Peerless version - 4/23/2014 (C) William Schmidt. Ph.D.

The B18 occurs when the P-Indicator has been positive

for 41 straight days. No Buy B18s are allowed in Junes,

Julys, Septembers or Novembers.

The lowest levels seen in the past for each of the key

values will give a good idea of the minimums allowed:

Lowest Highest

Recorded Recorded Observations

LA/MA .9785 1.0316

ANN-ROC -.048 1.046

P-I 14.8 577.1

P-I change -77.2 158.9

Adjusted P-I 30.6 880.4 High Adj. P-Is bring bigger gains.

IP21 -.034 .27 High IP21s bring bigger gains/vice verse

V-I 1 377 (est)

ObvPct -.068 .736 Low ObvPct produce smaller gains.

65-day Pct Change -.025 .217

The average gain for the 48 Buy B18s since 1928 was 12.1%.

There was but one losses, as the Buy B18 is designed.

The biggest average B18 gains came in the mid-term

election year (15.4% ) when a Republican was in the White House,

not a Democrat and well as in August (27.9%) and October ( 14.1%).

The year after the Presidential Election saw the lowest average gain (7.2%).

Paper losses were all under 5% with two exceptions, 1954 (4.6%) and

2002 (5.4%.). The average paper loss was 1.1% for all years.

Size of B18 Gains

-----------------------

No. Pct.of Total

=>.10 20 .417

=>.05 - <.10 8 .167

=>.02 - <.05 16 .333

=>0 - <.02 3 .063

<0 1 .021

--------------------------------------

Total 48 1.0 (100%)

It should be noted that Buy B18s have become less powerful over

they years. See how the average trading gains they produced has

fallen:

Buy B18s

Years No. Avg.Gain Avg.Paper Loss

1928-2013 48 .121 .011

1965-2013 29 .083 .011

1984-2013 21 .0895 .014

2000-2014 11 .053 .016

B18s: 1928-2013

Number of Trades = 48

Avg.Gain = .121

Avg.Paper Loss = .011

Avg.LAST/21DMA = 1.013

Avg.Ann.Roc. = .005

Avg.PI = 177.3

AVG.PI Change = 12.5

AVG.Adj.PI = 337.6

AVG.IP21 = .107

AVG.V-I = 54.7

AVG.OBV-Pct = .232

AVG.65-dPctCh. = .088

-------------------------

BUY B18s since 1928

BREAKDOWN of BUY B18 TRADES: 1929-2013 ===================================== No. Date of Buy Signal DJI Pct Paper

