TigerSoft's Elite Stock

Professional Report

5/16/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

Table 4- Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

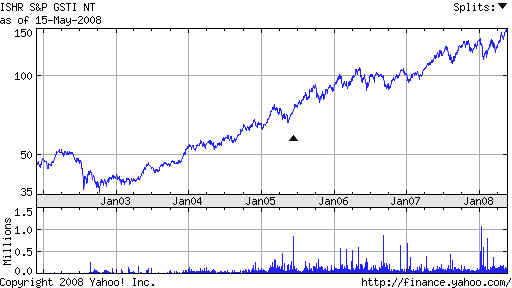

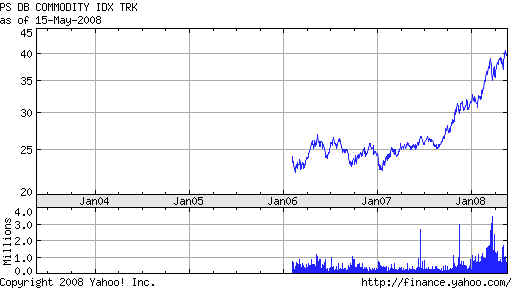

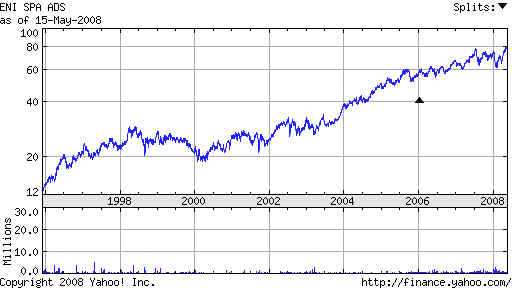

190 SID 50.94 +1.72 (+3.8 for week) NH OBV is OK ITRS>.221 and IP21>.10 BraZIL STEEL Look also at Brazilean GGB 86 IGE 153.94 +4.30 (+7 for week) recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum.  183 DBC 40.53 +.58 Close to NH ITRS=.01 OBV is confirming. Recent Accum. Index bulge. Commodity ETFs - metals, oil, corn, wheat.  173 BHP 95 +1.58 87.92 (+7 for week) IP21= +.10 NH OBV confirming B Hill Property BHP Billiton Limited, together with its subsidiaries, operates as a diversified natural resources company. The company operates 10 customer sector groups (CSGs), aligned with the commodities that the company extracts and markets, which includes Aluminium, Base Metals, Uranium, Diamonds and Specialty Products, Energy Coal, Iron Ore, Manganese, Metallurgical Coal, Petroleum, and Stainless Steel Materials. 154 ILF Latin America 302.13 +6.30 ( 20 for week) IP21=.12 pullback to breakout point.  159 E 83.23 +2.66 IP21=.37 NH OBV is rising bullishly. Eni SpA, an integrated energy company, operates in the oil and gas, electricity generation, petrochemicals, oilfield services, and engineering industries. It engages in the exploration and production of hydrocarbons, oil, and natural gas in Italy, North Africa, West Africa, the North Sea, Latin America, Kazakhstan, the United States, and Asia.  126 MAM 46.25 +.82 IP21=.60 OBV is at NH B12 on Wednesday, 42 was breakout. Maine & Maritimes Corporation, along with its subsidiaries, provides electric transmission and distribution services in Aroostook County and Penobscot County in northern Maine.  156 CPE 25.74 +1.61 Breakout was at 19. OBV strong. IP21=.25 Callon Petroleum Company engages in the exploration, development, acquisition, and production of oil and gas properties. Its properties are primarily located in Louisiana and offshore Gulf of Mexico.  132 DRS 78.32 -.14 B12 and OBV confirms DRS Technologies, Inc. provides defense electronic products, systems, and military support services.  =============================================================================== |

