Early Keynesian Warnings

Deflation, Breadth

Divergences and Inadequate Consumer Demand

vs

Corporate Profits, Rising Blue Chip Stock Prices and A Republican

Victory in November...

Then What?

(C) 2014 William Schmidt, Ph.D.

9/28/2014

=================================================================================

My caution and concerns now are borne from seeing falling commodity/fuel prices,

a rising dollar and a big divergence between the DJI and 70+% of all stocks.

My dissertation

at Columbia was on this subject, except that it was Britain in the 1920s.

Unemployment never went below 7.5% there in 1920s but stocks rose and

rose. The Chancellors all did the bidding of the elite of the "City",

England's financial

community. After Churchill, as Chancellor, pegged the Pound Sterling to Gold

a severe deflation ensured. At the time, Keynes observed these facts in 1925

and warned of a

coming severe depression because of the divergence between weakened export

industries and consumer buying power. He predicted that the mounting unsold

inventories and decline in wages were on a collision course with the unreal rise in

equities.

See his The

Economic Consequences of Mr. Churchill

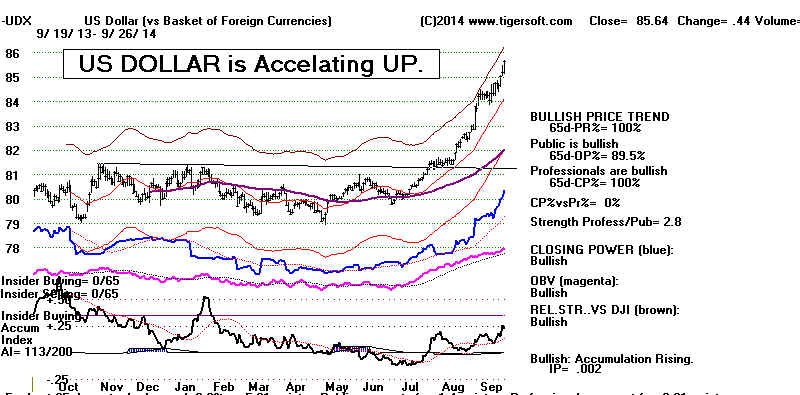

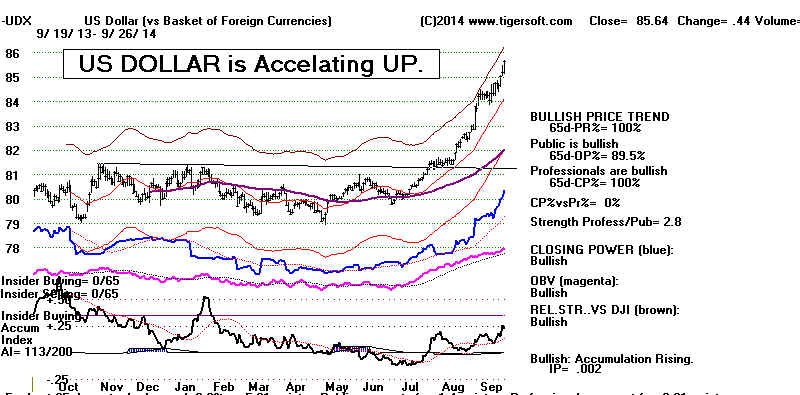

US Dollar Is Sky-Rocketing Up.

Deflationary Statistical Warnings

before

The Crash in 1929.

Our world economy is softening by most reports. Look at the Foreign ETFs'

downtrend. This has dangerous precedents. And were will the markets be found

for what

must be sold to drive profits? Even sending plants overseas may no longer help shore

up profits.

1929 offers some insights. It might be of interest to note that housing starts

peaked in the

Spring of 1923, 6 months before the DJI's top. The Federal Reserve's production

index

peaked in June 1929. By September, had declined 8%. April brought a simular

peak in Germany and July was the industrial production peak in Britain. The stock

markets

for Germany, Sweden and Switzerland peaked in 1929. (Source,

page 25.)|

Deflation

in agriculural commodities, raw materials was severe in the 1920s. Coal and

crude

oil prices declined in the years before the Crash. Robert Prechter shows the how

commodities

and bonds topped out before the DJI-30 did in the 1920s.

Source: http://www.online-stock-trading-guide.com/financial-parallels-between-1920s/

But a strong Dollar helps trhe stock market. Isn't that so? Certainly, a very

strong

Dollar makes blue chips a haven for hot overseas money fleeing their declining

currencies.

This was the hidden agenda for London's financial community in the 1920s and why

they lobbied so hard for a return to the Gold Standard when Churchill was Chancellor

of The Exchequer.

It's also true that the strong Dollar gives the biggest corporations the power to continue

to buy out their competition. And it's also true that the boost the strong Dollar

gives

share prices also allows the biggest corporations to continue to buy shares in their

own company without immediate risk that such a strategy will backfire. Buying

one's own shares is now a much-used short-term strategy to boost corporate

earnings. It placates the company's biggest shareholders and increases the net

worth nicely of those running the company, who are paid large stock bonuses.