Gain Loss

=============================================================================

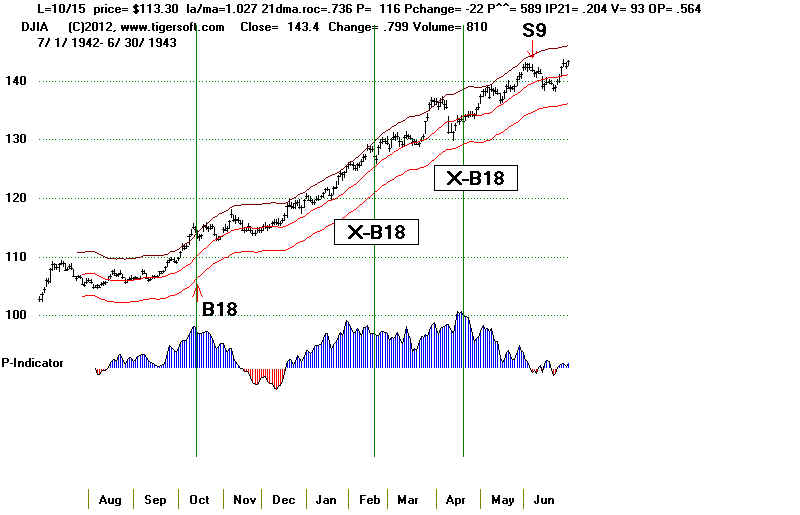

1 19420805 B18 105.6 .348 none

----------------------------------------------------------------------

2 19421015 B18 113.3 .257 .002

----------------------------------------------------------------------

3 19430219 B18 126.7 .124 none

----------------------------------------------------------------------

4 19430420 B18 128.5 .07 none

----------------------------------------------------------------------

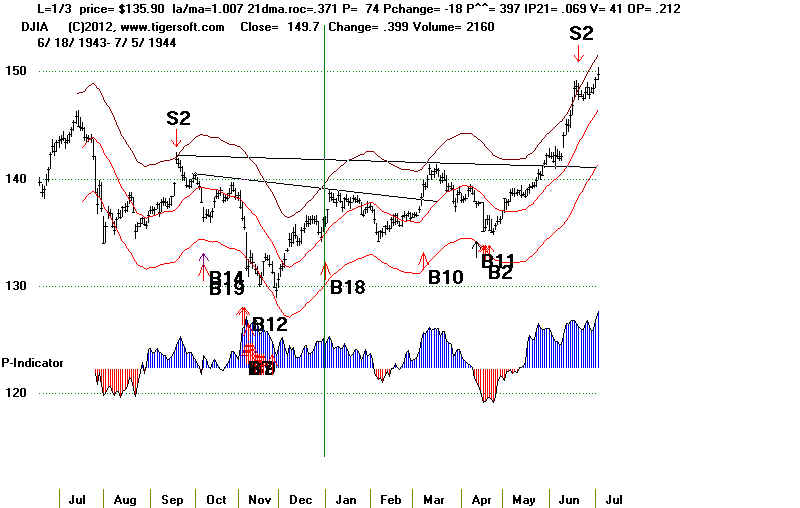

5 19440103 B18 135.9 .207 .013

----------------------------------------------------------------------

6 19441016 B18 148.1 .107 .017

----------------------------------------------------------------------

7 19450214 B18 157.1 .044 .030

----------------------------------------------------------------------

8 19450511 B18 163.2 .005 none

----------------------------------------------------------------------

9 19451011 B18 185.7 .073 none

----------------------------------------------------------------------

10 19451213 B18 193.5 .029 .023

----------------------------------------------------------------------

11 19490829 B18 177.8 .241 none

----------------------------------------------------------------------

12 19501013 B18 228.5 .134 .026

----------------------------------------------------------------------

13 19510110 B18 240.4 .078 none

----------------------------------------------------------------------

14 19540318 B18 300.1 .561 .012

----------------------------------------------------------------------

15 19540802 B18 349.6 .34 .042

----------------------------------------------------------------------

16 19580801 B18 505.4 .287 .005

----------------------------------------------------------------------

17 19581003 B18 533.7 .218 none

----------------------------------------------------------------------

18 19581203 B18 558.8 .164 .005

----------------------------------------------------------------------

19 19610201 B18 649.3 .08 .019

----------------------------------------------------------------------

20 19650315 B18 899.9 .043 .013

----------------------------------------------------------------------

21 19670303 B18 846.6 .048 .006

----------------------------------------------------------------------

22 19710128 B18 865.14 .084 none

----------------------------------------------------------------------

23 19710329 B18 903.48 .038 none

----------------------------------------------------------------------

24 19750305 B18 752.82 .149 .012

----------------------------------------------------------------------

25 19780530 B18 834.2 .039 none

----------------------------------------------------------------------

26 19821201 B18 1031.09 .025 none

----------------------------------------------------------------------

27 19830308 B18 1119.78 .111 .006

----------------------------------------------------------------------

28 19851220 B18 1543 .183 .026

----------------------------------------------------------------------

29 19860303 B18 1696.67 .076 .006

----------------------------------------------------------------------

30 19870310 B18 2280.09 .055 .014

----------------------------------------------------------------------

31 19910326 B18 2914.85 .039 none

----------------------------------------------------------------------

32 19930317 B18 3426.74 .021 .016

----------------------------------------------------------------------

33 19950303 B18 3989.61 .391 .009

----------------------------------------------------------------------

34 19950525 B18 4412.23 .258 .010

----------------------------------------------------------------------

35 19950801 B18 4700.37 .181 .025

----------------------------------------------------------------------

36 19961009 B18 5930.62 .156 none

----------------------------------------------------------------------

37 19980317 B18 8749.99 .049 none

----------------------------------------------------------------------

38 20020103 B18 10172.14 -.006 .054

----------------------------------------------------------------------

39 20030514 B18 8647.82 .134 .018

----------------------------------------------------------------------

40 20031217 B18 10145.26 .047 none

----------------------------------------------------------------------

41 20041221 B18 10759.43 .014 .036

----------------------------------------------------------------------

42 20060111 B18 11043.44 .048 .034

----------------------------------------------------------------------

43 20060315 B18 11209.77 .033 none

----------------------------------------------------------------------

44 20061005 B18 11866.69 .045 none

----------------------------------------------------------------------

45 20061204 B18 12283.85 .009 none

----------------------------------------------------------------------

46 20070518 B18 13556.53 .029 .021

----------------------------------------------------------------------

47 20130201 B18 14009.79 .083 .016

----------------------------------------------------------------------

48 20130502 B18 14831.58 .023 none

----------------------------------------------------------------------

Total N0.= 48 .120 .011

Returns by Size of Gain

-----------------------

No. Pct.of Total

=>.10 20 .417

=>.05 - <.10 8 .167

=>.02 - <.05 16 .333

=>0 - <.02 3 .063

<0 1 .021

--------------------------------------

Total 48 1.0 (100%)

Returns by Year

---------------

No. Avg.Gain Pct.of Total

Pres. Election Years 4 .12 .08

Year after Pres.El.Yr. 11 .072 .23

Mid-Term Election Yr. 17 .154 .35

Year before Pres.El.Yr. 16 .114 .33

----------------------------------------------------------------------

Total 48 .1165 1.0 (100%)

Returns by Month

----------------

No. Avg.Gain Pct.of Total January 5 .082 .104 February 4 .082 .083 March 13 .124 .2711 April 1 .07 .021 May 6 .081 .135 June 0 0 0 July 0 0 0 August 5 .279 .104 September 0 0 0 October 7 .141 .146 November 0 0 0 December 7 .067 .146 -------------------------------------------------------- Total 48 .1165 1.0 (100%) Returns by Day of Month

-----------------------

No. Avg.Gain Pct.of Total

-------------------------------------------------------

1-10 22 .148 .458

11-20 19 .104 .396

21-31 7 .101 .146

-------------------------------------------------------

Total 48 .1165 1.0 (100%)

|

Key Values of BUY

B18s since 1928

|

================================================================================

2012 Version of Peerless Buy B18

(C) 2013 William Schmidt,

Ph.D. All rights reserved.

www.tigersoft.com 2/5/2013

The B18 occurs when the P-Indicator has

been positive for 41 straight days.

