TigerSoft's Elite Stock

Professional Report

4/25/2008 -

(C) 2008 Wm. Schmidt, Ph.D.

| Abbreviations: price versus 50 day ma: A=Above B=Below AR = Above rising (Bullish) BF = Below Falling H = 12 month high L= 12 month low. Current Accum. Index = IP21 TISI = 21-day ma of IP21 SS = Sell Short BO = Breakout NC = non-confirmation. |

| Buys

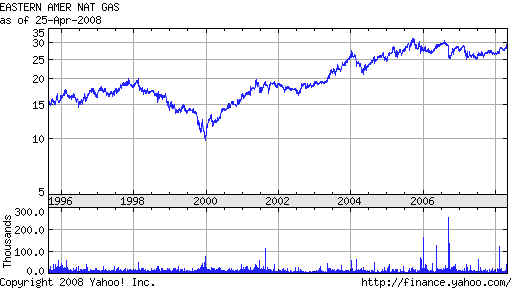

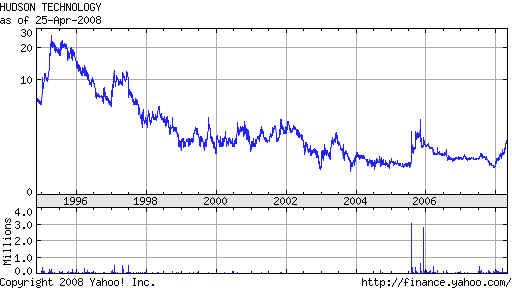

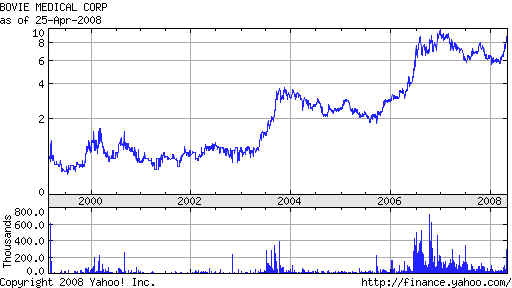

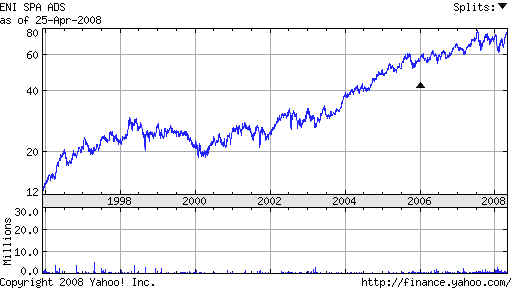

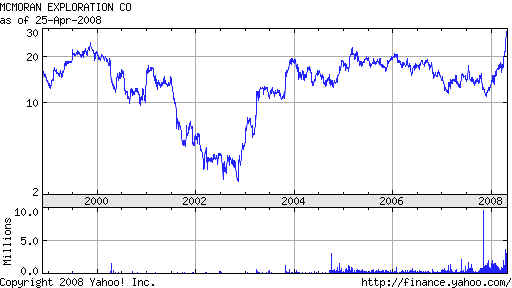

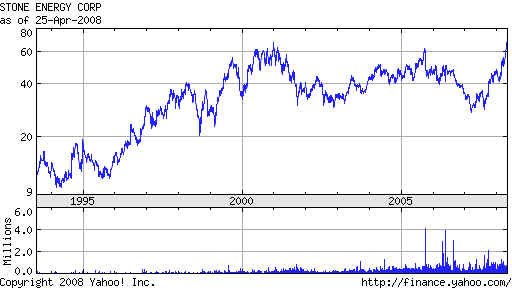

The best below are BCF, SID, IGE, DBC, GSG. Oil stocks are clearly the strongest group. The top Power -Ranked oil stocks are PBR, TOT, MDR, HP, RD, BZP, WFT and APA. As long as oil keeps rising, so will they.. 193 NGT 29.21 OBV NHs ITRS=.04 IP21=.33 Needs to hit 33 for all-time high. Eastern American Natural Gas Trust engages in acquiring and holding net profits interests in producing gas wells and proved development well locations.  119 HDSN 2.09 _.10 IP21=.40 OBV confirmed ITRS=.50 note earlier major Buys. Turn-around. Hudson Technologies, Inc., through its subsidiary, Hudson Technologies Company, provides various refrigerant products and services primarily to the commercial air conditioning, industrial processing, and refrigeration systems in the United States  190 SID 42.75 +.12 H=45 recent NH OBV is OK ITRS=.28 and IP21>.20 42=support Companhia Sider?rgica Nacional (CSN) primarily operates as an integrated steel producer in Brazil. Previously recommended and striog. 