TigerSoft and Peerless Daily

Hotline

www.tigersoftware.com/9933Hot

(C) 1985-2014

William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Tiger

Software 858-273-5900

PO Box

22784 San Diego, CA 92192

Email william_schmidt@hotmail.com

On Thursday

-----------------------------------------------------------------------------------------------------------------------

Previous Hotline - http://tigersoftware.com/2233HL/index.html

6/25/2013-9/1/2014

http://tigersoftware.com/112211-H/index.htm 11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

Past Hotline Predictions

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

----------------------------------------------------------------------------------------------------------------------

PLEASE...Sharing this hotline address with

non-subscribers is a violation of our contract

with you and a violation of copyright laws. I

work hard for you. Respect that effort!

---> To

renew this Hotline, order

here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

--------------------------------------------------------------------------------------------------------------------

A Guide

To Profitably Using The Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969

1969-70

1970

1970-1

1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

1976

1976-7

1977 1977-1978

1978 1978-79

1979

1979-80

1980

1980-1

1981

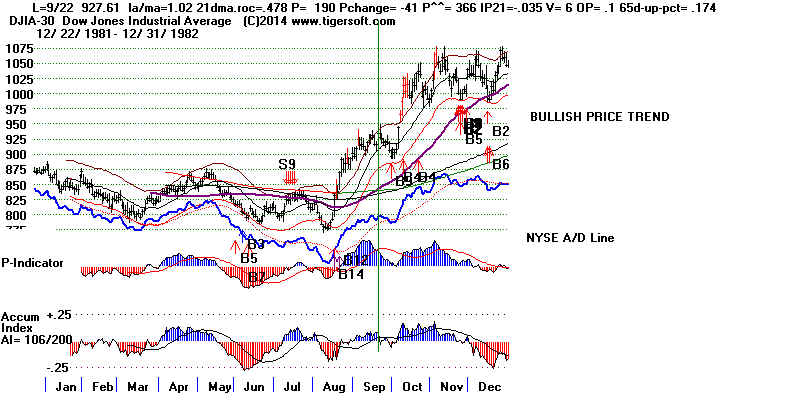

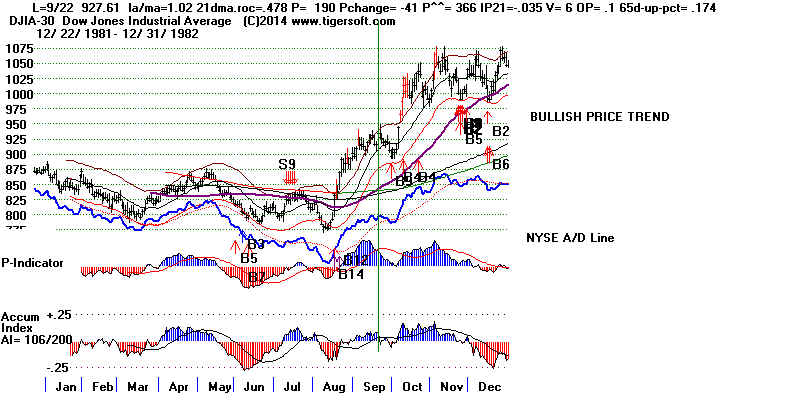

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

1985 1985-1986

1986

1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7

1997

1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009

2009-10

2010

2010-11

2011

2011-12

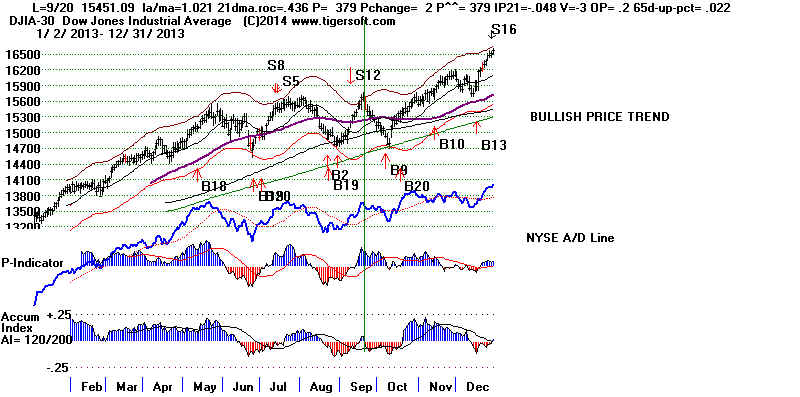

2012

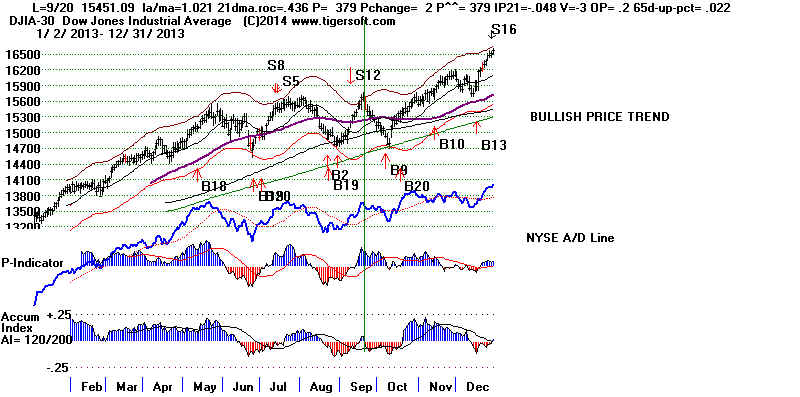

2012-2013

Background and New Studies

Announcement:

1 The On-Line Explosive Stocks

is finished.

2 The

On-Line Killer Short

Sales book is also finished, but

will be

re-edited this coming week.

I call your attention now to the many new concepts and

the considerable new research in them: For example:

1) A very good New Tiger Buy B12 for Low Priced Stocks (1)

2) After Red high volume reversal days use CP uptrend-breaks.

3) Buy the stocks the Federal Govt wants you to buy. (1)

4) 100-Day Power Rankings... (1)

5) Using Closing Power Hooks after Buy B26s and B20s. (1)

6) How A Stock Reacts to Its Earnings Report Is Very important. (1)

7) TigerSoft Major Buy Signals' Combinations

Which are most Powerful? Reliable? (1)

8) Augmented Buy B20s' Independent Success Rate. (1)

9) What factors warn a rising 65-dma will not hold? (2)

10) The classic cluster of technical characteristics that commonly appear

in the 23 stocks falling 70% or more in the deep pullback of 2011. (2)

Purchase each all new book by CC for $42.50 or send a check

for $37.50 to me: William Schmidt, 5970 Gullstrand St., San Diego, CA 92122.

Introduction to

Tiger/Peerless Buys and Sells.

new

Sept 2014 Peerless Buy and

Sell Signals

Different Types of

TigerSoft/Peerless CHARTS, Signals and Indicators

Documentation for

TigerSoft Automatic and Optimized Signals.

How reliable support is the

DJI's rising 200-day ma?

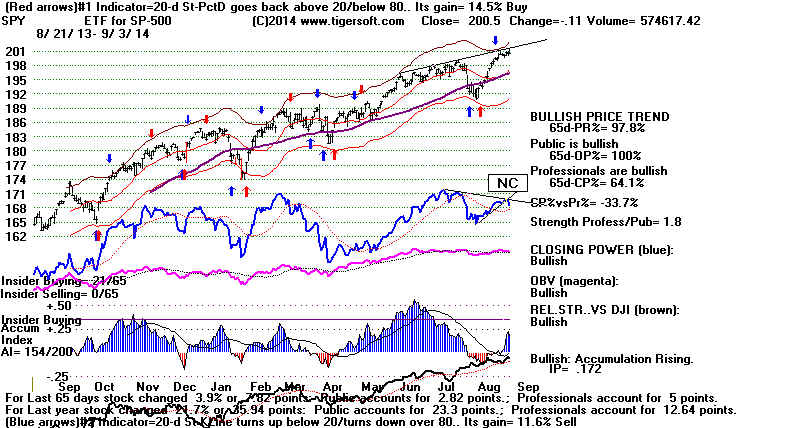

SPY Charts since 1994:

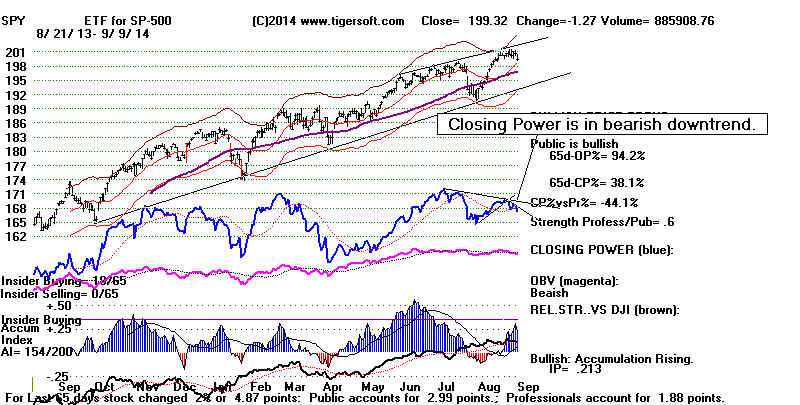

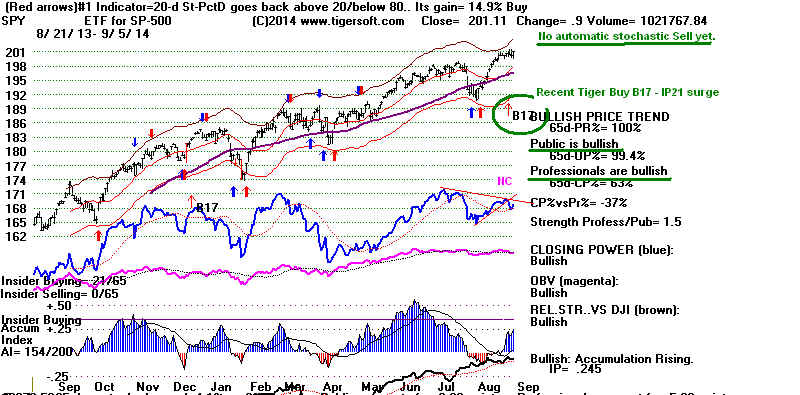

Advisory Closing Power S7s, Accum. Index, 65-dma, Optimized

Signals.

"The Jig Is Up": Calling

September and October Tops.

A Keynesian's Warning Signs.

4/7/2014 Advisory Pink Closing Power

S7s at ETF at top since 1994

1994 1996 1997 1998 1999

2000 QQQ SPY

DIA 2002

2007

2008

SPY 2011 2013-2014

Tiger Buy and Sell Signals: New 2014 Research:

These are randomly chosen groups.

but clearly we need to back-test them in more years.

You can replicate or do similar studies yourself

for other signals and/or other years.

9/1/2014 - 2014 Tiger B19s -

Steady rallying and no pullbacks below the 21-day ma.

9/2/2014 - 2014 Tiger B17s on 14As taken

alphabetically

9/3/2014 - 2014 Tiger B17s on 60 Biotechs taken

alphabetically

9/4/2014 - 2014

Tiger B18s on all "R" stocks taken alphabetically

9/8/2014 - 2014

Tiger B20s - Conclusion: Use Closing Power trendbreaks in aftermath.

9/8/2014 - 2014

Tiger B16s - Conclusion: Use mostly when LA/MA

under 1.05.

9/11/2014 - 2014 Tiger B15s - Conclusion: Certain conditions improved the results dramatically.

9/12/2014 - 2014

Tiger B25s - Conclusion: 87.5% success rate when

other internals are positive.

9/15/2014 - 2014 Tiger B25s - Best conditions for using B25s with somewhat higher RSX

capitalization stocks.

9/16/2014 - New Tiger

Closing Power Take-Off Buy Signal in 2014: 14s, QQQ, DJI-30 and ETFs

9/17/2014 - New

Tiger Closing Power Take-Off Buy Signal: 2009A-s

9/18/2014 - New

Tiger Closing Power Take-Off Buy Signal: 2010A-s

9/21/2014 - New

Tiger Augmented Sell S8s: DJI-30 - 2014

Requiring S8s to show Negative CP%-Pr and IP21<+.15 produced a 70% success rate

in a rising market. for DJI-30 stocks and big ETFs.

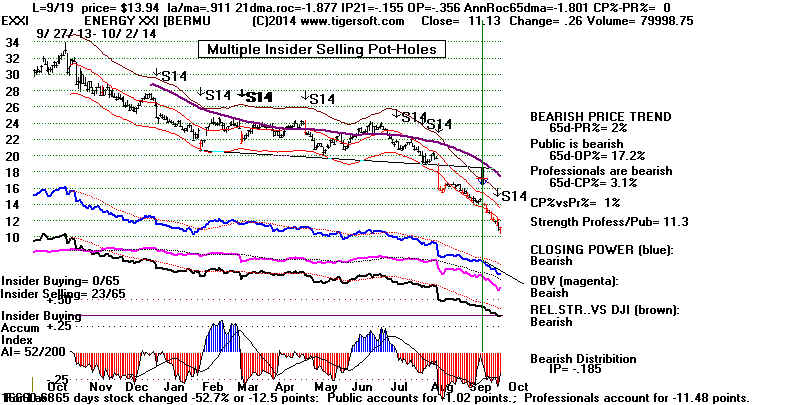

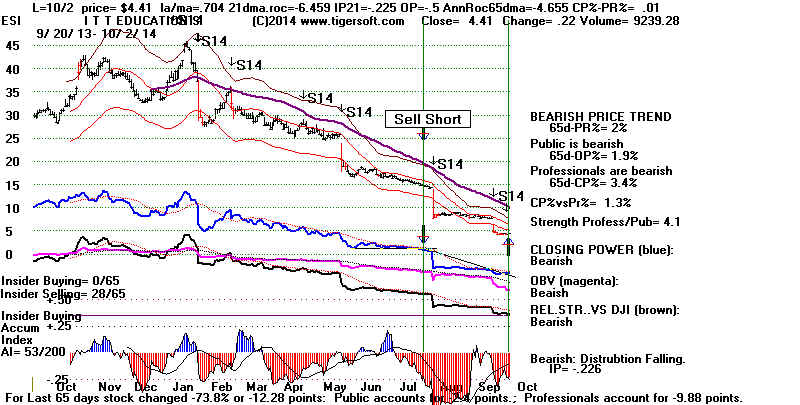

9/24/2014 - Tiger

Sell S14s: They make price breakdowns very bearish.

The New 2014 Peerless.exe Software has now been posted on the Elite Stock Professional

Page.

---> To Older Hotlines

Lines

Announcements

NEW S17 Peerless update has been posted on Tiger Elite Stock Professionals' Page.

It includes new Tiger signals showing most reliable tests of 65-dma, a Buy B2

and a Sell S2. Also in it

is a Buy B13 and S13 to show Closing Power spikes.

NEAR65.exe on Data Page

The Tiger Data page

now offers a night download of the stocks that have

closed within 1% of a 65-dma. We want to see which way stocks are jumping.

We also want to find stocks perfectly poised to take off or collapse. Here the

Closing Power trend reversals are important.

Lots of factors affect whether a stock will hold or whether

it will fail on a test

of the 65-dma. I think the Closing Power Percent - Price Percent using their

65-day highs and lows is one of the best predictors. More on this in the

coming nights. The current CP%-Pr% is shown to the right of the graph.

This update is $95 if you do not have a subscription to

the Elite Page. If you

purchased the B20 update a few weeks ago, I will send you the link to this

update on Wednesday.

-------------------------------------------------------------------------------------------------------------------------------------------------------

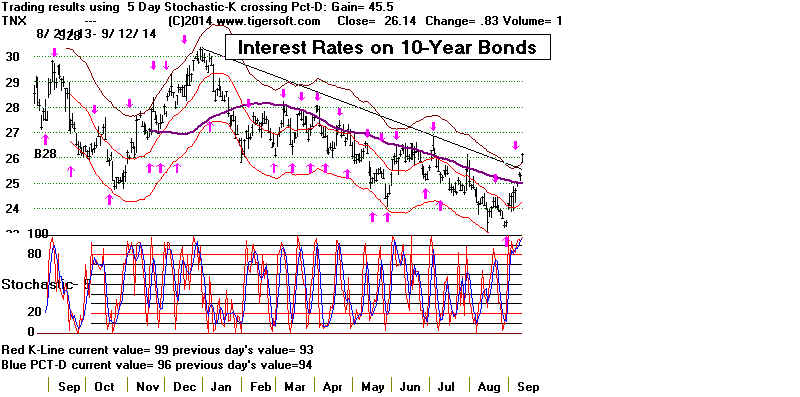

Additional Peerless Indicators:

65-day ma Percent Data for

Different Sectors

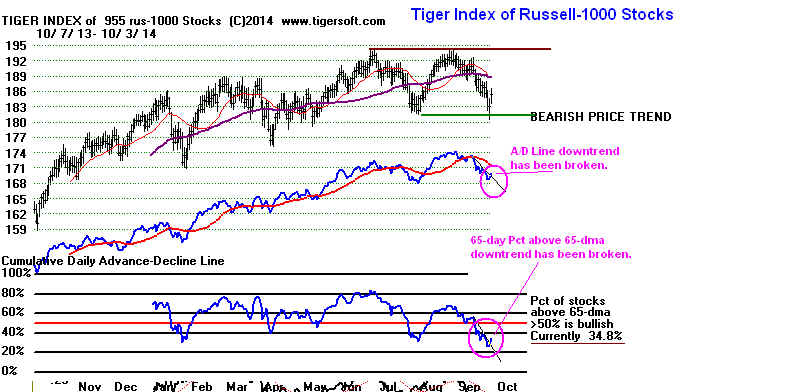

Steep breadth downtrend-lines were

broken today.

But only Bonds, Utilities, DJI stocks and

Beverages show a majority of their stocks above the 65-dma.