The OBV-Pct must be at least .152.

The V-Indicator should be above zero.

There are times in th four year cycle

when buying on strength is too risky

and so these signals are not allowed in

Junes, Julys and Septembers. Momentum

strength cannot be trusted in Deceember

after the 23rd. During a Presidential

Election Year, no B18s are allowed except

in January, November and December.

Though allowed, be careful about using

the B18 when Peerless is already on a

Buy and the DJI is more than 2.4% over

the 21-dma.

New research shows that Peerless Buys are apt

to be unproductive in the first

year after a Presidential Election if a

Republican is in the White House

and quite profitable if a Democrat is in the

White House. There

were 5 profitable B18s in the post-Presidential

Election Year. A Democrat

was in the White House in all cases.

Year after Presidential Election Year

Party in

Date B18 Gain B18 Paper

Comments

White House

Loss

LA/MA

--------------------------------------------------------------------------------------------------------------

Dem

2/5/45 +5.5% <2%

only 1.008

Dem

4/25/45 +.0.1%

<1%

1.032 (high)

Dem

12/11/45 +6.8% 3.6%

1.025

Dem

2/1/61 +10.2% <2%

1.021

Dem

8/26/93 +8.8% 3.0%

1.017

A Democrat is the White House produced much smaller gains

on Peerless Buys in the second year after a Presidential Election

than Republicans. This was clearly the case for B18s.

Two Years after Presidential Election Year

Rep

3/18/54 +58.3% 1.5%

1.013 Reversing B18.

Rep

8/2/54 +34.9%

3.9%

1.022

Rep

8/1/58 +28.7%

<.5%

1.032 (high)

Rep

12/3/58 +16.4% 0

1.003

Rep

10/26/82 +5.1% 1.4%

1.031 (high)

Rep

3/3/86

+7.6% 0%

1.028

(Dem

3/17/98 +3.8% 0

1.025)

Rep

1/3/02 -0.6%

4.2%

1.017

Rep

1/27/06 +6.1% 1.5%

1.005

Rep

4/4/06 +3.3% 1.2%

1.003

Rep

10/5/06 +4.5% 0

1.024

(Dem

4/21/10 -6.4%

0

1.014)

Buy B18s have become weaker since 2000.

Chasing momentum has become

less effective. As such, the

signals are mainly used now to show that breadth

has been persistently positive and, in

case Peerless was somehow still

on a Sell, that we would switch to a Buy.

There have been 43 Buy B18s since 1928. As a group, B18s averaged

+10.5% gain per trade. 17 of the gains were more than 10%, 12 were between

5% and 10%. In 11 cases, the gains were less than 5%. There were 3

losses,

all occurring since 2000. The biggest loss was 6.4%. This occurred in April

2010

and could easily have been avoided by heeding the dangers inherent in a completed

head/shpulders pattern.

The average B18 gain was only +2.3% in the 12 cases since 2000. There has

not been a 10% gain among B18s since 1996. In additon, the two biggest paper

losses occurred in 2010 (11.8%) and 2011 (5.7%)

8 of the 43 Buy B18s brought a paper loss of 3% or more. The best way to

avoid a bigger paper loss with these signals is to not chase and to wait for

a dip when they occurred more than 1.7% over the 21-day ma, unless they serve to

reverse a Peerless Sell signal, which is rare. 25 of 43 B19s occurred with

DJI more than 1.7% over the 21-day ma, 8 of these brought paper losses

of more than 2%.

Nearly all the B18s were are not reversing Buys. Rather, they usually reinforce

an already operative Peerless Buy. They usually are a sign of a healthy bull

market.

It is significant that there were no cases in the bear market years from 1929 to 1941.

There were 2 cases where they reversed an existing Peerless Sell. They

were important to employ, because the market in each case went significantly

higher.

3/18/1954

300.1 +58.3%

Paper

Loss = 1.5%

LA/MA

ROC

P-I

P-ch IP21

V-I

OPct

1.013 .423

84 42

.207 39 .253

Fell back to 295.40 and the

21-dma and rallied powerfully to 475.

===> This was a reversing Buy.

----------------------------------------------------------------------------------------------------------------------------------------------------

33) 11/3/2003

9858.46 +8.9% Paper loss =

- 2.3%

LA/MA

ROC

P-I

P-ch

IP21

V-I

OPct

1.015 .351 317

11 .103 2

.228

Fell back to 9629 and then rallied.

===> This was a reversing Buy signal.