160 BVX 8.56 IP21=.44 B10,B12, B20 Needs to surpass 10. Bovie Medical Corporation engages in the manufacture and marketing of medical products and the development of related technologies. 162 employees Web Site: http://www.boviemedical.com  159 E 76.94 +1.00 IP21=.39 H=78.41 OBV is rising bullishly. Move to 79 would be bullish. http://finance.yahoo.com/q/pr?s=E Eni SpA, an integrated energy company, operates in the oil and gas, electricity generation, petrochemicals, oilfield services, and engineering industries.  119 MMR 28.82 +.55 Note January bulge of Accum. and B12/B24 IP21=.30 OBV confirm McMoRan Exploration Co. engages in the exploration, development, production, and marketing of crude oil and natural gas offshore in the Gulf of Mexico and onshore in the Gulf Coast area. 110 employees - Web Site: http://www.mcmoran.com New All-Time High.  172 RBA Ritchie Auctioneer IP21=.20 OBV confirms NH breakout. ITRS=.04 Ritchie Bros. Auctioneers Incorporated operates as an auctioneer of industrial equipment primarily to the used construction, transportation, and agricultural equipment sectors worldwide. 943 employees - Web Site: http://www.rbauction.com Breakout to new highs.  120 SGY 67.11 +1.86 OBV confirms NH IP21=.25. Stone Energy Corporation engages in the acquisition, exploration, development, operation, and production of oil and gas properties located in the Gulf of Mexico, the Rocky Mountain Basins, and the Williston Basin in the United States. Breakout to new all-time high.  |

