TigerSoft's Elite Stock Professional Report 3/7/2008 - (C) 2008 Wm. Schmidt, Ph.D. Abbreviations: price versus 50 day ma AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 A = above U = Under (Bearish) SS = Sell Short BO = Breakout

-------------------------------------------------------------------------

---- BUYS:----

AI/200 Symbol Close IP21 High/OBV Confirm ITRS

------------------------------------------------------------------

183 DBC - Commodities-ETF 37.19 -.4- IP21=.5- OBV near NH. ITRS=.30

175 AZS Arizona Star Resource 18.18 -.10 IP21=.25 ONB near NH ITRS=.08

D-fund will pursue its investment objective by investing in a

portfolio of exchange-traded futures on the commodities comprising

the index, or the index commodities. The index commodities are light,

sweet crude oil, heating oil, aluminum, gold, corn and wheat.

179 SID 37.44 -.55 IP21=.18 ITRS=.34

Companhia Sider?rgica Nacional (CSN) primarily operates as an integrated

steel producer in Brazi ... No long term chart available.

Buy on pullback below 34.

175 DBE Power Shares DB Energy IP21=.34 OBV confirming NH ITRS=.28

---- SHORT SALES: ----

Stock Close AI/200 IP21 OBV Confirming --------------------- ------- ----- ---------------- ISLE 7.85 -.12 15 -.25 NL yes Isle of Capri Casinos, Inc. and its subsidiaries engage in the development, ownership, and operation of gaming facilities and related lodging and entertainment facilities in the United States and internationally. The company owns and operates casinos in Biloxi, Lula, and Natchez, Mississippi; Lake Charles, Louisiana; Bettendorf, Davenport, Marquette, and Waterloo, Iowa; and Boonville, Caruthersville, and Kansas City, Missouri, as well as a casino and harness track in Pompano Beach, Florida. It also operates two casinos in Black Hawk, Colorado.CSGS 10.97 -.04 29 -.25 OK CSG Systems International, Inc. provides outsourced billing, customer care, and print and mail solutions and services for cable and direct broadcast satellite markets in North America. The company offers a suite of processing, software, and professional services, which allows clients to automate their customer care and billing functions. Its functions include set-up and activation of customer accounts, sales support, order processing, invoice calculation, production and mailing of invoices, management reporting, electronic presentment and payment of invoices.

BYD 18.66 -.36 36 -.35 yes Boyd Gaming Corporation operates as a multi-jurisdictional gaming company in the United States. As of December 31, 2006, it owned and operated 16 casino facilities located in Nevada, Mississippi, Illinois, Louisiana, and Indiana.

ENOC 11.26 -.66 62 -.36 yes EnerNOC, Inc. develops and provides demand response and energy management solutions to commercial, institutional, and industrial customers, as well as electric power grid operators and utilities in the United States. The company provides technology-enabled demand response and energy management solutions that enables in optimizing the balance of electric supply and demand. USMO 8.04 -.55 61 -.35 yes USA Mobility, Inc. provides wireless communications solutions to the healthcare, government, enterprise, and emergency response sectors in the United States. It offers one-way and two-way wireless messaging services including information services through its digital networks.

XRIT 7.07 -.19 67 -.37 yes X-Rite, Incorporated operates as a technology company that develops color management systems and solutions in North America, Latin America, Asia Pacific, and Europe

NT 6.75 -.53 53 -.33 yes

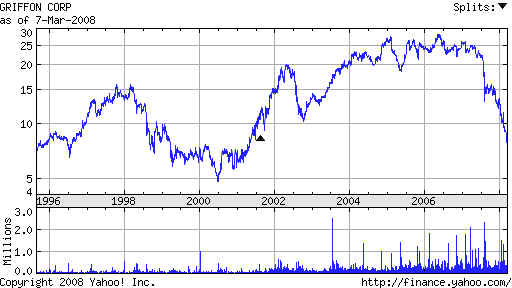

GFF 7.89 -.04 52 -.35 yes Griffon Corporation, together with its subsidiaries, operates as a manufacturing company in the United States, Germany, the United Kingdom, Canada, and Poland. It has four segments: Garage Doors, Installation Services, Specialty Plastic Films, and Electronic Information and Communication Systems. The Garage Doors segment designs, manufactures, and sells garage doors for use in the residential housing and commercial building markets.

Mostly stocks above their rising 50-day ma are listed here. BF= below falling 50-day ma

Positive Accumulation Consistency for the last year.

