TigerSoft's Elite Stock

Professional Report

6/1/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

and Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

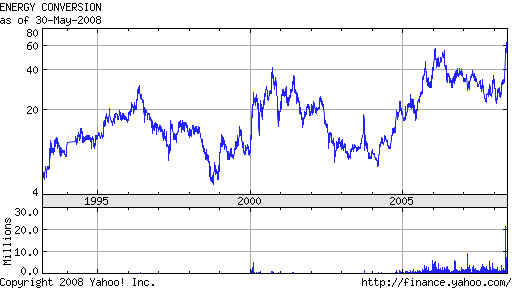

164 AXYS 59.16 +1.90 IP21=.15 red high volume breakout from flat top. OBV at NH http://www.axsys.com Axsys Technologies, Inc. designs and manufactures precision optical solutions for defense, aerospace, homeland security, and commercial applications. The company operates in two Segments, the Surveillance Systems Group and the Imaging Systems Group. 166 CLR 64.17 +2.62 Start of move was at 30. amd running still. OBV at NH. IP21=.25http://www.contres.com Continental Resources, Inc. operates as a crude-oil concentrated, independent oil and natural gas exploration and production company. 148 CWEI 94.27 +9.75 Bulge of Accum in October. IP21=.25 OBV confirms. http://www.claytonwilliams.com Clayton Williams Energy, Inc., an independent oil and gas company, engages in the exploration for and production of oil and natural gas properties primarily in Texas, Louisiana, and New Mexico. 61 ENER 63.48 +8.78 B12 up from 35 in April. http://www.ovonic.com Energy Conversion Devices, Inc. commercializes materials, products, and production processes for the alternative energy generation, energy storage, and information technology markets. The company operates in two segments: United Solar Ovonic and Ovonic Material 1204 employees  161 FDG 80 +2.37 Minor flat topped breakout. NH ITRS>.45 IP21=.30 OBV confirming http://www.fording.ca Fording Canadian Coal Trust operates as an open-ended mutual fund trust in Canada. The company holds a 60% interest in Elk Valley Coal, which produces and sells metallurgical coal that is used for making coke by integrated steel mills. 150 FMC 73.98 +1.95 IP21=.43 ITRS=.31 http://www.fmc.com FMC Corporation, a chemical company, provides solutions, applications, and products to various end markets worldwide. It operates through three segments: Agricultural Products, Specialty Chemicals, and Industrial Chemicals. |