|

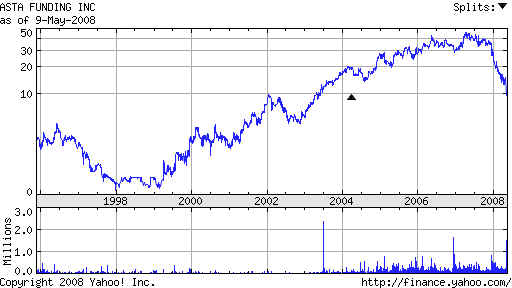

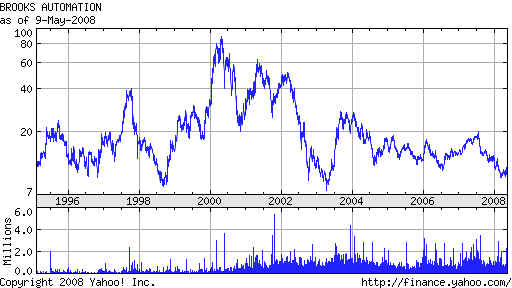

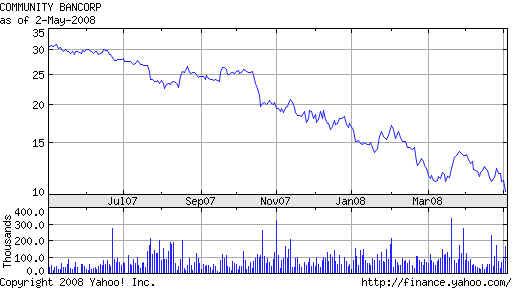

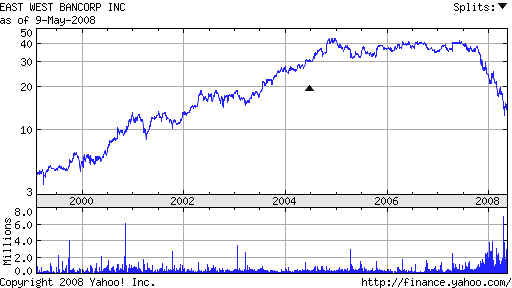

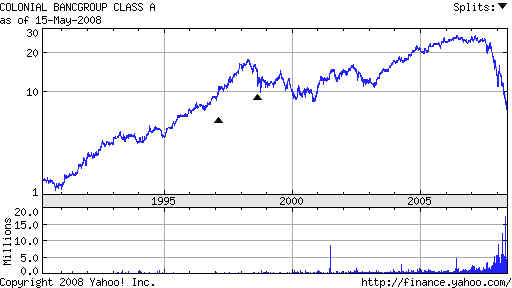

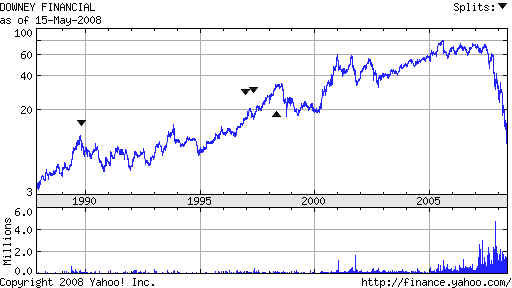

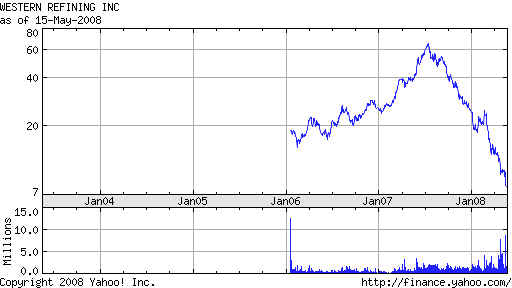

| Short Sales ASFI 8.73 -.05 IP21=-.25 OBV is at new low. Asta Funding, Inc., together with its subsidiaries, engages in purchasing, managing for its own account, and servicing distressed performing and non-performing consumer receivables. It acquires, manages, collects, and services portfolios of consumer receivables, including charged-off receivables...  14 BRKS 10.00 -.32 Dropped below 50-dma on hiogh volume and gap. IP21=TISI Brooks Automation, Inc. supplies a range of technology products and solutions to the semiconductor market.  62 CBON 8.65 -.38 Breakdown below 3x tested support. OBV NC. Community Bancorp operates as the holding company for Community Bank of Nevada, which provides commercial banking products and services to small and medium-sized businesses in Nevada. Web Site: http://www.communitybanknv.com  92 CORS 5.36 -.19 Corus Bankshares OBV confirmed new low. IP21<-.25 Corus Bankshares, Inc. operates as the holding company for Corus Bank, N.A. that offers various banking products and services. It primarily engages in generating deposits and originating loans.  40 EWBC 13.18 -.48 AI/200=40 East West Bancorp, Inc., together with its subsidiaries, operates as the holding company for East West Bank, which provides a range of personal and commercial banking services to small and medium-sized businesses, business executives, professionals, and other individuals in California.  CATY 15.60 -.32 IP21=-.35 OBV at NL Cathay General Bancorp operates as the holding company for Cathay Bank, which offers various financial services for individuals, professionals, and small to medium-sized businesses primarily in California. Its deposit products include passbook accounts, checking accounts, money market deposit accounts, certificates of deposit, individual retirement accounts, college certificates of deposit, and public funds deposits  CNB 7.05 -.20 IP21>TISI on Friday OBV at NL The Colonial BancGroup, Inc. operates as the holding company for Colonial Bank, National Association, which provides commercial banking, wealth management services, mortgage banking, and insurance services in Florida, Alabama, Georgia, Nevada, and Texas.  