Study of Unusual NASDAQ Strength Compared to DJIA

(C) 2009 www.tigersoft.com 6/21/2009

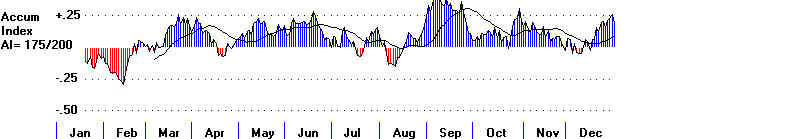

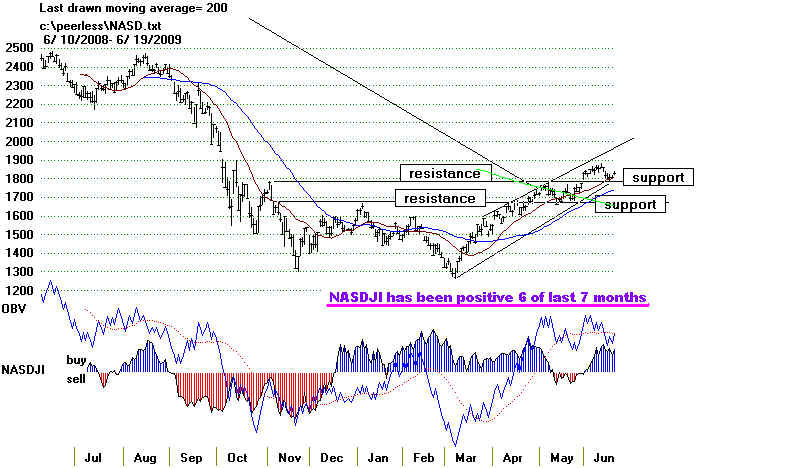

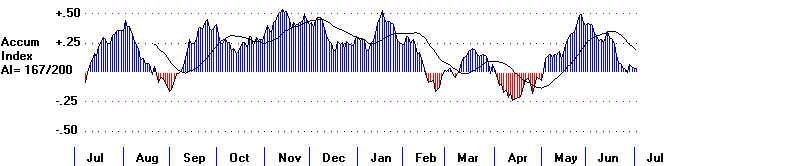

NASDAQ 2008-2009

There are 3 previous cases where the NASDJI stayed positive 6 of 7 months: 1992-1993, 1999-2000

and 2003. as long as now.

Tiger's "NASDJI" Indicator is a relative strength indicator that compares NASDAQ with DJI.

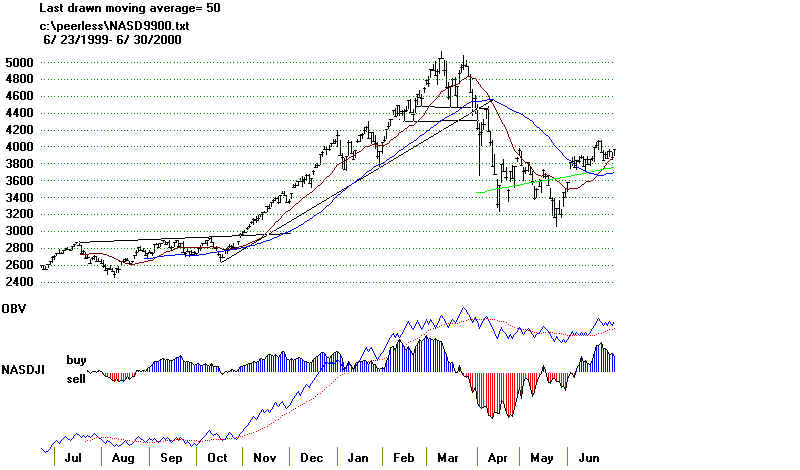

In runaway NASDAQ markets, like 1999-2000, there may be a premature Peerlesss Sell. 7 months'

positive NASDJI readings out of 8 months is the maximum in earlier cases. .

In 1968, secondary stocks went wild as now. This was before there was a NASDAQ.