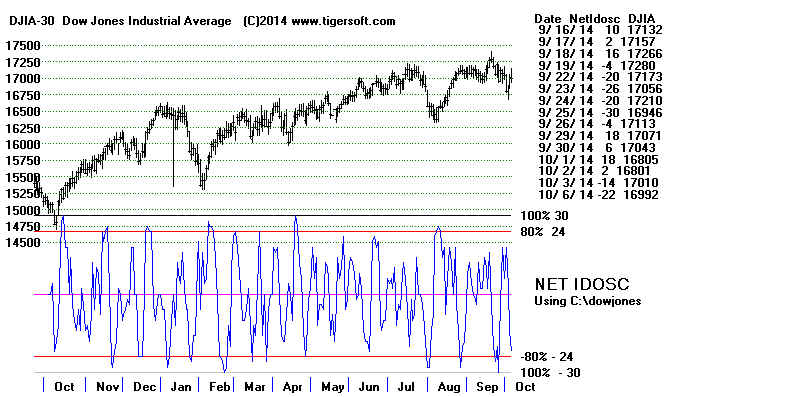

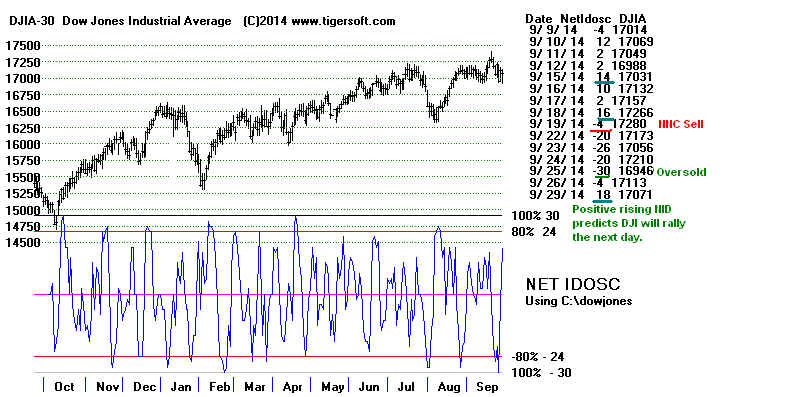

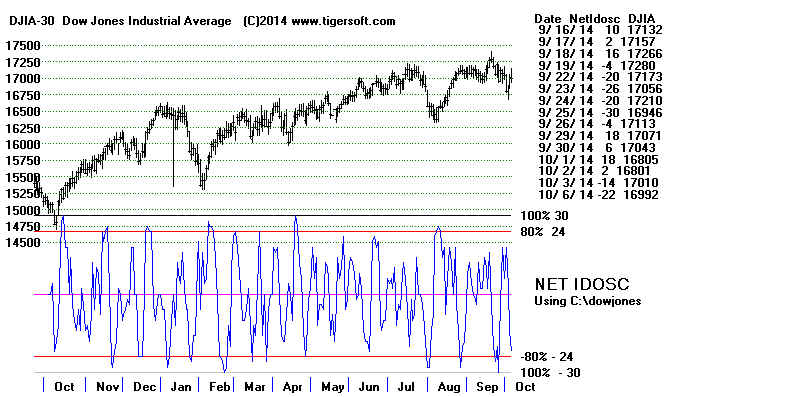

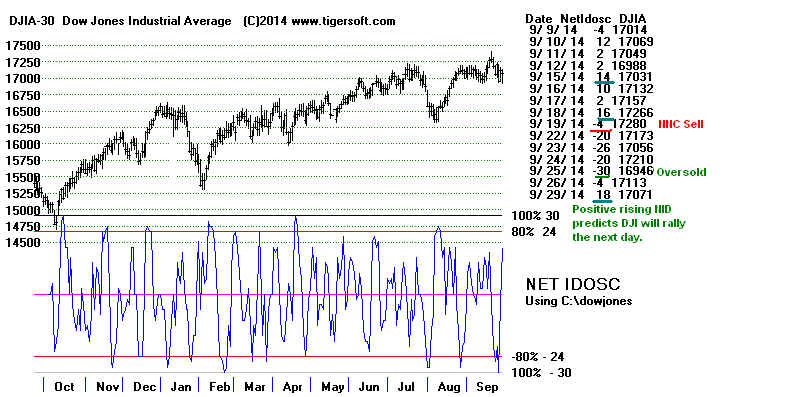

Net Idosc on DJI, QQQ, SP-500 and Russell-1000

(very short-term)

The NID fell today for the stocks

in QQQ, SP-500 and Rus-1000 despite the big rally.

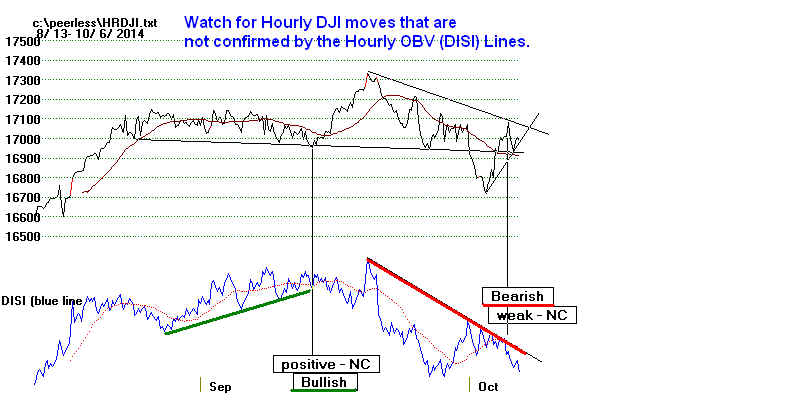

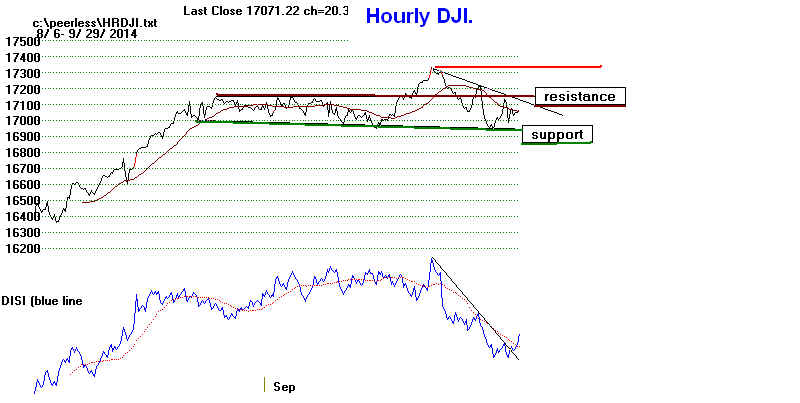

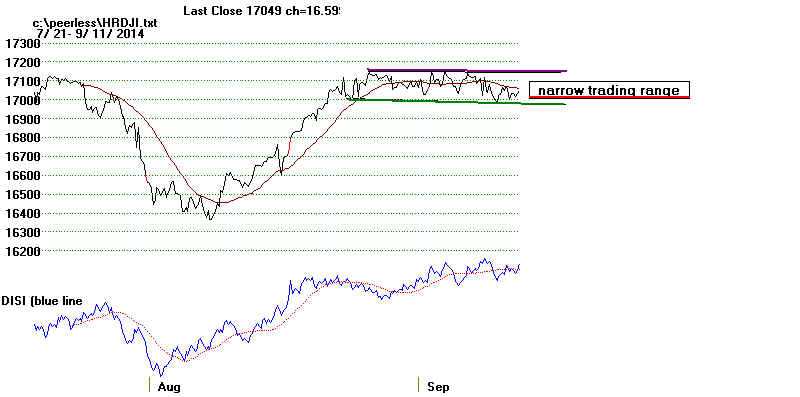

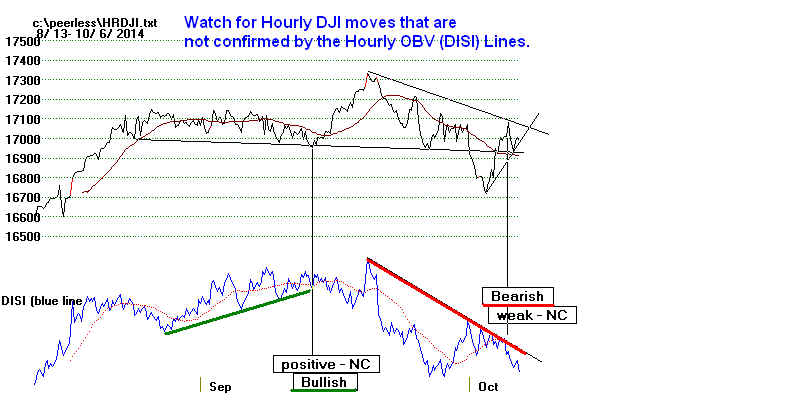

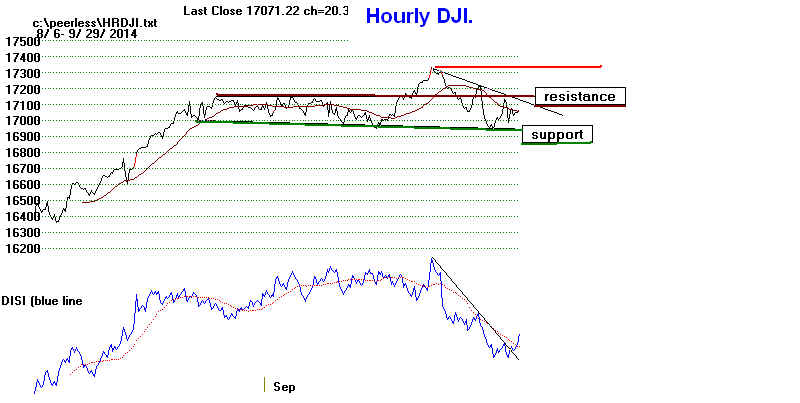

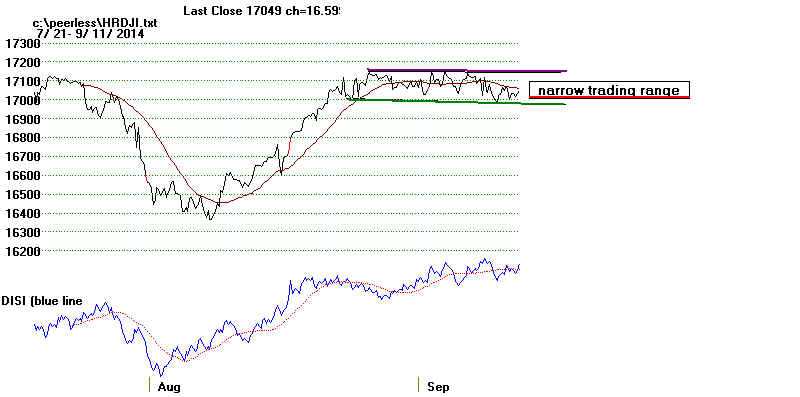

Hourly DJI (very short-term)

The DISI (OBV Line) is still

downtrending.

NIGHTLY HOTLINES

10/8/2014

The Two-Day Reversal today was Bullish.

Who wants

to fight the Fed? Buy IBB, but wait on buying

the other

ETFs. The pattern of wild Closing Power

fibrillations may not be broken. We need to see the

Bears'

response to this rally.

Key Values

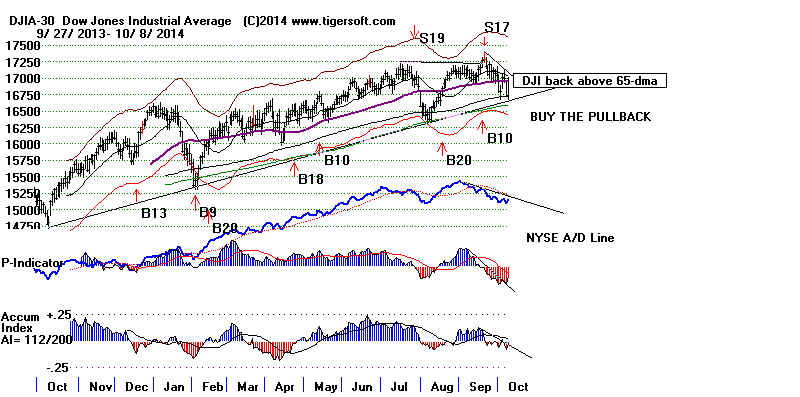

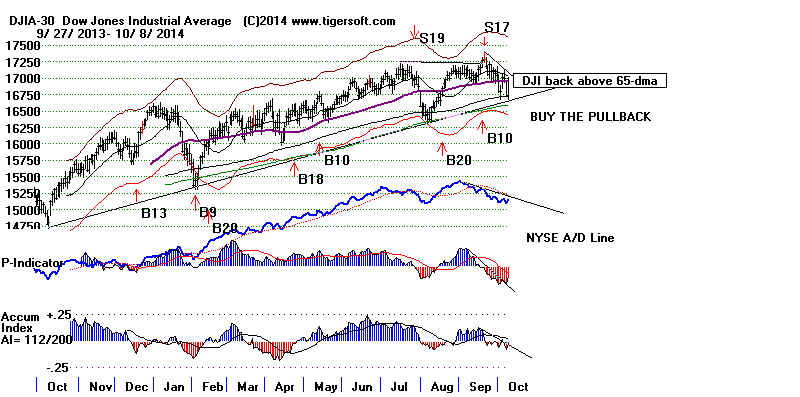

16994 la/ma=.997 21-dmaROC= -.014 P = -290 P-ch = 172

IP21 = -.011 V = -.126 OPct= -.003 65-d UpPct = .005

A New 2-Day Turn-Around Buy B19?

Today's fine two-day turn-around did not generate a Peerless Buy signal.

No Buy B19 was given here because the DJI closed a little too close to

the 21-dma and showed an Adv/Decl Ratio of 4.0, which was less than

the 4.74 level required of Buy B19s. In addition, the previous day's A/D

Ratio was only .297. It needed to be less than .211 to get a Buy B17.

Still, who wants to fight the Fed? The Fed as a whole clearly

wants to

give investors every confidence that they will not be raising rates soon,

that investors will be warned in a timely and a transparent way when this

is going to happen, that they consider a Dollar that runs away on the upside

does too much harm to US manufacturing to allow and that they need

much more good Jobs' Data to believe the US economy is safely on a growth

path. Clearly, the Fed is on the side of keeping stocks rising. They

do not want a potential October melt-down.

So, what can we say about today's reversal? When we

test A/D

Ratio parameters that bracket what we saw today, we do find this

could easily be made into a good Buy signal, except that all

but one of the 10 test-B19s occurred before 1960. The only real

paper losses came when this test-B19s occurred in the Summer.

See Table 1. 5 of the 10 would have gained more than 9% on

the DJI. So, why fight the Feds?

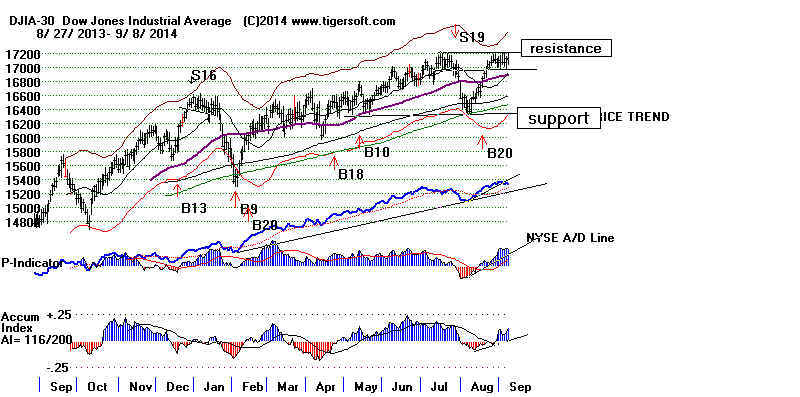

My judgement is that after a few days' hesitation here at 17000, at the

DJI's 21-day ma and flat 65-day ma, the NYSE A/D Line will probably

break its downtrend and the DJI will rally back up to its resistance at 17200

where it will fall back again. Since 70% of all stocks are still

below their 65-day ma,

the Hourly DISI remains weak and

the Net IDOSC actually fell today for the

stocks in the QQQ, SP-500

and Russell-1000, I would expect a pullback and some

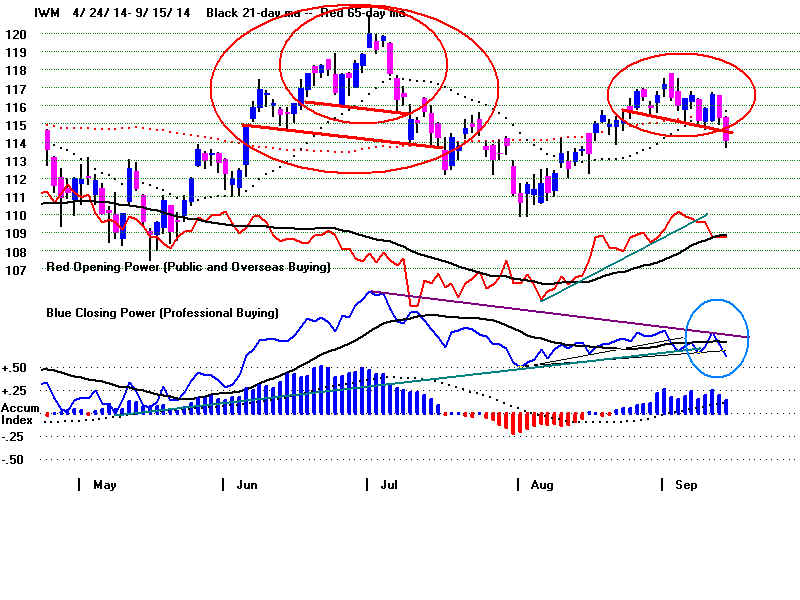

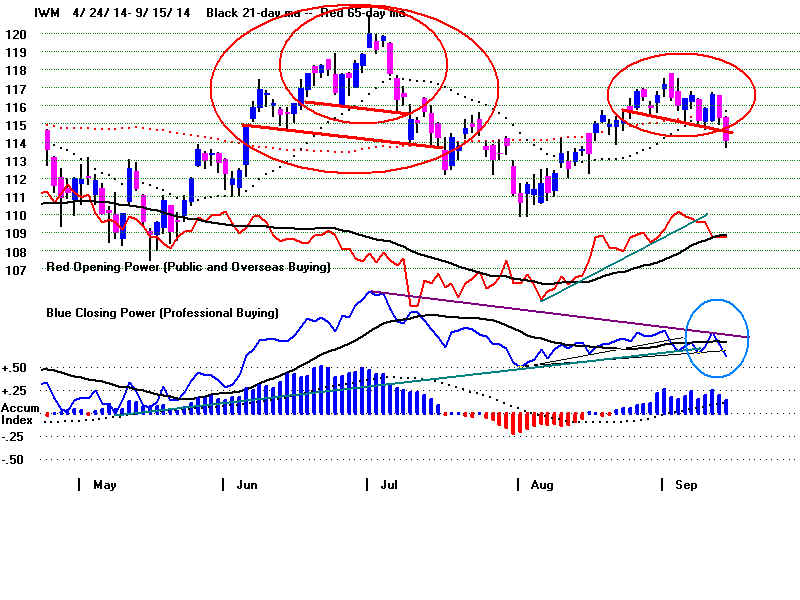

re-grouping, although IWM did break its Closing Power's

downtrendline.

