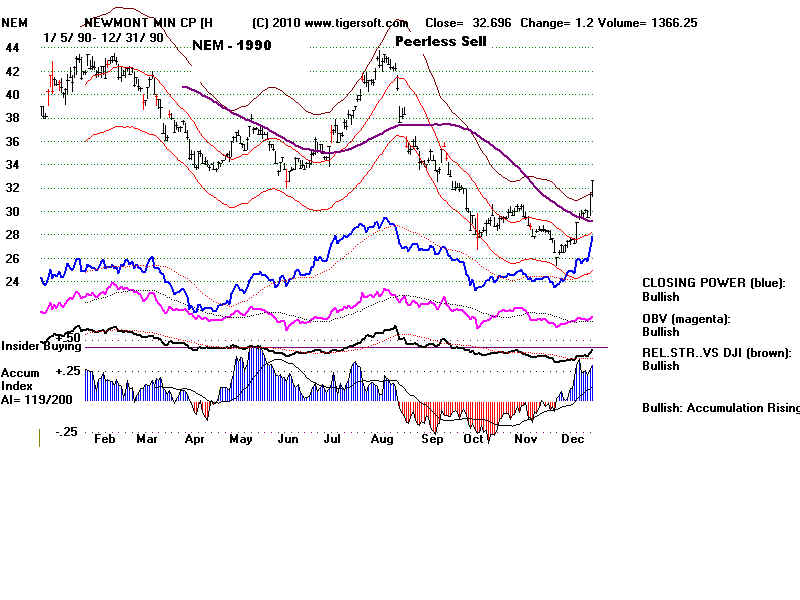

1990 none - (but Peerless worked well here).

1991 1 OK (31-27)

