TigerSoft's Elite Stock

Professional Report

5/9/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

Table 4- Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

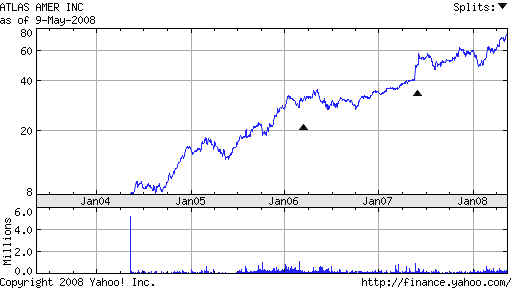

Look also at Brazilean GGB 190 SID 47.13 +.88 IP21=.05 OBV confirming. BraZIL STEEL Look also at Brazilean GGB 146 ATLS 74.42 +.22 OBV confirms and IP21>.27. tlas America, Inc., through its subsidiary, Atlas Energy Resources, LLC, operates as an independent developer and producer of natural gas and oil.  121 CE 46.35 +.76 OBV confirms NH IP21=.25 Celanese Corporation engages in the production and sale of industrial chemicals 1601 West LBJ Freeway Dallas, TX 75234-6034 United States - Map Phone: 972-443-4000 Web Site: http://www.celanese.com

|

|

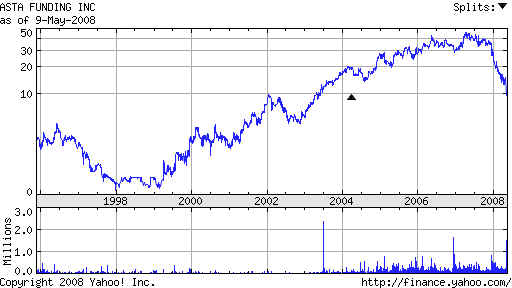

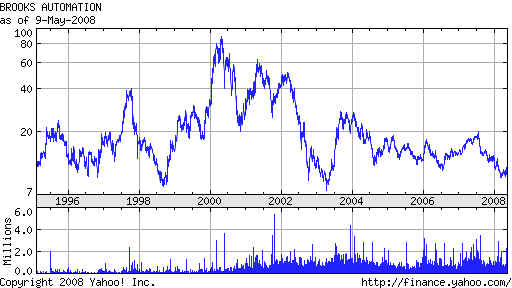

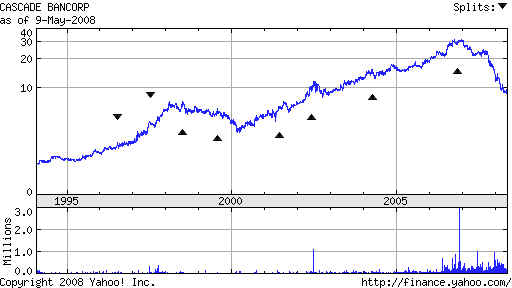

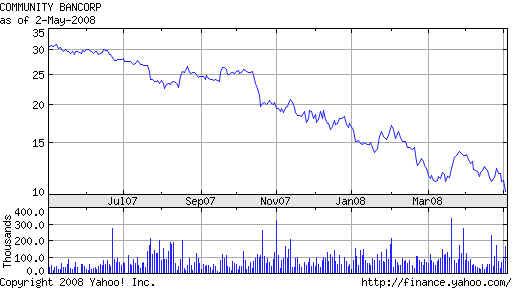

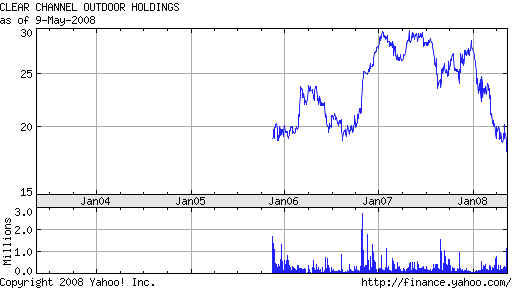

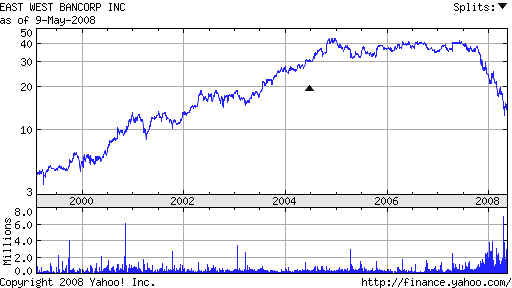

| Short Sales 33 ASFI 9.57 -.16 sta Funding, Inc., together with its subsidiaries, engages in purchasing, managing for its own account, and servicing distressed performing and non-performing consumer receivables. It acquires, manages, collects, and services portfolios of consumer receivables, including charged-off receivables...  14 BRKS 10.02 -1.04 Dropped below 50-dma on hiogh volume and gap. IP21=TISI Brooks Automation, Inc. supplies a range of technology products and solutions to the semiconductor market.  22 CACB 8.78 -.08 Cascade Bancorp operates as the holding company for Bank of the Cascades that provides commercial and retail banking services in Oregon and Idaho markets.  62 CBON 9.04 -.61 Breakdown below 3x tested support. OBV NC. Community Bancorp operates as the holding company for Community Bank of Nevada, which provides commercial banking products and services to small and medium-sized businesses in Nevada. Web Site: http://www.communitybanknv.com  58 CCO 18.05 -.84 high volume fall to new low. IP21=.15 OBV confirmed low Clear Channel Outdoor Holdings, Inc., an outdoor advertising company, owns and operates advertising display faces worldwide.  92 CORS 6.68 -.37 Corus Bankshares OBV confirmed new low. IP21<-.25 Corus Bankshares, Inc. operates as the holding company for Corus Bank, N.A. that offers various banking products and services. It primarily engages in generating deposits and originating loans.  