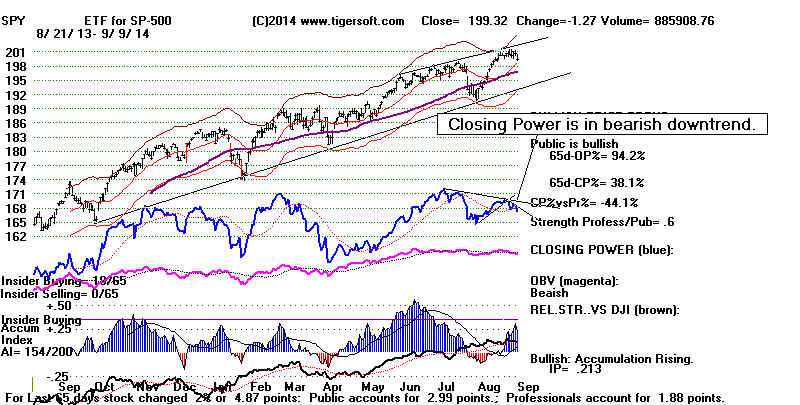

Above its CP>its CP%-Pr%

IP21 Automatic

65-dma 21-day ma

Signal

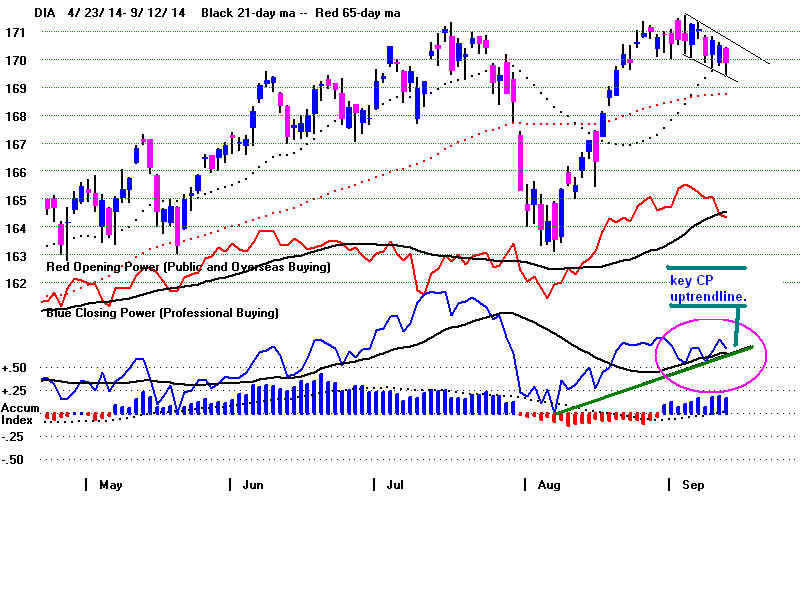

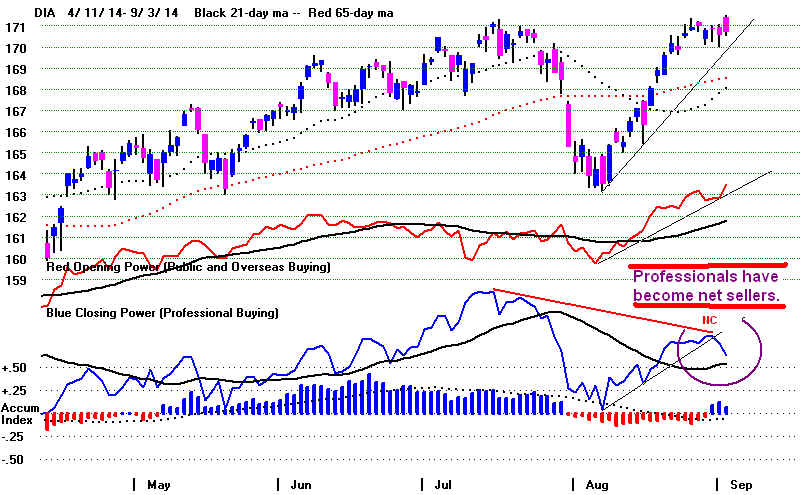

DIA

No

no -17%

-.009 Red Sell

CP is below its wildly fibrillating downtrend.

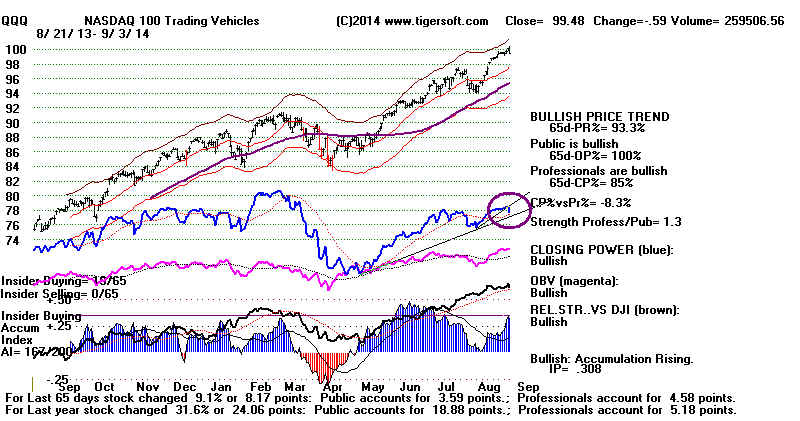

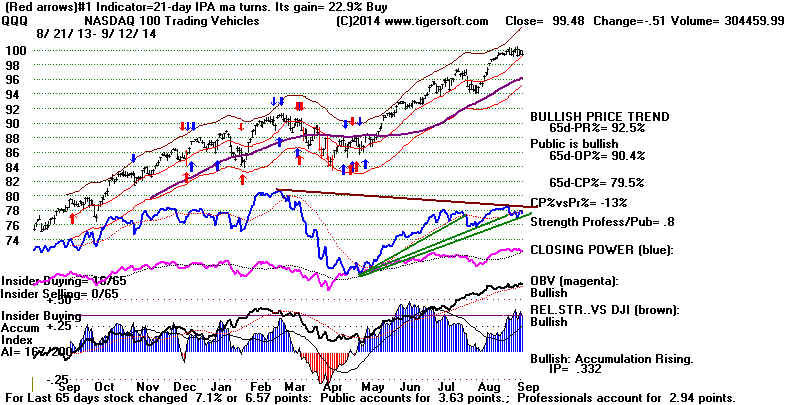

QQQ

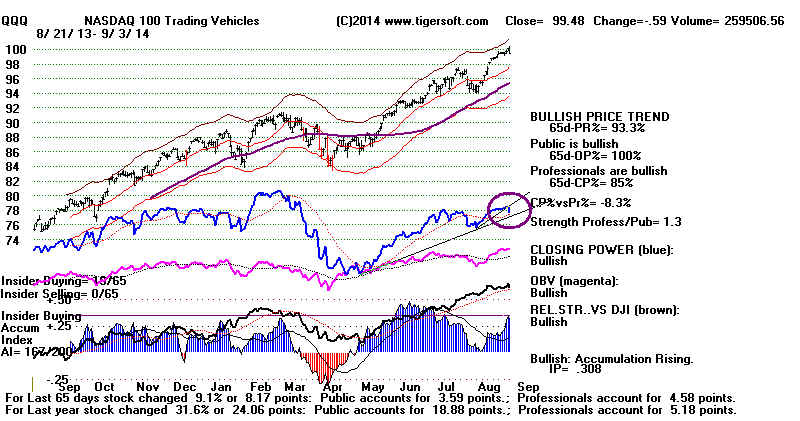

Yes

yes -7.5%

.088

.............. CP caught in its own trading range

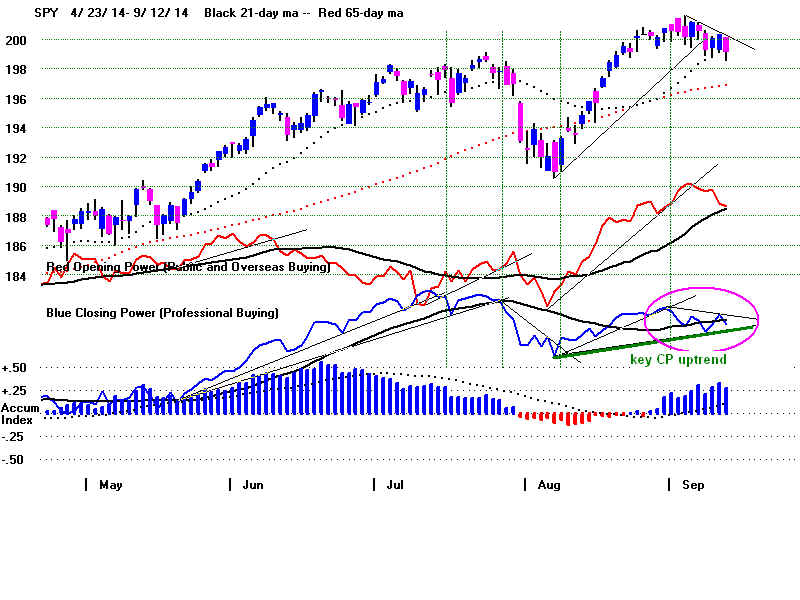

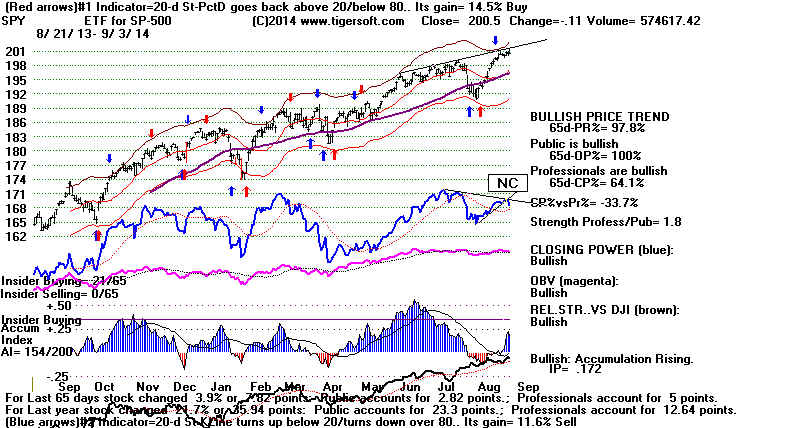

SPY

No

no -6.9%

+.026 Red Buy

CP is below its wildly fibrillating downtrend.

IWM

No

no +1.9% -.116

Red Buy CP broke its steep downtrend slightly.

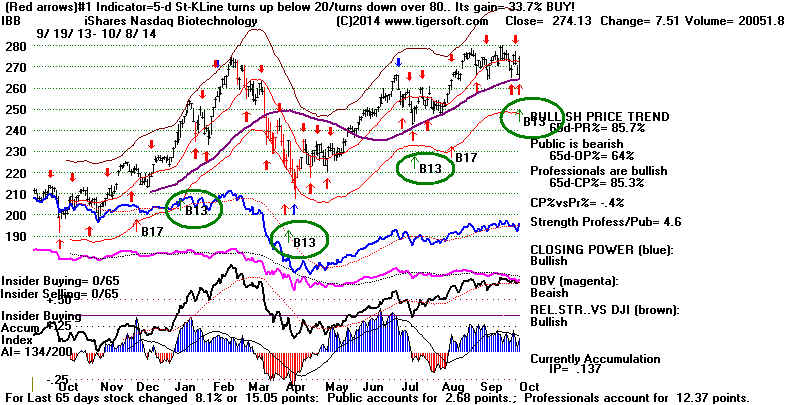

IBB

Yes

yes

-0.4% +.137 Red

Buy CP broke its downtrendline.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

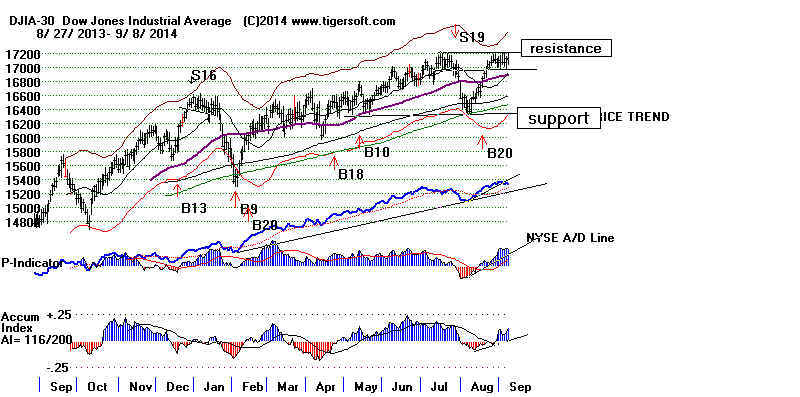

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->58 +44 MAXCP stocks Bullish MAXCP Stocks (11/8/2014)

--> 221 -173 MINCP stocks Bearish MINCP Stocks (11/8/2014) Bearish

plurality

--> 21 +12 New Highs on NASDAQ

93 -86 new lows.

Bearish plurality

--> 27 +15 New Highs on NYSE 56 -90 new lows.

Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

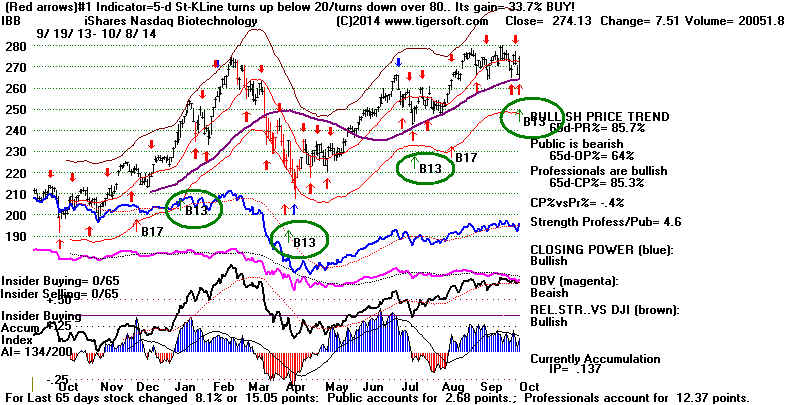

Buy IBB

Buy some of the Bullish MAXCP stocks and holding short

the Bearish MINCP stocks as long as they stay below their

falling Closing Power. I would wait for the Closing Power

downtrends to be more clearly broken to do any buying in the

major market ETFs. IBB is more bullish than any of these.

I would buy IBB. See it below. It also shows a

new Tiger Buy B13.

Today its Closing Power took the biggest leap upwards in last

65 trading days. See how well two earlier Tiger Buy B13s worked

in buying IBB.

IBB

Table

1 What happens when yesterday's and today's Advances/Declines Ratio

are similar to that of yesterday and today. Yesterday's A/D Ratio must

between .25 and .35 AND today's A/D Ratio must be between 3.5 and 4.5

3/3/1933

Rose from

53.8 to 108.7 on 7/10/1933 Superb

signal. No paper loss

.966 -1.509

-71 11 -517 -.013 -239 -.059 -.092

Bear Market bottom.

---------------------------------------------------------------------------------------------

3/19/1935 Rose from

98.3 to 116.6 on 5/16/1935 Superb

signal. No paper loss

.970 -.75

-120 1 -669 -.114 -200 -.091

-.026 On-Going Bull Market

---------------------------------------------------------------------------------------------

6/1/1938 Rose 110.6 to

144.9 on 7/25/1938 Superb signal.

No paper loss

.968 .052

-45 29 -237 -.036 -57 -.07

-.147 Bear Market Ending.

---------------------------------------------------------------------------------------------

7/19/1944 Fell from 148

to 143.6 on 9/7/1944 3% Paper Loss before

rallying to the upper band.

.994 -.032

39 8 209 .008 0 .137 .074 On Going Bull

Market

---------------------------------------------------------------------------------------------

9/15/1944 Rose from 144.1. to

152.3 on 12/15/1944 6+% Gain. No paper loss

.986 0.260

23 1 126 -.096 -3 -.191 -.007

---------------------------------------------------------------------------------------------

11/26/1945 Rose from

188.2 to 205.8 on 2/4/1946 9+% Gain. No

paper loss

.997 .126

103 42 469 .145 106 .018 .153

---------------------------------------------------------------------------------------------

7/31/1947 Fell from

183.2 to 175.1 before rally back to upper band at 185.3 on 10/20/1947

.997 .188

88 -6 367 .053 53 .17 .085 +1% Gain. 4.5% Paper Loss

---------------------------------------------------------------------------------------------

10/17/1952 Rose from

267.3 to 293.8 on 1/5/1953 9+% Gain.

1.5% Paper Loss

.987 -.137

-68 -6 -250 -.036 -163 -.216 -.033

---------------------------------------------------------------------------------------------

8/20/1959 Fell from

655. to 618.2 on 9/21/1959 A head/shoulders

pattern intervened.

.986 -.168

-63 20 -186 -.038 -364 .052 .036

6.0% Paper Loss

---------------------------------------------------------------------------------------------

10/28/2008 Rose from

9065.12 to 9319.83 on 11/3/2008 and then fell to 7552.29 on 11/20/2008

.997 -.014

-290 172 -290 -.011 -126 -.003 .005

3+% Gain. No paper loss

--------------------------------------------------------------------------------------------

Table 2 below shows that the 10/3/2014 rebound had a weaker breadth ratio than

any of the 18 rebounds that

took the DJI back up to the upper band or higher since the

bear market bottom in March

2009. That the next day saw the DJI decline is not inconsistent

with a rally to the upper

band, but it occurred only in 3 of the 18 earlier rebounds.

For the 10/8/2014 rebound to look

more like the other successful rebounds below,

the DJi will need to rally on

10/9/2014.

Table 2

------------ Big DJI Reversals

Following Declines --------

NYSE A/D

DJI Daily

Jumps Next Day

up down Ratio

---------------------------------------------------------------------------------------------------------------------------

10/8/2014 2551 638

4.00 16719.39

to 16994.22

10/3/2014 2124 1035

2.05

16801.05 to 17009.69 16991.91 Rally Failed.

8/8/2014 2397 773

3.10

16368.27 to 16553.93 16569.98

2/6/2014 2345 776

3.02

15440.23 to 15628.53 15974.08

10/10/2013 2557 450

5.68 14702.98

to 15126.07 15237.11

9/9/2013 2464 615

4.01

14922.50 to 15063.12 15191.06

6/25/2013 2493 820

3.04

14659.56 to 14760.31 14910.14

11/19/2012 2696 356

7.57

12588.31 to 12795.96 12788.51 hit 13350.96

6/6/2012 2691 377

7.14

12127.95 to 12414.79 12460.96

10/6/2011 2607 474

5.50

10939.95 to 11123.33 11103.12 hit 12231.11

8/11/2011 2832 228

12.42 10719.94 to

11143.31 11269.02

6/28/2011 2457 605

4.06

12043.56 to 12188.69

12261.42

3/17/2011 2232 819

2.72

11613.3 to

11744.59 11858.52

12/1/2010 2403

676 3.55

11006.02 to 11255.78 11362.41

9/1/2010 2668

431 6.19

10014.72 to 10269.47 10320.1

7/7/2010

2689 447

6.02

9743.62 to 10018.28 10138.99

6/10/2010

2731 405

6.74

9899.25 to 10172.53

10211.07

11/5/2009

2495 537

4.64

9802.14 to 10005.96

10023.42

7/13/2009

2565 498

5.15

8146.52 to 8331.68

8359.49

3/10/2009

2936 225

13.05

6547.05 to 6926.49 6930.40 |

|

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------------------------------

10/7/2014

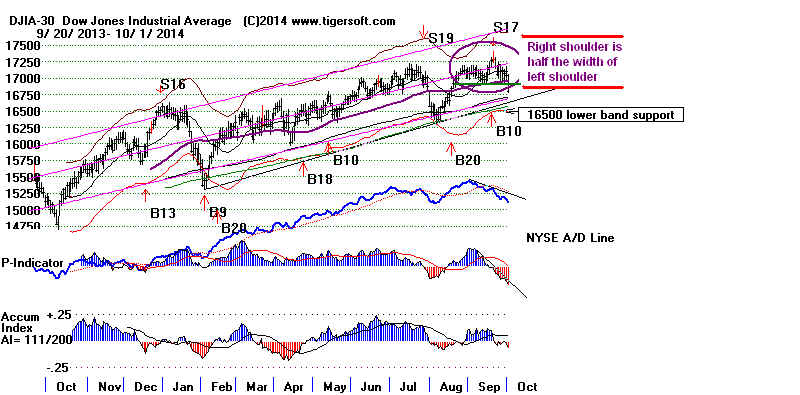

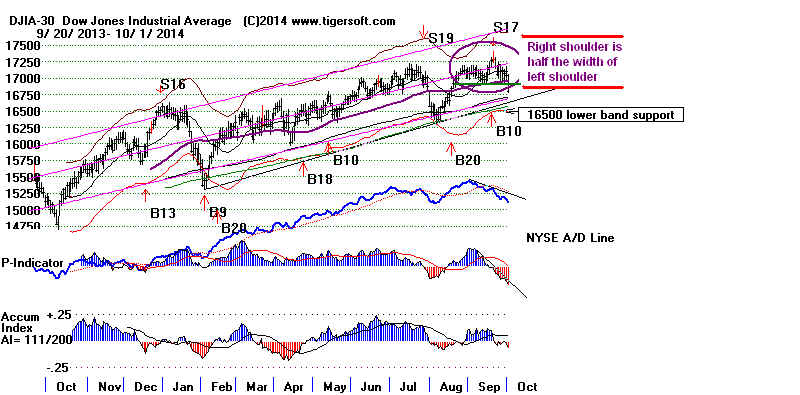

The Sell S17 and lop-sided DJI head/shoulders pattern normally

promise a test of the lower band. Today's sell-off was occasioned

by heavy institutional and Professional Selling. That is about 200

points lower. We much watch now to see if the DJI

can hold above

its well-tested uptrendline. This crosses at 16624, or 95 points lower.