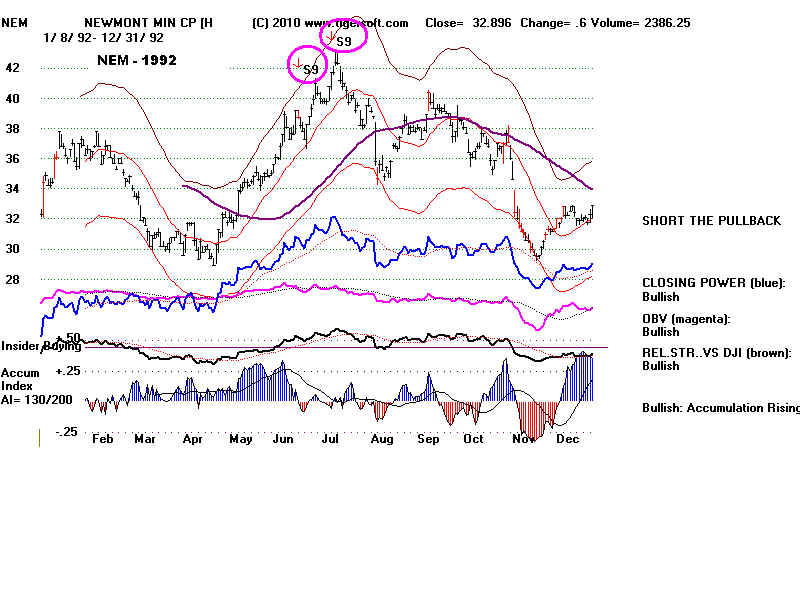

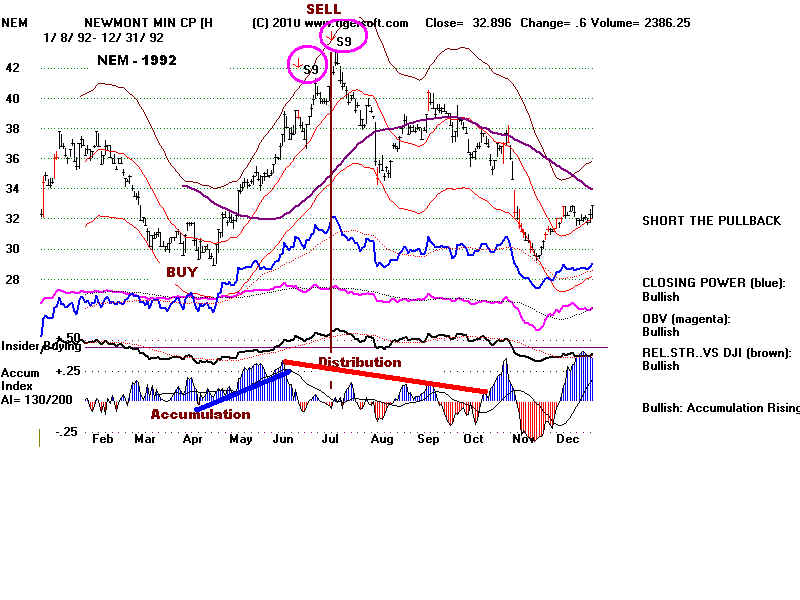

1992 2 OK (38-30)

1993 1 bad 1 OK (46-36)

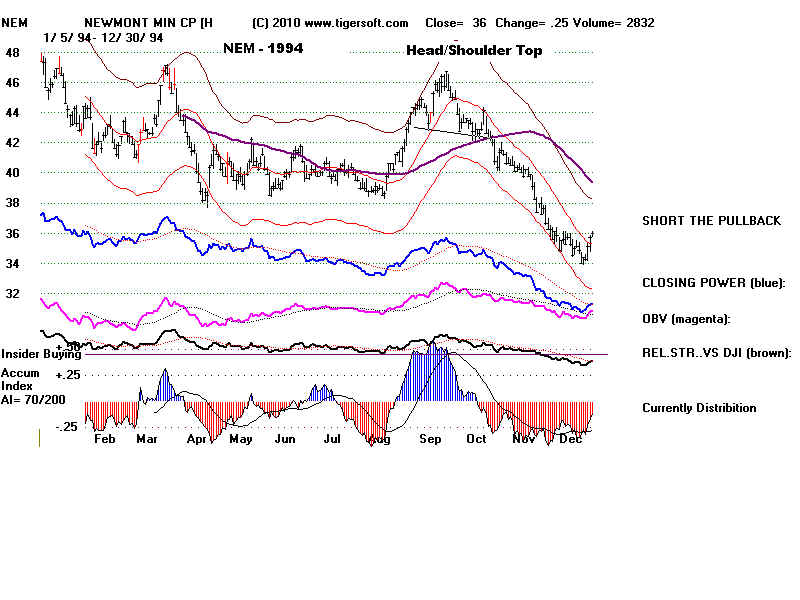

1994 none - but one valid head and shoulders pattern.

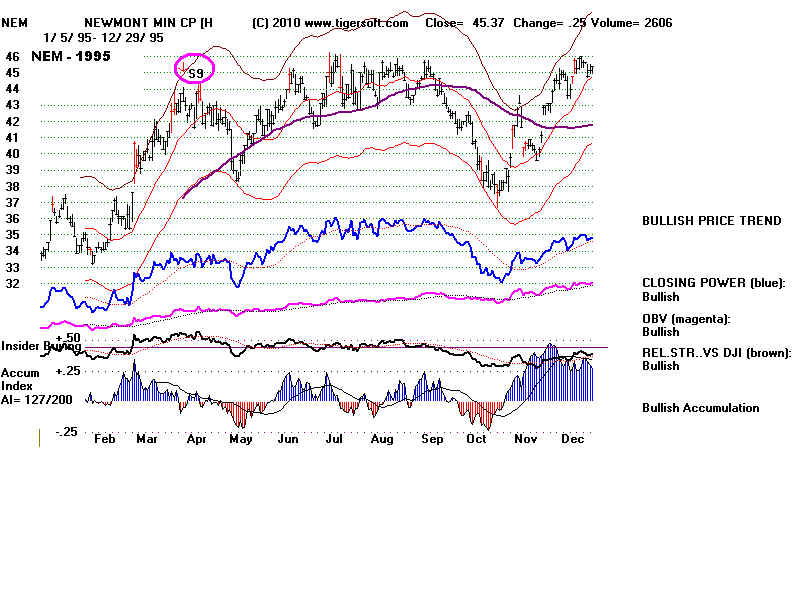

1995 1 OK (44-39)

