TigerSoft's Elite Stock

Professional Report

6/8/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

Look also at a new list, Table 3.

This shows stocks with significant Accumulation Index bulges at some time this past year.

These stocks will show a Buy B24 if they make a new high. Use Buy B6, B7, B8 and

B9s.

Buy on pullbacks to a 50-day and a 50-day ma.

Contents:

Bullish Selections

Bearish Selections

Table 1 - Highest AI/200 Stocks

Table 2 - New High Stocks -

Table 3 - Accumulation Index Bulges

and Buy B12 Stocks

Table 5 - New Lows/Bearish Stocks - over $5.00

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

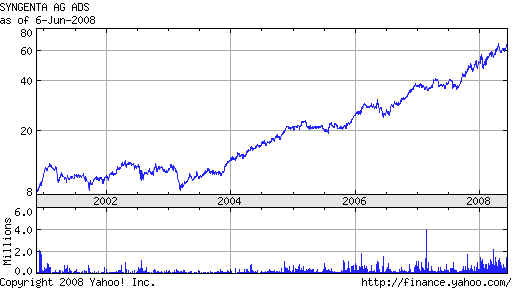

195 SYT 63.52 +2.23 IP21=.20 H=66 Very Good OBC Syngenta AG, an agribusiness company, operates in crop protection and seeds businesses worldwide. http://www.syngenta.com  177

PHX 35.15 +1.90 IP21=.20

OBV NC H=31.80 bulge of Accum in April.

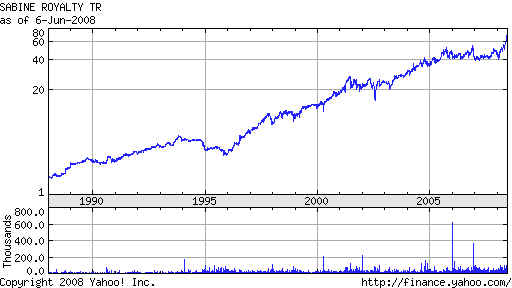

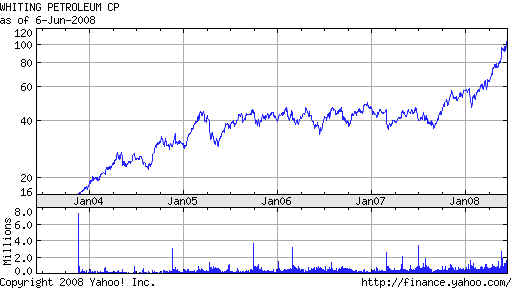

WLL 180 +3.54 IP21=.30 OBV NC

Very powerful because of consistently high levels of Accum. |

|

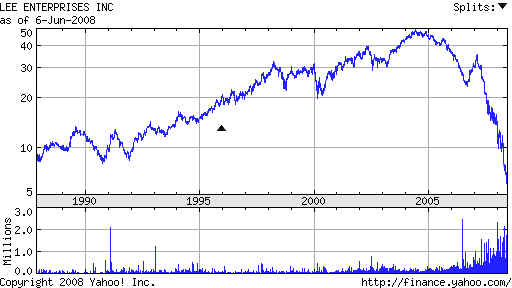

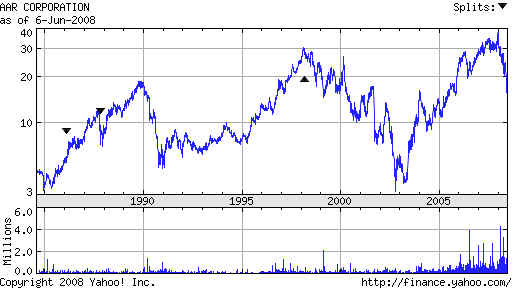

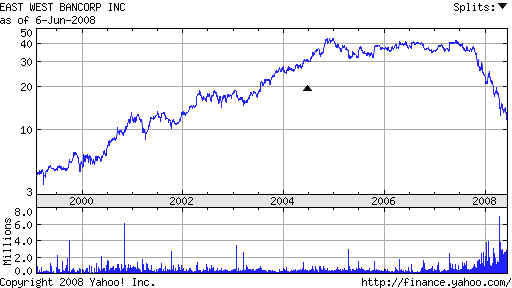

| Short Sales AIR 15.89 -1.56 OBV confirming NL.... AAR Corp  EWBC 11.69 -.81 OBV confirmingNL . East West Bancorp Also Bearish. Pasadena, CA 91101 http://www.eastwestbank.com  LEE 5.95 -.56 OBV confirming NL. Lee Enterprises. Also Bearish Lee Enterprises, Incorporated publishes daily newspapers, weekly newspapers, and specialty publications in the United States. http://www.lee.net

