TigerSoft's Elite Stock

Professional Report

5/2/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

Table 4- Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

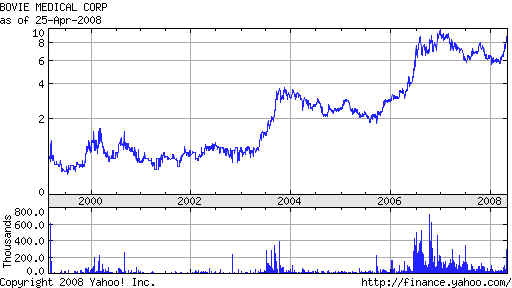

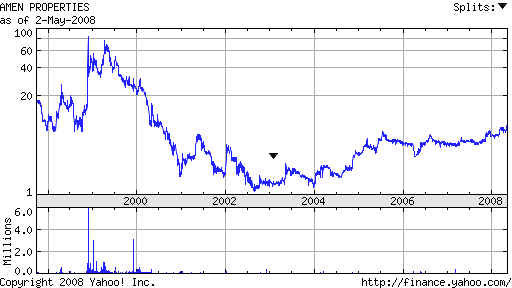

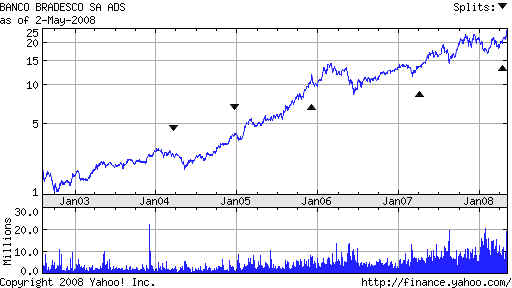

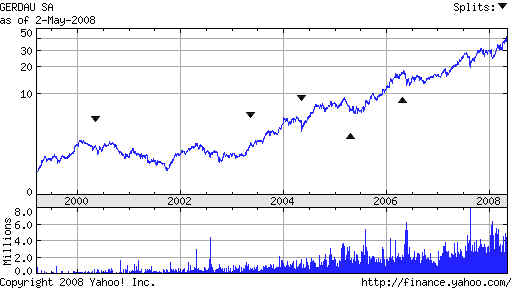

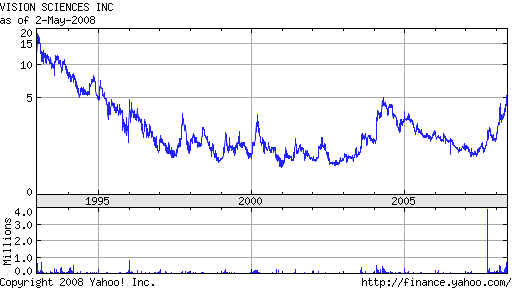

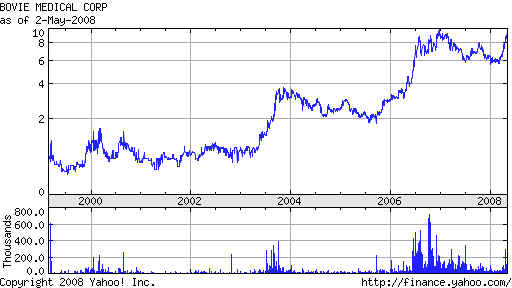

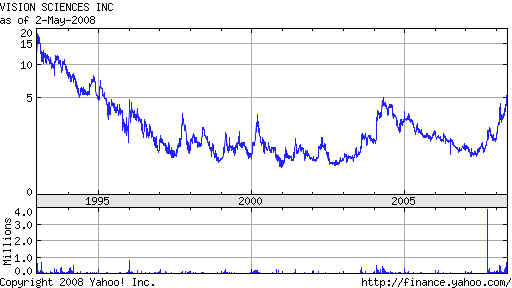

| Buys

The best below are SID, BVX, AMEN, BBD, GGB, IDRA, VSCI. Brazilian stocks stand out in this list: SID, BBD and GGB 190 SID 43.31 -.03 H=45.24 recent NH OBV is OK ITRS=0 and IP21>.10 42=support Companhia Sider?rgica Nacional (CSN) primarily operates as an integrated steel producer in Brazil. Previously recommended and striog. 147 BVX 9.09 +.14 IP21=.48 Buy B10,B12, B20 on 4/25/08 Needs to surpass 10. Bovie Medical Corporation engages in the manufacture and marketing of medical products and the development of related technologies. 162 employees Web Site: http://www.boviemedical.com  138 AMEN Crosstalk.com 9.25 +.25 B24 IP21=.40 ITRS=.27 OBV NC THIN AMEN Properties, Inc., together with its subsidiaries, acquires investments in commercial real estate, oil and gas royalties, retail electricity operations, and energy related business properties in the United States.  168 BBD 24.60 +.19 Red high vol breakout on Thursday. IP21>.25 Banco Bradesco S.A. provides a range of banking and financial products and services in Brazil and internationally to individuals, small to mid-sized companies, and local and international corporations and institutions.  166 GGB 41.79 +2.11 OBV confirms NH and IP21>,25 Gerdau S.A., through its subsidiaries, produces and sells steel and related long rolled products, drawn products, and long specialty products.  160 IDRA 14.76 +.21 B24 OBV confirms. IP21>.45 ITS=.28 Web Site: http://www.iderapharma.com Full Time Employees: 38 dera Pharmaceuticals, Inc., a biotechnology company, engages in the discovery and development of synthetic DNA and RNA-based compounds for the treatment of cancer, infectious diseases, autoimmune diseases, asthma/allergies, and for use as vaccine adjuvants.  102 VSCI 5.23 +.46 IP21=.55 OBV confirming ITRS=.45 Web Site: http://www.visionsciences.com Full Time Employees: 38 Vision-Sciences, Inc. engages in the design, development, manufacture, and marketing of endoscopes and disposable endosheaths for the medical device market, and flexible borescopes for the industrial device markets primarily in the United States.|  |