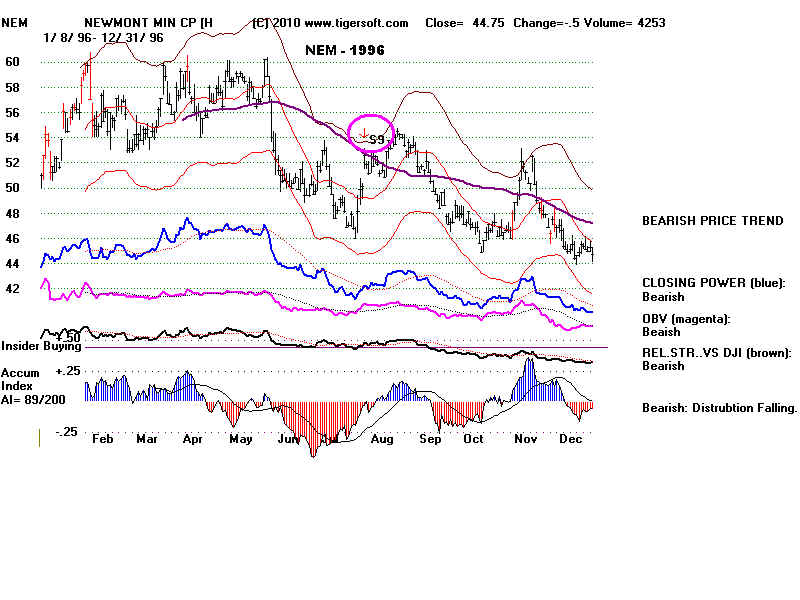

1996 1 OK (52-46)

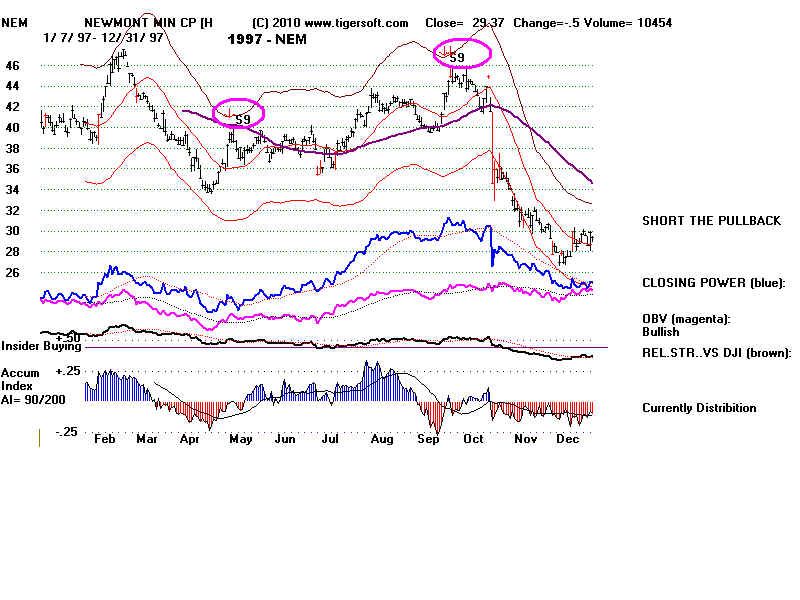

1997 2 OK (39-36) and (44-28)