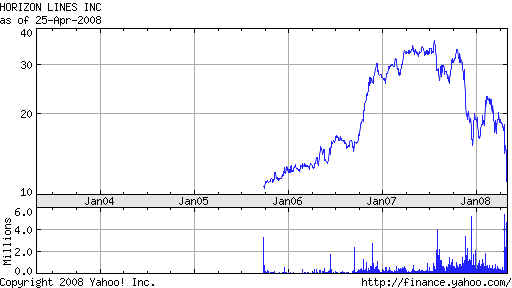

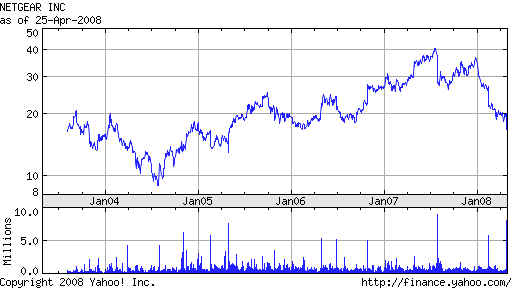

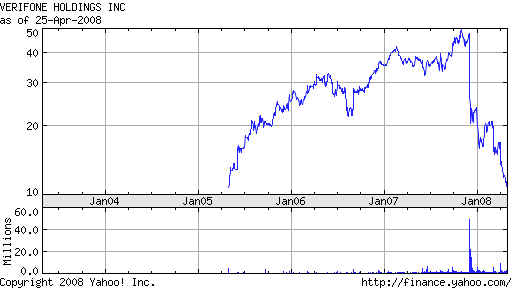

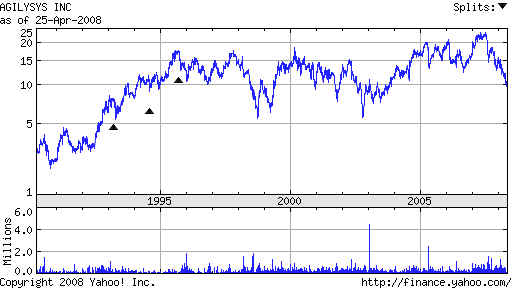

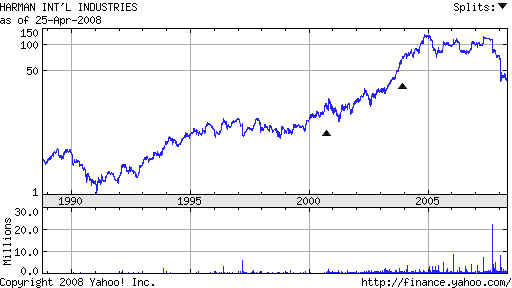

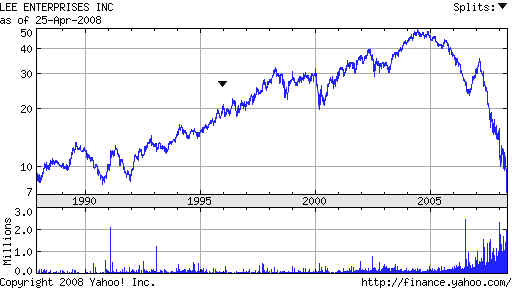

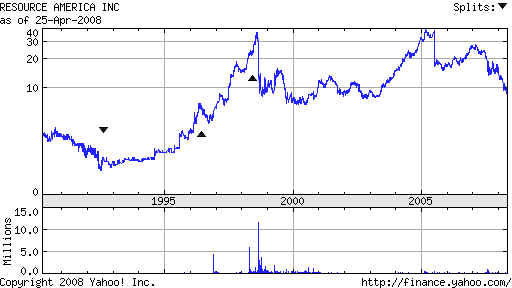

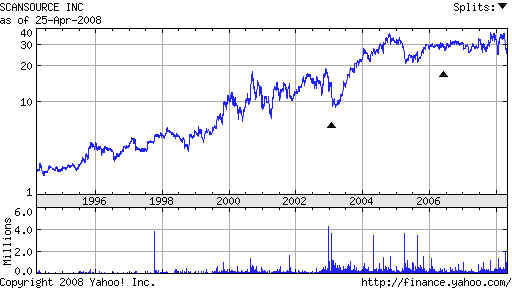

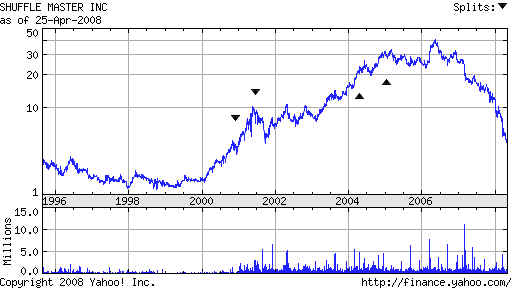

| Short Sales AI/200=96 HRZ 12.29 _1.04 in after hours on Friday. Breakdown below 15 support. IP21<-.20 Horizon Lines, Inc., through its subsidiaries, engages in container shipping and integrated logistics operations.  AI/200=44 NTGR 16.76 -3.37 Breakdown below 18 support. IP21<-.30 high volume decline on Friday. NETGEAR, Inc. engages in the design, development, and marketing of networking products for home users and small businesses worldwide.  AI/200=112 PAY 10.92 - .49 IP21=-.24 OBV confirms new low. ITRS<-.30 AI/200=114 VeriFone Holdings, Inc. engages in the design, marketing, and service of transaction automation systems that enable electronic payments. Too much competition.  AGYS AI/200=9 10.37 +.07 At falling 21-day ma Agilysys, Inc. and its subsidiaries provide information technology (IT) solutions to corporate and public-sector customers. The company's products include enterprise servers, data storage hardware, systems infrastructure software, and networking equipment.  AVTR AI/200=11 43.11 -.64 Just broke below declining 50-day ma. Watch closely. Use close Buy Stop. Avatar Holdings, Inc. engages in the business of real estate operations in Florida and Arizona.  HAR AI/200=33 40 -.31 ... At 50-dma. IP21=-.18 Harman International Industries, Incorporated engages in the development, manufacture, and marketing of audio products and electronic systems worldwide.  LEE AI/200=24 7.30 -.12 OBV is making new low. Lee Enterprises, Incorporated publishes daily newspapers, weekly newspapers, and specialty publications in the United States.  REXI AI/200=42 8.78 +.06 IP21-.20 Resource America, Inc. operates as an asset management company. The company, through its subsidiaries, operates in three segments: Financial Fund Management; Real Estate; and Equipment Finance.  SCSC AI/200=18 25.26 -2.55 IP21=-.20 OBV leading prices to NL. ScanSource, Inc. operates as a wholesale distributor of specialty technology products, providing distribution sales to resellers in the specialty technology markets.  SHFL AI/200=51 4.88 +.01 IP21=-.20 ITRS=-.42 Shuffle Master, Inc., a gaming supply company, engages in the development, manufacture, and marketing of technology and entertainment-based products for the gaming industry.  |