|

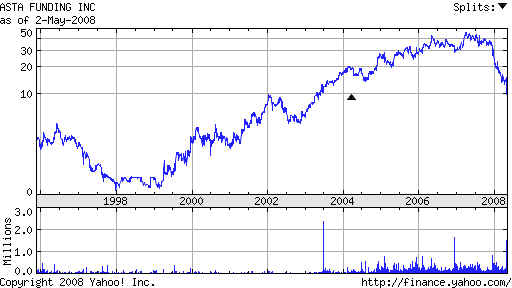

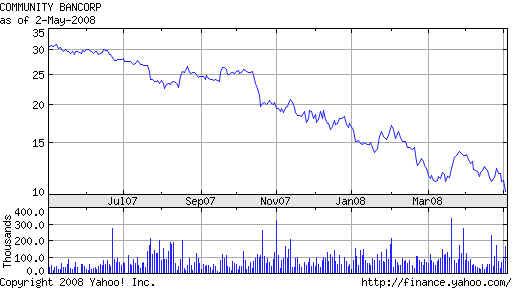

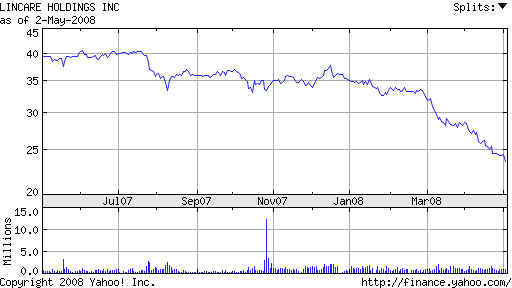

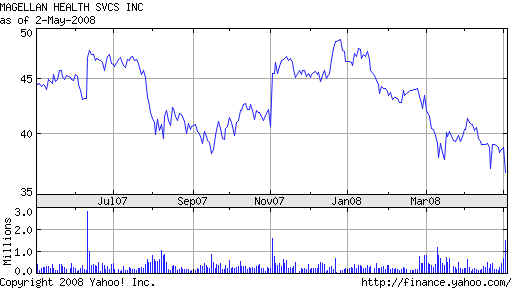

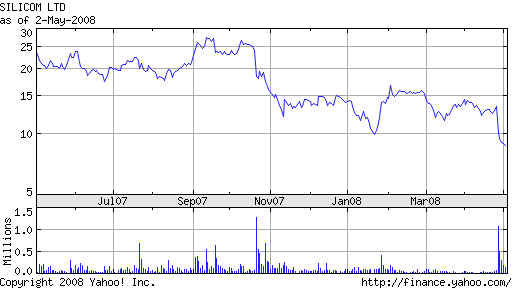

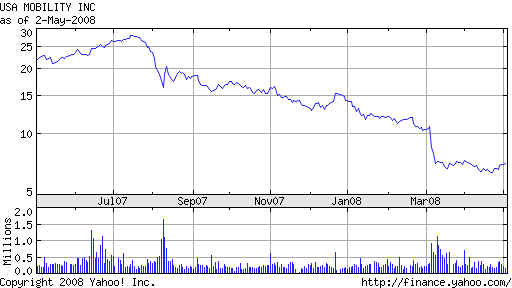

| Short Sales 36 ASFI 9.71 -5.29 Below lower band. OBV confirms low. Asta Funding, Inc., together with its subsidiaries, engages in purchasing, managing for its own account, and servicing distressed performing and non-performing consumer receivables. It acquires, manages, collects, and services portfolios of consumer receivables, including charged-off receivables, semi-performing receivables, and performing receivables. Web Site: http://www.astafunding.com  62 CBON 10.29 - 89 Breakdown below 3x tested support. OBV NC. Community Bancorp operates as the holding company for Community Bank of Nevada, which provides commercial banking products and services to small and medium-sized businesses in Nevada. Web Site: http://www.communitybanknv.com  98 LNCR 23.65 -.76 IP21<-.30 OBV confirming. Lincare Holdings, Inc., together with its subsidiaries, provides oxygen and other respiratory therapy services to the home health care market in the United States  67 MGLN 36.71 -2.08 IP21<-.25 OBV NC. Magellan Health Services, Inc. provides managed behavioral healthcare, radiology benefits management, and pharmaceutical management services in the United States.  82 SILC 8.80 -.22 IP21=-.40 OBV confirms. Silicom, Ltd., through its subsidiary, Silicom Connectivity Solutions, Inc., engages in the design, manufacture, marketing, and support of connectivity solutions for a range of servers and server-based systems in Israel, the United States, and internationally. It primarily manufactures server networking cards with and without bypass (Server Adapters), and legacy products, including connectivity solutions for portable personal computers and broadband Internet access products.  ---- Bearish with IP21<Tisi (21-day ma of Accum Index) 23 USMO 7.18 +.08 USA Mobility, Inc. provides wireless communications solutions to the healthcare, government, enterprise, and emergency response sectors in the United States.  |