In the short run, a strong Dollar is likely to boost profits and share prices for the

DJI and the SP-500.

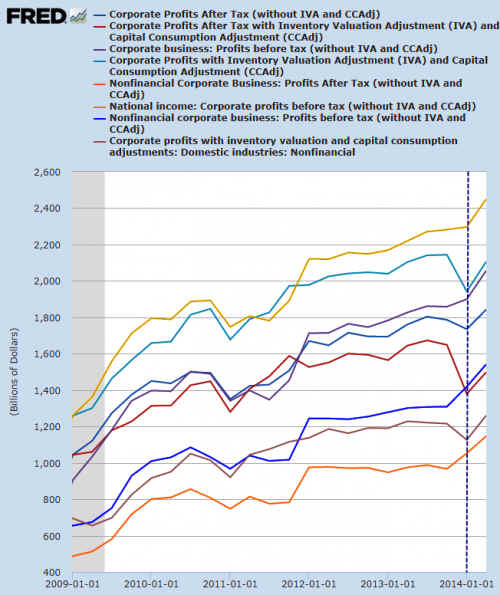

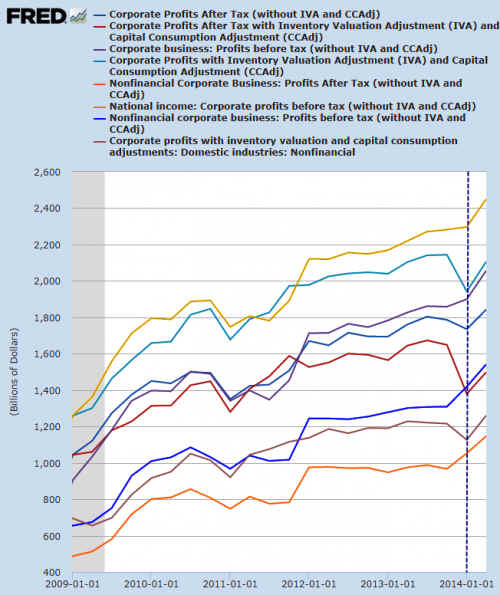

The bull market depend upon the expectation of rising stock prices. As long as

US corporations' profits rise, the stock market as measured by the DJI and the SP-500

is probably be safe. But a turn-down in profits would be deadly. See how a turn down

in profits led to the bear markets of 1990, 2000 and 2007-8.

A

Republican Victory In November

A Republican victory in November should temporarily boost stock prices.

Republicans are certainly widely perceived as much more protective of blue chip profits.

And the turnout for the Democrats is likely to be light this Election.

But after that, how much longer can corporate profits rise. The Fed will not

do much more. Nor does it have the power to help much. The way out of

the dilema of a week economy is an expansionary fiscal pilicy, i.e. public works,

infrastructure rebuilding and improved mass buying power. But a more

Republican Congress will not allow this and Obama does not even propose

more Public Works expenditure. Obama is no a Keynesian. He is no

New Dealer. (Keynes advocated large schemes of public works after

1925 to improve the British economy. Only the weak and dying Liberal Party

empbraced his recommendations.)

The market's advance is long and tiring. Perhaps, a new rally will

start to bring in the bullish 3rd year of the Presidential cycle. But that's

asking a lot and what will bring it about? A continuation in the

profits' growth and buy-outs possibly. Better economic data would be

a big help. But the stronger Dollar will hurt US manufacturing even

as it helps Retailers who import what they sell.

The danger is that there will a sharp-sell off. There will be a panic, a rush to

the exits by those who are already nervously hoarding records amount of

cash. (The Fed records show that money velocity is at a 50-year low.)

All the leveraged short-ETFs will almost certainly accelerate and extend

the decline, just as they have promoted the bull market since 2009.

Watch the A/D Line trendline, the NYSE, the DJIs, the SP-500s, the

NASDAQ-100's and the Russel-1000's via the Tiger Hotline

That's the simplest approach and be careful what you buy. Most stocks

are in downtrends, the biggest corporations are more likely to be

holding steady.

As for the major market ETFs, if their Closing Power down trendlines are broken,

I'd become short-term bullish. Meanwhile, I'd use the 1.75% upper band as a

finder of where resistance is likely to be intense.

True - no Sells S9s, but there is an A/D Line divergence from rising DJI.

It would be much greater if interest rates were not pushing up

bond funds and dividend stocks. There are cases where there were no

Sell S9s and a market top. But you are right, the lengthy A/D, IP21

divergences and multiple S9s are not present now, as were seen

in 1929, 1973-1974, 1987 or 1999-2000.

We'll see. So much depends on what one trades.

If you'd like to read more about Keynes, see:

TigerSoft Blog - Keynes Revisited: Public Works Can Solve ...

Aug 3, 2011 -

Ignoring The Lessons of Keynes and Forgetting Economic

History

Put America in Needless Great Peril. America Is Following The Same ...