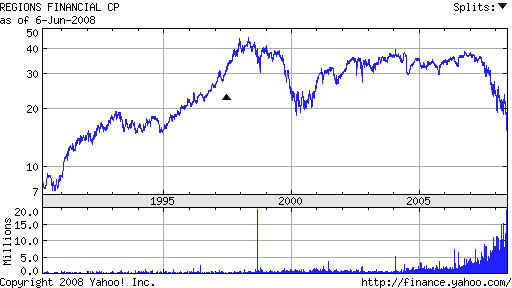

RF 15.45 -1.09

IP21=-.30

WGO 13.15 -.61 IP21=-.25

OBV confirms Winnebago

|

|

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 Changes were for last week, unless otherwise stated. AI/200 Stock Notes ====== ================= ==================================================== 200 CMKG 2.95 +.05 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. 200 CVF Castle Convertible 24.32 -.22 H=26 Breakout past declining long term ma at 23-23.5 IP21>.50 196 HIX 10. +.02 IP21=.05 Possible turn around. Now slightly above rising 200-day ma | 195 SYT 63.52 +2.23 IP21=.20 H=66 Very Good OBC 195 KTEC 37.64 +1.07 IP21=.25 H=39.25 this week. OBV is lagging. 194 BCF 18.72 +.25 OBV confirmed NH IP21=.20 Red Sell. December bulge of Accumulation. 190 SID 48.21 -.96 NH OBV is OK ITRS>.27 and IP21>.15 189 PBR 68.97 -4.32 IP21<0 OBV OK 188 BBL 74.77 -1.59 IP21<0. April spike of Accum. At earlier high. Back to rising 50 dma 187 HEIA 33.50 -6.12 H=45 IP<9 ITRS=-.14 Red Sell Very strong OBV 186 XBI 59.35 -.61 H=62.4 IP21=.30 Red Sell OBV lagging 186 UBB 144.25 -12.62 OBV is lagging IP21=.1 Red buy 192 ARA 87.44 -3.30 marginal NH IP21=.15 Aracruz Celulose 179 IGE 151.42 +1.140 IP21<0 recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 185 DAIO 5.89 H=6.7 IP21=.55 ITRS=.32 Red Sell Support at 21-day ma. 183 DBC 40.55 +.27 Running ITRS=.04 OBV is confirming. Recent Accum. Index bulge. Commodity ETFs - metals, oil, corn, wheat. 182 ISYS 36.72 -2.87 NH IP21=.40 B12 OBV confirming run. Below rising 21-dma 180 RIG 143.50 -3.97 daily change IP21=.05 H=161 OBV NC ................................................................................................................. 179 PLUS 10.90 -1.00 Broke below rising 50-dma. IP21=.20 Steady high acdcumulation. 187 HCP 33.76 -.50 Below rising 50-dma H=38.25 OBV NC IP21=-.12 179 TS 64.65 +3.37 OBV lagging badly. IP21=.25 179 MOS 133.36 +8.05 H=141 IP21=.05 OBV strong. 178 ADRE Emerging Mkts ADR 54.07 - 2.35 H=60.10 IP21=.05 head and shoulders top? 178 GSG 72.68 +4.78