|

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 AI/200 Stock Notes ====== ================= ==================================================== 196 CVF Castle Convertible 22.05 H=26 Declining long term ma at 23-23.5 IP21>.50 196 HIX 9.88 +.03 IP21=.50 Possible turn around. At falling 200-day ma 195 KTEC 33.27 -.63 IP21=.05 H=38.5 194 BCF 17.48 December bulge of Accumulation. Tested 50-day ma. Red Sell. 193 NGT 28.32 +.28 OBV MHs ITRS=<0 IP21=.20 192 GENC 29.95 +2.27 Classic explosive super stock. Breakout at 12 in January. 190 SID 43.31 -.03 H=45.24 recent NH OBV is OK ITRS=0 and IP21>.10 42=support 189 PBR 124.42 IP21-,20 OBV confirming. False breakout in February. Careful here. On red Sell 188 BBL 74.52 +3.40 April spike of Accum. Tested 50-dma. Very good OBV, H=78 IP21=.30 189 CMKG 3.05 +.05 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. First stocks to move are not usually thin special situations. 189 XBI 57.48 +.04 at flat 30wk ma resistance. H=62.4 Red Sell. 186 UBB 155.66 +4.09 marginal nh. IP21=.05 184 ARA 80.65 +.71 84 =12 mo resistance high. IP21=<0 186 IGE 139.52 +2.37 recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 185 DAIO 5.60 +.10 H=6.7 August bulges of Accum. ITRS<0 184 JLN 8.35 -.10 IP21=.02 H=12 Strong OBV. At rising 50-dma 183 DBC 37.99 _.94 H=39.3 ITRS=.02 Up off rising 50-day ma Recent Accum. Index is a bulge. Commodity ETFs - metals, oil, corn, wheat. 181 LRT 2.26 -.03 IP21=.50 Lagging OBV. H=2.65 Buy B24 181 HYV 11.78 +.09 6 at declining 200-day ma. IP21=.54 180 IGE 139.52 +2.37 On Red Sell. B24 at 140 .. Goldman Sachs Natl Resources. ................................................................................................................. 179 PLUS 13.15 -.24 Testing last week's high at 13.54 OBV strong. IP21=.48 178 HCP 35.70 -.10 at NH OBV NC IP21=-.05 179 HEIA 40.97 -.02 H=45 IP rising .40 ITRS=.08 Very strong OBV 179 MOS 124.63 +2.08 IP21=.13 OBV strong. 178 ADRE Emerging Mkts ADR 55.49 +.68 H=60.10 178