|

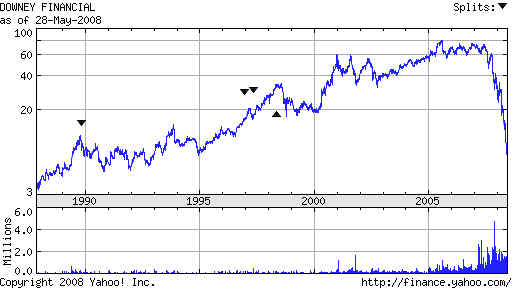

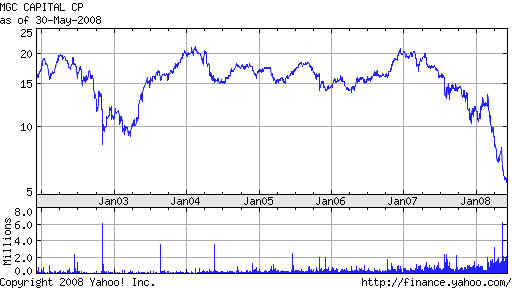

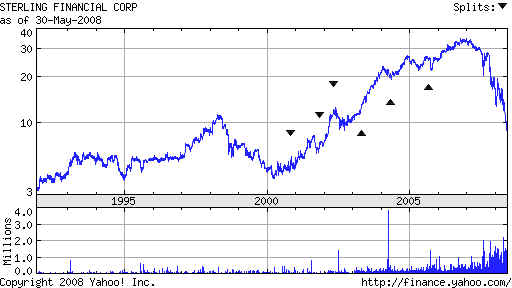

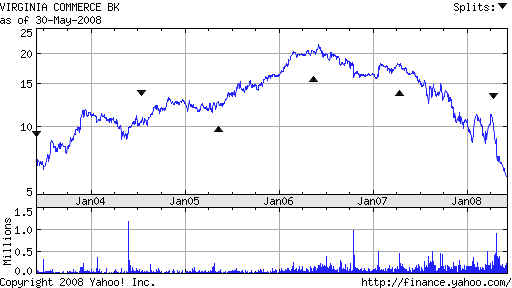

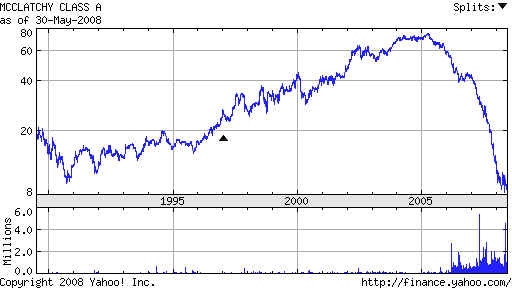

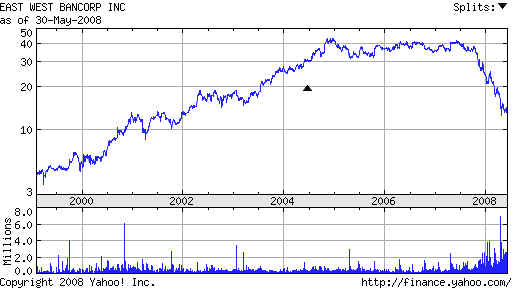

| Short Sales CUTR 10.24 -.07 IP21=-.15 OBV at NL IMPORTANTL - This could rebound from lows just below 9. This chart shows what to be on alert for from them.  DSL 6.72 -.75 IP21=-.32 OBV at NL  MCGC 5.73 -.21 IP21=-.25 OBV at NL  STSA 8.88 -.45 IP21= -.20 OBV at NL  VCBI 6.05 -.14 IP21=-.30 OBV at NL  MNI 8.80 -.32 AI/200=38 IP21= -.50  EWBC 13.24 -.50 AI/200=40 IP21=-.25  WM 9.02 -.17 AI/200=59  |

|

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 AI/200 Stock Notes ====== ================= ==================================================== 200 CMKG 2.95 +.12 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. 200 CVF Castle Convertible 24.54 +.04 H=26 Breakout past declining long term ma at 23-23.5 IP21>.50 196 HIX 9.98 +.01 IP21=.10 Possible turn around. Now below falling 200-day ma 195 KTEC 36.57 +.92 IP21=.01 H=38.5 194 BCF 18.47 +.08 OBV confirmed NH IP21=.25 Red Sell. December bulge of Accumulation. 190 SID 49.17 +.12 NH OBV is OK ITRS>.27 and IP21>.15 189 PBR 70.50 -.28 IP21=.04 OBV confirming. 188 BBL 76.36 -,74 April spike of Accum. At earlier high. Watch 188 HEIA 39.62 +3.26 H=45 IP rising .35 ITRS=<0 Red Sell Very strong OBV 186 XBI 59.96 -.15 H=62.4 Red Sell OBV lagging 186 UBB 156.87 +5.68 OBV is lagging IP21=.2 184 ARA 90.74 +1.19 NH OBV NC . IP21=.15 Aracruz Celulose 186 IGE 150.12 +1.59 recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 185 DAIO 5.89 H=6.7 IP21=.55 ITRS=.32 Red Sell Support at 21-day ma. 183 DBC 40.55 +.27 Running ITRS=.04 OBV is confirming. Recent Accum. Index bulge. Commodity ETFs - metals, oil, corn, wheat. 182 ISYS 39.59 -.22 NH IP21=.50 B12 OBV confirming run. 180 RIG 150.19 -1.89 IP21=.05 H=161 OBV NC ................................................................................................................. 179 PLUS 11.90 -.42 Tested rising 50-dma. IP21=.25 Steady high acdcumulation. 178 HCP 34.26 -.33 H=38.25 OBV NC IP21=-.05 179 TS 61.38 +.93 OBV lagging IP21=.30 179 MOS 125.32 +3.53 H=141 IP21=.13 OBV strong. 178 ADRE Emerging Mkts ADR 56.42 +.40 H=60.10 IP21=.12 178