198 TRNS 6,75 .64 ITRS=.22 IP21=.25 H=8.03

194 DUC 11.15 +.19 ITRS=.20 IP21=<0 H=11.02

194 BCF Burlingtom Coat Fact 16,62 -.34 recent 12-month high with confirming OBV.

192 PBR 111.67 -1.86 OBV strong...IP21=.14 ITRS=.21

This has flat resistance at a set of 4 tops at 119-120. At rising 21-dma

192 BBL 63.52 -2.50 OBV is making new highs. IP21=.06

186 IGE Natl Resources 129.81 -2.46 IP21=.50 OBV very strong... H=138.63 Red Sell.

184 SVT Servotronics 19.97 +.07 IP21= .25 OBV is very strong ITRS=.60 H=20.77 thin

183 RIG 136.31 IP21=.20 ITRS=.08 H=150. OBV is lagging.

183 DBC - Commodities-ETF 37.20 -.38 IP21=.50 OBV near NH. ITRS=.26

179 SID 37.44 -.55 IP21=.14 ITRS=.42 OBV was at NH

179 JLN 8.40 +.15 at falling 200-day ma.

==================================================================================

===================================================================================

======= At New High or Close ========-

Necessary conditions

AI/200>140

IP21 (Current Accum.)>.25

AI/200=>140

confirming OBV

Itrs>.05

There are very few stocks that meet this conditions.

Bearish = NNC - S9 - IP21 on new Stock high closing.

IP21 bulge - over 45

AI/200 Symbol Close IP21 NH High/OBV ITRS

------- -------- ----- ------ ---------------- -----------

new ATAI - ATA 10.84 .04

151 DBO 38.67 +.27 .25 No .27

144 HLF - Herbalife 46.58 +1.53 .06 No .29

150 KNM - Konami 38.20 +.99 -.20 yes .32

=======================================================================

Table 4 ======= BUY B12 at 12 mo highs ========

AI/200 should be at least 100.

No Stocks Qualift this week.

Best - short Only Stocks also with an IP21<-.09 and over $5.

AI/200

With the market down already 8% from its highs and a new red

Buy signal from the NASDAQ, I post only the stocks here that

a considered "bearish" among the stocks that have recently made

a new lows. We would also want to look at high volume new lows,

because these might be special situations.

There is good evidence that the stocks when an AI/200 score less

than 62 are weaker. Tax loss selling is now a bearish factor for

them.

======================= Bearish and New Lows ============================

AI/200 should be below 62 here. Stoch should be below 21-day ma.

Stock Close AI/200 IP21 OBV Confirming

--------------------- ------- ----- ----------------

MNI 8.95 -.12 17 -.20 NL yes

BONT 5.29 -.02 15 -.20 yes

ISLE 7.85 -.12 15 -.25 NL yes

CSGS 10.97 -.04 29 -.25 OK

AGYS 11.78 +.14 11 -.17 yes

ETM 10.43 -.10 17 -.15 yes Entrecom

BYD 18.66 -.36 36 -.35 yes

JRS 14.93 -.07 20 -.35 yes ITRS=0

CHS 7.42 -.14 22 -.03 no

XING 5.89 -.31 27 -.35 yes

C 20.91 -.26 37 -.14 yes Citigroup

BX 14.58 -.47 ,,, -.17 no

GSBC 17.68 +.31 31 -.34 yes

New lows and AI/200<66 and IP21<-.20 and confirming OBV

BGV 8.47 -.02 27 -.20 yes

BGP 8.09 -.17 62 -.20 yes

ENOC 11.26 -.66 62 -.36 yes

JRN 6.48 -.02 55 -.17 yes

LGDT 7.73 -.09 63 -.36 yes

MCRY 5.47 -.28 70 -.37 yes

NTRI 12.83 -.95 66 -.95 yes

SIRF 5.63 -.18 39 -.20 yes

SLE 12.49 -.24 71 -.22 yes Sara Lee

USMO 8.04 -.55 61 -.35 yes

WM 10.71 -1.05 71 -.14 yes

XRIT 7.07 -.19 67 -.37 yes

BYD 18.66 =.36 36 -.35 yes

GXP 24.66 -.07 72 -.30 yes

NT 6.75 -.53 53 -.33 yes

UNS 21.66 -.27 75 -.18 yes

SNDK 21.41 -.58 54 -.20 yes

GFF 7.89 -.04 52 -.35 yes

See bearish charts shown on Blog for March 2,2008