Basics of Closing

Power (CP) and Candle Sticks

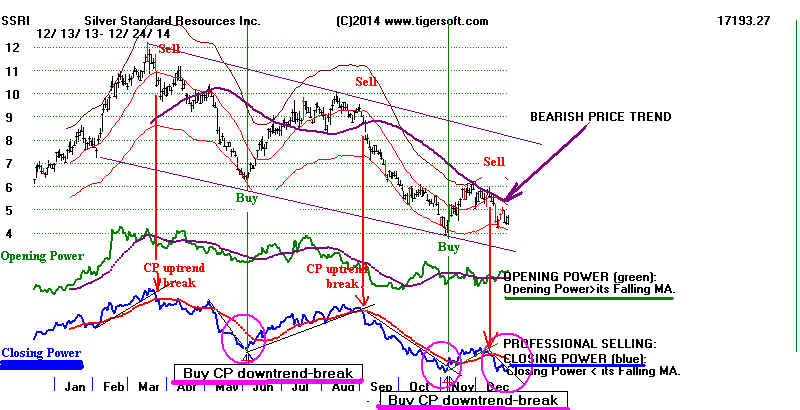

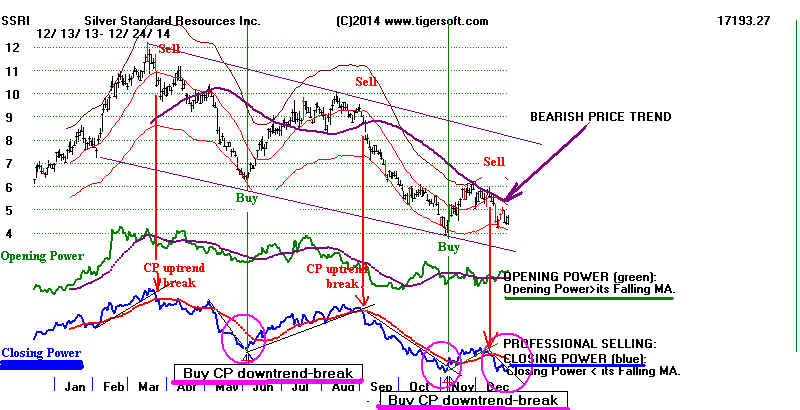

Applied to SSRI,

PAAS, NEM, NUGT and DUST.

Charts

shown here are regularly on the Tiger Hotline Charts Links.

12/26/2014

---------------------------------------------------------------------------------------------------------------------------------

Regarding

NEM

and NUGT are close to breaking their CP downtrends.

As the Accum Index is red and the 65-dma is falling, a rally

to

only the 65-dma can be predicted as an upside target

if

the CP downtrends are broken.

Tiger

SSRI chart - 12/26

5.4

is most important resistance. It is where (dotted red) 65-dma crosses.

NO

break in CP downtrend.

Accumulation

is still (red) negative.

and

below falling 21-day and 65-dma

Only

(red) Openings and Opening Power are rising and in rising trend.

-------------------------------------------------------------------------------------------------------------------------------

Six Closing Power Rules

It is the

intermediate-trend of the Closing Power that I mostly trust. The only

time this

does not work real well is when the Public and over-seas buyers are

temporarily

dominant. And even then, trading with the Professionals works

satisfactorily.

Really big moves almost never take place against the Closing

Power

trend. So, generally:

Closing Power Usually Is Right

(Opening

Power is more likely to be Wrong if they disagree.)

1

Opening Power Trend Rising + Closing Power Trend

Falling ---> expect lower prices

2

Opening Power Trend Falling + Closing Power Trend

Rising ---> exect higher prices

Breaks in Lengthy and Well-Tested Closing Power Trends

3

Breaks in well-tested and lengthy Closing Power downtrends are bullish.

SSRI

may soon make a Closing Power downtrend-break. See below.

4

Breaks in well-tested and lengthy Closing Power uptrends are bearish

DUST

might be about to have a CP breakdown. This would be bullish

for

NUGT and mining stocks.

CP: Both Up and Both Down.

In the

short-term, the Closing Power and Opening Power can point in the same direction.

This

indicates the Professionals and the the Public are both net buyers or both net sellers.

This also

usually means the move hast become fast, furious and is reaching a price-climax,

a top or a

bottom. The next direction of prices will be determined by the change

in

direction that the Closing Power takes. So, the BOTH-UP condition is

short-term

very

Bullish. Prices open higher and then go still higher by the close. But this

can only

last a while. The opposite is true to the downside. This is the BOTH-DOWN

situation.

5.

Both Up is short-term bullish until Closing Power breaks its uptrendline.

6.