DSL 9.12 -.68 IP21=TISU IP2=-.25 OBV at low. Newport Beach, CA 92660 Downey Financial Corp. operates as the holding company for Downey Savings and Loan Association, F.A. that provides various financial services to individual and corporate customers.  WNR 7.98 +.02 IP21=-.20 AI/200=14 OBV confirms NL heavy trading/ Western Refining, Inc., through its subsidiaries, operates as an independent crude oil refiner and marketer of refined products  |

|

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 AI/200 Stock Notes ====== ================= ==================================================== 200 CMKG 3.00 +.05 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. 196 CVF Castle Convertible 24.40 +.03 H=26 Breakout past declining long term ma at 23-23.5 IP21>.50 196 HIX 10.01 +.05 IP21=.20 Possible turn around. Now above falling 200-day ma 195 KTEC 36.07 IP21=.02 H=38.5 194 BCF 19.02 +.36 OBV confirmed NH IP21=.25 December bulge of Accumulation. 193 NGT 29.41 +.06 OBV OK ITRS=<0 IP21=.20 190 SID 50.94 +1.72 (+3.8 for week) NH OBV is OK ITRS>.221 and IP21>.10 189 PBR 70.65 +2.30 (+4.05 for week) IP21=.04 OBV confirming. False breakout in February. Careful here. On red Sell 188 BBL 85.62 +1.38 (+7.24 for week) April spike of Accum. At earlier high. Watch Very good OBV, H=78 IP21=.10. At upper band. 189 XBI 58.42 +.10 just above flat 30wk ma . H=62.4 Red Sell. 186 UBB 152.04 +3.00 (+8 for week) OBV is lagginf IP21=.2 184 ARA 88.04 +.74 (+6.53 for week) NH ONB confirms. IP21=.05 Aracruz Celulose 186 IGE 153.94 +4.30 (+7 for week) recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 185 DAIO 594 +.19 H=6.7 August bulges of Accum. ITRS<0 183 DBC 40.53 +.58 Close to NH ITRS=.01 OBV is confirming. Recent Accum. Index bulge. Commodity ETFs - metals, oil, corn, wheat. 181 LRT 2.32 +.06 IP21=.02 Lagging OBV. H=2.65 Buy B24 testing 50-dma 181 HYV 11.87 at declining 200-day ma. IP21=.48 180 IGE 153.94 +4.30 (+7 for week) On Red Sell. B24 at 140 .. Goldman Sachs Natl Resources. ................................................................................................................. 179 PLUS 12.05 -.20 Testing last week's high at 13.54 OBV strong. IP21=.25 178 HCP 34.70 -1.07 at NH OBV NC IP21=-.05 183 HEIA 39.30 -.83 H=45 IP rising .40 ITRS=.05 Red Sell Very strong OBV 179 MOS 129.66 _.73 (+3 for week) H=141 IP21=.13 OBV strong. 178 ADRE Emerging Mkts ADR 57.63 +.85 (+3 for week) H=60.10 IP21=.25 OBV is strong 178 GSG 67.96 +1.00