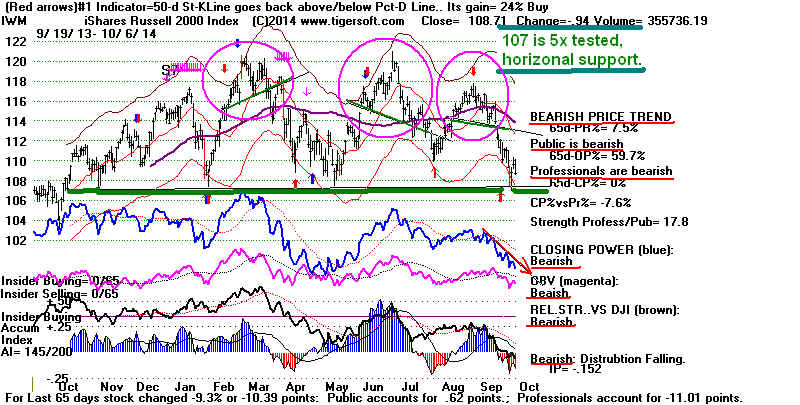

As we feared, the Russell-2000 could not bounce up from its

well-tested

flat support. Because it is October and because there are so many

leveraged vehicles for short sellers to apply theri trade on down-ticks,

I think it would be dangerous to try to call a market bottom here.

Today's weakness caused a majority of the DJI stocks to break

below the support of their 65-dma. About 79% of ALL stocks are

now under that key support level. The major market ETFs; Closing Powers

are all in downtrends. The Hourly Down-Volume has bearishly picked

up and Down-Hour Volume is now leading the DJI lower. The

Russell-2000 and IWM penetrated their well-tested horizontal

support. Now the SP-500 and DJIA are testing their price uptrend-lines.

I would think these will need to be thoroughly challenged before

there can be much of a rally. Until the Closing Powers break their

downtrends, I would expect lower prices.

How Can The Economy Hold

Up

Now That The Big Boys Starting To Panic?

It is said that the big boys are now in a

great hurry to get out of the market

and some are

selling short. And I read that 95% of SP-500 profits

are being used to buy back shares of stock rather than invest in

a business expansion. This is a recipe for big trouble. With the

shrinking middle class holding off on more and more big purchases

and the working class living pay check to pay check, only small businesses

and Government can keep the economy going. Republicans don't

believe in Goverrnment stimulus and Democrats have utterly forgotten

how to teach Keynesian economics to the electorate. So, everything

now depends on small business. Let's hope the next Jobs Report

stays strong. But now we are hearing of big corporate lay-offs

again. Hewett

Packard just announced today it will lay off 56,000 workers.

That will definitely hurt next month's Jobs numbers. The recent declines in

the stocks of Ford, Boeing, Caterpillar and United Technologies

are so

steep (because of the rising Dollar and weaker demand globally), I can't

see how they, too, will not be forced to layoff tens of thousands of workers.

And, as I showed this weekend here, negative Job Growth and lower

profits are what seem to set off bear markets.

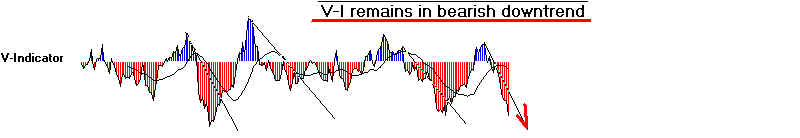

The DJI (DIA), the Falling Closing Power

and the Falling A/D Line for all the "C" Stocks.

Lest we trust too much that the absence of Sell S9s can save the market,

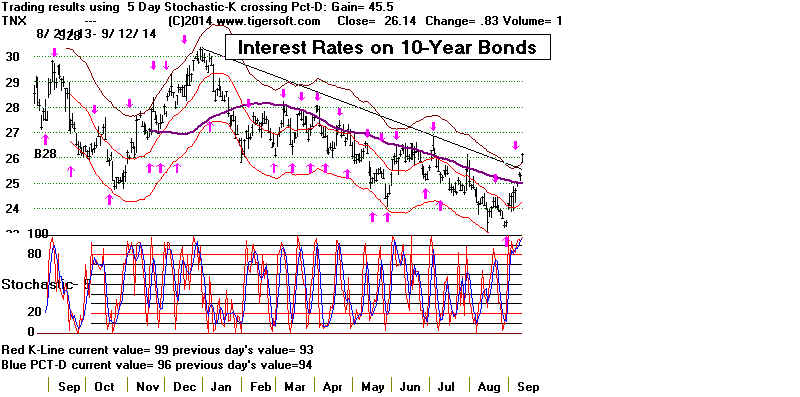

I need to remind readers that Sell S9s are based on the NYSE A/D Line

falling way behind the DJI. But with interest rates so low, bond funds and

dividend stocks on the NYSE have gotten an extraordinary lift for years.

Even now with the market falling, bond funds have turned up. Low interest

rates reflect not just loose monetary policy but a lack of demand for Money,

in a weak economy,

Such forces have artificially boosted the A/D Line ever since

2009. What we need now to do is to be aware of how much weaker the

average common stock is than the DJI-30. We can remedy this.

If we plot the DJI on top and, say, the A/D Line on the bottom for,

all the stocks beginning with "C", for example, we see that a growing bearish

divergence is taking shape between the DJI stocks and most other stocks.

If we also allowed S9s based on such breadth divergences when the DJI

tagged only the 1.75% band, we would have seen a Sell S9 two weeks ago

instead of a Sell S17. I think we will have to start watching for such

bearish divergences.

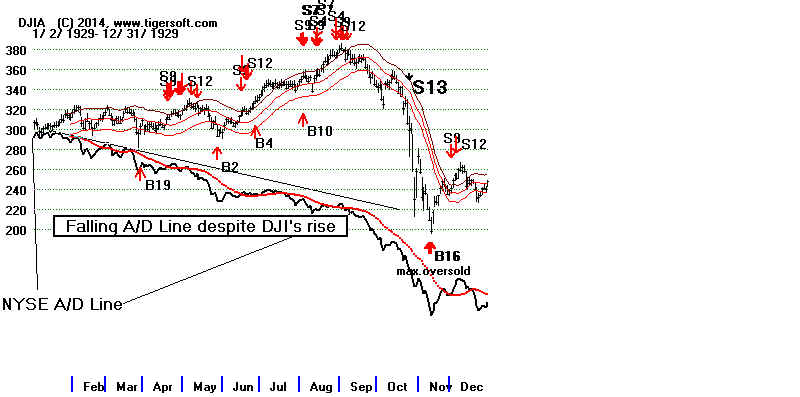

The good news is that this divergence only became glaring several

weeks ago. In 1929, 1987, 2000 and 2007-8, the A/D Line lagged

the DJI for 6 or more months before a final top was reached.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->14 -4 MAXCP stocks Bullish MAXCP Stocks (11/7/2014)

--> 394 +58 MINCP stocks Bearish MINCP Stocks (11/7/2014) Bearish

plurality

--> 9 -3 New Highs on NASDAQ

179 +75 new lows.

Bearish plurality

--> 12 -5 New Highs on NYSE 146 +111 new lows.

Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------------------------------

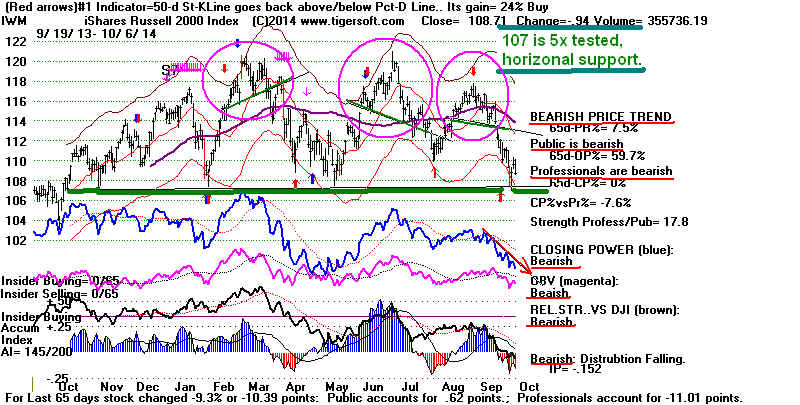

10/6/2014 "When the foundation weakens enough,

even the penthouse will

come down."

This Monday's failure to continue Friday's rally suggests there are a lot of big

Sellers who urgently

want out of this market. I don't know why, but

we should fear that

they have good reasons for selling so hurriedly.

A Test of the 3.5% lower band appears likely.

Octobers are notorious

for bringing violent declines: 1929, 1930, 1932,

1933, 1937, 1941,

1957, 1967, 1971, 1973, 1977, 1978, 1979, 1987, 1989,

1997, 2000, 2002 and

2008. We should be careful now. Each of these

years saw a drop of

more than 10% from September to an October low.

Simply knowing this, I

have suggested being fully hedged with

Bearish MINCP short sales.

If IWM and the

Russell-2000 break their well-tested flat support, the sell-off will

surely accelerate.

The presence of so many minor head and shoulders patterns

in IWM's chart is a

bearish warning that there are serious cracks in the

market.

GTAT's sudden bankruptcy today will surely scare some tech

investors. Add to

that: all our measures of internal strength are bearish on the IWM

chart below. Last

but not least, Professionals are selling to the Public.

Sell S9s and S12s Are Not

The Only Peerless Sells We Should Heed.

Though we have not had

any of the Sell S9s or S12s that usually end a bull market,

we certainly have had

plenty of warnings that there might have to be a test

of the lower band, with

perhaps a 33% chance that it will drop even more.

The first warning was

the Sell S17. Though S17s

are only September Sells,

S17s are based on a

concept that we also use with Tiger, namely that big drops in IP21

for stocks are bearish

(Tiger S17) just as big leaps up are bullish. (B17). The

next warning was the

head/shoulders pattern, which showed the DJI was too weak to form a

symmetrical right

shoulder. The third was the relative narrowness of Friday's

rally and the fourth

was the failure of the DJI to follow-through to the upside today,

as usually happens on

rebounds that lead to prices rallies to the upper band.

(See Table 2 below.)

Presently, the Hourly DJI shows that volume was badly

missing on the current

rally. (See Box 2 Below.) The Closing Powers for the key

ETFs are all falling.

Finally, our Tiger Net IDOSC refused to rally on Friday and

fell more deeply into

negative territory today. (See Table 3 below.)

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->18 -13 MAXCP stocks Bullish MAXCP Stocks

(11/6/2014)

--> 326 +70 MINCP stocks Bearish MINCP Stocks (11/6/2014) Bearish

plurality

--> 12 -8 New Highs on NASDAQ

72 +28 new lows. Bearish plurality

--> 17 -7 New Highs on NYSE 35-17 new lows.

Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

Calling

Major Tops in Stocks and Key ETFS.

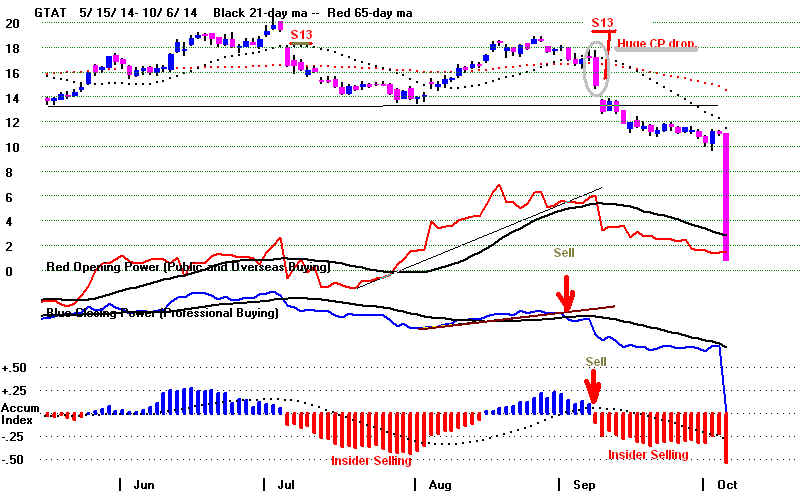

Today GTAT "suddenly" filed

for bankruptcy. There

were lots of warnings signs. And we should study these

because they will appear over and over again, as more

and more stocks top out while DJI maintains the

appearance that all is well on Wall Street.

1) Watch for Bearish Head/Shoulders Patterns.

2) Watch for S14s (Institutional Dumping.

3) Watch for S13s (Biggest Closing Power Declines in 65-trading days)

- See also the Tiger Candle-stick charts for BIG RED DAYS

- Especially bearish if they occur as 65-dma is penetrated.

4) Watch for S17s (Big IP21 drops.)

5) Watch for pattern of Closing Power weakness (S7 warnings) and then

break in 65-dma.

6) Watch for Sell S2s (Failures of prices to get past or stay above falling S65-dma)

Example: GTAT - Apple

sapphire supplier GT Advanced files for bankruptcy 10/6/2014

|

BOX 2 - Hourly DJIA

|

Table

2 below shows that the present (10/3/2014) rebound had a

weaker breadth ratio than

any of the 18 rebounds that

took the DJI back up to the upper band or higher since the

bear market bottom in March

2009. That the next day saw the DJI decline is not inconsistent

with a rally to the upper

band, but it occurred only in 3 of the 18 earlier rebounds.

Table 2

------------ Big DJI Reversals

Following Declines --------

NYSE A/D

DJI Daily

Jumps Next Day

up down Ratio

---------------------------------------------------------------------------------------------------------------------------

10/3/2014 2124 1035

2.05 16801.05 to

17009.69 16991.91

8/8/2014 2397 773

3.10

16368.27 to 16553.93 16569.98

2/6/2014 2345 776

2.02

15440.23 to 15628.53 15974.08

10/10/2013 2557 450

5.68 14702.98

to 15126.07 15237.11

9/9/2013 2464 615

4.01

14922.50 to 15063.12 15191.06

6/25/2013 2493 820

3.04

14659.56 to 14760.31 14910.14

11/19/2012 2696 356

7.57

12588.31 to 12795.96 12788.51 hit 13350.96

6/6/2012 2691 377

7.14

12127.95 to 12414.79 12460.96

10/6/2011 2607 474

5.50

10939.95 to 11123.33 11103.12 hit 12231.11

8/11/2011 2832 228

12.42 10719.94 to

11143.31 11269.02

6/28/2011 2457 605

4.06

12043.56 to 12188.69 12261.42

3/17/2011 2232 819

2.72 11613.3 to

11744.59 11858.52

12/1/2010 2403

676 3.55

11006.02 to 11255.78 11362.41

9/1/2010 2668

431 6.19

10014.72 to 10269.47 10320.1

7/7/2010

2689 447

6.02

9743.62 to 10018.28 10138.99

6/10/2010

2731 405

6.74

9899.25 to 10172.53

10211.07

11/5/2009

2495 537

4.64

9802.14 to 10005.96

10023.42

7/13/2009

2565 498

5.15

8146.52 to 8331.68

8359.49

3/10/2009

2936 225

13.05

6547.05 to 6926.49 6930.40 |

Table 3

Interpreting the Net IDOSC

as A Day-to-Day Predictor of DJIA

The Tiger Net Idosc for the DJI predicts the next day or two in the DJI by

using simple

rules when the DJI appears to be in a trading range or locked

inside its normal

3.5% bands.

You must each day

consider:

(1) whether the Net IDOSC rises or falls from the previous day as the DJI does.

By itself, this suggests that the DJI will continue to move in the same direction

another day. This more reliably predicts a rally the next day if the NID is

positive.

It more reliably predicts a decline the next day if the NID is negative.

(2) whether the Net IDOSC moves in a direction contrary to the daily direction of

the DJI. By itself, this weakly predict the DJI will

reverse directions

on the next day to be of use. In these cases, we need

also to see a negative NID

to predict a decline or a positive NID to predict a rally. A movement by NID

for two or more days that is contrary to the DJI's price movement also predicts

a reversal.

(3) whether the Net IDOSC moves in a direction contrary to the daily direction of

the DJI AND is NEGATIVE when the

DJI advances or is POSITIVE

when the DJI declines. This rule has special force when the DJI has reached

the 1% upper band or higher or the 1% lower band or lower.

(4) A reading of -26 or lower shows an oversold condition and predicts a rally

in a day or two. Oppositely, a reading of +26 or higher shows an overbought

condition and predicts a decline in a day or two.

(5) Do not use these rules when the DJI shows unusual upwards or downwards

momentum.

Illustration - Net Idosc from 9/16/2014 to 10/16/2014

11 good predictions of next day.

2 bad predictions of next day.

9/16/2014 17132 + 10

9/17/2014

17157 +2 NID falls but is still

positive. Rule #2

9/18/2014 17266

+16 NID rises. Rally to continue. Rule #1

9/19/2014 17280 -4 Contrary to price rise, NID falls and is negative.

Very bearish. Rule #3

9/22/2014 17173 -20 NID falls and is negative. Decline to

continue. Rule #2

9/23/2014 17056 -26 Oversold bounce predicted. Rule #5

9/24/2014 17210 -20 Contrary to price rise, NID falls and

is negative.

Very bearish. Rule #3

9/25/2014 16946 -30 Oversold bounce predicted. Rule #5

9/26/2014 17113 -4 Contrary to price rise, NID falls and is negative.

Very bearish. Rule #3

9/29/2014 17071 +18

Rally predicted using Rule #3. BAD PREDICTION.

9/30/2014

17043 +6 Falling NID. Decline likely

to continue. Rule #1

10/1/2014 16805

+18 Rally predicted using Rule #3. BAD PREDICTION.

10/2/2014 16801

+2 DJI

falls but NID remains positive. Predicts rally.