-----------------------------------------------------------------------------------------------------------------------------------------

Buy B18s in a Presidential Election year were rare and less bullish.

10/16/1944 +10.7%

10/18/1996 +12.1%

1/2/2004 +3.1%

12/1/2004 +2.5%

Avg = 7.7%

B18s in the year after a second year of a Presidential cycle (1942, 1946...)

produced

an average gain of +13.7% in the 14 cases. There was only one loss. These are

generally

the strongest Buy B18s, provided the V-Indicator is above +7.

Bull markets often have seen these Buy signals at an early stage.

Sustained

very good breadth is very bullish. Examples at the start of the

best bull markets: 1942-1944, 1949, 1954, 1958, 1985, 1995-1996

and 2003. Very often there is more than one B18 signal in an

upswing. The first brings the highest gains.

If we include the cases where the V-Indicator was 0-7, there

in 36 of the 61 cases there was an immediate rally after the Buy B18.

In 25 cases there would have been a paper loss after the Buy B18.

There were only 3 instances of paper losses of more than 5%. Continued

good breadth is the best safeguard against a "bad Buy B18" if the

DJI is already up more than 10% from its 4 month lows. Given the

average gain of 10% and the 36/61 probability of there being very little

or no paper loss, in most cases, these should be treated as automatic

Buys. But be careful if the V-Indicator is below 10 and/or if a bearish

head and shoulders or hands above the head price pattern develops.

Also, as a working hypothesis, the key Peerless indicators (P-Indicator, IP21and OP)

should be higher than say 12, .10 and .06, respectively.

Buy B18s in a Presidential Election year were sometimes problematic

if they were allowed. if allowed, they would have meant chasing a rally and

buying at the upper band on

10/16/1944 148.10

3/4/1988 2057.86 -1.1%

and were not needed when the market was exceptionally strong in

a Presidential Election Year, as Peerless was already on a Buy.

2/4/1972 +4.0% if allowed

3/3/1976 +3.1% if allowed

8/1/1980 +3.3% if allowed

2/15/96 0 gain if allowed.

1/2/2004 +3.1% if allowed

It is probably best for the overall system if users discard B18s from February through

September in a Presidential Election Year.

V-Indicator Needs to be above +7.

Readings by the V-Indicator of +7 are lower tend to bring smaller gains.

In these 17 cases, the average gain was only 3.6%. There was one other

case were a B18 reached +7: this did gain 36.8% on 3/3/95, but this was clearly

not a good point to sell, given the classic flat topped breakout into all-time

high territory. The Peerless program has been adjusted to disallow Buy B18s

when the V-Indicator is 7 or lower. You can see further below the cases of B18s that

are eliminated because the V-Indicator was not positive enough. They are

indented

and marked with an "X"

3 Bad Buy B18s.

The March 2013 version of Peerless eliminated each of these

by changing the P-I and OPct requirements.

1)

9/ 20/ 1951

274.1 Gain= 0

la/ma=1.01 ma.roc= .387 98 P= 11 (LOW) IP21=.141 V= .65 OP=.053 (LOW)

Note development of bearish hands above the head price pattern in chart for this period

just below.

Paper loss of 7%. DJI

fell to 256 in November and then rallied back.

2) 3 / 7 / 1997

7000.89 -.024

la/ma=1.009 ma.roc= .437 P= 11

(LOW) 137 IP21= .114 V=11 OP= .137 (LOW)

Fell to 6386 (8%) before strongly rallying

3) 8 / 1 / 1997

8194.04 -.002

la/ma=1.021 ma.roc= .593 P=234 IP21= .089 (low)

V=16 OP= .301

The DJI was already up more than 20% from 4 month low.

Fell to 7600 (6% paper loss) before rallying back to the upper band.

The Requirements:

Peerless P-Indicator has been positive 42 straight

days and the V-Indicator is above

+7 with the DJI not more than

3.9% over the 21-day ma. The signal is not allowed in June or July

and is not allowed in Januaries the year before a Presidential Election.

---Buy B18 Cases, Key Values and Outcomes-- 1928-1941 no cases 1942-2009

Date of B18 DJI Gain

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

1) 10 /15 /1942 113.3 +25.2% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.027 .736 116 -22 .204 93 .532

high

Up strongly immediately. There had already been numerous Sells.

--------------------------------------------------------------------------------------------------------------------------------------------------------

2) 2/19/1943 126.7 +11.9% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.008 .579 110 -5 .215 106 .358

at 21-day ma

Up strongly immediately.

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

3) 4/20/1943 133.1 +6.5% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

.993 .329 174 -18 .081 246 .247

at 21-day ms

Up immediately.

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

4) 1/3/1944 135.9 +8.8% Paper Loss = 1%

LA/MA ROC P-I P-ch P^^ IP21 V-I OPct

1.007 .371 74 -18 +397 .069 41 .212

Up immediately.

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

4) 1/3/1944 135.9 +8.8% Paper Loss = 1%

LA/MA ROC P-I P-ch P^^ IP21 V-I OPct

1.007 .371 74 -18 +397 .069 41 .212

Up immediately.