NH B24 Sept & April bulge of

Accum. Weakening OBV |

|

| Table 2

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. 139 ACFN 6.25 +.10 IP21=.35 OBV NH Friday breakout on red high volume. 176 ANR 68.43 Up a lot already IP21=.15 OBV is good. 173 APWR 22.50 +.35 Breakout was at 20. IP21=.47 OBV at NH B12 on Friday 194 BCF 19.02 +.36 Long base breakout. Very good OBV IP21=.25 154 BTE 29.02 +.78 March breakout was at 22. OBV strong. IP21=.25 138 BWA 55.28 +.29 swings up and down. OBV NC 156 CPE 25.74 +1.61 Breakout was at 19. OBV strong. IP21=.25 158 CVX 100.38 +1.89 Breakout was at 96. OBV NH and IP21=.25 146 EGN 74.14 +1.71 OBV NH and IP21=.25 147 EGY 7.54 +.23 breakout was at 6. 166 GGB 48.87 +2.88 IP21=.35 OBV is at NH. 156 HCH 199.48 +2.50 Feb breakout was at 150. OBV NH and IP21=.25 174 HES 128.03 +5.89 IP21=.35 OBV is at NH. 156 HP 61.26 +1.13 IP21=.25 OBV is at NH 161 JRCC 35.65 +2.39 IP21=.25 OBV is at NH Warning - This was 8 in January. 126 MAM 46.25 +.82 IP21=.60 OBV is at NH B12 on Wednesday, 42 was breakout. 145 MEE 64.52 +2.96 IP21=.30 OBV is at NH. Breakout in April was at 45. 93 MXC 19.90 +5.75 up from 5 in April. Ridiculous?! 143 NBL 101.54 +2.59 74 was breakout. OBV is at NH... IP21=.25 146 NBR 41.13 +1.06 NH confirmed by OBV and IP21>.25 134 NFG 58.80 +1.39 IP21=.25 Breakout was at 50 on March. NA PCX 93.25 +6.81 IP21=.34 OBV is at NH 135 PDE 45.95 +1.11 IP21=.30 OBV is lagging. Breakout on Friday. 149 PXD 69.73 +1.36 IP21=.35 OBV confirming NH IP21=.30 143 RTP 554.93 +8.43 Breakout on Wednesday. IP21=.25 OBV confirms 134 SM 50.31 +.78 B12 last week. OBV NC on Friday. 136 STOSY 71.75 +4.15 60 was breakout. OBV NC. OBV and ITRS are strong 143 STR 67.50 +1.69 Breakout was at 61. OBV confirms IP21=.25 141 TELOZ 34.42 +2.56 IP21=.40 Wild-swinging 130 TLM 23.92 +.73 wild swinging 144 UNP 153.00 +1.00 breakout was at 140 IP21=.25 OBV is at NH 163 WFT 88.60 +2.50 OBV is lagging IP21=.30 169 WLL 86.54 +5.51 red volume breakout on Friday with gap. OBV NC IP21=.25 146 WTI 53.23 +1.78 IP21=.35 OBV confirms 148 X 181.27 +4.66 IP21=.30 OBV NC

|

|

Table 4- Buy B12 Stocks Less than 10% fromt their highs: GIII, LGVN, NLS CTT 2.68 +.18 H=3 MAM 46.25 .61 NH running and recent B12 AI/200=126 VSCI 4.7 .49 H=6 B12 was in February. WHT 4.81 .54 NH running and recent B12 AI/200=126 |

|

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 (>-.15) and New Lows ---- New Lows --- IP21must be blow -.10 ASFI 8.73 -.05 IP21=-.25 OBV is at new low. CATY 15.60 -.32 IP21=-.35 OBV at NL CBI 6.71 -.11 IP21=-.20 OBV NC. CNB 7.05 -.20 IP21>TISI on Friday OBV at NL DSL 9.12 -.68 IP21=TISU IP2=-.25 OBV at low. FRC 4.85 -1.10 IP21<TISI IP21=-.40 OBV NC HMN 18.26 -.44 IP21=-.50 ONB NC THIN PFBC 8.54 -.73 IP21=-.27 OBV confirms Steady Distribution: AI/200<20 ISLE AI/200-=12 IP21>0 at falling 50-day ma. watch. MRLN AI/200=12 IP21=0 OBV NC BRKS 10.00 -.32 IP21= -.10 OBV NC CACB 8.93 -.06 IP21=-.05 WNR 7.98 +.02 IP21=-.20 AI/200=14 OBV confirms NL heavy trading/ Western Refining OMPI 7.82 -.12 USMO 8.08 +.22 Above 50-day ma AGYS 10.63 -.03 IP21>0 |