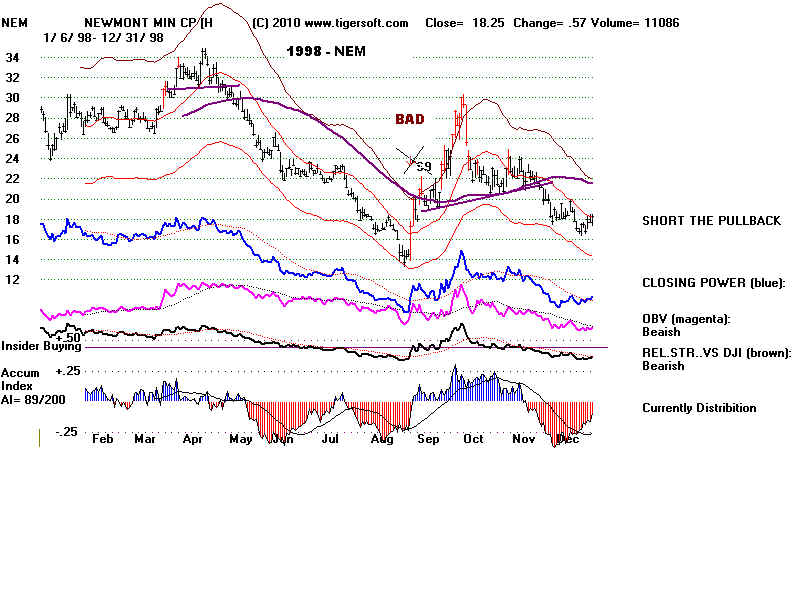

1998 1 bad

1999 2 bad 2 OK (20-17) (29-21)

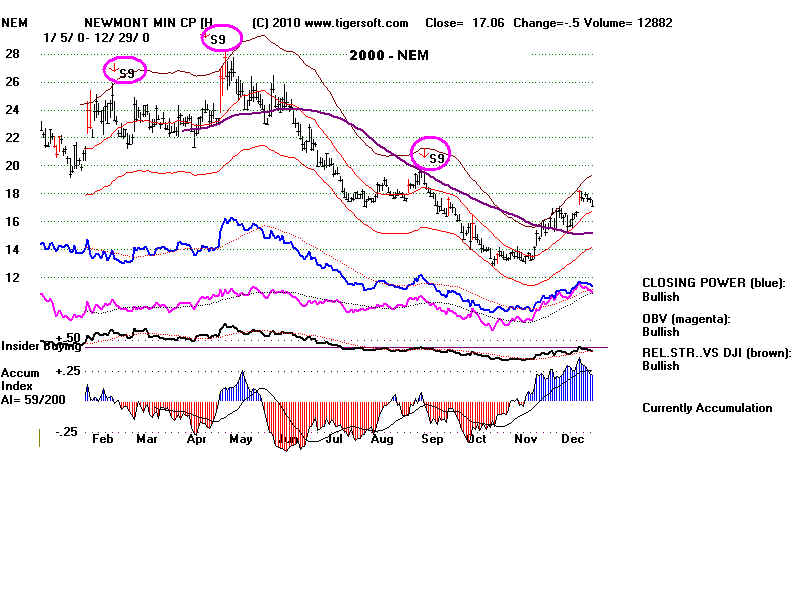

2000 3 OK (25-18) (19-13)