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

5) 10 / 16 / 1944 148.1 +10.7% Paper Loss = 1.6%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.008 .422 112 7 .124 68 .236

DJI hesitated for 1 month. Fell back to 145.66 before rallying.

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

6) 2/5/1945 155.4 + 5.5% Paper Loss = 1.7%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.009 .108 73 16 .14 27 .188

DJI hesitated for 1 month. Fell back to 152.8 before rallying.

Note the false head and shouders pattern in February and March 1945.

The fact that the P-Indicator and Accum. Index were very positive

was the alert that it might fail. Surpassing the right shoulder's apex

launches prices here.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

7) 4 / 25 / 1945 163.90 +0.1% Paper Loss <1%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.032 .873 173 30 .193 188 .526

high

Rallied immediately to a sell at upper band in two months.

The DJI is already 3.2% above the21-day ma here. A retreat

has to be considered a better buy.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

8) 12/11/1945 195.8 +6.8% Paper Loss = 3.6%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .441 138 -11 .237 148 -.001

too high

DJI fell immediately to 185.80 and then rallied.

DJI was already up a long ways when B18 occurred. It was best to wait

for a decline at least to the 21-day ma.

------------------------------------------------------------------------------------------------------------------------------------------------------

9) 10 / 2 / 1950 228.9 +1.1% Paper Loss < 1%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .253 87 4 .08 53 .181

too high

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

5) 10 / 16 / 1944 148.1 +10.7% Paper Loss = 1.6%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.008 .422 112 7 .124 68 .236

DJI hesitated for 1 month. Fell back to 145.66 before rallying.

--------------------------------------------------------------------------------------------------------------------------------[-----------------------

6) 2/5/1945 155.4 + 5.5% Paper Loss = 1.7%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.009 .108 73 16 .14 27 .188

DJI hesitated for 1 month. Fell back to 152.8 before rallying.

Note the false head and shouders pattern in February and March 1945.

The fact that the P-Indicator and Accum. Index were very positive

was the alert that it might fail. Surpassing the right shoulder's apex

launches prices here.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

7) 4 / 25 / 1945 163.90 +0.1% Paper Loss <1%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.032 .873 173 30 .193 188 .526

high

Rallied immediately to a sell at upper band in two months.

The DJI is already 3.2% above the21-day ma here. A retreat

has to be considered a better buy.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

8) 12/11/1945 195.8 +6.8% Paper Loss = 3.6%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .441 138 -11 .237 148 -.001

too high

DJI fell immediately to 185.80 and then rallied.

DJI was already up a long ways when B18 occurred. It was best to wait

for a decline at least to the 21-day ma.

------------------------------------------------------------------------------------------------------------------------------------------------------

9) 10 / 2 / 1950 228.9 +1.1% Paper Loss < 1%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .253 87 4 .08 53 .181

too high

----------------------------------------------------------------------------------------------------------------------------------------------------

10) 1/10/1951 240.4 +14.4% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.027 .699 131 -45 .075 198 .212

high

Up 10% over next 4 months.

----------------------------------------------------------------------------------------------------------------------------------------------------

10) 1/10/1951 240.4 +14.4% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.027 .699 131 -45 .075 198 .212

high

Up 10% over next 4 months.

----------------------------------------------------------------------------------------------------------------------------------------------------

11) 3/18/1954 300.1 +58.3% Paper Loss = 1.5%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.013 .423 84 42 .207 39 .253

Fell back to 295.40 and the 21-dma and rallied powerfully to 475.

===> This was a reversing Buy.

----------------------------------------------------------------------------------------------------------------------------------------------------

12) 8 / 2 / 1954 349.6 +35.9% Paper Loss = 3.9%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.022 .541 173 8 .207 229 .304

high

Up strongly after test of 65-dma and 335.8

----------------------------------------------------------------------------------------------------------------------------------------------------

13) 8 / 1 / 1958 505.4 +28.7% Paper Loss = 0.53%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.032 .614 111 13 .209 141 .43

high

Up strongly after re-testing rising 21-day ma at 502.70 on 8/18/1958.

----------------------------------------------------------------------------------------------------------------------------------------------------

14) 10 / 3 / 1958 533.70 +21.8% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.017 .462 79 21 .064 15 .25

Up strongly.

----------------------------------------------------------------------------------------------------------------------------------------------------

15 ) 12 / 3 / 1958 558.8 +16.4% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.003 .334 82 -1 .085 5 .337

Up strongly.

----------------------------------------------------------------------------------------------------------------------------------------------------

16 ) 2/1/1961 649.3 +10.2% Paper Loss = 1.9%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .736 197 13 .13 377 .324

high

10 day decline to 637 at 21-dma and then rally to 705 in 3 months.

-------------------------------------------------------------------------------------------------------------------------------------------------

17 ) 1/28 /1971 865.14 +9.4% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.021 .326 243 -24 .096 1 .464

high

DJI rallied immediately, then fell to 21-dma and then rallied to new highs.