10/3/2014

17010 -14 DJI

rallies but NID turns negative. Very bearish. Rule #3

10/6/2014

16992 -22 Falling NID. Decline likely to

continue. Rule #1

|

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------------------------------

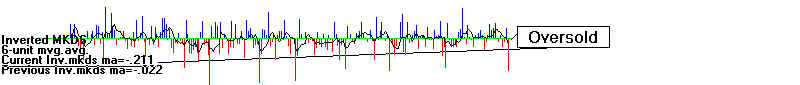

10/3/2014

The rebound Friday will

probably allow the DJI to go back up

to its recent highs. It is doubtful unless breadth and the hourly

up-volume improve from Friday's pace that other indexes will be

able to get back to their peak. Peerless has not given a reversing

Buy signal, but a good rally based on how oversold the Invested MKDS

was at Thursday's close is a 75% probability, I reckon.

Our Stocks' Hotline suggests staying short many of the Bearish

MINCP stocks. But I would cover the most recently shorted

Bearish MINCPs and those down 20% or more in recent decline.

Buy some of MAXCP stocks. IBB looks like the best major

market ETF. Its Closing Power and Relative Strength Lines

are still rising.

The up-trend of the Dollar coupled with the very good Jobs Report should

help the DJI avoid an October Massacre. The strength in the DJI will

continue to camouflage just how weak many other segments of the

market are. Eventually, the NYSE A/D Line's divergence from the

DJI will give us Sell S9s. Right now, the DJI must quickly destroy

its lopsided head/shoulders pattern by getting past 17200. It is not

clear that it will be able to do this.

Can We Trust Friday's Reversal?

We've gotten used to expecting good rallies like Fridays to mean a

major market rally back to new highs. This reversal was on little

more than 2:1 to the upside on the NYSE. But very good breadth

with a 3:1 ratio of NYSE Advances to Declines may still follow.

Since 2009, we have always seen such ratios jump above 3.0 when they

started rallies to the upper band. If a 3:1 ratio does not follow,

I would expect a narrow rally. In addition, the DJI, SP-500,

NASDAQ and QQQ will struggle to make new highs. See Table 1 below.

Become An Expert on Jobs' Reports.

Friday's Job Report was quite bullish. Even though, we

mostly look

at technicals, we should follow the Job Report numbers closely. With

real wages and interest rates holding steady, corporate profits

must be expected to rise when so many non-agricultural workers

are hired, as the Job Report suggests. Follow these numbers

using the tables supplied by the US Dept of Labor. I will post

them here. http://tigersoftware.com/PeerlessStudies/JobsR/index.html

In the Jobs' numbers, we want to take note of the changes up

or down

from the month before and the year before. As you

go over

this data, you will start to see how often the Job Report leads

the stock market. In Feb. 2004 (44), the bull

market's rally ended

for 7 month, only to resume again as the very fine October

2004 (346) Jobs' numbers were released. We got a

Peerless S9

only a few days after the very weak May 2006 (23)

Jobs' Report.

See below the deterioration in 2007, especially in October 2007 (2).

Then in February 2008, the numbers turned negative (-86).

By the Summer, they were terrible. More recently, last

December showed a sharp drop to 84. Small wonder,

Peerless

gave a Sell at the end of the year when the Santa Claus rally

was so weak. The recent weakness may be attributed to

the preliminary August 180 figure.

This was well below the

previous month and the same month a year earlier.

Net Change in US Non Agricultural Employment by Month

(000s)

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

| 2004 |

161 |

44 |

332 |

249 |

307 |

74 |

32 |

132 |

162 |

346 |

65 |

129 |

|

| 2005 |

134 |

239 |

134 |

363 |

175 |

245 |

373 |

196 |

67 |

84 |

337 |

159 |

|

| 2006 |

277 |

315 |

280 |

182 |

23 |

77 |

207 |

184 |

157 |

2 |

210 |

171 |

|

| 2007 |

238 |

88 |

188 |

78 |

144 |

71 |

-33 |

-16 |

85 |

82 |

118 |

97 |

|

| 2008 |

15 |

-86 |

-80 |

-214 |

-182 |

-172 |

-210 |

-259 |

-452 |

-474 |

-765 |

-697 |

|

| 2009 |

-798 |

-701 |

-826 |

-684 |

-354 |

-467 |

-327 |

-216 |

-227 |

-198 |

-6 |

-283 |

|

| 2010 |

18 |

-50 |

156 |

251 |

516 |

-122 |

-61 |

-42 |

-57 |

241 |

137 |

71 |

|

| 2011 |

70 |

168 |

212 |

322 |

102 |

217 |

106 |

122 |

221 |

183 |

164 |

196 |

|

| 2012 |

360 |

226 |

243 |

96 |

110 |

88 |

160 |

150 |

161 |

225 |

203 |

214 |

|

| 2013 |

197 |

280 |

141 |

203 |

199 |

201 |

149 |

202 |

164 |

237 |

274 |

84 |

|

| 2014 |

144 |

222 |

203 |

304 |

229 |

267 |

243 |

180(P) |

248(P) |

|

|

Table 1 shows that the present (10/3/2014) rebound had a weaker breadth ratio than any of

18 rebounds that took the DJI back up to the upper band since the bear market bottom

in March 2009. That the next day saw the DJI decline is not inconsistent with a

rally

to the upper band, but it occurred only in 3 of the 18 earlier rebounds.

Table 1

------------ Big DJI Reversals

Following Declines --------

NYSE NYSE Ratio DJI Daily

Jumps Next Day

up down

10/3/2014 2124 1035

2.05 16801.05 to

17009.69 16991.91

8/8/2014 2397 773

3.10

16368.27 to 16553.93 16569.98

2/6/2014 2345 776

2.02

15440.23 to 15628.53 15974.08

10/10/2013 2557 450

5.68

14702.98 to 15126.07 15237.11

9/9/2013 2464 615

4.01

14922.50 to 15063.12 15191.06

6/25/2013 2493 820

3.04

14659.56 to 14760.31 14910.14

11/19/2012 2696 356

7.57

12588.31 to 12795.96 12788.51 hit 13350.96

6/6/2012 2691 377

7.14

12127.95 to 12414.79 12460.96

10/6/2011 2607 474

5.50

10939.95 to 11123.33 11103.12 hit 12231.11

8/11/2011 2832 228

12.42 10719.94 to

11143.31 11269.02

6/28/2011 2457 605

4.06

12043.56 to 12188.69

12261.42

3/17/2011 2232 819

2.72

11613.3 to

11744.59 11858.52

12/1/2010 2403 676

3.55

11006.02 to 11255.78

11362.41

9/1/2010 2668 431

6.19

10014.72 to 10269.47 10320.1

7/7/2010

2689 447 6.02

9743.62 to 10018.28

10138.99

6/10/2010 2731 405

6.74

9899.25 to 10172.53

10211.07

11/5/2009 2495 537

4.64

9802.14 to 10005.96

10023.42

7/13/2009 2565 498

5.15

8146.52 to 8331.68

8359.49

3/10/2009 2936 225

13.05

6547.05 to 6926.49 6930.40 |

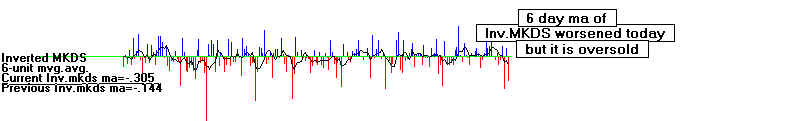

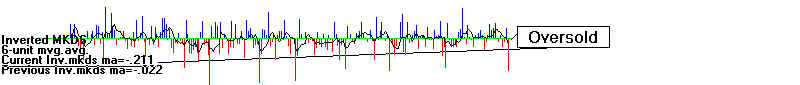

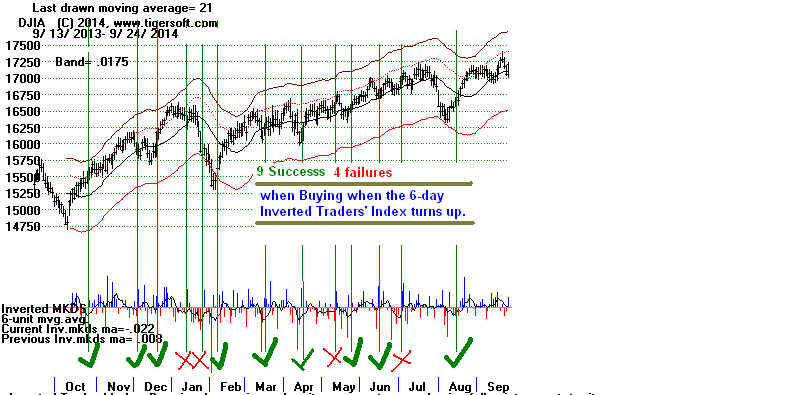

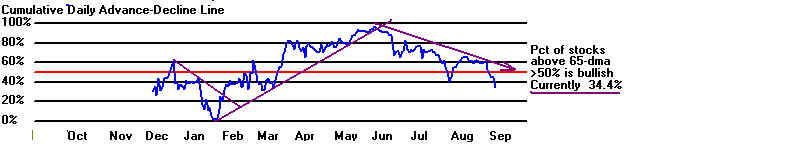

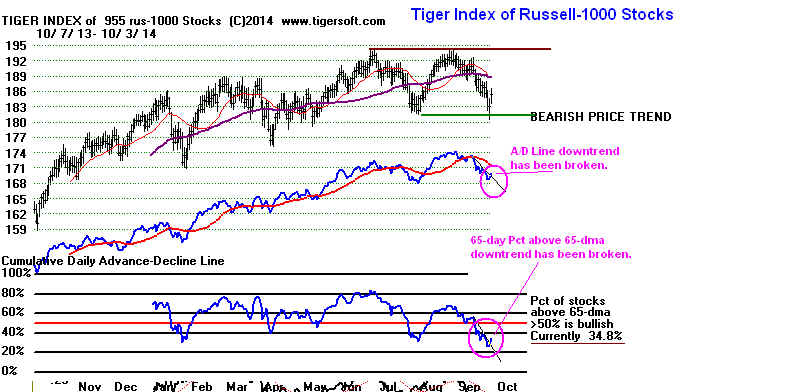

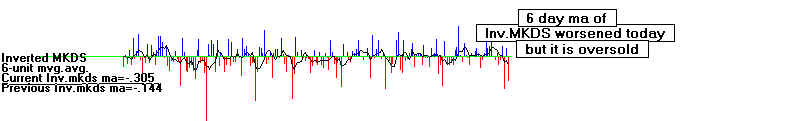

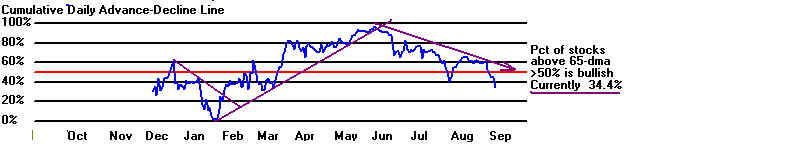

Watch The Breadth Indicators

for the Broader Market.

There is no new Peerless Buy signal, despite the big jumps in

in the DJI from its uptrend, in the SP-500

or SPY from their rising 30-week

(149-day ma)) or the Russell-2000 from its well-tested

support.

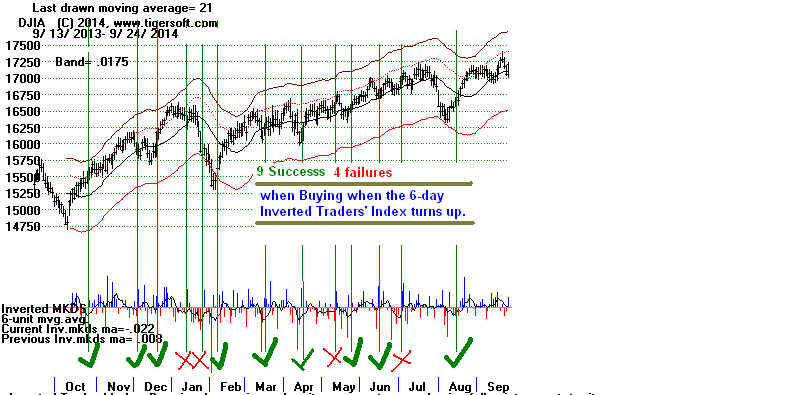

A good trading bounce does, however, occur 75% of the time

since 2009 when the 6-day ma of the Tiger Inverted Traders Index

reaches a deeply oversold condition, such as occurred on Thursday

night.

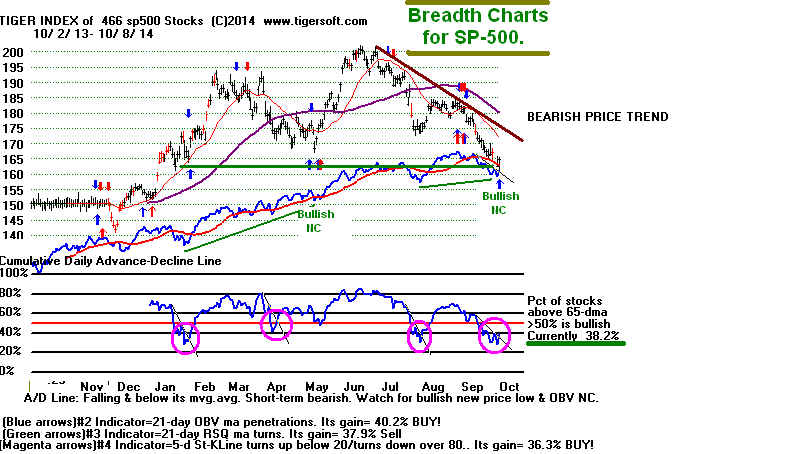

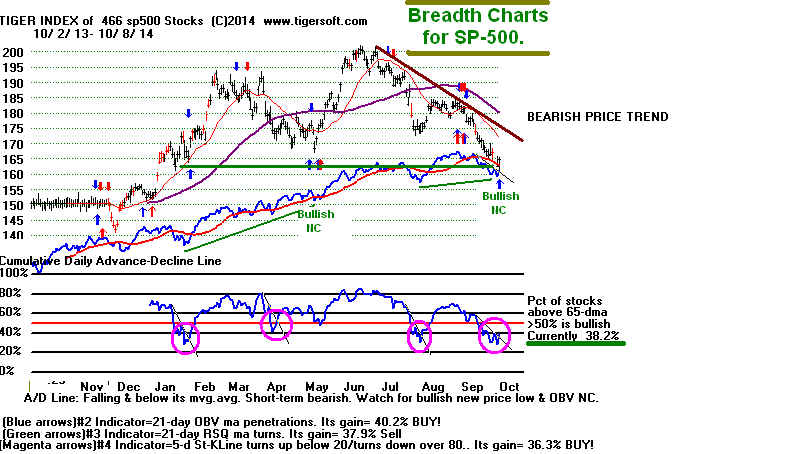

The problem now for the bulls is that the recovery must extend to

stocks other than blue chips and defensive stocks. One way we may

watch to see if the recovery broadens is to watch IWM. See below

how the key breadth downtrends for the Russell-1000 have been

slightly broken. These are its A/D Line and the Pct above 65-dma.

The same thing is true for the SP-500 stocks. See this in the second

chart below.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->31 +10 MAXCP stocks Bullish MAXCP Stocks (11/3/2014)

--> 256 -95 MINCP stocks Bearish MINCP Stocks (11/3/2014) Bearish

plurality

--> 20 +4 New Highs on NASDAQ

34 -33 new lows. Bearish plurality

--> 24 +19

New Highs on NYSE 52-28 new lows.

Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

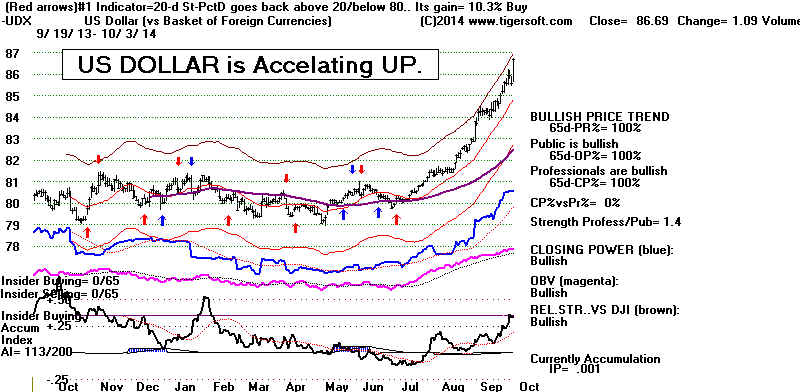

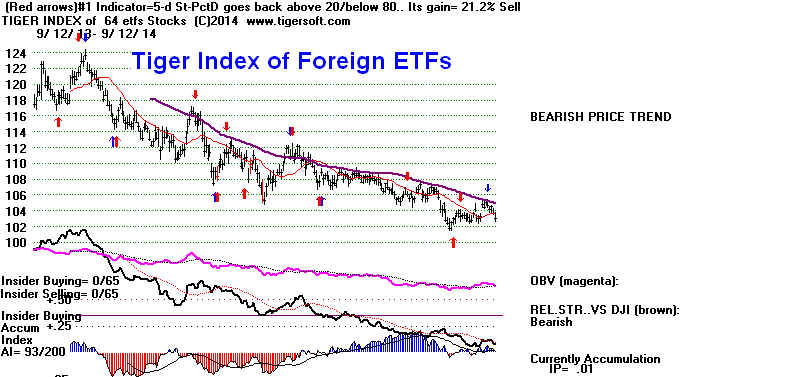

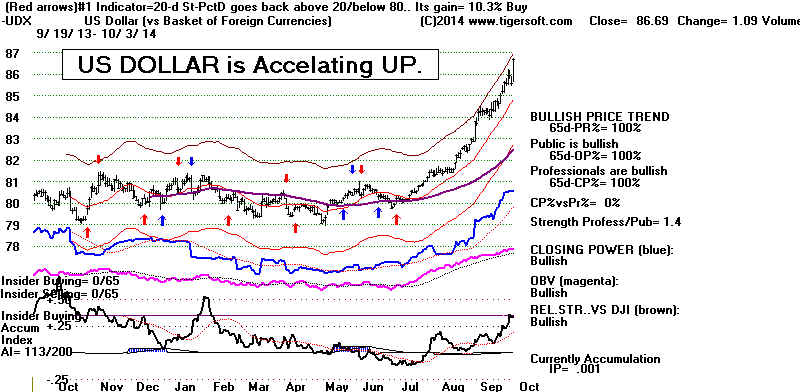

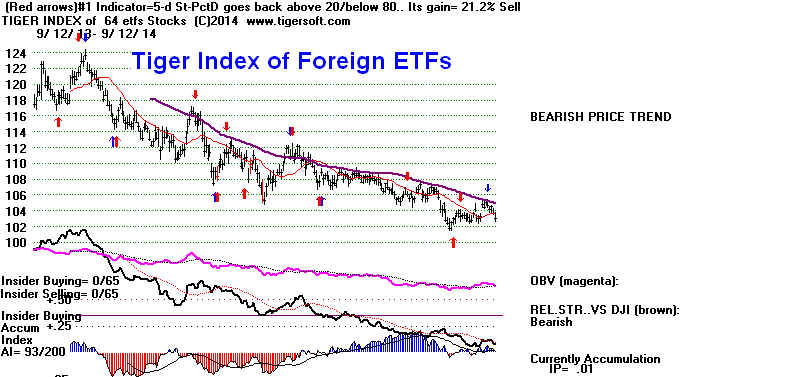

The Strong Dollar Plays Favorites

The Big Banks love the stronger Dollar. JPM and GS reflect that

in the DJI-30. The Dollar's advance buttresses New York's

position as the center of international finance. It brings in the money

of the very Rich from overseas to make investments that are Dollar

denominated. Banks, blue chips and bonds are biggest beneficiaries.