32 ELY 13.52 -.34 IP21=-.20 OBV confirms NL Callaway Golf Company, together with its subsidiaries, designs, manufactures, and sells golf clubs and golf balls in the United States and internationally. Its products include drivers, fairway woods, hybrids, irons, wedges, putters, and golf balls.  40 EWBC 13.77 -.13 AI/200=40 East West Bancorp, Inc., together with its subsidiaries, operates as the holding company for East West Bank, which provides a range of personal and commercial banking services to small and medium-sized businesses, business executives, professionals, and other individuals in California.  |

|

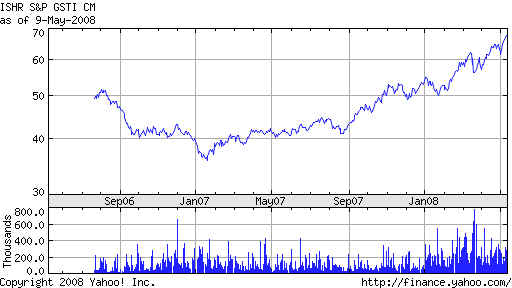

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 AI/200 Stock Notes ====== ================= ==================================================== 196 CVF Castle Convertible 22.18 +,13 H=26 Declining long term ma at 23-23.5 IP21>.50 196 HIX 9.94 IP21=.40 Possible turn around. At falling 200-day ma 195 KTEC 33.88 IP21=.05 H=38.5 194 BCF 18.30 -.03 NH December bulge of Accumulation. 193 NGT 20.32 +.28 OBV MHs ITRS=<0 IP21=.20 192 GENC 31.85 -.44 Classic explosive super stock. Breakout at 12 in January. 190 SID 47.13 +4 NH OBV is OK ITRS>.20 and IP21>.10 189 PBR 64.60 +.82 IP21=.14 OBV confirming. False breakout in February. Careful here. On red Sell 188 BBL 78.38 +.18 April spike of Accum. At earlier high. Watch Very good OBV, H=78 IP21=.25 189 CMKG 2.95 +.12 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. First stocks to move are not usually thin special situations. 189 XBI 57.22 +.11 at flat 30wk ma resistance. H=62.4 Red Sell. 186 UBB 144.44 -3.36 marginal false nh. IP21=.12 184 ARA 81.51 (1 for week) -.52 84 =12 mo resistance high. IP21=.05 186 IGE 146.69 -.60 recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 185 DAIO 5.50 +.63 H=6.7 August bulges of Accum. ITRS<0 183 DBC 40.62 +.62 NH ITRS=.08 Up off rising 50-day ma Recent Accum. Index is a bulge. Commodity ETFs - metals, oil, corn, wheat. 181 LRT 2.19 -.01 Deteriorating IP21 Lagging OBV. H=2.65 Buy B24 testing 50-dma 181 HYV 11.87 -.01 at declining 200-day ma. IP21=.48 180 IGE 146.69 (+7 for week) -.60 On Red Sell. B24 at 140 .. Goldman Sachs Natl Resources. ................................................................................................................. 179 PLUS 12.75 -.05 Testing last week's high at 13.54 OBV strong. IP21=.48 178 HCP 34.48 +.04 at NH OBV NC IP21=-.05 183 HEIA 39.61 +.17 H=45 IP rising .40 ITRS=.05 Very strong OBV 179 MOS 126.42 -.66 IP21=.13 OBV strong. 178 ADRE Emerging Mkts ADR 54.47 -.28 H=60.10