Table 1 - Highest AI/200 and Highest IP21 Stocks AR=Stocks must be above rising 50-day ma OBV should confirm IP21 must be over .05 AI/200 Stock Notes ====== ================= ==================================================== 200 CVF Castle Convertible 21.90 H=26 Declining long term ma at 23-23.5 196 HIX 9.77 -.03 IP21=.55 Possible turn around. 195 KTEC 31.81 +1.76 At declining 50-day ma and 30-wk ma IP21=.25 H=38.5 194 BCF 17.82 A weekago- Breakout B24 December bulge of Accumulation. 193 NGT 29.21 OBV MHs ITRS=.04 IP21=.33 192 GENC 27.38 +2.93 Up from 12 on major Buys in February. H=30.3 IP21=.25 190 SID 42.75 +.12 H=45 recent NH OBV is OK ITRS=.28 and IP21>.20 42=support 189 PBR 123.33 Marginal NH. IP21-,20 OBV confirming. False breakout in February. Careful here. On red Sell 188 BBL 75.03 +1.95 Very good OBV, H=78 IP21=.40 ITRS=.18 189 XBI 56.58 -.46 at flat 30 wk ma 189 CMKG 2.90 -.04 Thin...Very good OBV H=3.20 IP21=.60 Heavy accumulation. First stocks to move are not usually thin special situations. 189 XBI 56.68 -.46 at flat 30wk ma resistance. H=62.4 Red Sell. 188 GENC 27.80 +2.40 Classic explosive super stock. Breakout at 12 in January. 186 UBB 132.26 +2.09 160=H. IP21=.02 186 ARA 78.82 +.75 80.28 =12 mo resistance high. IP21=.10 186 IGE 142.14 +2.39 recent NH B24 IShares Goldman Natural Resources. Feb bulge of Accum. 186 HIX 9.77 185 DAIO 5.38 H=6.7 August bulges of Accum. ITRS<0 184 JLN 8.67 +.05 IP21=.02 H=12 Strong OBV. 183 DBC 38.85 +.70 H=39.3 IP21 is tailing off. OBV is strong. ITRS=.13 Recent Accum. Index is a bulge. Commodity ETFs - metals, oil, corn, wheat. 181 LRT 2.30 +.05 IP21=.60 neutral OBV. H=2.65 Buy B24 181 HYV 11.62 0.06 at declining 30-wk ma. IP21=.38 180 IGE 142.14 +2.39 On Red Sell. B24 at 140 O .. Goldman Sachs Natl Resources. ..... 179 PLUS 13.25 +.25 Testing last week's high at 13.54 OBV strong. IP21=.48 179 HCP 38.35 +.10 at NH OBV NC IP21=.14 179 EWT 16.77 -.05 IP21<0 18.2=H Weak OBV. ITRS-.18 179 MOS 131.30 +8.92 IP21=.13 OBV strong. 177 GSG 64.31 +.33 NH B24 Sept bulge of Accum. Weakening OBV 177 MDR 59.90 +1.20 IP21=.10 H=64 177 PMFG 36.35 H=41 177 DBE 44.92 +.80 NH OBV NH along with price. IP21=.06 ENERGY ETF 176 HEIA 39.98 IP21=.34 H=45 175 SYT 61.69 -.52 IP21=.27 H=66 Good OBC 172 ISYS 31.45 IP21=.18 NH OBV NC Jan bulge of Accum. 172 RIG 154.73 IP21=.20 H=160 OBV NC 172 DBO 43.95 +1.09 OBV NC running. IP21=.26 ITRS=.22 170 REP 41.17 +.23 IP21=.35 H=45 IP21=.41 170 PDA 52.72 -.63 IP21=.25 H=58 IP21=.25 166 USO 95.47 +.204 IP21=.35 H=96 Running small OBV NC 165 PHX 30.15 -.11 IP21=.40 H=31.80 164 EWU (UK ETF) 23 +.27 H=27.2 declining longer term ma=24 163 PRFE 77.75 +.21 On red Sell. A week ago there was a high bulge of Accum. OBV OK 161 FDG 62.87 +.68 67=H 60-support. ITRS>30 IP21=.31 161 ATW 106.70 +1.44 IP21=.25 H=113 160 BVX 8.56 IP21=.44 B10,B12, B20 159 E 76.94 +1.00 IP21=.39 H=78.41 OBV is rising bullishly. Move to 79 would be bullish. 159 NOV 73.19 IP21=.40 H=42 157 AKS 67.24 +3.24 AK Steel 70=H IP21=.26 157 ARE 107.04 +.37 Alexandria REIT H=112 156 TRU 12.00 -.25 Recent NH OBV confirmed. IP21=.58 Thin Touch Energy 155 HP 55.04 +2.07 H-57.2 IP21=.41 155 INSW 11.17 +.15 IP21=.44 Hit 12.5 recently. Recent false breakout. 155 POWL 42.11 -.36 IP21=.45 H=47 154 ILF Latin America 273.79 -3.18 IP21=.26 pullbach to breakout point. 151 BEXP Brigham Explor. 9.22 +.03 H=10.2 recently. 148 DRQ 59.45 -.13 H=63.5 IP21=.41 147 KEF 11.55 +.10 IP21=.50 H=15.3 147 TTES 54.50 -1.125 IP21=.45 H=60 146 APFC 17.02 +.03 IP21=.36 H=19 146 NBL 88.92 +2.47 H=91 IP21=.27 145 CLF 163.32 +5.48 NH OBV NC ITRS>.30 IP21=.37 145 CPE 20.17 +.22 H=20.9 IP21=.25 145 LGF 10.26 -04 H=12 IP21=.71 142 IXC 145.41 +.76 High this week. Pullback to breakout point IP21=.59 Global Energy 142 MEE 55.04 +3.78 NH Slight OBV NC 142 OIH 202.57 +1.20 Oil Service ETF - pn red Sell. H=211 IP21=.37 |