GSG 67.90 +.58 NH B24 Sept

& April bulge of Accum. Weakening OBV |

|

| Table 2

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. 147 ACEN 6.37 IP21=.24 OBV confirms previous bulge in April B24 124 ACTL 17.15 +.25 IP=.25 OBV NH flat topped breakout. IP21=.25 183 ANR 81.68 +3.35 IP21=.24 OBV at NH 164 AXYS 59.16 +1.90 IP21=.15 red high volume breakout from flat top. OBV at NH 107 BNI 113.05 +1.18 166 CLR 64.17 +2.62 Start of move was at 30. amd running still. OBV at NH. IP21=.25 148 CWEI 94.27 +9.75 Bulge of Accum in October. IP21=.25 OBV confirms. 61 ENER 63.48 +8.78 B12 up from 35 in April. 161 FDG 80 +2.37 Minor flat topped breakout. NH ITRS>.45 IP21=.30 OBV confirming 150 FMC 73.98 +1.95 IP21=.43 ITRS=.31 188 HIL 16.15 +.19 OBV at NH IP21=.10 154 PVA 63.02 +10.02 IP21=.35 OBV at NH 150 SBR 65.00 +2.20 IP21=.23 OBV at NH 150 SPX 132.68 +2.70 IP21=.20 OBV confirming. IP21=.22 147 WDC 37.53 +.64 IP21=.37 OBV at NH

|

|

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 (>-.15) and New Lows ---- New Lows --- IP21must be blow -.10 BL 13. 13.70 IP21=-.20 OBV Confirming CUTR 10.24 -.07 IP21=-.15 OBV at NL DSL 6.72 -.75 IP21=-.32 OBV at NL MCGC 5.73 -.21 IP21=-.25 OBV at NL STSA 8.88 -.45 IP21= -.20 OBV at NL VCBI 6.05 -.14 IP21=-.30 OBV at NL Bearish ASFI 8.17 -.03 AI/200=30 LEE 6.80 -.01 AI/200=22 MNI 8.80 -.32 AI/200=38 IP21= -.50 EWBC 13.24 -.50 AI/200=40 IP21=-.25 GSBC 11.55 -.01 AI/200=36 IP21= -.15 ABCW 14.02 -.72 Anchor Bancorp AAR 18.95 -.54 AAR Corp BAMM 7.50 -.47 Books-A Million IP21=-.05. BYD 15.53 -.81 Biyd Gaming Corporation IP21=-.14 CAL 13.18 -1.16 IP21=-.15 OBV confirming. CNB 6.38 -.24 Colonial BancGroup -.25 CRBC 5.74 -.26 IP21=-.40 DSL 8.29 -.55 IP21= -.18 Downey Financial FTBK 14.36 -.32 IP21=-.30 Marginal new low. OBV NC HZO 10.31 -.45 IP21=-.05 Maginal new low. LEE 6.69 -0.22 IP21=-.07 MBWM 8.75 -.02 IP21=-.30 PNCL 6.63 -.37 IP21=-.30 SBKC 5.50 -.27 IP21=-.40 SKYW 14.87 -.61 IP21=.13 VCBI 6.40 -.15 IP21=.30 CRFT 6.45 -.04 IP32=-.35 CTB 11.38 -.27 IP21=-.30 Cooper Tire and Rubber Steady Distribution: AI/200<20 ASFT AI/200=32 7.37 +.29 IP21=-.25 CACB AI/200=19 8.60 -.15 IP21<TISI Cascade Bank CIX AI/200=36 5.91 -.19 IP21=-.30 EWBC AI/200=40 13.80 -.08 IP21=-.15 East West Bank GSBC AI/200=36 11.79 -.15 IP21=-.10 Great So. Bank LEE AI/200=22 6.69 -.22 IP21= -.10 MNI AI/200=38 9.02 -.04 IP21=-.20 AI/200=38 NTGR AI/200=44 18.40 -.28 IP21=-.20 AI/200=44 XING AI/200=14 6.27 -.10 IP21=-.25 |