Meanwhile, foreign ETFs are likely to drop even further.

But the DJI's strength will not lift all stocks, especially

those

being hurt by the advance of the Dollar, most notably the

weakest MINCP stocks, especially those in Natural

Resources,

Foods, Gold, Silver and Coal. Oil as a commodity looks better internally,

but the great strength in the Dollar will likely continue to suppress

oil and gas stocks, too. This will help Transportation stocks just

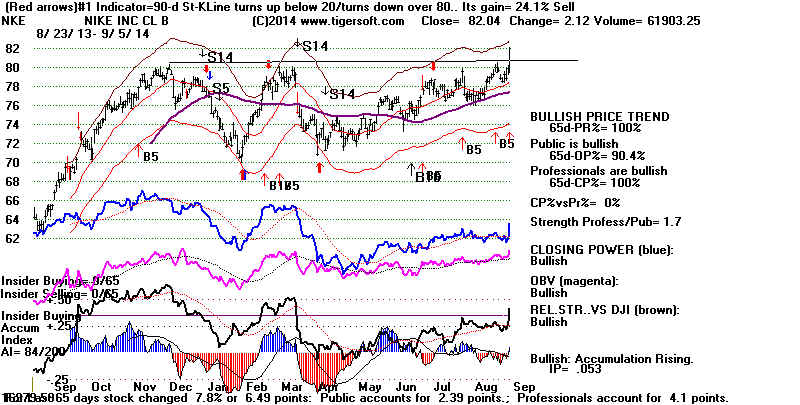

as the Rising Dollar helps importers, like WMT, HD and NKE

in the DJI and may hurt CAT and BA,

as manufacturing exporters.

Many of our Bearish MINCP short sales continued to plunge

despite Friday's recovery. As long as their Closing Powers

are falling, we will stay short them.

More DJI stocks benefit than are hurt by the stronger Dollar,

as long as Deflation, Over-Production and Under-Consumption

don't bring a Depression, as in the 1920s. Traders will want to

buy the DJI stocks mentioned above when their Closing Powers

break downtrend-lines.

------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------------------------------

10/2/2014

The new Peerless Sell S17 and the half-sized right

shoulder H/S pattern

argue that there will be more new lows, and no reliable bottom probably

until the DJI reaches the lower band or quite possibly not until another

month has passed. The percentage of all stocks below their 65-dma did

improve today, but this statistic is in a downtrend for all the larger

groups of stock, other than DJI-30 and Bonds. See today's

65-day ma Percent Data.

Foreign ETFs remain very weak. This

suggests a world-wide economic slow-down, which helps make Deflation

a much bigger risk than Inflation.

Today Japan announced that they would start supporting the Yen.

This

hurt Japanese car exporting firms' stocks. It also finally stopped the

Dollar's rally. This may put a new dynamic in the

market. So, too would some

new liberal assurances by the Fed tomorrow after the the Jobs Report

is released. But right now, all the trendslines point downward.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->21 +5 MAXCP stocks Bullish MAXCP Stocks (11/2/2014)

--> 351 MINCP stocks Bearish MINCP Stocks (11/2/2014) Bearish

plurality

--> 16 +9 New Highs on NASDAQ

67 new lows. Bearish plurality

--> 5 New Highs on NYSE 80 new lows.

Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

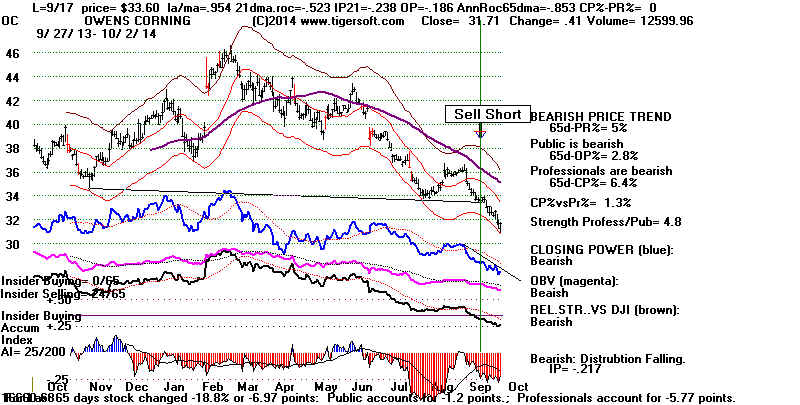

When Peerless Shifts To A Sell,

Sell Short the weakest ETFand/or a handful of the

most Bearish MINCP stocks.

Then sit back and relax and wait for the Closing Power downtrends

to be broken, even when the stock you have shorted has fallen 30%

or more in a few weeks or days.

By watching the Closing Powers and heeding their trend changes we should

be able to stay in tune with the best trends the market gives us to trade. With a

Peerless Sell signal, we want to switch to shorting the weakest major market

ETF where its Closing Power is already in a downtrend or else where

a Closing Power trend has just been broken.

Then we wait. We simply let Professionals tell us when to cover. When they

switch

and become significant buyers, the Closing Power downtrend will be broken.

This is when we should cover. Sometimes, it's a little late or early. But

seeking perfection will only lead to frustration and losses in the market.

The breaks in the ETFs' Closing Power will also tell us about the state

of the general market and which direction it will probably take.

In our case now, we want to be looking at the charts of, IWM or TNA

(the 3x leveraged IWM). They have a three or four times tested flat support

that now has been reached. A rally back upwards would become very likely

if the Closing Powers break their uptrends. At that point, it is not safe to

stay short.

Weak Stocks Go Down A Lot Faster and Further

Than The Weakest ETFs

The same Closing Power rules apply to the Bearish MINCP stocks we pick

to hedge. Our 2x-3x/week Tiger Stocks' Hotline will be watching the

Closing Power downtrends in the stocks we shorted.

If the stock has fallen a long ways down, we should work with steep Closing

Power downtrends.

Below are the charts for the biggest gaining short sales for the past few weeks.

They represent about half the stocks chosen to sell short. Many of these gains

were excellent. I present them to try to convince some of you to consider

selling short our Bearish MINCP stocks, especially when they look as ugly

as these did when we shorted them. As you can see our timing was, by no

means perfect. But they kept falling. This is because both Professionals and

Insiders were heavy sellers. This is the beauty of the nightly "Bearish

MINCP"

stocks. It makes shifting to an increasingly net short position is very easy

when hedging. I think it would be a strategic mistake not to take

advantage

of this simple and effective Tiger shorting strategy.

Recent Stock Hotline Short Sales

====================================================================================

OLDER HOTLINES

====================================================================================

10/1/2014

Lower Prices Are Expected.

The DJI's completed head and

shoulders pattern adds to the bearishness and predicts that

a bottom may be 5 to 8 weeks away.

Today the DJI fell through the neckline in a head and shoulder pattern.

This H/S pattern features a half-sized right shoulder. Its right shoulder

is less than half the duration of its left shoulder. This suggests the market

was too weak to even complete a symmetrical head/shoulders pattern.

The history of such patterns is distinctly bearish. Bottoms are not made

for 3 to 8 weeks. Such patterns in September are particularly bearish.

in 6 of the 9 cases, the DJI fall more than 8%. This new information

adds to my own bearishness. It calls for more short selling and holding

fewer long positions. Our Bearish MINCP stock

shorts all are in various

stages of panic now. Institutions and insiders are dumping them across

the board. Look for multiple Tiger Sell S14s now.

Keep in mind that our theory is that head and shoulders patterns

reflect

some new bearish information has surprised Wall Street and stock

prices must quickly make downward adjustments.

DJI Head/Shoulders with "Half-Sized" Right Shoulders

9/19/1930 229 to 174 in 6 weeks.

-24.1%

7/21/1944 146.8 to 142.9 in

7 weeks. -2.7%

6/26/1950 213.9 to 187.5 in

3 weeks. -12.3%

5/18/1951 250.1 to 242.6 in

6 weeks. -3.0%

5/21/1965 922 to 840 in 5

weeks. -8.9%

9/22/1971

894.55 to 797.97 in 8 weeks. -10.8%

9/1/1987

2610.97 to 1738.74 in 7 weeks. -33.4%

8/3/1990 2809.65 to 2365.10

in 8 weeks. -15.8%

5/18/2006 11128.29 to

10706.14 in 4 weeks 3.8%

Less than 25% of all stocks are above their 65-dma; the key ETFs'

Closing Powers made minor news and are downtrending; the NYSE

A/D Line is falling and we are operating under the new Peerless Sell S17,

which in all 4 of its previous cases brought a DJI decline down to the

3% lower band. The DJI made a 30-day low. Because the duration of

the right shoulder above 16900 was only 4 or 5 days, the pattern is

far from being a perfect head/shoulders pattern.

The percentage of Russell-1000 stocks below their 65-dma is now

26.1%. This is the lowest percentage this year.

Without a new Peerless Buy signal, a break in the A/D Line

downtrend or the Closing Power downtrends, Id suggest waiting

and seeing if there will be more weakness. The ETF for the

Russell-2000 has now fallen to a support level that has held on

four previous tests over the last 12 months. We should watch

this Index to see if the small caps as well as the Foreign ETFs

lead the market, including the DJI, SP-500 and NASDAQ still

lower.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->16 -27 MAXCP stocks Bullish MAXCP Stocks (too few)

--> 494 MINCP stocks Bearish MINCP Stocks (11/1/2014) Bearish

plurality

--> 7 -16 New Highs on NASDAQ

171 new lows. Bearish plurality

--> 5 -12 New Highs on NYSE 184 new lows.

Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------------------------------

10/1/2014 70% of all stocks are below their 65-dma. I believe we have

weakening market conditions that seem consistent with

the Sell S17 , the declining A/D Line and the still falling Pcts. of

Stocks above their 65-dma. Time Warner Cable's internet

service was out from 5PM to 3:AM. They should have problem

fixed soon.

-------------------------------------------------------------------------------------------------------------------------------------------------------

9/29/2014

The new Peerless Sell S17

still warns us that the 65-dma support may

still breakdown for the DJI. But today's reversal was impressive. So, a

retest of 17150-17200 seems likely. The Closing Powers are still caught

in extended trading ranges. There still are more than 70% of all stocks below

their 65-dma. Down volume was proportionately still higher than up volume.

The NYSE A/D Line is still in a downtrend. And if the DJI does stall out

at the upper 1.75% upper band, it would look more and more like a bearish

head/shoulders pattern.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->43 +30 MAXCP stocks Bullish MAXCP Stocks (9/29/2014)

--> 117 -120 MINCP stocks Bearish MINCP Stocks (9/29/2014) Bearish

plurality

--> 23 -3 New Highs on NASDAQ

58 +9 new lows.

Bearish plurality

--> 17 -1 New Highs on NYSE 88 +43 new lows. Bearish

plurality

-----------------------------------------------------------------------------------------------------------------------------------

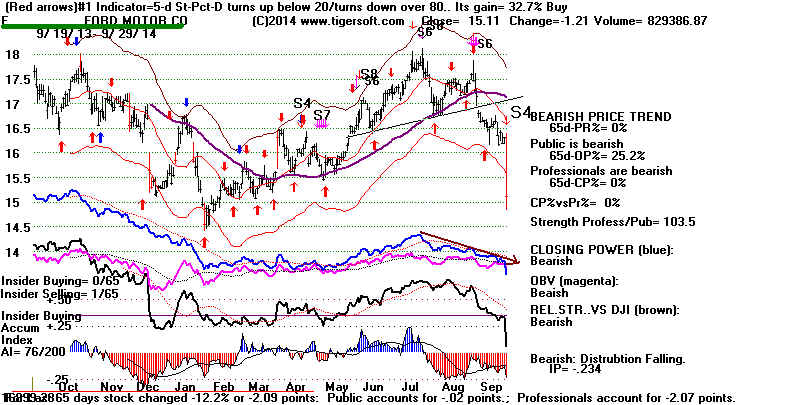

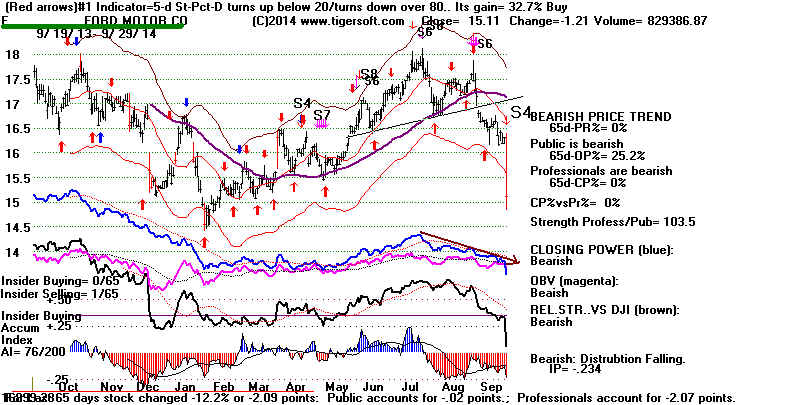

Schizophenia Is Not Usually A Constructive Condition.

This remains a market of multiple personalities. A

handful of breakouts get the

bulls' full attention and money, just as bears remain happy driving the weakest

MINCP stocks still lower. Adding to the schizoid

aspect of the market

is how the rising dollar helps and hurts different stocks. US manufacturers

like Ford are getting hit hard, but retailers like Nike love how much cheaper their

imports are. I fault both the President and the Congress for neglecting

what's left of American manufacturing. Since neither the Dems nor the Republicans

take up trade issues, nothing is present now to prevent the divide between

US manufactures and US importers from getting still bigger.

|

|

I also don't see any reason why the market's internal chasms will dimminish anymore

than will the Grand Canyon sized class chasms that reduce consumer buying

power but have sent many stocks soaring. Meanwhile, the DJI is the

third personality here. Its narrow price range might mislead a casual onlooker

into thinking that all is calm and quiet in the US or in the world of international

finance,

but the collapse of Foreign ETFs is a warning. In 1929, the DJI was the

last to peak.

The DJI is stuck in an unusually narrow trading range between 16880 and 17300.

Watching the Hourly DJI bounce around reminds me of a

ping-pong game between equally

matched players. This can be entertaining and profitable, however. See below

how

our Net Idosc program run against the 30-DJI stocks can make this narrow trading

much more interesting.

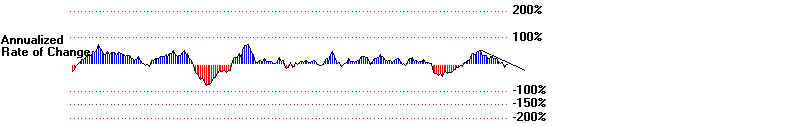

Daily Net Idosc on DJI-30

The Tiger Net Idosc (NID) oscillator here has a maximum oversold reading of -30

and overbought reading of +30 when applied to the DJI-30. New highs with

negative Net Idosc readings are bearish. New lows with a positive Net Idosc

are bullish. Watch also how changes of day-to-day direction usually lead price

movements, upwards if NID is positive and downwards if NID is negative.

This indicator works best when the market trades relatively narrowly. I will start

posting it with the other graphs each night.

===================================================================================

OLDER HOTLINES

===================================================================================

9/26/2014

The new Peerless Sell S17

still warns us that Friday's 168 point rally does not prove

that the 65-dma will hold. In fact, the DJI may even

be forming a reversing

and bearish head/shoulders pattern. The 2007 Peerless gave a Sell, too,

based on the A/D Line NC. Right now the NYSE A/D Line

is still

downtrending. None of the Closing Power trends of the key major market

ETFs line is rising. (See SPY, DIA,

QQQ and IWM.) The 6-day Inverted Traders'

Index did turn up, but not visibly.

The broad market is still much weaker than the DJI or the SP-500.

Our data still show that less than 30% of

all the A-Z stocks are above their 65-dma.

And, very important, the A/D Lines for these A-Z directories are all still falling.

See the 14-C stocks' A/D Line further below. The downtrends of the Percent of stocks

above the 65-dma are still intact for all the A-Z directories. Their numbers

are still low, so we have no assurance that a bottom has been made. This

data also shows that Friday's recovery did not generally bring improvements

above levels of a week ago.

Compare the current Over 65-day Percent Line with those earlier this year and

those in 2009, 2010, 2011, 2012 and 2013 for the sampled C-stocks. This letter's

stocks are believed to be representaive, not special. It was simply chosen

because it has more than 400 stocks in it and so is a large sample.

Can The Rally Continue?

Volume was lower on Friday's turn-around than on the day before. But

Nike's good earnings go to show that there's still plenty of life left in blue

chips reporting good earnings. As long as earnings are rising, bull markets

like this tend to keep rising. See a new study I

found on earnings and market tops.

See how earnings peaked before the 1990, 2000 and 2007 tops. Earnings

are still rising now.

It does seem that the Republicans may win big in the mid-term elections. This would

almost certainly bring a celebration on Wall Street. In turn, this could give

bull market a chance to make a strong start in the normally bullish third

year in the 4-year Presidential cycle.

But right now, the NYSE A/D Line is still downtrending. It's risky to fight

a Peerless Sell signal when the Closing Powers and the A/D Line are falling.

Our stocks' Hotline remains hedged. Let's be patient here.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->13

MAXCP stocks Bullish

MAXCP Stocks (9/26/2014)

--> 239 +22

MINCP stocks Bearish MINCP Stocks (9/26/2014) Bearish

plurality

--> 26 +12 New Highs on NASDAQ

49 -9 new lows. Bearish plurality

--> 18 +2 New Highs on NYSE 45 -14 new lows.

Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------------------------------------

9/25/2014

The new Sell S17 seems to be working.

The DJI has now

reached its rising 65-dma. If this mvg.avg. were likely to

bring a good rally, Peerless would have issued a Buy B11.

A bounce from the oversold condition is likely, but it may

only produce a right shoulder in a DJI head and shoulders'

pattern. Note that the SP-500 did break its 65-dma and

SPY's Closing Power has decisively broken its uptrend

and so its CP is considered in a bearish downtrend. Less

than 40% of the SP-500 stocks are

above their 65-dma

Selling

on Rosh Hashanah and Buying on Yom Kippur is

generally a very good strategy when the high holidays begin

between September 20th and September 26th.

DJI

1971 -2.7%

1976 -3.1%

1979 -2.3%

1987 + 2.1

1990 -4.1%

1995 -0.5%

1998 -0.7%

2006 +1.4%

The Broader Market Worsened

Compared to Two Days Ago.

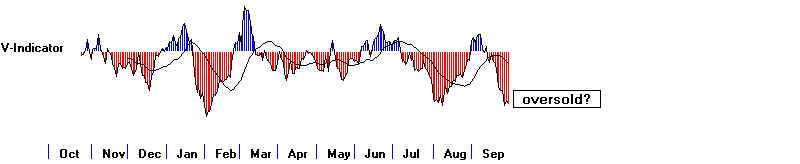

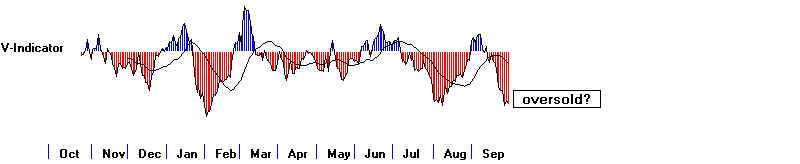

We have reached over-sold territory according to our 6-day

inverted traders Index but all the key internal strength indicators

for the DJI are still declining. What is worse? Only 27%

of all the stocks that we follow

are above their 65-dma. The DJI

will have a hard time holding up when almost all the sectors we

follow now have a majority of stocks below their 65-dma.

