"Men

who can both be right and sit tight are uncommon."

“Reminiscences

of a Stock Operator” by Edwin Lefevre, 1923

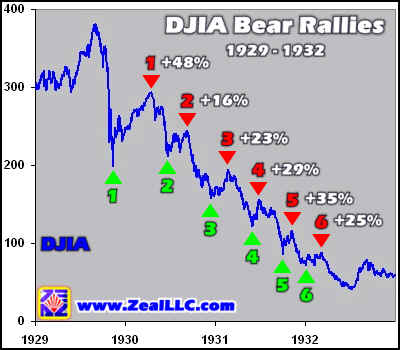

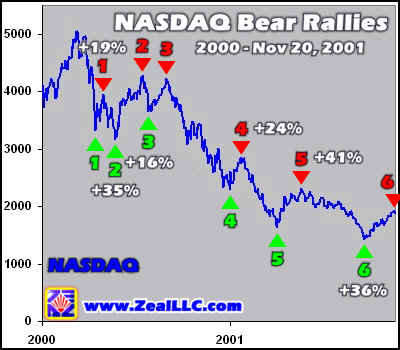

Be extremely careful in concluding that rising stock prices after a sharp 15% decline in the

SP-500 represent a meaningful new advance. For a market, which has become very over-sold,

it is only natural to rebound, but frequently these rebounds are merely bear market rallies, which

are subsequently followed by vicious declines. The Fed rate cuts and that this is a Presidential

Election year will reduce the decline. Probably the most famous bear market rally in history is

the rise, which took place following the October crash of 1929. Stocks began to recover strongly

following the November 13th 1929 low amidst wildly bullish comments and confident statements

by a very large number of respected Wall Street personalities. The rally from 200 in November

1929 rose 45% to 290 in April 1930. (See http://www.ameinfo.com/16529.html )

Tiger Index of 17 Brokerage Stock

Volume is important to watch in what are bear market rallies. The volume will drop sharply on the rally

if it is a bear market. It will stay high if the rally is to be trusted. We see a high volume turn around in brokerages.

Use short-term Stochastics with Options. Red Buys and Sells gain 61% here.

Bear market rallies will stop at falling 21-day mvg.avgs. and 50-day mvg.avgs. You

will se narrowing rising wedge patterns. Often the first day down from the rising pattern will

be a high volume down day.