----------------------------------------------------------------------------------------------------------------------------------------------------

18 ) 3/5/1975 752.82 +16.6% Paper Loss = 1.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.032 .677 89 -50 .093 1 .175

very high

DJI fell to just above the lower band and then rallied strongly.

----------------------------------------------------------------------------------------------------------------------------------------------------

19 ) 5/12/1978 840.7 +3.1% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.02 .949 182 -6 - .001 7 .324

DJI rallied to upper band sell.

----------------------------------------------------------------------------------------------------------------------------------------------------

20) 10/26/1982 1006.07 +5.1% Paper Loss = 1.4%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.031 1.043 237 -10 .118 13 .174

very high

DJI fell to 21-dma and rallied to upper band sell.

----------------------------------------------------------------------------------------------------------------------------------------------------

21) 3/8/1983 1119.78 +11.1% Insignificant Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.013 .452 188 -59 .017 7 .174

DJI fell to 1113.49 and rallied past upper band.

---------------------------------------------------------------------------------------------------------------------------------------------------

22) 12/20/1985 1543 +18.3% Paper Loss = 2.6%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.031 .828 179 27 .065 13 .185

very high

DJI retested 1502 needed for a month. Then rally resumes.

--------------------------------------------------------------------------------------------------------------------------------------------------

23) 3/3/1986 1696.67 +7.6% Insignificant Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.028 1.046 295 -10 .27 19 .305

very high

DJI fell to 1686.66 and rallied past the upper band.

--------------------------------------------------------------------------------------------------------------------------------------------------

24) 3/10/1987 2280.09 + 5.5% Paper Loss = 1.4%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .50 35 17 .102 +4 .257

high

DJI fell to 2248.44 and rallied to upper band.

--------------------------------------------------------------------------------------------------------------------------------------------------

25) 4/18/1991 2999.26 +10.2% Paper Loss = 4.5%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.029 .538 183 22 .02 11 .232

very high

DJI fell to 2865.38 and rallied to upper band.

--------------------------------------------------------------------------------------------------------------------------------------------------

26) 2/1/1993 3332.18 +19.1% Insignificant Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.016 .113 154 4 .023 3 .202

DJI fell to 3312.19 and rallied steadily or 10 months.

--------------------------------------------------------------------------------------------------------------------------------------------------

27) 8/26/1993 3648.17 +8.8% Paper Loss = 3.0%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.017 .315 161 7 .089 11 .334

Fell to 3537 at rising 65-dma and then rallied for 4 months.

-----------------------------------------------------------------------------------------------------------------------------------------

28) 3/3/1995 3989.61 36.8% Paper Loss = 0.7%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.007 .427 149 -26 .104 6 .333

Fell to 3962.63 at rising 65-dma and then rallied for 4 months.

-----------------------------------------------------------------------------------------------------------------------------------------

29) 5/25/1995 4412.23 +23.7% Paper Loss = 1.0%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.007 .306 133 -10 .127 v=10 .299

Fell to 4369.00 at rising 21-dma and then rallied.

-----------------------------------------------------------------------------------------------------------------------------------------

30). 10/18/1996 6094.23 +12.1% Paper Loss = 1.4%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .454 157 20 .104 13 .227

high

Fell to 6007.02 at rising 21-dma and then rallied.

-----------------------------------------------------------------------------------------------------------------------------------------

31) 3/17/1998 8749.99 +3.8% No paper loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .531 204 4 .153 24 .238

high

Immediately rallied, which lasted 6 weeks.

-----------------------------------------------------------------------------------------------------------------------------------------

32) 1/3/2002 10172.14 loss = 0.6% Paper loss = 4.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.017 .487 288 78 .059 10 .256

high

Fell to 9744.24 and then rallied to upper band and Sell S9.

-----------------------------------------------------------------------------------------------------------------------------------------

33) 11/3/2003 9858.46 +8.9% Paper loss - 2.3%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.015 .351 317 11 .103 2 .228

Fell back to 9629 and then rallied.

===> This was a reversing Buy signal.

-----------------------------------------------------------------------------------------------------------------------------------------

34) 1/2/2004 10409.95 +3.1% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .653 425 13 .107 44 .341

high

Immediately rallied.

-----------------------------------------------------------------------------------------------------------------------------------------

35) 12/1/2004 10590.22 +2.5% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.015 .613 518 33 .067 145 .309

Immediately rallied.

----------------------------------------------------------------------------------------------------------------------------

36) 8/1/2005 10623.15 -3.2% Paper Loss = 3.8%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.007 .394 385 25 .057 37 .237

Fell back to 10200 (4% paper loss) and then rallied strongly.

----------------------------------------------------------------------------------------------------------------------------

37) 1/27/2006 10907/21 +6.1% Paper Loss = 1.5%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.005 .142 487 108 .079 83 .196

Fell back to 10750 and then rallied strongly for 4 months.

----------------------------------------------------------------------------------------------------------------------------

38) 4/4/2006 11203.85 +3.3% Paper Loss = 1.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.003 .262 204 88 -.02 4 .172

Fell back to 11073 and then rallied to Sell S9 at the upper band.

----------------------------------------------------------------------------------------------------------------------------

39) 10/5/2006 11866.69 +4.5% No paper loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .474 326 149 .115 24 .289

Rallied immediately.