The DJI lagged badly. The second break in the NYSE A/D uptrendline brought on a severe bear

market for all stocks. That bull market lasted 8 months. It had started when LBJ announced

he was not going to run again. The war in Viet Nam was very inflationary, as the wars in Iraq

and Afghanistan are now. The FED held back raising interest rates. When investors sense

inflation is not going to be checked by the FED and interest rates remain low, secondary stocks

get a special play, I would say. That is true now. But the secondary stocks' run upwards, in

the four past cases only lasted 8 months. That puts a 6 weeks' more limit on what we can expect

for a strong NASDAQ. hotmail.com

Year

Number of

Months NASDJI Positive Top of NASDAQ Rally Recognized by

-----

-------------------------------------

----------------------------

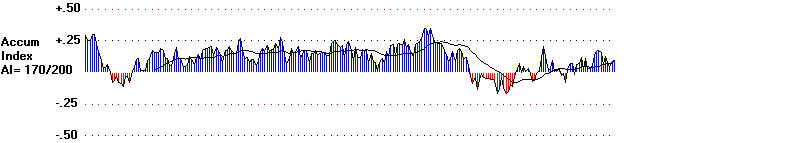

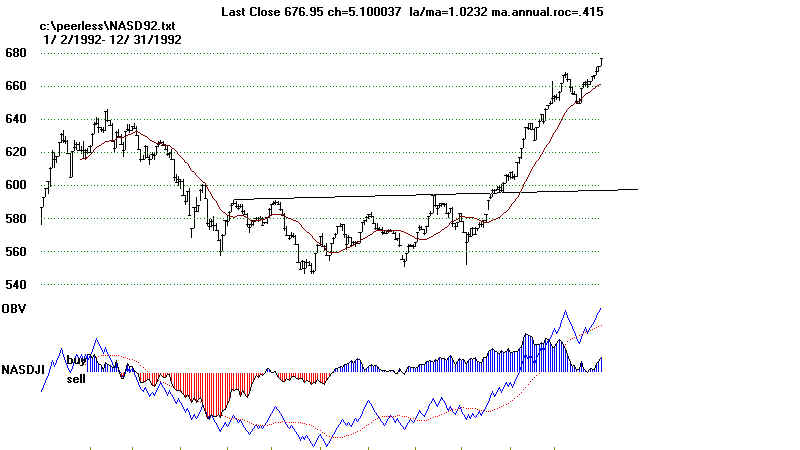

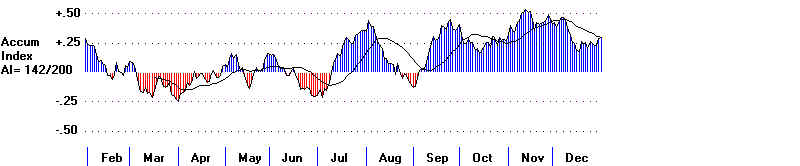

1992-1993

7

Double

Top and Support Failure.

Second

violation of 21-dma

Peerless

S15 on 5/20/1993

1999-2000

7

Double

Top and Support Failure

Hands

above the Head Pattern (shows over-speculation)

Premature

Peerless Sell S12 on 1/16/2000

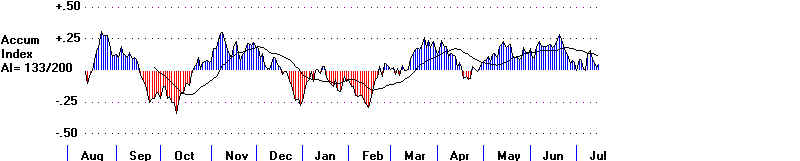

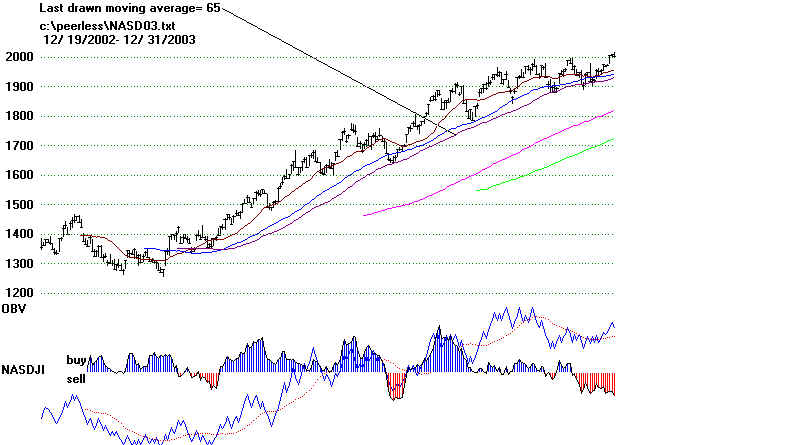

2003-2004

7

NASDAQ

starts to under-perform

Peerless

S15 - 2/11/2004

Peerless

S9 -2/20/2004

2008-2009

6.5

=======================================================

NASDAQ - 1999-2000