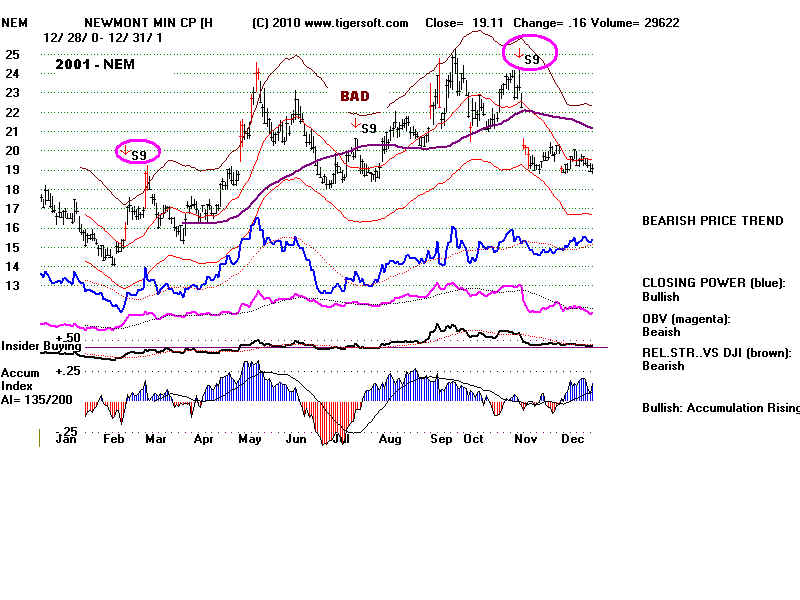

2001 1 bad 2 OK (23-19)

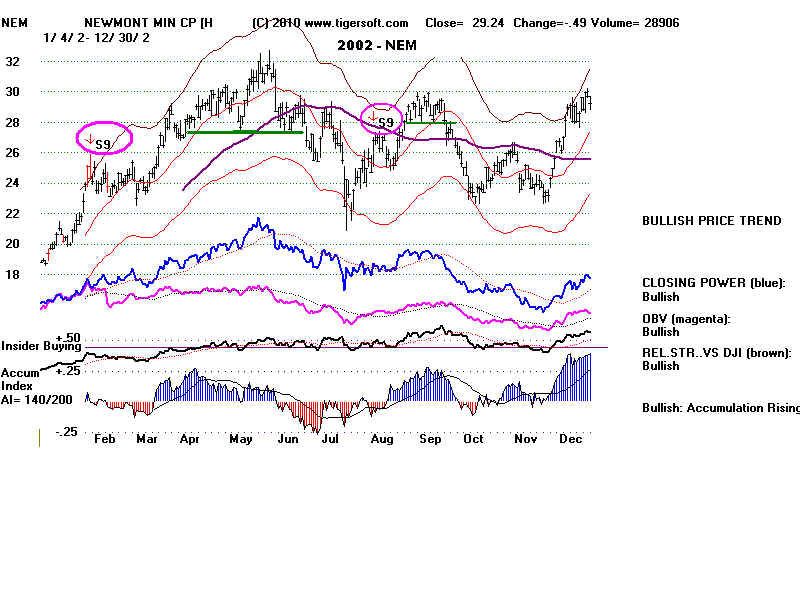

2002 2 OK (26-23)

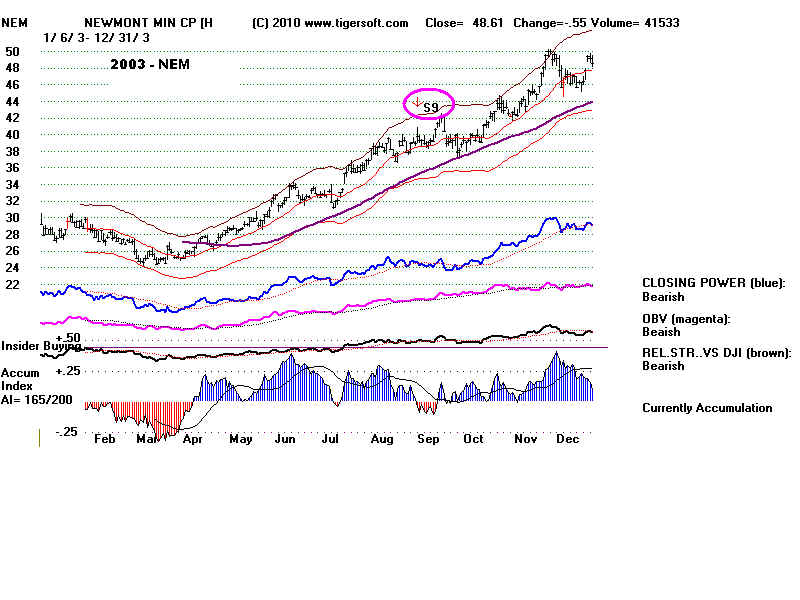

2003 1 OK (sidewise for 2 months)