----------------------------------------------------------------------------------------------------------------------------

40) 12/4/2006 12283.85 +0.9% No paper loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.006 .259 53` 101 .113 90 . 336

Rallied immediately.

----------------------------------------------------------------------------------------------------------------------------

41) 5/18/2007 13556.53 + .031 Paper loss = 2.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .675 157 82 .143 44 .514

Fell back to 13263 and then rallied for a month to Sell.

----------------------------------------------------------------------------------------------------------------------------

42) 4/21/2010 11124.92 Loss = -6.4% Paper loss = 11.8%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.014 .368 317 -27 .095 4 (LOW) .439

Fell back to 9816.49 and then rallied to upper band.

Note that prices had reached rising resistance line.

This was far from being a reversing Buy. And a head/shoulderspattern appeared.

----------------------------------------------------------------------------------------------------------------------------

43) 2/17/ 2011 12318.14 +4.0% Paper loss = 5.7%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.019 .486 398 115 .218 32 .385

At top of price channel. A pullback was expected.

DJI fell back to 11613.30 and then rallied to upper band.

-------------------------------------------------------------------------------------------------------------------------------

44) 2/1/ 2013 14009.79 Not closed out yet. +?% Paper loss =

LA/MA ROC P-I P-ch IP21 V-I OPct

1.027 .522 454 -43 .198 37 .316

At top of price channel. and challenging 2007 high.

==========================================================

Avg. Gain about 9%

Not yet cl

----------------------------------------------------------------------------------------------------------------------------------------------------

11) 3/18/1954 300.1 +58.3% Paper Loss = 1.5%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.013 .423 84 42 .207 39 .253

Fell back to 295.40 and the 21-dma and rallied powerfully to 475.

===> This was a reversing Buy.

----------------------------------------------------------------------------------------------------------------------------------------------------

12) 8 / 2 / 1954 349.6 +35.9% Paper Loss = 3.9%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.022 .541 173 8 .207 229 .304

high

Up strongly after test of 65-dma and 335.8

----------------------------------------------------------------------------------------------------------------------------------------------------

13) 8 / 1 / 1958 505.4 +28.7% Paper Loss = 0.53%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.032 .614 111 13 .209 141 .43

high

Up strongly after re-testing rising 21-day ma at 502.70 on 8/18/1958.

----------------------------------------------------------------------------------------------------------------------------------------------------

14) 10 / 3 / 1958 533.70 +21.8% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.017 .462 79 21 .064 15 .25

Up strongly.

----------------------------------------------------------------------------------------------------------------------------------------------------

15 ) 12 / 3 / 1958 558.8 +16.4% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.003 .334 82 -1 .085 5 .337

Up strongly.

----------------------------------------------------------------------------------------------------------------------------------------------------

16 ) 2/1/1961 649.3 +10.2% Paper Loss = 1.9%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .736 197 13 .13 377 .324

high

10 day decline to 637 at 21-dma and then rally to 705 in 3 months.

-------------------------------------------------------------------------------------------------------------------------------------------------

17 ) 1/28 /1971 865.14 +9.4% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.021 .326 243 -24 .096 1 .464

high

DJI rallied immediately, then fell to 21-dma and then rallied to new highs.

----------------------------------------------------------------------------------------------------------------------------------------------------

18 ) 3/5/1975 752.82 +16.6% Paper Loss = 1.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.032 .677 89 -50 .093 1 .175

very high

DJI fell to just above the lower band and then rallied strongly.

----------------------------------------------------------------------------------------------------------------------------------------------------

19 ) 5/12/1978 840.7 +3.1% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.02 .949 182 -6 - .001 7 .324

DJI rallied to upper band sell.

----------------------------------------------------------------------------------------------------------------------------------------------------

20) 10/26/1982 1006.07 +5.1% Paper Loss = 1.4%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.031 1.043 237 -10 .118 13 .174

very high

DJI fell to 21-dma and rallied to upper band sell.

----------------------------------------------------------------------------------------------------------------------------------------------------

21) 3/8/1983 1119.78 +11.1% Insignificant Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.013 .452 188 -59 .017 7 .174

DJI fell to 1113.49 and rallied past upper band.

---------------------------------------------------------------------------------------------------------------------------------------------------

22) 12/20/1985 1543 +18.3% Paper Loss = 2.6%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.031 .828 179 27 .065 13 .185

very high

DJI retested 1502 needed for a month. Then rally resumes.

--------------------------------------------------------------------------------------------------------------------------------------------------

23) 3/3/1986 1696.67 +7.6% Insignificant Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.028 1.046 295 -10 .27 19 .305

very high

DJI fell to 1686.66 and rallied past the upper band.

--------------------------------------------------------------------------------------------------------------------------------------------------

24) 3/10/1987 2280.09 + 5.5% Paper Loss = 1.4%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .50 35 17 .102 +4 .257

high

DJI fell to 2248.44 and rallied to upper band.