| Table 2A - New

High Stocks - Stocks should be above 50-day ma. OBV confirm. IP21>.20 To Buy: IP21 should be over .24 or ITRS should be over .30 and AI/200 should be over 140 162 AXYS 54.15 +3.96 NH OBV NC IP21=.15 129 BUCY 127.83 +11.20 NH OBV-NC IP21=.20 163 CRK 46.07 +2.47 OBV NC IP21=.15 ITRS=.32 78 CPX 27.85 +.78 OBV confirms B12 123 CSX 61.94 +1.17 OBV confirms NH IP21=.14 101 GWR 36.87 +.32 flat-topped breakout. OBV NC 142 HCN 50.19 +.47 OBV NC of NH 119 HDSN 2.09 _.10 IP21=.40 OBV confirmed ITRS=.50 note earlier major Buys. 163 HK 25.19 +2.54 NH OBV NC 123 KTII 138.75 +.19 IP21=.65 119 MMR 28.82 +.55 Note January bulge of Accum. and B12/B24 IP21=.30 OBV confirm 172 RBA Ritchie Auctioneer IP21=.20 OBV confirms NH breakout. ITRS=.04 120 SGY 67.11 +1.86 OBV confirms NH IP21=.25. 134 SWN 44.46 +6.87 IP21=.12 OBV NC of NH 100 WSCI 17.45 +1.02 IP21=.28 OBV NH. June 2006 IP21 bulge 102 VSCI 4.48 +.26 IP21=.48 OBV confis NH. IP21=0 |

Table 3 - Buy B12 Stocks no new stocks this week. |

| Table 4 - New Lows/Bearish Stocks - over $5.00 Weak OBV and negative IP21 and New Lows ---- New Lows --- IP21must be blow -.10 AWBC 4.30 -.94 Note how Accum. Index bulge with stock below 30 wk ma was very misleading. CLMT 14.15 -.11 0.11 Note how Accum. Index bulge with stock below 30 wk ma was very misleading. HRZ 11.25 -3.38 Breakdown below 15 support. IP21<-.20 NTGR 16.76 -3.37 Breakdown below 18 support. IP21<-.30 high volume decline on Friday. April 25, 6:30 pm ET Earnings roundup: Netgear 1Q profit drops 20 percent, NETGEAR's products that enable Ethernet networking include switches; network interface cards, adapters, and bridges; peripheral servers, such as print servers and disk servers; and VPN firewalls. The company also offers various products that enable broadband access, which comprise routers, gateways, IP telephony products, and wireless gateways; and products that enable network connectivity and resource sharing consist of wireless access points, wireless network interface cards and adapters, media adapters, wi-fi phones, network attached storage, and powerline adapters and bridges. NETGEAR sells its products through traditional retailers, online retailers, wholesale distributors, direct market resellers, value added resellers, and broadband service providers. PAY 10.52 - .49 IP21=-.24 OBV confirms new low. ITRS<-.30 AI/200=114 PEBC 11.92 -.15 IP21=-.15 OBV confirms ITRS<-.37 TEO 17.24 -1.12 IP21=-.20 OBV NC UCBH 6.80 -.33 IP21=-.30 OBV confirms low. Now RD ----- Bearish --------------------------- AGYS AI/200=9 10.37 +.07 At falling 21-day ma AVTR AI/200=11 43.11 -.64 Just broke below declining 50-day ma. CKR AI/200=20 10.55 HAR AI/200=33 40 -.31 ... At 50-dma. IP21=-.18 LAD AI/200=36 7.85 -.05 at lower band IP21=-.25 ITRS=-.40 LEE AI/200=24 7.30 -.12 OBV is making new low. JRN AI/200-37 5.88 -.04 new red buy REXI AI/200=42 8.78 +.06 IP21-.20 SCSC AI/200=18 25.26 -2.55 IP21=-.20 OBV leading prices to NL. SHFL AI/200=51 4.88 +.01 IP21=-.20 ITRS=-.42 34 WNR 12.23 +.15 IP21=-.25 |