There are some remaining pockets of strength. If they cave in,

only very quick action by the Fed can hold up the market.

Our Hotline will suggest doing more selling and shorting tonight.

Our existing short sales should just be held.

Note the Falling Internal Strength Indicators.

The Institutional Dumping

Has Started To Include The Blue Chips.

I warned that there were mounting signs of instutional dumping

as well as professional shorting. Institutions and traders did not

even give Wednesday's 0.9% rally any chance to continue higher.

They started unloading shares right from today's beginning.

Why are they in such a hurry to get out of the market?

What do they know that has not yet become public knowledge?

Has the Fed leaked to the big bankers and their friends that

it plans to wait and watch more numbers come in before providing

any more stimulus?

With the bull market now 5 years and 6 months old, a lot of folks

simply do not want to take a chance, especially since 74.8% of all the stocks

we track are now below their 65-dma. Personally, I fear Deflation and a Fed

that has no more ammunition to fight off a severe recession

a lot more than I fear the Russians or even ISIS.

If the DJI rallies with little company except the "BigFidel", the Big Bios

and some big soda pop companies, it will only be postponing a much

bigger decline.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->10 -14 MAXCP stocks Bullish MAXCP Stocks (9/25/2014)

This is a a market environment in which professionals remain very nervous.

--> 351 +134

MINCP stocks Bearish MINCP Stocks (9/25/2014) Bearish

plurality

--> 10 -4 New Highs on NASDAQ

91 +33 new lows. Bearish plurality

--> 7 -9 New Highs on NYSE 125 +66 new lows. Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

Two-Day Dow Reversal Down.

Back in the Summer of 2008, I back-tested worse two day reversals'

statistics than we just saw and came up with the Sell S13. This turned

out to be a signal that would appear in super bear markets, 1929-1932

or in the very steep declines of 1987 and 2008-9.

What happens after a two-day reversal like we have just seen

where the statistics are not so extreme and are similar to what we

have just seen. I searched for all the cases where the DJI rose .9%

on the first day and fell more than 1.5% on the second day. In addition,

the first day had to have a breadth (NYSE advances/declines) ratio of

1.45 or moreand the second day had to have a breadth ratio of .25 or

lower. As the DJI closed today .9% below the 21-day ma, I also

screened out all cases where the LA/MA was below .974 or above 1.1.

The study came up with 12 cases where the market had had such a

two-day reversal. In 8 cases a short seller would have made money

selling short but in 4 instances he would have lost. In Septembers,

bear market declines followed the type of two day reversal we

have just seen. The IP21 (current Accummulation Index) now

stands at a moderately negative -.035. There were 5 two-day

reversals with the IP21 between -.001 and -.05. In 3 instandes

the trader would have made money selling short and in two

cases, he would have lost money.

Date

LA/MA IP21 Result

9/25/2014 .991

-.035

(Good = tradeable decline, Bad = market rallied significantly.)

-----------------------------------------------------------

5/13/1929 .999 -.099 316.5 to 293.4 good

11/27/1933 1.005 -.025 95.8 to 103.39

bad

3/12/1936 .995 -.037

153.1 to 150.4 and then up bad

11/6/1944 .997 +.042 168.9 to 163.6 LB good

11/6/1980 .988 -.278 935.41 to 932.42 to 1000 bad

11/1/2007 .978 +.021 13567.87 to 12743.44 good

9/9/2008 .977 -.049 11230.73 to 8451.19 good

9/22/2008 .974 +.061 11015.69 to 8451.19 good

10/30/2009 .984 +.045 9712.73 rose immediately bad

(rose on successful testing of 65-dma)

5/4/2010 .988 +.045 10926.77 to 9816.49 good

6/1/2011 .979 -.033 12290.14 to 11897.27 good

9/28/2011 .981 -.002 11010.9 to 10655.3 good

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

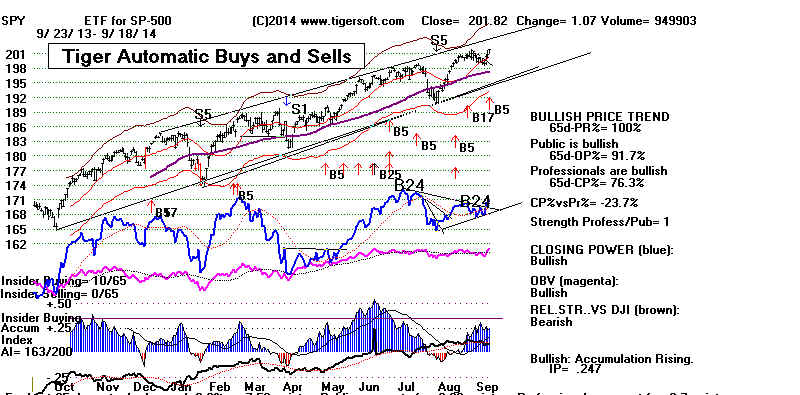

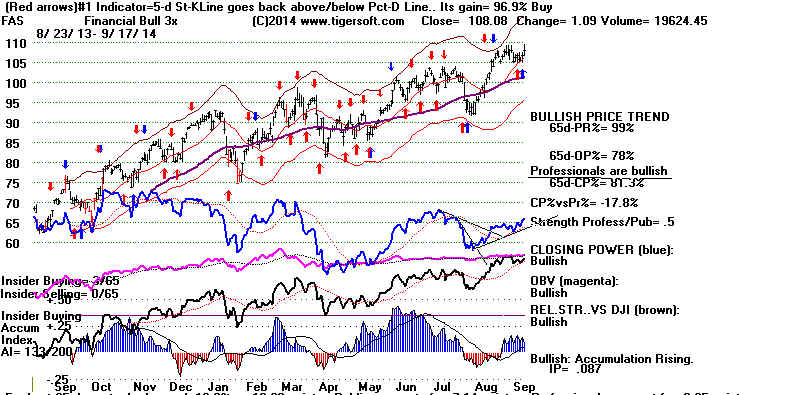

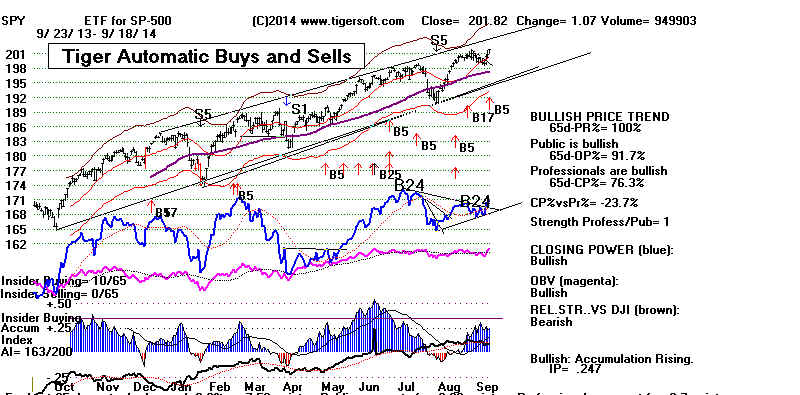

9/24/2014

A Tale of Two

Markets and Two Programs. Peerless predicts the DJI,

but can warn of the troubles we now see in the broader market. TigerSoft

can focus on finding the weakest stocks to short now, just as

it picked the strongest not too long ago.

Internals remain weak, despite the DJI rally. Keen resistance should

be expected at 17300-17350 unless breadth and volume improve

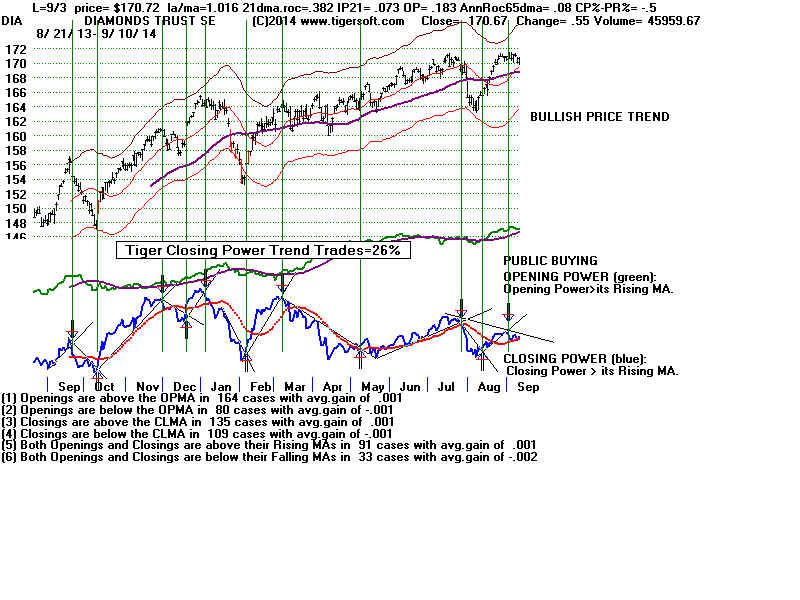

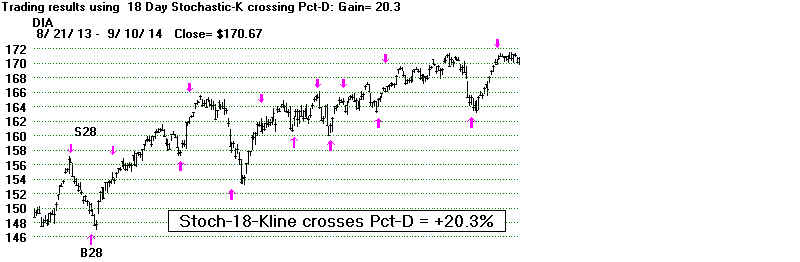

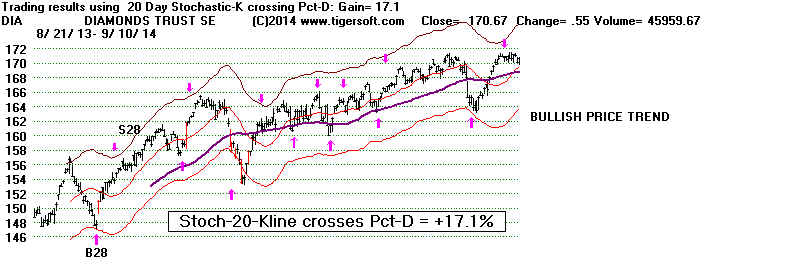

markedly. ETF traders may want to consider the operative Peerless

signal to be the new Sell S17, but with only 3 previous cases, I

would not be surprised if the leading ETFs rallies continue somewhat

higher. That is why I would watch the Closing Powers.

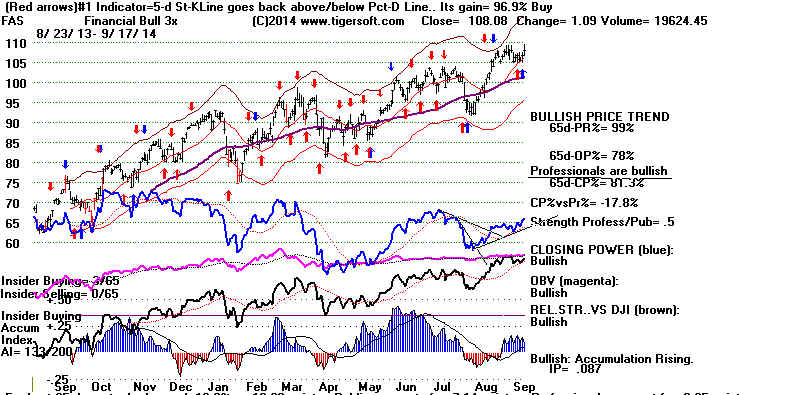

My general suggestion is for ETF traders to pick the strongest/weakest

ETF for longs/shorts with the highest volatility they are comfortable with and

use the Closing Power trends. The

gains with FAS and IBB for the last

year are about 50%!

Right now, only IBB has made a Closing Power

new high. IWM is still in a downtrend. The

Closing Powers for DIA, SPY

and FAS remain locked in narrowing triangles.

The Broader Market Remains Very Weak

The Bearish MINCP stocks far outnumber the Bullish MAXCP stocks.

Professionals did not rush to cover these heavily shorted

stocks. Less than 35% of

all stocks are above their 65-dma. More

and more stocks are being "dumped" by institutions. We can

define dumping as having a series of Tiger Sell S14s. This signifies

a big jump in down-day volume. More and more stocks show

steady red distribution, as defined by an AI/200 score below 70.

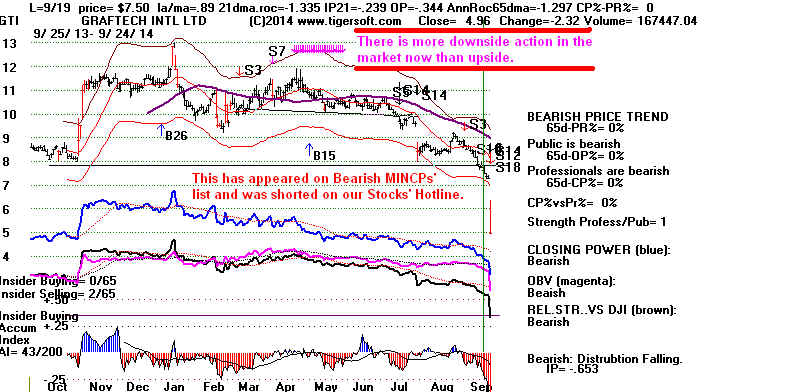

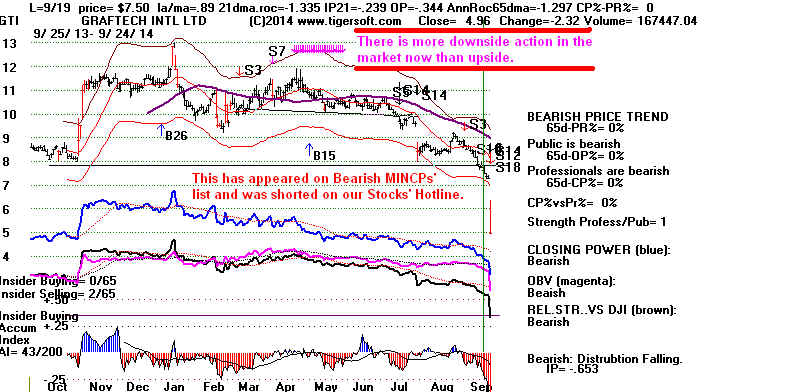

More and more lesser known stocks look GTI below. Here's

how we found this stock to short a few days

ago.

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->24 +12 MAXCP stocks Bullish MAXCP Stocks (9/24/2014)

This is a a market environment in which professionals remain very nervous.

--> 217 -125

MINCP stocks Bearish MINCP Stocks (9/24/2014) Bearish

plurality

--> 14 +2 New Highs on NASDAQ

58 new lows. Bearish plurality

--> 16 +7 New Highs on NYSE 59 -58 new lows. Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