--------------------------------------------------------------------------------------------------------------------------------------------------

25) 4/18/1991 2999.26 +10.2% Paper Loss = 4.5%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.029 .538 183 22 .02 11 .232

very high

DJI fell to 2865.38 and rallied to upper band.

--------------------------------------------------------------------------------------------------------------------------------------------------

26) 2/1/1993 3332.18 +19.1% Insignificant Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.016 .113 154 4 .023 3 .202

DJI fell to 3312.19 and rallied steadily or 10 months.

--------------------------------------------------------------------------------------------------------------------------------------------------

27) 8/26/1993 3648.17 +8.8% Paper Loss = 3.0%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.017 .315 161 7 .089 11 .334

Fell to 3537 at rising 65-dma and then rallied for 4 months.

-----------------------------------------------------------------------------------------------------------------------------------------

28) 3/3/1995 3989.61 36.8% Paper Loss = 0.7%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.007 .427 149 -26 .104 6 .333

Fell to 3962.63 at rising 65-dma and then rallied for 4 months.

-----------------------------------------------------------------------------------------------------------------------------------------

29) 5/25/1995 4412.23 +23.7% Paper Loss = 1.0%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.007 .306 133 -10 .127 v=10 .299

Fell to 4369.00 at rising 21-dma and then rallied.

-----------------------------------------------------------------------------------------------------------------------------------------

30). 10/18/1996 6094.23 +12.1% Paper Loss = 1.4%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .454 157 20 .104 13 .227

high

Fell to 6007.02 at rising 21-dma and then rallied.

-----------------------------------------------------------------------------------------------------------------------------------------

31) 3/17/1998 8749.99 +3.8% No paper loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .531 204 4 .153 24 .238

high

Immediately rallied, which lasted 6 weeks.

-----------------------------------------------------------------------------------------------------------------------------------------

32) 1/3/2002 10172.14 loss = 0.6% Paper loss = 4.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.017 .487 288 78 .059 10 .256

high

Fell to 9744.24 and then rallied to upper band and Sell S9.

-----------------------------------------------------------------------------------------------------------------------------------------

33) 11/3/2003 9858.46 +8.9% Paper loss - 2.3%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.015 .351 317 11 .103 2 .228

Fell back to 9629 and then rallied.

===> This was a reversing Buy signal.

-----------------------------------------------------------------------------------------------------------------------------------------

34) 1/2/2004 10409.95 +3.1% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .653 425 13 .107 44 .341

high

Immediately rallied.

-----------------------------------------------------------------------------------------------------------------------------------------

35) 12/1/2004 10590.22 +2.5% No Paper Loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.015 .613 518 33 .067 145 .309

Immediately rallied.

----------------------------------------------------------------------------------------------------------------------------

36) 8/1/2005 10623.15 -3.2% Paper Loss = 3.8%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.007 .394 385 25 .057 37 .237

Fell back to 10200 (4% paper loss) and then rallied strongly.

----------------------------------------------------------------------------------------------------------------------------

37) 1/27/2006 10907/21 +6.1% Paper Loss = 1.5%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.005 .142 487 108 .079 83 .196

Fell back to 10750 and then rallied strongly for 4 months.

----------------------------------------------------------------------------------------------------------------------------

38) 4/4/2006 11203.85 +3.3% Paper Loss = 1.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.003 .262 204 88 -.02 4 .172

Fell back to 11073 and then rallied to Sell S9 at the upper band.

----------------------------------------------------------------------------------------------------------------------------

39) 10/5/2006 11866.69 +4.5% No paper loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.024 .474 326 149 .115 24 .289

Rallied immediately.

----------------------------------------------------------------------------------------------------------------------------

40) 12/4/2006 12283.85 +0.9% No paper loss

LA/MA ROC P-I P-ch IP21 V-I OPct

1.006 .259 53` 101 .113 90 . 336

Rallied immediately.

----------------------------------------------------------------------------------------------------------------------------

41) 5/18/2007 13556.53 + .031 Paper loss = 2.2%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.025 .675 157 82 .143 44 .514

Fell back to 13263 and then rallied for a month to Sell.

----------------------------------------------------------------------------------------------------------------------------

42) 4/21/2010 11124.92 Loss = -6.4% Paper loss = 11.8%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.014 .368 317 -27 .095 4 (LOW) .439

Fell back to 9816.49 and then rallied to upper band.

Note that prices had reached rising resistance line.

This was far from being a reversing Buy. And a head/shoulderspattern appeared.

----------------------------------------------------------------------------------------------------------------------------

43) 2/17/ 2011 12318.14 +4.0% Paper loss = 5.7%

LA/MA ROC P-I P-ch IP21 V-I OPct

1.019 .486 398 115 .218 32 .385

At top of price channel. A pullback was expected.

DJI fell back to 11613.30 and then rallied to upper band.

-------------------------------------------------------------------------------------------------------------------------------

44) 2/1/ 2013 14009.79 Not closed out yet. +?% Paper loss =

LA/MA ROC P-I P-ch IP21 V-I OPct

1.027 .522 454 -43 .198 37 .316

At top of price channel. and challenging 2007 high.

==========================================================

Avg. Gain about 9%

Not yet cl