NH B24 Sept & April bulge of Accum. Weakening OBV |

|

| Table 2

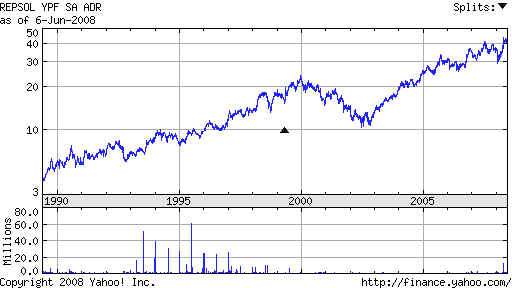

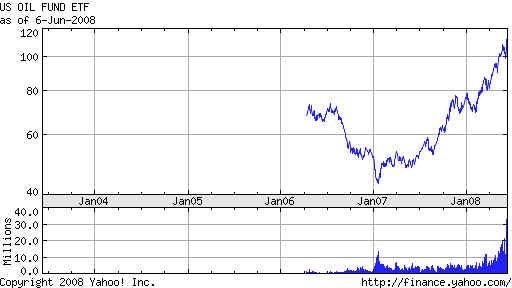

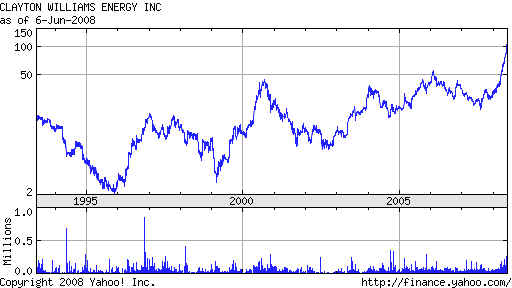

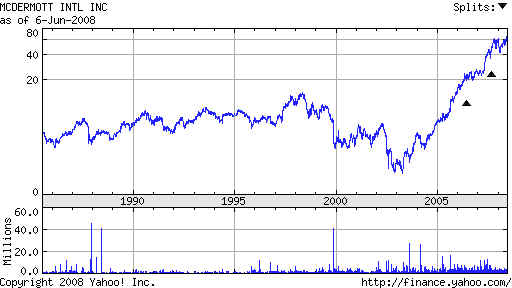

- New High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 Consider a stock with an Accum. Index bulge over .50 to be capable of advancing for 12 months after the bulge. Daily change in price shown hereafter. 169 ACI 72.79 +2.13 IP21=.10 NH confirmed by OBV 154 BTE 32.18 +1.19 IP21=.20 OBV NC 156 BUCY 75.36 +1.57 IP21<0 OBV confirmed high At upper band. 112 CHP 8.04 +1.28 IP21=.35 Friday breakout above 7. B10, B20 171 CLR 74.50 +4.69 IP21=.20 Up from 40 in March. 128 CMP 81.00 +1.57 IP21=.25 OBV confirming NH 105 CRR 54.20 +.12 IP21=.25 OBV not making a 12 mo high. 153 CWEI 104.34 +2.89 IP21=.27 UP from 40 in March. OBV confirming. 128 CXO 36.11 +3.58 Look at bulge of Accum last August. 183 DBC 43.20 +2.19 IP21=.15 177 DBE 52.74 +2.77 IP21<0 OBV NC DB Energy 172 DBO 50.55 +3.17 IP21=.15 OBV confirming 174 GSG 72.68 +4.08 IP21<0 OBV NC 177 GTLS 45.25 +2.67 IP21=.30 OBV NC Triple top breakout on friday. 152 HOS 54.65 +.44 IP21=.04 132 IPHS 29.88 +.98 IP21=.35 OBV is confirming. Up from 17 in early April. 161 MDR 65.42 +.36 IP21=.24 OBV NC 7 times breakout. 159 MEE 73.42 +1.07 IP21=.05 OBV NC 171 NOG 14.15 +.61 IP21<0 ITRS=.70 See bulges of Accum at start of move in September 109 PCX 135.46 +.69 IP21=.26 OBV confirming. Reversal Day? 153 PXD 76.02 +.67 IP21=.10 OBV NC Pioneer Natl Resources 151 SBR 69.50 +4.00 IP21=.24 OBV confirming. 120 SD 59.81 +1.86 IP21=.05 OBV is confirming. 122 SHS 34.32 +.92 IP21=.30 OBV is confirming 148 SM 53.12 +2.20 IP21=.20 Bulge of accum in April. OBV is not confirming. Sulzer Medica 160 SQNM 11.87 +.72 IP21=.20 OBV confirming. High volume started Wednesday. Bulge of Accumulation back in October. 184 UPL 98.55 +1.07 IP21=.05 OBV is confirming. 168 USO 112.15 _8.43 IP21=.12 OBV NC Oil 180 WLL 180 +3.54 IP21=.30 OBV NC Very powerful because of consistently high levels of Accum.