2004 5 OK (10% declines)

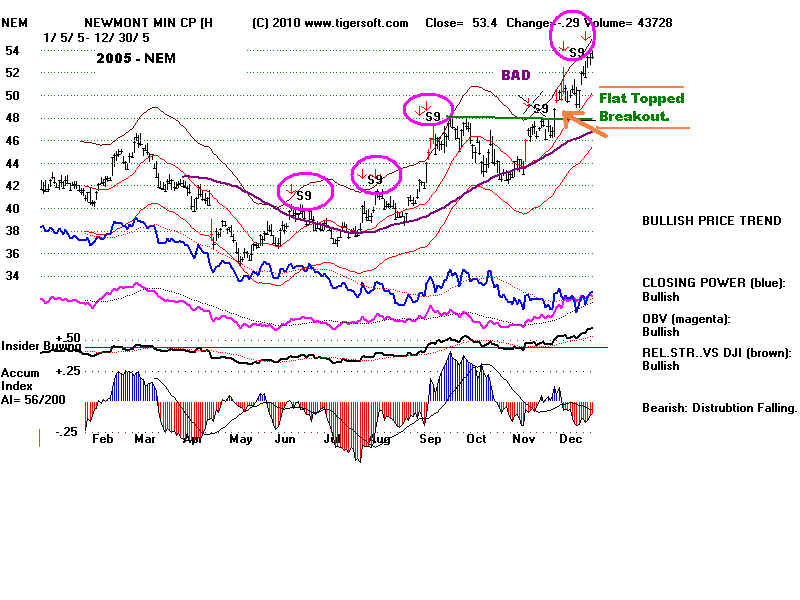

2005 1 bad 4 OK

2006 4 OK (56-40)

2007 none

2008 1 bad 1 OK (53-22)

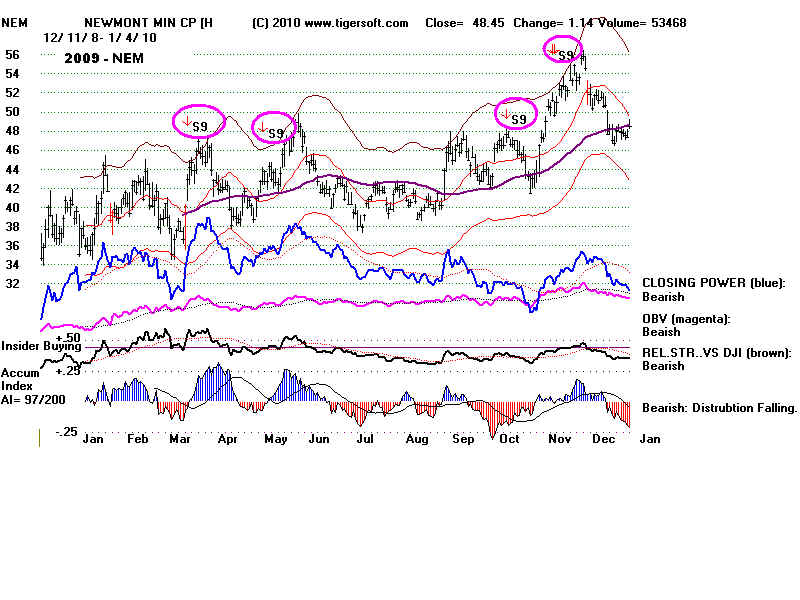

2009 4 OK (46-38). (44-38), (47-42), (51-47)

2010 1 OK (54-52)