178 GSG 67.68 +4

NH B24 Sept & April bulge of Accum. Weakening OBV |

|

| Table 2

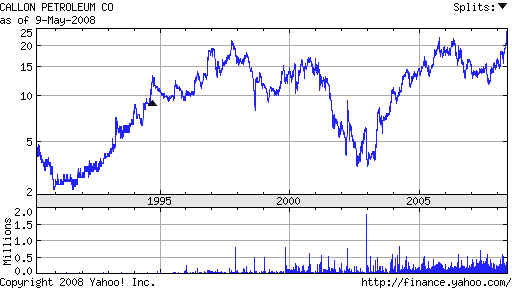

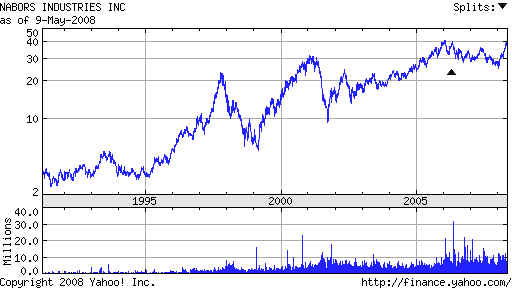

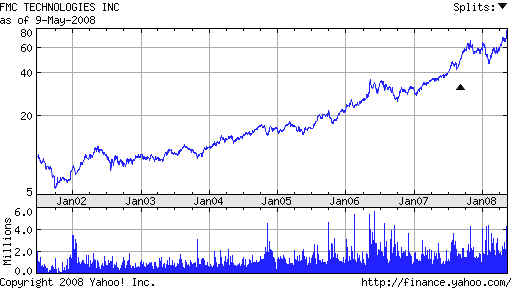

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. 141 AMEN Crosstalk.com 10.29 +1.12 B24 IP21=.40 ITRS=.33 OBV NC THIN 146 ATLS 74.42 +.22 OBV confirms and IP21>.27. 154 BTE 25.25 +.94 OBV NC IP21-.30 170 BZP 23.67 +1.77 OBV NC IP21=.25 121 CE 46.35 +.76 OBV confirms NH IP21=.25 152 CPE 24.12 +.26 OBV confirms NH IP21=.25 134 CWEI 75.32 +4.55 OBV confirms NH IP21=.20 179 DBE 48.46 +1.07 OBV confirms NH IP21=.33 193 DBC 40.57 +.57 OBV NC IP21=.30 High IP21 for a long time. 127 DRS 74.80 +.91 B12 and OBV confirms 161 FDG 71.59 +1.89 OBV NC IP21=.25 155 GEOI 20.03 +1.30 OBV confirms IP21=.06 High IP21 for a long time. 166 GGB 43.47 +.93 IP21=.25 OBV at NH 141 GIFI 43.49 +1.59 IP21=.25 OBV at NH Gulf Island Fabriaction 177 GSG 67.68 +.64 IP21=.40 OBV at NH 156 HCH 189.48 +2.50 IP21=.20 OBV at NH 155 HP 57.98 +.69 IP21=.34 139 ICO 9.62 +.24 IP21=.20 141 IEZ 73.47 +.31 IP21=.25 OBV NC October bulge of Accum. 143 MEF 58.96 +.78 IP21=.27 OBV NC 163 MRB 7.56 +.15 IP21=.20 OBV NC 141 NBR 39.66 +.13 IP21=.29 OBV confirming. 144 PDC 18.30 +.03 IP21=.35 OBV NC 190 SID 47.13 +.88 IP21=.05 OBV confirming. 132 SPN 52.60 +1.28 IP21=.40 OBV confirming. Security of PA 166 USO 102.30 +1.37 IP21=.55! OBV confirming 141 WTI 49.03 +.41 IP21=.30 OBV confirming 158 FTI 77.85 +3.59 IP21=.25 OBV confirming

|

|

Table 4- Buy B12 Stocks AMEN 10.29 +1.12 is close to a B12 CTT 2.65 -.08 3.75=12 mo high. CTV 51.04 +.45 H=63 DRS 74.80 +.91 Close to a B12. gap on high volume. ENER 47.74 -2.17 High volume Gap. GENC 31.85 -.44 B12 in April IDRA 14.54 -.10 IDTI 12.18 +.01 16.5=12 mo high INVR 0.76 12 mo high = 2 NGAS 8.02 -.13 12 mo high= 9 NYNY 3.44 +.12 12 mo high = 9.5 SPN 52.60 +1.28 ITRS=.22 VSCI 5.90 +.32 |

|

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 and New Lows ---- New Lows --- IP21must be blow -.10 62 CBON 9.04 -.61 Breakdown below 3x tested support. OBV NC. 58 CCO 18.05 -.84 high volume fall to new low. IP21=.15 OBV confirmed low 41 CIX 6.10 -.17 Confirmed new low. IP21=-.30 92 CORS 6.68 -.37 Corus Bankshares OBV confirmed new low. IP21<-.25 55 DK 10.15 -.20 IP21=-.20 OBV confirms NL 39 DPSG 8.48 -.23 confirmed NL IP21= -.25 32 ELY 13.52 -.34 IP21=-.20 OBV confirms NL 37 MCGC 6.45 -.15 66 PFBC 10.16 -.41 IP21=-.25 OBV at NL 63 TSO 21.98 -1.27 Confiirmed NL |