TigerSoft - www.tigersoft.com 1/4/2008 --- by William Schmidt, Ph.D.

Insider Trading: News and Reviews: Articles Found on the Net

See www.tigersoft.com Use TigerSoft Scans ...for insider trading. It shows you how

to trade profitably in an age of rampant insider trading.

TigerSoft Offers:

Peerless Stock Market Timing: 1928-1966

Track Record of Major Peerless Signals

Earlier Peerless-DJIA charts

7 Paths To Making 25+%/Yr. Using TigerSoft

Index Options

FOREX trading

Investing Longer-Term

Mutual Funds

Speculative Stocks

Swing Trading

Day Trading

Stock Options

Commodity Trading

====================================================================================

Insider Trading at Bear Stearns (BSC).

How A TigerSoft User Would Spot It And

Make Money from It.

FEDERAL INVESTIGATORS ARE PROBING INSIDER TRADING AT BEAR STEARNS

(Business Week: http://www.businessweek.com/bwdaily/dnflash/content/dec2007/db20071217_019781.htm?chan=top+news_top+news+index_top+story )

It seems likely that some insiders pulled their money out of the company's riskier hedge

funds, backed by subprime mortgages. The alleged withrawls occurred just when fund managers

were uging investors generally to stap put. "The Wall Street Journal subsequently reported that

Ralph Cioffi is the manager drawing scrutiny, after moving $2 million of his $6 million investment in the funds

into another Bear-managed hedge fund. BusinessWeek has learned the other Bear fund in question is the $228

million Bear Stearns Structured Risk Partners fund. People familiar with the probe say investigators have been

reaching out to investors in the highly leveraged funds, seeking information about the comments the funds'

managers made during the spring with regard to the issue of redemptions, as well as the funds' exposure to the

subprime mortgage market. The funds once controlled nearly $35 billion in collateralized debt obligations and

other mortgage-backed securities, and investors lost a combined $1.6 billion when the funds filed for

bankruptcy in July." If true, BSC will certainly be heavily sued. This, as much as the turn-down in the

US economy, lies behind the steep decline in BSC stock.

THREE WAYS TIGERSOFT SPOTS INSIDER TRADING

Insider selling puts pressure on a stock which we detect in several ways.

1) Most obvious is the failure of the stock to move up in a market that is lifting the DJI-30.

TigerSoft's Intermediate-Term Relative Strength (ITRS) Indicator had been negative for most of 2007.

That was the first sign of insider selling.

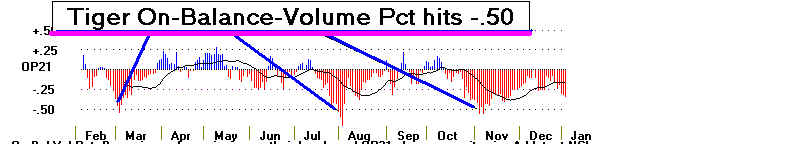

2) A second significant sign of insider selling comes from On Balance Volume. Tiger's measure

of aggressive selling and buying here is our unique On-Balance-Volume Percent. That gave tell-tale

readings below -.50 in early March.

3) The third tool we use is our creation, the TigerSoft Accumulation Index. It dropped below

-.25 in early August.

Insider-inspired selling was undeniable. A TigerSoft trader looking at this evidence could

reasonably have planned a short-selling campaign focusing on this stock. Using the automatic

Red Sell Signals to sell short at the next day's opening and buying when a Red arrow appeared

at the next day's opening would have gained that trader more than 93% for 2007..

-------------------------- BEAR STEARNS Chart using TigerSoft -------------------------------------------

ANOTHER WAY TO TRADE USING TIGERSOFT

On 7/17/2007, Tiger's Peerless Stock Market Timing Software gave a reversing major SELL

on

the general market. It is shown on the BSC chart below. The DJI immediately

fell 10% until

the

Fed intervened and cut interest rates. That Sell Signal on general market made us

search for

suitable

short sales. Normally, brokerages rise and fall with the general market quite

closely.

That

made BSC with its technical weakness a reasonable short sale. TigerSoft offers many

unique

tools.

In the chart below you can see where the "Opening Power Mvg.Avg." turned

up. That could

have

been used as a good place to cover the short sales in BSC. It proved a better spot

than

waiting

for the blue 50-day ma to be penetrated to the upside. The upside penetration of the

50-day

ma

did bring a brief rally as shorts took profits. But the decline back below it was

another good

point

to sell short. The fact that Tiger's Closing Power Indicator was declining offered

additional

proof

that the stock was vulnerable. It showed insitutions had a lot more stock to sell

than they

could

unload during the early hours of trading. That is what Closing Power detects.

--------------------- TIGER

BROKERAGE STOCKS' INDEX - 2007 -------------------------------

TigerSoft

plots indexes of groups of stocks. Below is the Tiger Brokerage Stock Index.

Trend breaks

in price are

significant. So is the dropping below its mvg.avg. by the Accumulation Index.

We watch such charts

regularly. You

can see the timeliness of the major Sells from Peerless in July.

When Peerless gives a

major Sell we look at the stocks considered "bearish" by the Tiger-Power-Ranker.

We also look at

the first stocks to make 12 month lows. See also

http://www.tigersoft.com/Tiger-Blogs/8-13-2007/index.htm