Both Down is short-term bearish unil Closing Power breaks in uptrendline.

Closing Power

trendbreaks are most reliable when their trendline is well-tested (3x

or more and when

the Closing Power has recently failed to confirm a new price high

or new price low.

7.

The breaking of a well-tested Closing Power downtrendline is particularly

bullish when

Closing Power has failed to confirm a recent low. It is made more bullish

if the

Accumulation Index is positive, the pink OBV Line also did not confirm a

recent low and

the Relative Strength Quotient Line's downtrendline is also being

broken, or

already has been.

8.

The breaking of a well-tested Closing Power uptrendline is particularly

bearish

when Closing

Power has failed to confirm a recent high. It is made more bearish

if the

Accumulation Index is negative, the pink OBV Line also did not confirm a

recent high and

the Relative Strength Quotient Line's uptrendline is also being

broken, or

already has been. .

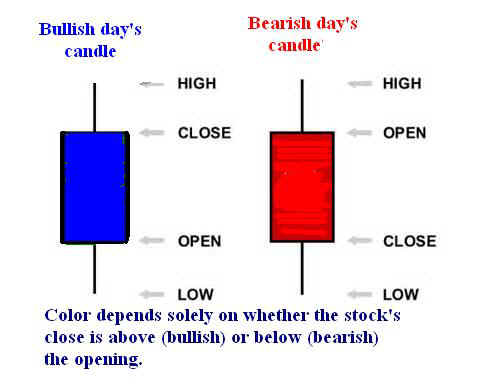

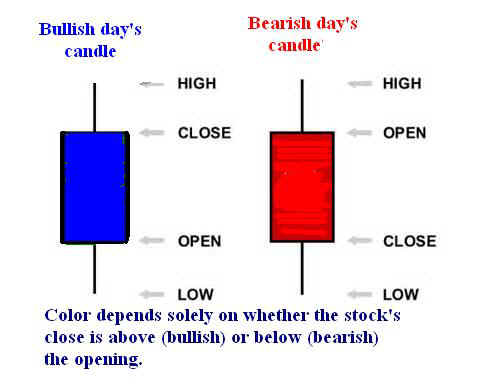

Candle Stick Charts

Each type

of colored bar in candle sticks has a unique Japanese name and a purported

indication

of strength or weakness.

.

I am mostly

a believer in the value of what I call "big reds" and "big

blues",

"popsicles",

red and blue, either upside down or right-side-up,

"roller

pins" and "hammers". These often appear one after another.

In this

situation, they are more likely to correctly call a reversal of an uptrend.

Candle stick charts show

each days' range of prices and within that,

they show each days' opening and the close. They do not show volume

at all. That's a big limitation because it usually takes rising volume for

prices to eat up overhead supplies of stock at resistance. Often you

will see weekly or monthly candle stick charts. But they have no

value, as I see it.

.

Candlesticks show the price range as the stick and they show the

range between the opening and the close as a box. If the box is

blue In Tiger charts, it means the opening is lower than the close. This

is a positive (bullish day). With Schwab charts, the box will then

be empty, I think. How bullish depends on how far above

the opening, the close is. So a really bullish day would be when

the stock opens down and the turns around and closes at(near) its

highs. Example

High

42.

Close

41.8

Opening 40.

Low

39.75

The opposite type of day is bearish or negative in itself. Here

like SSRI has often done the stock opens high, near its daily high

and then closes near or at its low. Our box from the opening

to the close would be red in color. A Schwab candle stick box would

(I believe) be filled in and black. The stick the box is on would show

the day's high and low. Example.

High

40

Opening 39.97

Close

38.00

Low

37.85

So, the candlestick charts show you patterns of closing above (bullish)

or below (bearish) the opening. This is not apparent to a novice.

But it is important. Openings can be quite deceptive.

Closings are much more important. They reflect the day's full trading by

those who watch the market, the Professionals.

Candle Sticks and Closing Powers

The connection to my Closing Power charting is that I make

cumulative the sum of the differences between openings and closes.

A rising trend would show a series of openings are lower than closes. And

vice verse. The full range is not a factor with my Closing Power.

Now, here is the secret I have found, though there is a whole literature

about different candle-stick formations

The most bullish daily pattern after a long decline would be a very

big blue (or clear - Schwab) box. Suddenly, Professionals are big

buyers again. These I would call; "Big Blues."

The most bearish daily pattern after a long decline would be

a very big red (or filled in - Schwab) box. Suddenly, Professionals

are big sellers. These I would call; "Big Reds"

You will readily see this on most Tiger cande-stick charts.

See how the dominant colors change. My Closing Power

just makes that trend more obvious and shows exactly

when there is a shift.