|

|

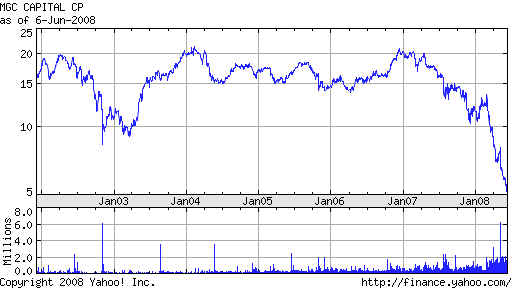

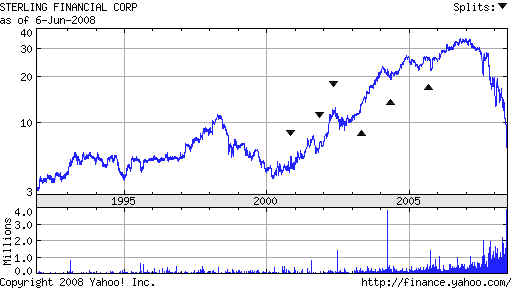

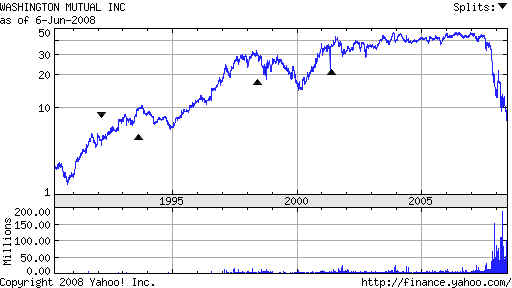

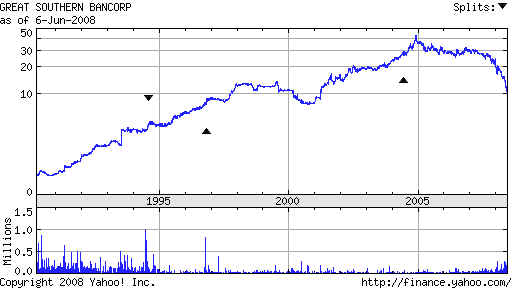

| Table 5 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 (>-.15) and New Lows ---- New Lows --- IP21must be blow -.10 ABCW 12.46 -.79 OBV confirming NL Anchor Bancorp Wisconsin AIR 15.89 -1.56 OBV confirming NL.... AAR Corp CBON 6.48 -.55 not confirming. EWBC 11.69 -.81 OBV confirmingNL . East West Bancorp Also Bearish. LEE 5.95 -.56 OBV confirming NL. Lee Enterprises. Also Bearish MCGC 5.17 -.27 IP21= -.35 OBV at NL Also Bearish PNCL 6.04 -.36 IP21=-.35 RF 15.45 -1.09 IP21=-.30 STI 46.39 -2.76 IP21=-.25 OBV NC Sun Trust Banks STSA 6.83 -1.04 IP21=-.35 OBV confirming NL VCBI 5.78 -.30 IP21=-.30 OBV NC WGO 13.15 -.61 IP21=-.25 OBV confirms WM 7.53 -1.08 IP21= -.45 OBV confirming. Bearish BZM 16.12 AI/200=18 very thin new red Buy C 20.06 AI/200=36 18.64 is March low. GSBC 10.70 AI/200=36 OBV is making new low. IP21=-.25 HAFC 5.97 -.14 OBV is making new low. IP21=-.25 IBCA 8.14 +.05 OBV confiring weakness. IP32=-.35 LCAV 8.15 -.26 OBV is not confirming. IP21=-.30 MNI 8.20 -.16 OBV is confirming. IP21=-.28 |