GSG 63.08 +1.55 NH B24

Sept & April bulge of Accum. Weakening OBV |

|

| Table 2

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. 138 AMEN Crosstalk.com 9.25 +.25 B24 IP21=.40 ITRS=.27 OBV NC THIN 117 ANYS 43.47 thin, OBV NC AREX 20.22+.76 new issue declining Accum 162 AXYS 56.71 +1.47 July bulge of Accum up more than 10% since then. steadily positive Accum. OBV lagging. 120 BABY 21.24 +.26 flat topped breakout. lagging OBV 168 BBD 24.60 +.19 Red high vol breakout on Thursday. IP21>.25 147 BVX 9.09 +.14 IP21=.48 Buy B10,B12, B20 on 4/25/08 132 CTRP 67.77 +2.72 Breakout past 4 tops at 63. IP21=.25 ITRS=.20 149 EBIX 88.31 +3.32 Previously 3 separate bulges of high Accum. Overpowering OBV NC IP21<0 at upper band. 166 GGB 41.79 +2.11 OBV confirms NH and IP21>,25 124 GHM 62.70 +4.47 NH on high volume. IP21=.20 Sept bulge of Accum. 160 IDRA 14.76 +.21 B24 OBV confirms. IP21>.45 ITS=.28 123 KTII 140.47 +1.89 IP21=.50 OBV at NH very thin 126 SM 45.30 +2.86 IP21=.45 high volume NH 126 SOHU 77.68 +2.24 IP21=.34 OBV at NH gap with high volume. Breakout was at 65. 102 VSCI 5.23 +.46 IP21=.55 OBV confirming ITRS=.45

|

|

Table 4- Buy B12 Stocks 147 BVX 9.09 +.14 IP21=.5 ITRS=.42 Breakout was at 8.25 Bovie Medical Corporation engages in the manufacture and marketing of medical products and the development of related technologies. Number of employees = 162 Web Site: http://www.boviemedical.com  106 VSCI 5.23 +.46 IP21=.55 ITRS=.40 Recent breakout ay 4.5 Vision-Sciences, Inc. engages in the design, development, manufacture, and marketing of endoscopes and disposable endosheaths for the medical device market, and flexible borescopes for the industrial device markets primarily in the United States. Number of employees = 92 Web Site: http://www.visionsciences.com  |

|

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 and New Lows ---- New Lows --- IP21must be blow -.10 36 ASFI 9.71 -5.29 Below lower band. OBV confirms low. 62 CBON 10.29 - 89 Breakdown below 3x tested support. OBV NC. 80 LAVA 7.00 - 2.57 Gap and high volume drop. Did not close at lows. 98 LNCR 23.65 -.76 IP21<-.30 OBV confirming. 67 MGLN 36.71 -2.08 IP21<-.25 OBV NC. 66 PFBC 11.39 -.28 IP21<-.27 OBV confirms 82 SILC 8.80 -.22 IP21=-.40 OBV confirms. ---- Bearish with IP21<Tisi (21-day ma of Accum Index) 23 USMO 7.18 +.08 36 ASFI 9.71 -5.29 33 PNSN 10.25 -.74 Must also drop back below rising 50-dma at 9.77 22 LEE 7.90 -.01 |