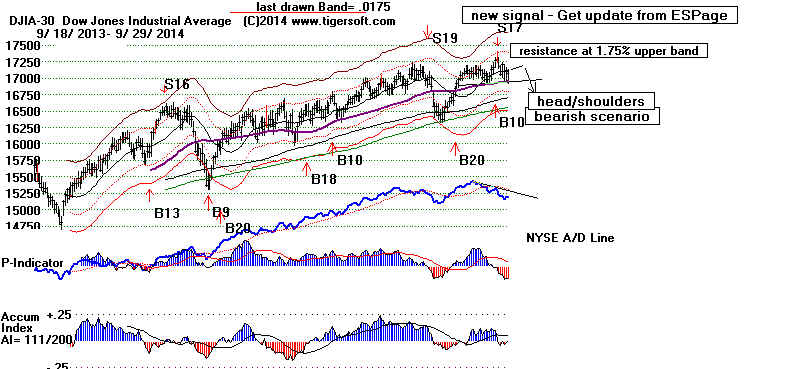

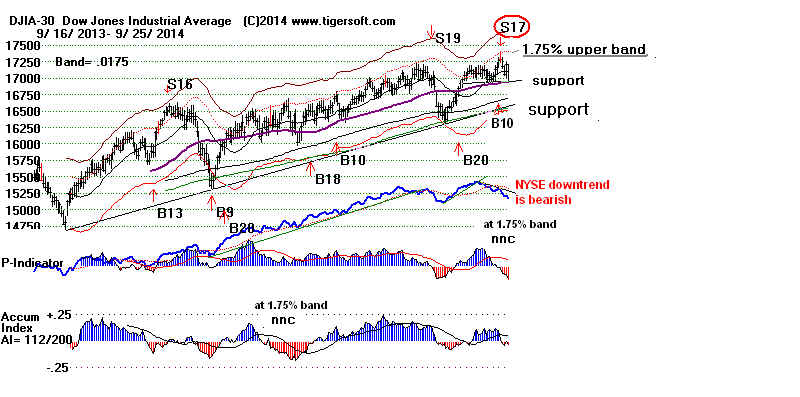

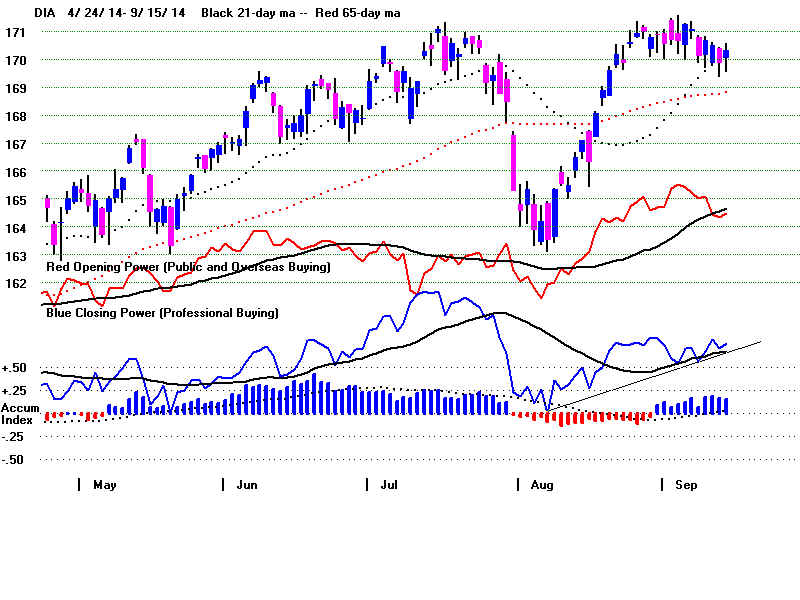

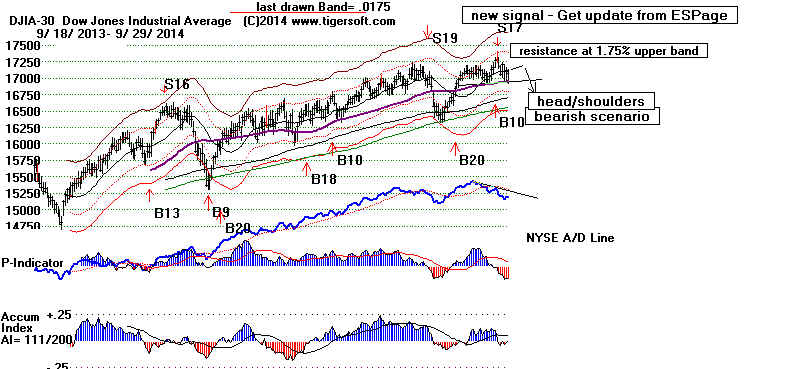

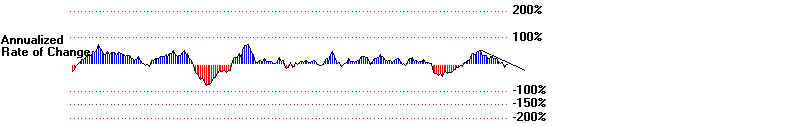

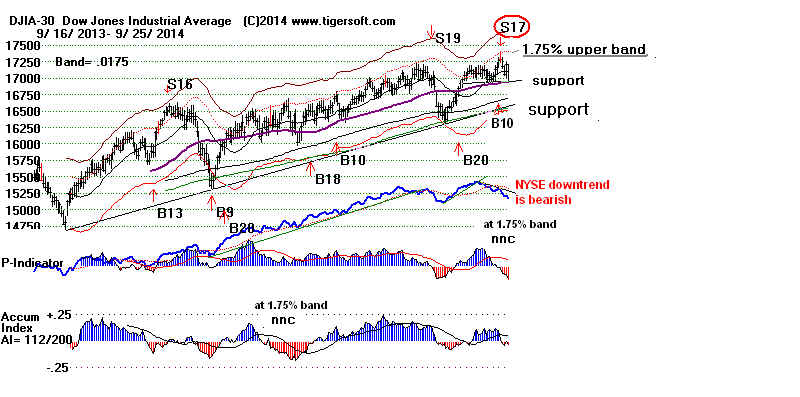

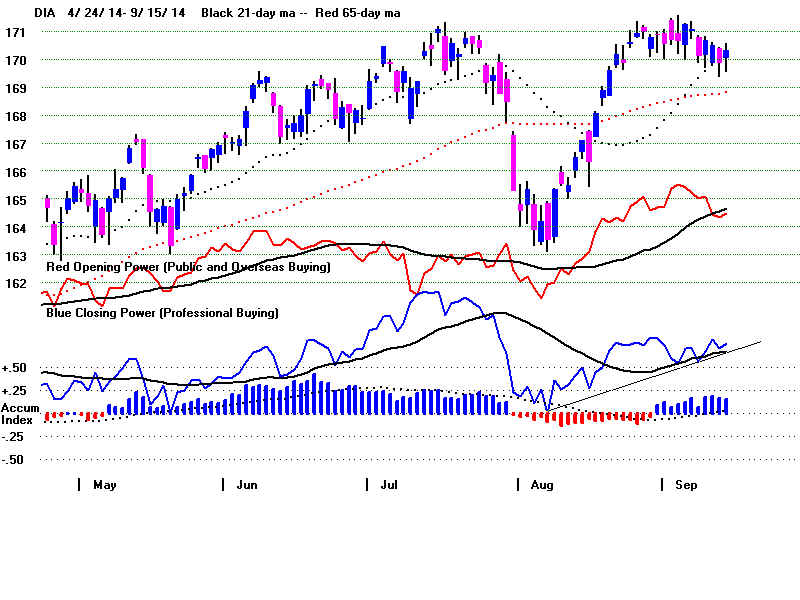

DJI's Technicals

Today's relief rally has take the DJI up to within 101 points of its

previous hourly DJI high. Expect resistance to become significant

at the DJI's 1.75% band. We've seen the DJI's upside volatility

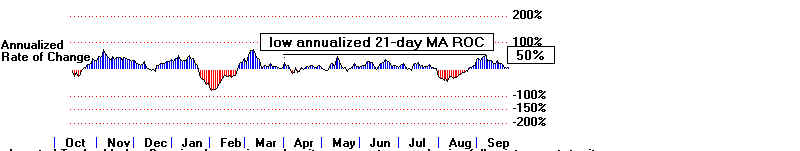

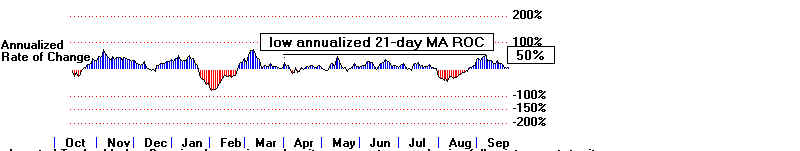

narrow in the last year or two. When the 21-day ma ROC (annualized

rate of change has been below 52%, there is a strong likelihood that

computerized programmed Sell programs will kick in and stop the

DJI's rally when its hypothetical reaches 1.75%. See the chart

below.

The narrowing upside volatility away from the 21-day ma

prevents Peerless from giving its usual good sell signals

at the 2.2%-3.5% upper bands when the P-I, IP21 or V-I

are negative or nearly so.

This is an important reason why trading ETFs with the

Peerless Sell signals has become much less profitable

than in the past. We can remedy this by:

(1) carefully choosing the best ETFs for the trend we expect,

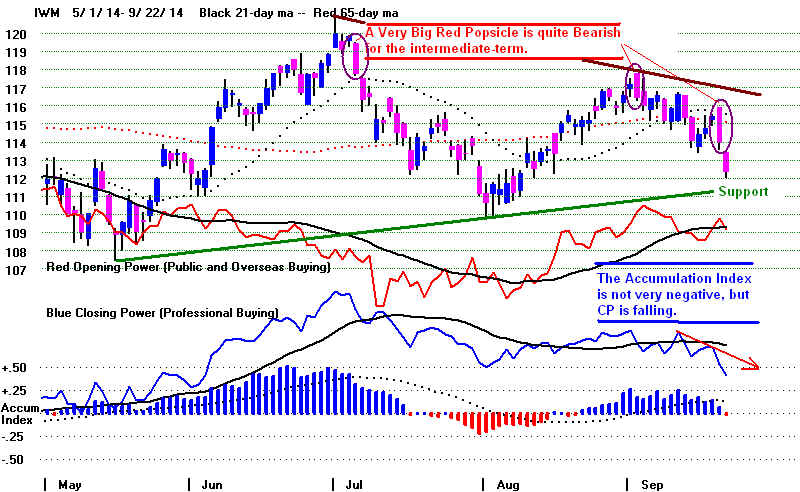

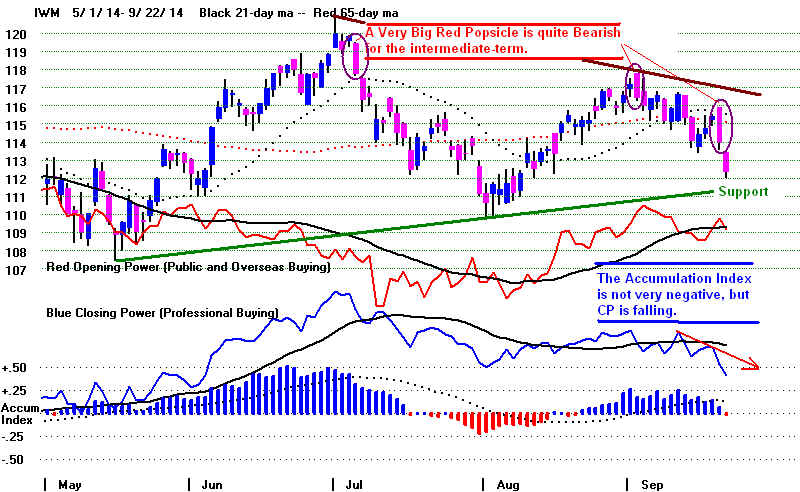

(2) using Closing Power trend changes,

(3) watching for big "red popsicles" on the ETFs' Tiger candle-stick charts,

(4) using bands about half the width we would ordinarily use and

(5) watching the 6-day Tiger Inverted Traders' Index for turns upward

when it is below 0 for good short-term buys on tests of support,

the 21-day ma and the normal lower bands.

See a new study today:

Trading ETFs with Peerless and Tiger

in The Current Market Environment.

On sell-offs, watch the Peerless 6-day Traders' Index (MKDS)

for turns up at the 21-day ma and at other support

levels from a negative (oversold) condition. Interestingly,

today's rally did not come with any improvement in the

inverted MKDS. Down volume did not decrease today

relative to the ratio of declines to advances on the NYSE.

====================================================================================

OLDER

HOTLINES

9/23/2014

After a brief relief rally, another 3% to

4% DJI decline is likely. It is not

clear that the DJI will be able to stay above its rising 65-dma at 16950, about

105 points lower. Secondary stocks continue to sell off. Stay hedged,

with some of the Bearish MINCPs and avoid holding long positions that

break their 65-dma after forming head/shoulders, or show accompanying

negative IP21s or negative Closing Power% - Price%. Be particularly

wary of breakdowns when the stock shows big red popsicles using

Tiger's candle-stick charts, ones that are larger than any blue bar

for a long time. (See yesterday's hotline for examples.)

-----------------------------------------------------------------------------------------------------------------------------------

> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Peerless DJI Chart SPY Chart NASDAQ Chart QQQ

Chart

IBB Chart

IWM Chart

Hourly DJI-OBV Hourly-MVM0735

FAS-3x Financials IBB-Biotechs

-----------------------------------------------------------------------------------------------------------------------------------

-->12 -6 MAXCP stocks Bullish MAXCP Stocks (9/23/2014) This is a a market environment

that professionals are very nervous in. Their buying is much curtailed despite the

weakness..

--> 342 +24

MINCP stocks Bearish MINCP Stocks (9/23/2014) Bearish

plurality

--> 12 New Highs on NASDAQ

92 new lows. Bearish plurality

--> 9 New Highs on NYSE 117 new lows. Bearish plurality

-----------------------------------------------------------------------------------------------------------------------------------

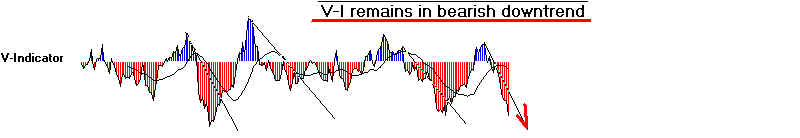

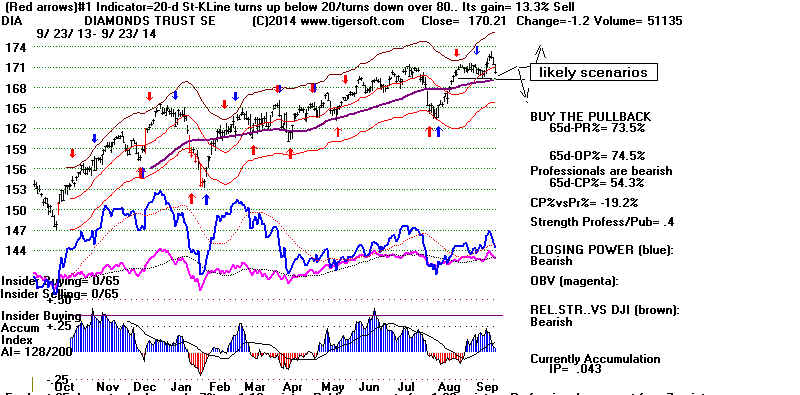

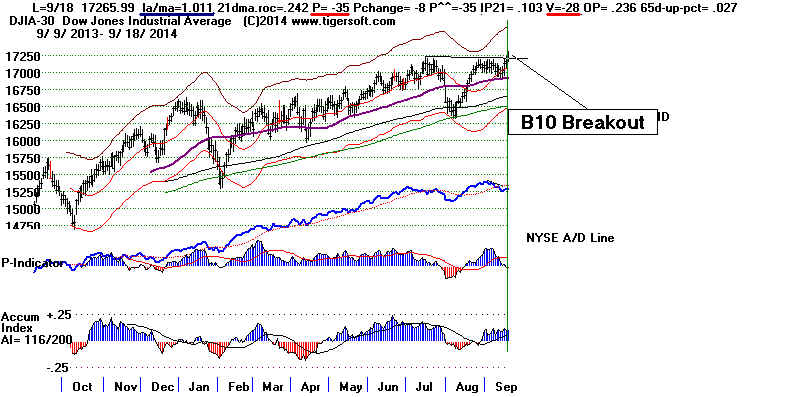

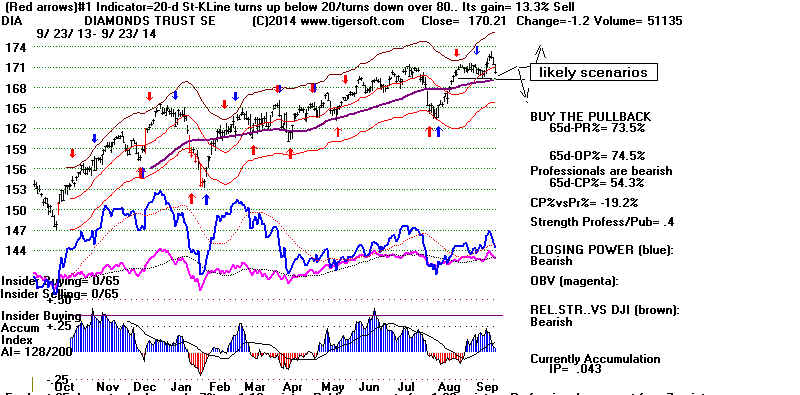

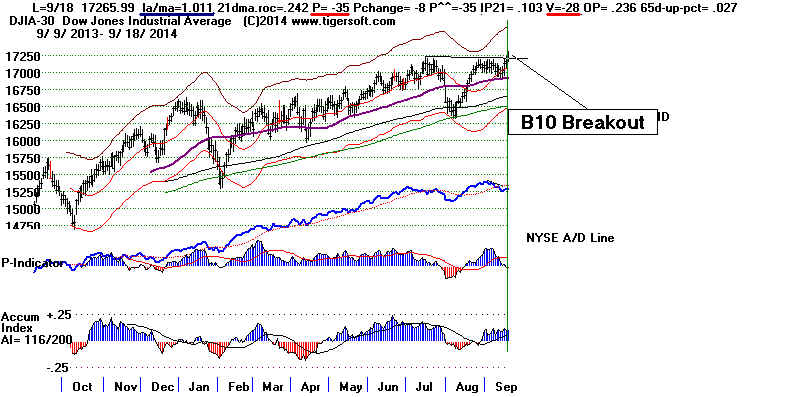

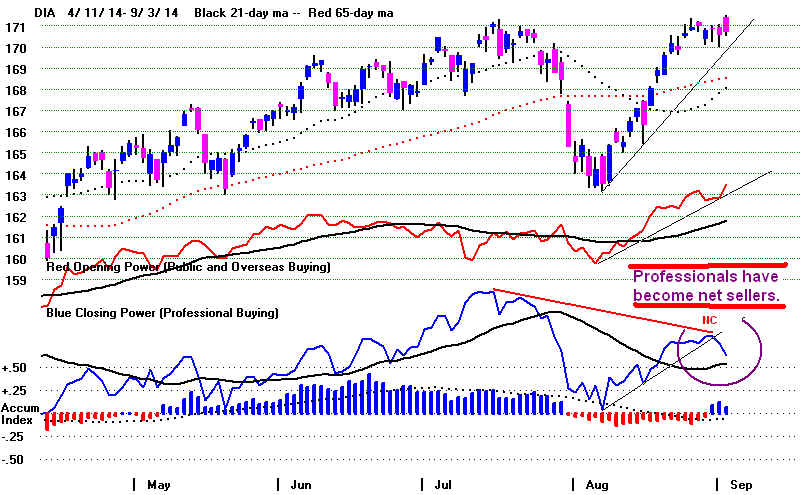

DIA's Closing Power's uptrend has been violated following a non-confirmation. We may

see the DIA rally up to a potential right shoulder in a new head/shoulders pattern.

IWM is much weaker. Its Closing Power has made new lows and must plumb,

I think, lower for support.

The DJI's Technicals

The DJI has failed the 17200 breakout. This does not come as much

of a surprise. There are no previous cases where a Buy B10 has occurred with

both the P-I and V-I negative on the breakout. Probably the Buy B10

should be changed to disallow such cases.

With or without a Buy B10. false breakouts above well-tested flat tops

are relatively rare. Usually there is a Peerless Sell signal before the decline.

I studied this

phenomenon a year ago Below are the false breakouts

above flat and well-tested resistance with Buy B10s.

False Breakouts

Warnings

Subsequent Action

--------------------------------------------------------------------------------------------------

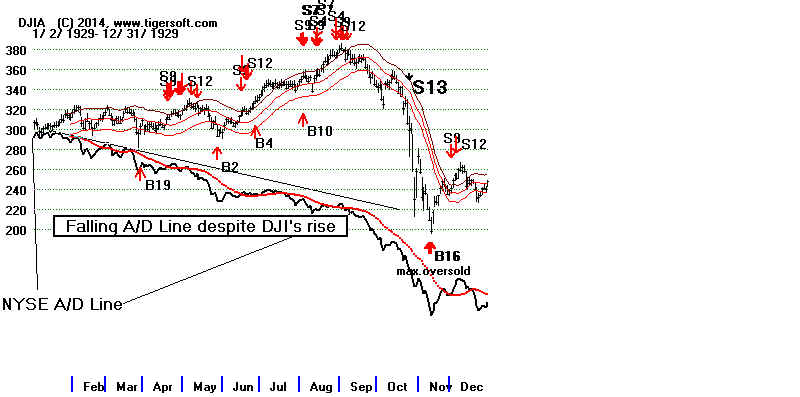

July 1929 S9, S12 A/D Line

NC, P<0, VI<0 10% decline

Nov 1940 earlier S4 very

high red volume Bear Market follows

---> Nov 1950

6% decline

Sept 1955 S7,

S8, S4, A/D Line NC, VI<0

10% decline

very high red volume warning

April 1965 S7, IP21<0, VI<0 on

breakout 11% decline

---> Dec 1986 A/D

Line NC, IP21<0, VI<0

3% decline

July 1998 S9, S12 A/D Line

19% decline

Dec 1999 S9, S12 A/D Line NC, P<0,

VI<0 17% decline

---> May 2014 DJI

did not close above rising resistance 2% decline

---> Sept 2014 P<0, AD

Line NC, V<0, IP21 only +.014 ?????

A New Peerless Sell S17

Based on A Sharp Drop in IP21 in September?

If we can say that Peerless gave no Sell signal a few days ago, then the

cases above strongly suggest that any decline now should not take the

DJI down more than 6%. But can we really say that? On the day after

the breakout, on Friday, the 19th, the DJI tagged its 1.9% band with

miserable internals. The P-I was a negative -69. The V-I was -54 and

the IP21 was only .014, having fallen sharply in one day from +.103. All this

took place on exceptionally high (red) volume, suggesting churning. Since the DJI

and the other indexes and key ETFs closed near their lows, this was also

a "dumping day" by professionals as well as a bearish "red

popsicle" day.

While it's true that the DJI did not quite rally high enough for Peerless to give a

Sell S9, S9V or S12, I noted that in all three previous September cases when the

DJI's IP21 fell so sharply (by .085 or more) from the previous day with the